- IRS forms

- Form 8038-TC

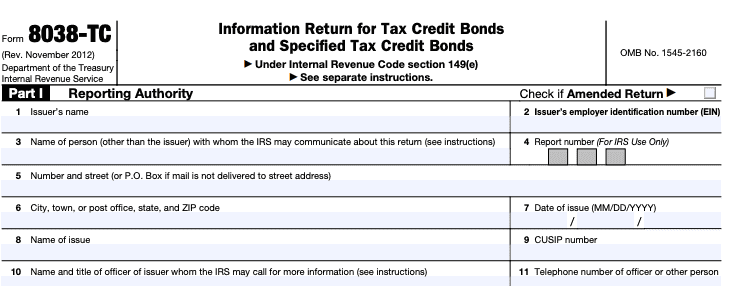

Form 8038-TC: Information Return for Tax Credit Bonds and Specified Tax Credit Bonds

Download Form 8038-TCWhen it comes to financing public projects and initiatives, governments often issue bonds as a means of raising funds. Tax credit bonds are a specific type of bond that offers investors federal tax credits instead of the traditional interest payments. To ensure proper reporting and compliance, issuers of tax credit bonds are required to file Form 8038-TC, the Information Return for Tax Credit Bonds and Specified Tax Credit Bonds.

When it comes to financing public projects and initiatives, governments often issue bonds as a means of raising funds. Tax credit bonds are a specific type of bond that offers investors federal tax credits instead of the traditional interest payments. To ensure proper reporting and compliance, issuers of tax credit bonds are required to file Form 8038-TC, the Information Return for Tax Credit Bonds and Specified Tax Credit Bonds. In this blog, we will delve into the significance of Form 8038-TC and explore the world of tax credit bonds.

In this blog, we will delve into the significance of Form 8038-TC and explore the world of tax credit bonds.

Purpose of Form 8038-TC

The purpose of Form 8038-TC is to provide information to the Internal Revenue Service (IRS) about the issuance and use of tax credit bonds. This form is filed by the issuer of the bonds and includes details such as the bond issuer's information, the type and purpose of the tax credit bonds, the amount issued, and other relevant information related to the bond issuance.

By filing Form 8038-TC, the issuer ensures compliance with federal tax regulations and provides the IRS with the necessary data to monitor the usage of tax credit bonds and the associated tax credits. This information helps the IRS administer the tax credit bond program and ensure that the tax credits are being used for their intended purposes.

Please note that tax laws and forms may change over time, so it's always essential to refer to the most recent IRS guidance or consult with a tax professional for the latest information regarding Form 8038-TC or any other tax-related matters.

Benefits of Form 8038-TC

This form is typically used by issuers of tax exempt bonds or their authorized representatives. The primary benefits of using Form 8038-TC include:

1. Information verification: Form 8038-TC allows issuers to verify the tax exempt status and other details related to their tax exempt bonds. This can be crucial for ensuring compliance with tax regulations and providing accurate information to stakeholders.

2. Record-keeping: By obtaining a transcript of tax exempt bond information through Form 8038-TC, issuers can maintain accurate and up-to-date records of their bond issuances. This aids in tracking financial transactions and helps with audits or compliance checks.

3. Avoiding penalties: Filing Form 8038-TC in a timely manner can help issuers avoid potential penalties or fines that might be imposed for non-compliance with tax regulations related to tax exempt bonds.

4. Transparency and disclosure: Providing a transcript of tax exempt bond information may enhance transparency for investors and other interested parties. Transparency is crucial for maintaining trust and credibility in the financial markets.

5. Simplified reporting: Form 8038-TC provides a standardized format for requesting the transcript, making the reporting process more straightforward and efficient for issuers.

6. Accuracy of tax returns: Obtaining a transcript through Form 8038-TC can help issuers ensure the accuracy of their tax returns by having access to verified bond information.

Who Is Eligible To File Form 8038-TC?

The eligibility to file Form 8038-TC lies with the bondholders or the issuers of these specified tax credit bonds. Here's a breakdown of who may be eligible to file the form:

Bond issuers: State and local government entities that have issued specified tax credit bonds are eligible to file Form 8038-TC. These entities include cities, counties, states, and various special government districts.

**Bondholders: **If you are a bondholder and entitled to claim the tax credit associated with the specified tax credit bonds you hold, you may also be eligible to file Form 8038-TC to request the credit.

It's important to note that tax laws and regulations can change, so I recommend consulting the most recent IRS guidelines and official sources to ensure that you have the correct and up-to-date information regarding eligibility and filing requirements for Form 8038-TC.

How To Complete Form 8038-TC: A Step-by-Step Guide

Here's a general overview of how to complete Form 8038-TC:

Step 1: Obtain the form

You can find the latest version of Form 8038-TC, "Information Return for Tax Credit Bonds and Specified Tax Credit Bonds," on the IRS website (www.irs.gov) or by calling the IRS at their toll-free number.

Step 2: Understand eligibility

Ensure that you are eligible to file Form 8038-TC. This form is used by issuers of certain tax credit bonds to report information about the bonds, including any associated tax credits.

Step 3: Gather information

Before starting the form, gather all the necessary information, including:

a. Issuer information: Name, address, and identification number (EIN or SSN) of the issuer.

**b. Bond information: **Details about the tax credit bonds issued, such as the CUSIP number, issue date, maturity date, and issue price.

**c. Tax credit information: **Information related to the type and amount of tax credit(s) associated with the bonds.

d. Reporting period: The tax year for which you are filing the form.

Step 4: Complete Part I

In Part I, you will provide general information about the issuer and the bond issue. This includes details about the issuer, the bond issue date, the type of tax credit bond, and the CUSIP number.

Step 5: Complete Part II

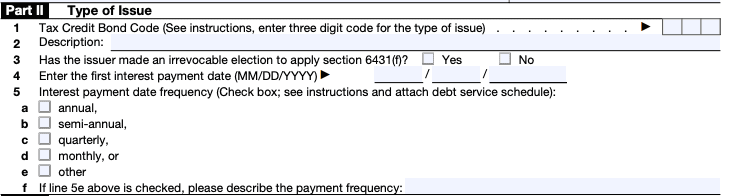

Part II is used to report information about the tax credit(s) associated with the bond issue. You will need to indicate the type of tax credit, the credit amount, and any carryforward amounts from previous years.

Step 6: Complete Part III & IV

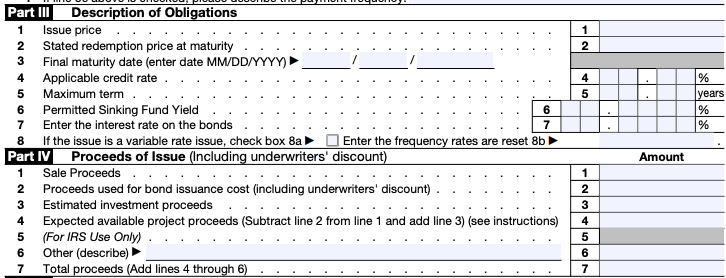

Part III is used to report any private business use of the bond proceeds or the property financed by the bond issue. This section is crucial for compliance with tax regulations related to tax credit bonds.

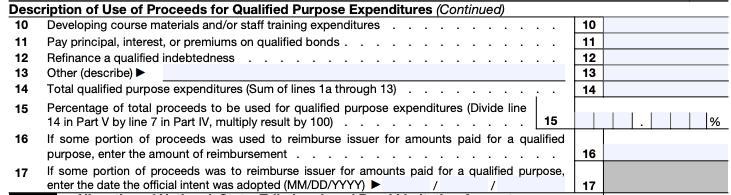

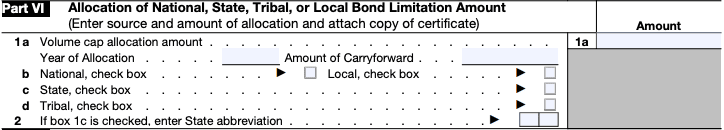

Step 7: Complete Part V, VI & VII

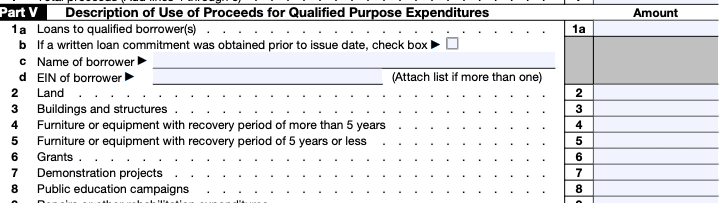

In Part V, provide information about the proceeds and allocations in Part VI & miscellaneous in Part VII.

Step 8: Check for accuracy

Ensure that all the information you have provided is accurate and double-check the form for any errors.

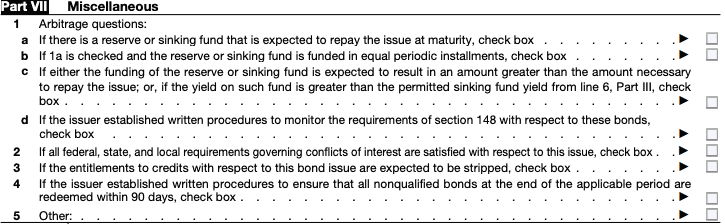

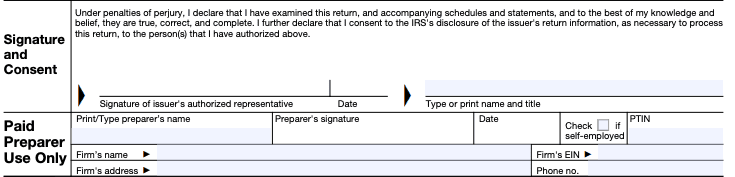

Step 9: Sign and date

Sign and date the form to certify that the information provided is true, correct, and complete to the best of your knowledge.

Step 10: Submit the form

Keep a copy of Form 8038-TC for your records and submit the original to the IRS. The mailing address for submission can be found in the instructions for the form.

Special Considerations When Filing Form 8038-TC

Here are some general considerations that could apply to filing Form 8038-TC:

**Correct and complete information: **Ensure that all the required fields on the form are filled out accurately and completely. Incorrect or missing information may result in delays or errors in processing your tax return.

Timely filing: Make sure to submit the form by the designated deadline. Late filing might lead to penalties or interest charges.

**Supporting documentation: **Include all necessary supporting documentation as per the IRS instructions. This could involve providing evidence of the bond issuance, the tax credit calculations, and any other information required to support your claim.

Compliance with regulations: Tax credit bonds come with specific rules and regulations. Ensure that the bond issuance and the tax credit claimed comply with all relevant laws and regulations.

**Professional assistance: **Filing Form 8038-TC can be complex, especially if you are dealing with significant bond issuances or multiple tax credits. Seeking advice from a tax professional or financial advisor experienced in tax exempt bonds can help ensure accurate compliance and maximize your tax benefits.

IRS resources: The IRS provides instructions and guidance for completing Form 8038-TC. Before filing, consult the most recent version of these instructions to ensure you have the correct information.

(link: https://fincent.com/blog/a-beginners-guide-to-record-keeping-for-small-businesses text: Record-keeping): Maintain copies of the filed form and all supporting documentation for your records. It's crucial to keep this information for several years in case of any future inquiries or audits.

How To File Form 8038-TC: Offline/Online/E-filing

Offline filing

To file Form 8038-TC offline, you need to obtain a physical copy of the form from the IRS. You can find the form on the official IRS website or order it by calling the IRS Forms and Publications department. Once you have the form, fill it out with accurate and complete information.

After completing the form, you can mail it to the appropriate address provided in the form's instructions. It's crucial to use certified mail or a method that allows you to track the delivery of your form to ensure it reaches the IRS within the required filing deadline.

Online filing

As of my last update, the IRS offered limited online filing options for tax exempt bond forms. However, this might have changed since then. It's best to check the IRS website for any updates on online filing options for Form 8038-TC.

E-filing

As of my last update, the IRS had introduced the Tax Exempt Bond Electronic Submissions (TEBES) system to allow electronic filing of certain tax exempt bond forms, including Form 8038-TC. To use this option, you need to request an account with the TEBES system on the IRS website. Once you have an account, you can submit the form electronically through the TEBES platform.

Again, it's essential to verify the current filing methods with the IRS since e-filing options and procedures may have changed since my last update. Additionally, the IRS may have introduced new online platforms or updated the process for filing Form 8038-TC.

Common Mistakes To Avoid When Filing Form 8038-TC

It is essential to file Form 8038-TC correctly, to avoid mistakes that could result in delays or penalties. Here are some common mistakes to avoid when filing Form 8038-TC:

Incorrect or incomplete information: Ensure that all required fields on the form are filled out accurately and completely. Double-check names, addresses, bond amounts, and other details to avoid errors.

Missed deadline: File the Form 8038-TC by the due date. Late filings may lead to penalties and interest charges.

Inaccurate calculations: Double-check all calculations related to the tax credit amounts to prevent errors that could lead to discrepancies and potential issues with the IRS.

Failure to attach required documents: Make sure you include all necessary attachments and schedules as specified in the instructions for Form 8038-TC. This may include schedules detailing the computation of the tax credit.

Improper identification of bond issues: If you are filing for multiple bond issues, ensure each one is correctly identified and that the information corresponds to the correct bond issue.

Incorrect credit amounts: Be careful when calculating the allowable tax credits. Mistakes in determining the qualified tax credit amount could result in under- or over-reporting.

Neglecting to sign the form: Sign the Form 8038-TC where required. Failure to sign the form can lead to processing delays or rejection.

**Not keeping a copy: **Always retain a copy of the filed Form 8038-TC and all related documentation for your records. This is essential for future reference and potential audits.

Reliance on outdated information: Make sure to use the most recent version of Form 8038-TC and review the latest instructions provided by the IRS to ensure compliance.

Ignoring professional advice: If you are unsure about any aspect of filing Form 8038-TC or the tax implications of tax credit bonds, seek advice from a tax professional or financial advisor to avoid costly mistakes.

Conclusion

Form 8038-TC plays a crucial role in facilitating transparency and accountability in the issuance and use of tax credit bonds. By providing essential information about the tax credit bond issue, the IRS can ensure compliance with regulations and track the distribution of federal tax credits. This process contributes to the promotion of public policy objectives, such as investments in renewable energy, education, and infrastructure, while also incentivizing investors to participate in projects that benefit society as a whole.

As tax laws and regulations can be complex and subject to change, issuers of tax credit bonds are advised to seek guidance from financial and legal professionals to ensure proper compliance with all reporting requirements. Properly managed and executed tax credit bond programs can prove to be valuable tools in advancing public initiatives and fostering economic growth while providing tax-efficient returns for investors.