- IRS forms

- Form 990

Form 990: Return of Organization Exempt from Income Tax

Download Form 990For any nonprofit organization, transparency is key to building trust with donors, stakeholders, and the public. A crucial document in achieving this transparency is Form 990, a filing required by the Internal Revenue Service (IRS) for most tax exempt organizations in the United States. Form 990 provides valuable insights into a nonprofit's financial health, governance, and mission, making it an essential tool for anyone interested in understanding the workings of these organizations.

Form 990 is an annual information return that tax exempt organizations, such as charities, foundations, and other nonprofit entities, must file with the IRS. It serves as a comprehensive snapshot of the organization's activities, financial position, and governance policies during the fiscal year. The form's primary purpose is to ensure that tax exempt organizations are operating within the guidelines of their tax exempt status and are fulfilling their mission as intended.

In this blog, we'll explore what Form 990 is, its significance, and how it promotes transparency in the nonprofit sector.

Purpose of Form 990

The purpose of Form 990 is to ensure transparency and accountability for tax exempt organizations, as they are exempt from paying federal income tax and are granted certain privileges due to their nonprofit status.

Here are the main purposes of Form 990:

Tax compliance: Form 990 is used to fulfill the annual reporting requirement for tax exempt organizations under section 501(c) of the Internal Revenue Code. By filing this form, organizations demonstrate that they continue to meet the criteria for tax exempt status and are fulfilling their tax related obligations.

Transparency: The form provides detailed information about the organization's finances, governance, activities, and management. This transparency allows the public, donors, regulators, and other interested parties to assess how the organization operates and how it uses its funds to achieve its mission.

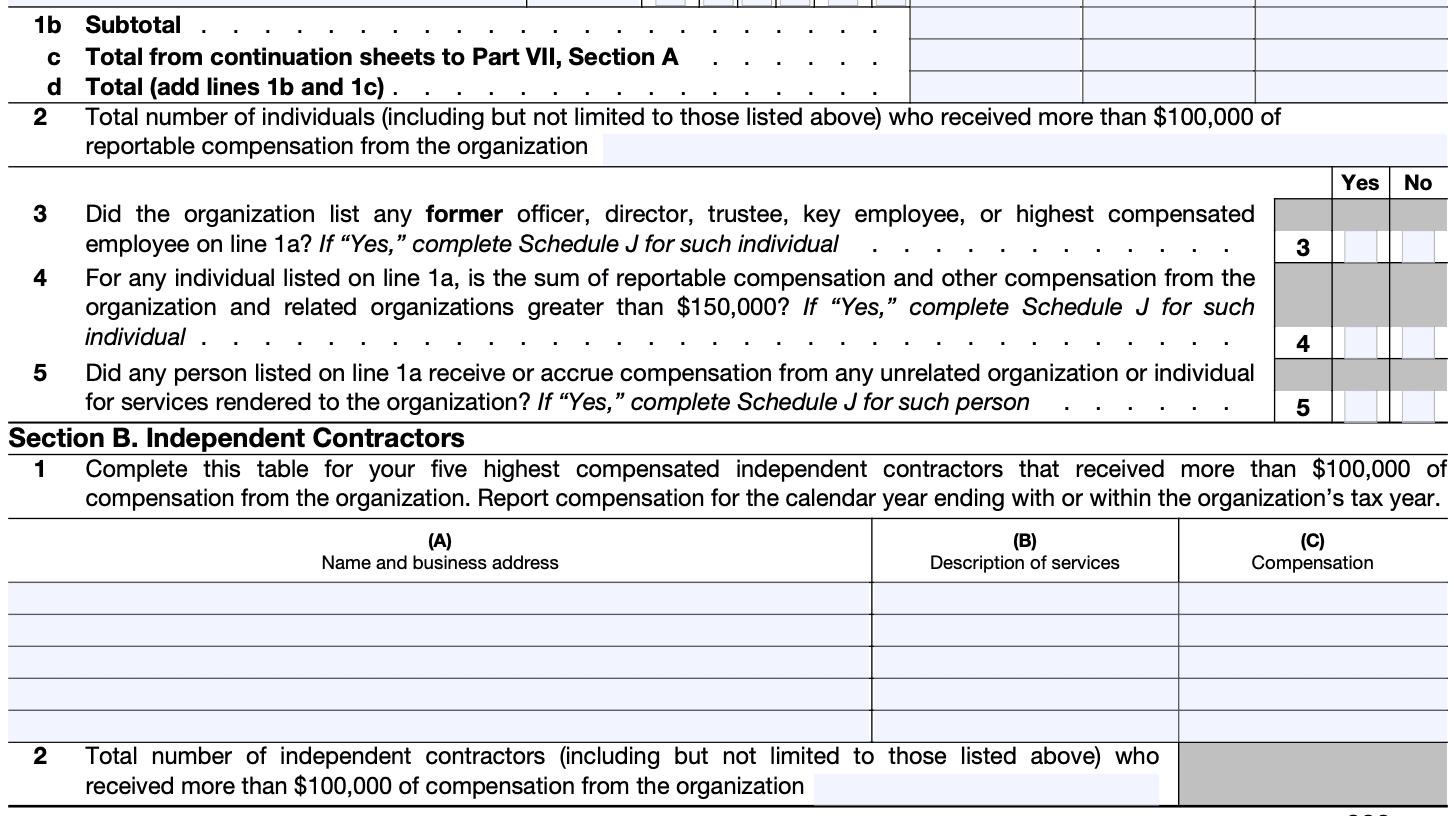

Accountability: Form 990 requires organizations to disclose their board members, key employees, and their compensation. It also requires information about related party transactions, potential conflicts of interest, and other governance-related matters. This helps ensure that the organization is being run ethically and responsibly.

Research and analysis: The information collected through Form 990 is a valuable resource for researchers, policymakers, and the public. It provides insights into the overall nonprofit sector, helps identify trends, and allows for comparisons between different organizations and their activities.

Public access: Form 990 is a public document, meaning it is available for anyone to access. It can be found on the IRS website, and many nonprofit organizations also make their recent Form 990 filings available on their websites. This accessibility allows interested parties to make informed decisions about supporting or engaging with a particular nonprofit.

Preventing abuses: The detailed reporting required by Form 990 helps the IRS and other regulatory agencies identify potential abuse or misuse of nonprofit status. By scrutinizing the financial information and activities disclosed in the form, the authorities can take appropriate actions against organizations that violate the rules or engage in activities inconsistent with their tax exempt status.

Benefits of Form 990

Form 990 plays a crucial role in maintaining transparency, accountability, and tax compliance within the nonprofit sector, which is essential for maintaining the public's trust and confidence in these organizations.

Some of the benefits of Form 990 include:

- Transparency and public accountability: Form 990 is a publicly available document, meaning anyone can access it. This transparency allows donors, stakeholders, and the general public to understand how the organization operates, how it uses its funds, and what its mission and activities are.

- Informed giving decisions: For potential donors or grantors, reviewing an organization's Form 990 can provide valuable insights into its financial health, governance, and overall effectiveness. It helps donors make informed decisions about where to contribute their funds, increasing confidence in the organization's legitimacy and impact.

- Strengthening governance: By requiring detailed information about the organization's leadership, governance practices, and policies, Form 990 promotes good governance. It helps the board of directors and management to be more accountable for their actions and financial management.

- Financial accountability: Form 990 provides a comprehensive view of the organization's financial activities, including revenue, expenses, assets, and liabilities. This financial transparency ensures that the organization is accountable for the funds it receives and spends.

- Tax compliance and exemption status: Filing Form 990 is a way for tax exempt organizations to maintain their tax exempt status. By fulfilling their reporting obligations, these organizations demonstrate their compliance with IRS regulations and retain their eligibility for tax exemption, which is essential for their fundraising efforts.

- Benchmarking and analysis: Researchers, policymakers, and analysts can use data from Form 990 to study trends, assess the performance of the nonprofit sector, and conduct comparative analyses between different organizations. This information can be valuable in evaluating the sector's overall impact and identifying areas for improvement.

- Grant applications and fundraising: Many foundations and grant-making institutions require nonprofits to submit their most recent Form 990 as part of their grant application process. Having an updated and accurate Form 990 can expedite the grant application and fundraising process.

- Avoiding penalties: Filing Form 990 on time and accurately is crucial for maintaining the organization's tax exempt status. Failure to file or filing incomplete or erroneous forms can result in penalties, fines, or even the revocation of tax exempt status.

In summary, Form 990 plays a crucial role in promoting transparency, accountability, and good governance in the nonprofit sector. It ensures that tax exempt organizations fulfill their reporting obligations, maintain their tax exempt status, and inspire confidence among donors and stakeholders in their operations and impact.

Who Is Eligible To File Form 990?

The following types of organizations are generally eligible to file Form 990:

501(c)(3) organizations: These are charitable organizations, including religious, educational, scientific, literary, and other organizations that qualify for tax exempt status under section 501(c)(3) of the Internal Revenue Code.

501(c) organizations: Various other types of tax exempt organizations under section 501(c) may be required to file Form 990, depending on their specific classification. Examples include 501(c)(4) social welfare organizations, 501(c)(6) business leagues, 501(c)(7) social clubs, and others.

The specific type of Form 990 (e.g., Form 990, Form 990-EZ, or Form 990-N) that an organization needs to file depends on its gross receipts and total assets. Smaller organizations may be eligible to file a simpler version, such as Form 990-EZ or Form 990-N (e-Postcard).

How To Complete Form 990: A Step-by-Step Guide

Completing Form 990 can be a complex task, especially for tax exempt organizations in the United States. Here is a general step-by-step guide to help you get started:

Step 1: Gather necessary information and documents

Collect all the relevant financial and organizational information, including:

- Basic information about the organization (name, address, EIN, etc.)

- Financial statements, including revenue, expenses, assets, and liabilities

- Details of key personnel, officers, directors, and employees

- Information about the organization's programs and activities

- Governance policies and procedures

Step 2: Choose the appropriate version of Form 990

Form 990 comes in different versions, such as 990, 990-EZ, and 990-N (e-Postcard). Select the form that best suits your organization's financial situation and filing requirements.

Step 3: Review IRS instructions

The IRS provides detailed instructions for each version of Form 990. Read through the instructions carefully to understand the requirements and what information to report in each section.

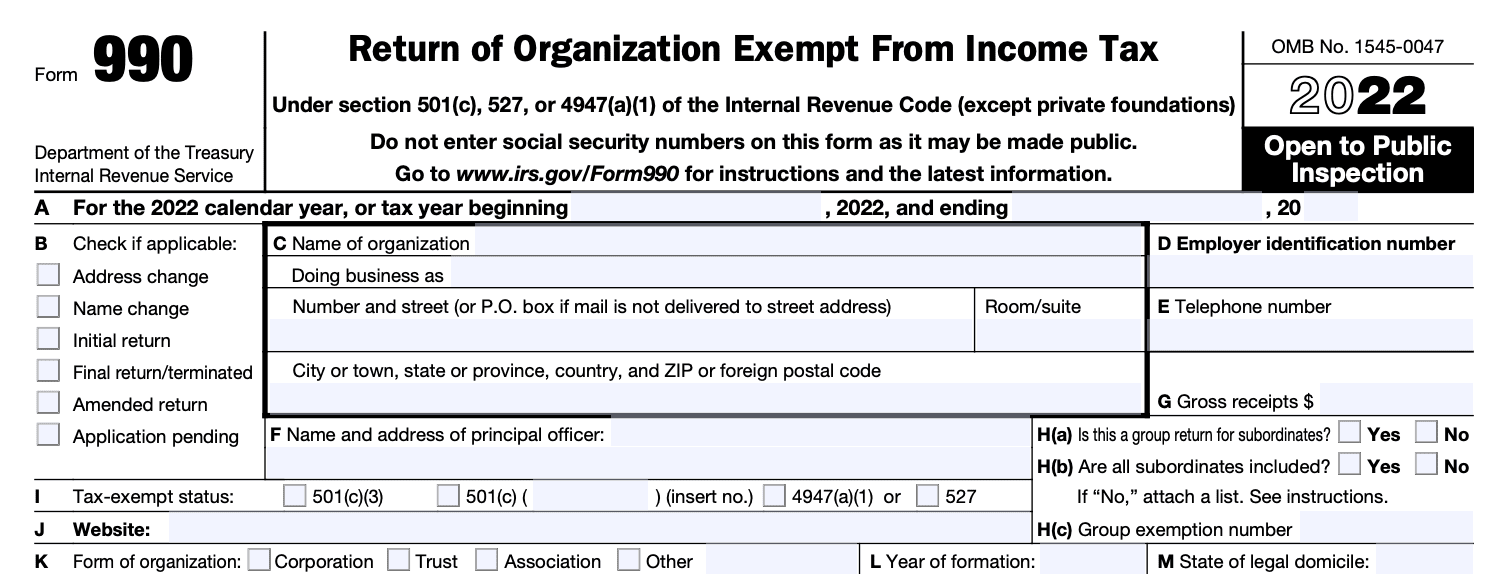

Step 4: Complete the header section

Fill out the basic information in the header section, including the organization's name, EIN, address, tax year, and any applicable tax exempt statuses.

Step 5: Provide an overview of the organization

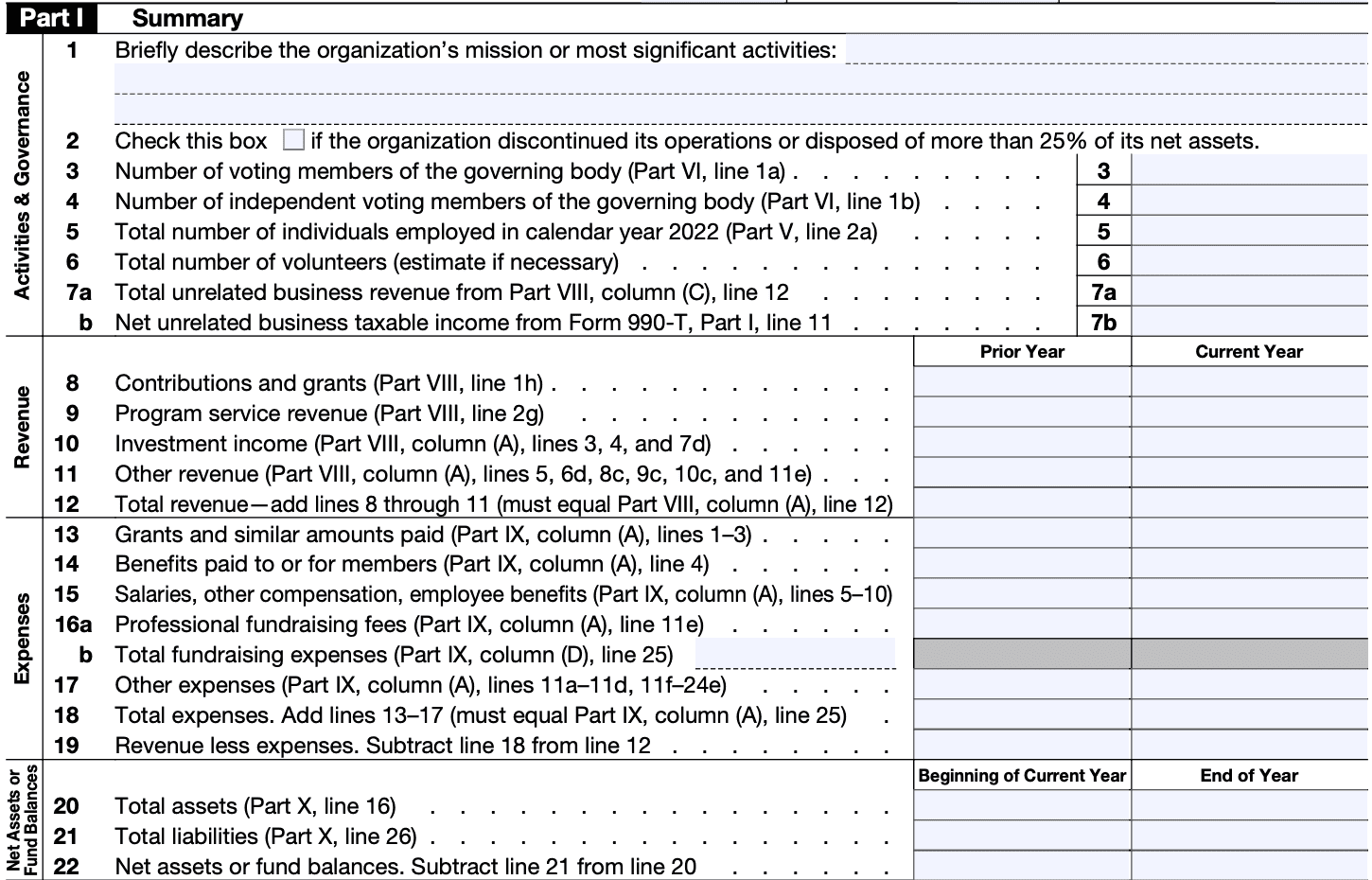

Complete Part I, which involves providing a brief description of the organization's mission, activities, and other relevant details.

Step 6: Report financial information

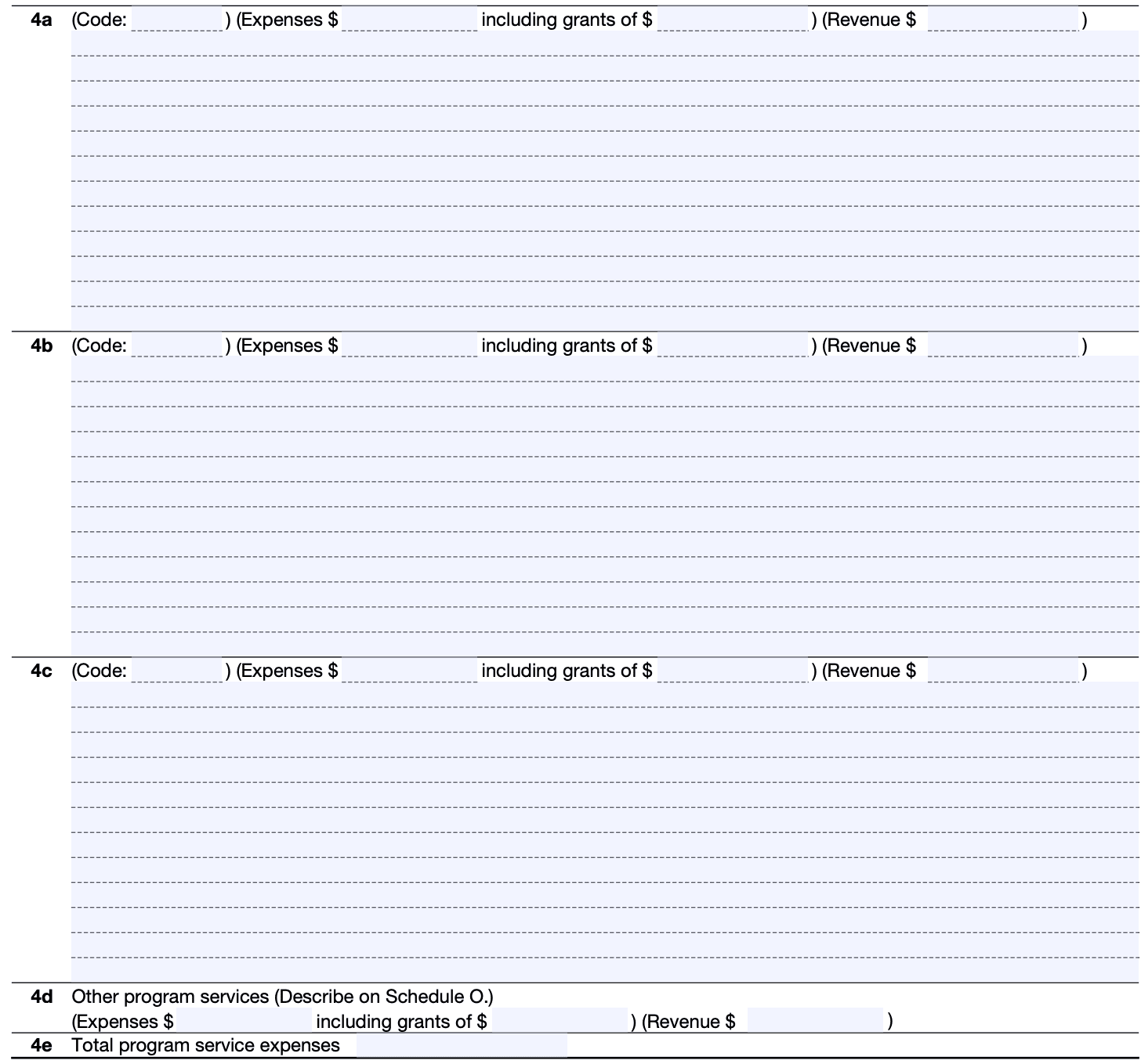

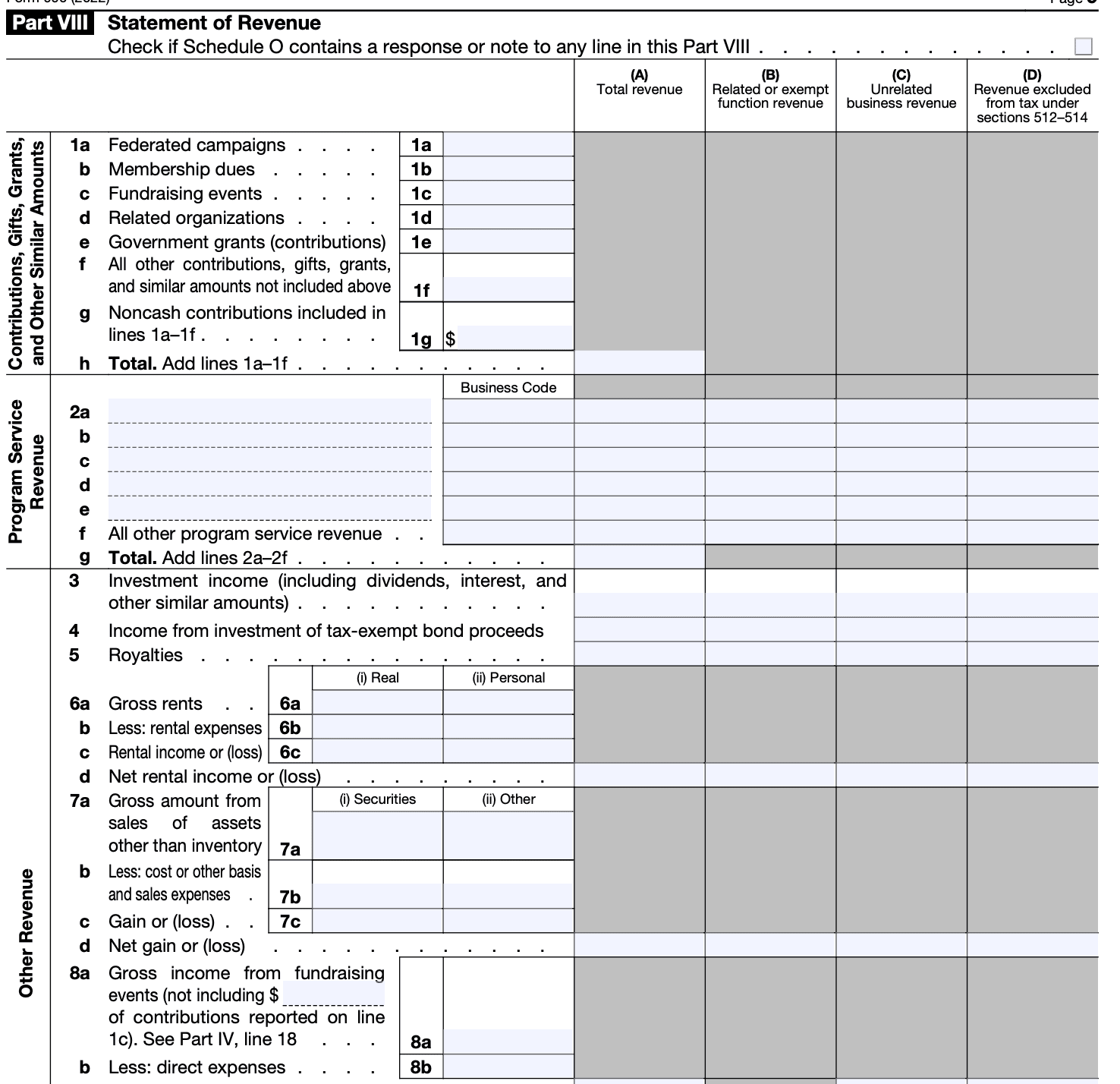

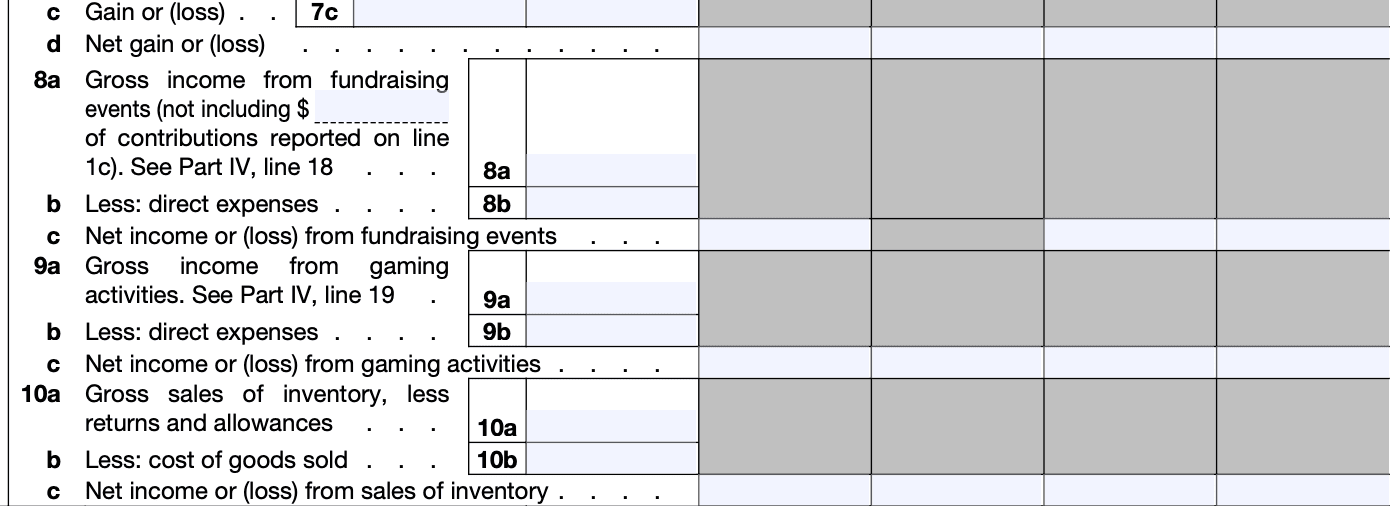

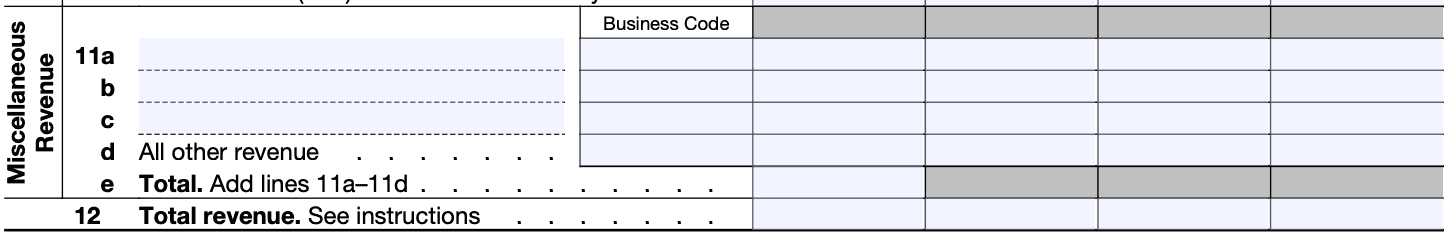

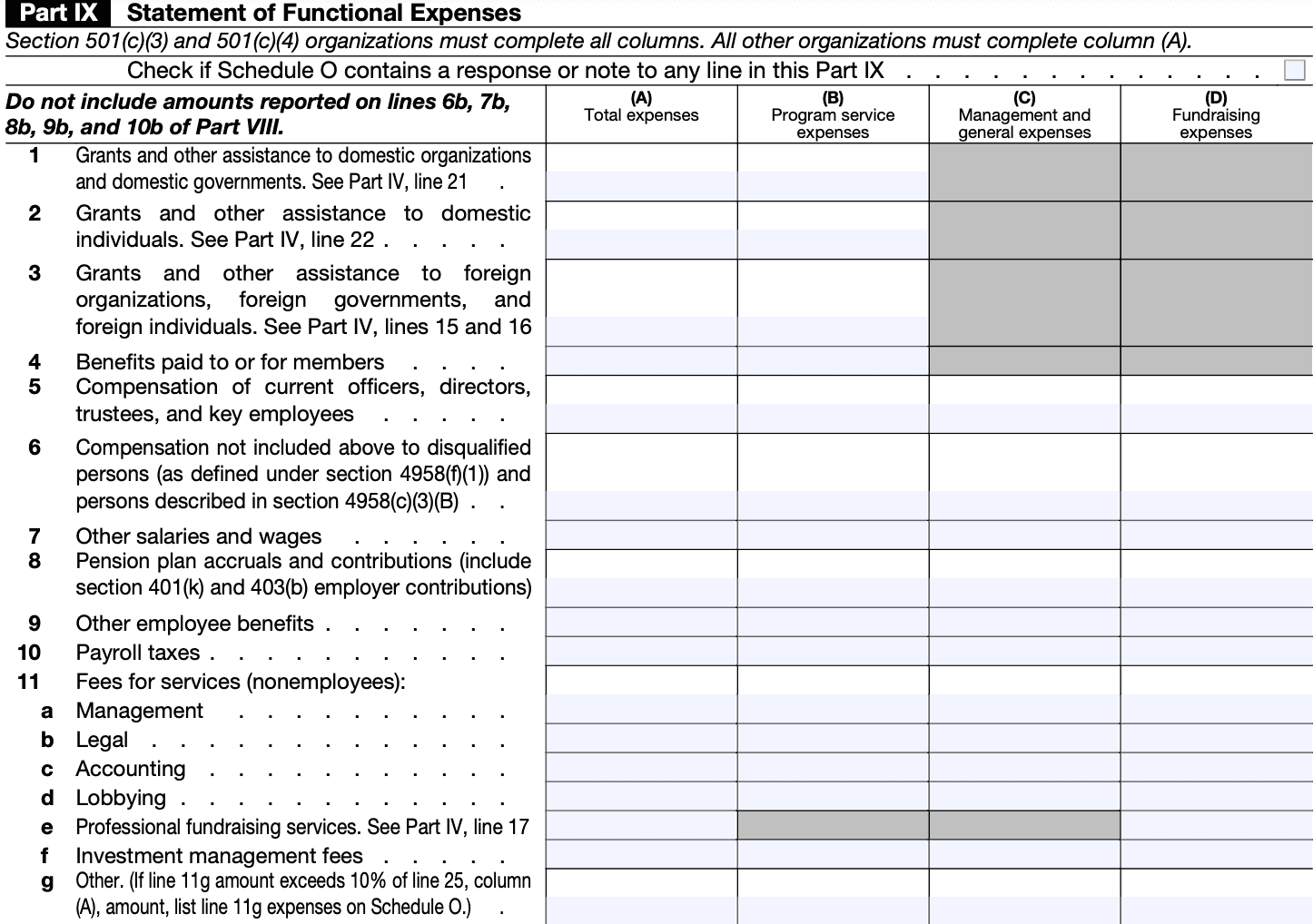

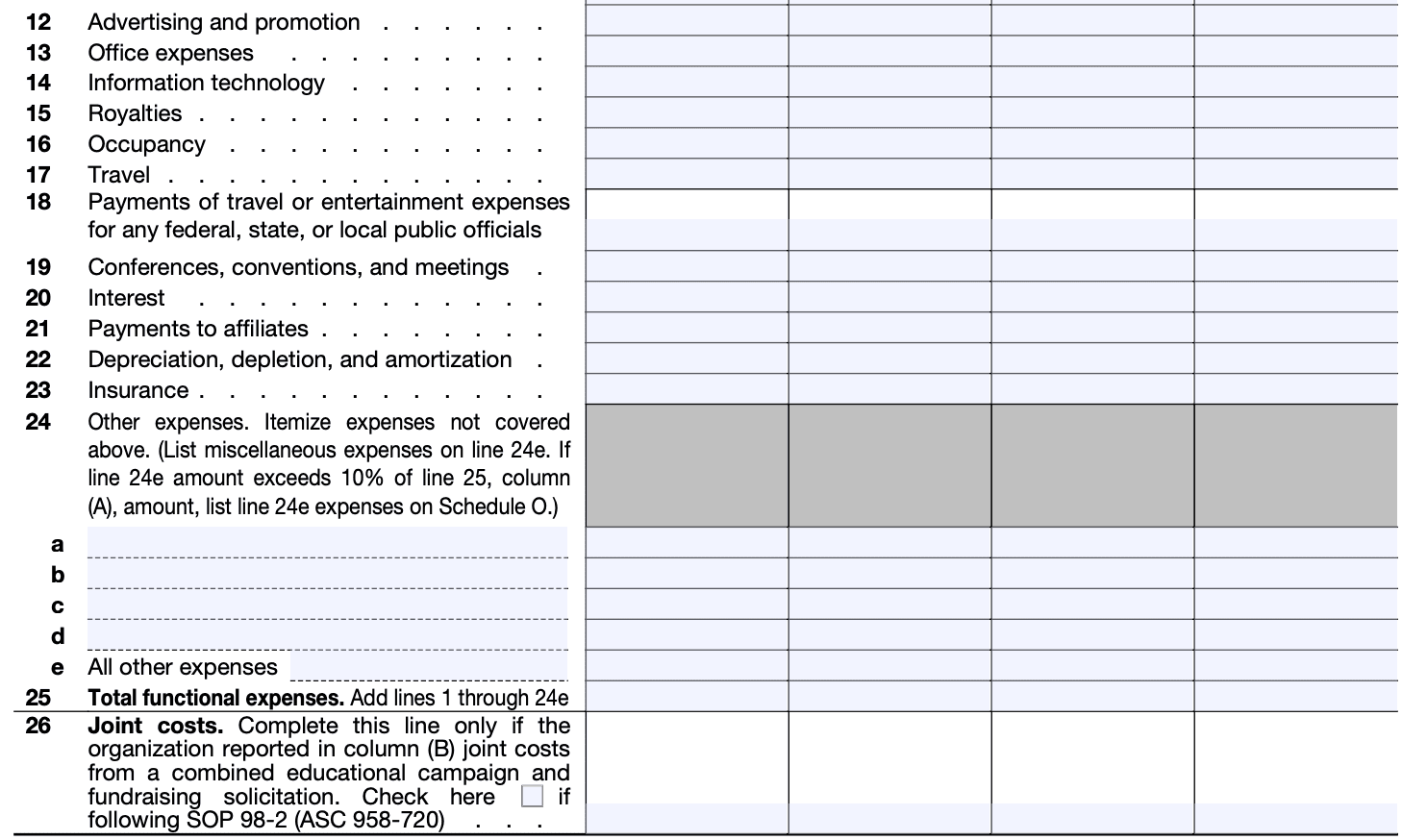

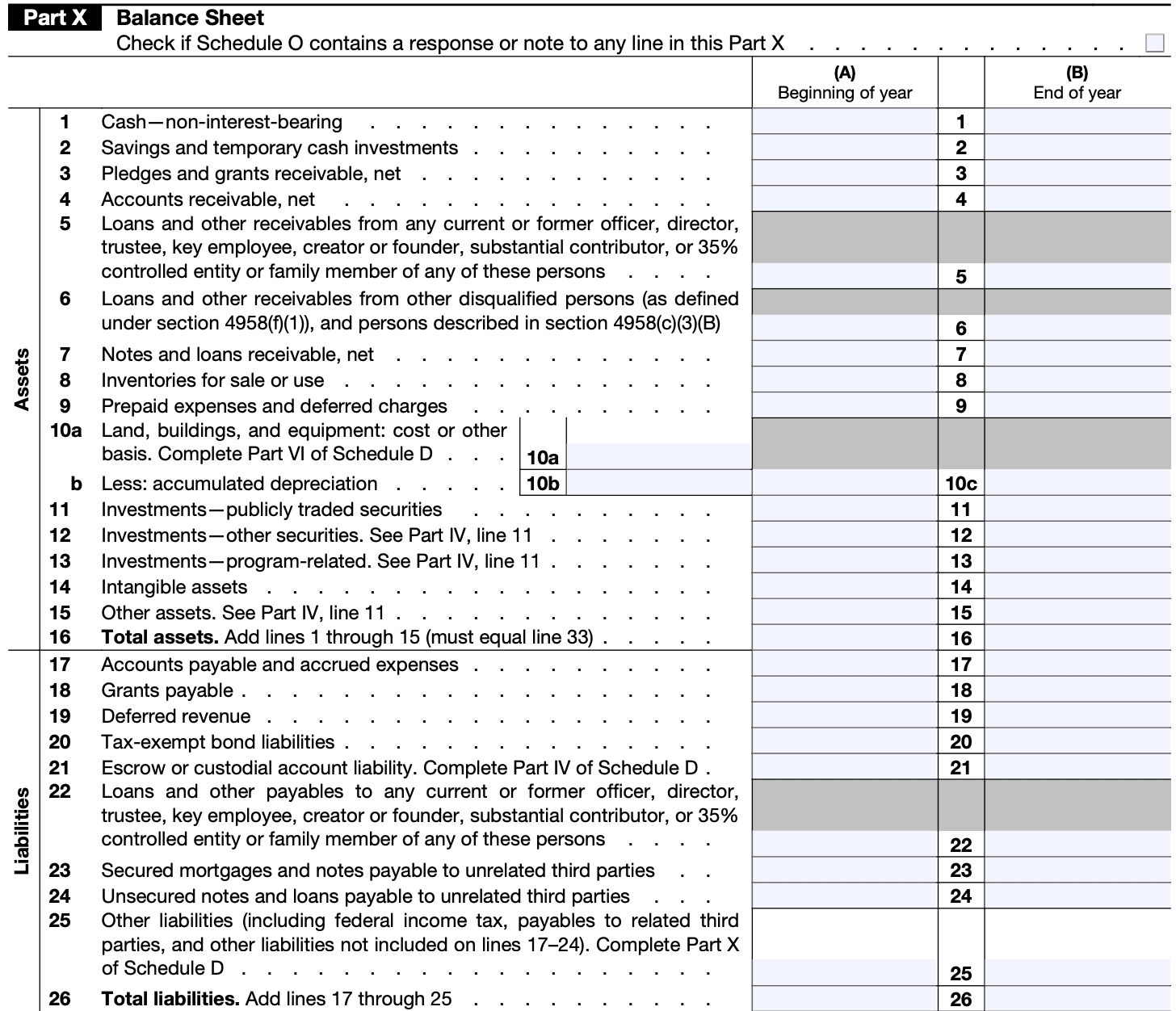

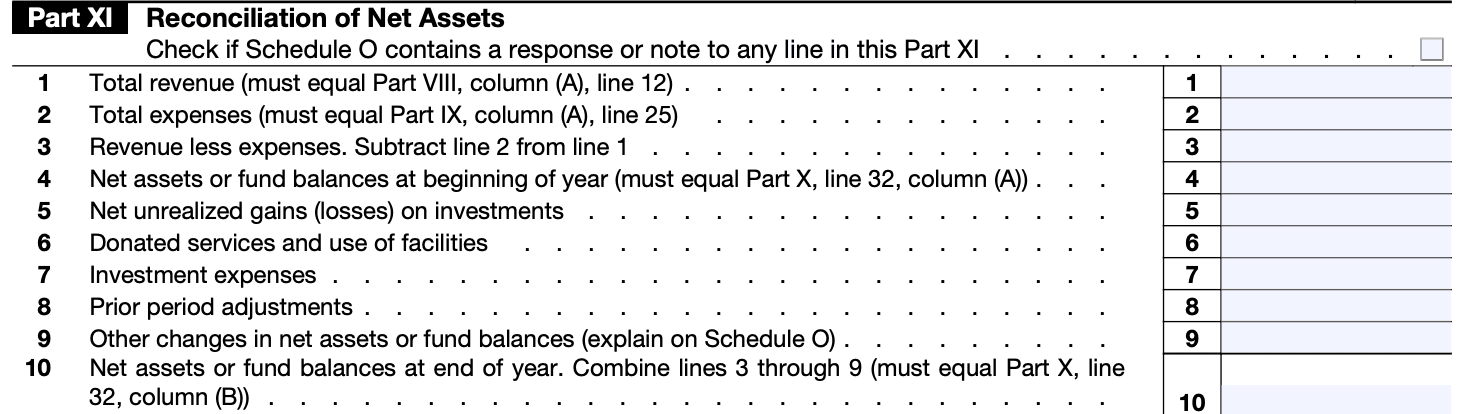

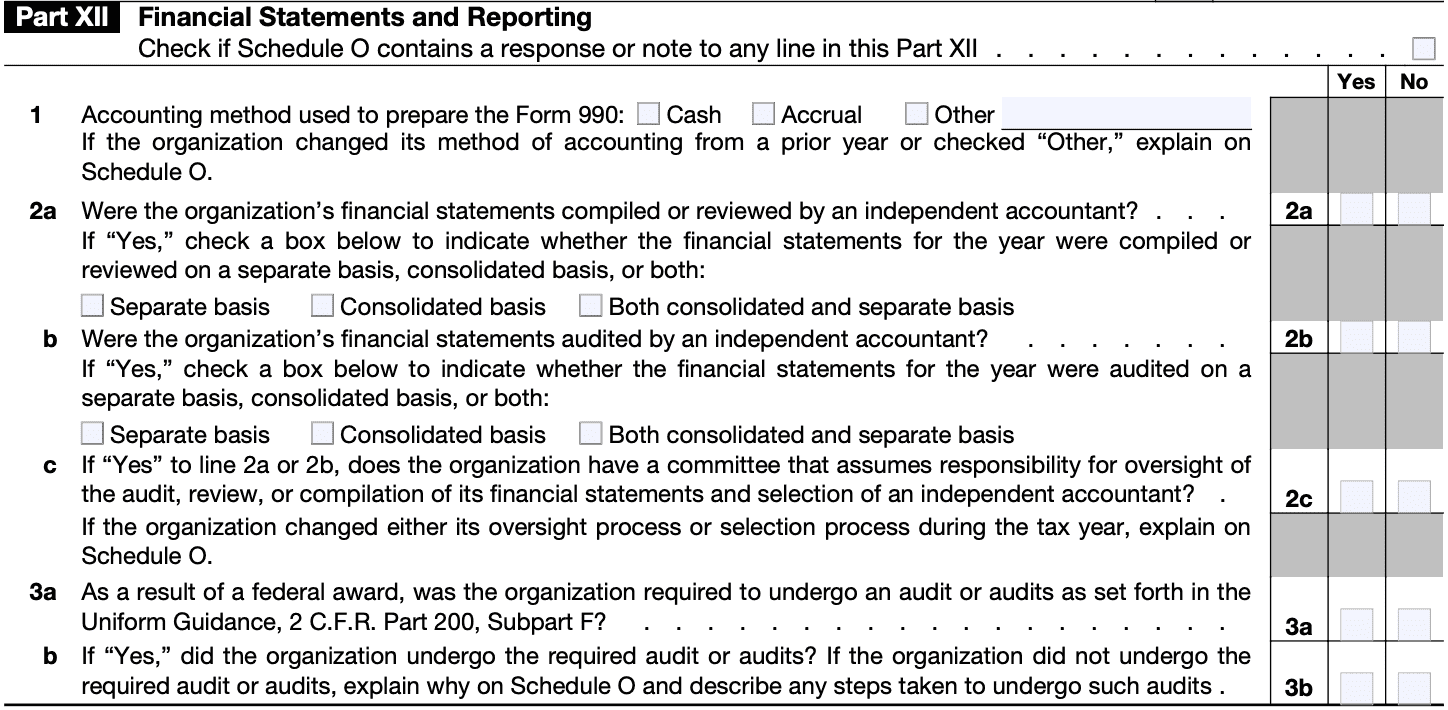

Complete Part II through Part XII, which covers various aspects of your organization's finances. This includes reporting revenue, expenses, assets, liabilities, and other financial transactions. Be sure to follow the instructions and include all required schedules and attachments.

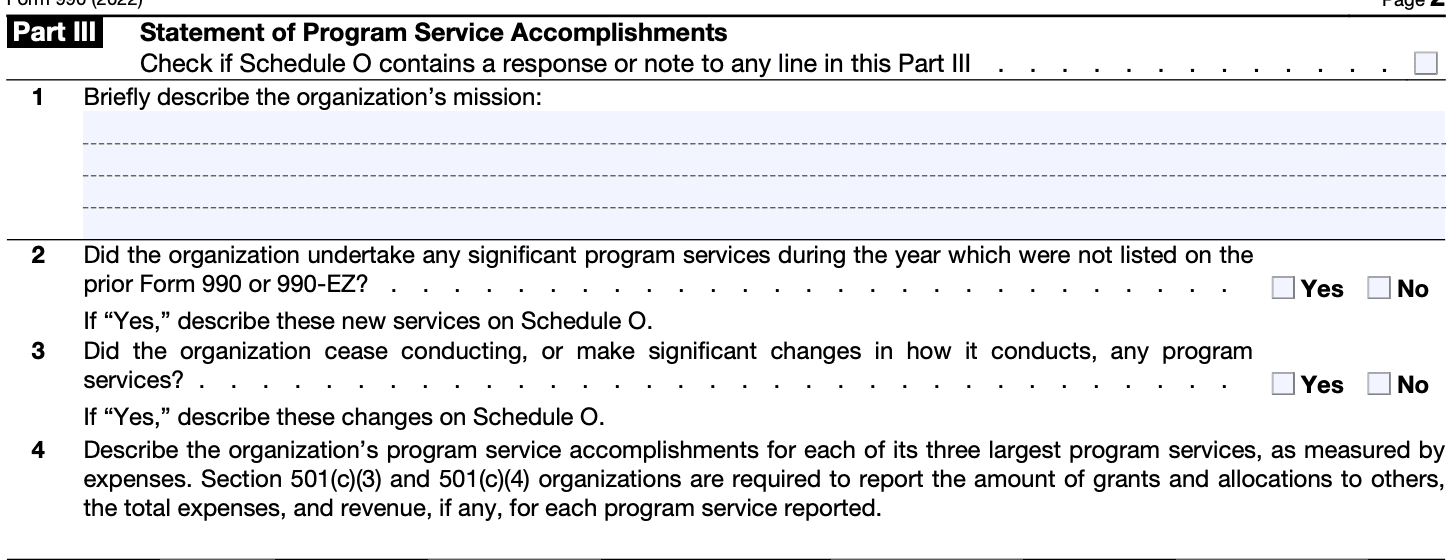

Step 7: Provide details about the organization's programs and activities

Part III of Form 990 requires information about the organization's programs, accomplishments, and other details about its tax exempt purpose

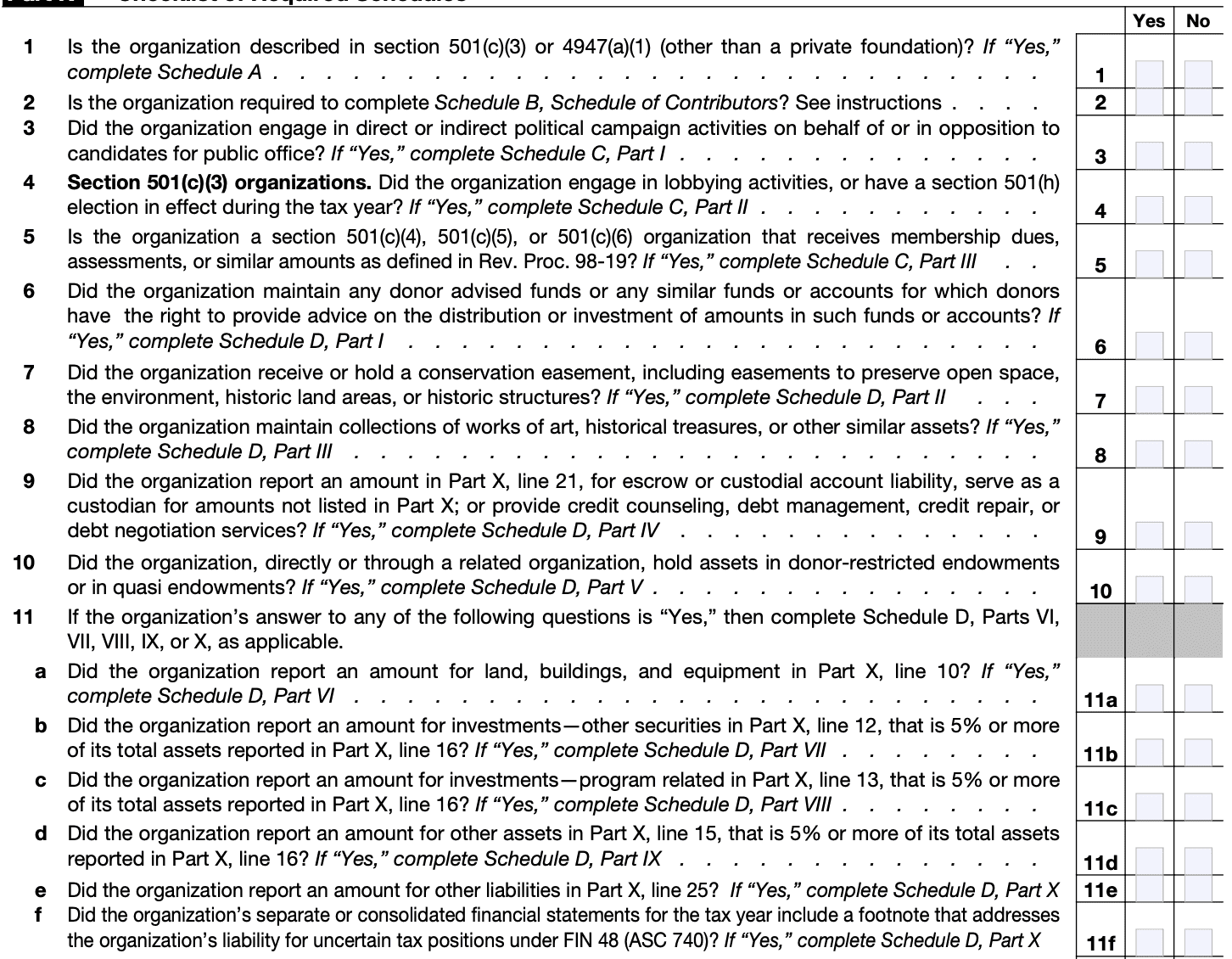

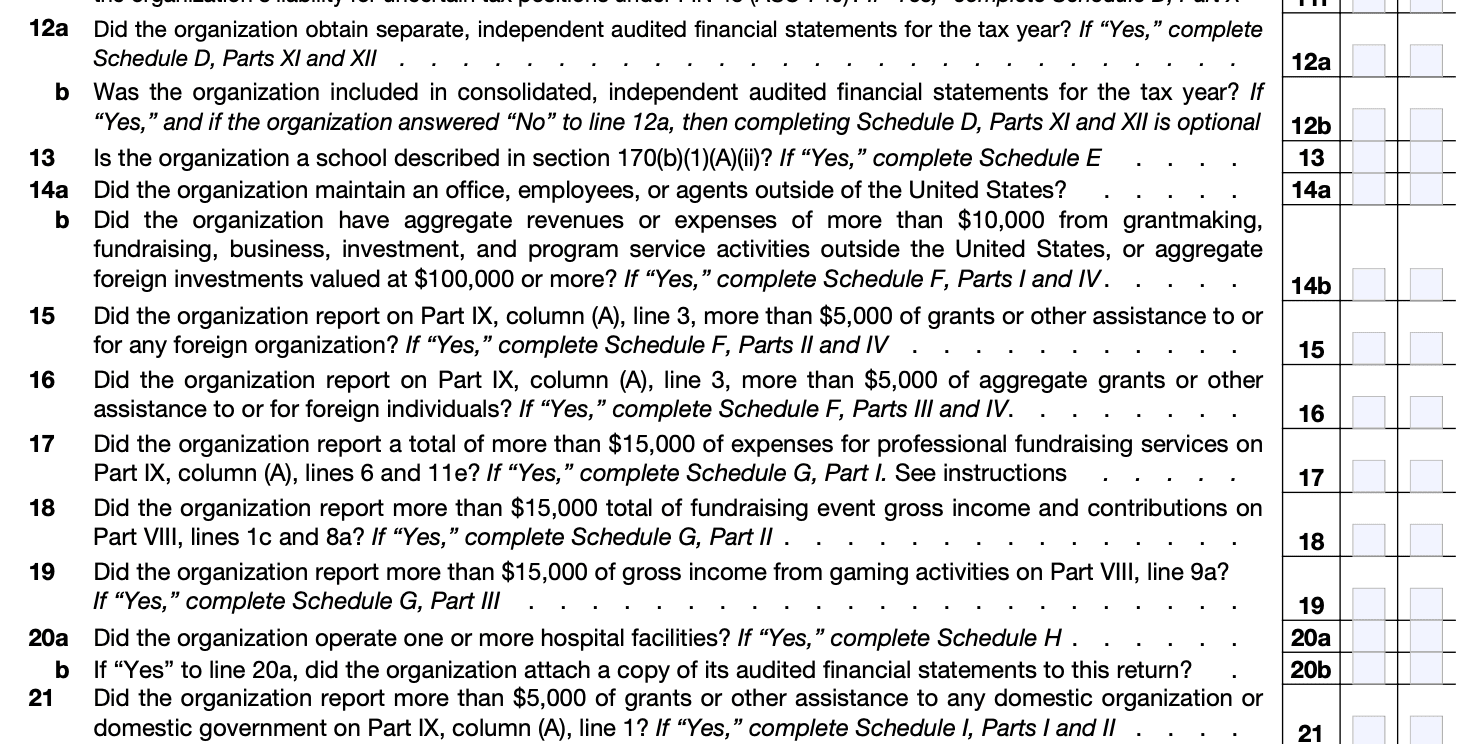

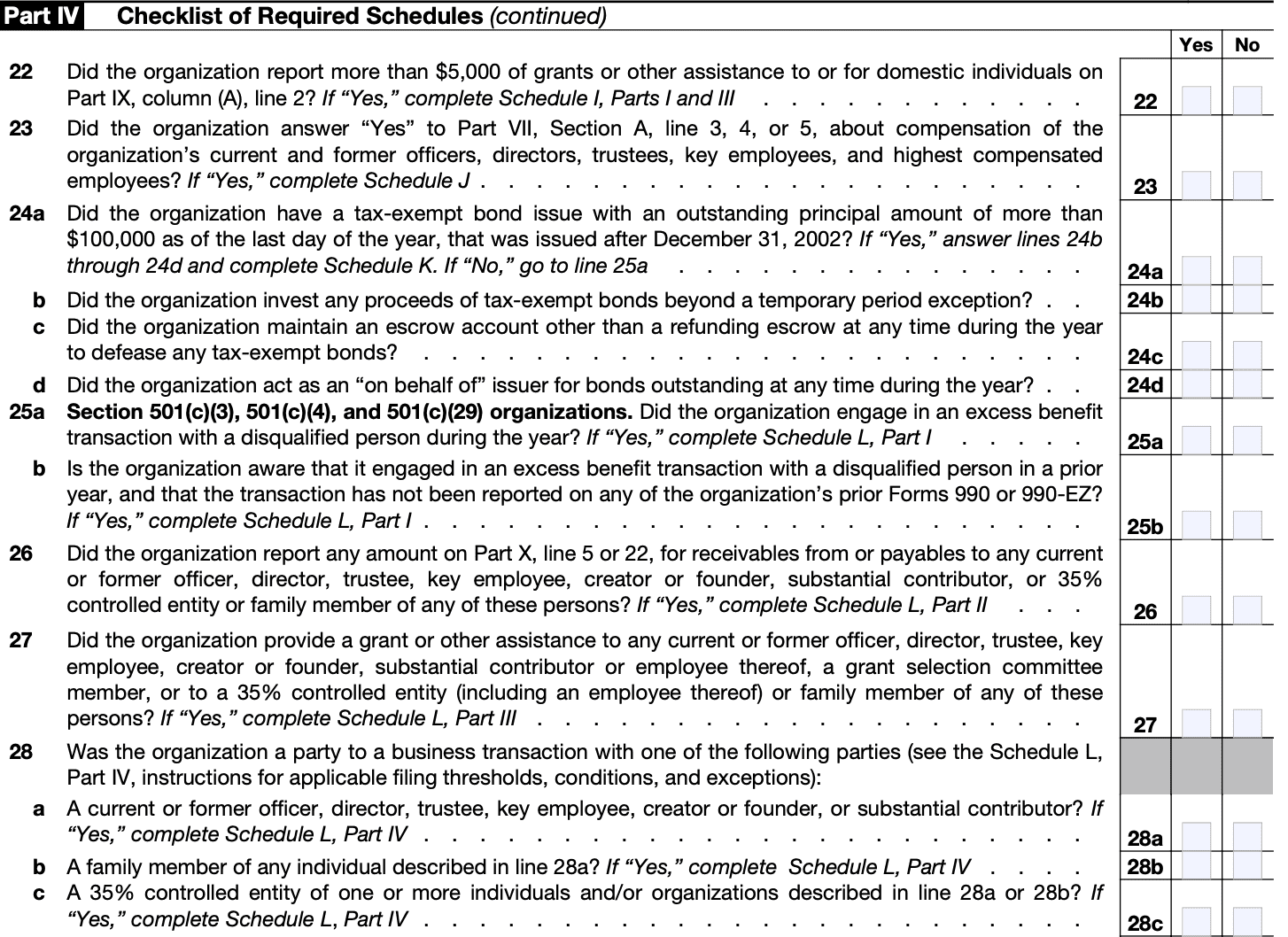

Step 8: Complete required schedules of section 501(c)(3) organizations

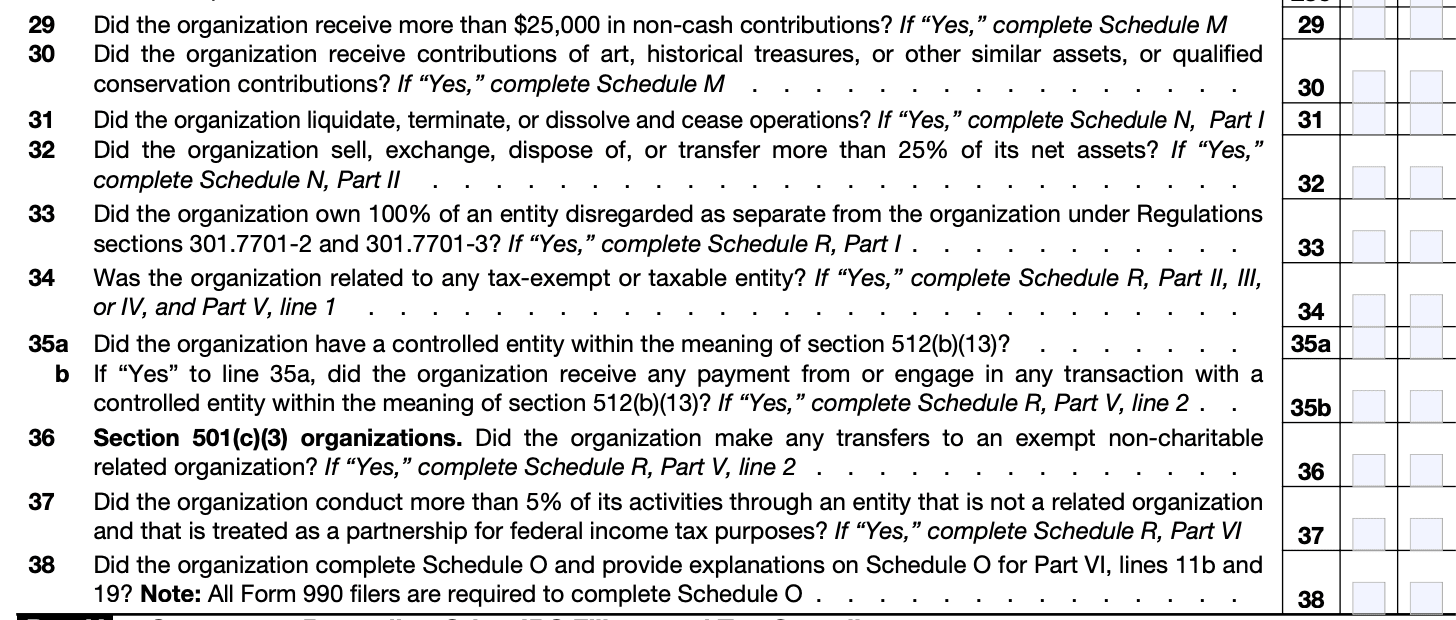

Part IV of Form 990 requires information about the organization's programs, accomplishments, and other details about its tax exempt activities

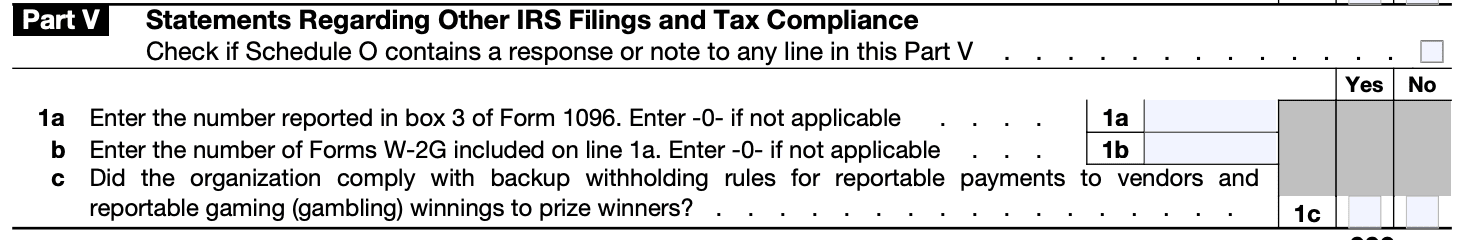

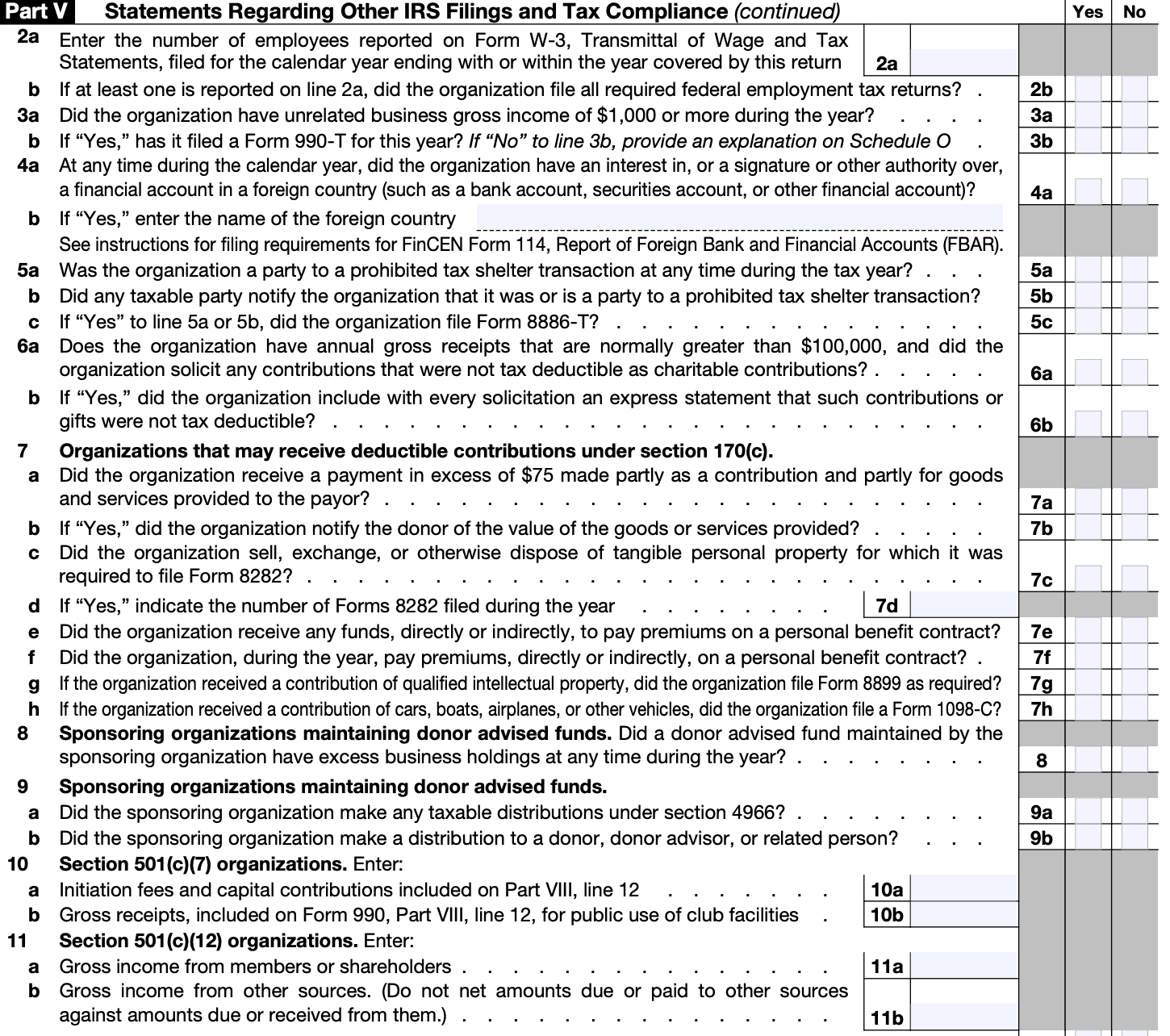

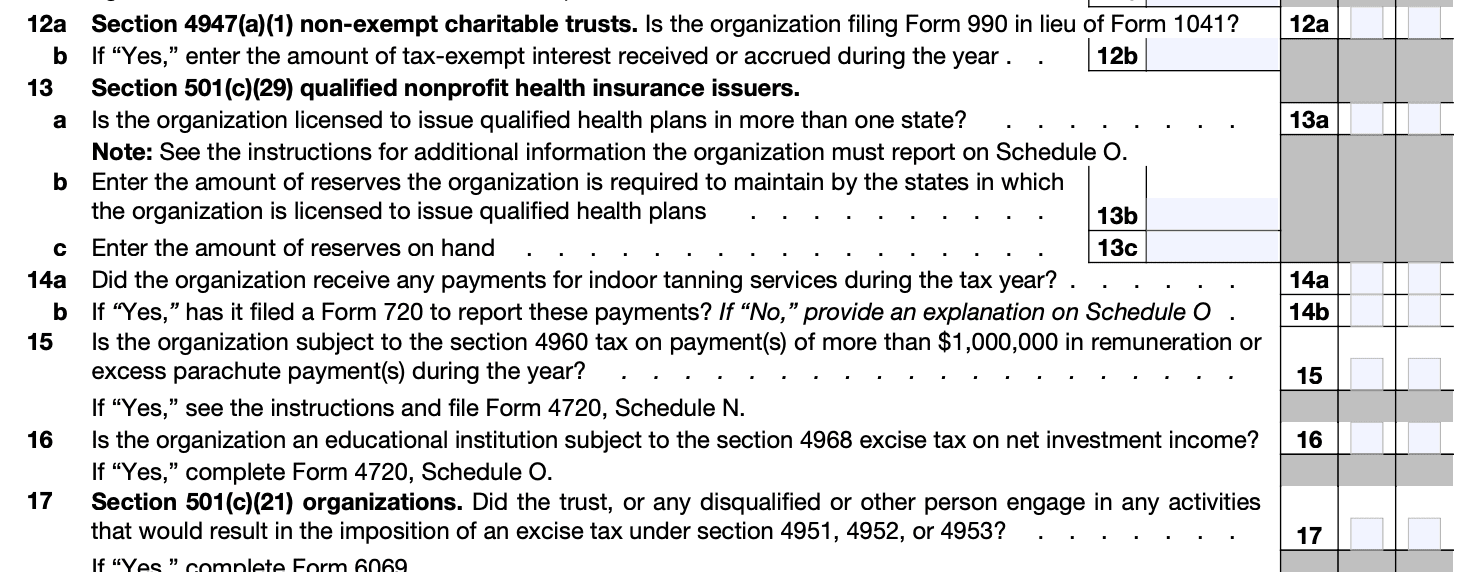

Step 9: Complete Part V - Statements regarding other IRS filings and tax compliance

Attach other IRS filings and tax reports in part V

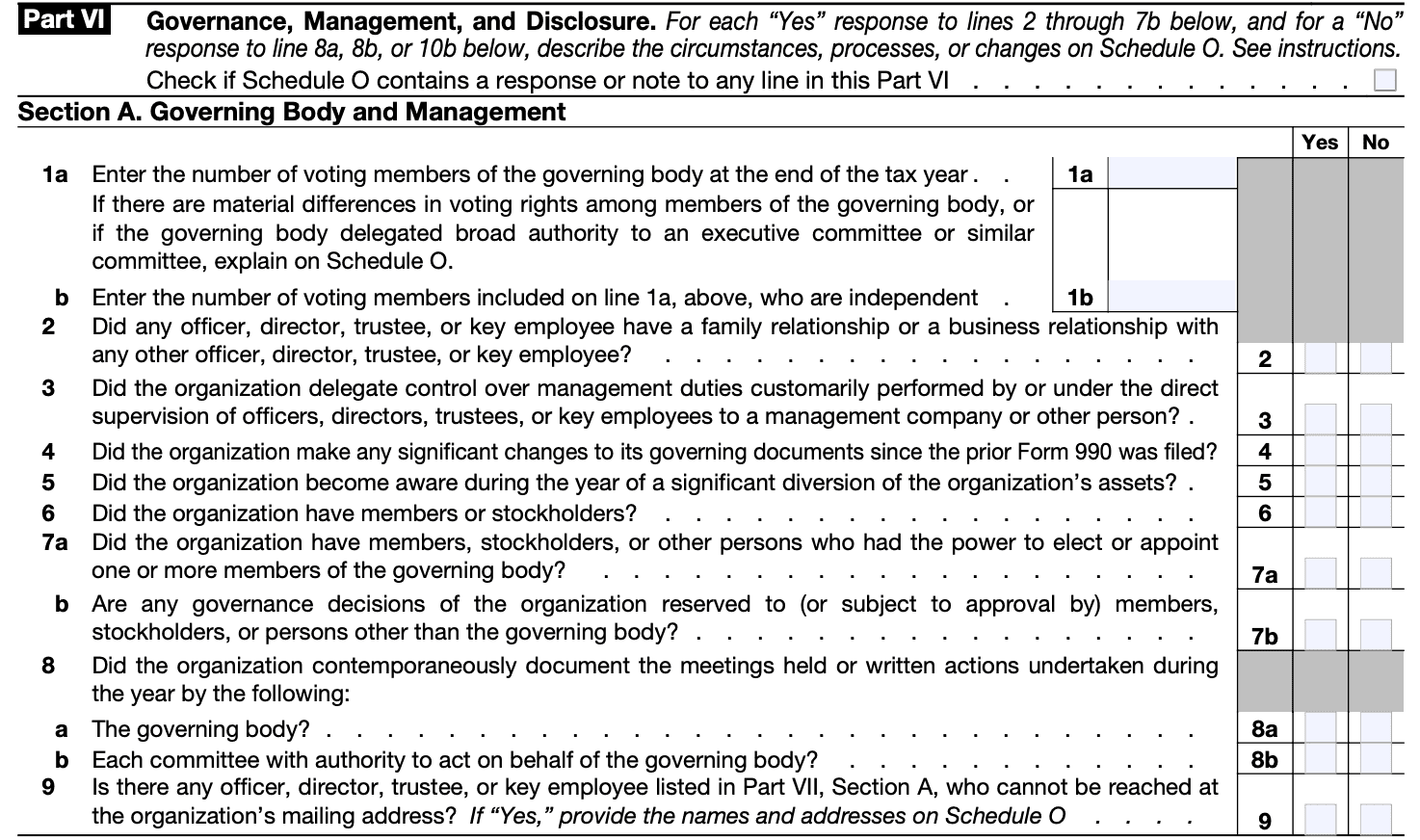

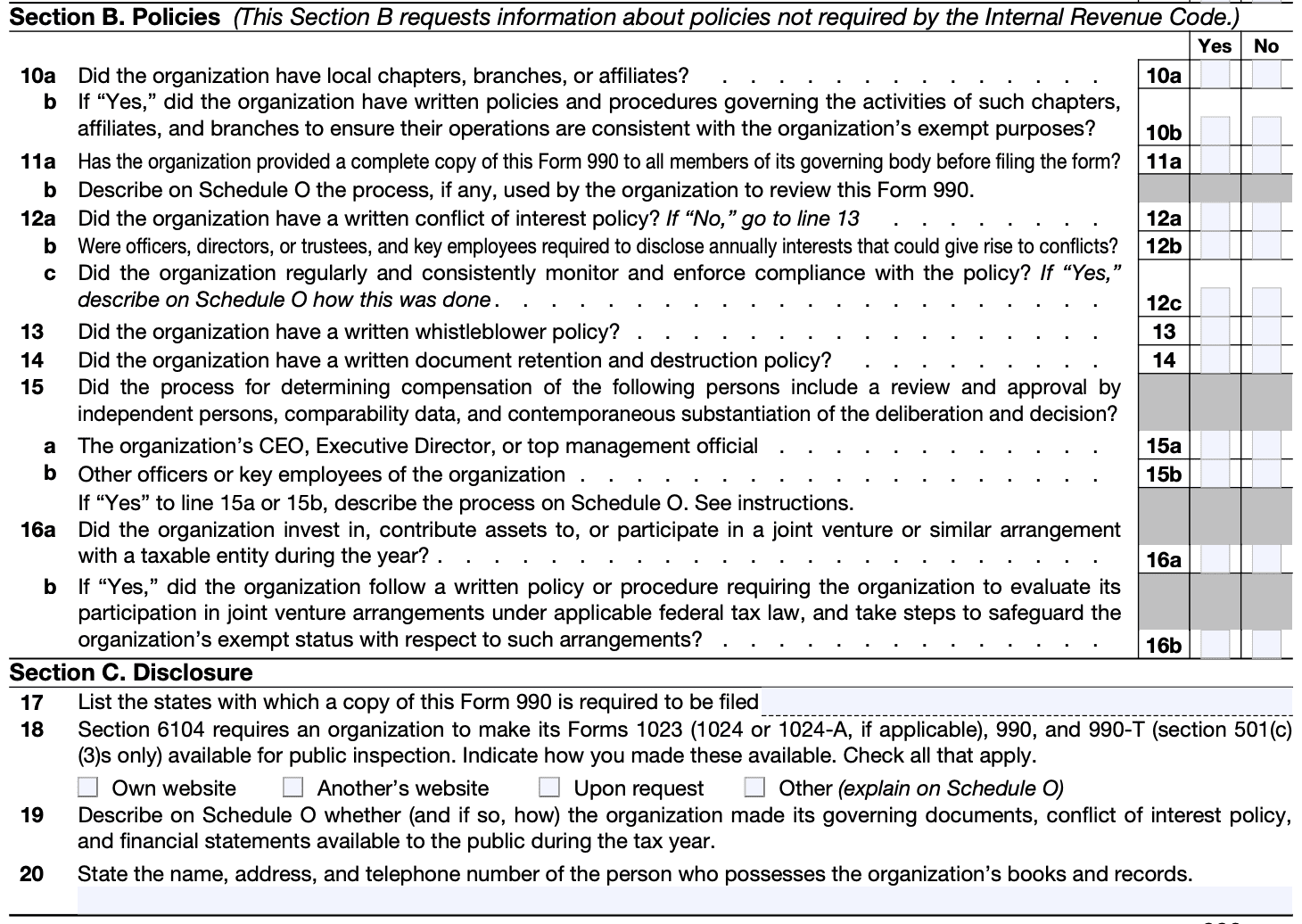

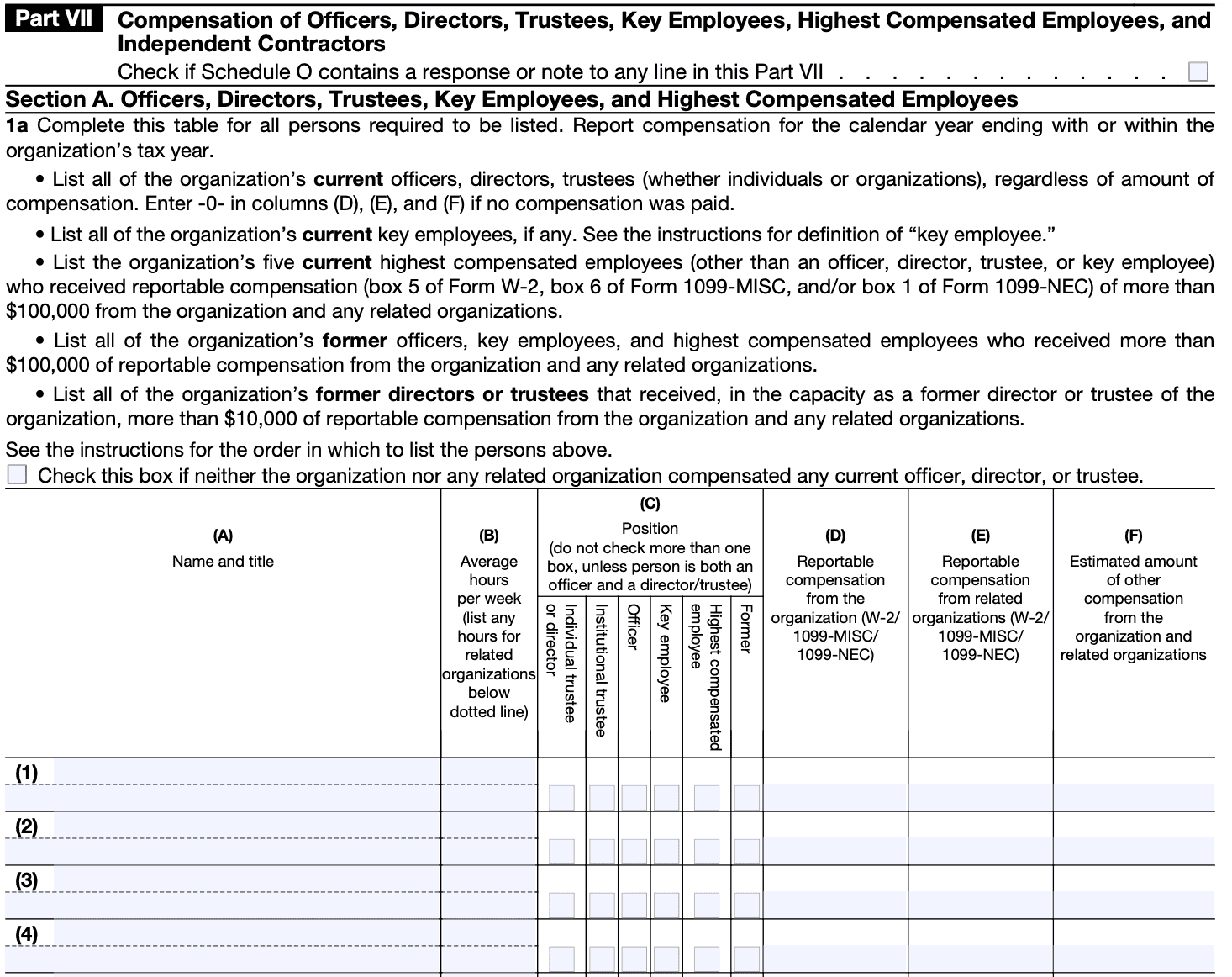

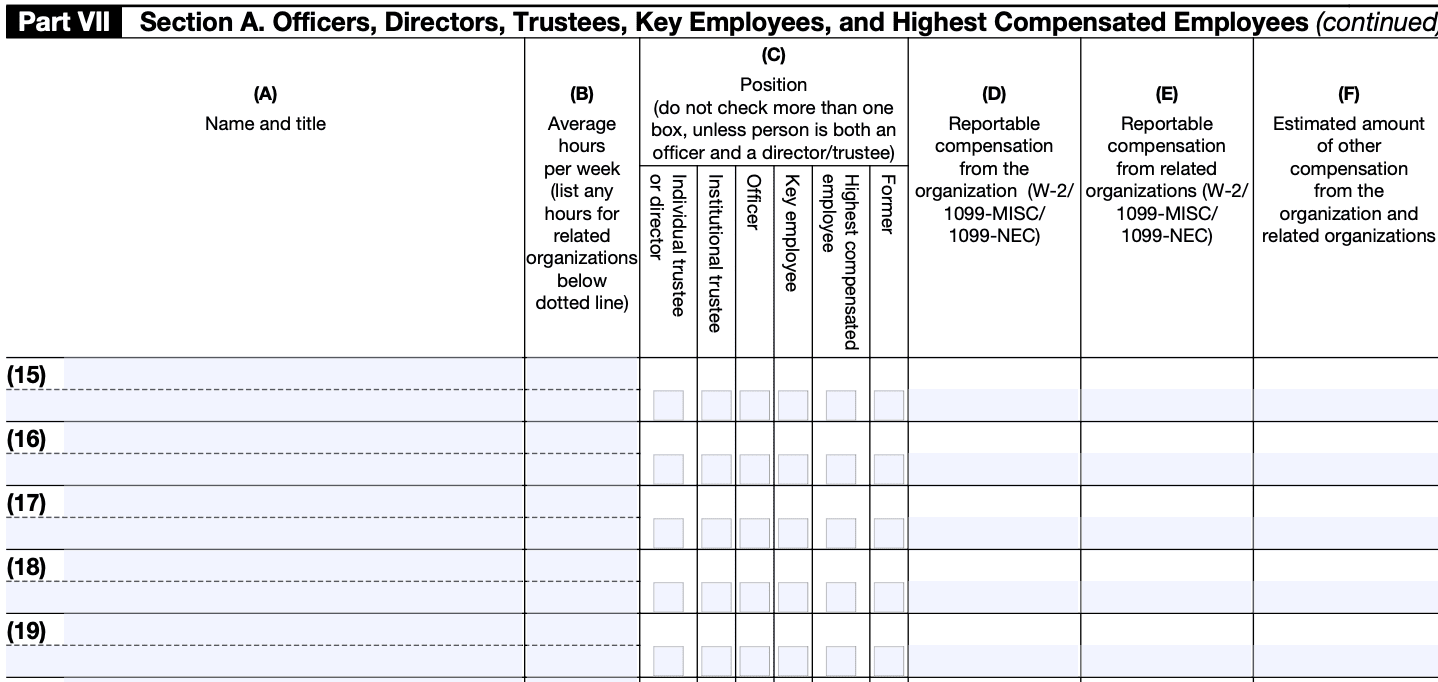

Step 10: Report on governance, management, and disclosure

From Part VI through Part VII, focus on governance policies, compensation of key personnel, and compliance with tax regulations.

Step 11: Financial statements

From Part IX through Part XII, furnish all important financial statements like balance sheet, bank reconciliation statement & reports.

Step 12: Complete the required schedules

Form 990 may require additional schedules depending on your organization's activities and financial situation. Make sure to fill out all the necessary schedules and attach them to the main form.

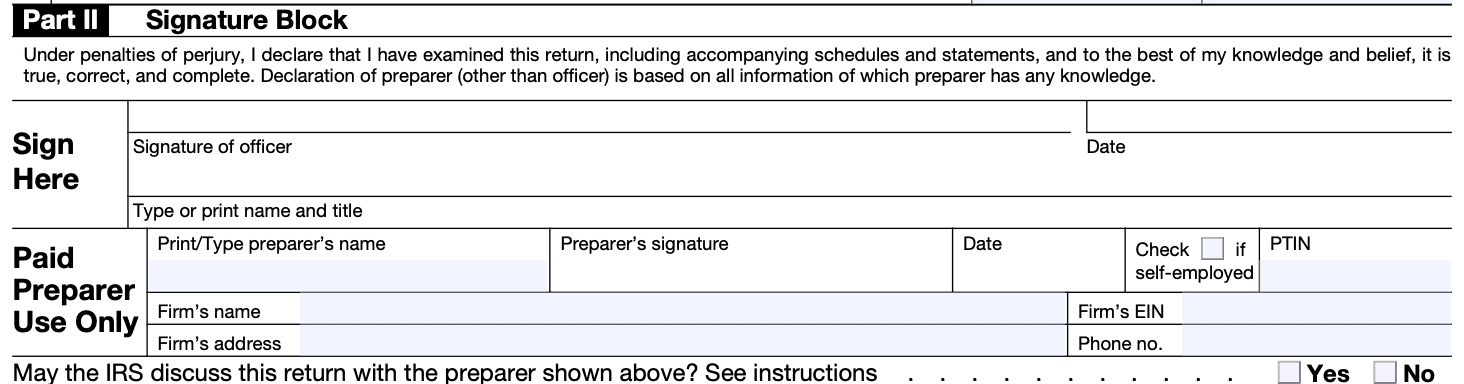

Step 13: Review and sign the form

Thoroughly review the completed form and all attached schedules for accuracy and completeness. Once you are confident that all information is accurate, have an authorized person sign the form before submission.

Step 14: File the form

File the completed Form 990 by the due date, which is usually the 15th day of the 5th month after the organization's tax year ends. You can file electronically through the IRS website or by mail.

Step 15: Keep a copy for your records

Make sure to keep a copy of the completed Form 990 and all supporting documents for your records.

It's important to note that completing Form 990 can be intricate, and it's advisable to seek assistance from a qualified tax professional or accountant to ensure compliance with all applicable tax laws and regulations.

Special Considerations When Filing Form 990

Here are some special considerations to keep in mind when filing Form 990:

Understand your organization's exempt status: There are different versions of Form 990, such as 990, 990-EZ, and 990-N (e-Postcard), depending on the organization's annual gross receipts and total assets. Make sure you know which version applies to your organization.

**Filing deadline: **Form 990 is typically due on the 15th day of the 5th month following the end of the organization's fiscal year. Extensions are available, but it's crucial to adhere to the deadlines to avoid penalties.

**Accurate financial reporting: **Provide accurate and detailed financial information about your organization, including revenue, expenses, assets, and liabilities. This is crucial for maintaining transparency and credibility with donors, stakeholders, and the IRS.

**Program service accomplishments: **Describe your organization's mission and provide a clear explanation of the programs and services offered to the community. Demonstrate how your organization achieves its exempt purpose.

Governance and policies: Disclose information about your organization's board members, key employees, and their compensation. Detail any conflicts of interest policies and procedures in place.

Public inspection: Form 990 is a public document, and it will be available for public inspection. Ensure that the information you provide is consistent with your organization's public image and messaging.

Lobbying and political activities: Nonprofits have limits on the amount of lobbying and political activities they can engage in to maintain their tax exempt status. Report any such activities accurately.

Related organizations and transactions: Disclose any relationships with other organizations, especially if there are transactions between them. The IRS is concerned about potential private insurance or excess benefit transactions.

Schedule B reporting: For some organizations, Schedule B requires reporting certain contributors, including individuals and corporations, if they exceed a certain threshold. Ensure compliance with the reporting requirements.

Unrelated business income tax (UBIT): If your organization engages in activities that generate unrelated business income, be sure to report it correctly and pay any applicable UBIT.

Foreign activities: If your organization operates internationally or has foreign financial accounts, you may need to file additional forms and report the foreign activities.

Changes in reporting requirements: Be aware of any changes in the reporting requirements and instructions issued by the IRS for the specific tax year.

It's essential to consult with a qualified tax professional or attorney with expertise in nonprofit tax law to ensure accurate and compliant filing of Form 990. Filing mistakes or non-compliance can result in penalties, loss of tax exempt status, and potential legal issues.

How To File: Offline/Online/E-filing

Offline filing

To file Form 990 offline, you will need to obtain a physical copy of the form from the IRS. You can download it from the IRS website or request a printed copy to be sent to you. After filling out the form, you'll need to mail it to the appropriate IRS address for filing. Make sure to use certified mail or a reliable delivery service to ensure it reaches the IRS on time.

Online filing

Online filing is typically done through the IRS's Modernized e-File (MeF) system. You can access this system through the IRS website or use approved third-party software. Here are the steps to file online:

- Gather the required information and complete Form 990 using IRS-approved e-filing software.

- Check for errors and review the completed form carefully.

- Once you are satisfied with the accuracy, submit the form electronically through the MeF system.

E-filing

E-filing is a specific method of filing electronically, often used by larger organizations or tax professionals who need to file multiple returns. It involves creating an XML file containing the required information and transmitting it directly to the IRS.

Common Mistakes To Avoid While Filing Form 990

Here are some common mistakes to watch out for when filing Form 990:

Filing the wrong form: There are different versions of Form 990, such as 990-N, 990-EZ, and 990. Ensure that you are using the correct form based on your organization's size and financial activity.

Missing or incorrect information: Failing to include all required information or providing inaccurate data can lead to delays in processing and potential penalties.

Late filing: Make sure to file the Form 990 by the due date, which is the 15th day of the fifth month after the organization's fiscal year-end.

Incomplete schedule attachments: Depending on the organization's activities, additional schedules might be required. Be sure to include all necessary schedules and ensure they are filled out correctly.

**Confusing program service accomplishments with financial data: **Clearly differentiate between program service accomplishments and financial data on Part III of Form 990. Program service accomplishments should be narrative descriptions of the organization's achievements.

Failure to report compensation accurately: Provide accurate compensation figures for key employees, officers, and directors. Reporting incorrect or incomplete compensation information can raise red flags during the IRS review.

Mishandling unrelated business income: If your tax exempt organization engages in activities that generate unrelated business income, make sure to report it correctly on Form 990-T.

Overlooking governance questions: Pay attention to the governance-related questions in Part VI of Form 990. Failure to answer these questions or providing incomplete answers could raise concerns during the IRS review.

Not reconciling financial information: Ensure that the financial information reported on the Form 990 matches the financial statements of the organization. Any discrepancies should be explained.

Forgetting to sign the return: Remember to sign and date the Form 990 before submission. An unsigned return is considered incomplete and may lead to penalties.

Neglecting state requirements: Some states require organizations to file state-specific forms, even if they are tax exempt at the federal level. Be aware of state-specific filing requirements.

Lack of (link: https://fincent.com/blog/a-beginners-guide-to-record-keeping-for-small-businesses text: record-keeping): Maintain detailed and accurate records to support the information reported on Form 990. The IRS may request documentation during an audit or review.

It's essential to be diligent and thorough when completing Form 990 to avoid potential issues with the IRS and maintain compliance with tax exempt status regulations. Consider seeking professional assistance or using specialized software to help with the filing process if needed.

Conclusion

Form 990 is more than just a mandatory tax filing; it embodies the principles of transparency, accountability, and good governance in the nonprofit world.

By providing a comprehensive view of a tax exempt organization's activities and financial health, Form 990 fosters trust and confidence among donors and the public.

Nonprofits should embrace this opportunity to showcase their commitment to transparency, and stakeholders should make use of the available data to ensure their contributions are well-placed and impactful.