- IRS forms

- Form 8027

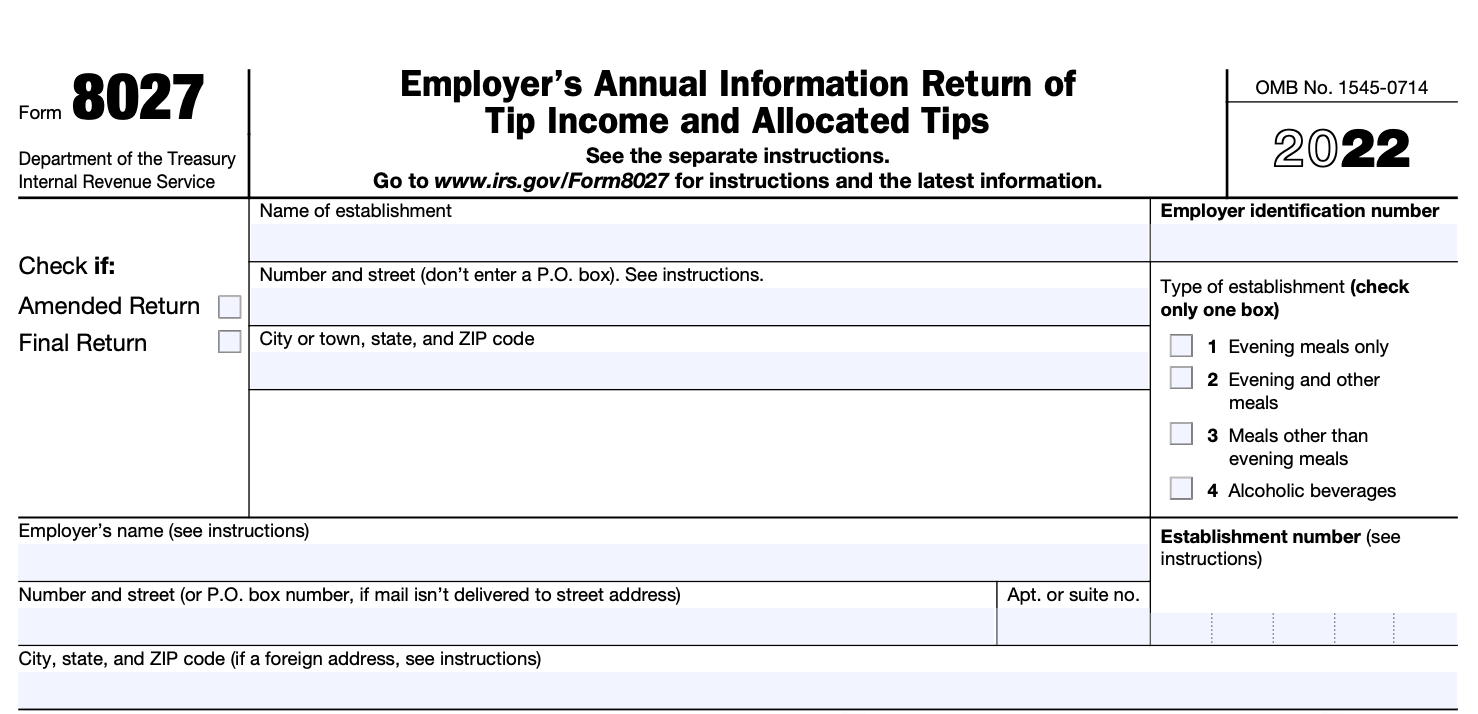

Form 8027: Employer's Annual Information Return of Tip Income and Allocated Tips

Download Form 8027In the United States, the hospitality industry relies heavily on the practice of tipping. Whether you're dining at a restaurant, staying at a hotel, or enjoying a drink at a bar, tipping is a customary way of showing appreciation for good service. However, the Internal Revenue Service (IRS) requires employers in the food and beverage industry to accurately report and account for tip income and allocated tips. This is where Form 8027, also known as the Employer's Annual Information Return of Tip Income and Allocated Tips, comes into play.

Form 8027 is a tax form used by employers in the food and beverage industry to report tip income received by employees. Its primary purpose is to ensure that all tip income is accurately reported, as tips are considered taxable income by the IRS. By filing Form 8027, employers provide the IRS with vital information about the total amount of tips received by their employees, which allows the IRS to monitor compliance with tax obligations.

In this blog, we will delve into the details of Form 8027, its purpose, and how it affects both employers and employees.

Purpose of Form 8027

The purpose of Form 8027 is to report the total amount of tips received by employees and to allocate tips among employees, particularly those in tipped positions.

Here are the key purposes of Form 8027:

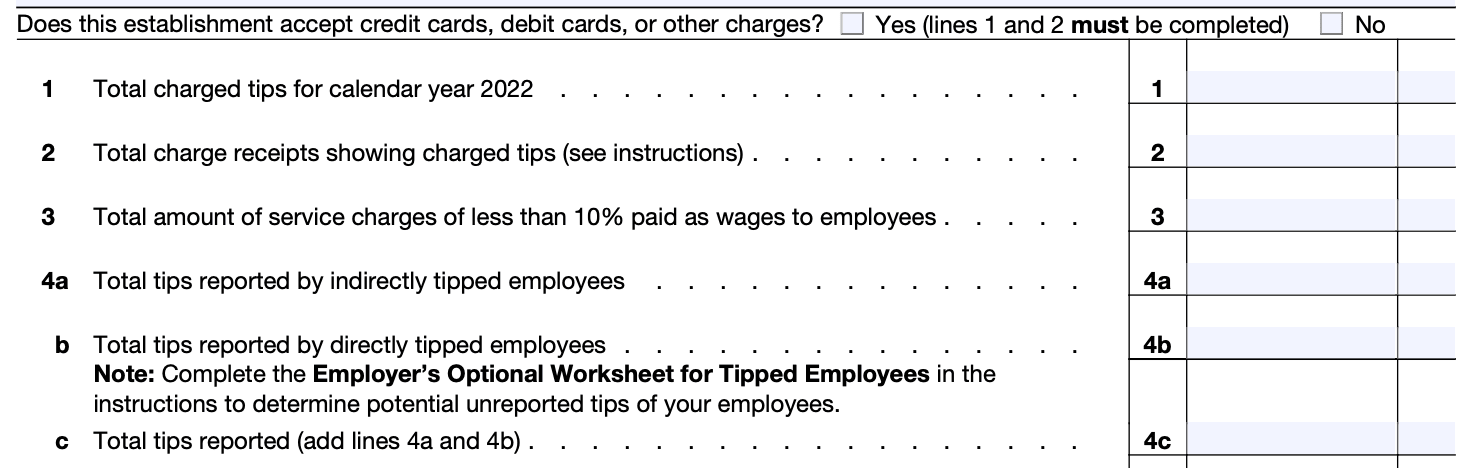

**Reporting tip income: **Employers use Form 8027 to report the total amount of tips received by employees during the calendar year. This includes both cash tips and credit card tips that are received by employees in the course of their work.

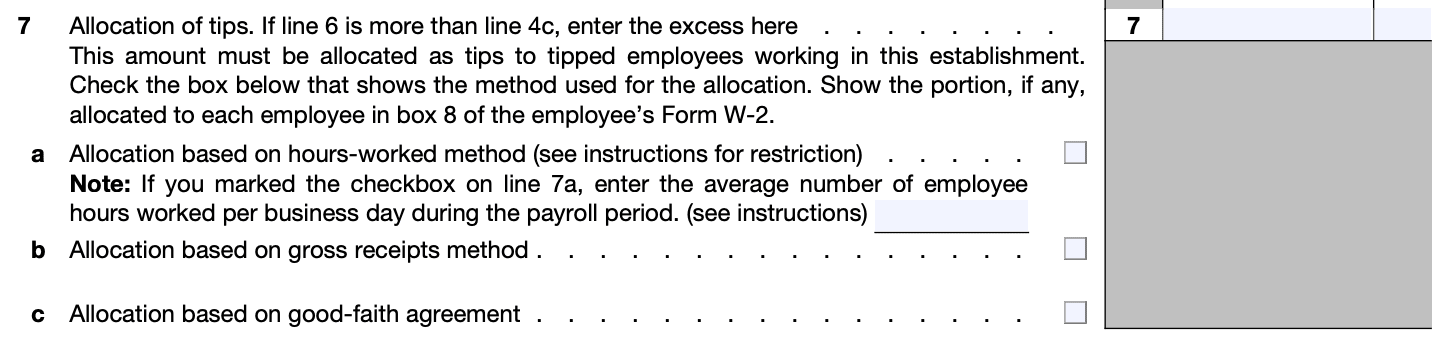

**Determining allocated tips: **If the total reported tips by employees in a large food and beverage establishment fall below a certain threshold, the employer must allocate additional tips to bring the total up to the required level. The allocation of tips is done based on a formula that takes into account factors such as sales, service charges, and other criteria.

Compliance with tax obligations: The information reported on Form 8027 helps the Internal Revenue Service (IRS) ensure that employees report their tip income accurately and pay the appropriate amount of taxes on those tips. It also helps employers meet their reporting obligations and ensures that they are correctly withholding and paying employment taxes related to tip income.

Monitoring and enforcement: Form 8027 provides the IRS with a tool for monitoring compliance and enforcing tip reporting regulations. By comparing the reported tip income with other data, such as sales and payroll records, the IRS can identify discrepancies and potential underreporting or noncompliance issues.

It's important for employers to accurately complete and file Form 8027 by the due date to fulfill their reporting obligations and comply with tax laws related to tip income. Failure to file or report inaccurate information may result in penalties or further scrutiny from the IRS.

Benefits of Form 8027

Form 8027 Offers several benefits, some of which are listed below:

**Compliance with tax regulations: **By filing Form 8027, employers ensure compliance with IRS requirements for reporting tip income and allocated tips. This helps them avoid penalties or audits related to unreported or underreported tip income.

Accurate allocation of tips: Form 8027 requires employers to allocate tips among employees based on specific methods, such as the gross receipts method or the hours worked method. This ensures a fair distribution of tips and helps prevent disputes among employees.

Tracking tip income: Form 8027 helps employers keep track of the tip income received by their employees. This information can be valuable for calculating payroll taxes and determining employee compensation, including wage adjustments, bonuses, or incentives based on tip performance.

**Understanding labor costs: **By reporting tip income on Form 8027, employers gain insights into the overall labor costs associated with their business. This information can be useful for budgeting, financial planning, and analyzing the profitability of the business.

Compliance with reporting obligations: Filing Form 8027 fulfills an employer's obligation to report tip income to the IRS. By meeting this requirement, employers demonstrate transparency and accountability, which can enhance their reputation and establish good relationships with tax authorities.

**Availability of tax credits: **Some employers may be eligible for tax credits related to tip income, such as the FICA Tip Credit. Filing Form 8027 accurately and on time is a prerequisite for claiming such credits, which can help reduce the employer's tax liability.

It's important to note that while Form 8027 carries benefits, it also imposes responsibilities on employers to accurately report tip income and comply with tax regulations.

Who Is Eligible To File Form 8027?

Eligible employers who are required to file Form 8027 include those who meet the following criteria:

Food or beverage establishment: The employer must operate a business where food or beverages are provided for consumption, such as restaurants, bars, lounges, or similar establishments.

Tipping is customary: The establishment must have tipping as a customary practice. This means that it is common for customers to leave tips for employees, and the employees regularly receive tips as part of their income.

Large establishment: The employer must meet the criteria for a large food or beverage establishment. As of my knowledge cutoff in September 2021, an establishment is considered large if it had more than 10 employees who worked for the employer for more than 80 hours in a typical workweek during the preceding calendar year.

How To Complete Form 8027: A Step-by-Step Guide

Here is a step-by-step guide on how to complete Form 8027:

Step 1: Obtain the necessary forms

Visit the Internal Revenue Service (IRS) website https www.irs.gov or contact the IRS to obtain a copy of Form 8027 and its instructions. You can download the form and instructions from the IRS website or request a printed copy to be mailed to you.

Step 2: Gather information

Collect all the necessary information needed to complete Form 8027. This includes:

- Employer information: Your business name, address, and Employer Identification Number (EIN)

- Employment information: The total number of employees and the total number of tipped employees

- Tip income and allocated tips: The total amount of tips reported by employees, as well as any allocated tips

- Gross receipts: The total amount of gross receipts or sales from food and beverages for the year

Step 3: Complete Part I

In Part I of Form 8027, you will provide general information about your business. This includes your business name, address, and EIN. You will also need to indicate the tax year you are filing for.

Step 4: Complete Part II

In Part II, you will provide details about the number of employees and tipped employees. You need to enter the total number of employees who received $20 or more in tips during the month, as well as the total number of employees who received less than $20 in tips during the month.

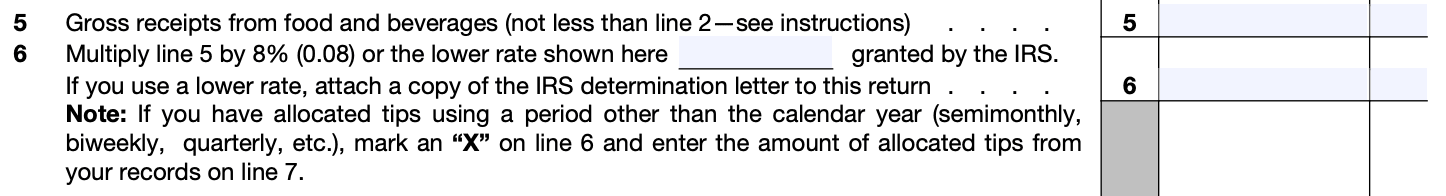

Step 5: Calculate gross receipts

Determine the total amount of gross receipts or sales from food and beverages for the year. This includes all revenue generated from these sources, excluding sales taxes and any tips received by the employer.

Step 6: Calculate tip income and allocated tips

Calculate the total amount of tips reported by employees and any allocated tips. Tip income is the total amount of tips reported by employees, while allocated tips are the tips that you allocate to employees based on a written formula. If you didn't allocate tips, the allocated tips amount will be zero.

Step 7: Complete Part III

In Part III, you will report the tip income and allocated tips amounts calculated in the previous step. You will also need to indicate if you are treating any of the tips as "large food or beverage establishments" tips.

Step 8: Calculate the tip rate

Calculate the tip rate by dividing the total tip income by the total gross receipts. This will give you the percentage of tip income in relation to your sales.

Step 9: Complete Part IV

In Part IV, you will provide information about any agreements you have with employees regarding tips or service charges.

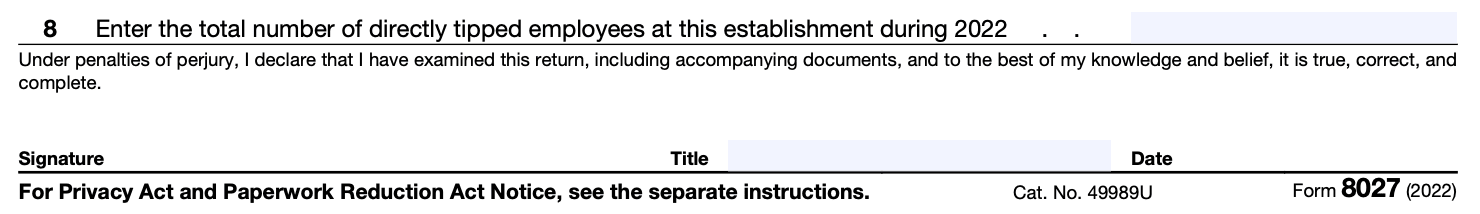

Step 10: Sign and submit the form

Review the completed Form 8027 for accuracy. Sign and date the form, and include your title if applicable. Keep a copy of the form for your records. Submit the original Form 8027 to the IRS by the due date specified in the instructions.

It's important to note that this guide provides a general overview of how to complete Form 8027. The form and its instructions may change, so it's always recommended to refer to the most current version of the form and instructions provided by the IRS.

Special Considerations When Filing Form 8027

Form 8027 is used by large food and beverage establishments to report their employees' tip income and allocate tips among employees.

Here are some important considerations when filing Form 8027:

Eligibility: Form 8027 is specifically for food and beverage establishments where tipping is customary, and either directly or indirectly tipped employees receive more than $20 in tips per month. Examples of such establishments include restaurants, bars, and catering services.

Tipped employees: You must identify all employees who receive tips directly from customers, including waitstaff, bartenders, bellhops, and buspersons. Exclude employees who do not typically receive tips, such as chefs, kitchen staff, and management.

Reporting requirements: If your establishment meets the eligibility criteria, you must file Form 8027 annually, regardless of whether there were any allocated tips. The filing deadline is February 28 (or the next business day if it falls on a weekend or holiday) following the calendar year for which the report is being filed.

Allocated tips: If your establishment has a large discrepancy between the total reported tips and the amount of tips allocated to employees, you may be required to allocate additional tips to your employees. This allocation is based on a formula that considers the reported tips and the gross receipts of your establishment.

Records retention: Keep detailed records of tip income, allocated tips, gross receipts, and other relevant information for at least four years. These records should support the amounts reported on Form 8027 and may be subject to IRS examination.

Signature requirement: The Form 8027 must be signed by an authorized person, typically the owner, corporate officer, or general partner of the establishment.

Common Mistakes To Avoid While Filing Form 8027

When filing Form 8027, it's important to be aware of potential mistakes that could lead to errors or penalties. Here are some common mistakes to avoid when filing Form 8027:

1. Incorrect calculations: Double-check all your calculations to ensure accuracy. Errors in adding or subtracting figures can lead to discrepancies in reported amounts.

2. Missing or incomplete information: Ensure that all required fields on the form are completed accurately. Provide all necessary details, including the establishment's name, address, and EIN (Employer Identification Number).

**3. Failure to report all tipped employees: **Make sure you include information for all tipped employees who worked during the reporting period. Each employee's total tips and wages should be accurately reported.

**4. Incorrect classification of employees: **It's crucial to properly classify employees as either tipped or non-tipped based on their job duties. Misclassifying employees can lead to inaccuracies in reporting.

5. Failing to account for allocated tips: If you have a large food and beverage establishment where the total reported tips are less than 8% of gross receipts, you must allocate tips to employees. Failure to account for allocated tips can result in underreporting.

6. Late or missed filing: Be aware of the deadline for filing Form 8027, which is generally February 28 or March 31, if filing electronically. Failing to file on time or not filing at all can result in penalties.

7. Inadequate record-keeping: Maintain accurate and detailed records of all tip-related information. This includes documenting tip-outs, cash tips, credit card tips, and any other relevant data. Poor record-keeping can lead to inconsistencies in reporting.

8. Ignoring updates and changes: Stay informed about any updates or changes to tax laws or reporting requirements. The IRS may issue new instructions or guidelines that could impact how you complete Form 8027.

9. Relying solely on estimates: Avoid using estimates for reporting purposes. While some estimations may be allowed under certain circumstances, it's best to have accurate and reliable data to support your reported figures.

Filing Deadlines & Extensions for Form 8027

As of September 2021, Form 8027 is used by employers in the food and beverage industry to report tips received by employees. The filing deadlines and extensions for Form 8027 are as follows:

Deadline for filing: Generally, Form 8027 must be filed by the last day of February following the calendar year for which the report is being filed. For example, if you are filing for the year 2022, the deadline would be February 28, 2023. However, if the last day of February falls on a weekend or a legal holiday, the deadline is extended to the next business day.

**Extension of time to file: **If you need additional time to file Form 8027, you can request an extension by filing Form 8809, "Application for Extension of Time to File Information Returns." This form must be filed by the original due date of Form 8027. If approved, it will grant you an additional 30 days to submit your Form 8027.

Conclusion

Form 8027 plays a vital role in ensuring accurate reporting of tip income in the food and beverage industry. By requiring employers to report tip income and allocated tips, the IRS can monitor compliance with tax obligations and ensure the fair treatment of employees.

Employers must understand their obligations and file Form 8027 accurately and on time to avoid penalties and maintain compliance with federal tax regulations. Likewise, employees should be aware of their rights and ensure their tip income is reported correctly to receive the benefits they are entitled to.