- IRS forms

- Form 8038

Form 8038: Information Return for Tax-Exempt Private Activity Bond Issues

Download Form 8038When it comes to financing various public projects such as infrastructure development, affordable housing, and nonprofit facilities, governments and organizations often turn to issuing bonds. Bonds are debt instruments that allow governments and other entities to raise funds from investors, promising to pay back the principal amount with interest over time.

Before delving into the details of Form 8038, let's first understand what tax exempt private activity bonds are. Private activity bonds are bonds issued by state and local governments or their instrumentalities to provide funding for projects initiated by private businesses or organizations. These projects must serve a significant public benefit, such as affordable housing, healthcare facilities, educational institutions, airports, and certain types of manufacturing facilities, among others.

Purpose of Form 8038

The purpose of Form 8038 is to provide the Internal Revenue Service (IRS) with essential details about these tax exempt bonds, including their issuance, use of proceeds, and compliance with federal tax regulations.

Here are the main uses and purposes of Form 8038:

Disclosure of bond issuance: When state or local governments issue tax exempt municipal bonds, they are required to report the issuance to the IRS using Form 8038. This provides the IRS with information about the bonds' creation, such as the issuer's name, address, and other identifying details.

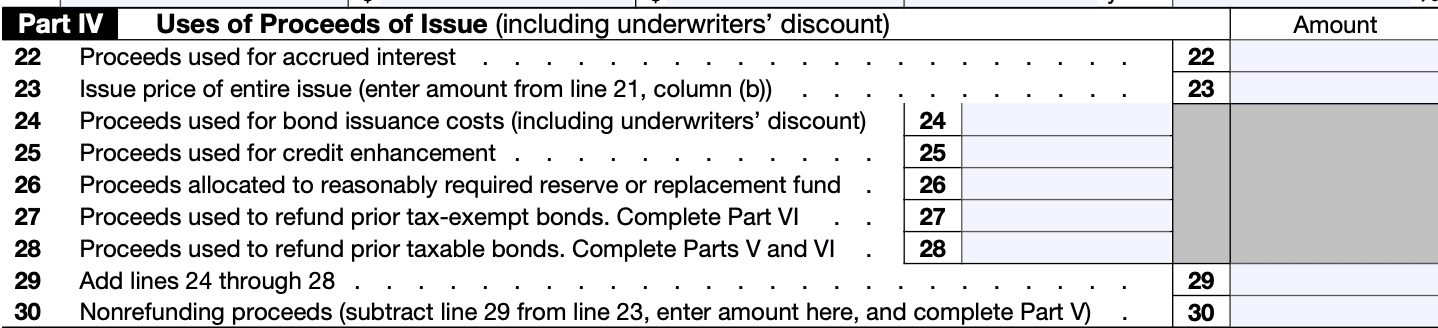

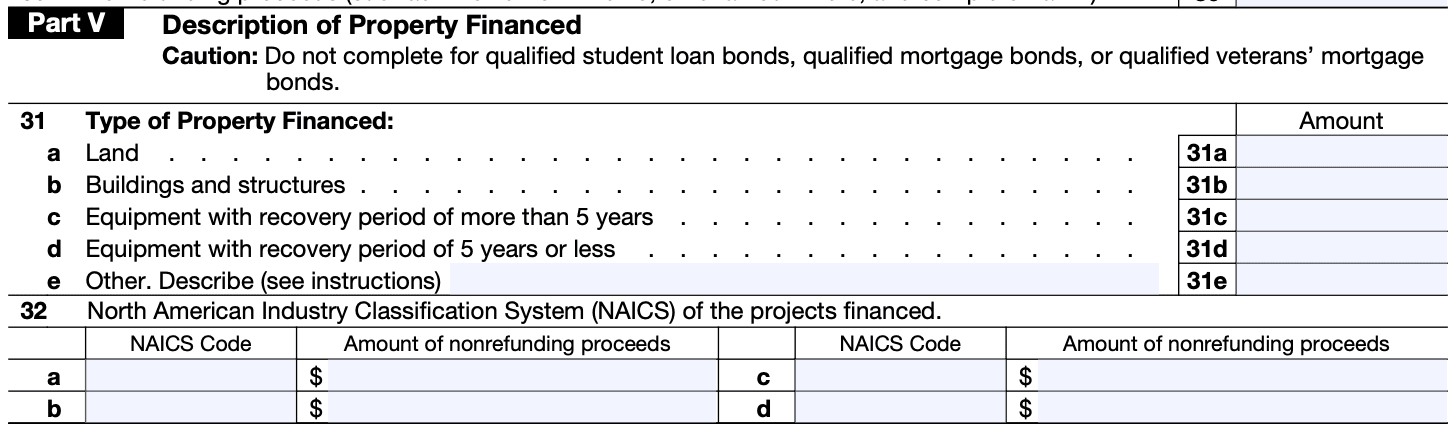

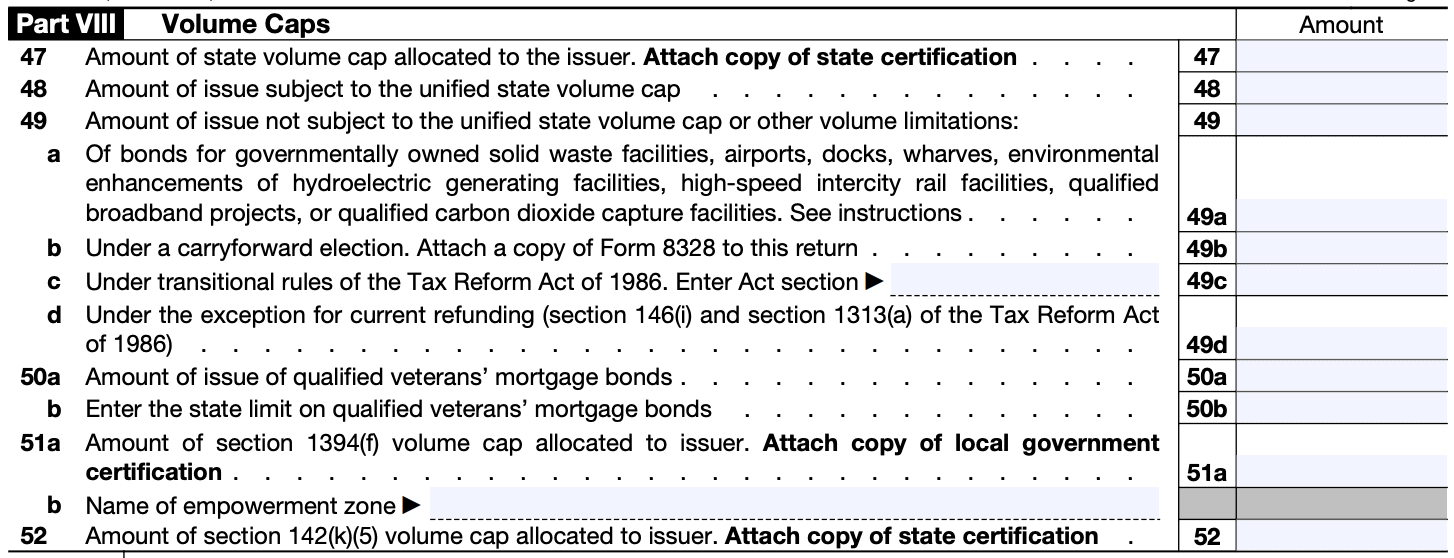

Use of proceeds: The form also requires information about how the proceeds from the bond issuance will be used. This helps ensure that tax exempt bonds are being used for qualified purposes, such as financing public infrastructure projects or capital improvements.

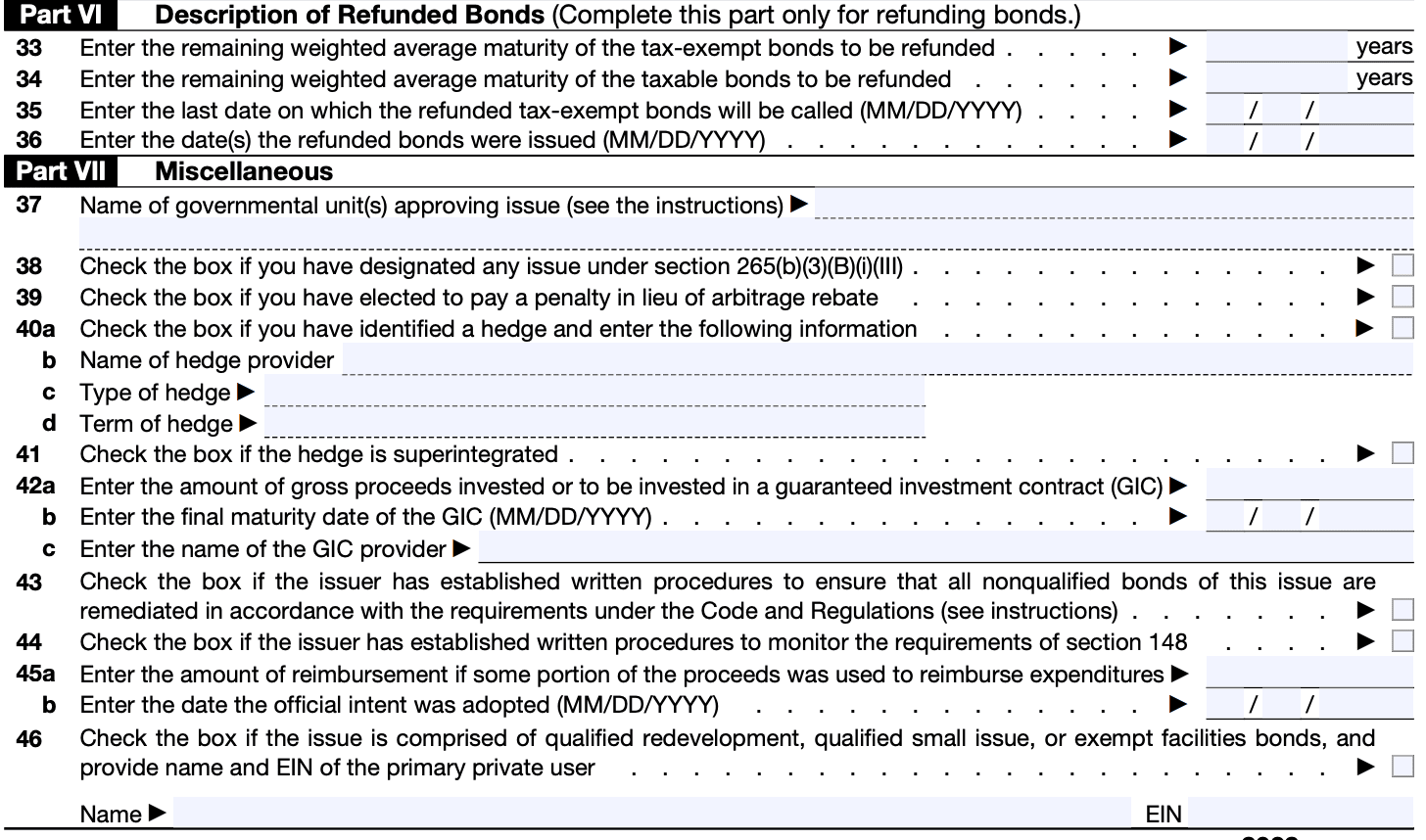

Compliance with tax regulations: Form 8038 serves as a means for the issuer to certify that they are complying with the applicable federal tax laws and regulations related to tax exempt municipal bonds. It helps the IRS monitor compliance and identify any potential issues or discrepancies.

**Arbitrage and rebate calculations: **Additionally, the form is used for reporting any arbitrage profits earned on the invested bond proceeds and whether the issuer needs to make any rebate payments to the federal government as required under the tax rules.

Benefits of Form 8038

Form 8038 is used to report information related to the issuance of these tax exempt bonds to the Internal Revenue Service (IRS). The benefits of filing Form 8038 include:

- Tax compliance: Form 8038 ensures that tax exempt organizations comply with the IRS reporting requirements. By providing essential information about the bonds issued, the IRS can monitor and track the usage of tax exempt bonds.

- Transparency: The form promotes transparency in the issuance of tax exempt bonds. It requires organizations to disclose details about the bond issuance, such as the purpose of the bonds, the amount issued, and the terms of the bonds.

- Record keeping: Filing Form 8038 helps the organization maintain a record of its bond issuance. This record can be useful for internal purposes, such as tracking financial transactions and obligations related to the issued bonds.

- Avoiding penalties: Failure to file Form 8038 or filing it inaccurately and late can result in penalties imposed by the IRS. By properly completing and filing the form, tax exempt organizations can avoid potential penalties.

- Compliance with federal tax law: Tax exempt organizations must adhere to various federal tax laws and regulations. Filing Form 8038 is part of fulfilling these obligations, helping the organization maintain its tax exempt status and avoiding potential legal issues.

- Smooth audit process: Having accurate and complete information on Form 8038 can streamline the audit process if the IRS decides to review the tax exempt organization's activities related to bond issuances.

Who Is Eligible To File Form 8038?

Here are some of the entities that may be eligible to file Form 8038:

State and local governments: This includes cities, counties, states, and other political subdivisions that issue tax exempt private activity bonds to finance projects that benefit the public, such as infrastructure development, affordable housing, and economic development initiatives.

Qualified 501(c)(3) organizations: Certain tax exempt organizations under section 501(c)(3) of the Internal Revenue Code that are involved in private activity bond financings may also need to file Form 8038.

Other qualified entities: There are other specific types of tax exempt organizations that may be eligible to issue tax exempt private activity bonds and, consequently, required to file Form 8038. This may include certain private colleges and universities, hospitals, and other qualified organizations engaged in specific types of projects.

How To complete Form 8038: A Step-by-Step Guide

Please note that tax forms and requirements may change over time, so it's essential to verify the latest version and instructions for Form 8038 from the IRS website or consult a tax professional for the most up-to-date information.

Here's a general step-by-step guide to completing Form 8038:

Step 1: Gather necessary information

Before you start filling out Form 8038, ensure you have all the required information on hand. This may include details about the issuer, bond issue, bondholders, and the purpose of the bond issuance.

Step 2: Download Form 8038 and instructions

Visit the IRS website (www.irs.gov) and search for "Form 8038" to locate the latest version of the form and its accompanying instructions. Download both the form and the instructions to understand how to complete it correctly.

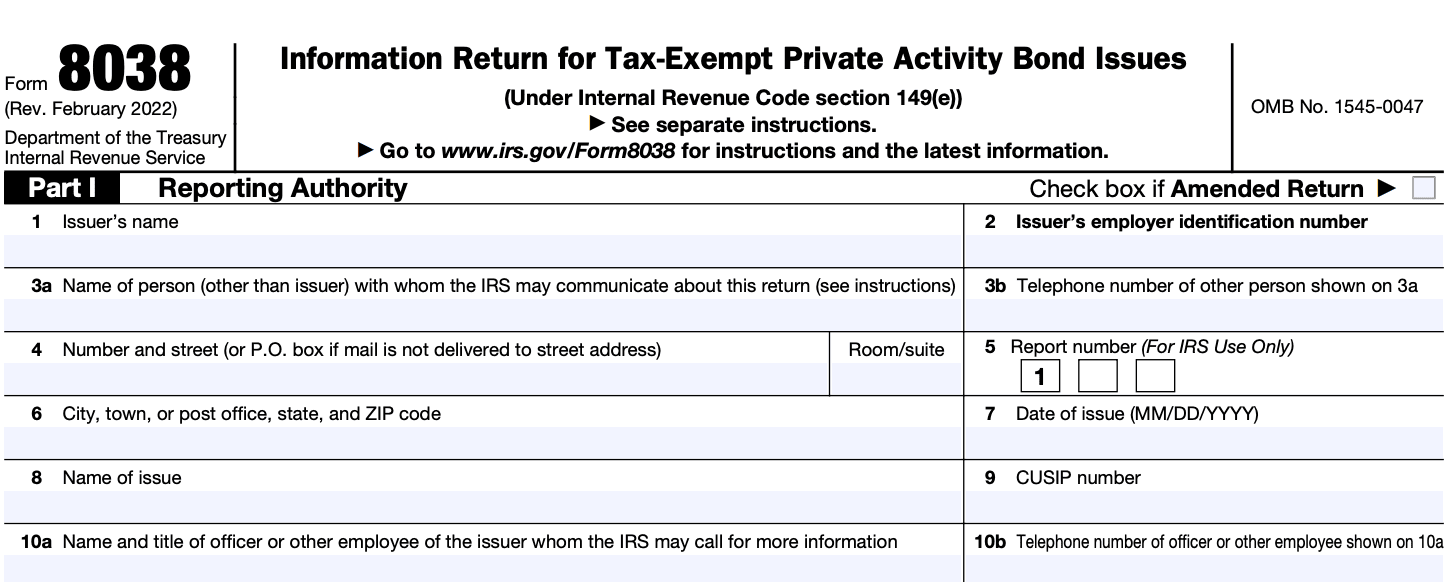

Step 3: Complete Part I - Identification of issuer

In Part I, you'll provide information about the issuer of the bonds, such as name, address, Employer Identification Number (EIN), type of issuer, and the date the issuer was created or organized.

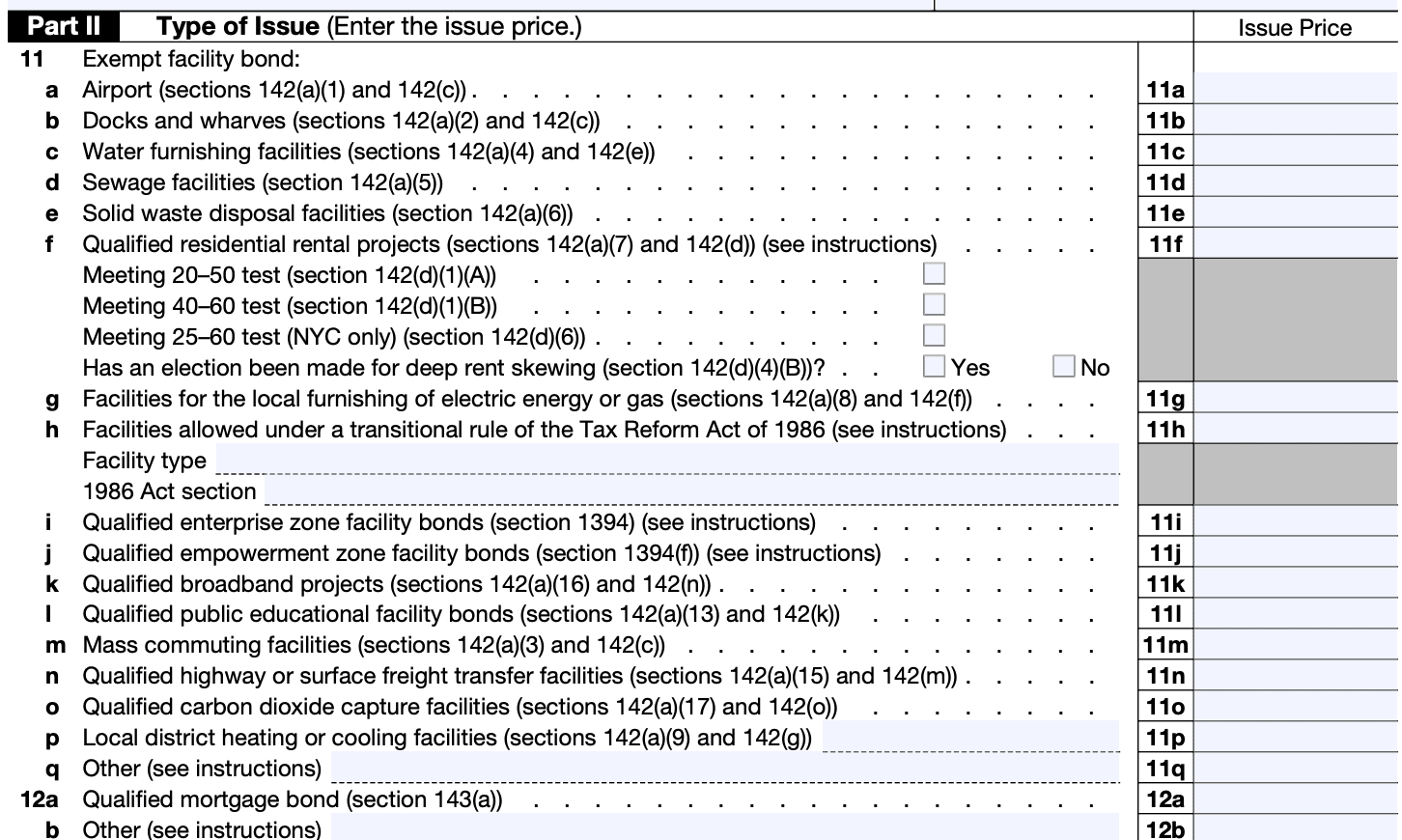

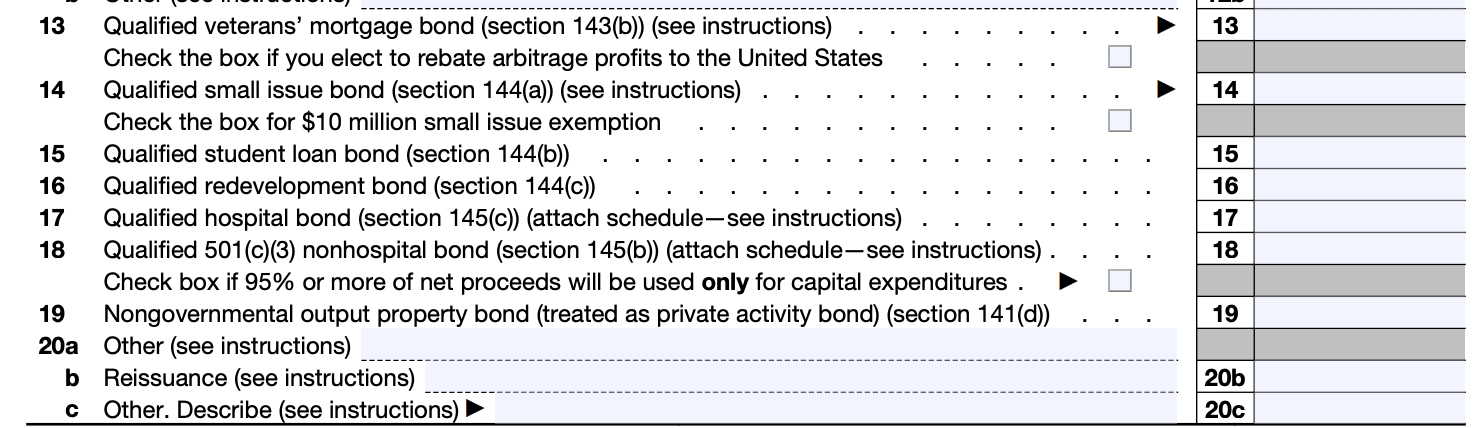

Step 4: Complete Part II - Background information on the Issue

Part II will require details about the bond issue, including the issue date, the type of issue, the total par amount, the type of project financed by the bonds, and whether the bonds were issued to advance refund of a prior issue.

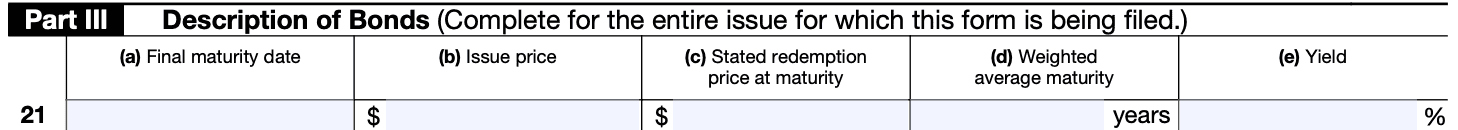

Step 5: Complete Part III - Issue price and arbitrage

Part III focuses on the issue price and arbitrage. You'll need to provide information about the issue price of the bonds and whether they were used to finance construction projects.

Step 6: Complete Part IV - Private business use

In Part IV, you'll determine the private business use of the bond proceeds. This section is crucial in determining the tax exempt status of the bond issue.

Step 7: Complete Part V - Issue price limit election (if applicable)

If the bonds are subject to the Issue Price Limit provisions, you'll need to complete Part V and make the necessary elections.

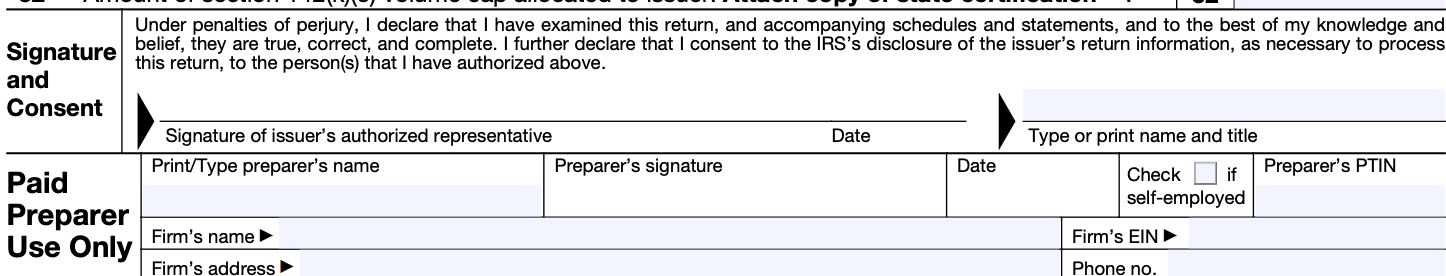

Step 8: Complete Part VI - Certifications and signature

The issuer or an authorized representative must sign and date the form to certify that the information provided is true, correct, and complete.

Step 9: Review and submit the form

After completing the form, carefully review all the information to ensure accuracy and completeness. Attach any required schedules or supporting documents, as specified in the instructions. Mail the completed Form 8038 to the address provided in the instructions.

Step 10: Retain a copy for your records

Make a copy of the completed Form 8038 and all supporting documents for your records. Keep them safe and easily accessible for future reference or potential audits.

Special Considerations When Filing Form 8038

If you are planning to file Form 8038, there are several special considerations you should be aware of:

Accurate and timely filing: Ensure that all the information provided on the form is accurate and complete. File the form by the due date to avoid any penalties or late fees.

Tax exempt bond requirements: Form 8038 is used to report various types of tax exempt bonds, such as governmental bonds, private activity bonds, and qualified 501(c)(3) bonds. Make sure you correctly identify the type of bonds being reported.

Form 8038-G: Form 8038-G should be filed by issuers of tax exempt governmental bonds to report specific information, including bond issuance details and compliance with applicable tax requirements.

Form 8038-B: Issuers of tax exempt private activity bonds are required to file Form 8038-B to provide information about the bond issuance and ensure compliance with tax laws.

Record-keeping: Maintain proper records of the bond issuance and any related documents. This is essential for ensuring accurate reporting and for providing supporting documentation in case of an audit.

Compliance with tax regulations: It's crucial to ensure that the bond issuance complies with all relevant tax regulations, including restrictions on the use of bond proceeds and the arbitrage rules.

**Reporting changes: **If there are any material changes to the bond issue, such as changes in use, ownership, or purpose, these changes may need to be reported to the IRS. You may have to file an amended Form 8038 if necessary.

Professional assistance: Tax exempt bond filings can be complex, and it is recommended to seek professional advice from tax experts or legal counsel familiar with municipal bonds and tax exempt financing.

Filing Deadlines & Extensions on Form 8038

Here are some key points regarding filing deadlines and extensions for Form 8038:

Filing deadline: The regular due date for filing Form 8038 is six months after the end of the issuer's fiscal year in which the bonds were issued. For example, if the fiscal year ends on December 31, the form is typically due by June 30 of the following year.

Extensions: If you need more time to file Form 8038, you can request an extension by filing IRS Form 8868, "Application for Automatic Extension of Time to File an Exempt Organization Return." This form grants an automatic six-month extension for Form 8038, extending the due date to a maximum of 12 months from the original due date.

Keep in mind that penalties may apply for late filing or failing to file the form correctly.

Common Mistakes To Avoid When Filing Form 8038

When Form 8038 it's essential to avoid common mistakes that could lead to errors or delays.

Here are some common mistakes to avoid when filing Form 8038:

Incorrect or incomplete information: Double-check all the information provided on the form, including the bond issuer's name, address, and taxpayer identification number (TIN). Make sure all required fields are completed accurately.

Filing the wrong form: Ensure that you are using the correct version of Form 8038 for the year in which the bonds were issued. Using outdated forms can lead to errors in the filing process.

Missing deadlines: Missing the filing deadline can result in penalties and interest charges. Be aware of the due date for filing Form 8038, which is generally the 15th day of the 2nd month after the bond issue date.

Incorrect bond classification: It's essential to correctly classify the type of bonds being reported on the form. Different types of bonds have different reporting requirements, so ensure you select the appropriate category.

Omitting necessary schedules or attachments: Depending on the type of bond issued, there may be additional schedules and attachments required. Make sure to include all the necessary supporting documentation with your Form 8038 submission.

Inaccurate bond amounts: Double-check the reported bond amount to ensure it matches the actual amount issued. Any discrepancies can cause issues with the IRS.

Neglecting to report amendments or reissuances: If there have been any amendments or reissuances of the bonds, ensure that you report these changes correctly and provide all the necessary details.

Not filing electronically (if Required): Some issuers may be required to file Form 8038 electronically. Check the IRS guidelines to see if electronic filing is mandatory for your situation.

**Forgetting to sign the form: **Make sure the form is signed by an authorized person. An unsigned form may be considered invalid, and you may need to resubmit it.

**Failing to keep copies for your records: **Always keep copies of the filed Form 8038 and all supporting documents for your records. These documents may be required for future reference or audits.

Conclusion

Form 8038 plays a crucial role in ensuring transparency and compliance in the issuance of tax exempt private activity bonds. By gathering comprehensive information about the bond issue and the financed project, the IRS can ascertain that these bonds are being used for the intended public benefit purposes.

For issuers, it is essential to be aware of their obligations regarding Form 8038 filing to avoid potential penalties and maintain the tax exempt status of their bond issues. As with any tax-related matter, seeking professional advice and guidance is advisable to navigate the complexities of tax exempt bond issuance successfully.