- IRS forms

- Form 8038-R

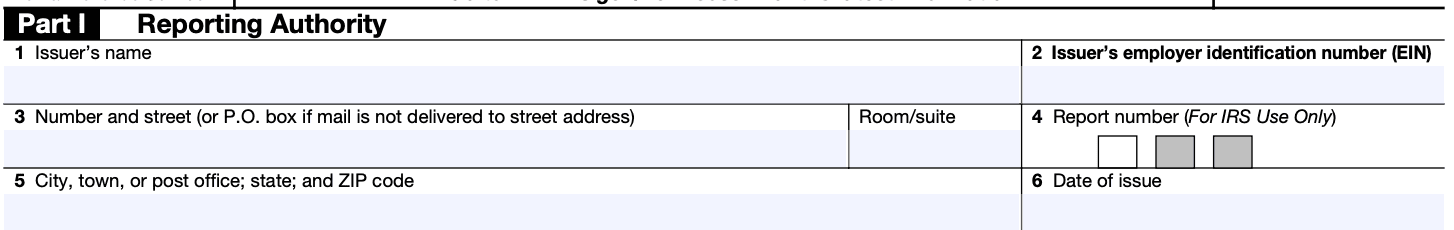

Form 8038-R: Request for Recovery of Overpayment Under Arbitrage Rebate Provisions

Download Form 8038-RAs part of the complex financial landscape of municipal bonds, the Internal Revenue Service (IRS) oversees regulations related to arbitrage rebate provisions. These provisions ensure that issuers of tax exempt bonds do not profit from investing the bond proceeds at higher interest rates than the bond's yield.

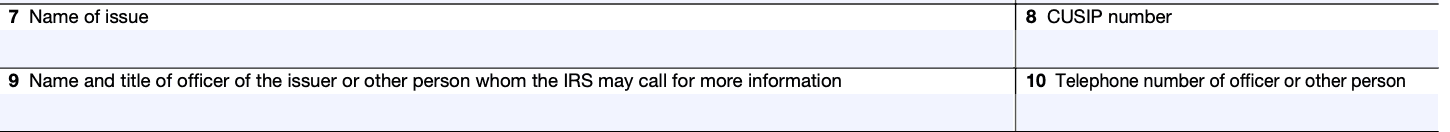

To maintain compliance with these regulations, issuers must calculate any arbitrage profits and submit payments to the IRS as necessary. However, due to various factors, overpayments can sometimes occur. In such cases, issuers can utilize Form 8038-R to request a recovery of the overpaid amounts.

Form 8038-R is a crucial IRS document used by issuers of tax exempt bonds to request a refund of overpaid arbitrage rebates. When an issuer calculates the arbitrage earnings on the invested bond proceeds and pays the required amount to the IRS, there may be instances where the actual arbitrage earned is less than initially estimated or anticipated. In such cases, the issuer can seek a recovery of the overpaid amount using Form 8038-R.

In this blog, we will delve into the details of Form 8038-R and understand the process of requesting overpayment recovery under arbitrage rebate provisions.

Purpose of Form 8038-R

The purpose of Form 8038-R is to provide the IRS with essential information about these bonds and the associated projects, as well as to ensure compliance with the tax laws governing tax exempt bonds. Some of the details that may be reported on this form include:

-

Identification of the issuer and the bond issue

-

The purpose of the bond-financed project

-

The location of the project

-

The amount of bonds issued and outstanding

-

The type of bond issue (e.g., new issue, refunding, etc.)

-

Any private business use of the bond-financed facility

Benefits of Form 8038-R

Here are some of the benefits of Form 8038-R for tax exempt organizations:

- Compliance: Filing Form 8038-R helps tax exempt organizations comply with the Internal Revenue Service (IRS) regulations and requirements for tax credit bonds. It ensures that the organization is meeting its obligations related to the issuance of these bonds.

- **Tax exemption: **By issuing tax credit bonds, the tax exempt organization can offer investors the benefit of tax credits. These credits can be used to offset the investors' federal income tax liabilities, making the bonds more attractive to potential buyers.

- Lower interest costs: Tax credit bonds may allow the issuing organization to secure financing at a lower interest rate than traditional taxable bonds. This can result in cost savings over the life of the bond issuance.

- **Attract investors: **The inclusion of tax credits in the bond offering can attract a broader range of investors, including those who may be interested in the tax benefits of the credits. This potentially increases the demand for the organization's bonds.

- **Financing projects: **Tax credit bonds can be used to finance specific projects that promote community development or meet other public purposes. These projects might include infrastructure development, affordable housing initiatives, or energy conservation efforts.

- Economic development: By financing projects that contribute to economic development, tax exempt organizations can positively impact local communities and stimulate growth.

- Public relations: Engaging in projects funded by tax credit bonds can enhance the public image of the tax exempt organization. It demonstrates a commitment to social responsibility and community development.

Who Is Eligible To File Form 8038-R?

Eligible filers for Form 8038-R typically include state and local governments or their instrumentalities that have issued tax exempt bonds. Here are some specific entities that might need to file Form 8038-R:

- State governments

- Local governments, such as counties, cities, towns, and villages

- Governmental agencies and authorities

- Tribal governments

These entities issue tax exempt bonds to finance public infrastructure projects, such as schools, hospitals, highways, and utilities. Form 8038-R is filed with the Internal Revenue Service (IRS) and helps ensure compliance with the tax rules related to tax exempt bonds.

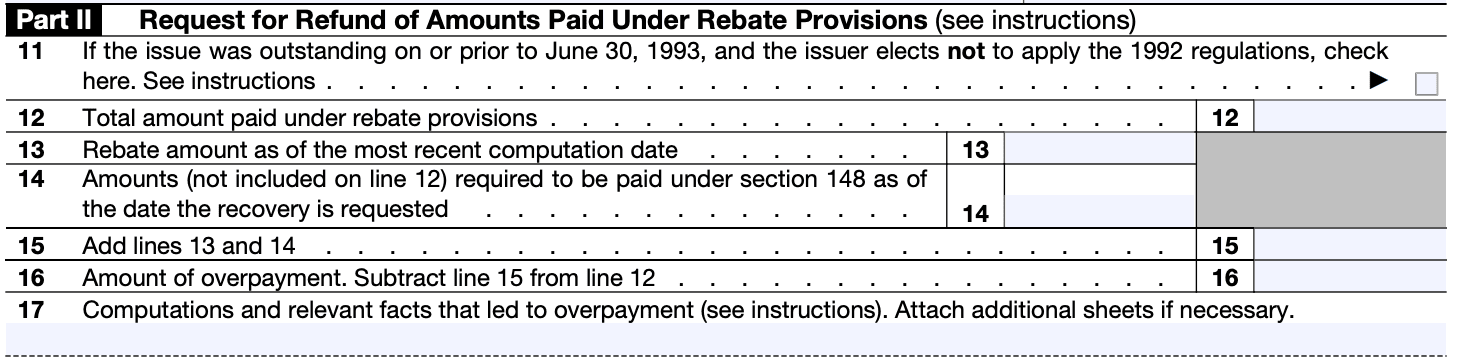

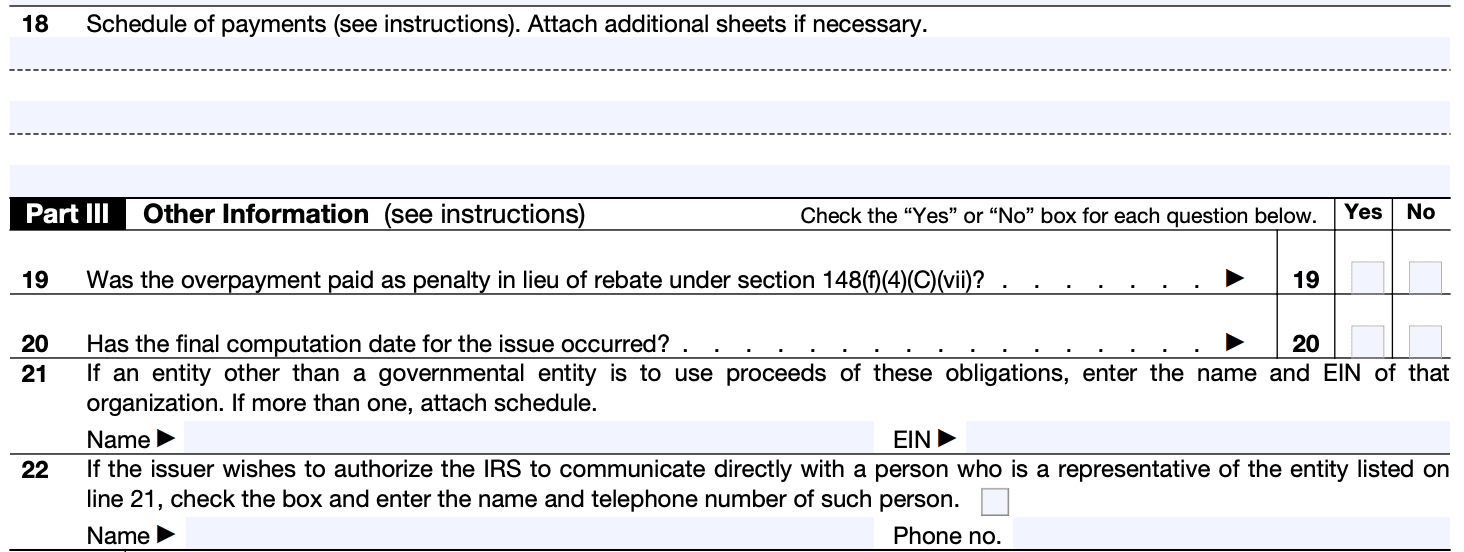

How To Complete Form 8038-R: A Step-by-Step Guide

Step 1: Obtain the form and instructions

Visit the IRS website and search for "Form 8038-R" to download the most recent version of the form and its instructions. Make sure you have the correct form for the tax year in question.

Step 2: Gather necessary information

Before you start filling out the form, gather all the relevant information required to complete it. This may include details about the issuer, the bond issue, the amount of bonds issued, the purpose of the bonds, and other related information.

Step 3: Provide issuer information

Fill out the top section of the form, which requires information about the issuer, such as name, address, taxpayer identification number (TIN), contact information, etc.

Step 4: Provide bond issue information

In this section, you will need to provide details about the bond issue, including the name of the bond issue, the date it was issued, the date it matures, the purpose of the bonds, and any other pertinent information.

Step 5: Answer compliance questions

Form 8038-R includes various compliance questions related to the bond issue. Answer these questions accurately based on the specifics of the bond issuance.

Step 6: Complete Schedule A (optional)

Depending on the type of bond issue and its use, you may need to complete Schedule A, which provides additional information about the private business use of tax exempt bond proceeds.

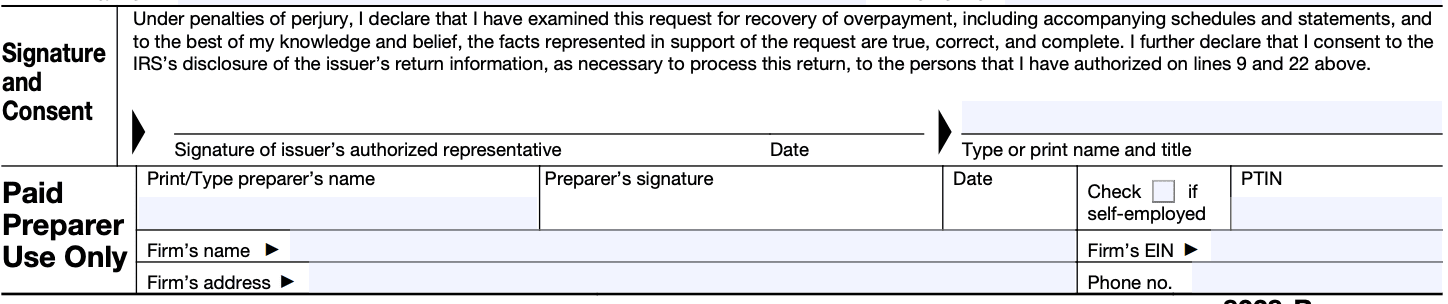

Step 7: Sign and date the form

The issuer or authorized representative must sign and date the form to certify its accuracy.

Step 8: File the form

Make sure to keep a copy of the completed Form 8038-R for your records, and file the original form with the IRS by the appropriate deadline. The filing deadline is typically within a certain number of days after the issuance of the bonds, so check the instructions for the specific timeframe.

Step 9: Follow up with the IRS

After submitting Form 8038-R, keep track of your records and any correspondence from the IRS regarding your bond issue. If there are any issues or discrepancies, address them promptly.

Please remember that this is a general guide, and the actual process and requirements may differ based on the specific tax year and any updates made to the form by the IRS

Special Considerations When Filing Form 8038-R

As of 2021, some special considerations when filing Form 8038-R included:

- Accurate and timely Filing: Ensure that you file the Form 8038-R by the due date. The due date generally varies depending on the type of bond and the specific circumstances. Late filing may lead to penalties .

- Proper identification of the issuer and bond: Provide accurate information about the issuing state or local government and the bond being reported. The issuer's name, address, and employer identification number (EIN) are crucial.

- Reporting bond information: You need to report details about the bond, such as the issue date, maturity date, issue price, and face amount.

- Private activity bonds (PABs): If the bond is a qualified private activity bond, there are specific additional requirements and limitations to consider. Different rules apply depending on whether the bond is used for qualified residential rental projects, exempt facilities, or other private activities.

- Tax credit bonds: If the bond is a tax credit bond, there may be additional information required to calculate and report the applicable tax credits accurately.

- Arbitrage rebate requirements: For certain bonds, there may be arbitrage restrictions and rebate requirements. These rules govern the investment of bond proceeds and the use of earnings to ensure the tax-advantaged status of the bonds.

- Information about federally subsidized debt: If the bond issue includes federally subsidized debt, this information must be reported on the form.

- Electronic filing: In most cases, Form 8038-R must be filed electronically using the IRS's Modernized e-File (MeF) system.

- Record-keeping: Maintain detailed records and documentation related to the bond issue and compliance with tax requirements. These records should be retained for a specific period, as required by the IRS.

- Tax exempt compliance: Ensure that the bond issuance complies with all relevant tax exempt requirements to preserve the tax exempt status of the bonds.

How To File Form 8038-R: Online/Offline/E-filing

If you need to file Form 8038-R, here's what you need to know about the filing options:

Online filing (e-filing)

The IRS allows electronic filing (E-filing) of Form 8038-R through the Filing Information Returns Electronically (FIRE) system. To use this option, you need to follow these steps:

- Register for an account on the FIRE system: Go to the IRS website and register for an account on the FIRE system. You will need to provide some information and agree to the terms of service.

- Obtain the appropriate software: You will need software that supports the electronic filing of Form 8038-R. The FIRE system provides a list of approved software vendors that you can choose from.

- Complete the form electronically: Use the approved software to enter the required information and complete Form 8038-R electronically.

- Submit the form: After completing the form, submit it through the FIRE system. The system will provide a confirmation once the submission is successful.

Offline filing (paper filing)

If you prefer to file the traditional way, you can complete a paper copy of Form 8038-R and mail it to the IRS. Here's what you need to do:

- Obtain the form: You can download Form 8038-R from the IRS website or request a physical copy by calling the IRS Forms and Publications department.

- Fill out the form: Complete all the required fields on the form following the instructions provided.

- Gather supporting documets: Ensure that you have all the necessary attachments and supporting documents required for Form 8038-R.

- Mail the form: Once the form is completed and signed, mail it to the address specified in the form's instructions.

Common Mistakes To Avoid When Filing Form 8038-R

Filing Form 8038-R correctly is important to ensure compliance with tax laws and to avoid potential penalties. Here are some common mistakes to avoid when filing Form 8038-R:

Late filing: Ensure that you submit the Form 8038-R on time. Filing deadlines are crucial, and late submissions may lead to penalties and interest charges.

**Incomplete or inaccurate information: **Double-check all the information provided on the form. Ensure that names, addresses, bond amounts, and other relevant details are accurate and complete. Any mistakes can delay the processing of the form and may require amendments.

Incorrect bond classification: Properly classify the bonds as either private activity bonds or other types of tax exempt bonds. Misclassifying the bonds can lead to incorrect tax treatment.

Omitting required attachments: Form 8038-R may require various attachments, such as bond transcripts, certificates, and opinions. Failure to include all the required attachments can cause delays and may result in the form being considered incomplete.

Not keeping copies of the filed form: Always keep copies of the completed Form 8038-R and all related documents for your records. This will be helpful for future reference and audits.

**Using outdated forms or instructions: **Make sure you are using the most recent version of Form 8038-R and following the latest instructions provided by the Internal Revenue Service (IRS).

**Ignoring changes in tax laws: **Stay updated with any changes in tax laws, reporting requirements, or other relevant regulations that may impact the filing of Form 8038-R.

Failure to report bond refundings or modifications: If there have been any bond refundings or modifications during the reporting period, ensure that they are properly reported on the form.

**Incorrectly calculating the yield on bonds: **Accurately calculate the bond yield and report it on the form. The yield is essential for determining compliance with tax exempt status and for tracking any potential arbitrage issues.

Not seeking professional assistance when needed: If you are uncertain about any aspect of filing Form 8038-R or if your situation is particularly complex, consider seeking advice from a tax professional or advisor with experience in municipal bonds.

Conclusion

Form 8038-R plays a crucial role in the recovery of overpaid arbitrage rebate amounts for issuers of tax exempt bonds. By adhering to the eligibility criteria, accurately completing the form, and providing all necessary documentation, issuers can streamline the process and increase the likelihood of a successful refund claim.

It is vital for issuers to stay informed about IRS guidelines and changes to ensure compliance with arbitrage rebate provisions. Seeking professional advice and assistance from financial experts or tax advisors can also be beneficial in navigating this complex aspect of municipal bond regulations.