- IRS forms

- Form 8936

Form 8936: Qualified Commercial Clean Vehicle Credit

Download Form 8936In recent years, the global shift towards sustainable practices and environmentally-friendly technologies has led to a growing interest in clean energy and green transportation. One significant initiative encouraging the adoption of eco-friendly commercial vehicles is the Qualified Commercial Clean Vehicle Credit, commonly referred to as Form 8936.

Form 8936 is a tax credit introduced by the U.S. government to promote the use of qualified commercial clean vehicles in the transportation sector. Enacted as part of the Energy Improvement and Extension Act of 2008, this credit encourages businesses and eligible taxpayers to invest in environmentally-friendly commercial vehicles, thereby reducing greenhouse gas emissions and dependence on traditional fossil fuel-powered transportation.

In this blog, we delve into the details of Form 8936 and explore how it supports the widespread adoption of eco-conscious commercial vehicles.

Purpose of Form 8936

The key purposes of Form 8936 can be summarized as follows:

Environmental impact: Encouraging the use of qualified commercial clean vehicles helps reduce the harmful emissions associated with traditional fossil fuel-powered vehicles. By promoting the adoption of electric, hybrid, and fuel cell-powered vehicles, the form supports the nation's efforts to combat climate change, improve air quality, and protect the environment.

Energy independence: By transitioning to clean energy vehicles, the United States can decrease its reliance on imported oil and fossil fuels. This supports the nation's goal of achieving energy independence and enhances its energy security.

Economic growth: Form 8936 stimulates economic growth by supporting the clean energy industry and creating jobs in the manufacturing, distribution, and maintenance of qualified commercial clean vehicles. The increased demand for clean vehicles drives innovation and technological advancements in the industry, further boosting economic activity.

Reduced operating costs: Clean vehicles often have lower operating costs compared to traditional internal combustion engine vehicles. Electric vehicles, for example, typically have lower fuel and maintenance costs, leading to potential long-term savings for businesses and taxpayers.

Tax incentive: Offering a tax credit to businesses and eligible individuals provides a financial incentive to invest in qualified commercial clean vehicles. The credit helps offset the higher upfront costs associated with purchasing clean vehicles, making them more financially accessible.

**Promotion of green transportation: **By promoting the adoption of qualified commercial clean vehicles, Form 8936 encourages the growth of green transportation alternatives. This, in turn, contributes to the development of a more sustainable and energy-efficient transportation system.

Corporate social responsibility: Embracing clean transportation options allows businesses to demonstrate their commitment to corporate social responsibility and environmental stewardship. Adopting green practices can enhance a company's reputation and appeal to environmentally-conscious consumers.

In summary, Form 8936 serves as a vital tool in the government's efforts to drive the adoption of clean and environmentally-friendly commercial vehicles.

Benefits of Form 8936

Benefits Of Form 8936, not only promotes sustainable transportation practices but also provides financial incentives that make the transition to clean commercial vehicles more appealing. Here are some of the key advantages of Form 8936:

- Financial incentives: One of the primary advantages of Form 8936 is the financial incentive it provides. Businesses and taxpayers can claim a tax credit for purchasing qualified commercial clean vehicles. This credit directly reduces the amount of tax owed, effectively lowering the overall cost of acquiring clean vehicles. It helps offset the higher upfront costs often associated with eco-friendly vehicle technologies, making them more accessible to businesses of varying sizes.

- Cost savings: Qualified commercial clean vehicles typically offer cost savings over time compared to traditional fossil fuel-powered vehicles. By leveraging Form 8936 to invest in clean vehicles, businesses can reduce their fuel and maintenance expenses. Electric and hybrid vehicles, for example, have lower fuel and maintenance costs, which can lead to significant long-term savings for commercial fleets.

- Environmental benefits: Embracing clean commercial vehicles can have a positive impact on the environment. These vehicles produce fewer greenhouse gas emissions and air pollutants, which helps combat climate change and improves local air quality. By encouraging the adoption of eco-friendly vehicles, Form 8936 supports the reduction of carbon footprint and promotes sustainability.

- Competitive advantage: Companies that incorporate clean transportation solutions may gain a competitive edge in their respective industries. As consumers become increasingly environmentally-conscious, businesses with green practices are likely to attract more customers and enjoy greater brand loyalty. Form 8936 encourages businesses to be proactive in addressing environmental concerns, enhancing their corporate social responsibility image.

- Technological innovation: The tax credit fosters innovation in the clean energy and transportation sectors. As demand for qualified commercial clean vehicles increases, manufacturers are encouraged to invest in research and development, driving advancements in clean vehicle technologies. This, in turn, can lead to more efficient and cost-effective commercial clean vehicles in the future.

- Reduced dependence on fossil fuels: The adoption of clean commercial vehicles contributes to reducing the nation's reliance on fossil fuels. As businesses transition to alternative energy sources, they play a vital role in promoting energy security and sustainability.

- Compliance with regulations: In some cases, businesses may be subject to local or regional regulations that mandate the use of eco-friendly vehicles or set emissions standards. By taking advantage of Form 8936 and investing in qualified commercial clean vehicles, businesses can ensure compliance with such regulations and (link: https://fincent.com/blog/how-to-avoid-tax-penalties-a-simple-guide text: avoid potential penalties).

- Potential grants and incentives: In addition to the federal tax credit, purchasing qualified commercial clean vehicles may also make businesses eligible for additional state or local incentives, grants, or rebates. These further reduce the cost of adopting clean transportation solutions, enhancing the overall financial benefits.

Who Is Eligible To File Form 8936?

To claim the Qualified Commercial Clean Vehicle Credit, businesses and taxpayers must meet certain criteria:

Eligible vehicles: The credit is applicable to a range of commercial clean vehicles, including electric, hybrid, and fuel cell-powered vehicles. These vehicles must be primarily used for business purposes, with at least 50% of their mileage attributable to business use.

New vehicles: The credit is applicable only to new vehicles. It does not cover used or refurbished commercial clean vehicles.

Gross vehicle weight Rating (GVWR): The credit amount varies based on the GVWR of the qualified vehicle. Generally, the higher the GVWR, the higher the potential credit.

Acquisition date: To be eligible for the credit, the vehicle must be acquired within the tax year for which the credit is being claimed.

Phase-out period: It's essential to note that the Qualified Commercial Clean Vehicle Credit is subject to a phase-out period, where the credit amount reduces as more vehicles are sold by the manufacturer. Thus, it's crucial to monitor the available credit amount for the specific tax year.’’

How To Complete Form 8936: A Step-by-Step Guide

Here’s a general step-by-step guide on how to complete the form:

Step 1: Obtain the form

Go to the IRS website (www.irs.gov) and search for Form 8936. Download the form and print it out if you prefer to fill it manually.

Step 2: Gather information

Gather all the necessary information, including:

- Details about your qualified plug-in electric vehicle (make, model, year, and Vehicle Identification Number (VIN)).

- The date the vehicle was placed in service.

- The total cost of the vehicle.

Step 3: Determine eligibility

Make sure you qualify for the tax credit by meeting the following criteria:

- The vehicle is a qualified plug-in electric drive motor vehicle.

- The vehicle was acquired for use or lease and not for resale.

- You placed the vehicle in service during the tax year.

Step 4: Calculate the credit amount

Determine the credit amount based on the specific make and model of your electric vehicle. Refer to the instructions provided with Form 8936 or the latest IRS guidelines for the credit amounts.

Step 5: Complete the form

Now you can start filling out Form 8936:

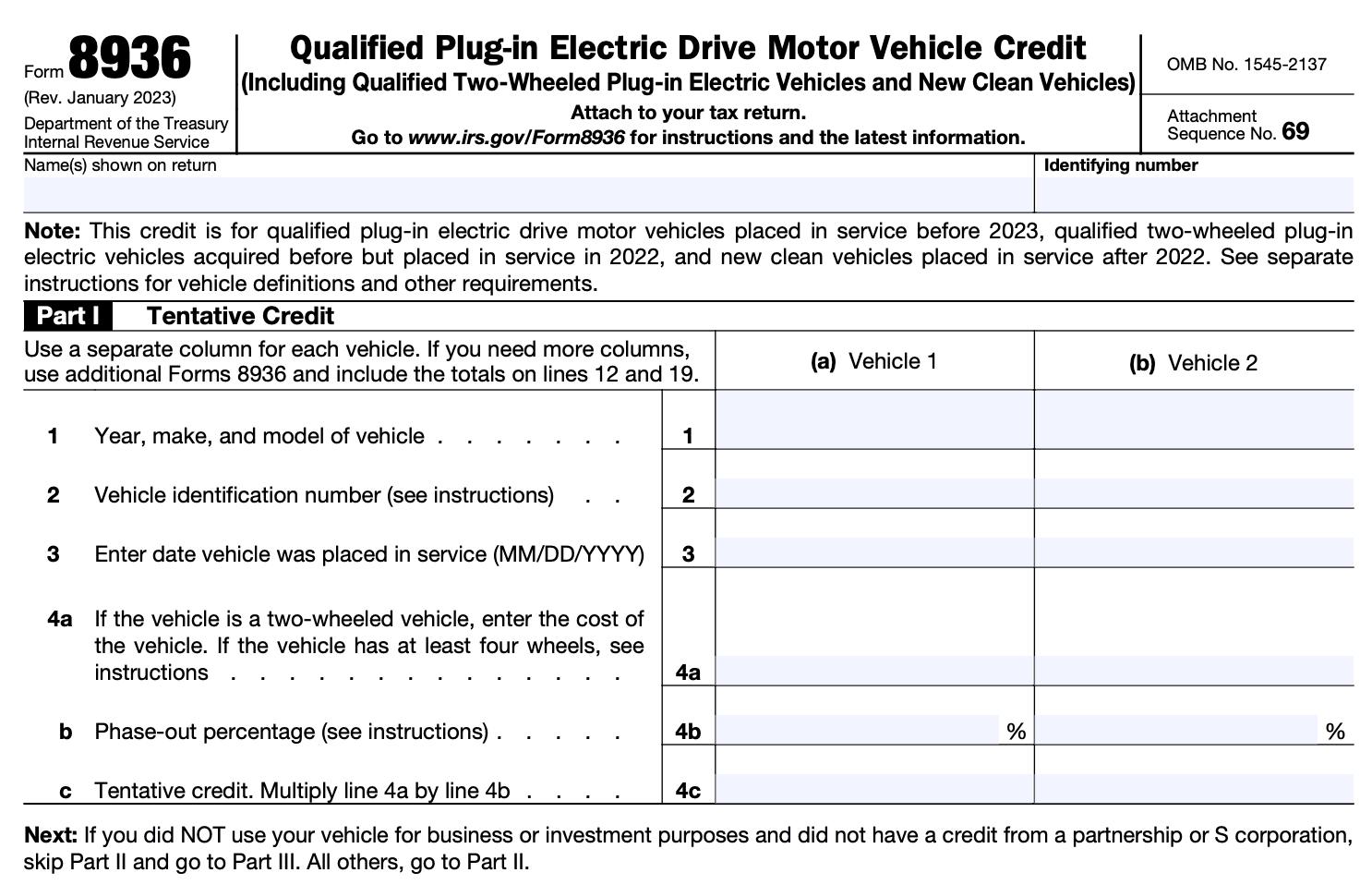

Part I: Enter your personal information and details about the electric vehicle.

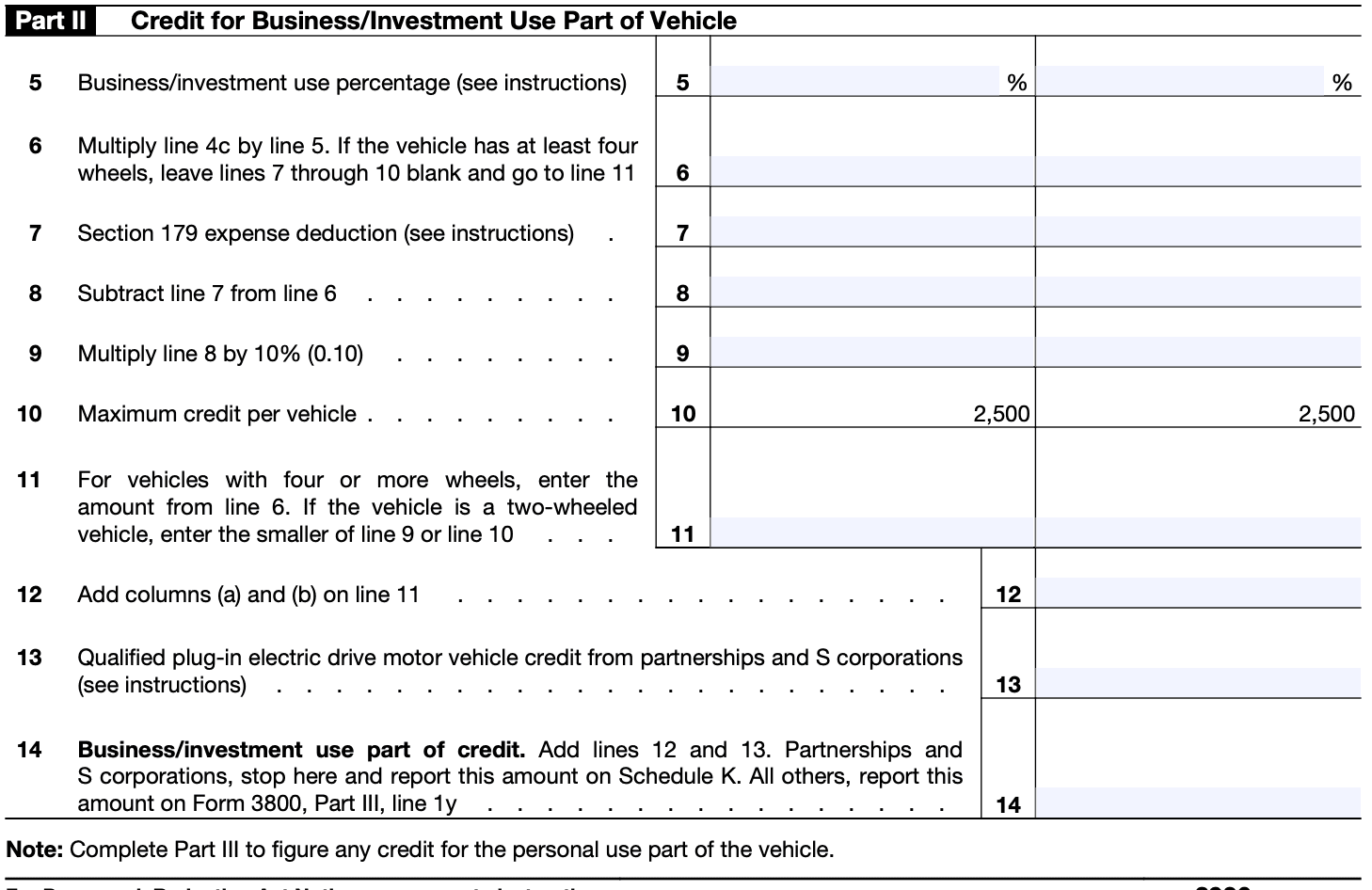

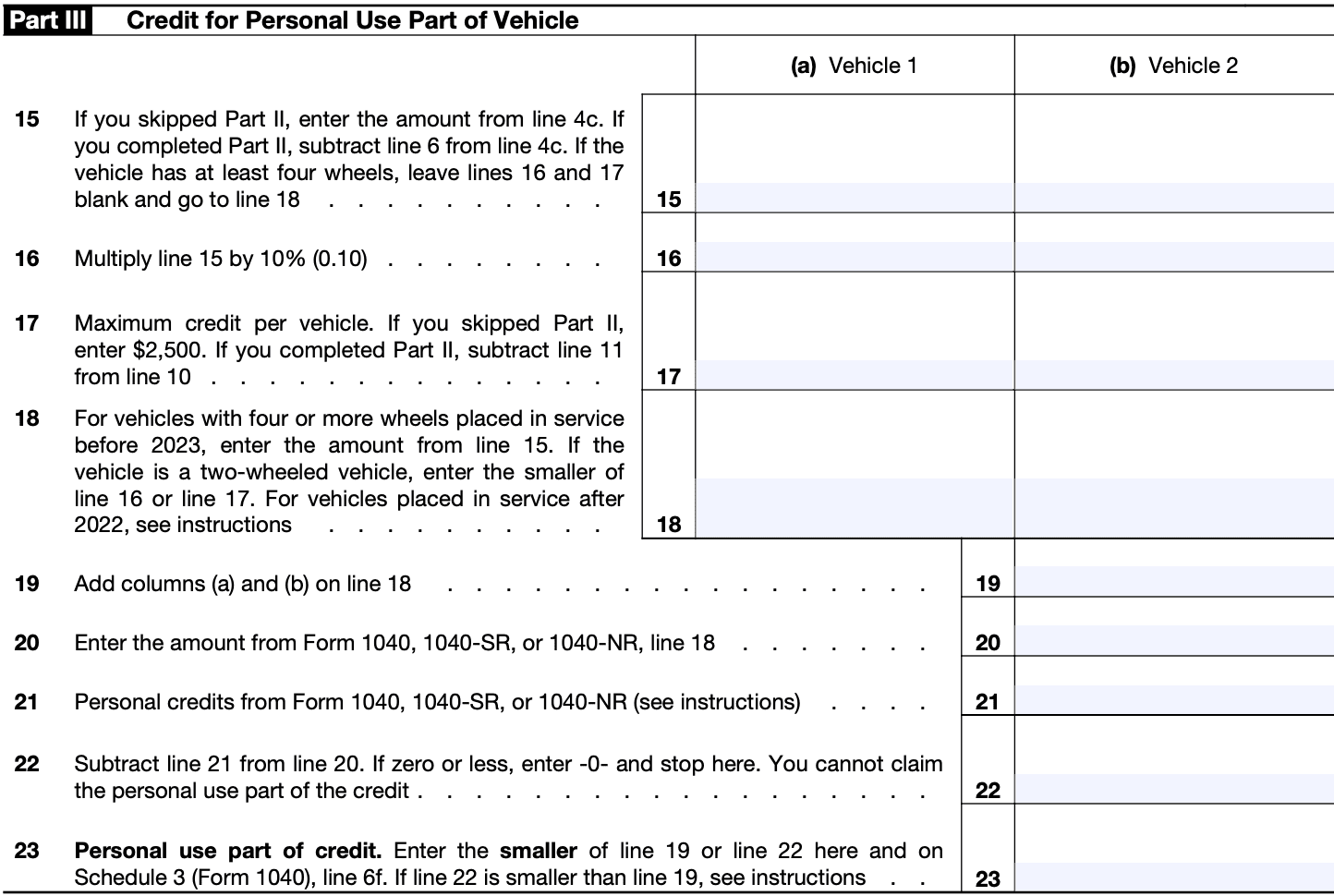

Part II: Calculate the credit by following the instructions in this section

Part III: Additional information related to the vehicle and credit

Step 6: Double-check and sign

Review the information you provided to ensure accuracy. Make sure you have attached any required documentation. Sign and date the form.

Step 7: Submit the form

If you are filing your tax return on paper, attach Form 8936 to your Form 1040. If you are filing electronically, follow the e-file instructions provided by your tax software.

Step 8: Keep records

Retain a copy of Form 8936 and all supporting documents for your records. These documents may be required in case of an audit.

Step 9: Seek professional advice

If you're unsure about any part of Form 8936 or your eligibility for the credit, consider consulting a tax professional or accountant.

Special Considerations When Filing Form 8936

Here are some special considerations to keep in mind when filing Form 8936:

Eligibility: Make sure the vehicle you purchased qualifies for the credit. Not all electric vehicles are eligible, and the credit amount varies based on the vehicle's battery capacity. Check the IRS website or consult with a tax professional to determine eligibility.

Purchase date: The credit is available for vehicles purchased after a specific date. Double-check the tax year and make sure your purchase date falls within the eligible period.

Vehicle use: The credit is generally available only for vehicles used primarily for personal use, not for business purposes. There might be exceptions for certain business use, but it's essential to understand the rules.

Credit limit: The credit has a maximum limit, which means you can only claim a certain amount, even if the credit calculation is higher based on the vehicle's battery capacity.

Vehicle cost: The credit is non-refundable, meaning it can reduce your tax liability to zero, but any excess credit may not be refunded to you. Therefore, it's crucial to calculate the credit accurately.

Reduce other credits: If you claim the electric vehicle credit, it might reduce your ability to claim certain other tax credits, so be aware of how it may affect your overall tax situation.

Documentation: Keep all relevant documentation related to the purchase of the electric vehicle and the credit claim, such as purchase agreements, vehicle information, and any other required records. You may need to provide them if requested by the IRS.

Form filing: Make sure you are using the correct version of Form 8936 for the tax year you are filing. Forms can change from year to year, so use the most current version available.

How To File Form 8936: Offline/Online/E-filing

Here’s a general outline of the filing options that were available as of 2021:

Offline filing

If you prefer to file your taxes using traditional methods, you can obtain a physical copy of Form 8936 from the IRS. You can download and print the form from the IRS website or visit a local IRS office or post office to pick up a copy. Then, you would need to complete the form manually by filling in the required information, attaching any necessary documentation, and mailing it to the appropriate IRS address. Be sure to make a copy of the form and all supporting documents for your records.

Online filing

The IRS offers a Free File program, which allows eligible taxpayers to file their federal taxes online for free using IRS-approved software. Depending on your income and other eligibility criteria, you may be able to find a participating software provider that supports Form 8936. The software will guide you through the process of filling out the form and will handle the calculations for you.

E-filing

E-filing is a popular and convenient method of filing taxes electronically. Many tax preparation software options allow you to e-file your tax return, including Form 8936, directly to the IRS. You can also use the IRS's own e-file service on their website, which is available for free to most taxpayers. E-filing is generally faster and more secure than traditional paper filing.

Before you proceed with any filing method, make sure you have all the necessary information and documents related to your electric vehicle and the tax credit. This may include details about the vehicle, its purchase date, and the amount of the credit you are eligible to claim.

Common Mistakes To Avoid When Filing Form 8936

To ensure accuracy and avoid potential issues when filing Form 8936, here are some common mistakes to avoid:

Not checking eligibility: Make sure your vehicle qualifies for the tax credit before filing Form 8936. The credit is only available for certain types of plug-in electric vehicles, and the eligibility criteria may change from year to year.

Incorrect vehicle information: Double-check all the details related to your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number). Entering inaccurate information could lead to processing delays or rejection of your claim.

Failing to provide required documentation: Attach all the necessary supporting documents, including a copy of the Manufacturer's Certification Statement, which verifies that your vehicle is eligible for the tax credit. Without this documentation, your claim may not be accepted.

Claiming the wrong amount: The amount of the tax credit depends on the capacity of the vehicle's battery. Make sure you calculate the credit accurately based on the specifications of your vehicle. The credit is also subject to a phase-out based on the number of electric vehicles sold by the manufacturer.

Missing the filing deadline: Be aware of the tax year deadlines for filing Form 8936. Filing late may result in penalties and interest charges.

Using outdated forms: Always use the most current version of Form 8936 provided by the Internal Revenue Service (IRS). Using an outdated form could lead to processing errors.

Ignoring state incentives: Remember that the federal tax credit is not the only incentive available for electric vehicles. Many states offer additional incentives or rebates, so be sure to research and take advantage of these opportunities as well.

Claiming the credit for leased vehicles: The tax credit for leased vehicles typically goes to the leasing company, not the lessee. If you are leasing an electric vehicle, the lessor should be the one claiming the credit.

Failing to retain records: Keep copies of all relevant documents, including the completed Form 8936 and supporting materials, for at least three years. These records may be necessary in case of an audit.

Not seeking professional advice if needed: If you're unsure about any aspect of filing Form 8936 or claiming the tax credit, consider consulting a tax professional or using reputable tax software to ensure accuracy and compliance.

Conclusion

As the world continues to embrace sustainable practices, initiatives like the Qualified Commercial Clean Vehicle Credit play a crucial role in fostering the adoption of clean energy solutions.

By incentivizing businesses and individuals to choose electric and plug-in hybrid vehicles, this tax credit not only benefits the environment but also contributes to building a greener and more sustainable future for generations to come.

If you believe your business could benefit from this credit, it's essential to consult with a tax professional to ensure you meet all eligibility requirements and accurately claim the credit on Form 8936. Let's drive together towards a more sustainable and cleaner tomorrow!