- IRS forms

- Form 8832

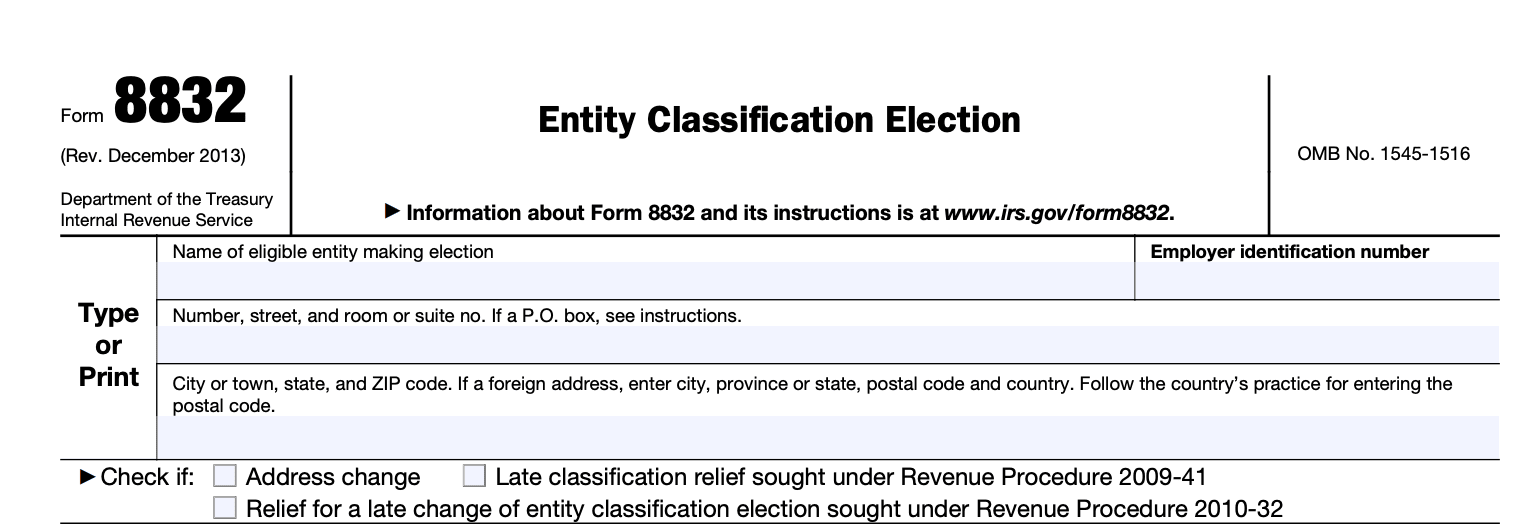

Form 8832: Entity Classification Election

Download Form 8832When starting a business, one of the key decisions you'll need to make is determining the legal structure that best suits your needs. The entity classification you choose for your business has implications on taxation, liability, and management, among other factors. The Internal Revenue Service (IRS) provides a helpful tool called Form 8832, also known as the Entity Classification Election, which allows you to elect the tax treatment for your business.

Form 8832 is a document used by eligible entities to make an election regarding their federal tax classification. It enables you to specify how your business entity will be taxed for federal income tax purposes. The form is typically used by domestic eligible entities, including limited liability companies (LLCs), corporations, and partnerships.

In this blog post, we will delve into the details of Form 8832 and discuss how it can impact your business.

Purpose of Form 8832

The purpose of Form 8832 is to allow eligible entities, such as limited liability companies (LLCs), to choose how they want to be treated for tax purposes.

The tax classification chosen on Form 8832 determines how the entity will be taxed by the Internal Revenue Service (IRS). The options available under tax classification are described below:

**Sole proprietorship: **If the entity is owned by an individual and has not elected to be treated as a corporation, it is classified as a sole proprietorship. The income and expenses of the business are reported on the owner's individual tax return.

**Partnership: **If the entity has two or more owners and has not elected to be treated as a corporation, it is classified as a partnership. The partnership itself does not pay taxes; instead, the income and expenses flow through to the partners, who report them on their individual tax returns.

Corporation: If the entity elects to be treated as a corporation, it is classified as a corporation for tax purposes. A corporation is a separate legal entity from its owners, and it files its own tax return and pays taxes on its income. The owners, known as shareholders, report any dividends or salary they receive from the corporation on their individual tax returns.

S corporation: If the entity meets specific eligibility criteria and elects to be treated as an S corporation, it is classified as such for tax purposes. An S corporation combines elements of partnerships and corporations. It allows the income and expenses to flow through to the shareholders, who report them on their individual tax returns, similar to a partnership. However, an S corporation has certain restrictions on the number and type of shareholders.

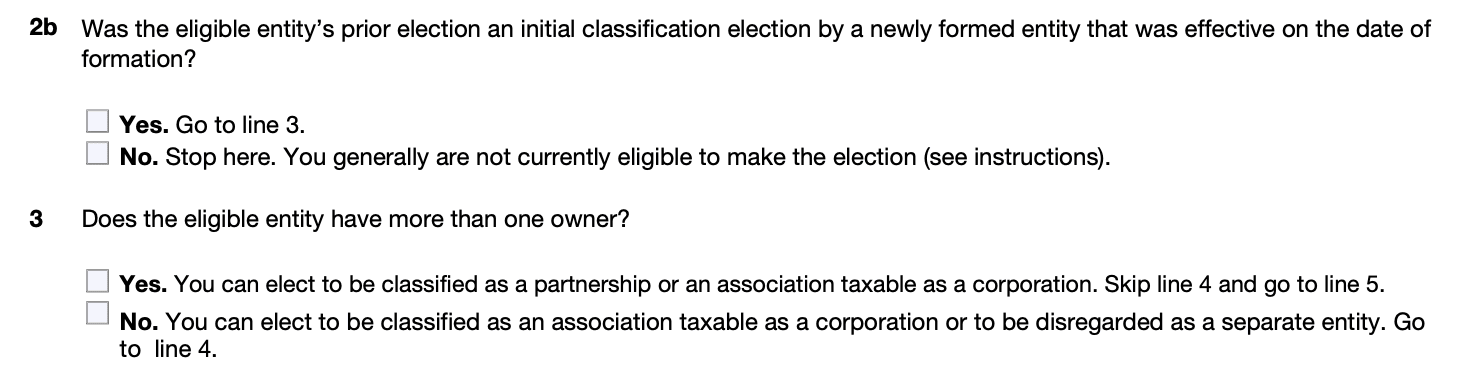

By completing Form 8832, the entity formally notifies the IRS of its chosen tax classification. It's important to note that the tax classification election made on Form 8832 is generally binding for a period of 60 months, so it should be considered carefully. Changing the tax classification before the 60-month period requires specific circumstances and IRS approval

Benefits of Form 8832

The primary benefit of filing Form 8832 is the ability to choose how your entity will be treated for tax purposes. Here are some of the benefits of filing Form 8832:

Entity classification: Form 8832 allows you to choose the tax classification for your business entity. By default, certain entities have a specific tax classification, but filing Form 8832 allows you to elect a different classification that may be more advantageous for your specific circumstances.

**Flexibility in tax treatment: **The form provides the opportunity to select a tax classification that offers the most favorable tax treatment for your entity. Depending on your goals and circumstances, you can choose to be treated as a corporation, partnership, or even as a disregarded entity (sole proprietorship for single-member LLCs).

Pass-through taxation: If you elect partnership or disregarded entity classification, the income and losses of the entity can pass through to the individual owners' tax returns. This means the entity itself is not taxed, but the owners report the income or losses on their personal tax returns, potentially allowing for lower overall tax liability.

Limited liability protection: Form 8832 does not affect the limited liability protection provided by certain entity types such as LLCs or corporations. This means that regardless of the tax classification chosen, the entity's owners generally have limited personal liability for the entity's debts and obligations.

Tax planning and optimization: By electing a specific tax classification through Form 8832, you can strategically plan and optimize your tax situation. Each tax classification has its own advantages and disadvantages, so by carefully considering your entity's financial situation and goals, you can choose the classification that aligns with your tax planning objectives.

**Future flexibility: **If your circumstances change over time, you can file another Form 8832 to change your entity's tax classification. This allows you to adapt to new business needs or take advantage of different tax benefits as your entity evolves.

It's important to note that the specific benefits of Form 8832 may vary depending on your entity's unique situation and the applicable tax laws.

Who Is Eligible To File Form 8832?

The following entities are eligible to file Form 8832:

-

Domestic LLCs: Limited liability companies that have at least two members and are not automatically classified as a corporation.

-

Domestic corporations: Corporations that are not S corporations or statutorily classified as partnerships.

-

Foreign LLCs: Limited liability companies that have at least two members and are not automatically classified as a corporation, and that are not classified as partnerships under U.S. tax regulations.

-

Foreign corporations: Corporations that are not automatically classified as a domestic corporation or as an S corporation.

-

Other entities: Certain eligible entities, such as certain business trusts, real estate mortgage investment conduits (REMICs), and grantor trusts, may also file Form 8832.

It's important to note that individuals, single-member LLCs, and certain types of trusts, such as simple trusts and charitable remainder trusts, are not eligible to file Form 8832.

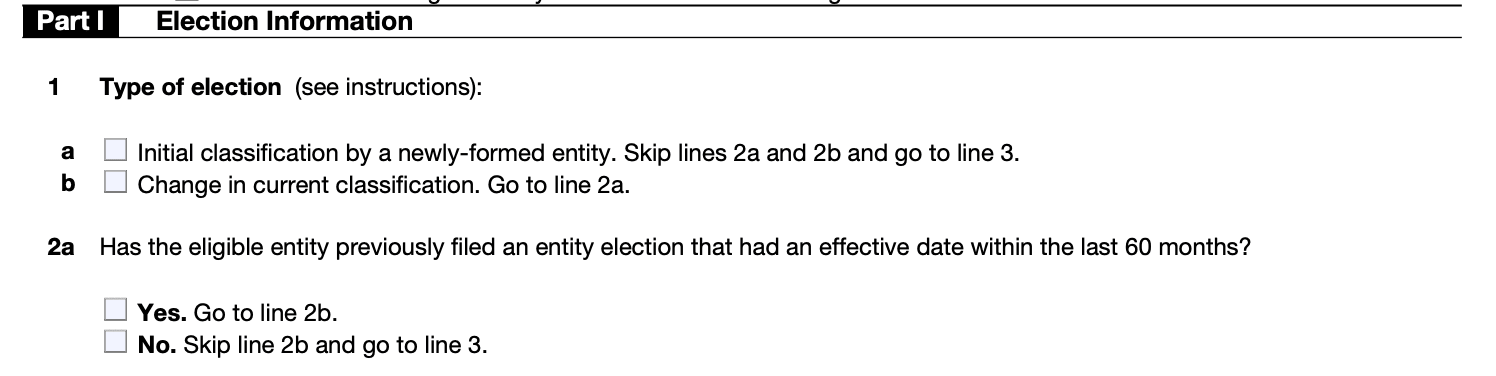

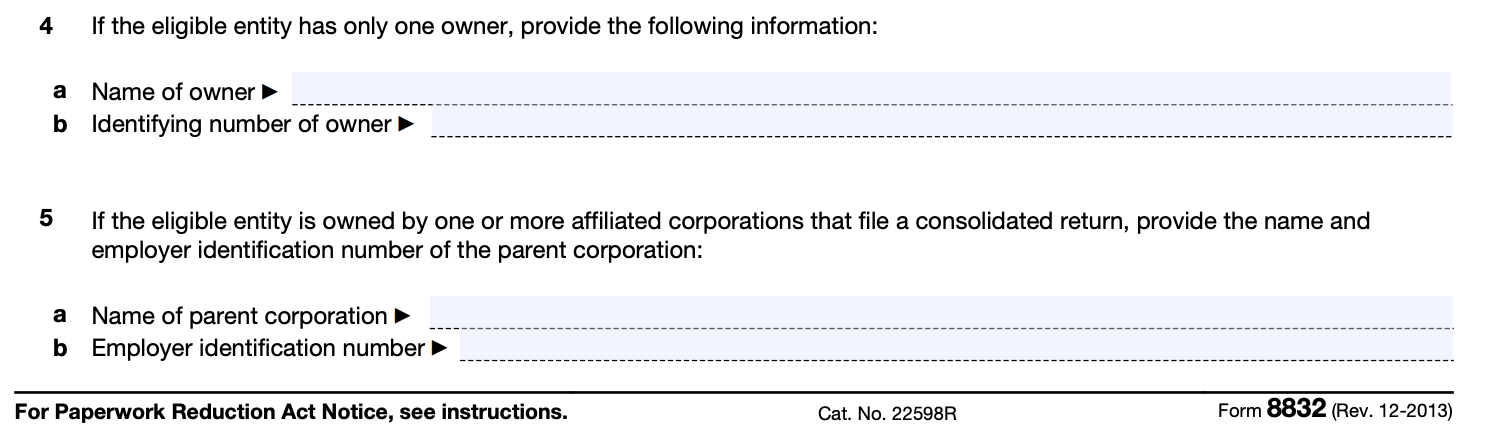

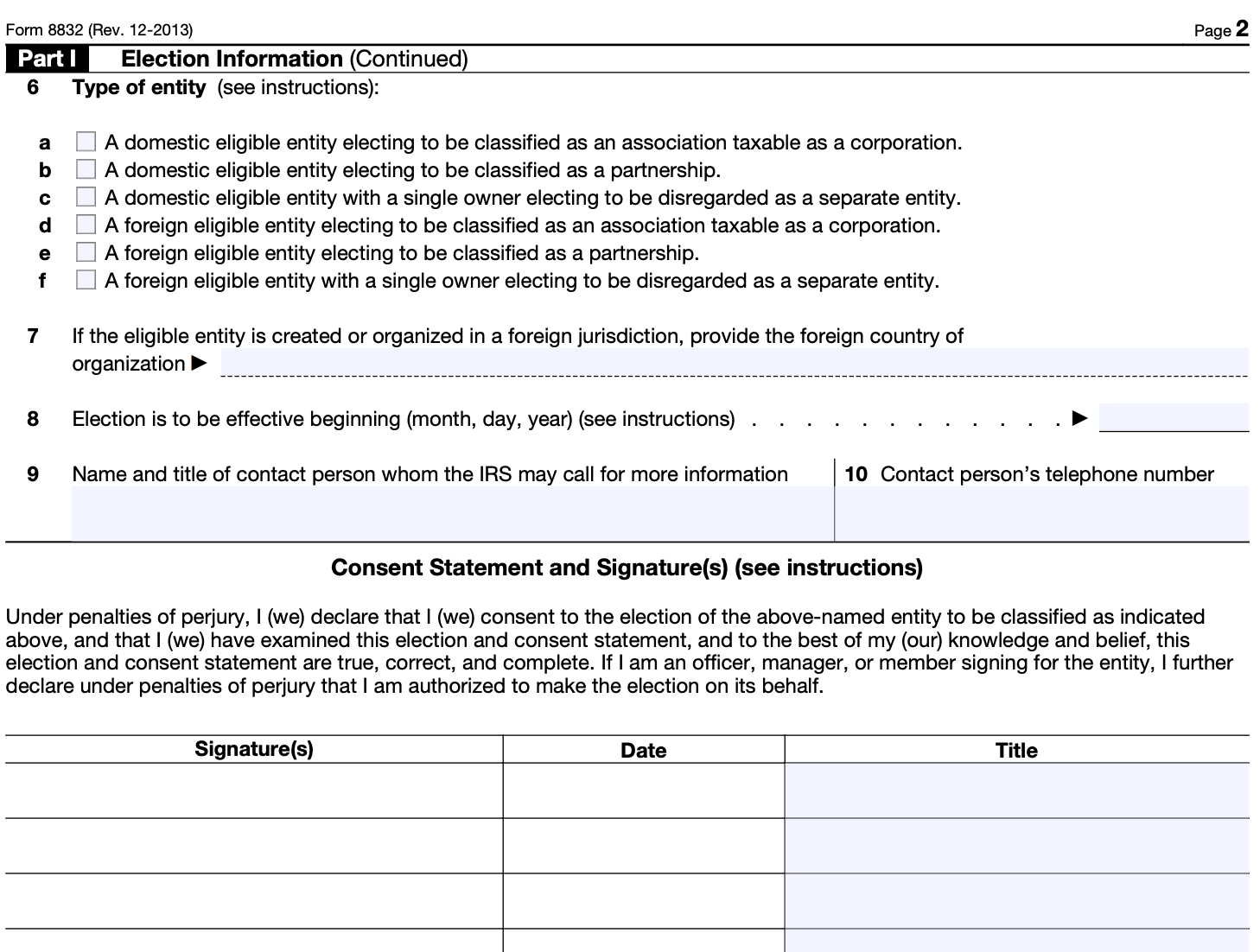

How To Complete Form 8832: A Step-by-Step Guide

Here's a step-by-step guide to help you complete Form 8832:

Step 1: Obtain the form

You can download Form 8832 from the official website of the Internal Revenue Service (IRS). Look for the most up-to-date version of the form to ensure accuracy.

Step 2: Provide general information

Enter the following details at the top of the form:

- Name of the entity: Write the legal name of your business entity exactly as it appears on your tax returns.

- Employer identification number (EIN): Enter the nine-digit EIN assigned to your business entity by the IRS.

- Address: Provide the complete mailing address of the entity.

Step 3: Select the applicable box

Section 3 of Form 8832 requires you to select one of the following options:

- Check the box for "Entity Classification Election" if you want to elect classification as a different type of entity for tax purposes.

- Check the box for "Late Entity Classification Election" if you want to make a late election and meet the eligibility criteria outlined in the instructions.

Step 4: Effective date of election

In Section 4, indicate the desired effective date of your entity classification election. This can be either the current tax year or a future date within the next 75 days.

Step 5: Entity information

Provide the requested information about your business entity, such as the type of entity (e.g., corporation, partnership, LLC), the state or foreign country of organization, and the date of formation or creation.

Step 6: Election details

In Section 6, specify the desired tax classification for your entity. This could be a corporation, partnership, or disregarded entity. Enter the requested information corresponding to your selected tax classification.

Step 7: Signature

The form must be signed and dated by an authorized person. For a corporation, this would typically be the president, vice president, or other principal officer. For other types of entities, refer to the instructions to determine who should sign the form.

Step 8: Filing the form

Ensure you have completed all necessary sections and attached any required additional documentation. Retain a copy of the completed form for your records and mail the original to the appropriate IRS address as indicated in the form's instructions. It is recommended to send the form via certified mail to have proof of delivery.

Special Considerations When Filing Form 8832

When filing Form 8832, there are several special considerations to keep in mind. Here are some key points to consider:

-

Eligibility: Ensure that your entity is eligible to file Form 8832. Most domestic entities with at least two members can make an election, including partnerships, corporations, and certain limited liability companies (LLCs). Single-member LLCs are generally disregarded entities, but they can elect to be treated as a corporation or an S corporation.

-

Timing: File Form 8832 within 75 days of the desired effective date of the election or up to 12 months after the entity's formation date, whichever is earlier. If the entity wants the election to take effect on the current tax year, the form must be filed by March 15, or by the 15th day of the 3rd month following the close of the tax year for fiscal-year entities.

-

Unanimous consent: For an LLC with multiple members, all members must sign the Form 8832 to make the election. If any member fails to sign, the election will not be valid. In the case of an entity with a large number of members, you can designate an authorized representative to sign on behalf of all members.

-

Election duration: The election made on Form 8832 generally remains in effect for the tax year specified on the form. However, you can specify a different duration if certain conditions are met. Generally, the election will continue until it is terminated or another valid election is made.

-

Effect on tax treatment: The election made on Form 8832 determines how the entity will be taxed for federal income tax purposes. The options include being treated as a corporation, a partnership, or a disregarded entity. Carefully consider the tax implications of each classification and consult with a tax professional to determine the best option for your entity.

-

State tax considerations: Form 8832 only affects the federal tax treatment of the entity. State tax authorities may have their own rules regarding entity classification. Check the requirements of the state(s) where your entity operates to ensure compliance with their regulations.

-

Additional filings: Depending on the chosen tax classification, there may be additional filing requirements. For example, if the entity elects to be treated as a corporation, it may need to file Form 1120, U.S. Corporation Income Tax Return, annually.

Filing Deadlines & Extensions for Form 8832

The filing deadlines and extensions for Form 8832 are as follows:

Initial classification election: The form should be filed by the business entity no more than 75 days prior to the desired effective date of the election, or no more than 12 months after the desired effective date. The entity can specify the desired effective date on the form.

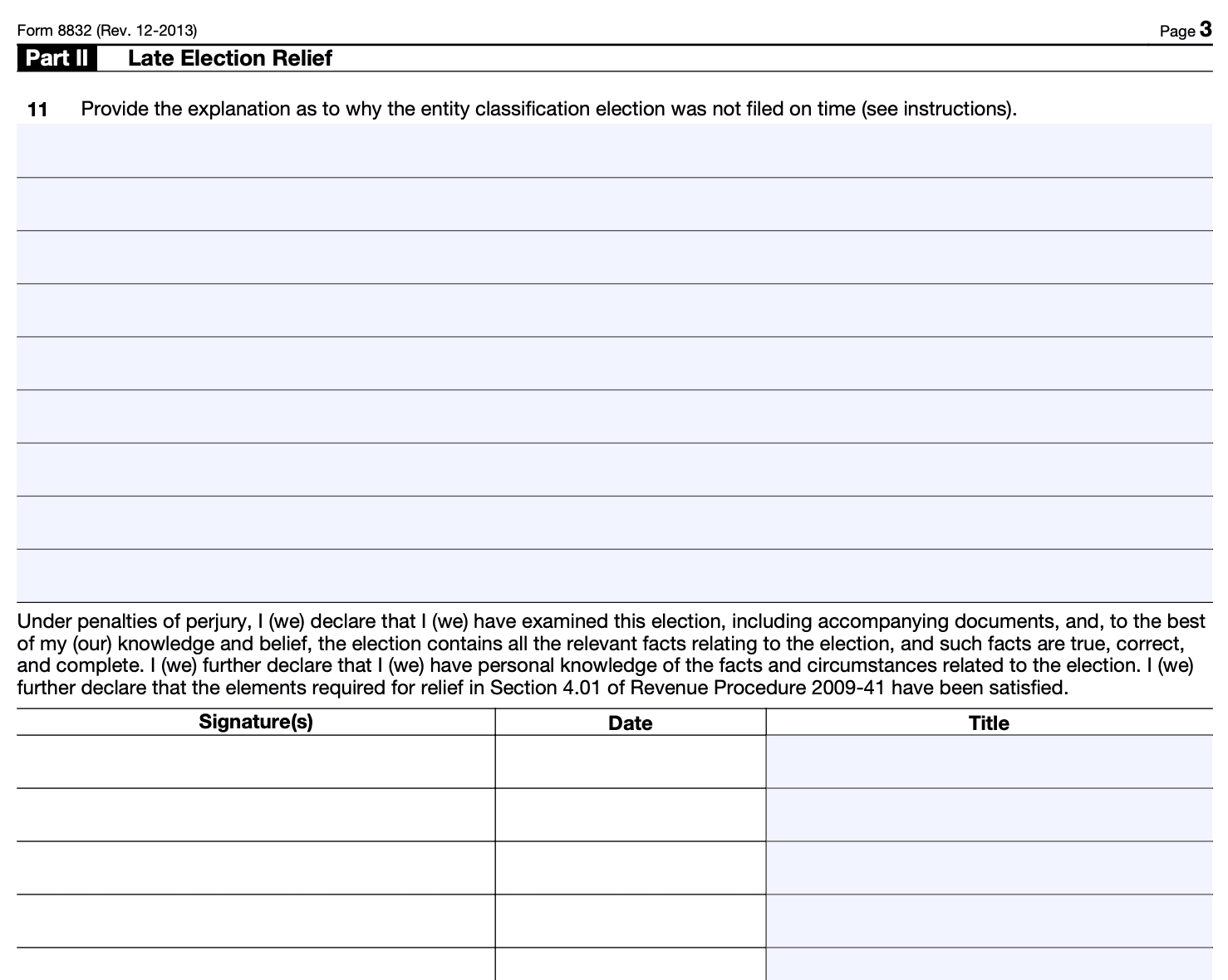

Late classification election: If a business entity fails to file Form 8832 by the required deadline, it may request a late election relief by filing a Private Letter Ruling (PLR) request with the IRS. The entity must provide a reasonable cause explanation for the delay. The IRS has the discretion to grant or deny the request.

Extension of time to file: There is no automatic extension available for filing Form 8832. However, if a business entity needs additional time to file the form, it can request an extension by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. The extension request must be filed by the original due date of the entity's tax return (typically the 15th day of the 3rd month following the end of the entity's tax year).

Common Mistakes To Avoid While Filing Form 8832

When filing Form 8832, which is used to elect the tax classification of an eligible entity, there are several common mistakes that you should avoid. Here are some of them:

-

Missing or incorrect information: Ensure that you provide accurate and complete information on the form. This includes the entity's name, address, Employer Identification Number (EIN), and the tax year for which the election is being made.

-

Failing to sign and date the form: The form requires the signature and date of an authorized person on behalf of the entity. Make sure to sign and date the form properly before submitting it.

-

Late submission: Form 8832 must be filed within 75 days of the desired effective date of the entity's tax classification change or the default classification will apply. Failing to file the form in a timely manner can result in the default classification being retained.

-

Inconsistent entity information: Ensure that the information provided on Form 8832 matches the information on file with the IRS. Any inconsistencies, such as variations in the entity's name or EIN, can lead to processing delays or rejection of the form.

5.Lack of supporting documentation: In certain cases, the IRS may require additional documentation to support the tax classification election. Make sure to review the instructions for Form 8832 and include any required attachments or supporting documents.

-

Failure to notify members or shareholders: If the entity has members or shareholders, it is important to inform them about the tax classification election. Failing to notify them can lead to confusion and potential issues down the line.

-

Ignoring state requirements: While Form 8832 is filed with the IRS, some states may have their own procedures or requirements for tax classification elections. Be sure to research and comply with any state-specific rules or forms that may apply.

-

Not keeping a copy of the filed form: It is crucial to keep a copy of the filed Form 8832 for your records. This will serve as proof of your tax classification election and can be helpful for future reference or in case of any inquiries from the IRS.

Conclusion

Form 8832 offers businesses the flexibility to choose their entity classification for federal tax purposes. By making an informed decision and understanding the implications of each classification, entrepreneurs can optimize tax benefits, protect personal liability, and align their business structure with their long-term goals. Consulting with a tax professional or legal advisor is recommended to ensure the entity classification election aligns with your business's unique needs and circumstances.