- IRS forms

- Form 14429

Form 14429: Tax-Exempt Bonds Voluntary Closing Agreement Program Request

Download Form 14429Tax-exempt bonds offer significant benefits to issuers by allowing them to finance projects at lower interest rates. However, to maintain their (link: https://fincent.com/glossary/tax-exempt text: tax-exempt status), bond issuers must comply with specific regulations and requirements set forth by the Internal Revenue Service (IRS).

The IRS sets strict guidelines regarding the issuance and use of tax-exempt bonds to ensure that these bonds serve their intended purpose and provide the promised community benefits. When issuers discover that they may have inadvertently violated these guidelines, they risk losing the tax-exempt status of their bonds, which can lead to higher interest costs and financial consequences.

The TEB VCAP offers a voluntary compliance program designed to help issuers correct unintentional violations of tax-exempt bond rules. By voluntarily coming forward to the IRS and requesting entry into the program, issuers can negotiate an agreement with the IRS to resolve the compliance issues and protect their bonds' tax-exempt status.

In this blog, we will explore Form 14429, its significance and how to complete it to request entry into the TEB VCAP.

Purpose of Form 14429

The program is designed to help issuers resolve compliance issues related to tax-exempt bonds in a cooperative and mutually agreed-upon manner with the IRS. By voluntarily participating in VCAP, issuers can avoid potential litigation and penalties that could arise from the IRS discovering the violations through an audit or other means.

IRS forms typically serve various purposes related to tax reporting, payments, and compliance. For example:

(link: https://fincent.com/blog/what-is-irs-1040-your-complete-guide-this-tax-season text: Form 1040) (U.S. Individual Income Tax Return): This is used by individuals to report their annual income and calculate the amount of taxes owed or refunded.

Form W-2: Wage and Tax Statement - Provided by employers to employees, showing the amount of wages paid and taxes withheld during the tax year.

Form 1099: Various types of (link: https://fincent.com/blog/1099-forms-for-freelancers-and-small-business-owners text: 1099 forms) are used to report different types of income, such as interest, dividends, self-employment income, and more.

Form 941 (Employer's Quarterly Federal Tax Return): This is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages.

Form 8863 (Education Credits) This is used to claim educational credits, such as the American Opportunity Credit or the Lifetime Learning Credit.

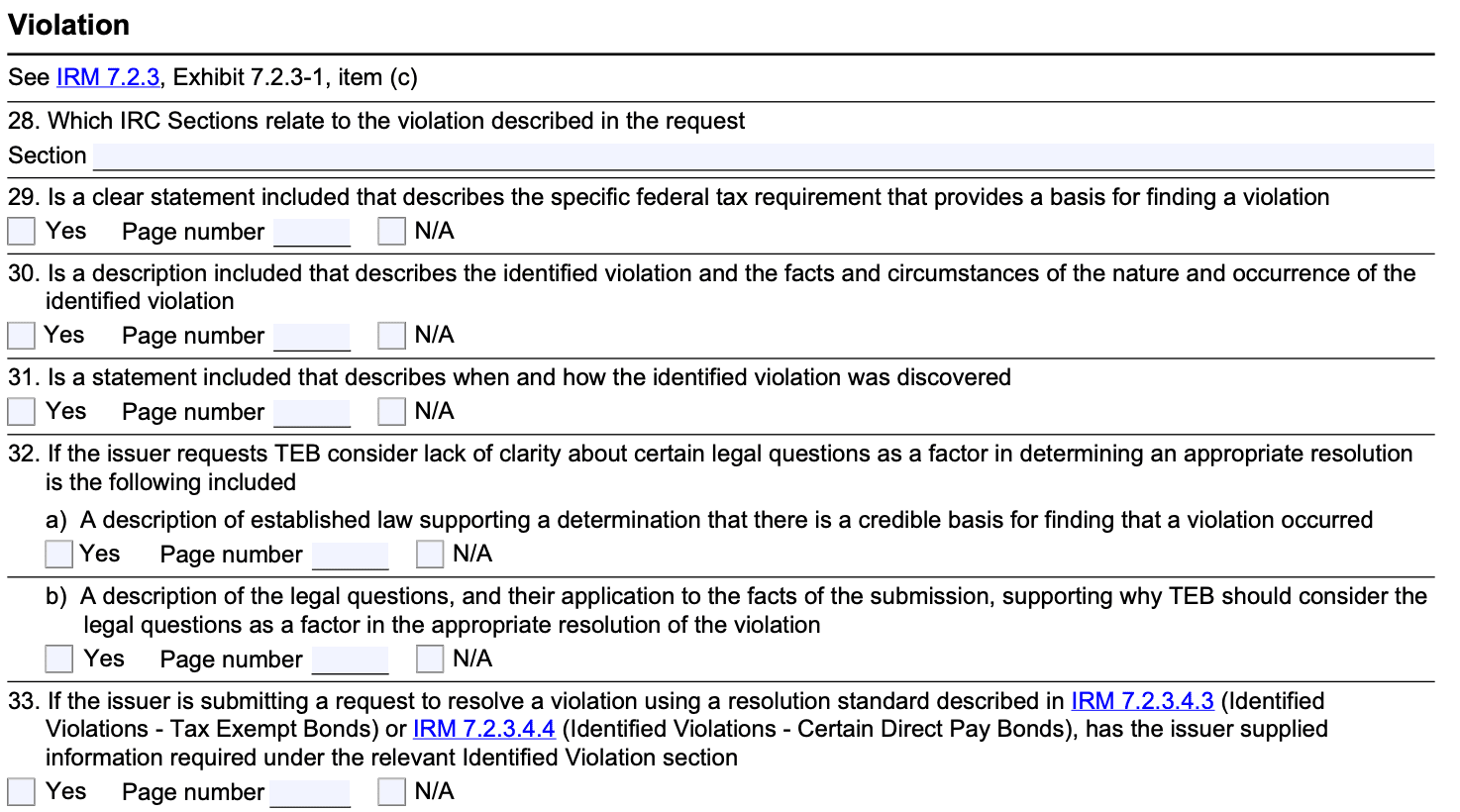

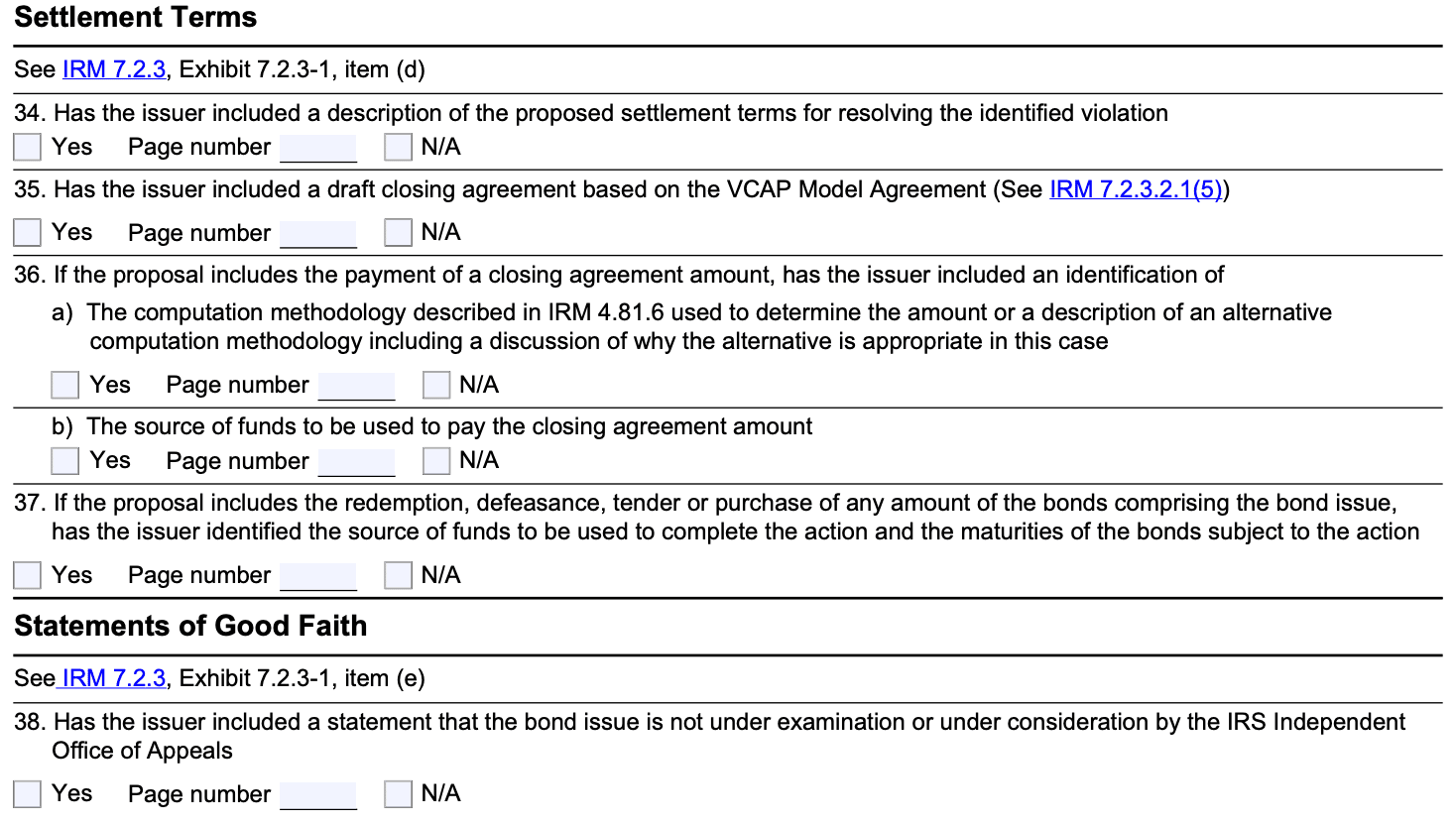

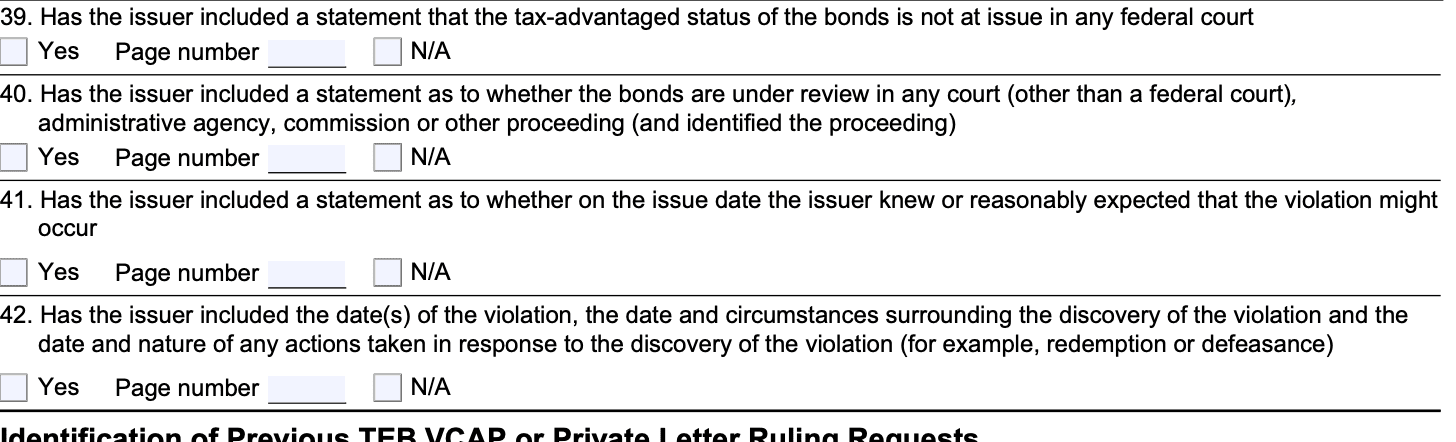

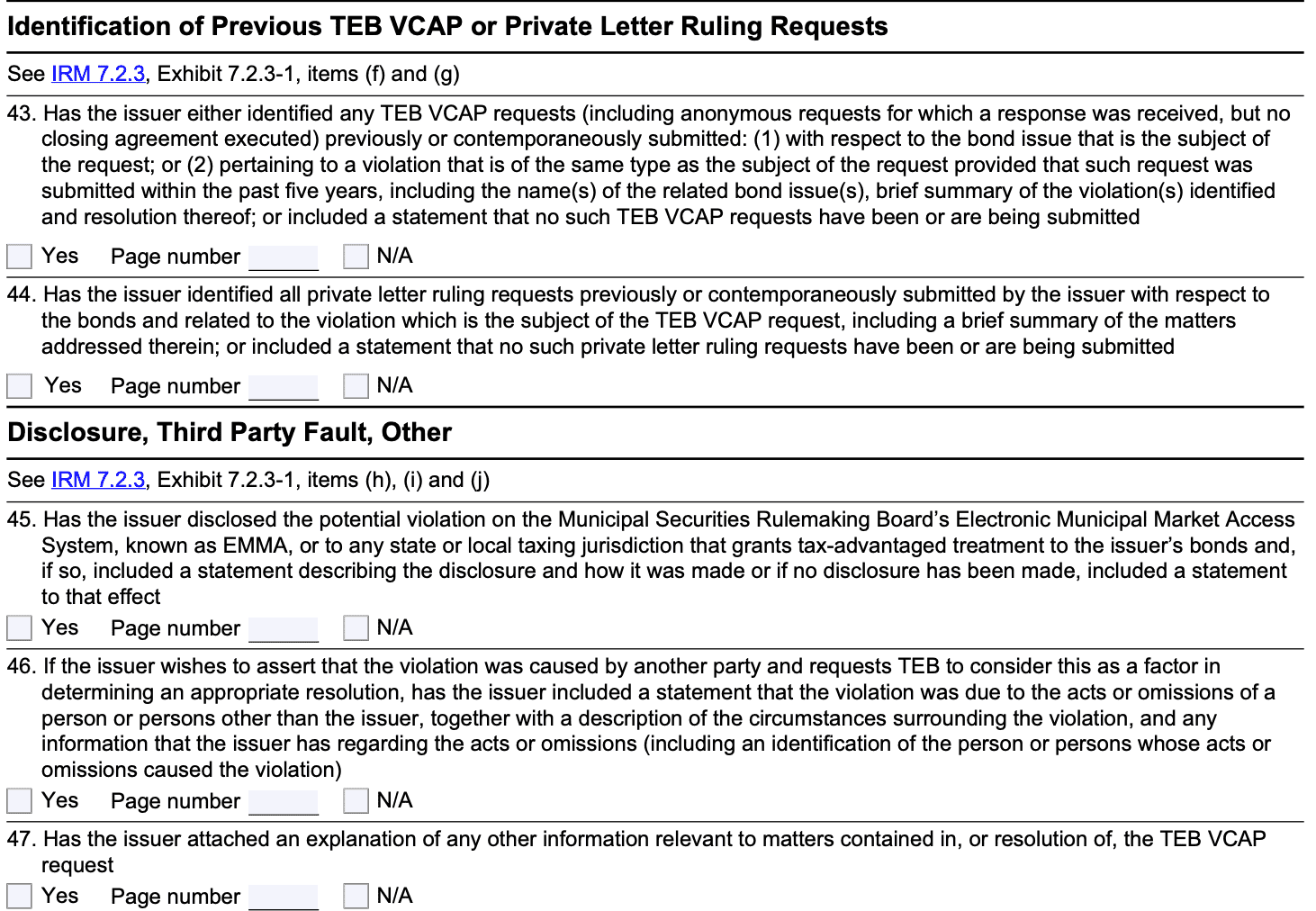

Key Components of Form 14429

Given below are some of the key components of Form 14429:

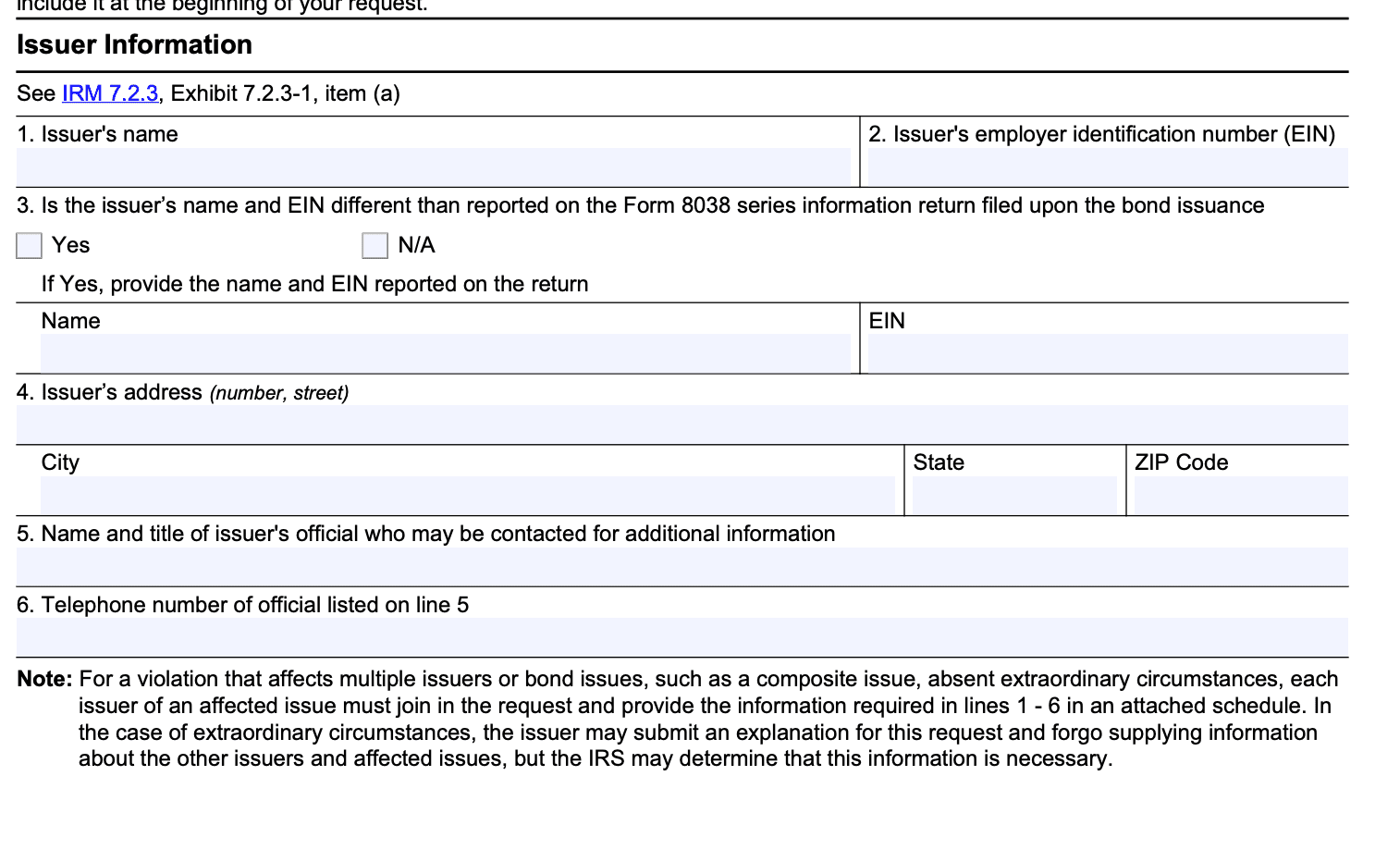

Issuer information: This section requires basic information about the issuer, such as the name, address, and contact details. It is essential to double-check this information to avoid any communication issues with the IRS.

Description of compliance issue: Here, issuers must provide a detailed description of the compliance issue they have identified. It is essential to be transparent and thorough when explaining the problem to ensure the IRS can accurately assess the situation.

Correction method: Issuers need to outline their proposed method for correcting the compliance issue. This may involve adopting certain remedial actions to address the violation effectively.

Impact on bondholders: In this section, issuers must explain the potential impact of the compliance issue on bondholders. This includes any financial consequences or changes to the bond's tax-exempt status.

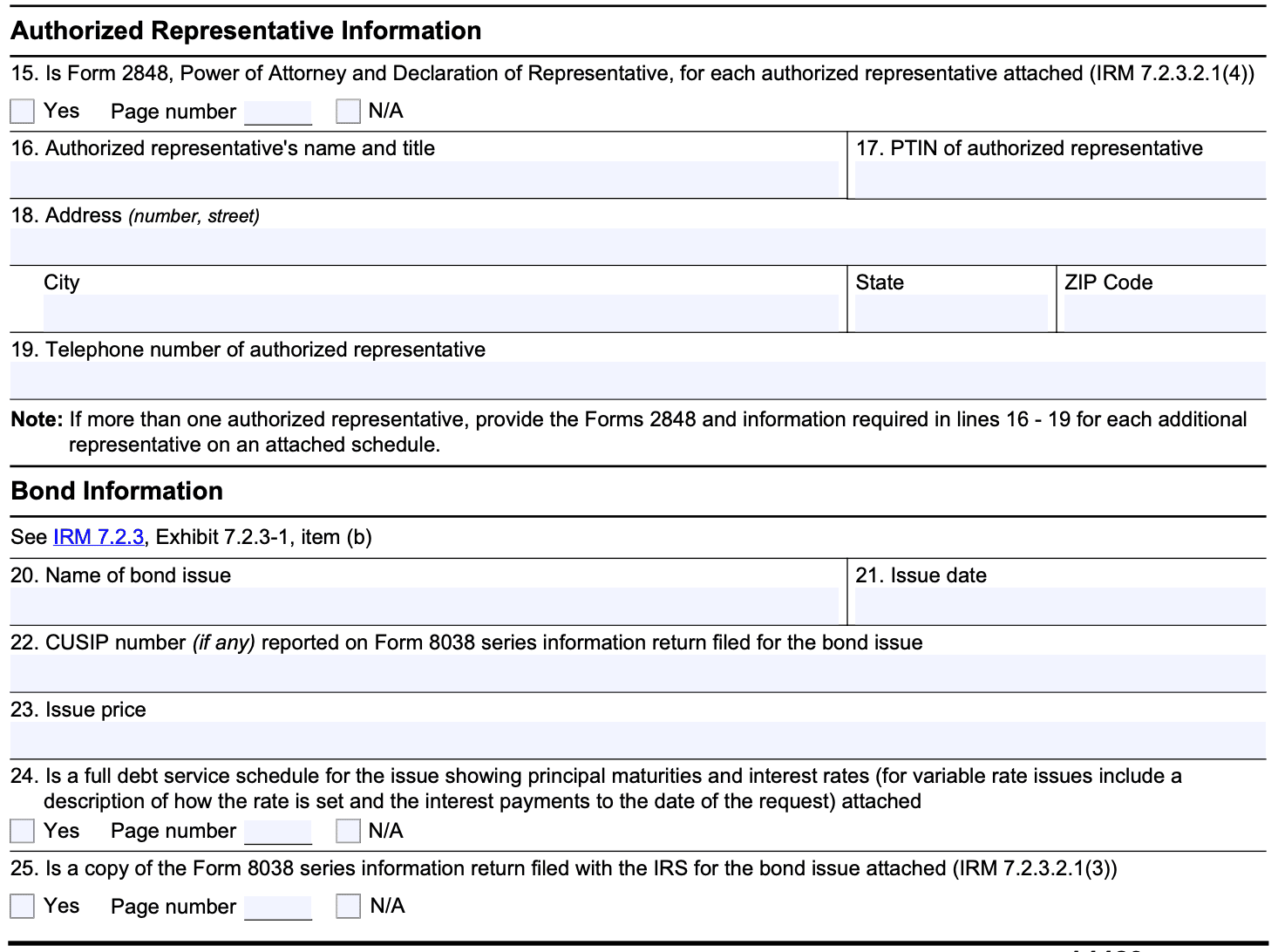

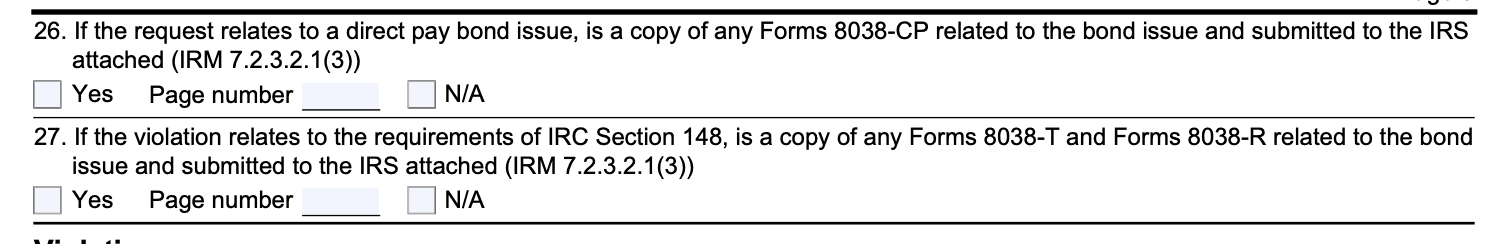

Additional documents: Form 14429 may require supplementary documentation to support the issuer's case. These documents can include legal opinions, bond transcripts, and other relevant records.

Benefits of Form 14429

Form 14429 is administered by the Internal Revenue Service (IRS) and is designed to help issuers of tax-exempt bonds address non-compliance issues. By participating in VCAP, issuers can potentially receive certain benefits and avoid more severe consequences that may arise from non-compliance.

The benefits of participating in the TEB VCAP can include:

-

Resolution of non-compliance: Issuers can resolve issues related to tax-exempt bond compliance and remedy violations in accordance with IRS guidelines.

-

No enforcement action: By voluntarily participating in VCAP, issuers can avoid potential enforcement actions, such as audits, penalties, or other sanctions that might otherwise be imposed if non-compliance issues are discovered by the IRS through other means.

-

Reduced penalties: If the IRS determines that penalties would have been appropriate under normal circumstances, they may offer reduced penalties for issuers who willingly come forward and correct their non-compliance through VCAP.

-

Preserved tax-exempt status: VCAP allows issuers to rectify compliance issues, helping to preserve the tax-exempt status of their bonds.

-

Tax credits for specific expenses: Certain forms provide tax credits for expenses related to education, energy-efficient home improvements, child and dependent care, adoption, etc.

-

Retirement savings contributions: Some forms may allow taxpayers to claim tax deductions for contributions to retirement accounts like IRAs or 401(k)s.

-

Child tax credit: Available to eligible taxpayers with dependent children, this credit helps reduce the tax burden.

Who Is Eligible To File Form 14429?

Form 14429 is used to request eligibility for the Tax Exempt Bonds Voluntary Closing Agreement Program (TEB VCAP). The TEB VCAP allows issuers of tax-exempt bonds to voluntarily resolve certain violations of the tax-exempt bond rules by entering into a closing agreement with the Internal Revenue Service (IRS).

Eligibility for the TEB VCAP typically depends on the specific circumstances of the issuer and the nature of the violations involved. Some common eligibility criteria for the program include:

Self-identification: Issuers must identify the violations on their own and disclose them to the IRS before the IRS discovers the issue through other means (such as an audit).

Materiality: The violations must be considered material, meaning they could potentially jeopardize the tax-exempt status of the bonds or result in significant adverse tax consequences.

Timeliness: The issuer should initiate the request for a voluntary closing agreement in a timely manner.

Non-willful: The violations should be non-willful, meaning they were not intentional but rather due to oversight or misunderstanding.

Cooperation: Issuers should be willing to cooperate with the IRS to correct the violations and come into compliance with the tax-exempt bond rules.

Good faith effort: Issuers must demonstrate a good faith effort to maintain compliance with the tax-exempt bond requirements.

How To Complete Form 14429 : A Step-by-Step Guide

Step 1: Obtain the form

Locate the most recent version of Form 14429. It is usually available on the official website of the issuing authority, such as the IRS or any other government agency.

Step 2: Read the instructions

Before you begin filling out the form, carefully read the accompanying instructions or guidelines. This will help you understand the purpose of the form and the specific information you need to provide.

Step 3: Gather necessary information

Collect all the information and documents you'll need to complete the form accurately. This may include personal information, financial data, or any other relevant details depending on the purpose of the form.

Step 4: Fill out personal information

Start by providing your name, address, contact details, and any other required personal information.

Step 5: Description of alleged violation

This is the critical section where you provide a detailed description of the (link: https://fincent.com/glossary/irs-scams text: alleged tax fraud) or suspicious activity. Be as specific as possible and include all relevant information and dates. Attach any supporting documents that can help the IRS understand the nature of the violation better.

Step 6: Attach required documents

If the form requires any supporting documents, make sure to attach them securely. Keep a copy of the filled-out form and supporting documents for your records.

Step 7: Add date and identification details

Enter the current date and any identification numbers or reference numbers that may be required.

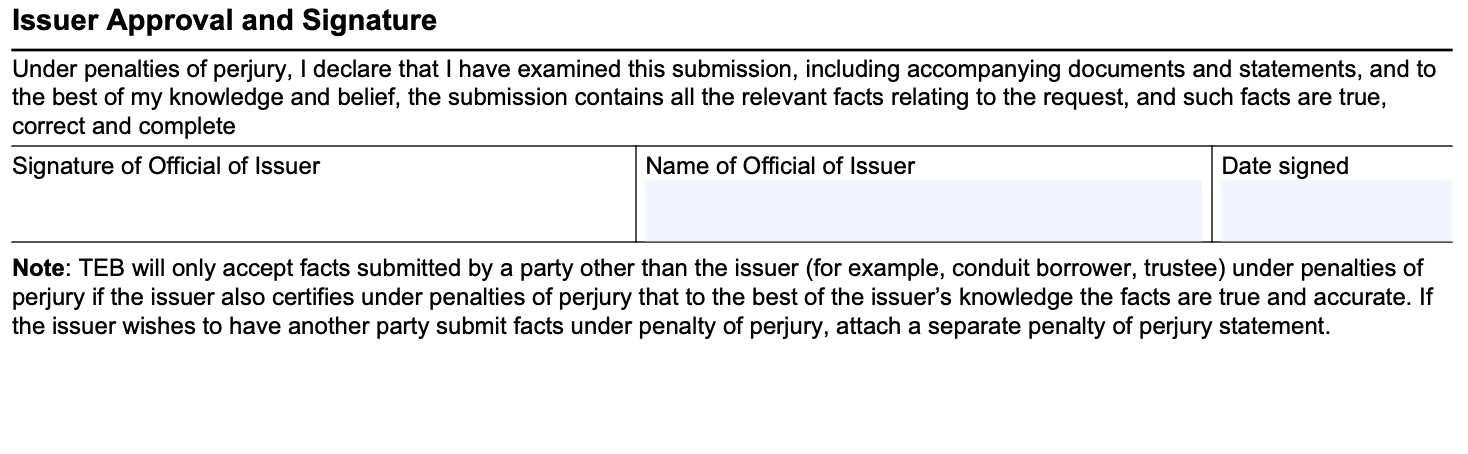

Step 8: Sign and date the form

If a signature is required, sign and date the form accordingly. Some forms may require a witness signature as well.

Step 9: Submit the form

Submit the completed form and any required attachments to the appropriate authority as specified in the form's instructions. This can often be done online, via mail, or in person, depending on the nature of the form.

Step 10: Confirm and follow up

If you submit the form electronically, you may receive a confirmation of receipt. If you submit it by mail, consider using certified mail to track delivery. If there are any updates or follow-ups related to the form, be sure to respond promptly.

How To File Form 14429: Offline/Online/E-filing

To file any tax form, including potentially Form 14429 if it exists in the future, you generally have three options: online, offline (paper filing), and e-filing. Here's a general overview of each method:

Online filing

Online filing is the most convenient and popular method for filing tax forms. The IRS offers several electronic filing options, including Free File Fillable Forms for taxpayers who want to do their taxes themselves. Additionally, many commercial tax software providers offer e-filing services for various tax forms.

To file online, you need to access the IRS website or use an authorized e-filing service. Follow the instructions provided, enter your tax information, and submit the form electronically. Online filing usually offers faster processing and reduces the likelihood of errors since the software can catch common mistakes.

Offline filing

If you prefer to file a paper tax return, you can download the relevant tax form, print it out, and complete it manually. For paper filing, you'll need to mail the completed form, along with any supporting documents or payments, to the appropriate IRS address, which can be found in the form's instructions.

E-filing through a tax professional

You can also choose to work with a tax professional, such as a certified public accountant (CPA) or a tax preparation service, to help you file your taxes. Many tax professionals offer e-filing services and can electronically submit your tax forms on your behalf.

Common Mistakes To Avoid While Filing Form 14429

Form 14429 is a form used by the Internal Revenue Service (IRS) to request additional information or clarification on documents submitted for the Individual Taxpayer Identification Number (ITIN) application. To avoid mistakes when filling out Form 14429, consider the following tips:

Double-check information: Ensure all information provided is accurate and matches the documents submitted. Mistakes in names, dates of birth, addresses, and other personal details can lead to delays or rejections.

Provide supporting documents: Include all necessary supporting documents with the form. Common documents required for an ITIN application include passports, birth certificates, and other identification documents. Ensure they are valid and not expired.

Complete all sections: Fill out all required sections of Form 14429. Leaving any part blank or incomplete could result in processing delays or rejection.

Use the latest version of the form: Always use the most recent version of Form 14429, which can be found on the IRS website. Using outdated versions may lead to processing issues.

Use legible handwriting: If you are filling out the form by hand, use clear and legible handwriting to avoid misinterpretation of the information provided.

Follow instructions carefully: Review the instructions provided with the form and follow them meticulously. This will ensure you include all the necessary information and documentation.

Include a cover letter (if applicable): If there are any special circumstances or explanations required, consider including a cover letter along with Form 14429 to provide additional context.

Submit the form to the correct address: Double-check the address provided on the form or in the instructions to ensure it is the correct location for submitting the completed Form 14429.

Keep copies of everything: Make copies of the completed Form 14429 and all supporting documents before sending them to the IRS. This will help you have a record of what was submitted.

Submit the form promptly: Submit the form and supporting documents as soon as possible after receiving the request from the IRS. Delays in response may lead to further complications.

Conclusion

Form 14429 may not be as well-known as some of the more common tax forms, but its significance cannot be overlooked. For taxpayers involved in certain types of property transfers to foreign corporations, this form plays a critical role in deferring the recognition of gains for tax purposes and ensuring compliance with the IRC.

If you believe Form 14429 may be relevant to your tax situation, it's crucial to consult a qualified tax professional who can guide you through the process, provide expert advice, and ensure that all required information is accurately provided to the IRS. Compliance with tax laws is vital to avoid potential penalties or issues with the IRS in the future.