A Detailed Guide to Filing the Schedule K-1 Tax Form

Schedule K-1 in Form 1065 is submitted by partners of a business to report their profits and losses to the IRS. Read about the various aspects of Schedule K-1.

Schedule K-1 is a form that you need to complete and submit if you are a partner in a business. It shows the details of profit sharing or losses in the past financial year. The form also features information on deductions and tax credits. Schedule K-1 is a part of (link: https://fincent.com/blog/irs-form-1065-what-it-is-how-to-file-it text: IRS Form 1065).

The K-1 form requires a lot of information to be filled in before submitting. Although it can be confusing, you will find most of the boxes self-explanatory. We guide you through all the aspects of Schedule K-1 of IRS Form 1065 to help you out.

Where Can I Find a K-1 Tax Form?

Schedule K-1 is a downloadable form that you can get from the official website of the IRS. Your accountant may also pass on one for you to complete while filing Form 1065.

Who Has to File the Schedule K-1 Tax Form?

Now that you know what a K-1 tax form is, the next question you may ask is who has to file it.

You will have to file a K-1 form if you are part of a general partnership, limited partnership, or a limited liability company (LLC). Given below are the three main categories of partnerships from which members could file a Schedule K-1 form:

- General Partnership: A partnership where each partner has an equal share and control of the business.

- Limited Partnership: A partnership with at least one general partner and one limited or sleeping partner. The sleeping partner isn't active but contributes money to run the business.

- Limited Liability Company (LLC): An LLC is a partnership that is incorporated to prevent it from being taxed on both the company income as well as the profits distributed to the partners. The partners have limited liabilities that prevent them from being sued or going bankrupt.

If you are a member of any of the above three categories of partnership companies, you have to file a scheduleorm 1065 K-1 form. As a responsible partner and taxpayer, you should ensure that:

- A partnership tax return has been filed by your partnership.

- You file your individual Schedule K-1 form.

But what if your business relationship with your partners has ended? Let's look at an example.

When Robert passed out of business school, he didn’t want to work in a regular job. His passion for food and fascination with the food industry motivated him to start a specialty restaurant in his locality.

Initially, the restaurant did well, but a year down the line, there were differences between the partners. The joint venture began to lose money, and the partners went their separate ways.

So did the partners have to file taxes at the end of the tax year? Yes, of course, they did. Following the filing of the partnership business tax tracker and returns, each partner had to file an individual K-1 tax form. So, whatever the status of the partnership, you have to file this form.

A sole proprietorship is a type of an unincorporated entity that is owned by one individual only. It is the simplest legal form of a business entity. Understand everything about sole proprietorship.

K-1 Distribution

There is a section in the K-1 form that asks you for a breakup in the distribution of profits in the partnership. It would need to reflect the provisions made in the partnership agreement, so you should refer to the partnership deed for this section.

Mentioning the profit distribution is very important because here, the IRS is asking you about your share in the company's profits. Your income level may vary, which will determine the amount of tax that you will finally have to pay.

What Is the Difference Between the K-1 and the 1099 Tax Forms?

When you go to file your income tax returns as a partner, you will come across two forms – the Schedule K-1 form and the 1099 tax form. Don’t be confused between the two. The difference is quite simple.

Schedule K-1, as we have already discussed, is a form for showing your profit and loss during the financial year. A 1099 form provides details of how other businesses have paid your partnership for amounts over $600 during the tax year.

On adding the total amount from all the 1099 forms, you will get an approximate figure of the partnership’s total income during that financial year. You can use the same information for filing your Form 1065.

Self-Employment Tax K-1

As a self-employed person, you are liable to pay self-employment tax in addition to state and federal income tax. The rate of the self-employment tax is 15.3% of your net income from the business.

Special Considerations for the Self-Employment Tax K-1

If you are a self-employed worker, you are not subject to Withholding Tax (also known as Retention Tax). It means that direct deductions need not take place, as is the case if you work for an employer. However, you need to make quarterly estimated tax payments.

Another important thing to note, a recent development is the CARES (Coronavirus Aid, Relief, and Economic Security) Act passed on 27 March 2020. Under this act, it defers employer payment as part of self-employment taxes, which would be paid to Social Security from 27 March 2020 to 31 December 2020.

50% of these taxes will be deferred until 31 December 2021, and the remaining 50% until 31 December 2022.

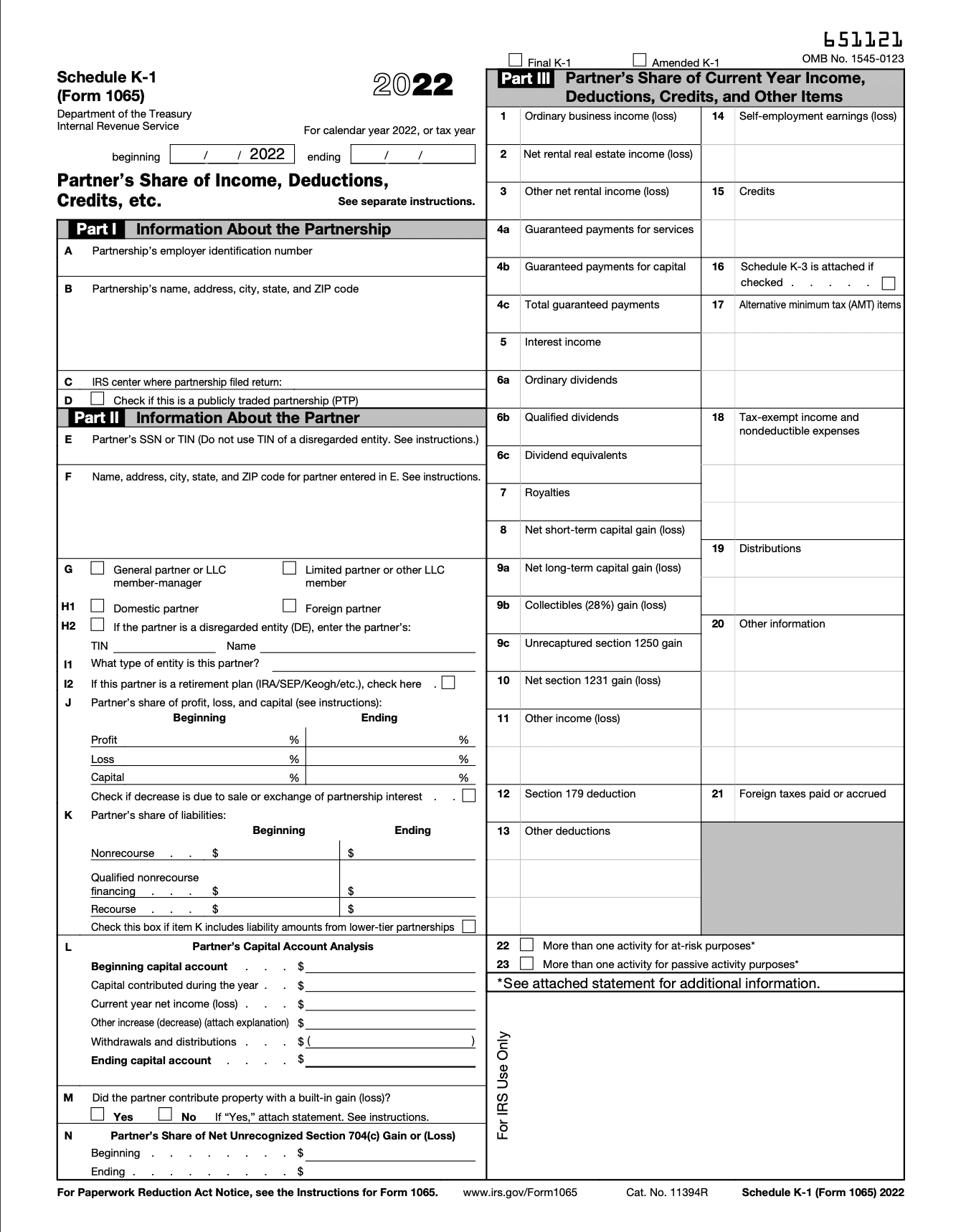

What Does the Schedule K-1 Form Look Like?

The Schedule K-1 form consists of three parts: Part I, Part II, and Part III. Each part deals with a particular aspect of income earned through the partnership. Here is a sample of the Schedule K-1 Form:

Source

How to Read a K-1 (Form 1065)

Schedule K-1 is divided into three parts that are further segmented into sections designated by alphabets. Most of the information for completing your Schedule K-1 is found in the income and expenses section.

You will have to record your business income or losses and also information like income from real estate, capital gains, royalties and dividends, and any other additional sources of income.

Here is a brief description of the different parts of the Schedule K-1 form and the details that they hold:

Part-I:

This part contains information on your partnership, employee identification number, and details of the type of partnership of which you are a member.

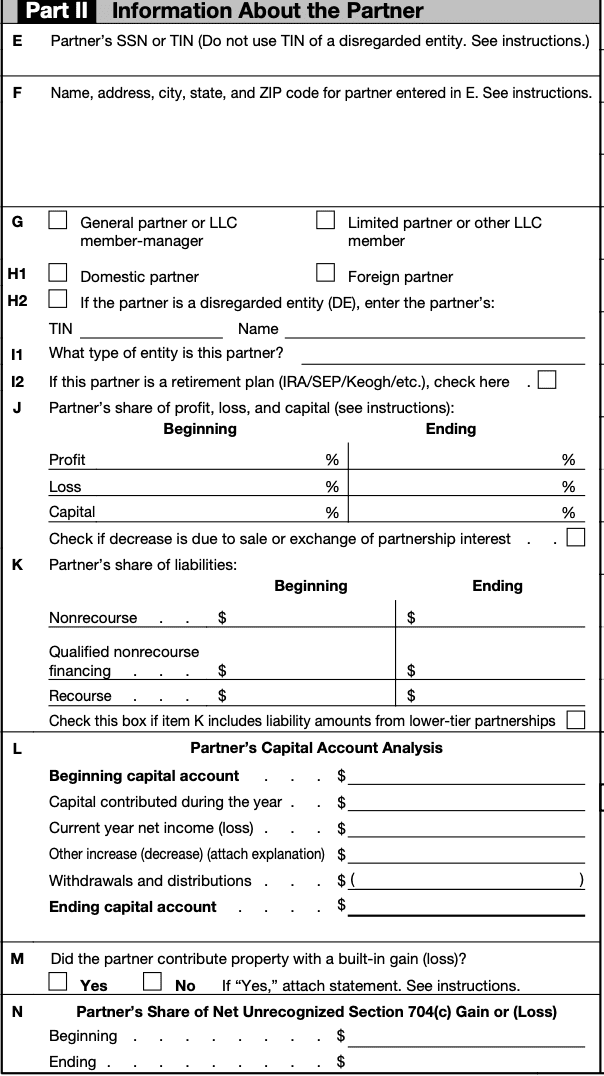

Part II:

This part includes contact details of your partner/s, tax numbers, partner’s contact information, and residential status (whether they are foreigners or US residents).

You will also provide the details of your partner’s profits (or loss), how long you have been partners, and the percentage share that you each have. Additionally, you must input information on your capital contribution, including whether you contributed property and the corresponding value thereof.

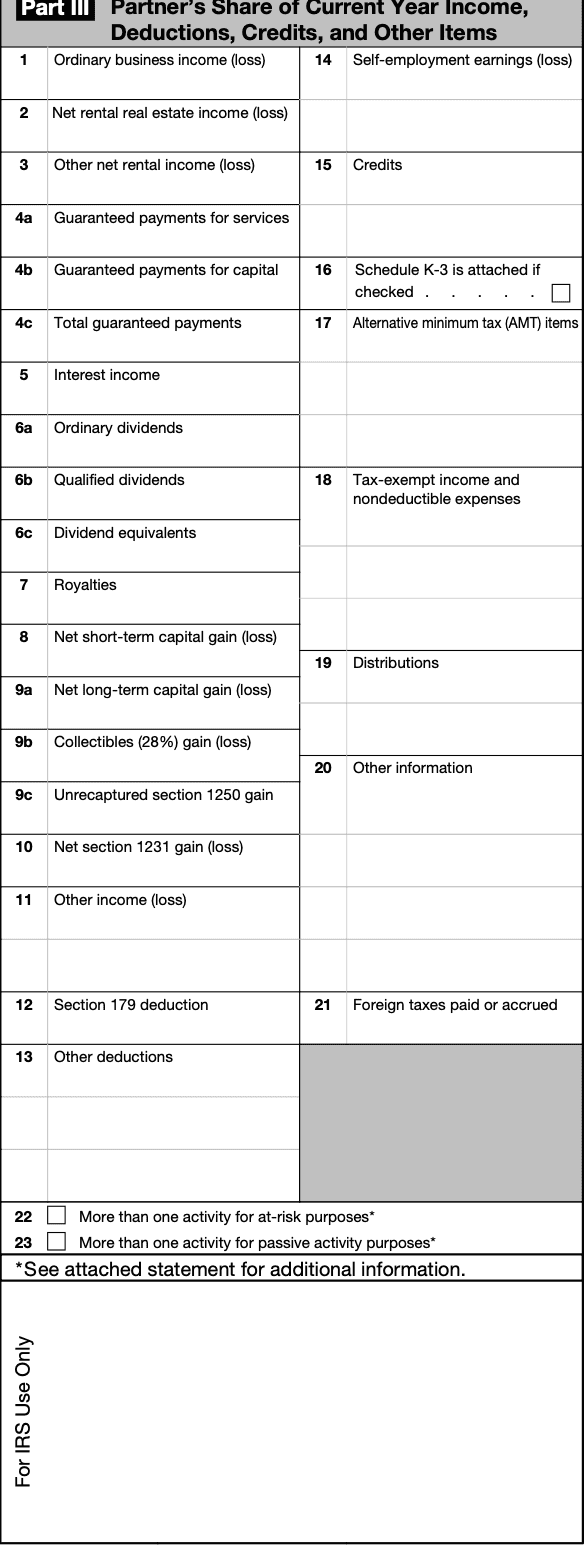

Part III:

This section deals with your share in the profit and loss of the partnership, along with details of deductions and credits.

When Are K-1s Due?

The Schedule K-1 form should be submitted on or before the 15 March of the year following the financial year being assessed. In case of any delay, you can submit Form 7004 that asks for an extension of six months.

All the partners have to adhere to the 15 March deadline.

Getting all the information and filling out the Schedule K-1 tax form can be an intimidating task. Even if you know what a Schedule K-1 form is, many confusing aspects could unnecessarily waste your time and energy.

Luckily, you can get the assistance of a professional bookkeeping service to help you with the process.

Also understand the working principle of LLC taxes which give business owners significantly greater federal income tax flexibility than a sole proprietorship, partnership and other popular forms of business organization.

About Fincent

Built by creative entrepreneurs, Fincent provides professional bookkeeping services to small creative businesses and believes that you were born to create, not do bookkeeping.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more