- IRS forms

- Form 5471

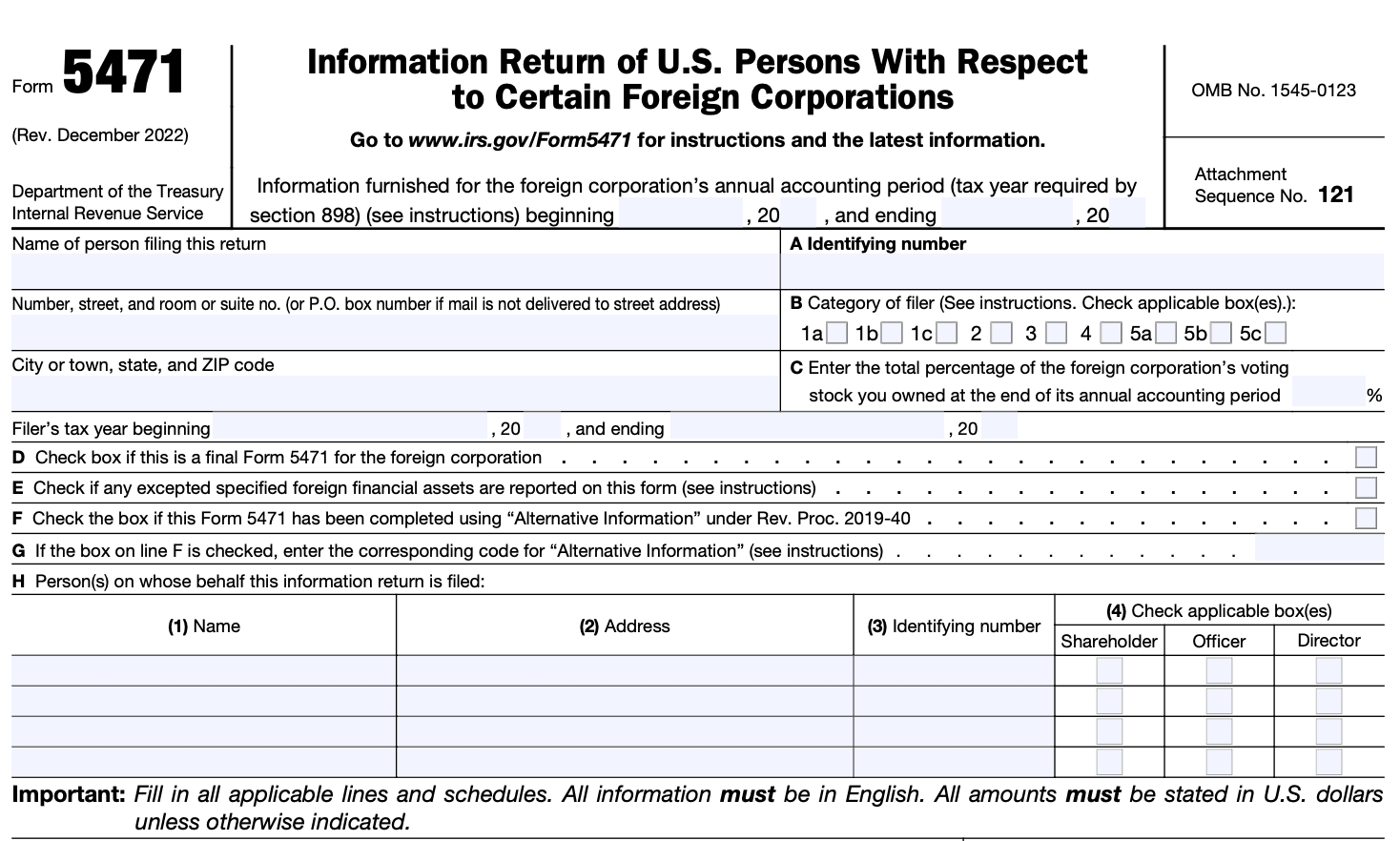

Form 5471: Information Return of U.S. Persons With Respect to Certain Foreign Corporations

Download Form 5471When it comes to international tax compliance, navigating the complex landscape of regulations and forms can be quite daunting. One such form that is essential for U.S. taxpayers with foreign investments or interests is Form 5471.

Form 5471, also known as "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," is a form required by the Internal Revenue Service (IRS). It is used to report information about U.S. taxpayers' ownership in certain foreign corporations, referred to as Controlled Foreign Corporations (CFCs). The purpose of the form is to ensure transparency and prevent tax evasion by U.S. citizens or residents who have significant control over foreign corporations.

In this blog post, we will explore what Form 5471 is, who needs to file it, and why it is crucial for international tax compliance.

Purpose of Form 5471

The main objective of Form 5471 is to help the IRS gather information about U.S. taxpayers' involvement in foreign corporations and to ensure compliance with U.S. tax laws. It helps the IRS identify potential tax evasion, prevent abusive tax practices, and enforce tax reporting requirements.

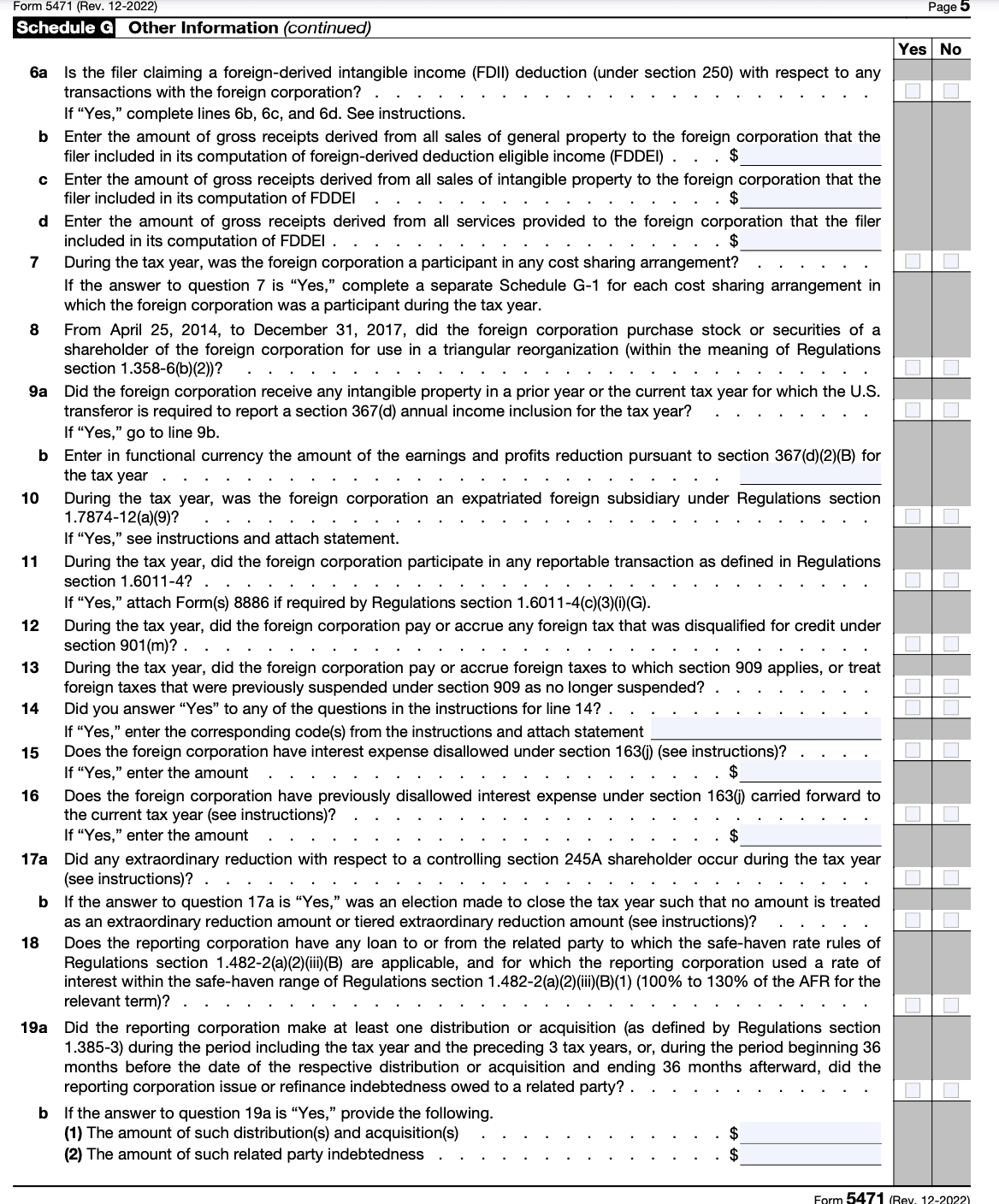

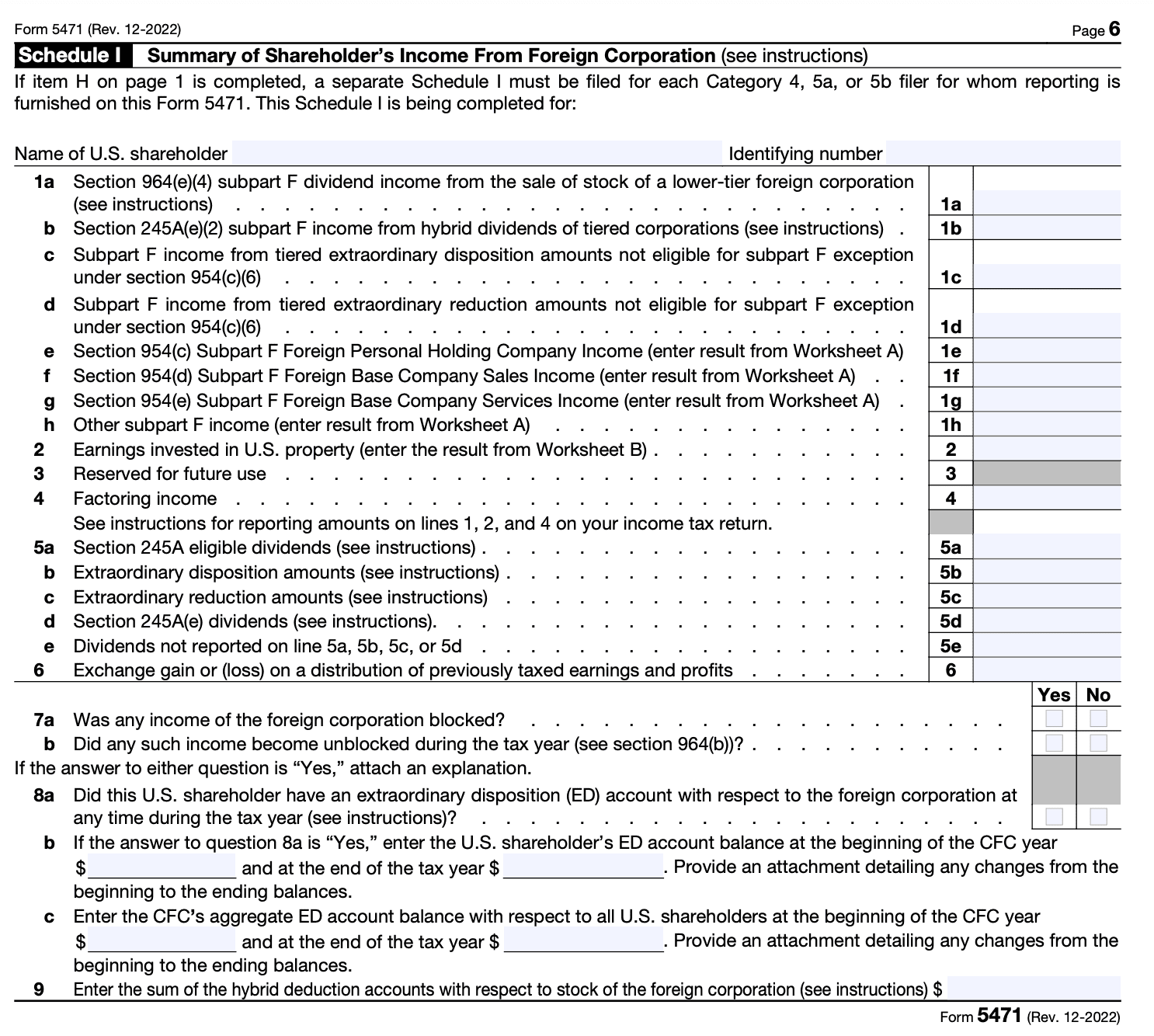

Form 5471 requires the filer to disclose various details about the foreign corporation, such as its financial information, capital structure, income, assets, and transactions with related parties. The form also captures information about the U.S. person's ownership percentage, voting power, and any changes in ownership during the year.

By filing Form 5471, the IRS can assess the U.S. taxpayer's compliance with Subpart F rules, Passive Foreign Investment Company (PFIC) rules, and other anti-deferral provisions. The information reported on the form helps the IRS determine the taxpayer's U.S. tax liability, prevent tax avoidance, and detect any potential tax evasion.

It's important to note that Form 5471 has complex reporting requirements and there are severe penalties for non-compliance or incorrect filing.

Benefits of Form 5471

While Form 5471 comes with reporting obligations and potential penalties for non-compliance, it also offers several benefits. Some of the key benefits of Form 5471 include:

Compliance with U.S. tax laws

Form 5471 ensures compliance with U.S. tax laws by requiring U.S. persons to disclose their ownership in foreign corporations. Filing this form helps individuals fulfill their reporting obligations and demonstrates transparency to the Internal Revenue Service (IRS).

Avoidance of penalties

Failing to file Form 5471 when required can result in substantial penalties. By timely and accurately filing the form, individuals can avoid penalties that may be imposed for non-compliance, such as monetary fines and potential criminal charges.

Tax planning opportunities

Form 5471 provides valuable information about the foreign corporation and its operations, which can be useful for tax planning purposes. It allows individuals to assess the impact of their ownership in the foreign corporation on their overall tax liability, take advantage of available tax benefits, and optimize their tax strategies.

Foreign tax credits

The information provided on Form 5471 can be used to claim foreign tax credits. U.S. taxpayers may be eligible to offset their U.S. tax liability by claiming credits for foreign taxes paid on income earned through foreign corporations. This can help reduce double taxation and minimize the overall tax burden.

Asset protection

Form 5471 assists in protecting an individual's assets by providing a record of their ownership interest in foreign corporations. It helps establish legal compliance and documentation that may be required in case of legal disputes, audits, or investigations related to foreign investments.

Enhanced financial transparency

Filing Form 5471 promotes transparency regarding an individual's foreign investments and business activities. This can be beneficial in various scenarios, such as obtaining financing, attracting investors, or demonstrating financial credibility to business partners or regulatory authorities.

Compliance with international tax reporting requirements

In addition to U.S. tax laws, many countries have implemented international tax reporting requirements as part of global efforts to combat tax evasion. By filing Form 5471, individuals can fulfill their obligations under these international reporting regimes, such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA).

Who Is Eligible To File Form 5471?

Form 5471, "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," is filed by U.S. citizens, resident aliens, and domestic corporations that meet specific ownership requirements and have control or certain interests in foreign corporations.

Generally, the following individuals or entities are eligible to file Form 5471:

- U.S. citizens or resident aliens who are officers, directors, or shareholders of a foreign corporation in which they have at least 10% ownership (directly or indirectly).

- U.S. citizens or resident aliens who acquire stock in a foreign corporation that results in them owning at least 10% of the total voting power or value of the corporation.

- U.S. citizens or resident aliens who become officers or directors of a foreign corporation with knowledge that the corporation is a controlled foreign corporation (CFC).

- U.S. corporations that own at least 10% of the voting stock of a foreign corporation (controlled foreign corporation).

It's important to note that there are various categories and filing requirements based on the specific ownership thresholds and relationships with the foreign corporation. The instructions accompanying Form 5471 provide detailed guidance on the different filing categories and requirements.

How To Complete Form 5471: A Step-by-Step Guide

Form 5471, also known as the "Information Return of U.S. Persons With Respect to Certain Foreign Corporations," is a complex form used to report ownership and financial information about certain foreign corporations. As a step-by-step guide, here's how you can complete Form 5471:

Step 1: Gather the necessary information

Before you begin, gather all the required information and documents, including:

- Basic information about the foreign corporation (name, address, tax identification number, etc.).

- Ownership details (percentage of ownership, stock classes, etc.).

- Financial information (income statements, balance sheets, etc.).

- Details about transactions with the foreign corporation (loans, sales, etc.).

- Any other relevant supporting documents.

Step 2: Determine the filing category

Form 5471 has multiple filing categories, and it's crucial to determine the appropriate category for your situation. The category will depend on factors such as your ownership percentage, your relationship with the corporation, and the corporation's activities. Review the instructions for Form 5471 to identify the correct category.

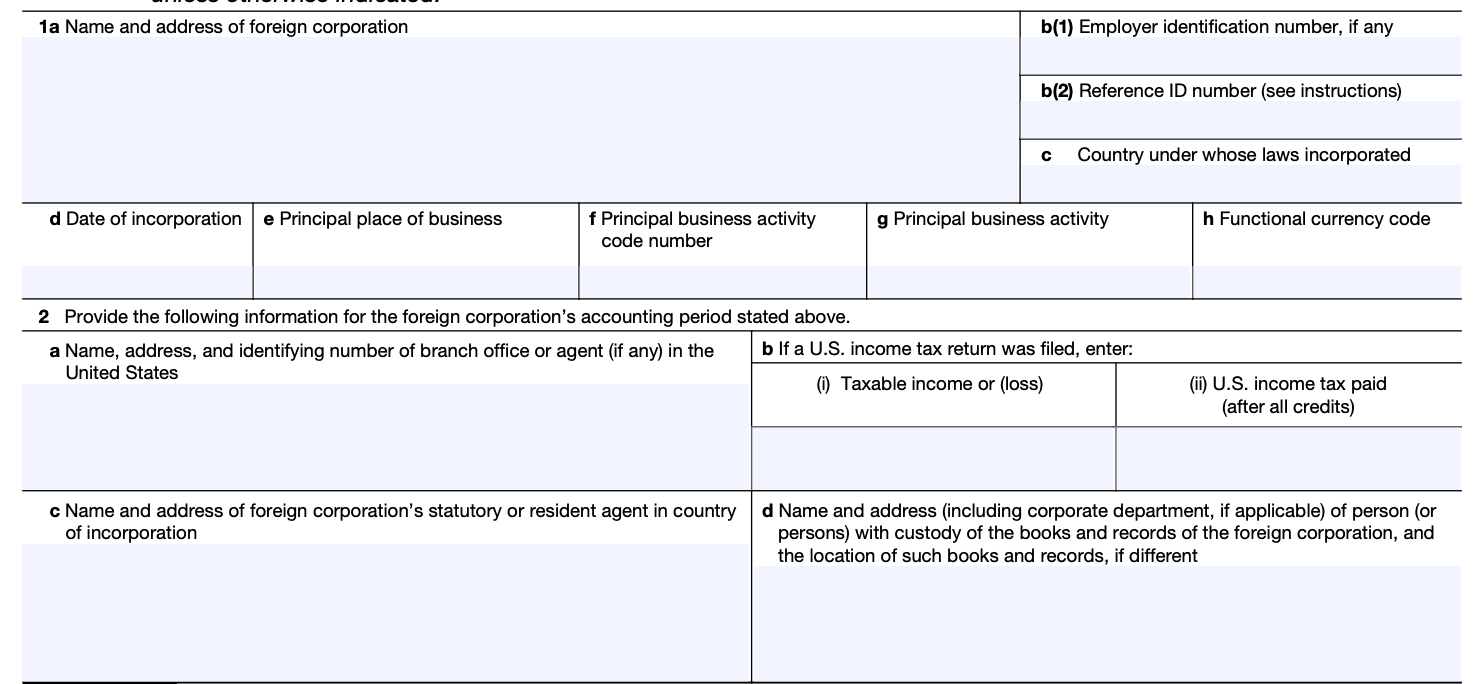

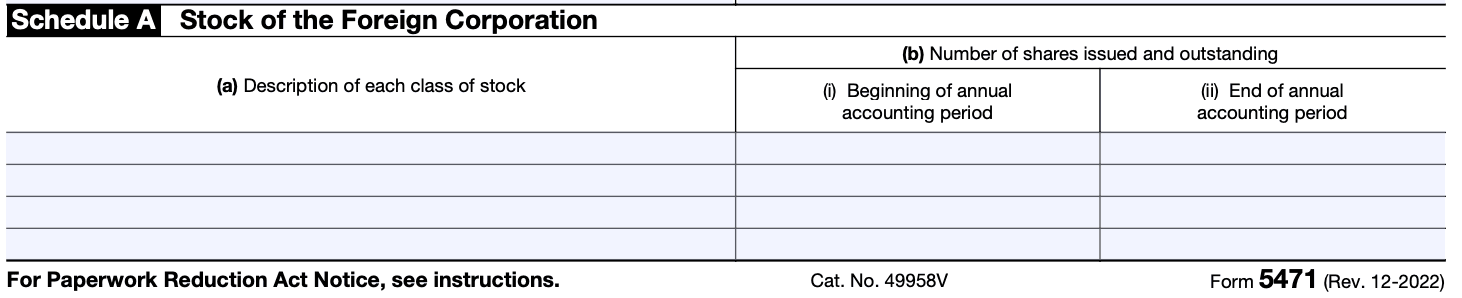

Step 3: Complete the required schedules

Form 5471 consists of various schedules that must be completed based on your filing category. The most commonly used schedules are:

Schedule A: This schedule requires general information about the foreign corporation, including its name, address, and principal business activity.

Schedule B: Here, you'll provide detailed information about the corporation's shareholders, including their names, addresses, ownership percentages, and other relevant details.

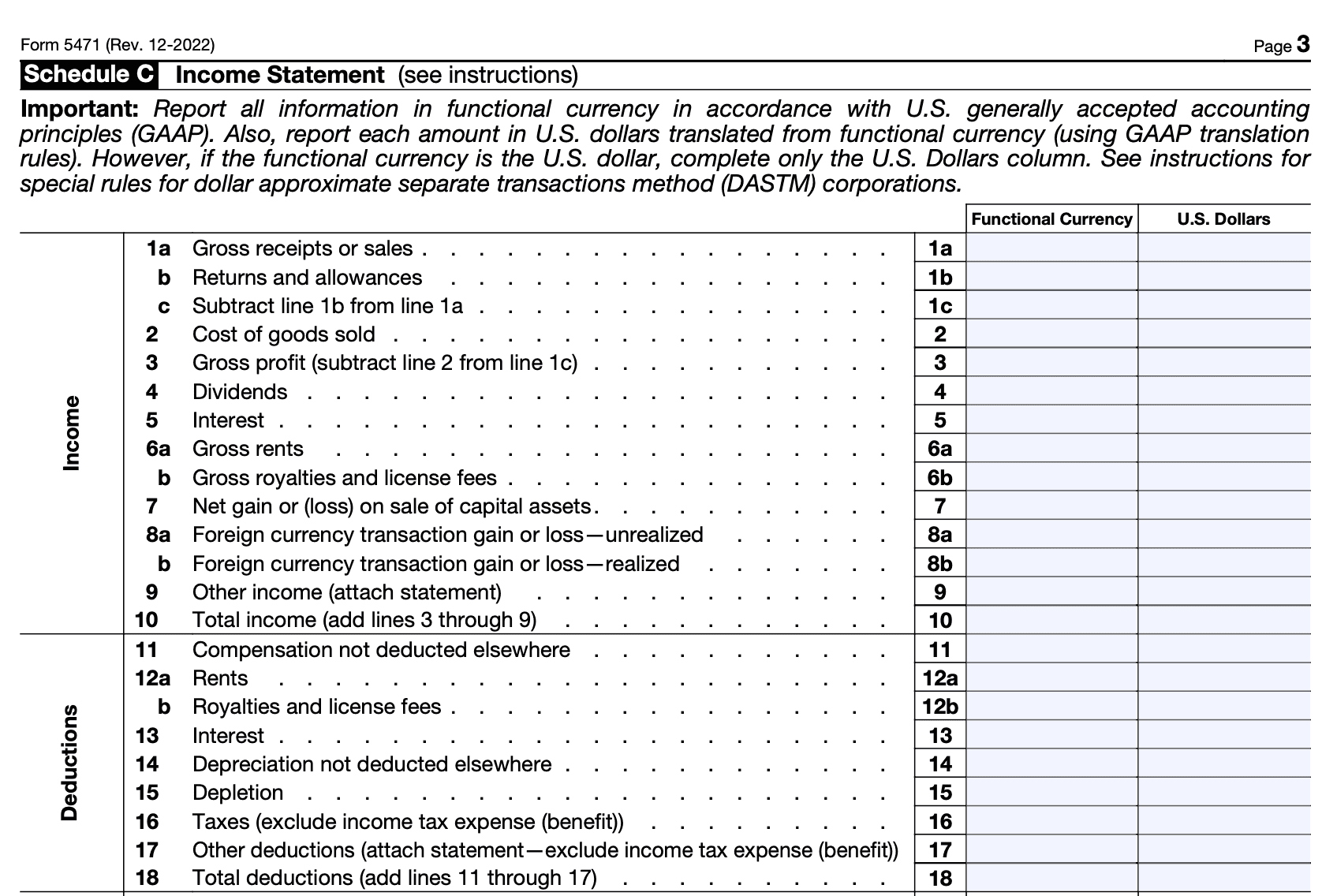

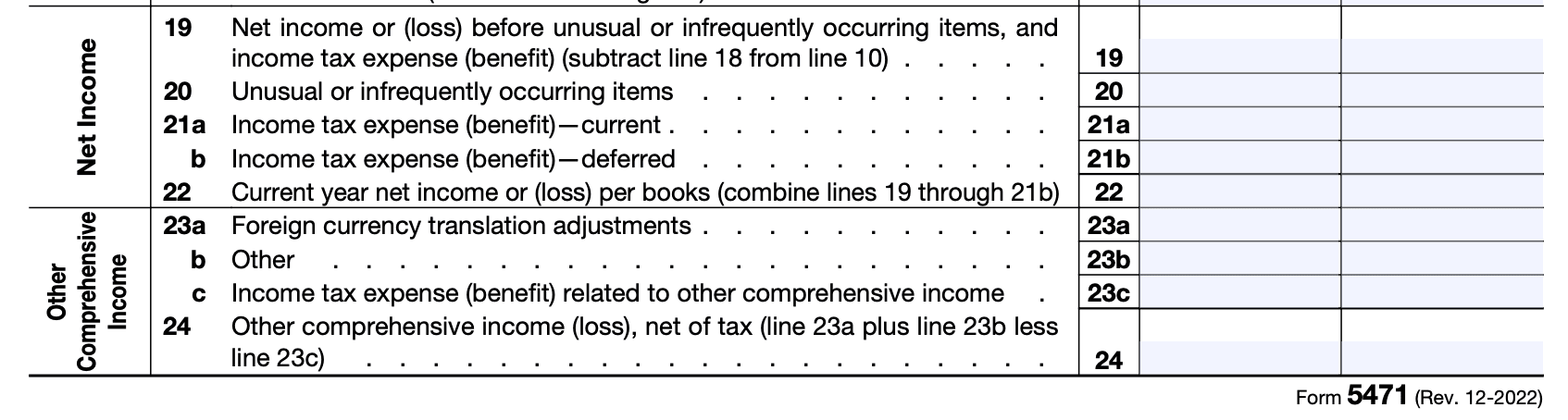

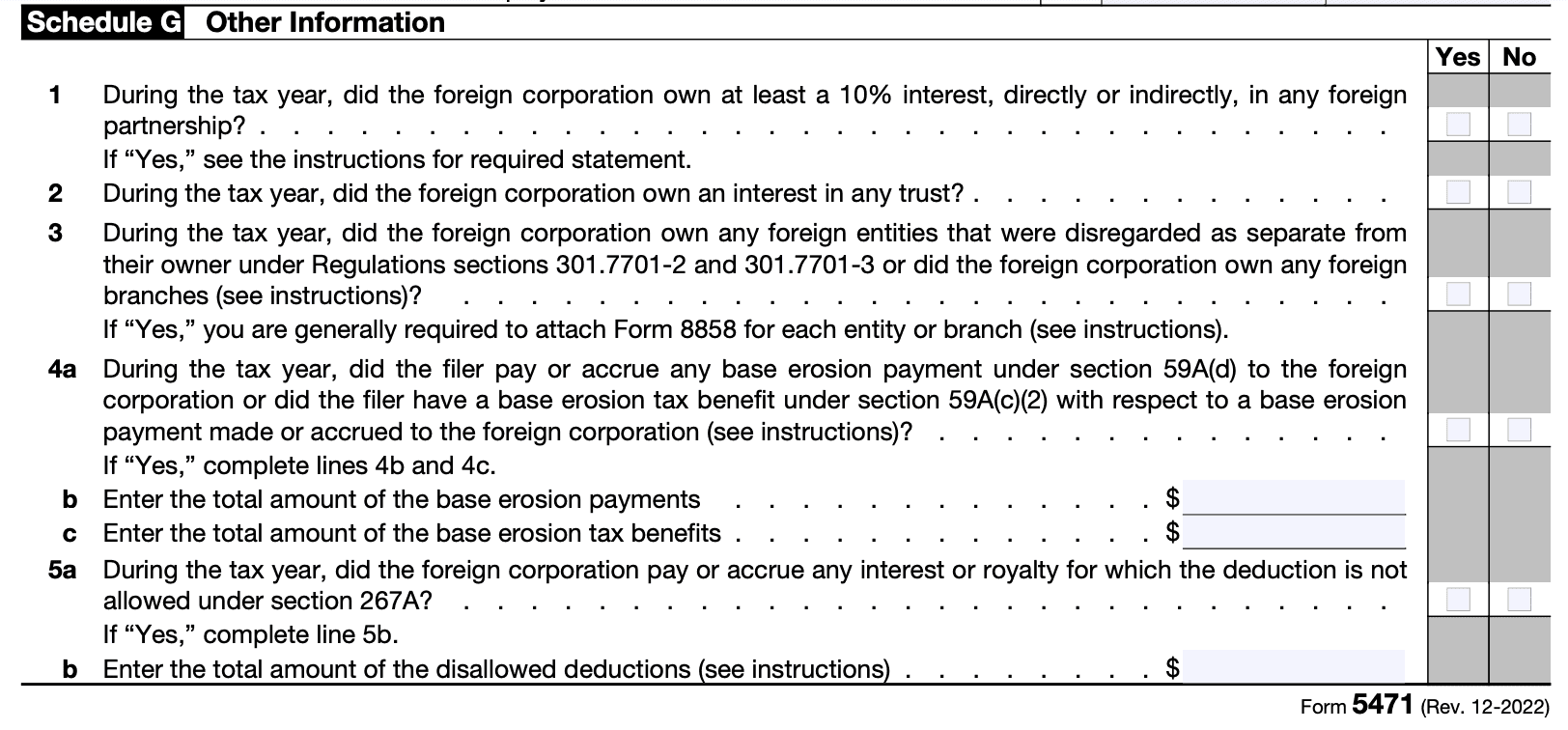

Schedule C: This schedule focuses on the balance sheet of the foreign corporation, including assets, liabilities, and equity.

Schedule E: Use this schedule to report the income statement of the foreign corporation, detailing its revenues, expenses, and net income.

Schedule F: If there were any transactions between the filer and the foreign corporation, such as loans or sales, this schedule captures the relevant information.

Step 4: Review and attach additional schedules

Depending on your filing category and the specific requirements, you may need to complete additional schedules beyond the ones mentioned above. Review the instructions for Form 5471 to determine whether any additional schedules are necessary.

Step 5: Complete the rest of the form

Apart from the schedules, there are other sections in Form 5471 that you need to fill out. These sections include identifying information, elections, and statements regarding your relationship with the foreign corporation. Ensure that all relevant sections are completed accurately.

Step 6: Double-check for accuracy

Before submitting Form 5471, carefully review all the information you've provided. Check for any errors, omissions, or inconsistencies. Make sure that the figures and details match the supporting documents you've gathered.

Step 7: File Form 5471

Once you're confident that the form is complete and accurate, you can file Form 5471. Follow the filing instructions provided by the Internal Revenue Service (IRS) to determine the appropriate filing location and method (paper or electronic).

Step 8: Retain a copy for your records

After filing, make a copy of the completed Form 5471 and all the supporting documents for your records. It's important to retain these documents for future reference or in case the IRS requests additional information.

Please note that completing Form 5471 can be complex, and it's advisable to seek professional assistance, such as a tax accountant or attorney, if you are unsure about any aspect of the form or your filing requirements.

Special Considerations When Filing Form 5471

When filing Form 5471, there are several special considerations you should keep in mind. Here are some important points to consider:

-

Filing thresholds: Determine whether you meet the filing requirements for Form 5471. Generally, U.S. citizens, resident aliens, and certain U.S. corporations must file this form if they have ownership in a foreign corporation that meets certain criteria.

-

Classification of filers: Form 5471 has multiple categories of filers (e.g., Category 1, Category 2, etc.) based on the individual's relationship with the foreign corporation. Make sure you correctly determine your filing category, as each category has different reporting requirements.

-

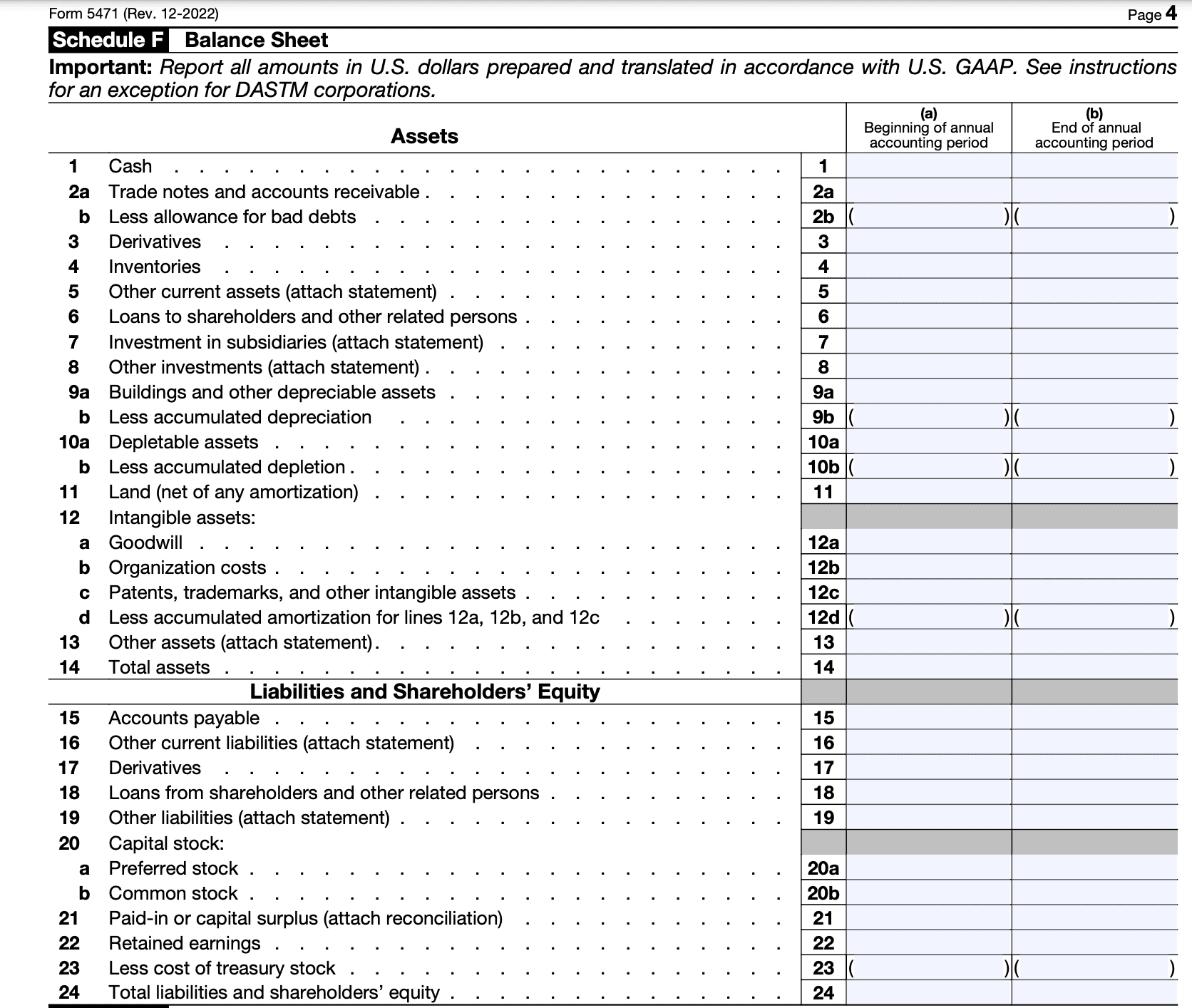

Completing all required schedules: Form 5471 consists of several schedules, and the specific schedules required depend on the filing category. Ensure that you complete all the applicable schedules and provide accurate and comprehensive information.

-

Reporting of financial information: Depending on the filing category, you may need to provide financial information about the foreign corporation, such as balance sheets, income statements, and details of transactions with related parties. Be prepared to gather and report this information accurately.

-

Currency conversion: If the foreign corporation's financial records are maintained in a currency other than U.S. dollars, you'll need to convert the amounts into U.S. dollars using the appropriate exchange rate. Use the method specified in the instructions for Form 5471.

-

Substantial compliance: Strive to achieve substantial compliance with the form's instructions and requirements. Failure to comply with the filing obligations or provide accurate information can result in penalties or other consequences.

-

Filing deadline: Form 5471 is generally due with your individual income tax return, including extensions. Ensure that you meet the applicable filing deadline to avoid late filing penalties.

-

Seeking professional assistance: Filing Form 5471 can be complex, especially if you have significant ownership or involvement with a foreign corporation. It is advisable to consult with a tax professional or qualified tax advisor who is familiar with international tax laws and regulations to ensure compliance and accuracy.

How To File Form 5471: Offline/Online/E-filing

The filing process for Form 5471 can be done offline (paper filing) or online (e-filing). Here's a breakdown of the options:

Offline filing (paper filing)

a. Obtain the form: You can download Form 5471 from the official IRS website (www.irs.gov) or request a copy by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

b. Fill out the form: Complete the form with the required information. Ensure that you provide accurate details about the foreign corporation, your relationship to it, and other relevant information.

c. Attach necessary schedules: Depending on your situation, you may need to attach additional schedules and forms to provide more specific information. These schedules are outlined in the instructions accompanying Form 5471.

d. Calculate and report applicable taxes: If there are tax implications associated with the foreign corporation, ensure you calculate and report them accurately on the form.

e. Mail the completed form: Once you have filled out the form and attached any required schedules, mail the completed package to the appropriate IRS address. The address can be found in the instructions for Form 5471.

Online filing

a. Determine e-filing eligibility: To file Form 5471 electronically, you must meet certain criteria. Check the IRS website or consult a tax professional to confirm if you qualify for electronic filing.

b. Use authorized software: If you are eligible for e-filing, you need to use authorized tax preparation software. The IRS provides a list of approved e-filing providers on their website.

c. Enter the information: Follow the instructions provided by the software to enter the required information accurately. The software will guide you through the process and may include built-in checks to ensure completeness.

d. Submit the form electronically: Once you have entered all the necessary information, submit the form electronically through the software. The software will provide instructions on how to complete this step.

e. Receive confirmation: After successfully submitting the form, you will receive a confirmation indicating that your filing has been received by the IRS. Retain this confirmation for your records.

Common Mistakes To Avoid While Filing Form 5471

When filing Form 5471, which is used to report ownership of a foreign corporation, it's important to be thorough and accurate to avoid mistakes that could lead to penalties or other complications. Here are some common mistakes to avoid:

**Failing to file: **Failing to file Form 5471 altogether is a serious mistake. If you meet the filing requirements, make sure to submit the form in a timely manner. Even if you have no financial activity, you may still need to file an informational return.

Incorrect classification: Determine the correct category of filer for Form 5471, as there are different requirements for each category (e.g., Category 1, Category 2, Category 3, etc.). Classifying yourself incorrectly can lead to errors and potential penalties.

Incomplete or missing information: Ensure that all required sections of the form are completed accurately and in their entirety. Provide the necessary details about the foreign corporation, including its income, assets, liabilities, and transactions.

Failure to include all necessary schedules: Form 5471 has various schedules that may need to be included, depending on the specific situation. Make sure to include all relevant schedules, such as Schedule B (Balance Sheet), Schedule C (Income Statement), Schedule E (Income, War Profits, and Excess Profits Taxes Paid), and others, as applicable.

Inconsistent or mismatched data: Double-check that the information provided on Form 5471 aligns with other tax forms, such as your personal tax return or other related reporting forms. Inconsistencies in data can trigger audits or inquiries from tax authorities.

Ignoring ownership thresholds: Understand the ownership thresholds that trigger the filing requirement for Form 5471. Different thresholds apply to different categories of filers, such as 10%, 25%, or 50% ownership of the foreign corporation's stock. Failure to recognize these thresholds can result in noncompliance.

Disregarding reporting requirements for disregarded entities: If you have a foreign entity that is treated as a disregarded entity for U.S. tax purposes, be aware of the reporting requirements. Depending on the circumstances, you may still need to report certain information on Form 5471 or on other related forms.

**Incorrectly reporting income or transactions: **Accurately report the income, deductions, and transactions related to the foreign corporation. Ensure that all amounts are converted to U.S. dollars using the appropriate exchange rates.

Missing or incorrect identification numbers: Provide accurate and valid taxpayer identification numbers (TINs) for all individuals and entities involved, including the foreign corporation, shareholders, and officers. Errors or missing TINs can lead to processing delays or compliance issues.

**Neglecting to consult with a tax professional: **Filing Form 5471 can be complex, especially if you have intricate foreign ownership structures or if you're unsure about the requirements. Consider consulting with a qualified tax professional who can provide guidance and help you navigate the process correctly.

Conclusion

Form 5471 is a critical component of international tax compliance for U.S. taxpayers with foreign investments or interests. By filing this form, taxpayers fulfill their reporting obligations and contribute to the transparency and integrity of the global tax system. It is essential to consult with a tax professional or seek expert guidance to ensure accurate completion of Form 5471, as the requirements and reporting thresholds can be complex and subject to change. Compliance with tax laws not only avoids penalties but also helps build trust and confidence.