Form 8822 Guide: Notify the IRS of an Address Change

Download Form 8822As it has always been said, “Change is always constant,” and embracing this statement, many people often change their address. Whenever any person moves to a new address it is important that they first update their address so that they can get all the information and important documents, such as bank statements and other tax-related documents.

For those who want to change their address on their official government documents, they need to fill out Form 8822. This form is very important in changing the address, and only then can one can file their taxes from the new given address. This form officially notifies the government that the particular individual has changed their address.

What is this Form 8822 all about?

IRS Form 8822 is a form issued by the government of the USA. This form is for all those individuals who officially want to change their address. This form can be filled out for either an individual changing their residential address or it is to change the address of their shop or certain businesses they need to fill out for 8822.

Who can fill out the Form 8822?

Those individuals who have moved and are individual taxpayers need to fill out IRS Tax Form 8822 and inform the government of their address change. Apart from this, business owners who are executors or administrators of certain businesses are eligible to fill out this form, and guardians of minors who have just shifted are required to fill out this Form immediately.

Is it important to notify the IRS of an address change?

Yes, it is very important for individuals to notify the government and fill out the IRS Change of Address Form 8822. This is required so that those who have paid taxes can receive their receipts or important tax-related documents and in case any of these government documents are missed it can cause a felony in the future. If the IRS-related documents don't reach the designated address then there can be significant delays, which can stop the individuals from claiming tax returns. The IRS from time to time issues several notices about important procedures related to taxes, such as audits payment reminders, and taxes that are owed previously, and with address change these might not reach the designated individual in time.

What are the types of addresses one can change by filling out form 8822?

Individuals can certainly change their home or personal address especially those who are taxpayers. Apart from these, these individuals can change the address of the child to whom they are guardians as it is their legal obligation to do so. Individuals who own or manage estates need to update their addresses as they are the executors or administrators. However, business owners do not have to fill out form 8822 but rather fill the other section which is from 8822 B which is essentially made to update their business address. An address change only affects the IRS and does not notify any other US Government Agencies.

When should an Individual fill up the Form 8822?

Individuals need to fill out this form as soon as they move out to a new location but one should fill the IRS change of address Form 8822 before they file for the taxes. This needs to be done to receive all the tax-related mail. It takes time for such kinds of Forms to process that's why individuals should always be prepared well in advance.

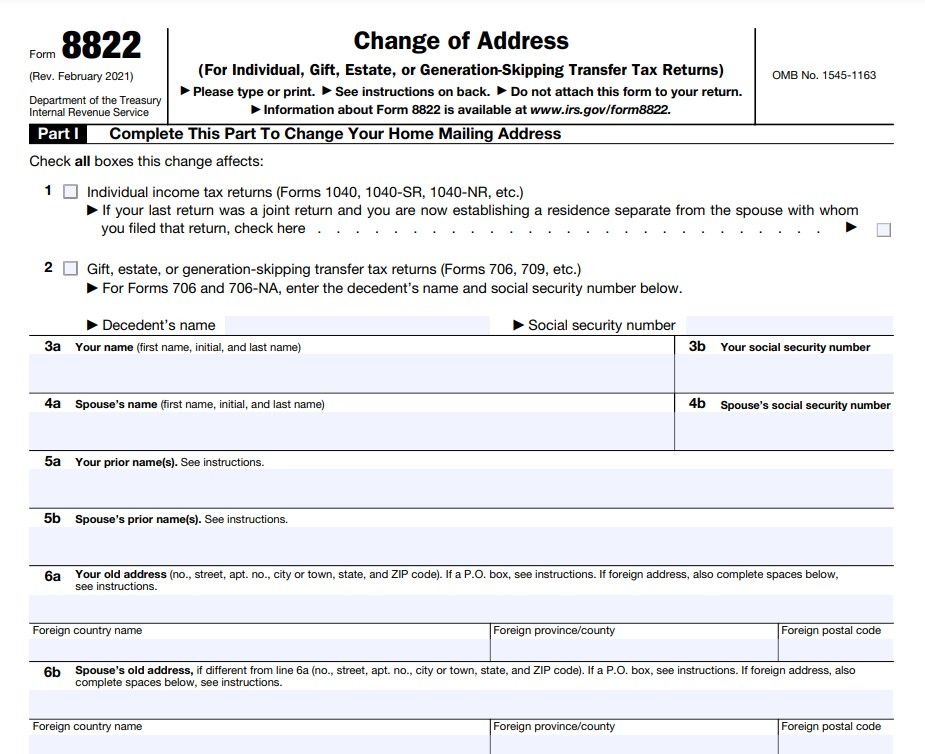

Let us learn how to fill out the Form 8822

To begin with, one should go on to the IRS website and search for Form 8822. It is a very easy process but one should be mindful of minute details as even a slight mistake can cause trouble while filing for taxes. To solve the hassle one should begin by going onto the website and searching for and reading Form 8822 instructions closely.

As soon as one opens the form one will know that the form is divided into 2 sections which are Section I and Section II.

Section I is for those individual taxpayers who wish to update their address and Section II is for those who have to fill out the form to change their real estate address.

The individuals should begin by filling out their full name and then proceed to Step 2 which is filling out the social security number. As per the questions asked on the form, individuals should start filling out the Form Accordingly.

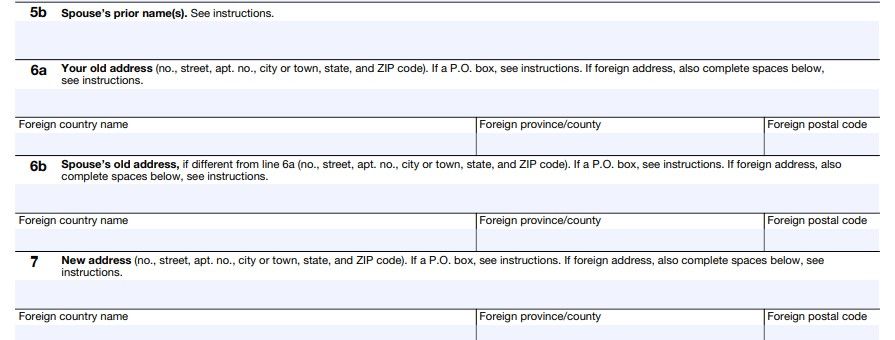

Individuals should fill out their name, and the name of their spouse (if any) correctly and then proceed on to Step 3. Step 3 is to fill out the previous address and then proceed to part 7 which is filling out the new address. One should fill out all the details such as IP Code, Street Name, Locality Name, City & Statue correctly and accurately.

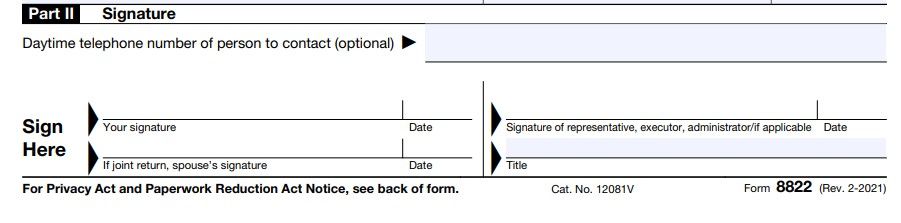

The last and final step to fill out Form 8822 is to sign and put on a date. The Form must have the signature of the individuals only then the form is eligible and will have met with all the criteria. If the form is filled jointly by both spouses both their signatures must be theirs. This ensures that the form has been filled correctly and for those who are filing it on behalf of an estate then the administrator or executor mandatorily needs to sign the form and put it on the date.

Where to send Form 8822 after filling it properly?

There are many mailing addresses provided by the IRS in different States and cities. Based on the new address of the individual one should file the nearest IRS mailing address and send it as per the instruction listed in Form 8822.

Can I Change my address online?

As per the rules and regulations, there is no procedure for one to change the address Online. One has to fill out Form 8822 and notify the IRS of changing their address to get all the mail-related documents and notices.

Frequently Asked Questions

Q: What if I am moving temporarily should I still fill out the Form?

A. Yes, all those individuals who are moving out temporarily also need to fill out the Gorm 8822. This is to ensure that the individuals receive the necessary tax-related and IRS-generated documents.

Q: What if I have moved out after filing my taxes but have not yet received my return?

A. In this case, one has to immediately begin to fill out Form 8822 and notify the IRS so that the return or refund is sent to the right address.

Q: How long does it take for the IRS Form 8822 to process?

A. IRS ideally takes around a month which is between four to six weeks to process the Gorm 8822. Keeping this timeline in mind individuals should work on it accordingly.

Conclusion

By closely following the steps mentioned in this blog one can successfully fill out Form 8822 and by filling it one can avoid all the delays in claiming their tax refund after moving to a new place.