- IRS forms

- Form 4684

Form 4684: Casualties and Thefts

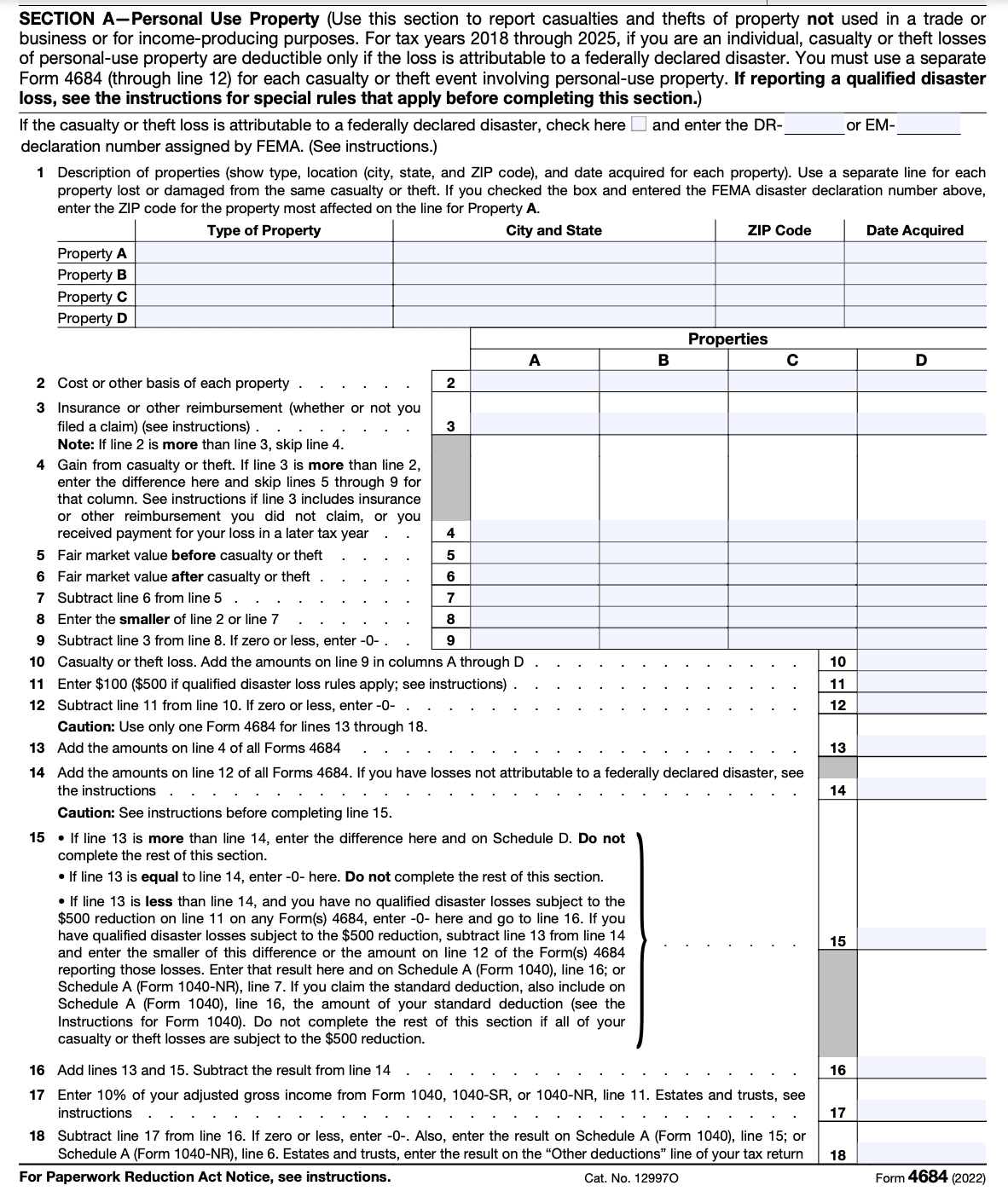

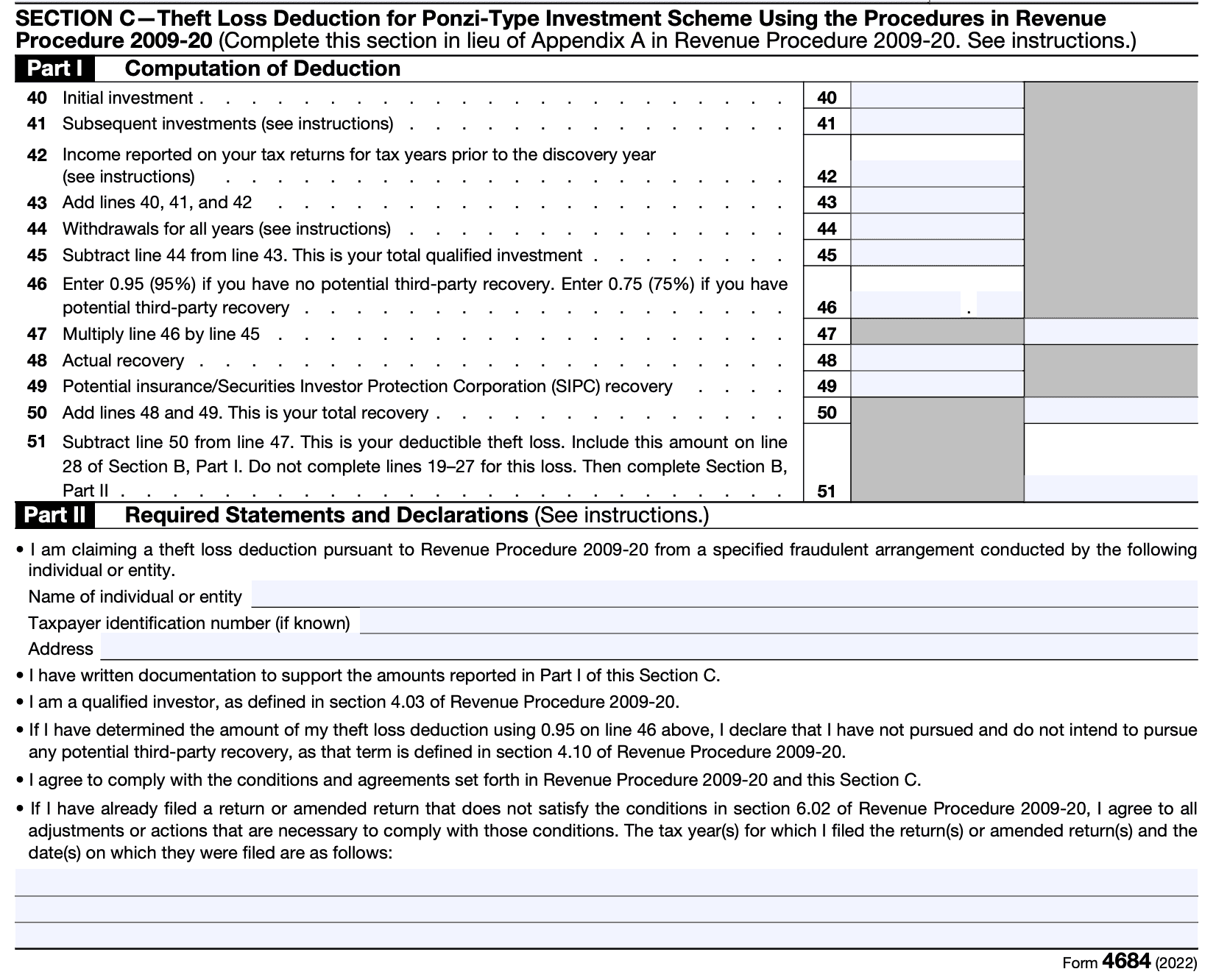

Download Form 4684Form 4684, officially known as "Casualties and Thefts," is an important IRS tax form that individuals and businesses use to report losses incurred due to casualties, thefts, or other similar events. This form plays a significant role in helping taxpayers claim deductions for losses that are not covered by insurance or any other type of reimbursement.

Form 4684 is a tax form used by individuals, businesses, and sole proprietors to report losses caused by casualties, thefts, or other similar events. These losses can include damage to property, destruction of assets, or the loss of property due to theft. By completing this form, taxpayers can determine the amount of their deductible loss and claim it on their tax return.

In this blog, we will explore the details of Form 4684, its purpose, and the benefits it offers taxpayers in navigating the aftermath of unfortunate events.

Purpose of Form 4684

The purpose of Form 4684 is to calculate the amount of deductible loss resulting from damage, destruction, or loss of property due to events such as fires, storms, accidents, thefts, or other similar circumstances.

When a taxpayer experiences a casualty or theft loss, they may be eligible to claim a deduction on their federal income tax return. The deduction is generally available for losses that are not covered by insurance or other reimbursements. Form 4684 helps determine the amount of the deductible loss by taking into account factors such as the adjusted basis of the property, any salvage value, and any insurance or other reimbursements received.

Form 4684 is typically used in conjunction with Schedule A (Itemized Deductions) of Form 1040 or Form 1040NR. The casualty or theft loss deduction is subject to certain limitations and requires the taxpayer to itemize their deductions rather than taking the standard deduction.

Benefits of Form 4684

Here are some of the benefits of using Form 4684:

-

Reporting losses: Form 4684 allows taxpayers to report losses incurred due to casualties (such as natural disasters) or thefts. By reporting these losses, taxpayers may be eligible for tax deductions, which can help offset their overall tax liability.

-

Claiming casualty loss deductions: The primary benefit of using Form 4684 is to claim casualty loss deductions. If your property, including your home, personal belongings, or business assets, was damaged or destroyed due to an event beyond your control (such as a fire, storm, or accident), you can use this form to calculate and report the loss. These losses can be deducted on your tax return, potentially resulting in a lower tax liability.

-

Theft loss deductions: If you experienced a theft during the tax year, you can use Form 4684 to report the loss. The form provides a structured way to calculate and report the stolen property's fair market value, allowing you to claim a deduction for the theft loss.

-

Insurance reimbursement adjustment: If you receive insurance reimbursements for your losses, Form 4684 helps you adjust your casualty or theft loss deduction accordingly. It ensures that you do not claim a deduction for losses already covered by insurance.

-

Business losses: Form 4684 can be used by businesses to report losses resulting from casualties or thefts. By reporting these losses, businesses can offset their taxable income, potentially reducing their tax liability.

-

Record-keeping: Using Form 4684 requires organizing and documenting information related to the casualty or theft loss. This can help you maintain proper records for tax purposes, making it easier to substantiate your deductions in case of an audit.

Who Is Eligible To File Form 4684?

The following individuals or entities may be eligible to file Form 4684:

Individuals: Any individual who has suffered a loss due to a casualty (such as a natural disaster) or theft may be eligible to file Form 4684. This includes homeowners, renters, and individuals who have personal property or business property.

Sole proprietors: If you operate a business as a sole proprietor and your business property has been damaged or stolen, you may be eligible to file Form 4684 to report the loss.

Partnerships and LLCs: Partnerships and Limited Liability Companies (LLCs) can also use Form 4684 to report losses from casualties or thefts. The individual partners or members can then claim their share of the loss on their respective tax returns.

Corporations: Corporations can use Form 4684 to report losses resulting from casualties or thefts. The losses are typically reported on the corporation's tax return.

How To Complete Form 4684: A Step-by-Step Guide

Here's a step-by-step guide on how to complete Form 4684:

Step 1: Obtain the form

You can download Form 4684 from the Internal Revenue Service (IRS) website (www.irs.gov) or request a copy by calling the IRS.

Step 2: Provide your personal information

At the top of the form, enter your name, Social Security number (SSN), and other required personal information.

Step 3: Determine the type of loss

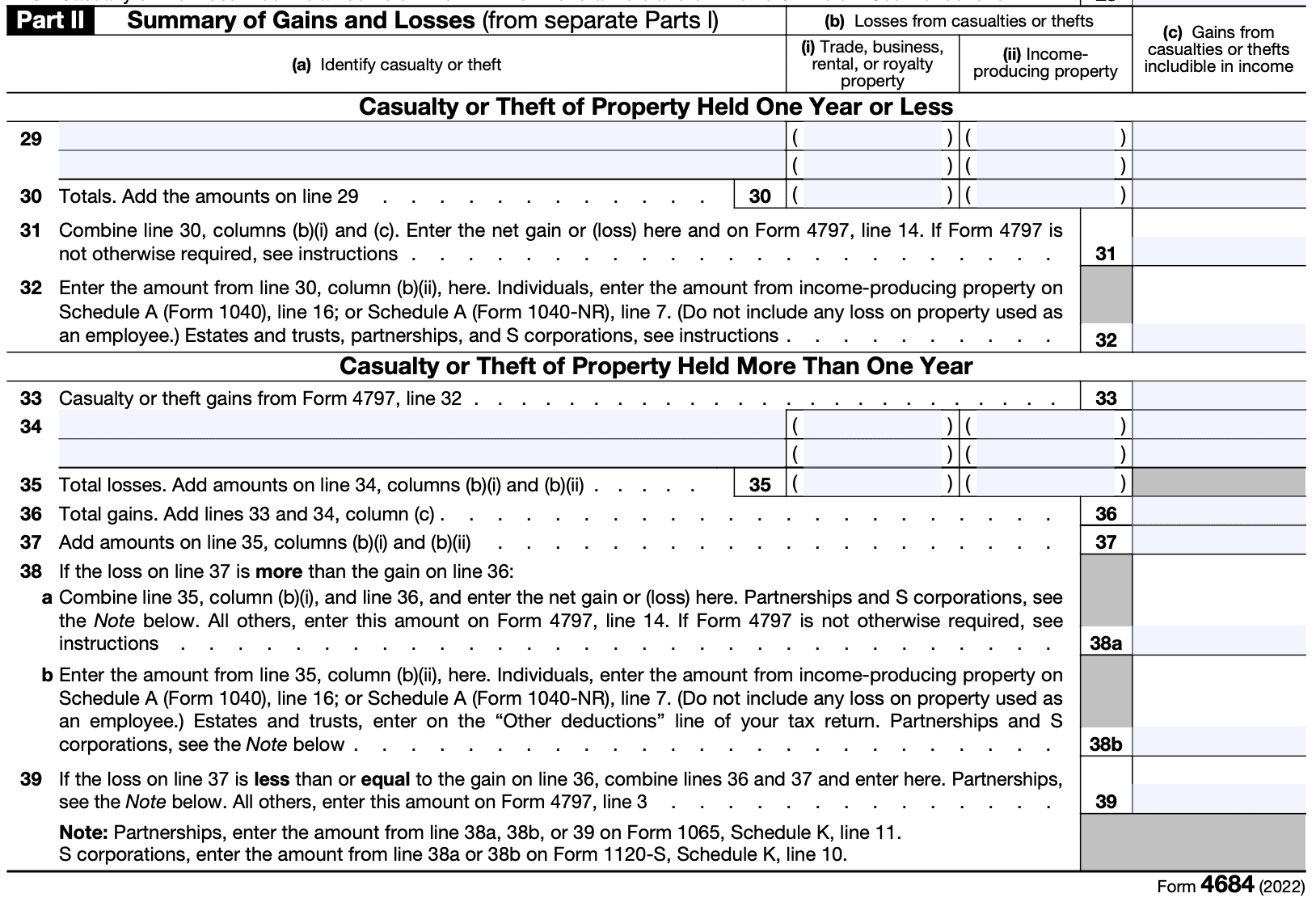

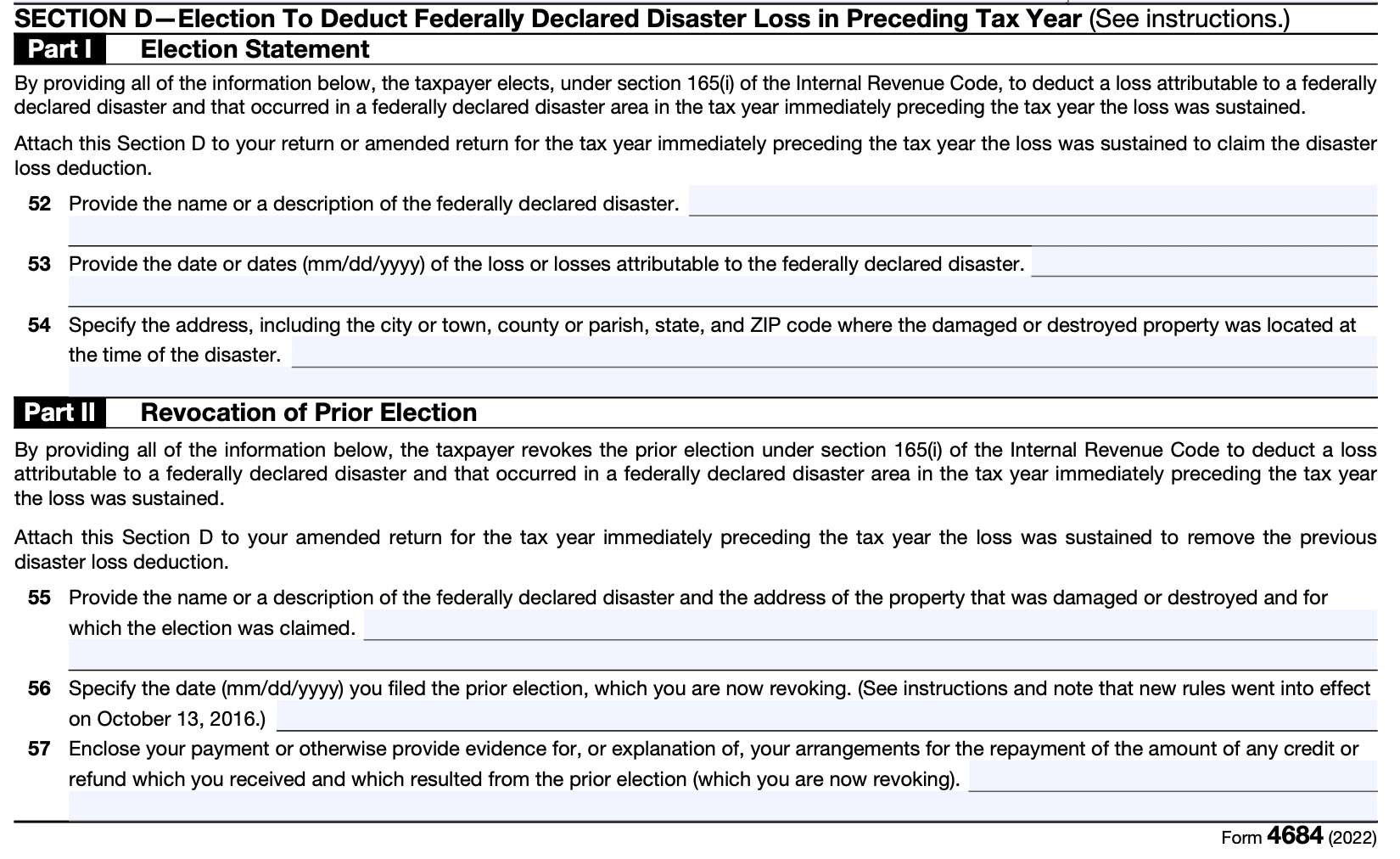

Form 4684 contains two sections, Section A for personal-use property (e.g., personal belongings) and Section B for business or income-producing property. Determine which section applies to your situation and focus on that section.

Step 4: Complete Section A or B

Section A: Personal-Use Property

Part I - Description of property and date of loss: Provide a description of the property that was lost or damaged and the date of the loss.

Part II - Cost or other basis: Enter the cost or other basis of the property. If you are not sure about the basis, consult the instructions or a tax professional.

Part III - Decrease in fair market value: Determine the decrease in the fair market value of the property as a result of the loss or damage.

Part IV - Adjusted basis: Calculate the adjusted basis by subtracting the decrease in fair market value from the cost or other basis.

Part V - Gain or (loss): Calculate the gain or loss by subtracting the adjusted basis from any insurance or other reimbursements you received.

Part VI - Amount of loss: Determine the amount of loss by comparing the adjusted basis with any insurance or other reimbursements received.

Part VII - Casualty and theft losses from other events: If you have any additional casualty or theft losses not covered by insurance, provide the necessary information in this section.

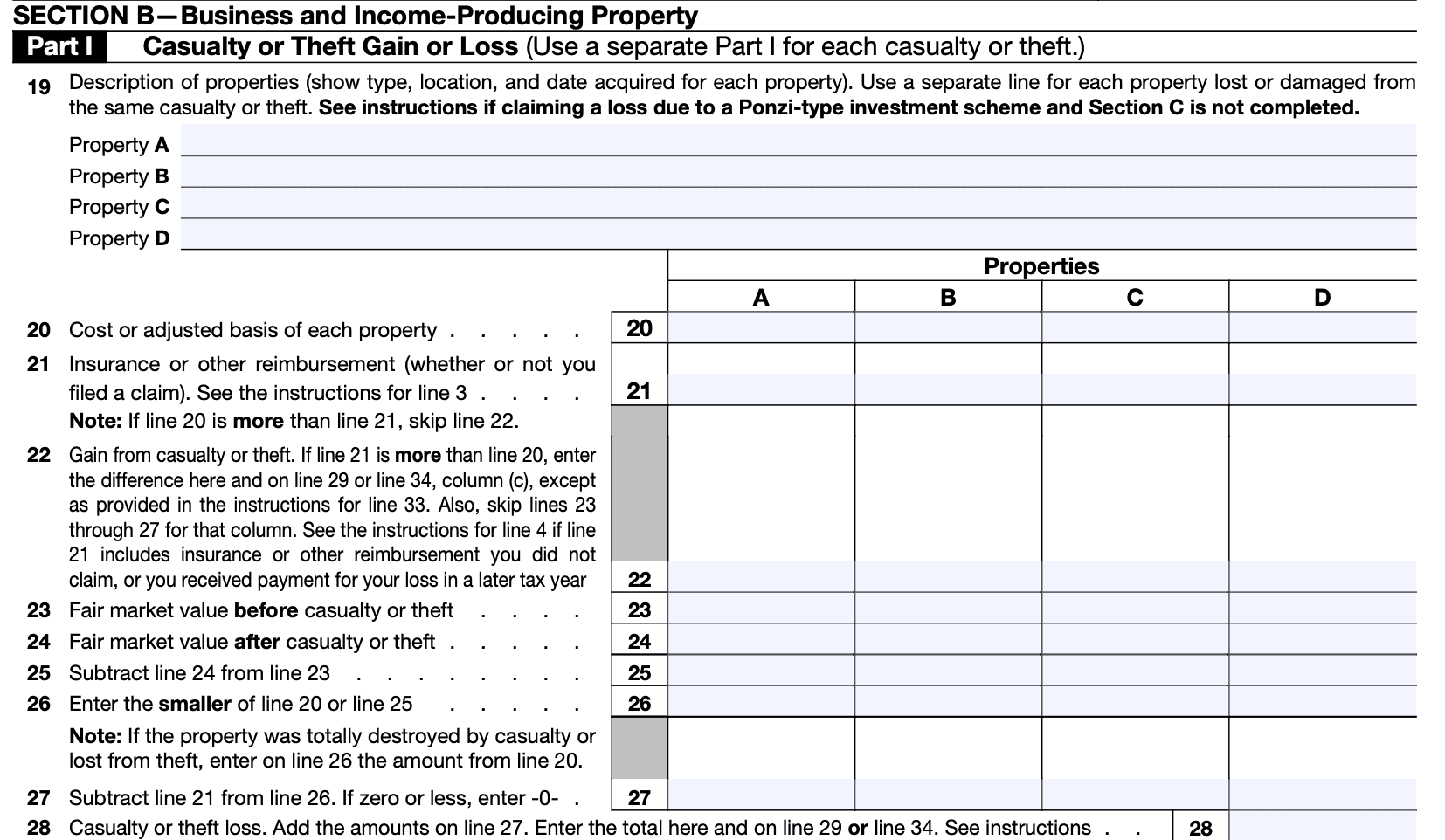

Section B: Business or Income-Producing Property

Part I - Description of property and date of loss: Provide a description of the property and the date of the loss or damage.

Part II - Cost or other basis: Enter the cost or other basis of the property.

Part III - Decrease in fair market value: Determine the decrease in the fair market value of the property due to the loss or damage.

Part IV - Adjusted basis: Calculate the adjusted basis by subtracting the decrease in fair market value from the cost or other basis.

Part V - Gain or (loss): Calculate the gain or loss by subtracting the adjusted basis from any insurance or other reimbursements you received.

Part VI - Amount of loss: Determine the amount of loss by comparing the adjusted basis with any insurance or other reimbursements received.

Part VII - Casualty and theft losses from other events: If you have any additional casualty or theft losses not covered by insurance, provide the necessary information in this section.

Step 5: Determine the amount of loss

Once you have completed the applicable section, calculate the total amount of your loss by adding up all the losses reported.

Step 6: Transfer the loss amount to your tax return

Transfer the total loss amount to the appropriate section of your federal income tax return (e.g., Schedule A for personal-use property or Schedule C for business or income-producing property).

Step 7: Retain documentation

Keep all relevant documentation, such as photos, appraisals, and repair estimates, to support your claimed losses. You may need to provide these documents if requested by the IRS.

It's important to note that Form 4684 can be complex, especially if you have multiple losses or unique circumstances. Consider consulting a tax professional for guidance to ensure you complete the form accurately and take full advantage of any eligible deductions.

Special Considerations When Filing Form 4684

When filing Form 4684, also known as the Casualties and Thefts form, there are several special considerations to keep in mind. Here are some important points to consider:

**Eligible events: **Form 4684 is used to report losses due to casualty or theft. Casualty events include sudden, unexpected, or unusual events such as accidents, fires, storms, floods, earthquakes, vandalism, and similar incidents. Theft refers to the unlawful taking of your property.

Personal and business Use: Determine whether the property affected by the casualty or theft was used for personal or business purposes. Different rules may apply depending on the use of the property. For example, if the property is used partially for business purposes, you may need to allocate the loss between personal and business use.

Insurance reimbursement: If you receive insurance reimbursement for the loss, you will need to adjust the amount of loss you report on Form 4684. Generally, you can only claim the loss to the extent it exceeds any insurance proceeds you receive. Report the net loss after subtracting the insurance reimbursement.

**Fair market value: **Determine the fair market value (FMV) of the property immediately before and after the casualty or theft. The FMV is the price the property would sell for on the open market. The difference between the two FMVs represents your loss. If you cannot determine the FMV accurately, you may need to consult a professional appraiser.

**Deductible loss: **Only deductible losses are reported on Form 4684. For personal use property, deductible losses are generally limited to those that are not reimbursed by insurance and exceed $100 per casualty event. Additionally, the total of all casualty and theft losses for the year must exceed 10% of your adjusted gross income (AGI) before you can claim the deduction.

**Reporting the loss: **Complete Form 4684 to report your casualty or theft loss. Transfer the calculated loss to Schedule A if you itemize deductions or Schedule C if the loss is related to your business. Be sure to follow the specific instructions provided by the IRS for accurate reporting.

Filing Deadlines & Extensions for Form 4684

Original filing deadline: The original filing deadline for Form 4684 is typically the same as the deadline for your federal income tax return. For most individuals, this is April 15 of the following year. However, if April 15 falls on a weekend or a holiday, the deadline may be extended to the next business day.

**Extension deadline: **If you need more time to file your tax return, you can request an extension. The extension gives you an additional six months to file your return, moving the deadline to October 15. To request an extension, you must file Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) with the IRS by the original filing deadline (usually April 15).

Extended filing deadline: If you have received an extension by filing Form 4868, your extended filing deadline for Form 4684 will be October 15. You should ensure that you include Form 4684 when you file your tax return by this extended deadline.

Remember, it's important to consult the latest IRS guidelines or a tax professional to get accurate and up-to-date information regarding filing deadlines and extensions for specific forms, including Form 4684.

Common Mistakes To Avoid While Filing Form 4684

When filing Form 4684, it's important to avoid certain common mistakes to ensure accurate and timely submission. Here are some mistakes to avoid:

Incorrectly identifying the type of loss: Form 4684 is used to report both casualty and theft losses. It's crucial to correctly identify the type of loss you are reporting to ensure accurate reporting on the form.

Failing to provide detailed descriptions: The form requires detailed descriptions of the property or items lost, damaged, or stolen. Avoid providing vague or incomplete information. Include relevant details such as make, model, serial numbers, and any distinguishing features.

Inaccurate valuation of the loss: When calculating the loss, use the fair market value of the property immediately before the casualty or theft occurred. Avoid overstating or understating the value, as this can lead to discrepancies and potential issues with the IRS.

Not reporting insurance reimbursements: If you received insurance reimbursements for the loss, they should be reported on Form 4684. Failure to include this information could raise red flags during an audit.

Missing supporting documentation: Form 4684 may require supporting documentation, such as police reports, insurance claim documents, or appraisals. Ensure you have the necessary documentation to substantiate your claimed losses. Keep copies for your records in case of future inquiries or audits.

**Incorrectly calculating the deductible loss: **The deductible loss is calculated by subtracting any insurance reimbursements, salvage value, and $100 (or $500 for federally declared disaster losses) from the total loss amount. Double-check your calculations to avoid errors.

**Failing to meet the reporting deadlines: **Form 4684 should be filed in the year the casualty or theft occurred. Make sure to meet the filing deadline to avoid penalties or the loss of potential tax benefits.

Conclusion

Form 4684 serves as a vital tool for individuals who have suffered losses due to casualties and thefts. By carefully completing this form and providing the necessary documentation, taxpayers can potentially reduce their taxable income and alleviate some of the financial burdens associated with these unfortunate events.

Remember to consult a tax professional for expert advice and guidance, ensuring you make the most of the deductions available to you during challenging times.