- IRS forms

- Form W-7

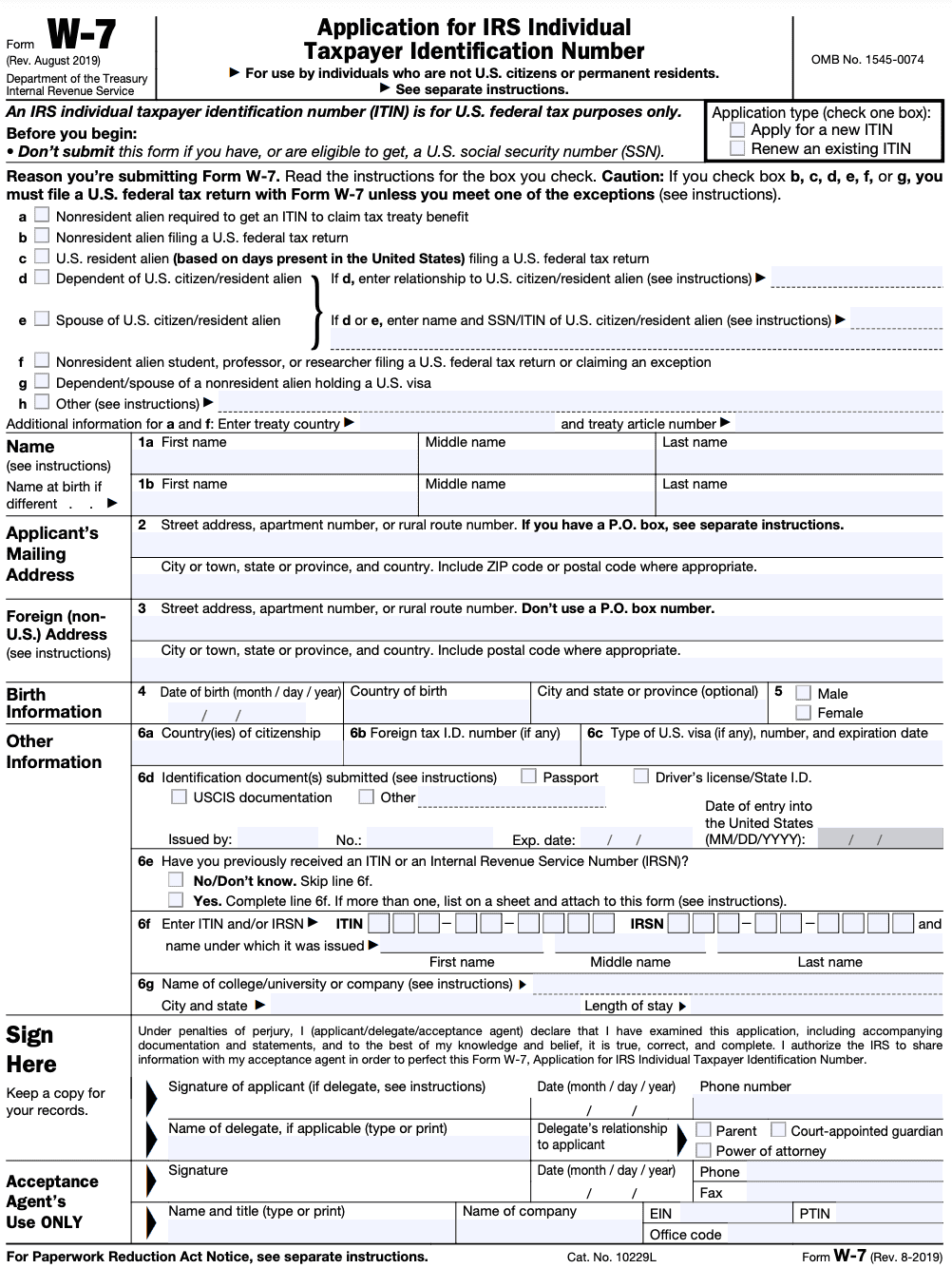

Form W-7: Apply for an ITIN

Download Form W-7In the United States, individuals who are not eligible to obtain a Social Security Number (SSN) but have a federal tax filing requirement can apply for an Individual Taxpayer Identification Number (ITIN) using Form W-7. The ITIN serves as a unique identification number for tax purposes, allowing individuals to comply with their tax obligations and potentially claim certain tax benefits. In this blog post, we will delve into the details of Form W-7, the process of applying for an ITIN, and the importance of having an ITIN for taxpayers in the United States.

What Is an ITIN, and Who Needs One?

The Internal Revenue Service (IRS) issues tax processing numbers called Individual Taxpayer Identification Numbers (ITINs).

It is designed for individuals who are required to file a federal tax return or are involved in a federal tax-related transaction but are not eligible for a Social Security Number (SSN). Non-resident aliens, dependents or spouses of U.S. citizens or residents, and certain resident aliens fall into this category. The ITIN allows these individuals to comply with their tax responsibilities.

Understanding Form W-7

Form W-7 is the official document used to apply for an ITIN. It is a relatively straightforward form that requires applicants to provide personal information, including their name, date of birth, and foreign status, along with supporting documents to establish their identity and foreign status.

Additionally, the form requires applicants to provide a valid reason for needing an ITIN and information about their U.S. tax reporting requirements.

Why Are ITINs Necessary?

A Social Security number is often only available to those who are legally permitted to work in the United States. This can apply to both citizens and non-citizens, such as permanent residents and citizens of other countries. These persons identify themselves when submitting their taxes using their Social Security numbers.

However, non-citizens without authorization to work in the country may also need to file tax returns if they get income from American sources or qualify for a refund of taxes withheld due to a tax treaty.

Additionally, taxpayers must supply ID numbers for any non-citizen spouses or dependents they identify on their tax return. Individual taxpayer identification numbers are relevant in circumstances like these. The ITIN gives a person a special identification number that the IRS can trace in its database.

About Form W-7

Form W-7 asks for the following information:

- The reason the applicant needs an ITIN

- Name, mailing address, and, if different, overseas address of the applicant

- Date and place of birth of the applicant

- Nation of citizenship of the applicant

- The applicant's foreign tax ID number, if they have one

- The applicant's U.S. visa number, if applicable

- Information on the documents submitted to prove the applicant's identity

How To Apply for an ITIN

The IRS emphasizes that using an ITIN with federal tax filings is the only appropriate application. One's residence or immigration status are unaffected by having one, and having one does not entitle one to employment in the US. As a general rule, you shouldn't apply for an ITIN until you actually require one for a tax return.

Primary documentation

- A completed copy of Form W-7

- The tax return that needs the number

- The person who needs the number must present valid identification

Valid forms of ID

A person's ID must demonstrate both identification and "foreign status," i.e., it must demonstrate that the person is not a citizen of the United States, in order for them to be granted an ITIN. Both are often demonstrated by a valid passport or a certified copy of a passport. If the person does not have a passport, then that person must supply at least two of the following documents. Some of them merely offer identification verification, while others demonstrate both identity and foreign status:

- U.S. Citizenship and Immigration Services' photo ID card (foreign identification and status)

- The State Department issues visas (foreign nationality and identity)

- U.S. or foreign driver’s license (identity only)

- U.S. military ID card (identity only)

- Military identification card issued by a foreign country

- National ID card from a foreign country (foreign status and identity)

- Non-driver ID card issued by a U.S. state (foreign status and identity)

- Voter registration card for foreigners

- Birth certificate from a foreign country (identification; if the certificate is from a foreign country, status and identity from a foreign country)

- Children under the age of six's medical records (identification; if from a foreign nation, foreign status and identity)

- School records for minors who are still enrolled (identification; if they are foreign citizens, then status and identity abroad)

The IRS looks through the W-7 and, if the application is accepted, assigns an ITIN and handles the tax return.

Submitting the form

The electronic submission of a tax return that includes one or more W-7 forms is not permitted. You can submit it in person at any IRS Taxpayer Assistance Centre that does in-person document reviews; there is at least one center in each state, and they are located in most major cities.

Additionally, you can send tax returns and W-7 forms by mail to:

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

An ITIN can be obtained in 6 to 10 weeks, according to the IRS. If an ITIN hasn't been used on a federal tax return in the previous three years, it will expire at the conclusion of the current year.

Processing Time and Status Updates

The processing time for an ITIN application can vary depending on several factors, including the time of year and the complexity of the application. Generally, it takes about seven weeks for the IRS to process the application and notify the applicant of their ITIN assignment.

To check the status of your application, you can contact the IRS ITIN Operations office or use the "Where's My ITIN?" online tool on the IRS website. Be prepared to provide your application information and any requested identification numbers.

Due dates & deadlines for Form W-7

Here are some general guidelines regarding the deadlines for Form W-7:

ITIN application deadline: There is no specific deadline for submitting Form W-7. However, it is recommended to submit the form as soon as possible if you anticipate needing an ITIN to meet a tax filing requirement. The IRS encourages individuals to apply for an ITIN well in advance of the tax return due date.

Tax return deadlines: The deadline for filing your tax return depends on the type of return you need to file. For most individuals, the deadline to file your federal income tax return is April 15. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day.

What’s New?

Renewal applications: Unless you qualify for an exception, a U.S. federal tax return must be submitted with all Form W-7 renewal applications.

Expanded discussion of allowable tax benefits: Unless they are claimed for an acceptable tax advantage or they file their own tax return, spouses and dependents are not eligible for an ITIN or to renew an ITIN. The subject of permissible tax benefits has been more thoroughly covered.

Child and dependent care credit (CDCC): If an alien dependent from Canada or Mexico is eligible for the child or dependent care credit (requested on (link: https://fincent.com/irs-tax-forms/form-2441 text: Form 2441)), an ITIN may be assigned to that dependent. The U.S. federal tax return and the Form 2441 need to be joined to the Form W-7.

Important Information To Consider

-

For the tax years 2018 through 2025, the personal exemption deduction was suspended as a result of the Tax Cuts and Jobs Act (TCJA) of 2017. Therefore, unless they are claimed for an acceptable tax advantage or they file their own federal return, spouses and dependents are not eligible for an ITIN or to renew an ITIN. A U.S. federal tax return with the applicable schedule or form and a copy of the person's identification must be attached.

-

Only your "identity" and "foreign status" can be verified using a passport. You do not have to provide a combination of at least two other current papers if you submit a passport that is currently valid (or a copy that has been certified by the issuing agency). However, any supplemental documentation to prove "Exception" criteria, must always be submitted along with your Form W-7.

Note: _For some dependents, a passport without a date of arrival into the country will no longer be recognised as a primary form of identification. _

-

You cannot e-file any tax returns using an ITIN that you applied for and received this year (including returns from earlier years) until you do so in the following year.

-

You must include the full date that you entered the country for the reason that you are applying for an ITIN in the entry date in the US field on Line 6d of the Form W-7. Month/day/year format (mm/dd/yyyy) should be used to input the date. If you have not entered the U.S. enter "Never entered the United States" on this line.

-

If a visa is necessary for your Form W-7 application, copies of a passport must also include the U.S. visa pages. (For example, if you check reason box (f) or (g) on Form W-7, make sure to provide a copy of the visa).

-

Outdated ITINs. Your ITIN will expire on December 31, 2021 if you didn't include it on a U.S. federal tax return at least once for the tax years 2018, 2019, and 2020. ITINs with the middle digits (the fourth and fifth positions) "70,""71,""72,""73,""74,""75,""76,""77,""78,""79,""80,""81,""82,""83,""84,""85,""86,""87," or "88" are no longer valid. The ITINs containing the middle digits "90," "91," "92," "94," "95," "96," "97," "98," or "99," IF assigned before 2013, have also expired.

Key Takeaways

Obtaining an Individual Taxpayer Identification Number (ITIN) through Form W-7 is a crucial step for individuals who have U.S. tax obligations but are not eligible for a Social Security Number. The ITIN allows individuals to fulfill their tax responsibilities, claim tax benefits, and open a U.S. bank account.

By following the proper application process and providing the required documentation, individuals can ensure a smooth ITIN application and compliance with U.S. tax laws. Remember to consult with a tax professional or visit the IRS website for the most up-to-date information regarding ITIN applications and requirements.