- IRS forms

- Form 9465

Form 9465: Installment Agreement Request

Download Form 9465Managing personal finances can sometimes be a daunting task, especially when facing a tax debt. If you find yourself unable to pay your tax liability in full, the Internal Revenue Service (IRS) offers options to help ease the burden. One such option is the Installment Agreement Request, which allows taxpayers to pay their debt in smaller, more manageable monthly installments.

In this blog post, we will explore Form 9465, the official document used to request an installment agreement from the IRS, and provide a step-by-step guide on how to navigate the process effectively.

Understanding Form 9465

Form 9465 is a form issued by the Internal Revenue Service (IRS) in the United States. It is used to request a monthly installment agreement for taxpayers who are unable to pay their tax liabilities in full. In other words, it is a way for individuals or businesses to set up a payment plan with the IRS to pay their tax debt over time.

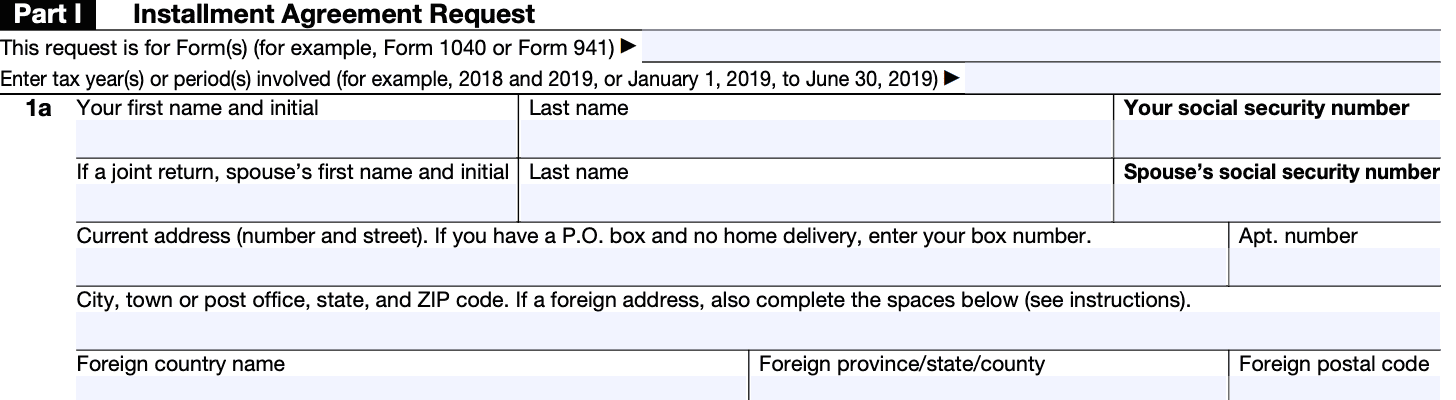

When completing Form 9465, taxpayers provide their personal information, including their name, address, Social Security number (or (link: https://fincent.com/blog/how-to-find-your-business-tax-id-number text: Employer Identification Number for businesses)), and details about their tax liability. They also specify the amount they can afford to pay each month towards their tax debt.

Submitting Form 9465 does not automatically guarantee approval of the installment agreement. The IRS will review the information provided and make a determination based on the taxpayer's financial situation. If approved, the taxpayer will be required to make the agreed-upon monthly payments until the tax debt is fully paid, including any applicable interest and penalties.

It's important to note that interest and (link: https://fincent.com/blog/irs-tax-penalty-identification text: penalties) will continue to accrue on the outstanding tax debt until it is fully paid, even if a payment plan is established. Therefore, taxpayers are encouraged to pay off their tax liabilities as soon as possible to minimize the additional costs.

Benefits of Form 9465

Form 9465, offers several benefits to taxpayers as detailed below.

**Payment flexibility: **One of the significant advantages of Form 9465 is that it provides payment flexibility to taxpayers. It allows individuals to pay their tax debts over time instead of making a lump-sum payment, which can be challenging for many people. This flexibility helps alleviate the financial burden and provides a structured approach to settling the tax liability.

Avoiding collection actions: By submitting Form 9465 and establishing an installment agreement, taxpayers can potentially (link: https://fincent.com/blog/how-to-avoid-tax-penalties-a-simple-guide text: avoid more severe collection actions) by the IRS. When the IRS approves the request, they generally halt any further collection efforts, such as wage garnishments, bank levies, or asset seizures. This can provide peace of mind and help individuals avoid more severe financial consequences.

Simplified application process: Form 9465 simplifies the application process for requesting an installment agreement. It outlines the necessary information that taxpayers need to provide, making it easier to understand and complete the form. Additionally, the form allows taxpayers to propose their monthly payment amount based on their financial situation, helping to tailor the installment plan to their specific needs.

Interest reduction: While an installment agreement does not eliminate the requirement to pay interest on the outstanding tax liability, it can help reduce the overall amount of interest accrued. By promptly paying the agreed-upon monthly installments, individuals can minimize the interest charges compared to other forms of unpaid tax debt.

**Avoiding more drastic consequences: **Failing to pay taxes or ignoring the tax debt can lead to more severe consequences, including penalties, liens on property, and potential legal actions. By utilizing Form 9465 to establish an installment agreement, individuals can proactively address their tax liabilities and avoid these more drastic consequences.

**Improved cash flow management: **For individuals facing financial difficulties, an installment agreement provides a structured approach to managing their tax obligations. It allows them to make smaller, more manageable monthly payments, ensuring they can allocate their available funds to other essential expenses while still fulfilling their tax responsibilities.

**Potential relief for low-income taxpayers: **The IRS offers certain relief programs for low-income taxpayers, such as the Low-Income Taxpayer Installment Agreement (LITIA). This program provides reduced fees and more flexible terms for taxpayers who meet specific income criteria. Form 9465 serves as the application form for LITIA, offering a beneficial option for individuals with limited financial resources.

Overall, Form 9465 plays a crucial role in providing taxpayers with a structured approach to pay their tax liabilities over time, reducing financial strain, and helping them avoid more severe consequences. It offers flexibility, relief, and peace of mind for individuals facing difficulties in meeting their tax obligations.

Who Is Eligible to File Form 9465?

Form 9465 generally has the eligibility criteria mentioned below:

**Individuals: **Form 9465 is generally available for individual taxpayers who owe $50,000 or less in combined tax, penalties, and interest.

Sole proprietors: Self-employed individuals, including sole proprietors, can also use Form 9465 to request an installment agreement.

Businesses: Certain small businesses may qualify to use Form 9465 if they owe $25,000 or less in combined tax, penalties, and interest.

**Compliance: **Before requesting an installment agreement, you must have filed all required tax returns. If you have any outstanding tax returns, you should file them before submitting Form 9465.

It's important to note that these are general guidelines, and the eligibility criteria may vary based on individual circumstances. Additionally, the IRS has the authority to approve or deny installment agreements on a case-by-case basis.

How To Complete Form 9465: A Step-by-Step Guide

Form 9465

Step 1: Obtain the form.

You can download Form 9465 from the IRS website or request a copy by calling the IRS at 1-800-829-3676.

Step 2: Provide your personal information.

Fill out your personal information in the top section of the form, including your name, address, Social Security number (or taxpayer identification number), and contact information.

Step 3: Indicate tax return information.

Enter the tax year for which you are requesting the installment agreement. If you have already filed your tax return, provide the date it was filed and the total amount you owe. If you haven't filed your return yet, indicate that on the form.

Step 4: Choose your installment agreement request.

Check the appropriate box to indicate the type of installment agreement you are requesting. You can choose between a guaranteed, streamlined, or non-streamlined agreement. The instructions on the form will help you determine which option is appropriate for your situation.

Step 5: Provide financial information.

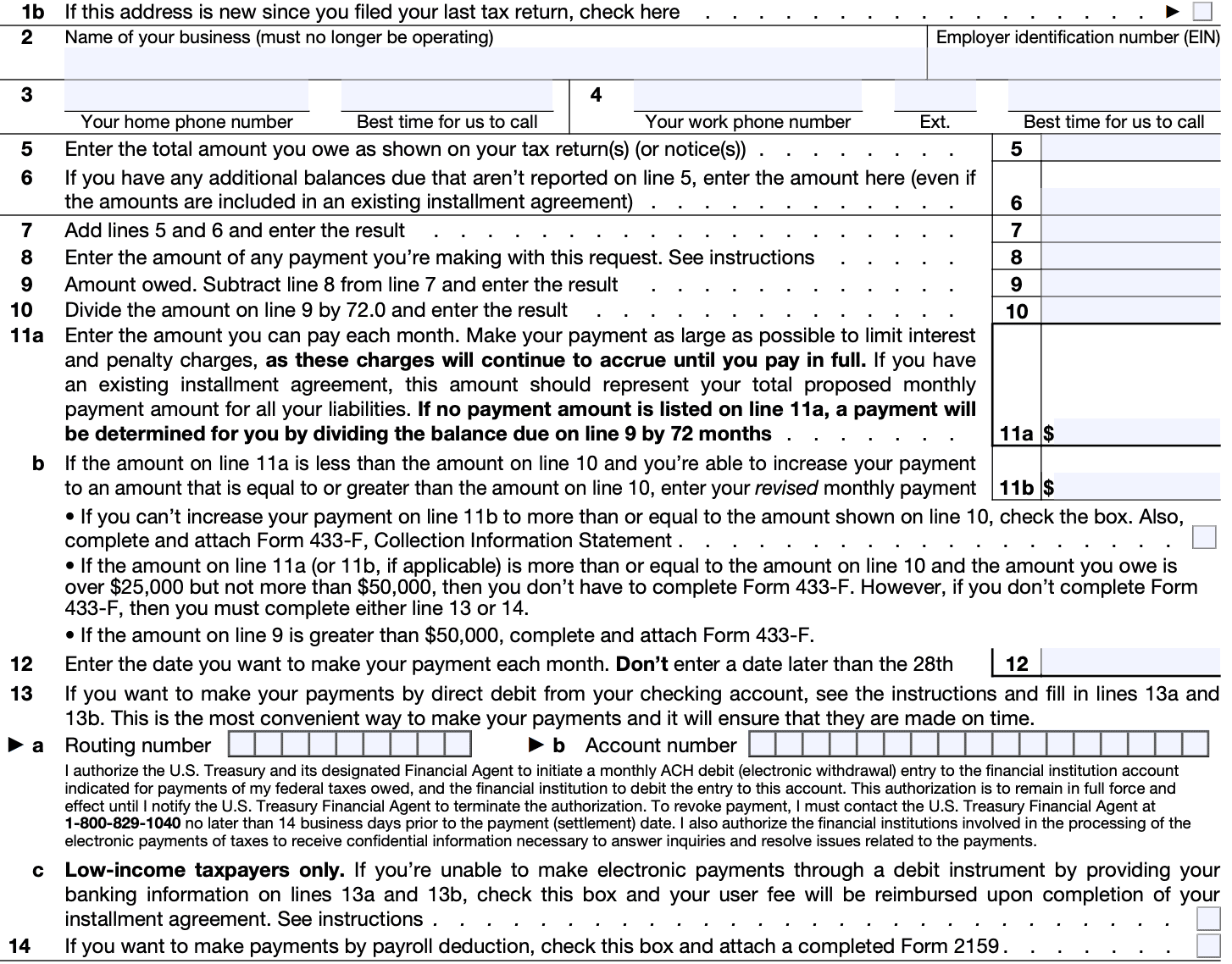

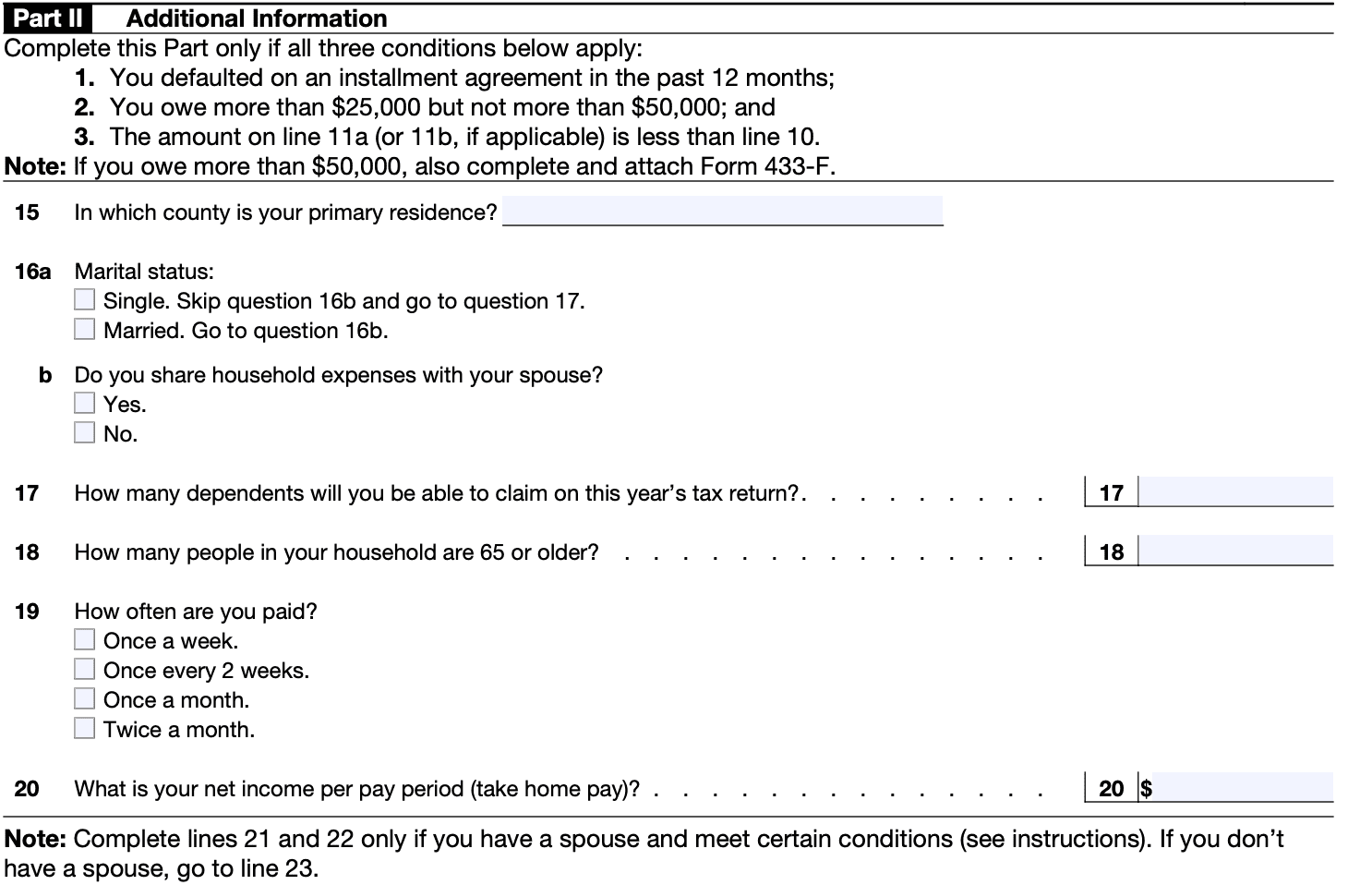

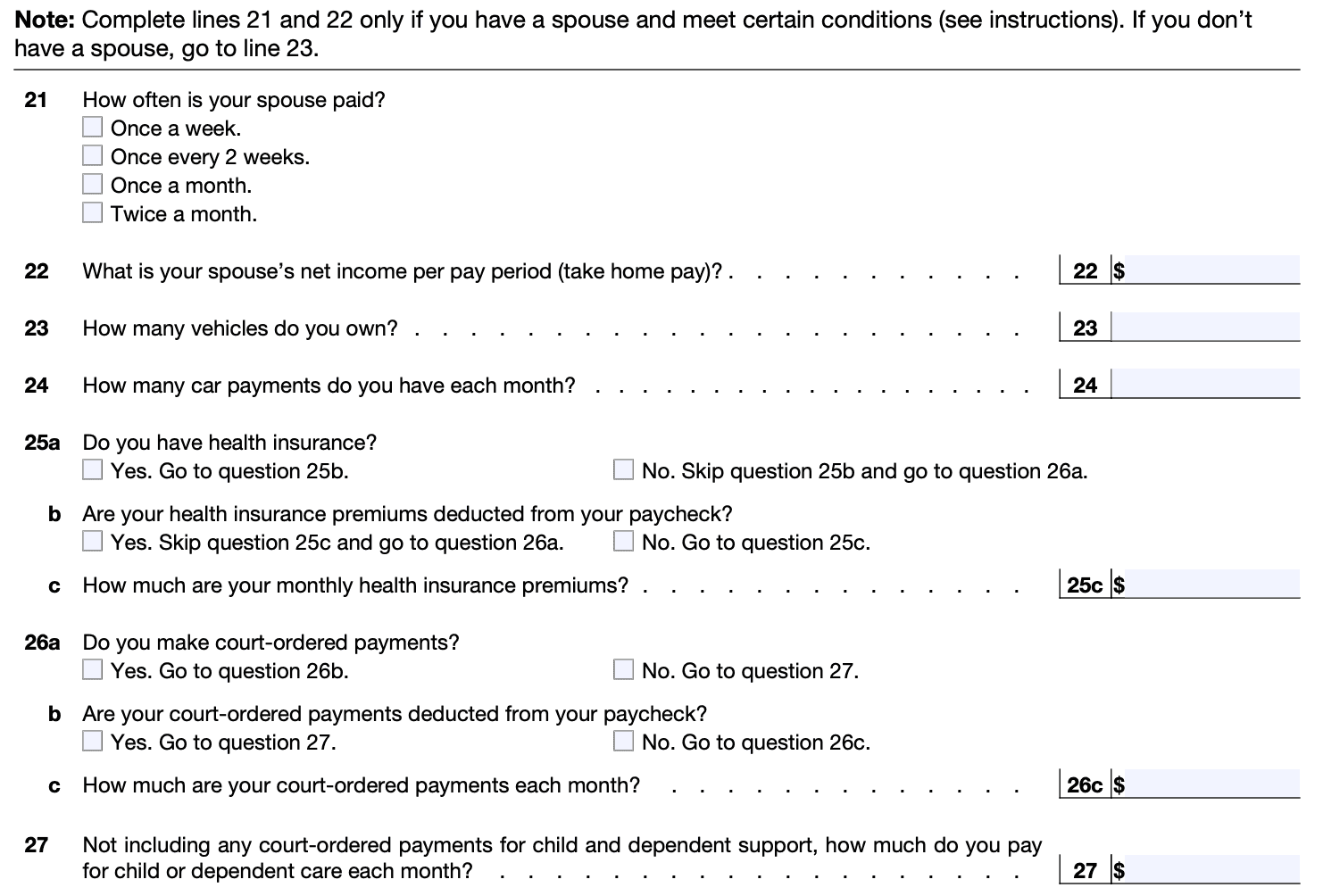

Fill out the financial information section, which includes details about your monthly income, living expenses, and assets. This information helps the IRS assess your ability to pay and determine the appropriate monthly installment amount.

Step 6: Propose your monthly payment.

In this section, you need to propose a monthly payment amount you can afford to pay towards your tax debt. Consider your financial situation and propose an amount that is realistic for you. The IRS will review your proposal and may accept it or suggest a different amount.

Step 7: Choose your payment method.

Select your preferred method of payment from the options provided on the form. You can choose to pay by direct debit, check, or money order. If you choose direct debit, you will need to provide your bank account information.

Step 8: Review and sign the form.

Carefully review all the information you have provided on the form. Sign and date the form in the appropriate spaces. If you have a spouse, they may need to sign as well, depending on your marital status and the agreement type.

Step 9: Attach required documents.

If you have any supporting documents requested in the form's instructions, such as a financial statement or proof of income, attach them to your completed Form 9465.

Step 10: Submit the form.

Make a copy of the completed form and all attachments for your records. Mail the original form and attachments to the address provided in the form's instructions. It's recommended to send it via certified mail or with tracking to ensure delivery.

Note:The IRS may take some time to process your request and review your financial information. Once your installment agreement is approved, the IRS will send you a notice detailing the terms and conditions of the agreement, including the monthly payment amount and due dates.

Special Considerations When Filing Form 9465

When filing Form 9465, which is used to request a monthly installment plan for paying your tax debt to the Internal Revenue Service (IRS), there are several special considerations to keep in mind:

Eligibility: Ensure that you meet the eligibility criteria for using Form 9465. Generally, you must owe $50,000 or less in combined individual income tax, penalties, and interest, and you must be able to pay off the debt within 72 months.

**Timely filing: **File your tax return on time, even if you can't pay the full amount. Filing your return late can result in penalties, and the IRS may reject your installment plan request if your return is not filed.

Accuracy: Double-check the accuracy of the information you provide on Form 9465. Any errors or incomplete information could delay the processing of your request or result in a rejection.

**Payment amount: **Determine the amount you can afford to pay each month towards your tax debt. The IRS will review your financial situation and may request additional financial documentation to support your proposed payment amount.

**Direct debit option: **Consider selecting the direct debit option when filling out Form 9465. This allows the IRS to automatically withdraw the monthly payment from your bank account, which can simplify the process and help you avoid missed payments.

Penalties and interest: Remember that penalties and interest will continue to accrue on your unpaid tax debt, even if you are approved for an installment plan. Paying off the debt as soon as possible can help minimize these additional costs.

**Financial hardship: **If you are facing financial hardship and cannot afford the monthly payments, you may qualify for a temporary delay in collections or an Offer in Compromise. Discuss your situation with the IRS or consult a tax professional to explore alternative options.

Filing Deadlines and Extensions for Form 9465

The filing deadlines and extensions for Form 9465 are as follows:

Filing deadline

The deadline for filing Form 9465 is typically the same as the deadline for filing your individual income tax return, which is April 15 of each year. However, if April 15 falls on a weekend or a legal holiday, the deadline is usually extended to the next business day.

Extension of time to file

If you need more time to file your tax return and request an installment agreement using Form 9465, you can file for an extension of time to file. To do so, you must file IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, by the original due date of your tax return (April 15). This will give you an additional six months to file your tax return, making October 15 the new deadline.

It's important to note that an extension of time to file does not extend the deadline for paying your taxes. If you owe taxes, you are still required to make a payment by the original due date (April 15) to avoid penalties and interest. The extension only provides additional time to complete and submit your tax return.

Modes of Filing the Form

Here's how you can file Form 9465 using different methods:

###Offline filing (paper)

a. Obtain a copy of Form 9465 from the IRS website (irs.gov) or by visiting your local IRS office. b. Fill out the form manually, providing accurate and complete information. Make sure to include your personal details, tax information, and proposed installment agreement terms. c. If you have a balance due, attach a check or money order for the first payment amount, payable to the "United States Treasury." d. Double-check the form for any errors or omissions and sign it. e.Mail the completed Form 9465, along with the payment (if applicable), to the appropriate IRS address listed in the instructions for the form. Make sure to keep a copy of the form for your records.

###Online filing a. Visit the IRS website (irs.gov) and navigate to the Online Payment Agreement application. b. Provide the required information, including your personal details, tax information, and proposed installment agreement terms. c. If you have a balance due, you may need to make an initial payment electronically using the IRS Direct Pay system or another accepted payment method. d. Review the information you entered for accuracy and submit the application. e. The IRS will review your request and send you a notification of approval or denial. If approved, they will provide you with further instructions.

###E-filing with tax preparation software a. Use tax preparation software approved by the IRS to file your tax return electronically. b. When prompted, indicate that you want to request an installment agreement (Form 9465). c. Follow the software's instructions to provide the necessary information, including your proposed installment agreement terms. d. If required, make the initial payment electronically through the software or using the IRS Direct Pay system. e. Submit your tax return and installment agreement request electronically through the software. f. The software will provide you with updates on the status of your request, and the IRS will communicate with you directly regarding the approval or denial of your request.

Conclusion

Form 9465, the Installment Agreement Request, provides taxpayers with a valuable opportunity to manage their tax obligations in a structured and manageable way.

By completing this form and submitting it to the IRS, individuals can establish a payment plan that suits their financial circumstances, avoiding the burden of paying their tax debt in one lump sum. However, it's essential to carefully consider eligibility criteria, evaluate available options, and diligently adhere to the terms of the agreement once approved.

By understanding and utilizing Form 9465 effectively, taxpayers can alleviate the stress associated with tax payments and maintain their financial stability.