- IRS forms

- Form 965-E

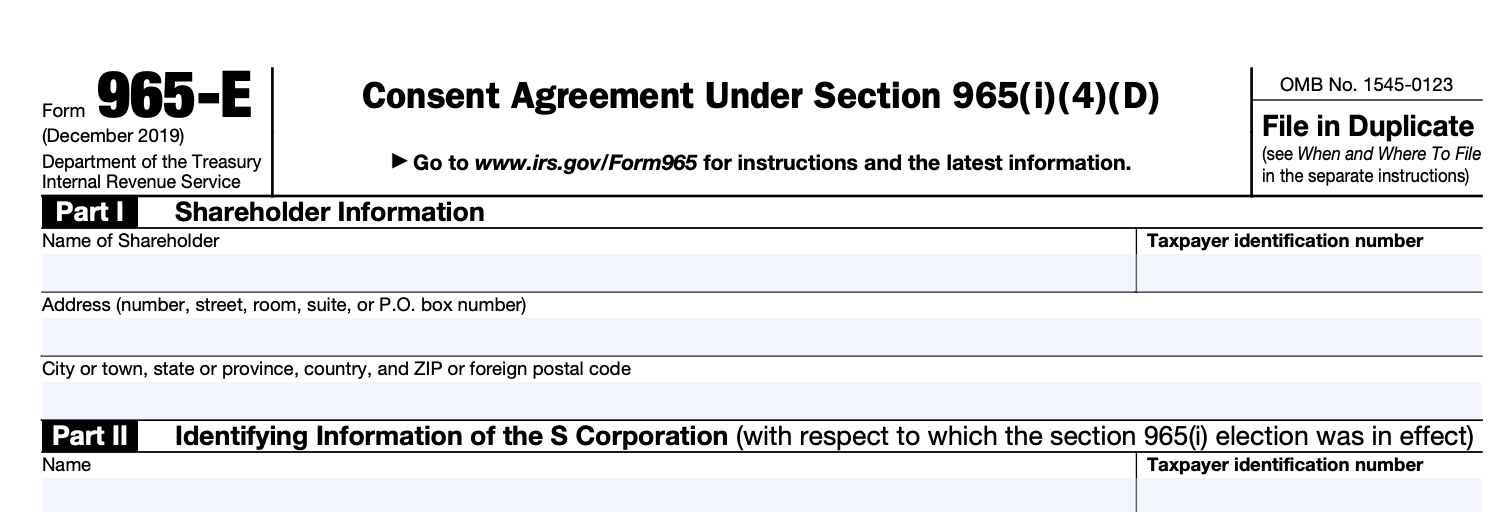

Form 965-E: Consent Agreement Under Section 965(i)(4)(D)

Download Form 965-EAs a business owner or taxpayer, staying informed about tax obligations and compliance requirements is crucial. One such requirement that arose from the Tax Cuts and Jobs Act (TCJA) is the Section 965 transition tax.

Under this provision, certain U.S. shareholders of foreign corporations must report and pay a one-time tax on accumulated foreign earnings and profits. One component of this process involves filing Form 965-E, the Consent Agreement under Section 965(i)(4)(D).

Form 965-E, also known as the Consent Agreement under Section 965(i)(4)(D), is an essential component of the transition tax reporting process. Its purpose is to provide consent from each shareholder to the inclusion of their share of accumulated deferred foreign income in the income of the specified foreign corporation. This form is typically filed by certain U.S. shareholders who have an interest in specified foreign corporations.

Key Components of Form 965-E

**Shareholder information: **Form 965-E requires the taxpayer to provide detailed information about the U.S. shareholder, including their name, taxpayer identification number, and contact information.

Specified foreign corporation information: The form also requires the disclosure of relevant information regarding the specified foreign corporation, such as the entity's name, Employer Identification Number (EIN), and tax year.

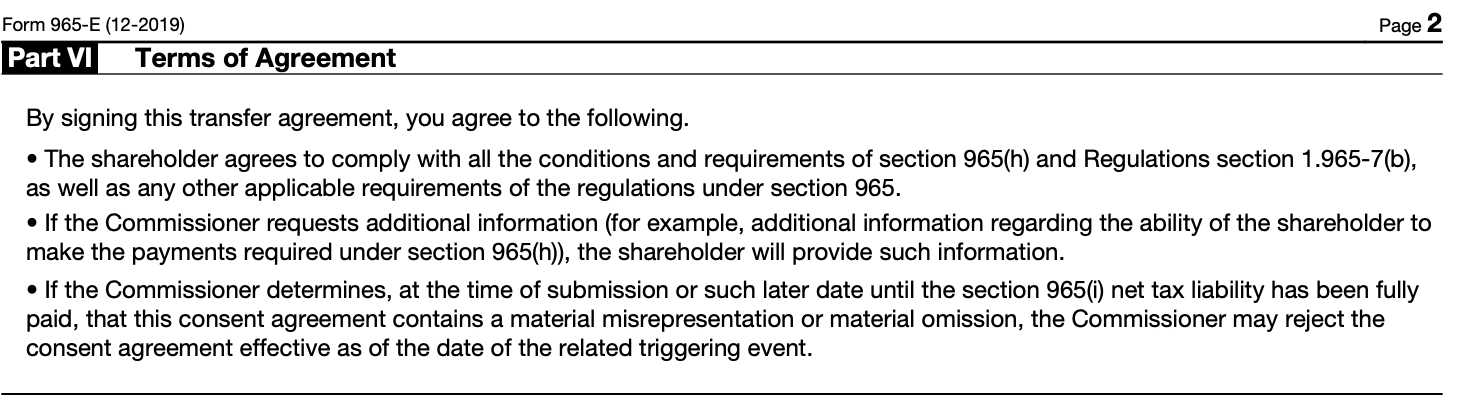

Consent agreement: The crucial part of Form 965-E is the consent agreement itself. The taxpayer must affirm their consent to the inclusion of their share of accumulated deferred foreign income in the specified foreign corporation's income.

Calculation of accumulated deferred foreign income: Additionally, the form may require the taxpayer to calculate and report the accumulated deferred foreign income to be included in the specified foreign corporation's income.

Benefits of Form 965-E

Here are some benefits of filing Form 965-E and entering into a consent agreement under Section 965(i)(4)(D):

-

Deferral of tax liability: The consent agreement allows eligible taxpayers to defer their tax liability related to the transition tax on certain foreign earnings. Instead of paying the full tax liability upfront, taxpayers can elect to pay the tax in installments over an eight-year period.

-

Reduced interest and penalties: By entering into a consent agreement, taxpayers may be eligible for a reduction in interest and penalties associated with the unpaid transition tax liability. This can help mitigate the financial burden of the tax liability.

-

Improved cash flow management: The ability to pay the transition tax liability in installments can provide businesses with improved cash flow management. It allows them to spread out the tax payments over several years, potentially easing the strain on their financial resources.

-

Compliance with tax obligations: Filing Form 965-E and entering into a consent agreement ensures compliance with the tax obligations imposed by the TCJA. It allows taxpayers to meet their reporting requirements and address their transition tax liability in a structured and agreed-upon manner.

-

Avoidance of adverse tax consequences: Failure to comply with the transition tax provisions can result in significant penalties and other adverse tax consequences. By filing Form 965-E and entering into a consent agreement, taxpayers can mitigate these risks and avoid potential legal and financial ramifications.

Who Is Eligible To File Form 965-E?

To be eligible to file Form 965-E, you must meet the following criteria:

**You are a United States shareholder of an SFC: **You must be a U.S. person who owns stock in a specified foreign corporation. A U.S. shareholder is generally a U.S. person (individual, corporation, partnership, etc.) who owns 10% or more of the voting stock of a foreign corporation.

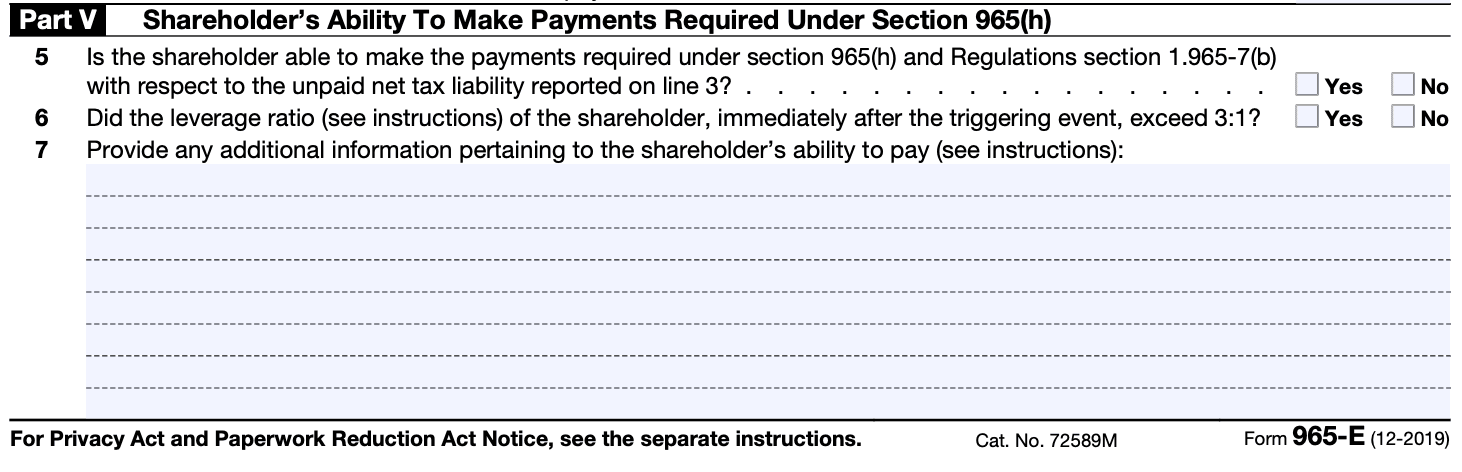

You have a net tax liability under Section 965: Section 965 of the TCJA imposes a transition tax on the untaxed foreign earnings of certain foreign corporations. If you have a net tax liability under Section 965, you may be eligible to enter into a consent agreement to defer the payment of that liability.

**You want to defer your net tax liability: **By filing Form 965-E and entering into a consent agreement with the IRS, you can defer payment of the net tax liability imposed under Section 965(i)(1) over a period of eight years.

How To Complete Form 965-E: A Step-by-Step Guide

Step 1: Obtain the form

Obtain the latest version of Form 965-E and the corresponding instructions from the IRS website. Make sure you have any additional supporting documents or schedules that may be required.

Step 2: Gather the necessary information

Gather the necessary information and supporting documents, including your financial statements, records of foreign income, and any relevant schedules or forms filed previously.

Step 3: Complete the header section

Begin by providing your identifying information at the top of Form 965-E, such as your name, Social Security number, and tax year.

Step 4: Calculate the deferred foreign income subject to transition tax

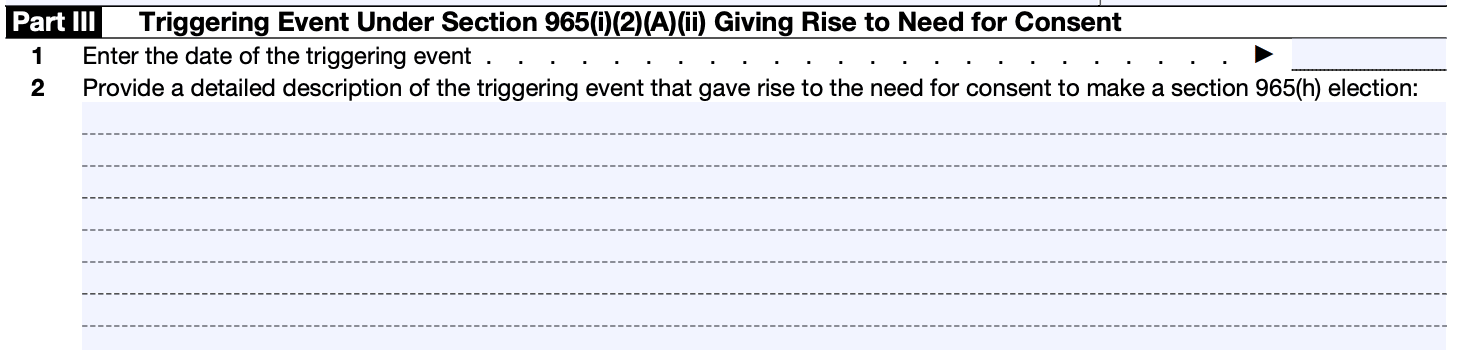

Follow the instructions on the form to determine the deferred foreign income subject to transition tax. This involves calculating the relevant amounts based on the specified rules and provisions.

Step 5: Fill details to report the deferred foreign income

Complete the required sections on the form to report the deferred foreign income, including the appropriate lines and schedules as instructed. Provide accurate figures based on your calculations and supporting documentation.

Step 6: Attach relevant schedules/forms

If applicable, attach any required schedules or forms that accompany Form 965-E. This may include Schedule A, which provides details of previously taxed earnings and profits (PTEP) and Schedule B, which reports specified foreign corporations.

Step 7: Double-check all the information

Double-check all the information you entered on Form 965-E to ensure accuracy and completeness. Review the form and instructions carefully to make sure you haven't missed anything.

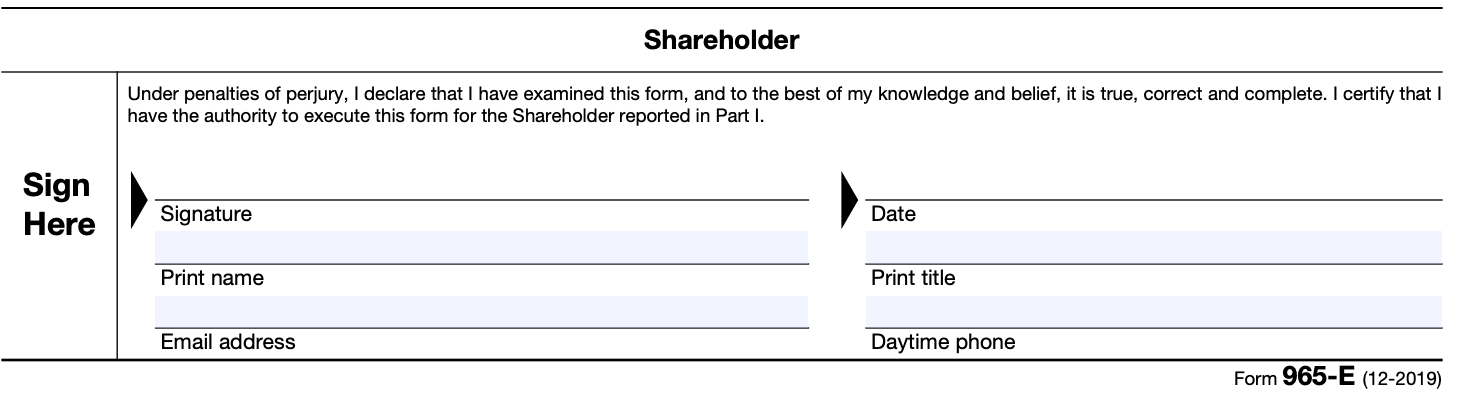

Step 8: Sign the form

Sign and date the form as required. If you're filing jointly, both spouses must sign the form.

Step 9: Submit the form

Keep a copy of the completed Form 965-E for your records and submit it according to the IRS instructions. This may involve mailing it to the designated IRS address or electronically filing if available.

Special Considerations When Filing Form 965-E

When filing Form 965-E, there are several special considerations to keep in mind:

Transition tax calculation: The transition tax is calculated based on the accumulated foreign earnings and profits (E&P) of specified foreign corporations as of certain specified dates. It's important to accurately calculate the E&P and follow the instructions provided by the IRS for the transition tax calculation.

Specified foreign corporations: Form 965-E applies to U.S. shareholders who own at least 10% of the voting stock in one or more specified foreign corporations. Ensure that the foreign corporations meet the criteria and are properly identified on the form.

Reporting deferred foreign income: The form requires reporting of previously untaxed foreign earnings and profits (deferred foreign income) that are subject to the transition tax. It's crucial to accurately determine the amount of deferred foreign income and report it correctly on the form.

Elections and adjustments: Form 965-E provides options for making certain elections and adjustments related to the transition tax. These include the election to pay the tax liability in installments over 8 years or making a one-time payment. Review the instructions carefully and make the appropriate elections or adjustments based on your circumstances.

Foreign tax credits: If you paid or accrued foreign income taxes on the deferred foreign income, you may be eligible for foreign tax credits. The form allows for the calculation and reporting of foreign tax credits, which can help offset the transition tax liability. Ensure that you accurately calculate and report any foreign tax credits you are eligible for.

Reporting and payment deadlines: Form 965-E has specific reporting and payment deadlines that must be adhered to. It's important to be aware of these deadlines and file the form and make the tax payment accordingly to avoid penalties or interest charges.

Professional assistance: Filing Form 965-E can be complex, especially if you have multiple foreign corporations and significant deferred foreign income. Consider seeking the assistance of a qualified tax professional or accountant who has experience with international tax matters to ensure compliance and accurate reporting.

Filing Deadlines & Extensions for Form 965-E

Here's some general information regarding filing deadlines and extensions for tax forms:

Original filing deadline: The original due date for Form 965-E is typically the same as the due date for the income tax return, which is generally April 15 for calendar year taxpayers. However, the due date can vary depending on weekends, holidays, and other factors. It's essential to refer to the specific tax year's instructions or consult the IRS website for the most up-to-date information.

Extension of time to file: If you need more time to complete Form 965-E, you can request an extension. To obtain an extension, you must file Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." This form extends the filing deadline for both your tax return and any related forms, such as Form 965-E. The extension is typically granted for an additional six months, moving the deadline to October 15 for calendar year taxpayers. It's important to note that the extension only applies to the filing deadline, not the payment of any taxes owed.

**Estimated tax payments: **If you have an estimated tax liability related to Form 965-E, it's important to make timely estimated tax payments to avoid penalties and interest charges. These payments are typically due in installments throughout the tax year, with the final payment due by the original due date of the tax return, or by the extended due date if an extension has been granted.

**Updated Information: **As tax laws can change, it's crucial to consult the most recent instructions, IRS publications, or visit the official IRS website (www.irs.gov) for the latest information on filing deadlines and extensions. Additionally, consulting a tax professional or accountant can provide personalized guidance based on your specific situation.

Common Mistakes To Avoid While Filing Form 965-E

It's important to ensure accurate and compliant filing to prevent any potential penalties or issues with the Internal Revenue Service (IRS). Here are some mistakes to watch out for when filing Form 965-E:

**Incorrect or incomplete information: **One of the most common mistakes is providing incorrect or incomplete information on the form. Make sure to carefully review the instructions and provide accurate details for all the required fields.

Improper calculation of the transition tax: The transition tax is a key aspect of Form 965-E. It is essential to correctly calculate the amount of deferred foreign income that should be included and the corresponding tax liability. Use the appropriate tax rates and follow the IRS guidelines to ensure accurate calculations.

Failure to include all relevant foreign subsidiaries: Ensure that you include all relevant foreign subsidiaries and associated deferred foreign income on the form. Failing to report any eligible subsidiaries can lead to inaccuracies in the calculation of the transition tax.

Inconsistent or conflicting information: Double-check all the information provided on the form to ensure consistency and avoid any conflicting statements. Any discrepancies or inconsistencies may trigger further scrutiny from the IRS.

**Missing or untimely filing: **Filing deadlines are crucial when it comes to tax forms. Be aware of the due date for Form 965-E and make sure to submit it on time. Missing the deadline can result in penalties and interest charges.

Lack of supporting documentation: Keep thorough records and maintain the necessary supporting documentation to substantiate the information reported on Form 965-E. This includes financial statements, tax returns, and any other relevant documents. Having proper documentation can help in case of an audit or IRS inquiry.

Ignoring updates or changes to the form: Stay up to date with any changes or updates to the form and instructions provided by the IRS. Tax laws and regulations can evolve over time, so it's essential to use the most recent version of the form and comply with any new requirements.

Conclusion

Form 965-E, the Consent Agreement under Section 965(i)(4)(D), plays a vital role in the reporting and compliance process associated with the Section 965 transition tax. It allows U.S. shareholders to provide their consent to the inclusion of their share of accumulated deferred foreign income in the specified foreign corporation's income. As with any tax-related form, it is essential to understand the requirements and seek professional advice when necessary to ensure compliance with the regulations imposed by the IRS.

Remember, tax laws and regulations can change over time. It is important to stay informed about the latest updates and consult with tax professionals or authorized advisors to navigate the complexities of tax compliance successfully.