Bookkeeping For Travel Agencies: All You Need to Know

If you run a travel agency, you can relate to the nuances of the ever-changing trends and needs of the industry. In the middle of such a dynamic business environment, the last thing you would want to do is spend hours figuring out the cash flows, expenses, revenue, and other financial figures.

Travel agencies serve numerous sectors and industries together. From transport to hospitality and all the planning that goes in between, numerous aspects need to be taken care of to run an agency smoothly. Handling finances for such businesses, especially with their presence in multiple locations – can easily become overwhelming for the stakeholders. It all starts with accounting, and if bookkeeping for travel agencies is handled effectively, smooth sailing of the business is assured.

If you run a travel agency, you can relate to the nuances of the ever-changing trends and needs of the industry. In the middle of such a dynamic business environment, the last thing you would want to do is spend hours figuring out the cash flows, expenses, revenue, and other financial figures.

After all, you have a business to run and massive opportunities to grow.

Handling business finances, however, cannot be ignored. But you don’t need to worry about the complexities that arrive with accounting or bookkeeping for travel agencies. This blog will break down the entire bookkeeping process for your travel agency business. We will also introduce you to a solution that will simplify your business accounting to a large extent.

What Is Bookkeeping?

The process of recording and maintaining all of your company’s financial transactions into organized accounts is referred to as bookkeeping. Bookkeeping is an integral part of accounting. Accurate and regular accounting is essential for every business – big or small, to make key financial decisions like investing and operating.

As bookkeeping involves maintaining day-to-day transactions – all the inflows and outflows including revenue, payroll, payment of taxes, expense tracking, interest payments against loans, investments, and more are recorded in the books of accounts.

For all the parties related to a business – owners, investors, financial institutions, or even the government, effective financial data management is the key to tracking the business’s financial status. Not to forget, the stakeholders should also be aware of all the transactions taking place in the company.

Here are the primary reasons that convey the importance of bookkeeping for all businesses:

- Accounting, which refers to measuring, processing, and communicating financial information of a company – totally depends on accurate and up-to-date bookkeeping.

- Summarizing the income and expenditure to make the right decisions for your company’s positive growth is done by periodic analysis of the books of accounts. Additionally, documents like balance sheets, income statements, and cash flow statements help you set up realistic and strategic business goals.

- Filing your taxes is not a straightforward task. Effective bookkeeping ensures that you comply with the Internal Revenue Services’s (IRS) regulations and financial governing systems. Hence, you can avoid any possible legal issues.

Also Read: Bookkeeping vs Accounting: Key Differences You Need to Know

Why Do Travel Agencies Need Bookkeeping?

We discussed the ins and outs of bookkeeping and why it is important for all businesses regardless of their industry, scale, location, or ownership.

Let’s now dive into the accounting needs of travel agencies and find out the various reasons why you as a business owner, need bookkeeping regularly.

1. Organizing crucial financial information

The financial records of your company reflect the biggest truth of your organization. Imagine you have to apply for loans or grants to grow your travel agency – your financial performance is the key there. Even basic business analysis and planning need financial information organized in one place.

In case proper books are not maintained, the transaction data of your travel business lies spread out all over the place. You cannot figure out what capital you’re holding, your profits, and which part of the business needs to be worked upon. Bookkeeping solves all of these by making the financial information readable.

2. Informing your business decisions

Running a business requires you to be a 24x7 decision-maker. Effective bookkeeping, followed by accounting helps you make better decisions easily.

Suppose in your travel agency; you might need to make decisions like:

- Hiring more employees

- Expanding your business geographically

- Hopping into more sectors and services related to travel and tourism

- Getting new office space for your growing team

- Marketing your business through new channels

- Giving your employees a raise

- Offers and discounts for customers

The list is endless, and an inside-out analysis of your financial records enables you to make informed decisions. Hence, you can determine if your business can afford all of your expenses or investments at a given point in time.

3. Filing taxes accurately

What comes to your mind when you hear ‘taxes’? Is it ‘deductions’?

No, we are not into the business of reading minds, but it’s usually the first thing business owners think about. Filing taxes can be confusing and stressful if not supported with accurate financial records. And regular, error-free bookkeeping can also help you identify all possible exemptions.

Not to forget – the extensive amount of time tax filing can consume. On the other hand, organized bookkeeping means having detailed records of your travel agency receipts, invoices, and balance sheets. In that case, getting your accounts audited would probably need much lesser time.

4. Performance analysis and budgeting

How do you set budgets for all the different verticals of your business? Will it be not right to say that it largely depends on your previous year’s performance?

Well-organized, clear, and updated records supported by effective bookkeeping allow you to review past performance and create future plans accordingly. For your travel agency, some meaningful metrics for analyzing performance can be:

- Annual revenue

- Revenue growth from the previous year

- ROI on different marketing expenditures

- The difference in costs of services now as compared to costs previously

A critical part of financial planning is budgeting from hiring to marketing, investments, growth, and everything in between needs you to set a budget upfront. So accurate bookkeeping is a core need for your business.

5. Getting Investors

Raising funds from external investors is a great option if you want to scale your travel agency services business. The funding can be in the form of capital, equity, grants, debt, or others. But your potential investors need to have a clear outlook and understanding of the business’s financials.

Unless you have detailed accounting records of your business, an investor cannot predict the success or failure of your travel agency – and hence cannot invest. Most VCs or Angel investors seek up-to-date books immediately, and you won’t have much to prepare. There’s no way you can raise funding without bookkeeping.

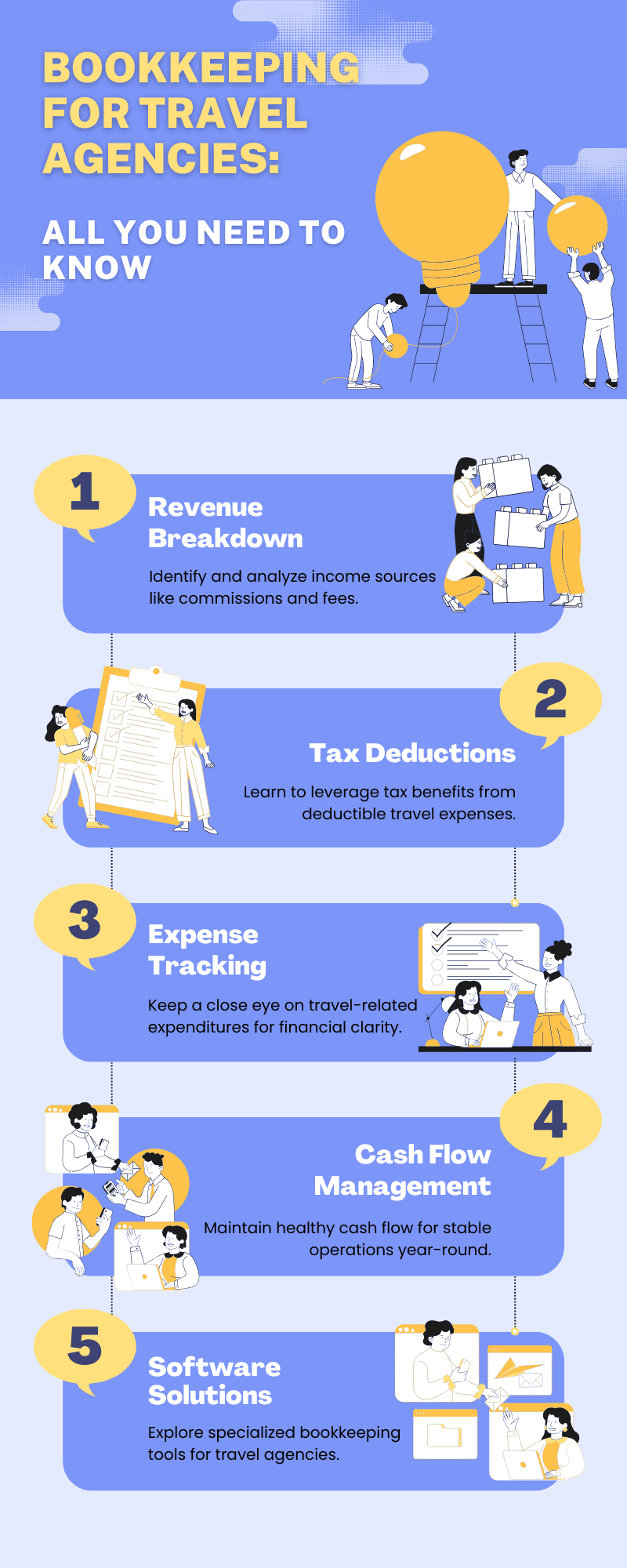

How to do Bookkeeping for Travel Agencies?

Step 1: Decide on the Method of Bookkeeping

Before you even start taking any records of transactions happening in your travel agency, you need to choose between the two methods of accounting:

- Cash basis accounting

- Accrual basis accounting

The difference between the two is quite straightforward – the cash-based system only records transactions when you get the money in your hand. It is the preferable method of bookkeeping and accounting for small businesses, and is much easier to comprehend too.

Accrual basis accounting, on the other hand, involves recording transactions as and when they take place, regardless of whether the amount has been received by you or not. The primary concern, in this case, is recording the transaction.

Step 2: Set Up Your Accounting and Open a New Bank Account

The next step is deciding on the mode of recording transactions for your travel agency bookkeeping. You need to finalize the following:

- Will the books be maintained offline or online? Cloud-based bookkeeping is highly recommended.

- Will you maintain the books yourself, or hire someone - either full-time or part-time?

- Are you willing to outsource the maintenance of your books to an accounting partner company?

- Will you be using an accounting software solution?

Analyze the scale of your travel agency business and answer these questions to move on to the next steps.

Ensure you open a new bank account for your travel agency business if you don’t already have one. Don’t perform business transactions from your personal bank account.

Step 3: Decide on the Methods of Receiving Payments

Establish your methods of receiving payments. If you opt for methods like cash, credit card, bank transfer, or others – define all of them before beginning your bookkeeping.

The methods you choose for receiving customer payments for your travel agency are recorded and verified accordingly. So it’s vital that you stick to the pre-determined modes of performing transactions. It makes your operations and finances simpler too.

Step 4: Start Recording Transactions Regularly

The key to effective bookkeeping is to record transactions regularly and, most preferably, daily. Most travel agencies have customer bookings happening daily, so it’s crucial to record them daily. Both your revenue and expenses should be recorded to balance the books.

- **(link: https://fincent.com/blog/business-cash-flow-overview-examples-and-types-of-cash-flows text: Manage cash flow): **Record the net cash flow from sales and expenses. This helps you keep track of cash management for your business and helps avoid any financial problems.

- **Maintain general ledger: **This records everything your travel agency owns and what it owes. It’s another tool that should be updated regularly as it impacts your company’s financial status.

- **Manage income statement: **This records your total income and the net expenses for your travel agency, which further helps evaluate the net profit over time. ** **

Recording your transactions in a timely manner also helps you create and map other accounting documents, along with (link: https://fincent.com/blog/what-is-income-tax-liability-and-how-do-you-calculate-it text: calculating tax liabilities).

Step 5: Maintain and Review Books

Now that you are recording all the transactions and practising bookkeeping regularly for your travel agency, the next step is maintaining and reviewing your books promptly.

To ensure that all the sales, expenses, and other transactions are being recorded correctly, you should track your business and your accounting activities. And it’s vital to thoroughly review your books at least once a month.

Simplify Your Travel Agency Bookkeeping with Fincent

Running a fast-paced and dynamic business like a travel agency and handling the accounts alone can be overwhelming at times, especially when you are looking to expand your agency and scale the business.

Gone are the days when you needed to handle your accounts manually in registers and ledger books. Effective cloud-based bookkeeping and accounting solutions now make your job a lot easier and ensure ease of doing business.

Fincent is your one-stop solution for all financial management needs. With cloud-based bookkeeping and accounting curated for your travel agency business, you can stop worrying about bookkeeping, filing your taxes, tracking expenses, collecting and making payments, and much more. We handle it all.

(link: https://fincent.com/bookkeeping-for-agency text: Sign up) for your ultimate finance department and focus on making better business decisions.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more