- IRS forms

- Form 8703

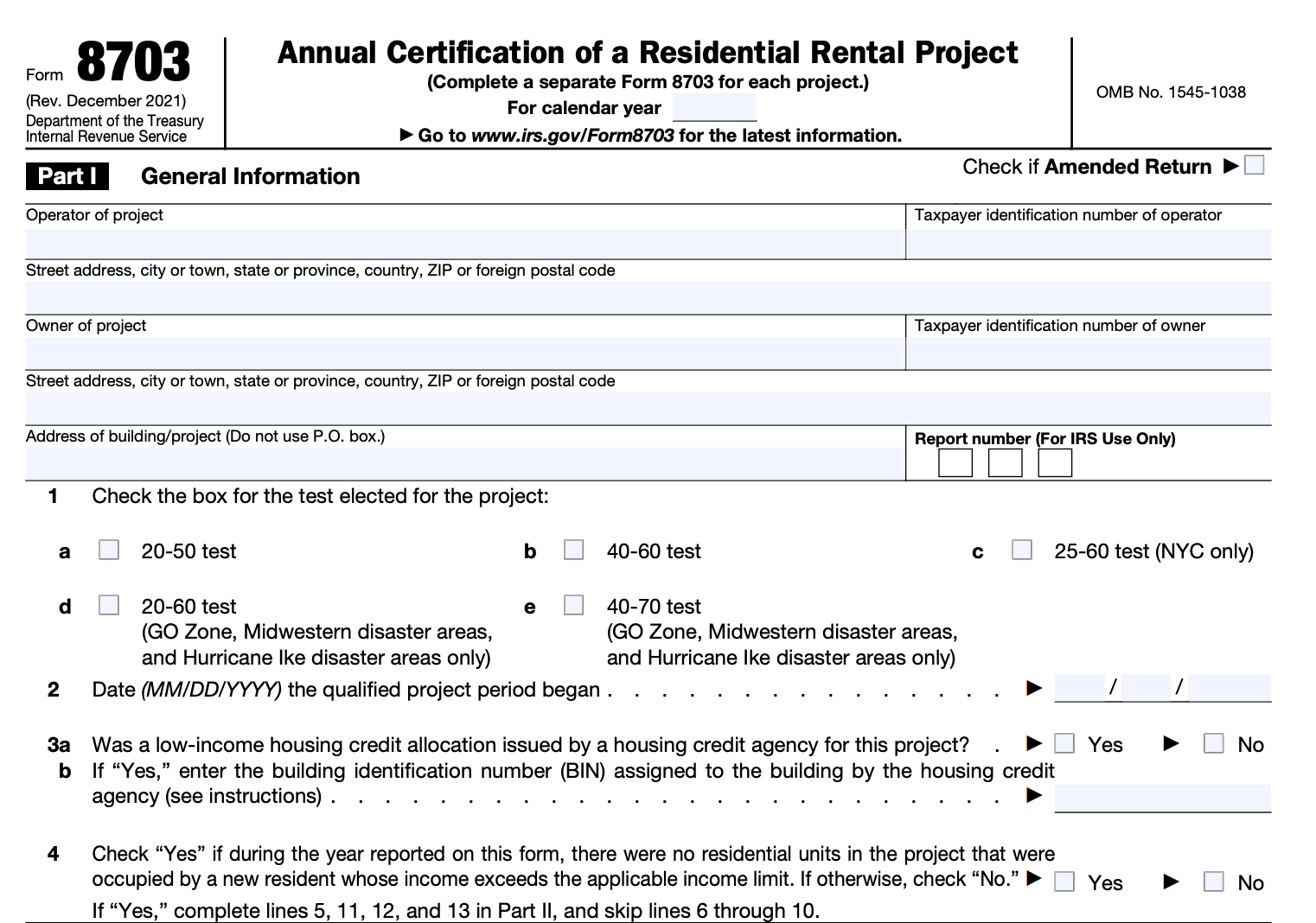

Form 8703: Annual Certification of a Residential Rental Project

Download Form 8703For investors and developers involved in affordable housing projects, staying compliant with tax regulations is crucial. One such important requirement is the submission of Form 8703: Annual Certification of a Residential Rental Project.

The Low-Income Housing Tax Credit (LIHTC) program was established by the of 1986 as an initiative to address the growing need for affordable housing options for low-income families. Under this program, state housing agencies allocate tax credits to qualified affordable housing projects, which developers can then use to raise capital for the construction, rehabilitation, or acquisition of rental properties.

This form plays a pivotal role in ensuring that affordable housing projects continue to receive tax benefits and operate within the guidelines set forth by the government. In this blog post, we will explore the significance of Form 8703 and its implications on affordable housing initiatives.

Purpose of Form 8703

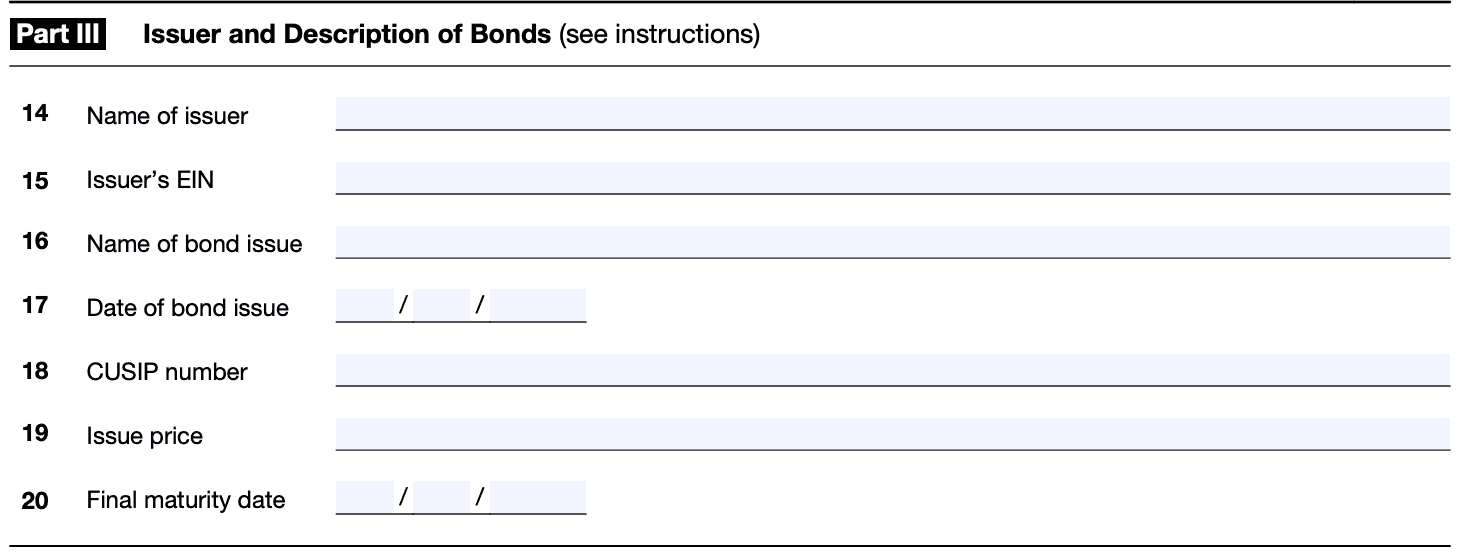

Form 8703 is used for the purpose of reporting and certifying compliance with the low-income housing requirements of a residential rental project. The form is specifically related to projects financed with tax-exempt bonds or housing tax credits under the Low-Income Housing Tax Credit (LIHTC) program.

The LIHTC program is a federal initiative that provides tax incentives to encourage private investment in affordable housing for low-income households. To qualify for these tax credits, property owners must agree to maintain certain affordability requirements and rent restrictions for a specific period, typically for at least 30 years.

Form 8703 is filed annually by the owner of a residential rental project to provide the IRS (Internal Revenue Service) with information about the project's compliance with the LIHTC program requirements. By completing and submitting this form, the owner certifies that the project continues to meet the necessary criteria for receiving the tax credits.

Benefits of Form 8703

The benefits of Form 8703 include:

-

Compliance: By filing Form 8703, the sponsoring organization of a donor-advised fund demonstrates compliance with IRS regulations and requirements, which helps maintain its tax-exempt status.

-

Information reporting: The form provides details about contributions made to the donor-advised fund and the distribution of funds from the DAF to various charitable recipients. This information allows the IRS to monitor the flow of funds and ensure proper tax treatment.

-

Tracking and transparency: Filing Form 8703 helps the IRS track the activities of the donor-advised fund, ensuring that the funds are being used for legitimate charitable purposes.

-

Tax deduction verification: For donors who contribute to a donor-advised fund, the information provided on Form 8703 helps verify their tax deductions for charitable contributions.

5.** Regulatory oversight**: The IRS uses the information reported on Form 8703 to oversee and regulate donor-advised funds, ensuring they adhere to the appropriate tax laws and guidelines.

- Preventing abuse: By requiring organizations to file Form 8703, the IRS can identify any potential abuse or misuse of donor-advised funds, helping to maintain the integrity of the charitable sector.

Who Is Eligible To File Form 8703?

To be eligible to file Form 8703, an organization must meet the following criteria:

**Be a tax-exempt organization: **The organization must have been recognized as tax-exempt under section 501(c) of the Internal Revenue Code. This includes various types of nonprofit organizations, such as charities, religious organizations, educational institutions, and more.

Have gross receipts less than or equal to $50,000: The organization should typically have gross receipts (total income before any expenses) of $50,000 or less in a taxable year.

**Qualify under section 6033(j)(2): **The organization must fall under the specific provisions of section 6033(j)(2) of the Internal Revenue Code, which allows certain small tax-exempt organizations to request a waiver of the annual information return filing requirement (e.g., Form 990 or Form 990-EZ).

The purpose of Form 8703 is to allow eligible small tax-exempt organizations to request relief from the burden of filing the Form 990 or Form 990-EZ, which are typically required for larger tax-exempt organizations.

How To Complete Form 8703: A Step-by-Step Guide

Here's the general guide to complete Form 8703:

Step 1: Obtain the form

Visit the official IRS website and search for "Form 8703." Download and print the form, if applicable. Ensure you have the latest version of the form and corresponding instructions.

Step 2: Gather information

Collect all the necessary information required to complete the form. This may include personal details, financial information, and any relevant documents like W-2s, 1099s, receipts, or other supporting documents.

Step 3: Read the instructions

Before you begin filling out the form, carefully read the provided instructions. The instructions will guide you through the various sections of the form, explain the terms, and provide information on how to complete each part correctly.

Step 4: Start with personal information

Fill in your name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN), and any other required identification details.

Step 5: Complete the relevant sections

Follow the instructions to complete all the applicable sections of the form. Be accurate and ensure that all the information is entered correctly.

Step 6: Double-check and review

Review the completed form thoroughly to avoid errors and omissions. Ensure that all the numbers match your supporting documents.

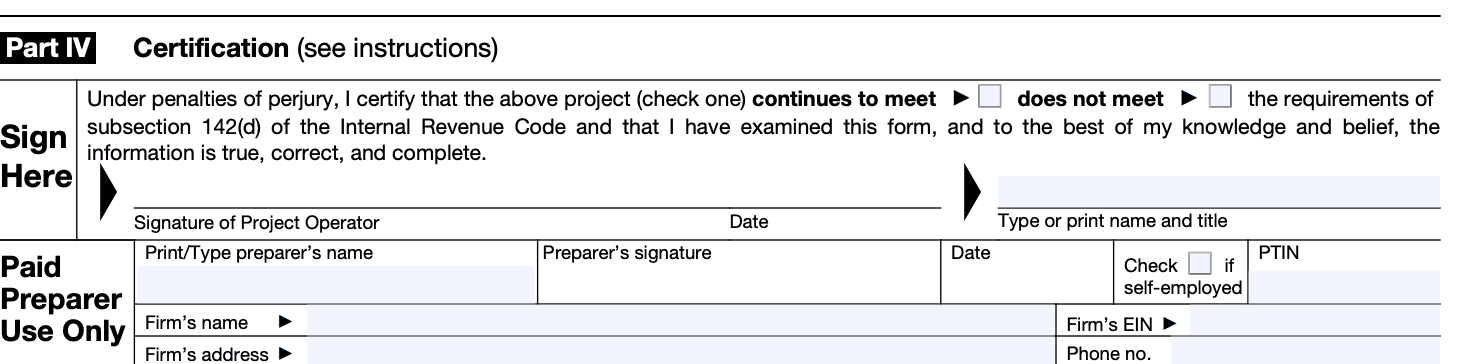

Step 7: Sign and date

Once you are confident that the form is accurate, sign and date it as required.

If you are filing a physical copy, mail the completed and signed Form 8703 to the IRS address provided in the instructions. Alternatively, if you are filing electronically, follow the instructions for e-filing the form.

Step 9: Keep a copy for your records

Make a copy of the completed form and all supporting documents for your records. Keep these documents in a safe place for future reference.

Special Considerations When Filing Form 8703

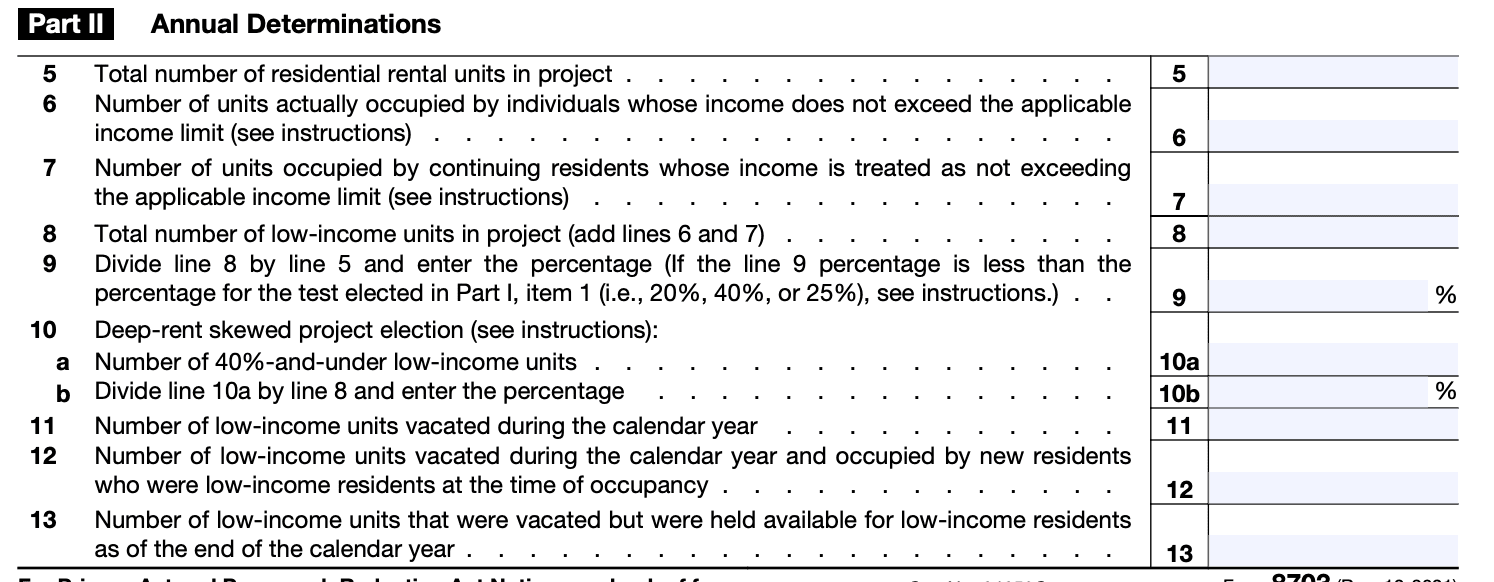

While filing Form 8703, it is essential to follow the specific guidelines and requirements when filing Form 8703 to ensure compliance with the LIHTC program.

Here are some special considerations to keep in mind when filing the form:

Deadline: Form 8703 must be filed annually by the owner of the low-income housing property. The deadline for filing the form is 12 months from the last day of the month in which the building was placed in service.

**Accuracy and completeness: **Ensure that all the information provided on the form is accurate and complete. Any errors or omissions can lead to delays in processing or potential non-compliance issues.

**Tenant income certification: **The LIHTC program requires income certifications for the tenants residing in the low-income housing property. Make sure that the income certifications are up to date and in compliance with the LIHTC program guidelines.

Property compliance: The property must comply with the applicable LIHTC program rules and regulations throughout the year. This includes maintaining the appropriate number of qualified low-income units and adhering to rent and income restrictions.

Record-keeping: It is crucial to maintain proper records and documentation related to the property's compliance with the LIHTC program. These records may be subject to audit by the IRS, state housing agencies, or other monitoring agencies.

**State and local requirements: **In addition to the federal requirements, there may be specific state and local requirements that need to be considered when filing Form 8703. Ensure compliance with all applicable regulations at the state and local levels.

**Ownership changes: **If there have been any changes in ownership during the year, ensure that the new owner has all the necessary information and documentation related to the LIHTC property's compliance.

Consistency with previous filings: Verify that the information provided in Form 8703 is consistent with the previous filings and certifications submitted for the property.

**Professional assistance: **Filing Form 8703 can be complex, especially for those unfamiliar with the LIHTC program requirements. Consider seeking professional assistance from accountants, tax advisors, or legal experts experienced in LIHTC compliance.

How To File Form 8703: Offline/Online/E-filing

Offline filing

If the form you need to file is not available for e-filing, you can still file it offline by following these steps:

a. Obtain the form: You can download the required form from the official IRS website (www.irs.gov) or request a copy by mail.

b. Complete the form: Fill out the form accurately and completely, following the provided instructions.

c. Attach documentation: If required, attach any supporting documents or schedules that are relevant to the form.

d. Mail the form: Once the form is filled out and all necessary attachments are included, mail it to the appropriate IRS address, which is typically provided in the form instructions.

Online filing

Online filing is generally faster and more convenient than offline filing. To file a form online, follow these steps:

a. Choose a service: The IRS offers various online platforms and authorized e-file providers through their website. Choose one that supports the form you need to file.

b. Create an account: If required, create an account on the chosen platform. This usually involves providing your personal information and creating a username and password.

c. Fill out the form: Complete the form online, following the instructions provided by the platform. They may ask questions and guide you through the process.

d. Submit the form: After completing the form, review it for accuracy and submit it through the platform. The platform will transmit the information securely to the IRS.

E-filing

E-filing refers to the process of electronically submitting tax returns and related documents directly to the IRS. E-filing is generally available for various tax forms and offers faster processing and fewer errors. To e-file a form:

a. Use IRS-authorized software: Choose an IRS-authorized e-filing software or hire a tax professional who offers e-filing services.

b. Prepare the form: Input your tax information into the software or provide the necessary information to the tax professional.

c. Review and confirm: Double-check all the information for accuracy and completeness before submitting.

d. Transmit to the IRS: Once you are satisfied with the form, authorize the e-filing software to transmit the form to the IRS securely.

Common Mistakes To Avoid While Filing Form 8703

Here are some common mistakes to avoid:

Failing to submit the form: The most obvious mistake is not filing Form 8703 at all if your business qualifies for empowerment zone tax benefits. Make sure you determine your eligibility and submit the form in a timely manner.

Incorrect or missing information: Ensure that all the required fields on Form 8703 are filled out accurately. Double-check your entries, including the business name, address, and Employer Identification Number (EIN).

**Wrong tax year: **Be sure to use the correct tax year for the form. Form 8703 is typically filed annually, so make sure you are reporting for the appropriate tax year.

Inadequate documentation: Keep all supporting documentation for your eligibility for empowerment zone benefits. The IRS may request evidence to verify your qualifications, so it's crucial to maintain proper records.

**Failing to sign the form: **Both the business owner and the authorized representative must sign Form 8703. Forgetting to sign the form can delay processing and may result in penalties.

**Missing the deadline: **Ensure that you file the form by the due date. Missing the deadline could lead to the loss of potential tax benefits.

**Using outdated forms or instructions: **Always download the latest version of Form 8703 and follow the most recent IRS instructions to avoid outdated or incorrect information.

Not seeking professional advice if unsure: If you're uncertain about any aspect of filing Form 8703 or claiming empowerment zone tax benefits, consider seeking guidance from a tax professional or an IRS representative.

Conclusion

Form 8703 plays a vital role in maintaining the tax-exempt status of residential rental projects financed with tax-exempt bonds. By certifying compliance annually, property owners and developers ensure that they continue to enjoy the tax benefits associated with such financing, while also contributing to the provision of affordable housing to those in need.

Adhering to the regulations and completing the form accurately and promptly is not only a legal obligation but also a commitment to promoting accessible and sustainable housing solutions for communities across the nation.