- IRS forms

- Form 8328

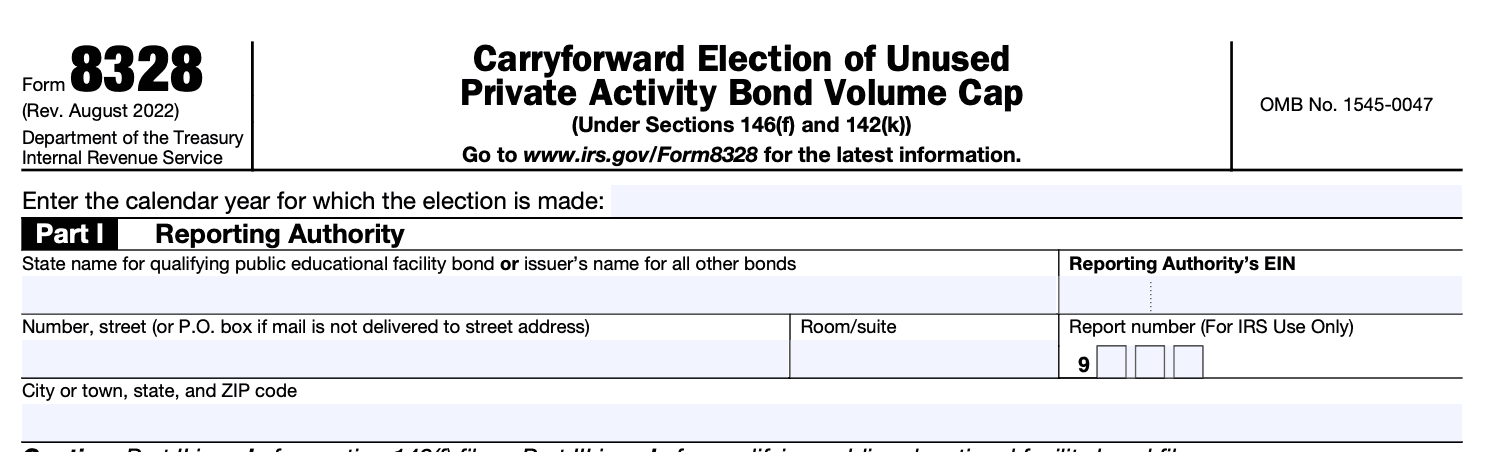

Form 8328: Carryforward Election of Unused Private Activity Bond Volume Cap

Download Form 8328When it comes to financing projects that promote public welfare, governments often issue private activity bonds (PABs). These bonds allow private entities to raise funds for qualifying projects with tax-exempt interest. However, there is a limited volume cap on the issuance of PABs to prevent abuse and ensure a fair distribution of resources. To make the most of this limited resource, the Carryforward Election of Unused Private Activity Bond Volume Cap, or Form 8328, comes into play.

In this blog, we will explore what Form 8328 entails and its significance in the realm of municipal finance.

Understanding Form 8328

Before diving into Form 8328, let's briefly discuss Private Activity Bonds (PABs). These are tax-exempt bonds issued by state and local governments or agencies to finance projects with a significant public benefit. Examples of qualifying projects include affordable housing, infrastructure development, student loans, and certain types of manufacturing facilities. By offering tax-exempt interest, PABs attract private investors who are willing to fund these projects at lower interest rates.

To prevent PABs from being used solely for private gain or non-essential projects, the Internal Revenue Code (IRC) imposes a volume cap on the issuance of these bonds. The volume cap limits the total amount of PABs that can be issued in a specific geographic area, typically on a state or local level, during a calendar year. The cap is usually calculated as a percentage of the state's population multiplied by an inflation adjustment factor, subject to a minimum amount.

Purpose of Form 8328

IRS Form 8328 is used for the "Carryforward Election of Unused Private Activity Bond Volume Cap." Private activity bonds are tax-exempt bonds issued by state or local governments to finance projects with a private business use, such as airports, hospitals, and certain types of housing.

Each state receives an annual allocation of private activity bond volume cap, which limits the total amount of tax-exempt private activity bonds that can be issued within the state for the year. If a state does not use its full allocation of volume cap in a given year, it has the option to carry forward the unused volume cap to future years.

Form 8328 is used by the state or local government to make a formal election to carry forward the unused private activity bond volume cap to future years. This form helps the IRS and other stakeholders keep track of the available volume cap for each state and ensures that the allocation is appropriately managed.

Benefits of Form 8328

Here are some potential benefits of filing Form 8328:

-

Carryforward of unused volume cap: Private activity bonds are subject to volume cap limitations set by the federal government. If a state or local government entity has an unused portion of its allocated volume cap for private activity bonds, they can carry forward that unused volume cap to future years. Form 8328 is used to make this carryforward election.

-

Maximizing bond issuance: By carrying forward the unused volume cap to subsequent years, state and local governments can potentially issue more private activity bonds in the future. This allows them to finance additional projects that benefit the public, such as affordable housing, infrastructure development, and other projects that promote community development.

**3. Flexibility in project financing: **The carryforward provision provided by Form 8328 offers flexibility to state and local governments in planning their infrastructure and development projects. It allows them to adjust the timing of bond issuances based on project needs and market conditions.

- Encouragement of public-private partnerships: Private activity bonds are often used to facilitate public-private partnerships where private entities invest in public projects. By allowing the carryforward of unused volume cap, Form 8328 may encourage more private investment in essential infrastructure and community development initiatives.

Who Is Eligible To File Form 8328?

In general, the issuer of the private activity bonds must file Form 8328 with the Internal Revenue Service (IRS) if they meet the following criteria:

- They are issuing tax-exempt private activity bonds that are subject to volume cap limitations.

- They did not use up their entire volume cap allocation for the current year.

- They want to carry forward the unused volume cap to be used in a future year.

- The form must be filed for each bond issuance that meets the criteria given above.

Please note that tax laws and regulations can change over time, so it's essential to verify the current requirements and consult with a tax professional or the IRS for the most up-to-date information before filing any forms related to private activity bonds.

How To complete Form 8328: A Step-by-Step Guide

Step 1: Obtain the form

You can find Form 8328 on the official IRS website (irs.gov) or by contacting the IRS directly.

Step 2: Read the instructions

Before you start filling out the form, carefully read the instructions provided by the IRS. This will help you understand the purpose of the form and the information you need to provide.

Step 3: Gather information

Collect all the necessary information, including details about the private activity bonds, the volume cap, and any carryforwards from previous years.

Step 4: Identify the tax year

Determine the tax year for which you are making the carryforward election.

Step 5: Complete Part I

Provide your identification information, such as name, address, and (link: https://fincent.com/blog/how-to-find-your-business-tax-id-number text: taxpayer identification number (TIN)).

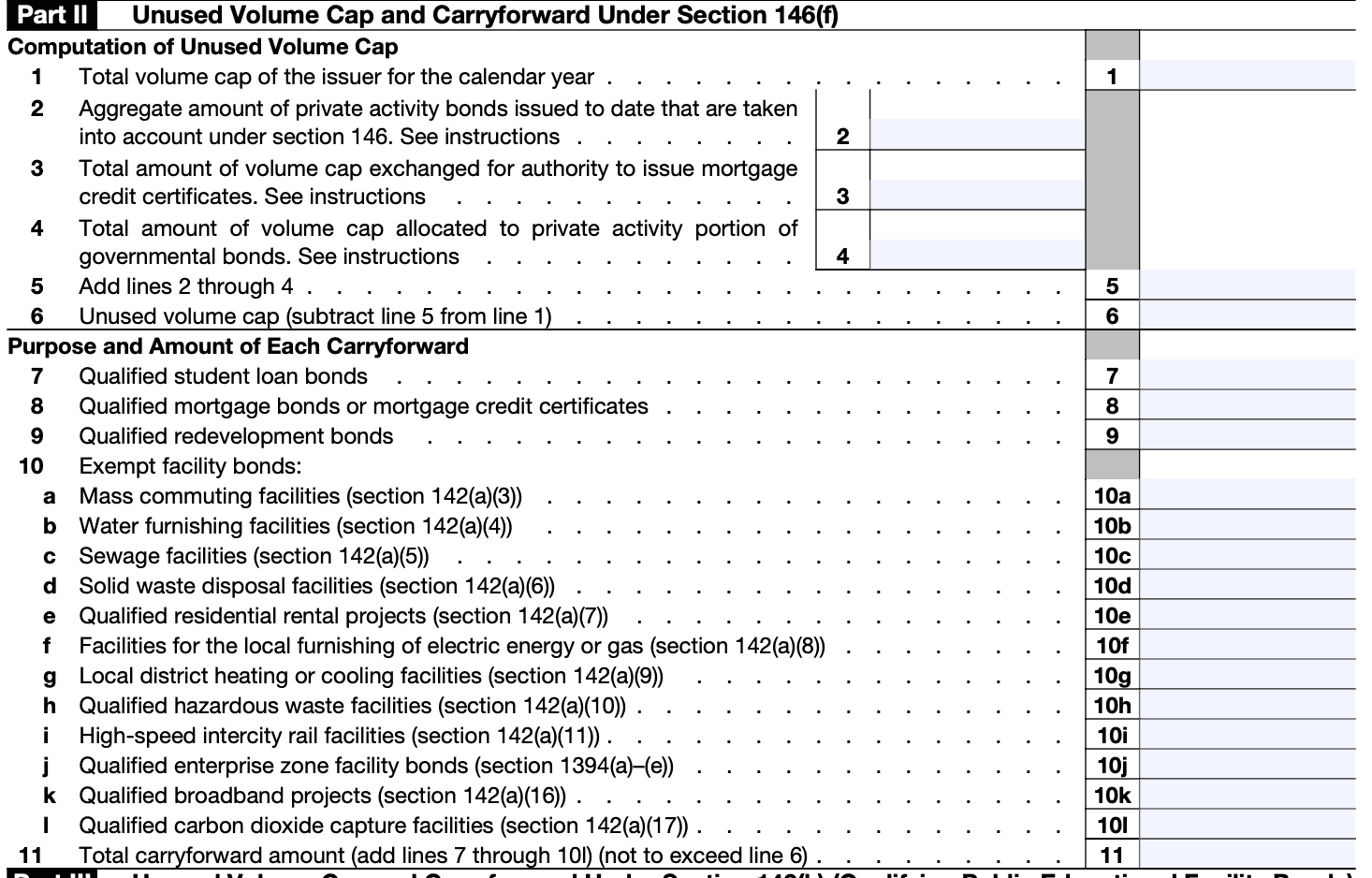

Step 6: Complete Part II

This section is likely to require details about the private activity bonds issued in the current year and the amount of volume cap used. Fill in the appropriate boxes accurately.

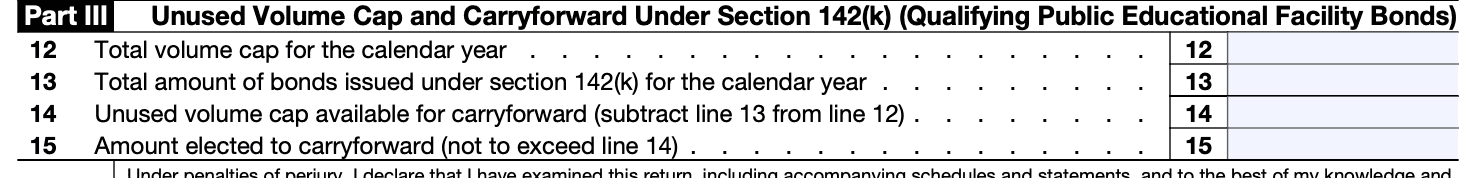

Step 7: Complete Part III

Here, you may need to provide information on any unused volume cap from previous years that you want to carry forward. Include the relevant details as instructed.

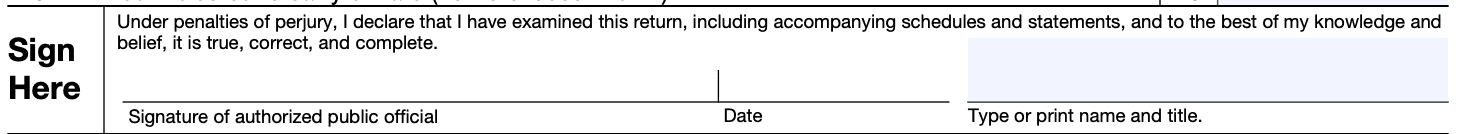

Step 8: Sign and date

Review the form to make sure all the information is accurate and complete. Sign and date the form where required.

Step 9: Submit the form

Send the completed Form 8328 to the address provided in the instructions or file it electronically if applicable.

Step 10: Keep a copy

Make a copy of the completed and signed form for your records.

It's essential to understand that tax forms can be complex, and any mistakes or omissions can lead to delays or issues with your tax return.

Special Considerations While Filing Form 8328

There are some special considerations to keep in mind while filing Form 8328. Here are a few:

Deadline: Form 8328 should be filed by the issuer on or before the due date (including extensions) of the federal income tax return for the year the private activity bond was issued.

Correct form: Ensure that you are using the correct version of Form 8328, as it may be updated or revised by the IRS. Check the official IRS website or with your tax advisor to get the latest version of the form.

Accuracy of information: Double-check all the information provided on the form to ensure accuracy. Errors or inaccuracies could result in delays or rejections of the carryforward election.

**Qualified bonds: **Only certain types of private activity bonds are eligible for the carryforward election. Verify that the bonds for which you are making the carryforward election meet the eligibility criteria.

**Volume cap limitations: **Understand the volume cap limitations for private activity bonds in the applicable state. The IRS sets an annual volume cap on the total amount of tax-exempt private activity bonds that can be issued in each state. The carryforward election allows unused volume cap to be carried forward to future years, subject to certain limitations.

**Record keeping: **Keep a copy of the filed Form 8328 and all related documentation for your records. This will help you in case of any future inquiries or audits.

**Professional advice: **Consider seeking advice from a qualified tax professional or bond counsel to ensure compliance with all relevant regulations and requirements.

State requirements: While Form 8328 is filed with the IRS, keep in mind that each state may have additional requirements or forms related to the allocation and carryforward of volume cap for private activity bonds. Be aware of any state-specific obligations.

How To File Form 8328: Offline/Online/E-filing

Here's a general overview of the filing options that were available at that time:

Offline filing

To file Form 8328 offline, you would typically download the form and instructions from the IRS website or obtain them from an IRS office. Then, you would fill out the form manually with the required information and mail it to the address specified in the instructions. Remember to include any necessary attachments or supporting documentation.

Online filing (IRS website)

At the time of my last update, some IRS forms could be filled out online using their website's web-based tools. To check if Form 8328 can be filed online, visit the IRS website and look for an option to "E-file" or "File Online." Follow the instructions provided on the website to complete the form electronically.

E-filing through authorized E-file providers

The IRS partners with authorized e-file providers who offer electronic filing services for various tax forms. These providers may include tax software companies or professional tax preparers. If Form 8328 is eligible for e-filing through an authorized provider, you can choose this option to file electronically.

Common Mistakes To Avoid When Filing Form 8328

When filing this form, it's essential to avoid certain common mistakes to ensure accuracy and compliance with IRS regulations. Here are some common mistakes to avoid:

**Late filing: **Form 8328 must be filed by the specified due date. Failure to file on time can result in penalties and may cause the issuer to lose the ability to carry forward the unused volume cap.

**Incomplete or incorrect information: **Ensure that all required fields are filled out accurately. Double-check the information provided, such as the issuer's name, taxpayer identification number (TIN), bond details, and the amount of unused volume cap being carried forward.

Incorrect calculation: The amount of unused volume cap being carried forward should be calculated correctly. Errors in this calculation can lead to discrepancies in future years' volume cap allocations.

Mismatched information with previous filings: If you are carrying forward volume cap from previous years, verify that the information on Form 8328 aligns with the data reported in previous filings (e.g., Form 8328 from prior years or Form 8038-G, Information Return for Tax-Exempt Governmental Obligations).

**Failing to attach required documentation: **The instructions for Form 8328 will specify if any supporting documentation needs to be attached. For example, if the carryforward involves a refunding bond, it may require additional documentation to support the calculation.

Incorrect reporting of refunded bonds: If the carryforward involves refunding bonds, make sure to accurately report the refunded bond information, such as the CUSIP number and the original issue date.

**Missing signatures: **Ensure that the form is signed by an authorized official of the issuer. Missing signatures can lead to the form being considered invalid.

Using outdated forms or instructions: Always use the most recent version of Form 8328 and follow the latest IRS instructions. Using outdated forms or instructions may result in errors or delays in processing.

**Failing to retain a copy: **Keep a copy of the filed Form 8328 for your records. This will be helpful for future reference and audits.

Not seeking professional advice when unsure: If you are uncertain about any aspect of the Form 8328 or the carryforward election process, it's best to seek advice from a tax professional or financial advisor experienced in dealing with private activity bonds.

Remember, the IRS treats private activity bonds and their related forms seriously, so accuracy and compliance are crucial to avoid potential penalties and issues with future bond issuances.

Conclusion

Form 8328, the Carryforward Election of Unused Private Activity Bond Volume Cap, is an essential tool in managing tax-exempt private activity bonds.

By allowing state and local governments to carry forward their unused volume cap, this provision ensures that precious resources are not wasted and can be directed towards projects with lasting public impact.

As a result, communities benefit from increased access to affordable housing, improved infrastructure, and other vital initiatives that enhance the quality of life for citizens across the nation.