- IRS forms

- Form 965-D

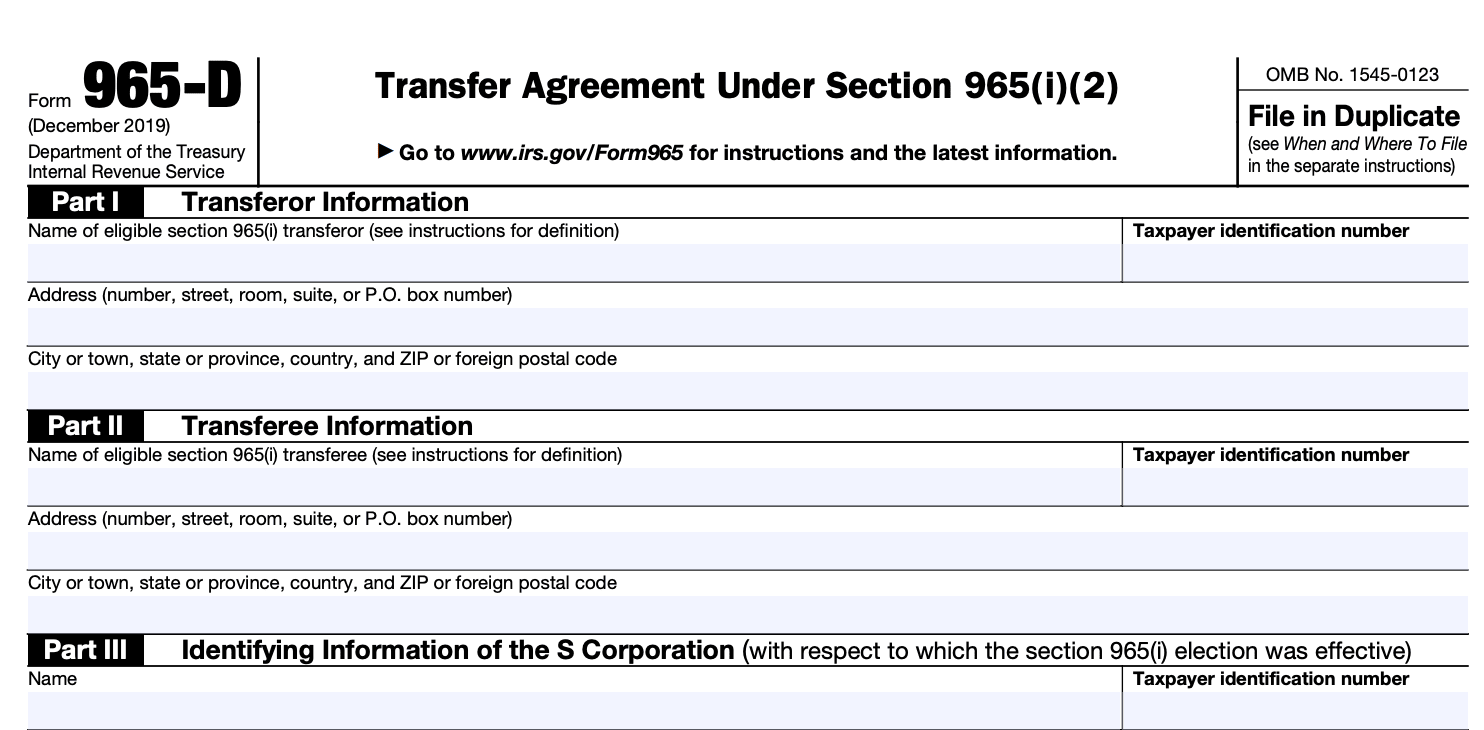

Form 965-D: Transfer Agreement Under Section 965(i)(2)

Download Form 965-DThe U.S. tax system is complex, and it often undergoes revisions and updates to adapt to changing economic landscapes. One such provision that was introduced as part of the Tax Cuts and Jobs Act of 2017 (TCJA) is Section 965, which addresses the taxation of previously untaxed foreign earnings of certain specified foreign corporations.

Within this section Form 965-D allows certain U.S. shareholders to defer their net tax liability for accumulated foreign earnings deemed repatriated under Section 965(a). It provides the option to pay the liability in installments over eight years.

In this blog post, we will delve into the purpose, requirements, and implications of Form 965-D.

Purpose Of Form 965-D

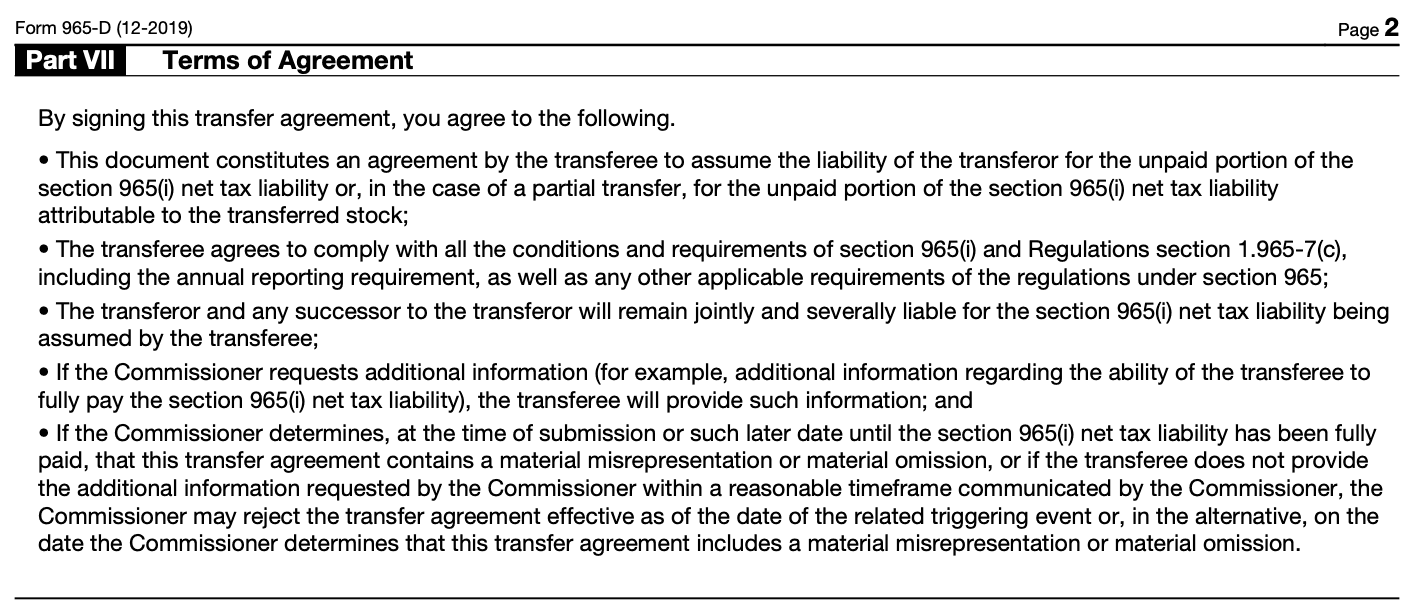

Form 965-D, also known as the Transfer Agreement Under Section 965(i)(2), is a specific form related to the United States tax law. It is used to report the transfer of a specified portion of a taxpayer's net tax liability under Section 965 of the Internal Revenue Code (IRC).

Section 965 of the IRC was enacted as part of the Tax Cuts and Jobs Act (TCJA) in 2017. It introduced a one-time mandatory repatriation tax on certain accumulated offshore earnings of U.S. shareholders of foreign corporations. This provision was designed to transition the U.S. international tax system to a territorial system.

Form 965-D is relevant for taxpayers who elected to pay the transition tax in installments under Section 965(h). It is used to report the transfer of the specified portion of the tax liability to another person, typically an affiliated corporation, as part of an agreement made under Section 965(i)(2). This form provides information about the taxpayer, the transferee, the amount of liability transferred, and other relevant details.

Benefits of Form 965-D

Here are some potential benefits of Form 965-D:

Transition tax calculation: Form 965-D helps individuals and businesses calculate and report the transition tax on previously untaxed foreign earnings. This tax provision was introduced under the TCJA to transition the U.S. international tax system from a worldwide system to a territorial system. By completing the form accurately, taxpayers can ensure compliance with the transition tax requirements.

Reduced tax liability: The transition tax allows taxpayers to pay the accumulated deferred foreign income at a reduced tax rate, rather than the regular corporate or individual income tax rates. By utilizing the provisions of Form 965-D, taxpayers may be able to reduce their overall tax liability compared to other tax treatment options.

Repatriation of foreign earnings: The transition tax and Form 965-D aim to encourage the repatriation of previously untaxed foreign earnings held by U.S. shareholders of foreign corporations. By reporting and paying the transition tax, taxpayers can bring these earnings back to the United States and invest them in the domestic economy.

Installment payment option: Form 965-D allows taxpayers to make the transition tax payment in installments over an eight-year period. This can provide financial flexibility by spreading the tax liability over several years instead of paying the full amount upfront. However, it's important to note that interest charges may apply to the deferred installments.

Compliance with tax regulations: Completing Form 965-D helps taxpayers comply with their reporting obligations related to deferred foreign income. By providing accurate and timely information on this form, taxpayers can avoid penalties and potential legal issues associated with non-compliance.

How To Complete Form 965-D: A Step-by-Step Guide

Here's a general outline of how to complete Form 965-D:

###1. Gather the necessary information

Collect all the relevant information required to complete Form 965-D, such as the names and identification numbers of the specified members of the consolidated group involved in the transfer, details of the transfer agreement, and the specific amounts being transferred.

###2. Obtain the official form

Obtain the latest version of Form 965-D from the IRS website or other reliable sources. Make sure you have the correct form for the applicable tax year.

###3. Review the instructions

Read the instructions provided with Form 965-D carefully. The instructions will provide specific guidance on completing each section of the form.

###4. Complete the header section

Fill in the header section of Form 965-D, including the tax year, the employer identification number (EIN) of the specified member transferring the liability, and the EIN of the specified member assuming the liability.

###5. Provide information about the transfer agreement

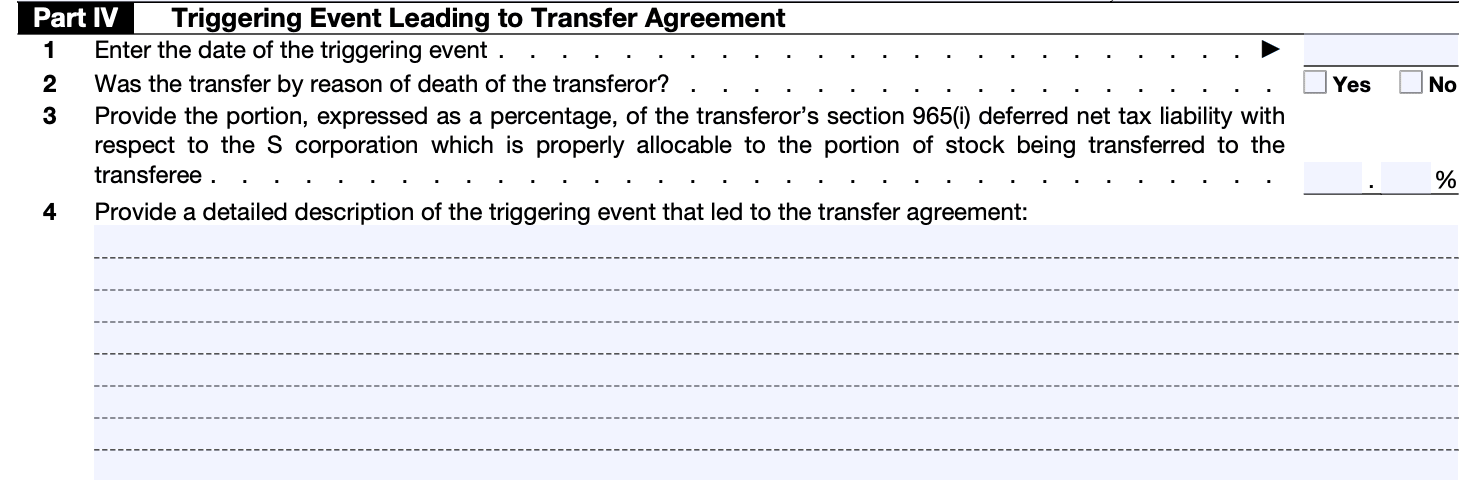

Provide the details of the transfer agreement, including the effective date of the agreement and any other relevant information as required by the form.

###6. Calculate and report the transferred amounts

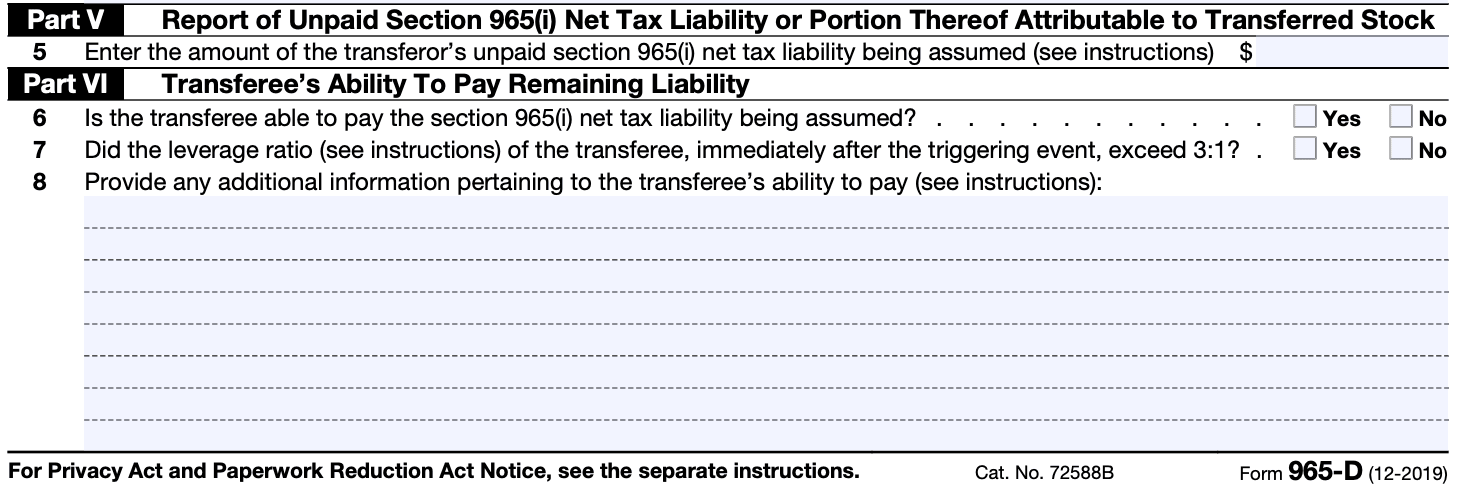

Calculate the net tax liability being transferred and report the appropriate amounts in the designated sections of the form. Follow the instructions carefully to ensure accurate reporting.

###7. Attach supporting documentation

Attach any required supporting documentation, such as copies of the transfer agreement or any other relevant documentation requested by the form.

###8. Review and verify

Double-check all the information entered on the form for accuracy and completeness. Review the form, supporting documents, and calculations to ensure they align with the instructions.

###9. Sign and submit

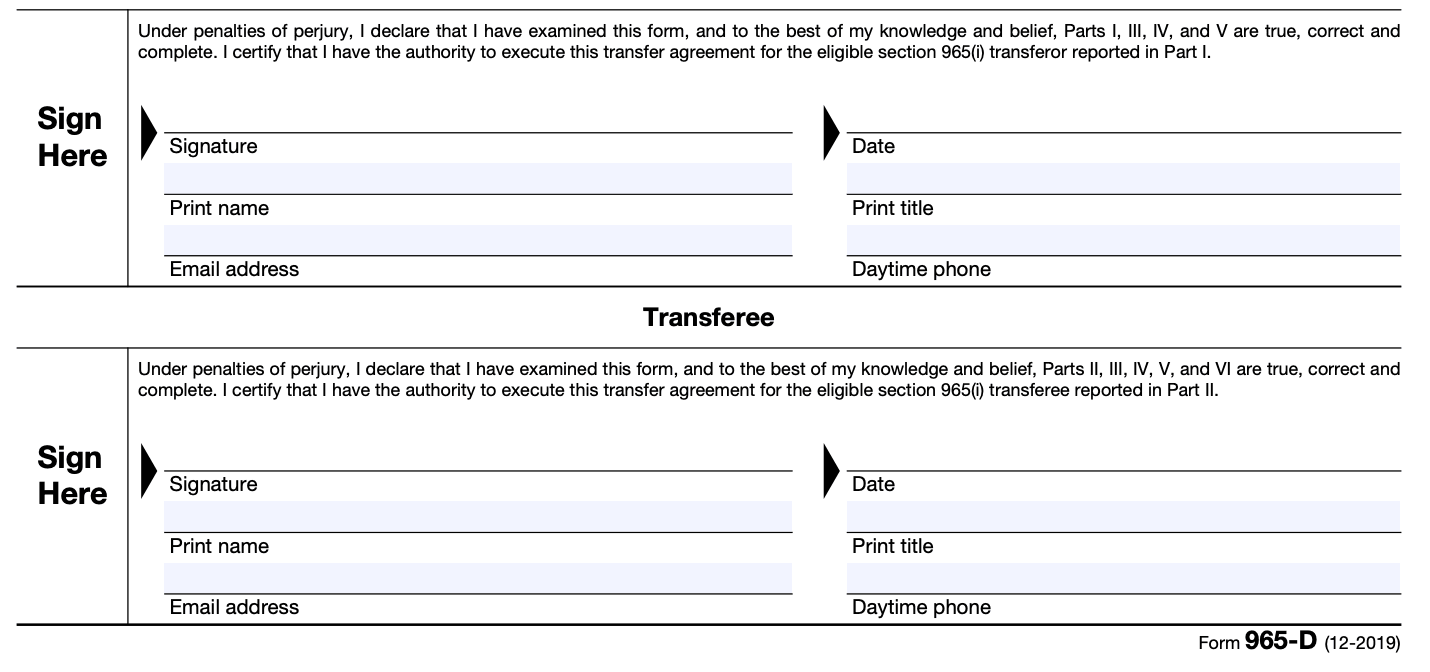

Sign and date the completed Form 965-D. Follow the instructions provided with the form to determine where and how to submit it. Retain a copy of the form and any supporting documentation for your records.

Special Considerations When Filing Form 965-D

Here are some special considerations to keep in mind when filing Form 965-D:

Eligibility: Ensure that you meet the eligibility criteria for filing Form 965-D. Generally, taxpayers who have made a transfer agreement under Section 965(i)(2) and have a net tax liability of at least $1 million in the aggregate under Section 965 are required to file this form.

**Reporting requirements: **Form 965-D is used to report the information related to the transfer agreement. You should provide the necessary details of the agreement, including the names and tax identification numbers of all parties involved, the agreement identification number, and the transfer agreement amount.

Calculation of installments: The transition tax liability can be paid in installments over eight years. When filing Form 965-D, you need to calculate the appropriate installment amount and report it accurately. This calculation involves dividing the total transition tax liability by eight and determining the due date for each installment.

Timely filing and payment: Ensure that you file Form 965-D by the specified due date. Failure to file the form on time may result in penalties and interest. Additionally, make sure to make timely installment payments for the transition tax liability as per the installment schedule.

**Coordination with other forms: **Form 965-D is part of a broader compliance process related to the transition tax under Section 965. You may need to coordinate the filing of Form 965-D with other forms, such as Form 965-A (Individual Report of Net 965 Tax Liability) or Form 965-B (Corporate Report of Net 965 Tax Liability).

Consult a tax professional: Filing Form 965-D and complying with the requirements of Section 965 can be complex. It is advisable to seek the assistance of a qualified tax professional who can provide guidance specific to your situation and help ensure accurate reporting.

How To File Form 965-D: Offline/Online/E-filing

Here's an overview of how you can file Form 965-D using different methods:

Offline filing

To file Form 965-D offline, you'll need to submit a paper copy of the form and any required supporting documents by mail. Here are the steps:

a. Obtain the form: Download or request a physical copy of Form 965-D from the Internal Revenue Service (IRS) website or by contacting the IRS directly.

b. Fill out the form: Complete the form by providing all the necessary information as required. Follow the instructions provided with the form to ensure accuracy.

c. Prepare supporting documents: Gather any supporting documents required to accompany the form. These may include documentation related to the transfer agreement under Section 965(i)(2).

d. Make copies: Create copies of the completed Form 965-D and all supporting documents for your records.

e. Submit the documents: Mail the original completed form and supporting documents to the appropriate IRS mailing address specified in the form instructions. Ensure you include any required fees or payments, if applicable.

f. Confirm receipt: Consider using registered mail or a tracking service to confirm that the IRS has received your submission. Retain the mailing receipts and any confirmation of delivery for your records.

Online filing

Currently, the IRS does not provide an online filing option for Form 965-D. Therefore, online filing is not available for this particular form.

E-filing

Since the IRS does not offer an electronic filing option for Form 965-D, e-filing is not applicable in this case.

Remember, tax regulations and procedures can change over time, so it's crucial to consult the most up-to-date instructions and guidance provided by the IRS for filing Form 965

Common Mistakes To Avoid While Filing Form 965-D

When filing Form 965-D, which is the Transfer Agreement Under Section 965(i)(2), there are several common mistakes that you should avoid. Here are some key points to keep in mind:

Incorrect or incomplete information: Ensure that all the required fields on Form 965-D are accurately filled out with the appropriate information. Double-check your entries for accuracy and completeness before submitting the form.

Missed filing deadline: Be mindful of the filing deadline for Form 965-D. Missing the deadline can result in penalties and other negative consequences. Stay aware of the due date and make sure to submit the form in a timely manner.

Inadequate supporting documentation: Form 965-D may require supporting documentation to be attached, such as agreements and transfer schedules. Make sure to include all the necessary documents to support your transfer agreement accurately.

Failure to follow instructions: The IRS provides detailed instructions for filling out Form 965-D. It's essential to carefully read and follow these instructions to ensure proper completion of the form. Failure to do so could lead to errors or omissions.

Incorrect calculation of amounts: Take extra care when calculating the amounts to be reported on Form 965-D. Errors in calculations can have significant implications. Utilize the appropriate formulas and verify your calculations to avoid mistakes.

**Neglecting to retain copies: **Always retain copies of all forms and documents submitted to the IRS, including Form 965-D. Keeping copies of your filings will help you with future reference and provide a record of your compliance efforts.

Ignoring changes in tax laws or regulations: Stay updated with any changes in tax laws or regulations that may impact the filing requirements for Form 965-D. Ignoring such changes could lead to incorrect or outdated filings.

It's important to note that while these are common mistakes, the specific requirements and considerations for Form 965-D can vary depending on your unique circumstances.

Conclusion

Form 965-D, the Transfer Agreement Under Section 965(i)(2), plays a critical role in allowing taxpayers to defer their net tax liability related to accumulated foreign earnings. By electing to pay in installments, taxpayers can manage their cash flow effectively. However, it is crucial to thoroughly understand the requirements, implications, and potential interest costs associated with Form 965-D. Consulting a tax professional is strongly advised to navigate this complex area of U.S. tax law successfully.