- IRS forms

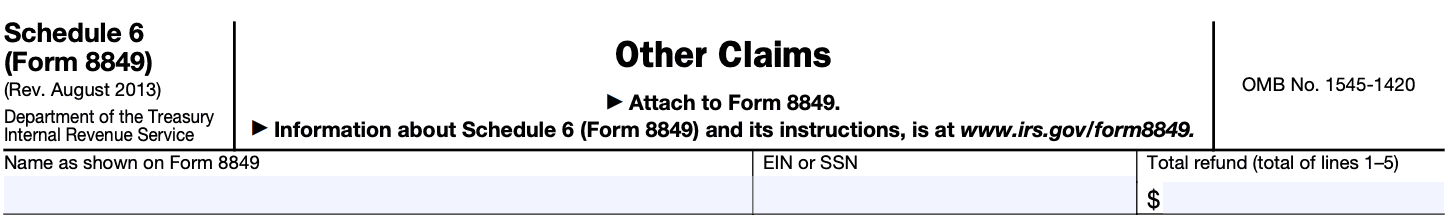

- Schedule 6 (Form 8849)

Schedule 6 (Form 8849): Other Claims

Download Schedule 6 (Form 8849)Tax forms can be intimidating, with their complex terminology and myriad of sections. One such form is Schedule 6 (Form 8849), which deals with "Other Claims." While it may sound vague, understanding the purpose and potential of this form can be immensely beneficial for taxpayers..

Schedule 6 (Form 8849) is an attachment to (link: https://fincent.com/irs-tax-forms/form-8849 text: Form 8849), which is used to claim certain fuel-related refunds or credits. While Form 8849 focuses primarily on specific claims, Schedule 6 serves as a catch-all section for other claims not covered elsewhere on the form. It allows taxpayers to seek refunds or credits for various taxes, such as federal excise taxes, customs duties, or certain other taxes or fees.

In this blog post, we will dive into the details of Schedule 6 and explore how it can be utilized to your advantage

Purpose of Schedule 6 (Form 8849)

Schedule 6 specifically focuses on "Other Claims" for the purpose of reporting and requesting credits or refunds related to specific fuel-related activities or situations.

Here are some examples of situations where Schedule 6 may be used:

Non-taxable use or use in certain intercity and local buses: If you have used certain types of fuel (such as dyed diesel fuel) for nontaxable purposes or for fueling intercity or local buses, you may be eligible for a tax credit or refund. Schedule 6 allows you to claim such credits or refunds.

Fuels used in certain off-highway business uses: If you have used fuels, such as gasoline or diesel, for off-highway business purposes, such as in farming, construction, or industrial operations, you may qualify for a refund or credit. Schedule 6 provides a space to report these claims.

Alternative fuel credit: Schedule 6 also allows for claiming credits related to alternative fuels, such as compressed natural gas (CNG), liquefied natural gas (LNG), and certain types of hydrogen. If you have used these fuels in eligible vehicles or equipment, you can use Schedule 6 to report and claim the credits.

Fuel tax paid on certain uses: If you have paid federal excise taxes on fuel that was used for certain non-taxable purposes, such as in airplanes for aerial application, you may be able to claim a refund. Schedule 6 provides a section for reporting such claims.

It's important to note that Schedule 6 is just one part of Form 8849, and additional schedules may be required depending on the specific type of credit or refund being claimed.

Benefits of Schedule 6 (Form 8849)

Here are some benefits of using Schedule 6:

-

Fuel tax credits: Schedule 6 allows taxpayers to claim tax credits for certain types of fuel used in various industries or activities. This can include alternative fuels like biodiesel, ethanol, natural gas, propane, and others. By claiming these credits, taxpayers can offset their tax liabilities and reduce their overall tax burden.

-

Refunds: In some cases, taxpayers may be eligible for refunds of certain fuel excise taxes they have paid. Schedule 6 provides a way to claim these refunds. This is particularly beneficial for businesses or individuals who use large amounts of fuel in their operations, such as trucking companies, farmers, or businesses with fleets of vehicles.

-

Environmental incentives: Schedule 6 encourages the use of alternative fuels, which are generally considered more environmentally friendly compared to traditional fossil fuels. By offering tax credits for alternative fuels, the form aims to incentivize the adoption of cleaner and renewable energy sources. This promotes sustainability and contributes to reducing greenhouse gas emissions.

-

Cost savings: By claiming fuel tax credits or refunds through Schedule 6, taxpayers can experience significant cost savings. The credits and refunds can help offset the expenses associated with fuel usage, making it more affordable for businesses and individuals to operate vehicles or equipment that rely on fuel.

-

Compliance with tax regulations: Using Schedule 6 ensures that taxpayers comply with the tax regulations regarding fuel taxes. It provides a structured format for reporting fuel-related information and calculations, helping to ensure accurate and complete reporting to the Internal Revenue Service (IRS). By properly utilizing Schedule 6, taxpayers can avoid potential penalties or audits related to fuel tax reporting.

It's important to note that specific eligibility requirements and limitations apply to each type of credit or refund available through Schedule 6.

Who Is Eligible To File Schedule 6 (Form 8849)?

Here are some common types of claims that can be filed using Schedule 6:

Claims for certain federal excise tax refunds

- Claims for the ultimate purchaser of gasoline or diesel fuel used for a nontaxable use, such as blending with alcohol or biodiesel

- Claims for gasoline or diesel fuel used by local transit systems

Claims for alternative fuel credits

- Claims for alternative fuel credit for certain types of alternative fuels, such as natural gas, liquefied petroleum gas (LPG), compressed natural gas (CNG), and liquefied hydrogen

Claims for alternative fuel mixtures credits

- Claims for alternative fuel mixture credit for mixtures of taxable fuels with certain alternative fuels, such as ethanol or biodiesel

Claims for biodiesel and renewable diesel fuels credits

- Claims for biodiesel or renewable diesel mixture credit for mixtures of biodiesel or renewable diesel with taxable fuels

Claims for certain fuel tax exemptions

- Claims for nontaxable uses of certain fuels, such as dyed diesel fuel used for a non-highway purpose

How To Complete Schedule 6 (Form 8849): A Step-by-Step Guide

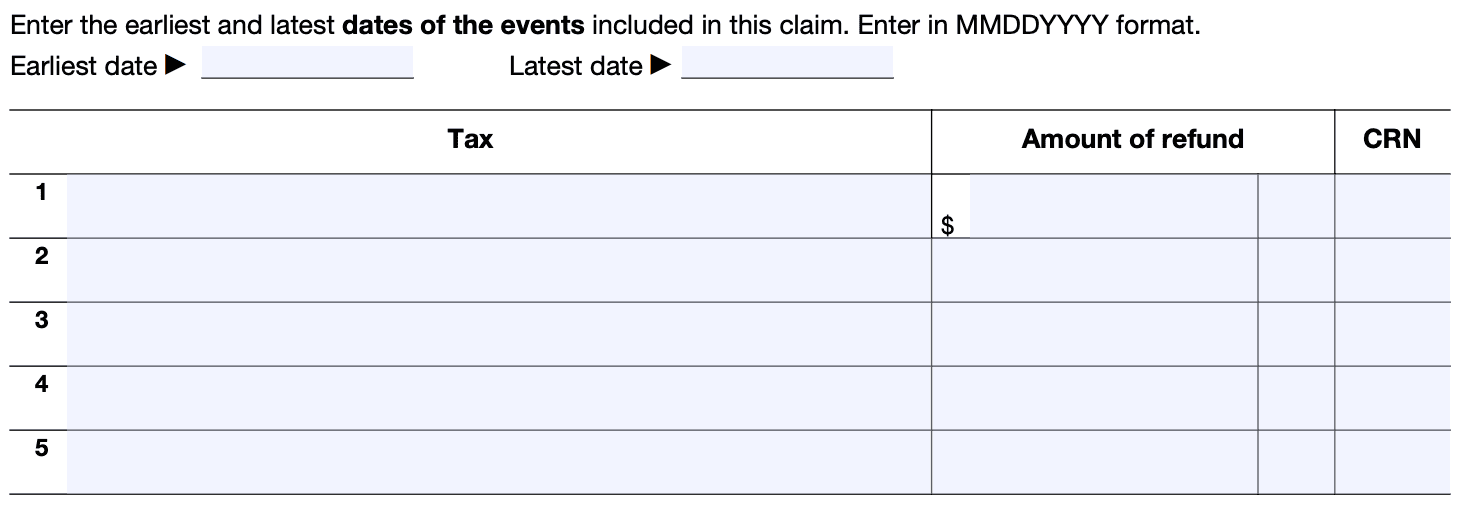

Completing Schedule 6 (Form 8849) involves reporting information related to certain fuel-related tax credits and refunds. Here's a step-by-step guide to help you through the process:

Step 1: Obtain the necessary forms and documents

Ensure that you have a copy of Form 8849, as well as any supporting documents such as receipts, invoices, and proof of payment related to the fuel taxes you're claiming credits or refunds for.

Step 2: Provide your identifying information

Start by entering your name, address, and other required identifying information at the top of Schedule 6.

Step 3: Determine the applicable lines

Identify the specific lines on Schedule 6 that correspond to the fuel tax credits or refunds you're claiming. The form provides instructions and line numbers for various types of fuel tax credits, such as biodiesel, alternative fuel, and gasoline used on a farm for farming purposes.

Step 4: Complete the applicable sections

For each line you're claiming, carefully follow the instructions and provide the necessary information. This may include details such as the type and quantity of fuel, the dates it was used, and the purpose for which it was used. Double-check your entries to ensure accuracy.

Step 5: Calculate the credits or refunds

Based on the information provided, calculate the total amount of credits or refunds you're claiming for each line. Follow the specific instructions for each line to determine the appropriate calculations.

Step 6: Summarize the totals

At the bottom of Schedule 6, there will be sections where you summarize the total credits or refunds claimed for each type of fuel tax. Ensure that you accurately enter the totals you calculated in the previous step.

Step 7: Review and sign the form

Carefully review all the information you've entered on Schedule 6 to ensure accuracy and completeness. Once satisfied, sign and date the form.

Step 8: Attach supporting documents

Attach any required supporting documents, such as receipts or invoices, to substantiate your claims for credits or refunds. Make sure you keep copies of these documents for your records.

Step 9: Submit the form

Send the completed Schedule 6 along with the other required forms and attachments to the appropriate address provided in the instructions. You may need to refer to the instructions for Form 8849 to determine where to submit your completed form.

Special Considerations When Filing Schedule 6 (Form 8849)

When filing Schedule 6 (Form 8849), which is used to claim certain fuel tax credits, there are several special considerations to keep in mind. Here are some important points to consider:

Eligibility: Ensure that you meet the eligibility criteria for claiming the specific fuel tax credit you are filing for. Different credits have different requirements, such as the type of fuel used, the purpose of its use, and the applicable tax laws.

Correct form selection: Make sure that Schedule 6 (Form 8849) is the appropriate form for claiming your fuel tax credits. Depending on the type of credit, you may need to file a different form or schedule.

**Tax periods: **Provide accurate information regarding the tax periods for which you are claiming the credits. This typically includes the beginning and ending dates of each tax period.

Supporting documentation: Gather all necessary supporting documentation to substantiate your claim. This may include invoices, receipts, and other relevant records. Ensure that you have proper documentation to prove your eligibility for the credit and the amount claimed.

Calculation accuracy: Double-check all calculations to ensure accuracy. Errors in calculations could lead to incorrect credit amounts and potential delays or issues with your tax return.

Filing deadlines: File your Schedule 6 (Form 8849) within the prescribed deadline. Generally, the deadline for filing a claim for a fuel tax credit is the last day of the fourth month following the last day of the applicable tax period.

Electronic filing: Consider electronically filing your Schedule 6 (Form 8849) using the IRS e-file system. Electronic filing can streamline the process, reduce errors, and expedite your refund, if applicable.

Consult a tax professional: If you are unsure about any aspect of filing Schedule 6 (Form 8849) or claiming fuel tax credits, it's advisable to consult a tax professional or certified public accountant (CPA). They can provide guidance based on your specific situation and ensure compliance with applicable tax laws.

Remember to always refer to the official IRS instructions and guidelines for Schedule 6 (Form 8849) to ensure accurate and compliant filing.

Filing Deadlines & Extensions on Schedule 6 (Form 8849)

September 2021, Schedule 6 (Form 8849) is used for claiming certain fuel tax credits, such as the biodiesel or alternative fuel credits. However, please note that tax laws and forms may change over time, so it's essential to consult the latest IRS guidelines or a tax professional for the most up-to-date information.

Regarding filing deadlines and extensions for Schedule 6 (Form 8849), the general due date for filing this form is determined by the tax year for which you are claiming the credit. Typically, the due date for most businesses is the last day of the first quarter following the end of the tax year.

For example, if your tax year ends on December 31, the due date for filing Form 8849, including Schedule 6, would be April 30 of the following year.

If you need more time to file, you can request an extension by (link: https://fincent.com/irs-tax-forms/form-7004#:~:text=Filing%20Form%207004%20allows%20a,for%20paying%20any%20taxes%20owed. text: filing Form 7004), Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. This extension will generally grant you an additional six months to file your return.

However, keep in mind that an extension to file does not extend the deadline for paying any taxes owed. You may still need to estimate and pay any tax due by the original due date.

Common Mistakes To Avoid While Filing Schedule 6 (Form 8849)

When filing Schedule 6 (Form 8849), which is used for claiming certain fuel tax credits, there are several common mistakes that you should avoid to ensure accurate and timely filing. Here are some common mistakes to watch out for:

**Incorrect or incomplete information: **Ensure that you provide accurate and complete information on the form. Double-check your entries for errors or missing data, such as your name, address, employer identification number (EIN), and other required details.

**Incorrect tax year: **Make sure you are filing for the correct tax year. The tax year should match the year for which you are claiming the fuel tax credit.

Using outdated forms: Always use the most recent version of Form 8849 and its schedules. Using outdated forms can lead to errors and delays in processing your claim.

Failing to attach required documentation: Schedule 6 may require supporting documentation, such as invoices or receipts, to substantiate your claim. Ensure that you attach all the necessary documents as specified in the instructions.

Mathematical errors: Take care to perform accurate calculations when reporting amounts on Schedule 6. Double-check your calculations and review the form for any mathematical errors before submitting it.

Missing signatures: If you are filing a paper copy of Form 8849, ensure that you sign and date the form. Missing signatures can result in the rejection of your claim.

Incorrectly claiming ineligible credits: Familiarize yourself with the eligibility criteria for the fuel tax credits you are claiming. Only claim credits for which you qualify, and be aware of any limitations or restrictions associated with each credit.

Late or delayed filing: Make sure to file your Schedule 6 within the designated due dates. Late filings may result in penalties or the loss of certain benefits.

Failure to keep copies: It is essential to keep copies of your filed Schedule 6 and all supporting documents for your records. These copies will be helpful for reference and documentation in case of any inquiries or audits.

To ensure accurate and error-free filing, it is advisable to review the instructions provided by the IRS for Schedule 6 (Form 8849) and consult a tax professional or use reputable tax software if you have any doubts or specific questions about your situation.

Conclusion

Schedule 6 (Form 8849) plays a crucial role in claiming refunds or credits for environmental taxes on ozone-depleting chemicals and imported products using such chemicals. By understanding the purpose of Schedule 6 and following the steps outlined above, you can ensure that your claim is accurately filed and increase the chances of a successful refund or credit.

It's important to note that tax laws and forms can change over time, so it's advisable to consult the latest instructions provided by the IRS or seek professional tax advice if you have any specific questions or concerns regarding Schedule 6 or any other tax-related matters.