- IRS forms

- Form 7205

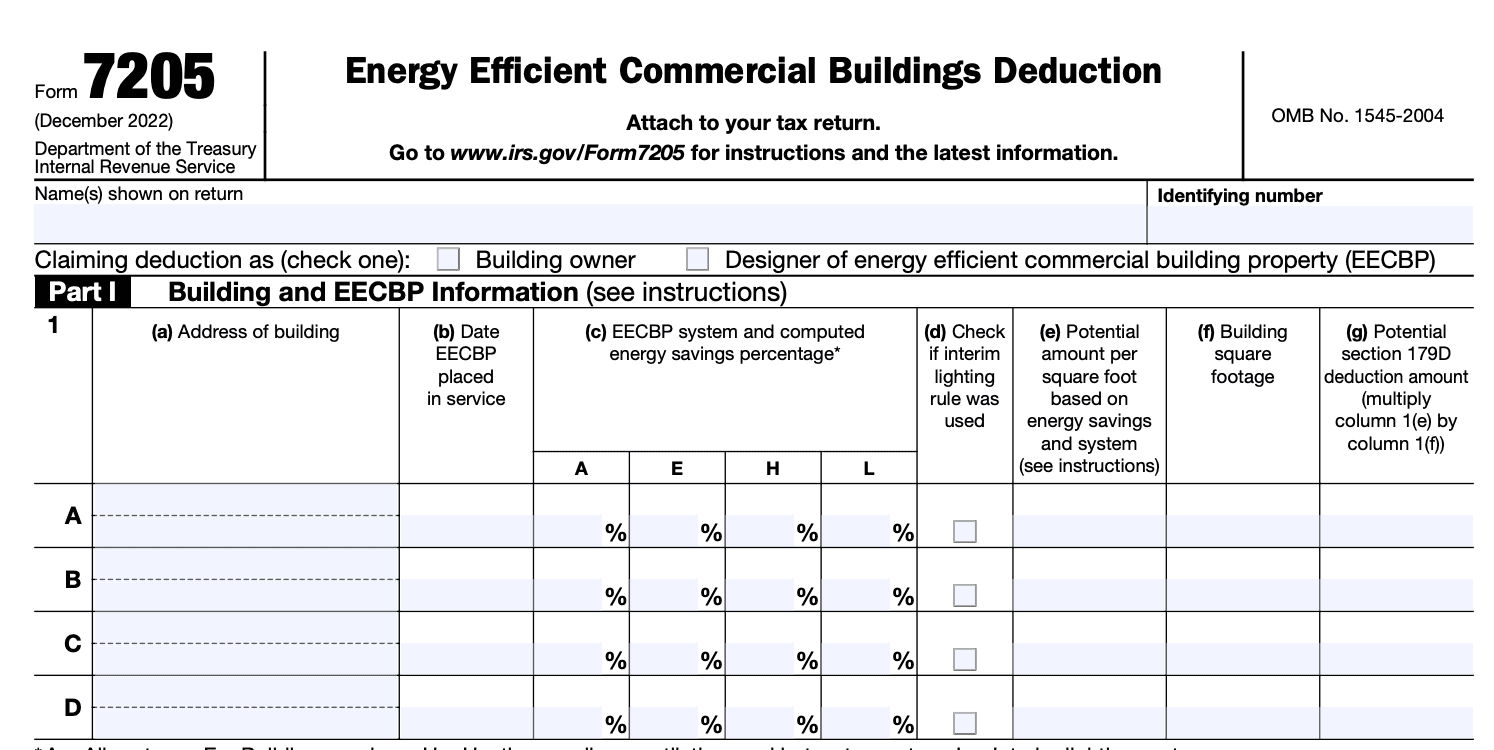

Form 7205: Energy Efficient Commercial Buildings Deduction

Download Form 7205In the pursuit of a greener and more sustainable future, energy efficiency has become a top priority for governments, businesses, and individuals alike. Among the various initiatives to promote energy conservation, the Energy Efficient Commercial Buildings Deduction, also known as Form 7205, stands out as a remarkable incentive for commercial property owners and lessees.

This (link: https://fincent.com/glossary/tax-deduction text: tax deduction) offers significant benefits to those who invest in energy-efficient upgrades for their commercial buildings, leading to reduced operating costs, improved environmental stewardship, and a positive impact on the bottom line.

Purpose of Form 7205

The purpose of Form 7205 is to provide a certification statement for qualifying energy-efficient building property. The deduction is available to building owners or designers who make eligible energy-efficient improvements to commercial buildings. These improvements could include measures to improve the building envelope (such as insulation and windows), HVAC systems, lighting, or other energy-saving upgrades.

To claim the EECB deduction, the building owner or the primary designer (for government-owned buildings) must obtain a certification from a qualified individual or a qualified software program that the building meets the necessary energy efficiency requirements. The qualified individual or software program must use the Department of Energy (DOE)-approved modeling software to assess the energy savings.

Form 7205 is the certification statement that needs to be completed and signed by the qualified individual responsible for the energy efficiency analysis. This form is then attached to the taxpayer's tax return (typically (link: https://fincent.com/blog/what-is-irs-1040-your-complete-guide-this-tax-season text: Form 1040) or Form 1065) to claim the deduction.

Benefits of Form 7205

Form 7205 offers several financial and environmental benefits

- Tax savings: The deduction provides an opportunity for eligible taxpayers to lower their (link: https://fincent.com/blog/what-is-income-tax-liability-and-how-do-you-calculate-it text: tax liability) by deducting the cost of energy-efficient improvements.

- Encouraging green practices: By offering tax incentives, the government encourages businesses to invest in energy-efficient technology, which supports environmental conservation and sustainability efforts.

- Reduced operating costs: Energy-efficient improvements can lead to reduced energy consumption and operating costs for commercial buildings, improving their overall financial efficiency.

- Increased property value: Energy-efficient upgrades can increase the value of commercial properties, potentially attracting tenants and improving market competitiveness.

- Stimulating economic activity: This deduction could encourage investment in energy-efficient technologies, fostering economic growth in related industries.

- Long-term savings: Energy-efficient upgrades often provide long-term cost savings on energy bills, which can continue well beyond the year of the tax deduction.

Who Is Eligible To File Form 7205?

Form 7205 is used to claim the Energy Efficient Commercial Buildings Deduction, also known as the (link: https://fincent.com/blog/guide-to-section-179-deductions text: Section 179D deduction). This deduction is available to eligible taxpayers who own or lease a commercial building and have made energy-efficient improvements to that building.

The eligible parties who can claim this deduction include:

**Building owners: **If you own the commercial building and have paid for the energy-efficient improvements, you can claim the deduction.

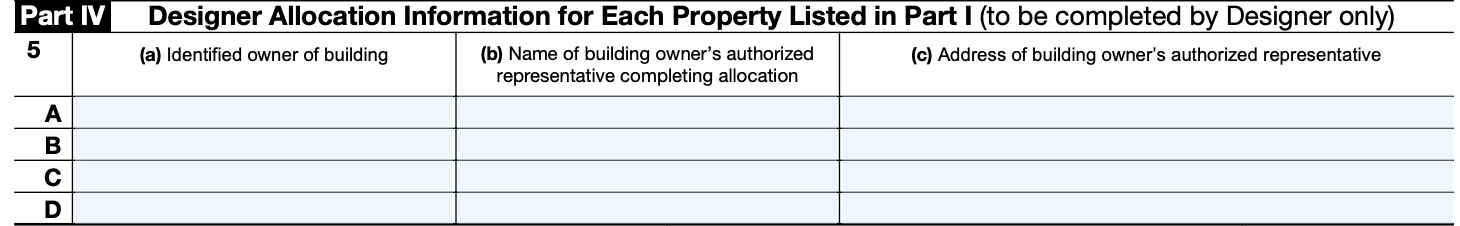

**Designers and contractors: **If you are a qualified designer or contractor and have made energy-efficient improvements to a government-owned building, you may be eligible to claim the deduction. The deduction can be allocated to you by the government building owner.

How To Complete Form 7205: A Step-by-Step Guide

As of September 2021, here's a general guide to completing Form 7205:

Step 1: Obtain the form

Download Form 7205 from the official IRS website or obtain a copy from a tax professional.

Step 2: Gather the required information

Before you start filling out the form, make sure you have all the necessary information at hand. This typically includes:

- Your company's tax identification number ((link: https://fincent.com/irs-tax-forms/form-ss-4 text: EIN) or TIN)

- Details about the energy-efficient commercial building(s) for which you are claiming the deduction (e.g., address, date placed in service, etc.)

- Information related to the energy-saving systems or improvements installed in the building(s)

- The total cost of qualified energy-efficient property installed during the tax year

Step 3: Identify the building and property information

In Part I of Form 7205, provide the required information about the commercial building and the energy-efficient property installed. This may include the building's name, address, date placed in service, and the type of property (e.g., HVAC, lighting, water heating, etc.).

Step 4: Calculate the deduction

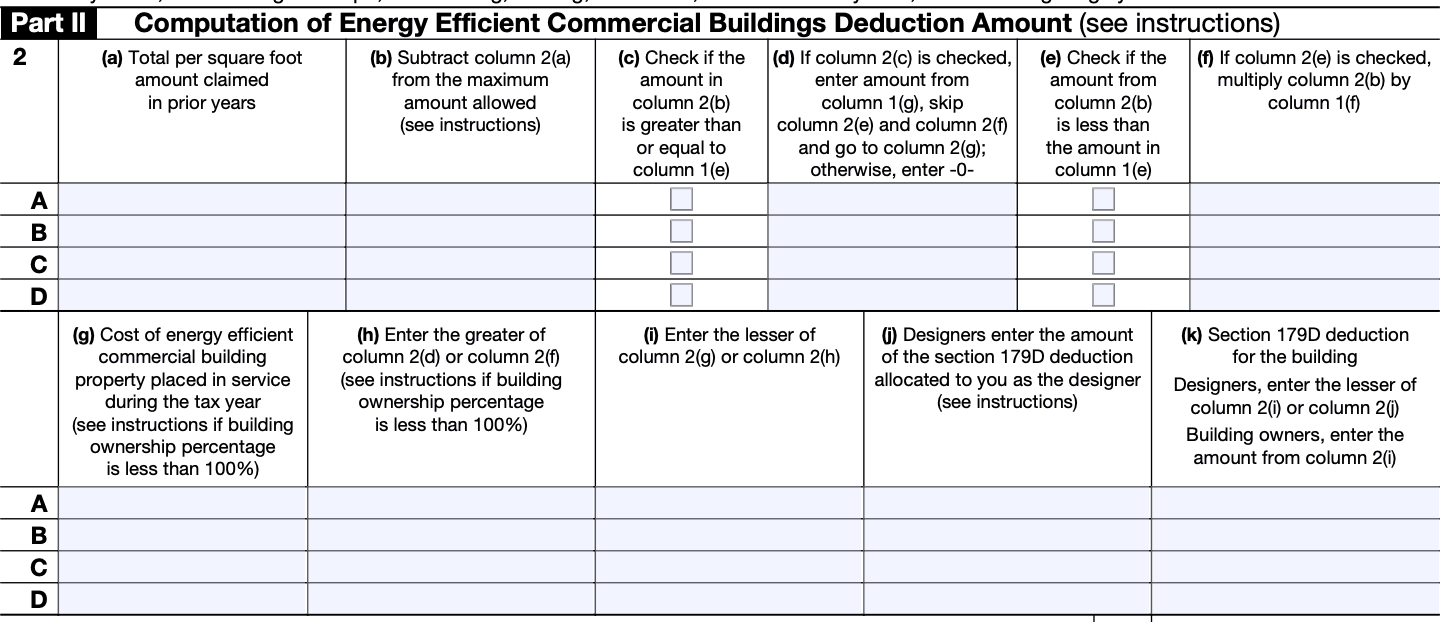

In Part II of Form 7205, you will calculate the energy-efficient commercial buildings deduction. This generally involves multiplying the energy-efficient property's total cost by the appropriate deduction rate for the specific property type.

Step 5: Determine the deduction limitation

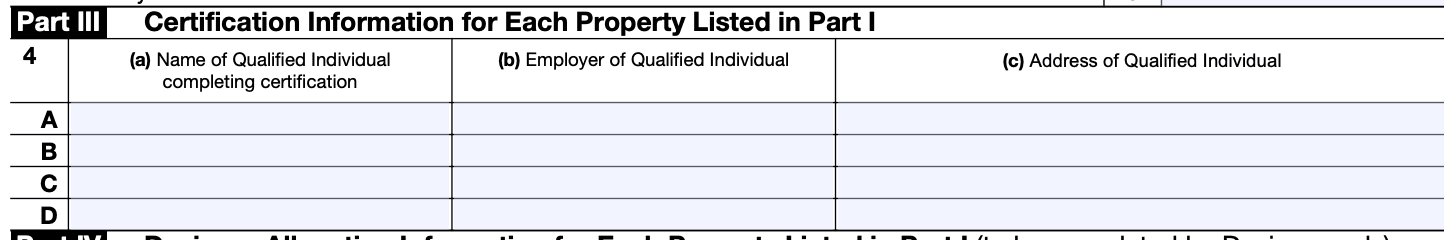

Certain limitations may apply to the deduction you can claim. In Part III of Form 7205, you will need to determine if any of these limitations affect your deduction.

Step 6: Complete the certification

In Part IV of the form, you, as the taxpayer, must certify that the information provided is accurate and that you have met the necessary requirements to claim the energy-efficient commercial buildings deduction.

Step 7: Submit the form

After completing the form, make a copy for your records and submit the original Form 7205 to the IRS along with your tax return. If you file your taxes electronically, follow the instructions provided by your tax software or e-filing service.

Special Considerations When Filing Form 7205

Here are some special considerations to keep in mind when filing Form 7205 for the Energy Efficient Commercial Buildings Deduction:

**Eligibility: **Ensure that your building qualifies for the deduction. To be eligible, the building must have been placed in service after December 31, 2005, and before January 1, 2022. Additionally, the improvements made to the building should meet specific energy efficiency requirements set by the IRS.

Certification: Obtain the required certification from a qualified individual or a licensed professional engineer. The certification must confirm that the energy-efficient improvements meet the necessary criteria as established by the IRS.

Documentation: Maintain thorough documentation of the energy-efficient improvements made to the building. This documentation should include invoices, receipts, contracts, and any other relevant records to support your claim.

Deduction amount: The maximum deduction available is $1.80 per square foot of the building for improvements that meet the highest level of energy efficiency criteria. There are also partial deductions of $0.60 per square foot available for improvements in lighting, HVAC systems, and the building envelope if they meet certain energy efficiency standards.

Allocation: In situations where multiple parties may be eligible to claim the deduction (e.g., a government entity owning the building but leasing it to a private tenant), special rules apply to allocate the deduction appropriately.

**IRS guidance: **It's essential to review the most recent IRS guidance and instructions related to Form 7205 to ensure compliance with the latest requirements.

Amendments: If you failed to claim the deduction in a prior year, you may be able to (link: https://fincent.com/blog/amend-a-tax-return-with-the-irs text: file an amended return) to do so, subject to certain limitations and timeframes.

Carryforward: If the deduction exceeds your tax liability for the current year, you can carry forward the unused portion to future tax years.

Filing Deadlines & Extensions Form 7205

For the tax filing deadline, the deadline to claim the Energy Efficient Commercial Buildings Deduction is typically the same as the regular tax filing deadline for corporations. In the United States, this is usually March 15 for calendar year corporations (C corporations) and April 15 for calendar year partnerships and S corporations.

If you need an extension to file Form 7205, you can generally request a 6-month extension. This means the extended deadline would be September 15 for C corporations and October 15 for partnerships and S corporations. However, be aware that an extension to file does not grant an extension to pay any taxes owed. If there's a tax liability, it should still be paid by the original due date to (link: https://fincent.com/blog/how-to-avoid-tax-penalties-a-simple-guide text: avoid penalties) and interest.

Again, it's crucial to verify the current deadlines and extension options for Form 7205 by referring to the latest tax forms, publications, or contacting the Internal Revenue Service (IRS) or a tax professional for the most accurate information.

Common Mistakes To Avoid When Filing Form 7205

Here are some general tips on common mistakes to avoid when dealing with tax forms:

**Filing outdated forms: **Always ensure you are using the most current version of Form 7205. The IRS updates forms periodically, and using an outdated form may lead to processing delays or errors.

Incorrect or missing information: Double-check all the information you provide on the form, such as employer identification number (EIN), employee information, and wage amounts. Any errors or omissions can cause delays in processing or (link: https://fincent.com/blog/irs-tax-penalty-identification text: potential penalties).

**Incomplete or illegible form: **Make sure to fill out all the required fields on the form and ensure that your handwriting is clear and legible. Illegible forms may result in processing delays or misinterpretation of information.

**Miscalculations: **Check all calculations, especially when dealing with figures related to wages, (link: https://fincent.com/glossary/tax-credits text: tax credits), and refunds. Mathematical errors can lead to incorrect refund amounts or delays in processing.

Missing or improper documentation: Be sure to attach any required supporting documentation as outlined in the form's instructions. Providing insufficient or incorrect documentation may lead to delays or denial of the credit.

Missing deadlines: Pay close attention to the deadline for filing Form 7205. Missing the deadline could result in the loss of the opportunity to claim the tax credits.

Misunderstanding eligibility criteria: Familiarize yourself with the eligibility criteria for the tax credits and make sure your business and employees meet the requirements before filing the form.

Not retaining copies: Keep a copy of the filed Form 7205 and all supporting documentation for your records. Having proper documentation will be helpful in case of any inquiries or audits.

**Ignoring changes in tax laws: **Stay updated with the latest tax laws and regulations that may affect the tax credits or the filing process. Ignoring changes in tax laws could result in incorrect filing or missed opportunities for credits.

Not seeking professional advice when needed: If you're unsure about any aspect of filing Form 7205 or handling the tax credits, (link: https://fincent.com/ text: consider seeking advice from a tax professional) or an accountant. They can provide guidance and help you avoid costly mistakes.

Conclusion

Form 7205, the Energy Efficient Commercial Buildings Deduction, is a significant step towards incentivizing sustainable practices in the commercial sector.

By encouraging energy efficiency upgrades, the federal government aims to drive positive change in how businesses manage their properties, resulting in a win-win situation for the environment and the economy.

As we move towards a greener future, the importance of such tax incentives cannot be overstated, and business owners should seize this opportunity to make their commercial buildings more energy-efficient while reaping the benefits of reduced energy consumption and tax savings.