- IRS forms

- Form 6627

Form 6627: Environmental Taxes

Download Form 6627As concerns about environmental sustainability continue to grow, governments around the world are taking steps to encourage businesses to adopt eco-friendly practices. One such measure is the implementation of environmental taxes, which aim to mitigate the negative impact of certain activities on the environment. In the United States, businesses subject to environmental taxes are required to file Form 6627.

Environmental taxes, also known as green taxes or eco-taxes, are levies imposed on activities that have a detrimental impact on the environment. The primary objective of these taxes is to discourage harmful practices and promote sustainable alternates. By imposing financial penalties on environmentally harmful activities, governments aim to incentivize businesses to adopt greener practices, reduce pollution, and conserve natural resources.

Form 6627, formally known as the "Environmental Taxes," is a document used by businesses in the United States to report and pay environmental taxes owed to the Internal Revenue Service (IRS). This form provides a means for businesses to fulfill their legal obligations while accounting for the environmental impact of their operations.

In this blog post, we will explore Form 6627 and gain a deeper understanding of environmental taxes and their significance.

Components of Form 6627: Environmental Taxes

Here are the components of Form 6627:

Identification information: This section requires the business's name, address, and Employer Identification Number (EIN). It also includes space for the tax period and the type of tax being reported.

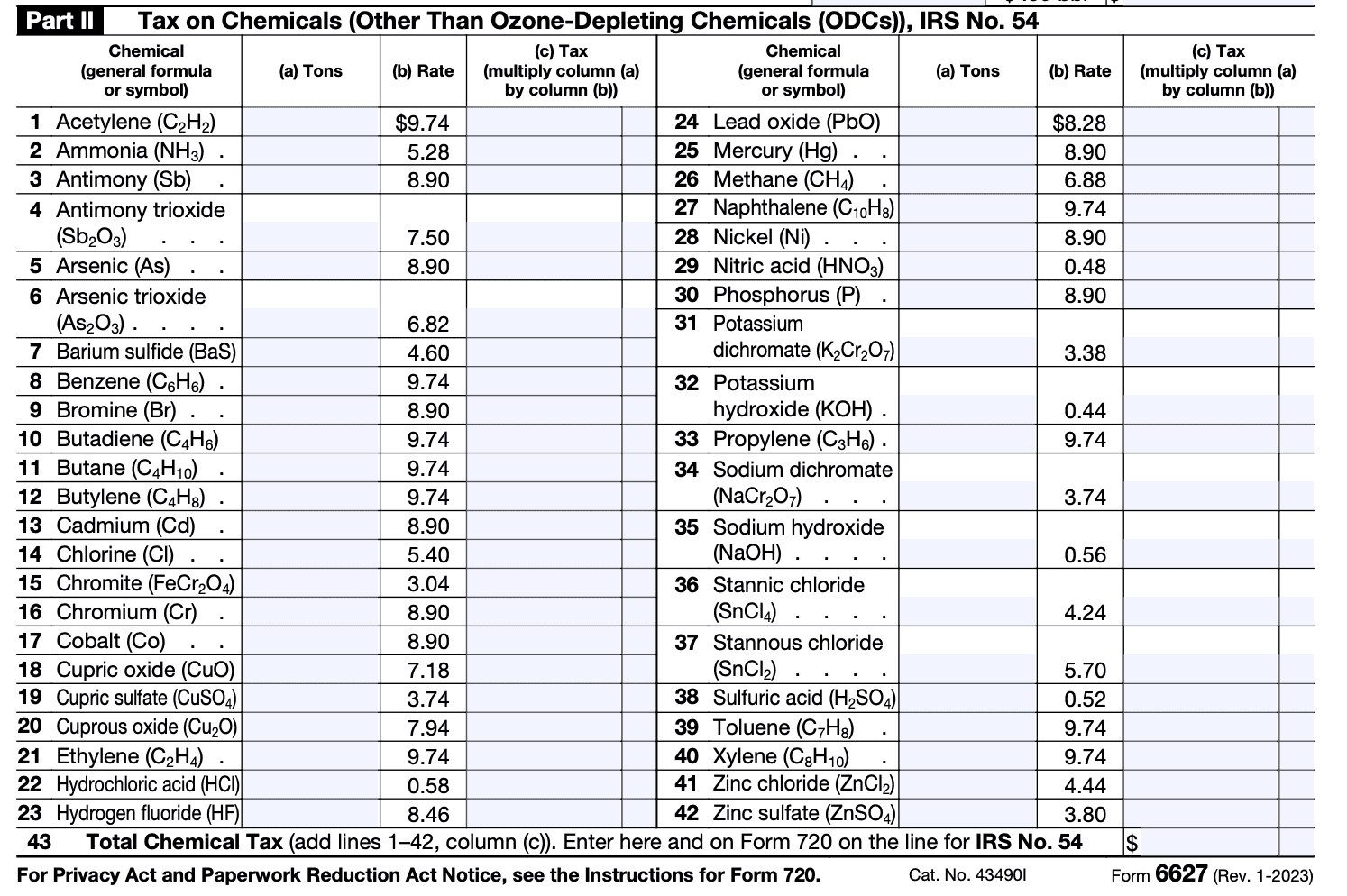

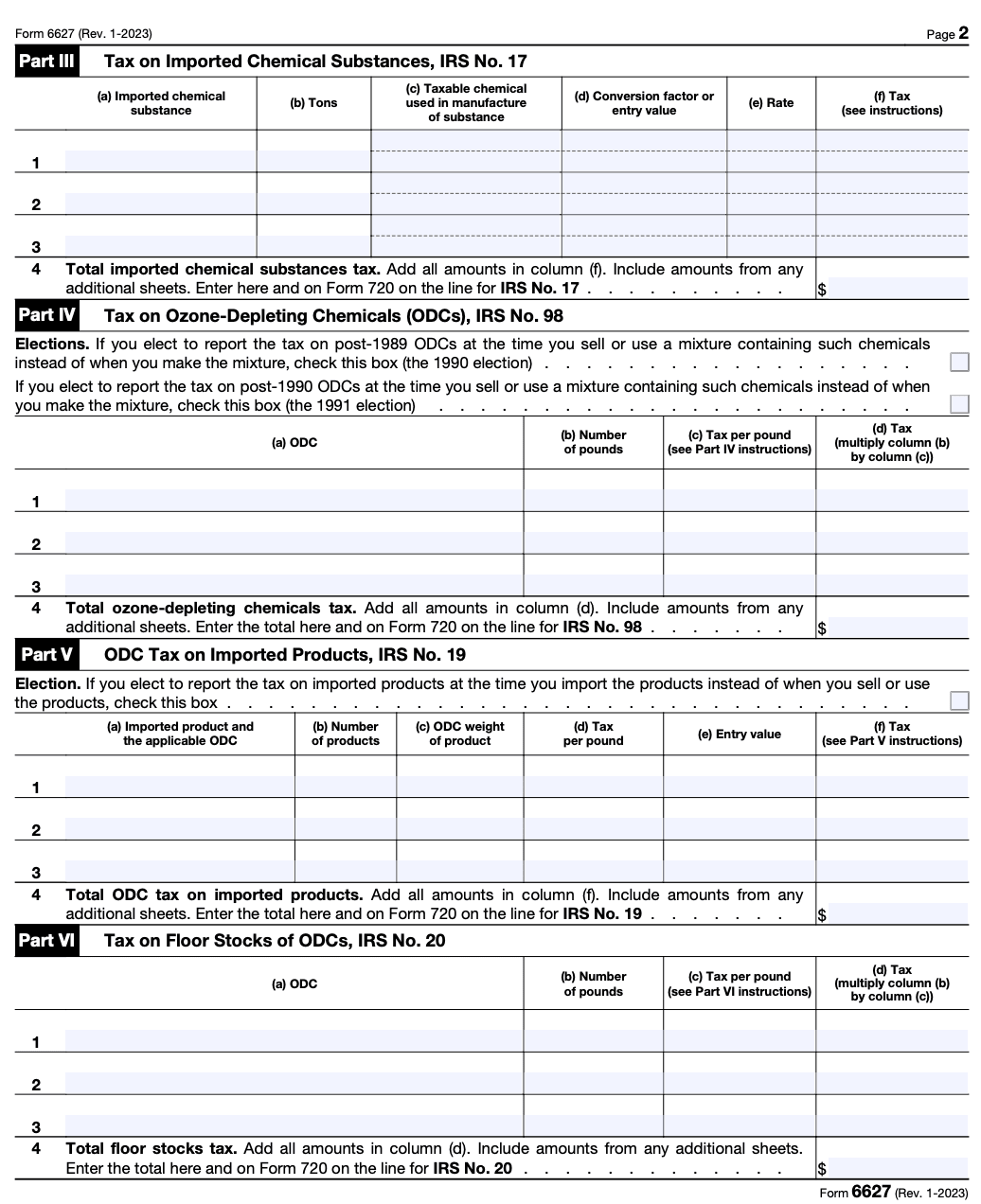

Environmental tax liability: This part of the form is used to report the total amount of environmental taxes owed for the tax period. It typically includes the various types of environmental taxes imposed, such as taxes on the sale or use of specific products or taxes on certain activities.

Calculation of environmental taxes: Here, the taxpayer must provide the detailed calculations used to determine the amount of environmental taxes owed. This may involve referencing other forms, schedules, or supporting documentation.

Payment and credits: This section allows the taxpayer to apply any tax credits or payments made for environmental taxes. It also provides space to indicate the total amount of tax due or any overpayment to be applied to future periods.

**Signature: **The form must be signed by an authorized person, certifying that the information provided is true, correct, and complete to the best of their knowledge.

Benefits of Form 6627: Environmental Taxes

Form 6627 offers several benefits to both businesses and the environment. Here are some of the advantages:

-

Compliance with environmental tax obligations: Filing Form 6627 ensures that businesses meet their legal obligations regarding environmental taxes. It allows businesses to report and pay the required taxes accurately and in a timely manner, thereby maintaining compliance with environmental tax laws.

-

Transparent reporting: By providing a structured framework for reporting environmental taxes, Form 6627 promotes transparency in the tax reporting process. It enables businesses to clearly disclose the amount of environmental taxes owed, ensuring accountability and reducing the likelihood of errors or underreporting.

-

Environmental conservation: Environmental taxes are designed to discourage activities that have negative environmental impacts. By imposing taxes on products or activities that generate pollution or contribute to resource depletion, these taxes incentivize businesses to adopt more environmentally friendly practices. Form 6627 facilitates the collection of data on environmental taxes, allowing authorities to monitor the effectiveness of these measures in promoting environmental conservation.

-

Revenue generation: Environmental taxes can serve as a source of revenue for governments. By accurately reporting and paying these taxes through Form 6627, businesses contribute to the funding of environmental programs, initiatives, and infrastructure. This revenue can be used to support environmental conservation efforts, develop renewable energy projects, invest in sustainable infrastructure, and more.

-

Encouragement of sustainable practices: environmental taxes can encourage businesses to adopt sustainable practices and technologies. by incorporating the cost of environmental taxes into their operations, businesses are incentivized to find ways to reduce their tax liability. This can lead to the adoption of cleaner production processes, energy-efficient technologies, waste reduction strategies, and the development of eco-friendly products.

-

Economic incentives: In some cases, environmental taxes may provide economic benefits to businesses. For example, businesses that invest in renewable energy sources or energy-efficient equipment may be eligible for tax credits or incentives. By accurately reporting their environmental tax liabilities through Form 6627, businesses can potentially access these incentives and reduce their overall tax burden.

Who Is Eligible To File Form 6627?

Generally, the following entities may be required to file Form 6627:

Businesses subject to environmental taxes: Companies or entities engaged in activities that are subject to environmental taxes are typically required to file Form 6627. This can include industries such as manufacturing, energy production, mining, transportation, waste management, and agriculture, among others.

Taxable products or activities: Businesses that produce, sell, import, or use products or engage in activities that are specifically designated for environmental taxation may be required to file Form 6627. These taxes are often imposed on goods or activities that have a negative impact on the environment, such as the use of certain fuels, disposal of hazardous waste, emissions of pollutants, or extraction of natural resources.

Threshold or exemption criteria: In some jurisdictions, there may be specific threshold limits or exemptions based on the volume of products or the size of the business. Businesses that exceed these thresholds or do not qualify for exemptions are typically required to file Form 6627.

It's important to note that the eligibility criteria for filing Form 6627 can vary significantly depending on the specific environmental tax laws and regulations in each jurisdiction.

How To Complete Form 6627: A Step-by-Step Guide

1. Obtain the necessary information

To accurately complete Form 6627, gather the following information:

- The type and amount of environmental tax liable for payment

- Records of environmental tax liabilities and payments made during the tax year

- Any exemptions, credits, or adjustments that apply to your business

2. Fill in your identifying information

Provide your business's legal name, address, and employer identification number (EIN) at the top of Form 6627.

3. Calculate environmental taxes

Determine the amount of environmental tax owed for each applicable category. The tax rates and calculation methods vary depending on the specific environmental tax involved. Consult the relevant tax laws, regulations, and guidance provided by the IRS to ensure accurate calculations.

4. Enter tax liability details

Complete the appropriate sections of the form to report the taxable amount, tax rate, and calculated tax liability for each applicable environmental tax.

5. Include adjustments, credits, or exemptions

If your business is eligible for any adjustments, credits, or exemptions related to environmental taxes, provide the necessary information in the corresponding sections of the form. Be sure to include any supporting documentation as required by the IRS.

6. Calculate the total tax liability

Sum up the tax liabilities from all applicable environmental taxes to determine the total amount owed.

7. Payment and submission

Pay the calculated tax liability by the due date specified by the IRS. Include the payment voucher or payment information with Form 6627 when submitting it to the IRS. Retain a copy of the completed form and supporting documents for your records.

8. Retention of records

Keep all records related to environmental taxes for at least three years after the tax filing deadline, as these may be subject to IRS review or audit.

Special Considerations When Filing Form 6627

Here are some key points to keep in mind while filing Form 6627:

Familiarize yourself with the applicable taxes: Form 6627 covers various taxes, including the Oil Spill Liability Trust Fund tax, the Leaking Underground Storage Tank (LUST) tax, the Ozone-Depleting Chemicals (ODC) tax, and the Imported Taxable Product tax. Ensure you understand the specific tax requirements and rates associated with the products you're reporting.

Correctly identify the products: When completing Form 6627, accurately identify the fuels or chemicals subject to taxation. Ensure you're using the correct codes and descriptions for each product. The instructions provided with the form will assist you in determining the appropriate codes.

Maintain accurate records: It's crucial to maintain accurate and detailed records related to the products subject to tax. This includes records of the quantity of each product received, sold, used, or exported. Retain these records for at least three years from the filing date of the return.

Timely filing and payment: Form 6627 is typically due quarterly, following the end of each calendar quarter. Make sure you submit your form and payment by the appropriate deadlines to avoid penalties and interest charges. Check the instructions or consult with a tax professional to determine the exact due dates.

Consider electronic filing: The IRS encourages electronic filing of Form 6627, which can help streamline the process and reduce errors. Electronic filing options may be available through the IRS e-file system or approved tax software. Check the IRS website for specific instructions on electronic filing for Form 6627.

Seek professional guidance if needed: Environmental taxes can be complex, and it's essential to understand the specific requirements and regulations applicable to your situation. If you have any doubts or questions, consider consulting a tax professional who specializes in environmental taxes or seeking guidance from the IRS.

Filing Deadlines & Extensions on Form 6627

Deadlines: The general deadline for filing this form is quarterly. Here are the deadlines for each quarter:

- Quarter 1 (January 1 to March 31) - Deadline: April 30

- Quarter 2 (April 1 to June 30) - Deadline: July 31

- Quarter 3 (July 1 to September 30) - Deadline: October 31

- Quarter 4 (October 1 to December 31) - Deadline: January 31 (of the following year)

If the due date falls on a weekend or a legal holiday, the deadline is extended to the next business day.

Extensions:

- The IRS allows for a 6-month extension to file Form 6627.

- To request an extension, you should file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, before the regular due date of the return.

- This extension applies only to the filing of the form, not the payment of the tax owed. You are still required to pay the tax by the original due date (April 30, July 31, October 31, or January 31) to avoid penalties and interest.

Common Mistakes To Avoid While Filing Form 6627

When filing Form 6627 or reporting environmental taxes on Form 720, here are some common mistakes to avoid:

Incorrect tax calculations: Ensure that you accurately calculate the amount of environmental tax owed. Refer to the applicable tax rates and regulations provided by the relevant authority, such as the Internal Revenue Service (IRS) in the United States.

Missing or incorrect information: Provide complete and accurate information on the form, including your business details, taxpayer identification number (TIN), tax period, and any other required information. Double-check that all fields are filled out correctly and legibly.

Failing to report all taxable activities: Be aware of all the taxable activities that require reporting on Form 6627. Examples may include the production or importation of ozone-depleting chemicals, petroleum-based fuels, or certain chemicals and products subject to environmental taxes.

Late or missed filings: Adhere to the filing deadlines for Form 6627. Typically, it is filed on a quarterly basis, and failing to file or filing late can result in penalties and interest charges. Stay informed about the applicable due dates and submit the form in a timely manner.

Inadequate record-keeping: Maintain accurate and organized records of environmental tax-related transactions, invoices, and supporting documentation. This includes records of the taxable activities, taxable quantities, and any exemptions or credits claimed. Good record-keeping helps in preparing the form accurately and provides documentation for potential audits or inquiries.

**Not seeking professional advice if needed: **Environmental tax laws can be complex, and it's essential to understand the specific requirements applicable to your business or industry. If you are uncertain about any aspect of Form 6627 or environmental taxes, consider consulting a tax professional or contacting the relevant authority for guidance.

Conclusion

Environmental taxes are an important tool in promoting sustainable practices and reducing the negative impact of businesses on the environment. By implementing financial penalties on activities that harm the planet, governments encourage businesses to adopt eco-friendly practices, invest in clean technologies, and reduce their carbon footprint.

Form 6627 serves as a means for businesses to fulfill their tax obligations and contribute to the collective efforts to build a greener future. By understanding and complying with Form 6627, businesses can demonstrate their commitment to environmental responsibility and pave the way for a more sustainable future.