- IRS forms

- Form 4506-T

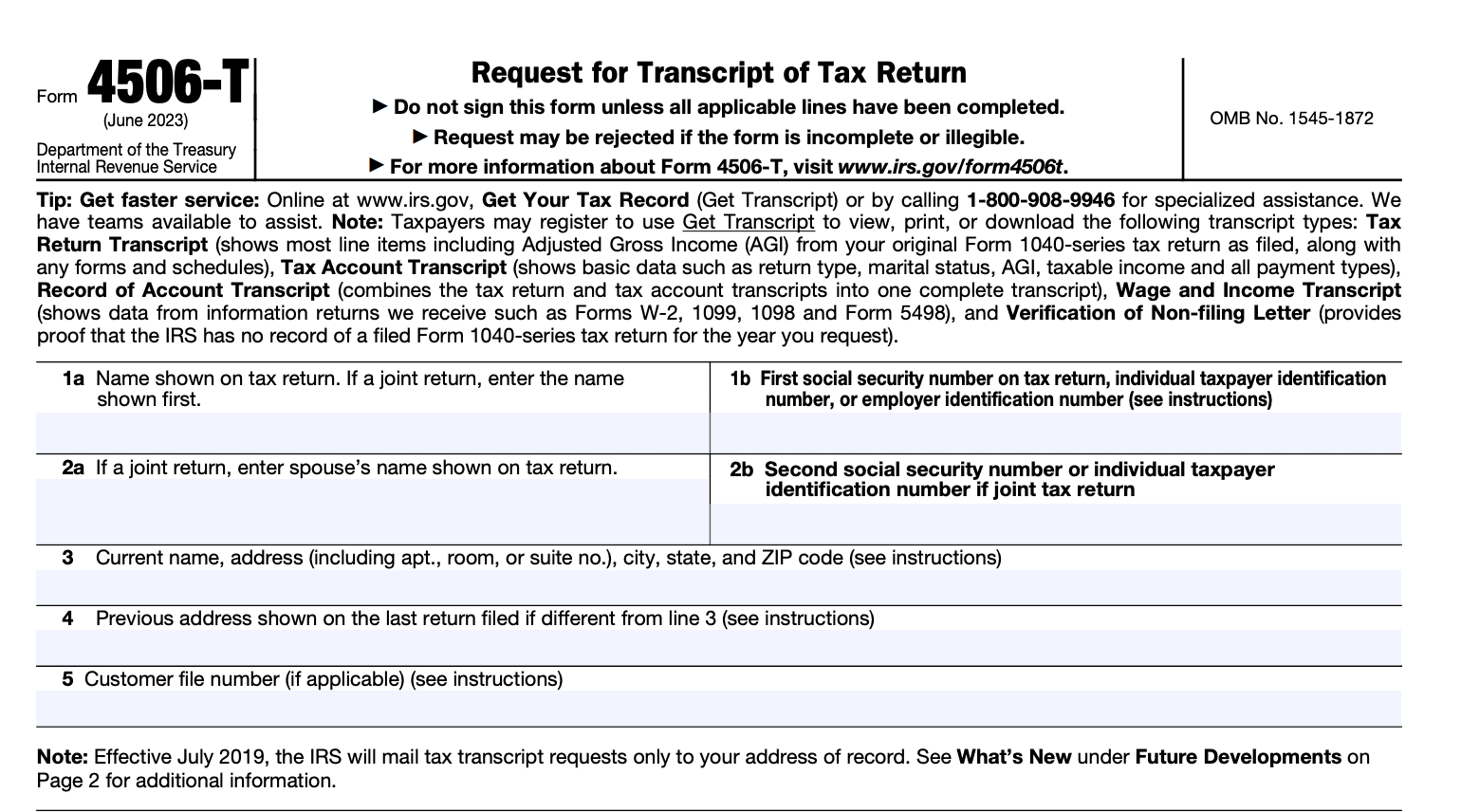

Form 4506-T: Request for Transcript of Tax Return

Download Form 4506-TTax returns play a crucial role in our financial lives, serving as a record of our income, deductions, and tax liabilities. However, there may be instances where you need to obtain a copy of your tax return information for various purposes, such as applying for a mortgage, student loan, or verifying income for government assistance programs. In such cases, Form 4506-T, also known as the Request for Transcript of Tax Return, becomes essential.

Form 4506-T is an official document issued by the Internal Revenue Service (IRS) in the United States. It allows taxpayers to request transcripts or copies of their previously filed tax returns, including information from Forms W-2, 1099, and 1098. A transcript is a summary of your tax return, while a copy includes all attachments and schedules filed with your return.

In this blog, we'll explore the purpose, process, and benefits of using Form 4506-T.

Purpose of Form 4506-T

The purpose of Form 4506-T is to authorize the IRS to release the requested information to the taxpayer or to a designated third party, such as a mortgage lender, financial institution, or authorized representative.

Here are some common reasons why Form 4506-T is used:

**Verification of income: **Lenders often require borrowers to provide proof of income when applying for a mortgage, loan, or credit. By submitting Form 4506-T, the lender can request tax transcripts directly from the IRS to verify the applicant's income information.

Tax compliance: The IRS may request individuals or businesses to submit Form 4506-T to verify their tax compliance or to resolve issues related to tax filings. This can include audits, investigations, or the need for additional information to complete a tax assessment.

Amending tax returns: If an individual or business needs to amend a previously filed tax return, they may use Form 4506-T to request a tax return transcript, which provides a record of the original return. This can help in accurately identifying and correcting errors or discrepancies in the tax filing.

**Loan modifications or forbearance: **During financial hardship or when seeking loan modifications, individuals may be required to provide tax information to lenders. Form 4506-T allows the lender to obtain the necessary tax transcripts directly from the IRS for assessment and decision-making purposes.

Legal or financial planning: Attorneys, financial advisors, or estate planners may request tax transcripts using Form 4506-T on behalf of their clients to gain insights into their tax history, assess financial situations, or prepare legal or financial documents.

Benefits of Form 4506-T

Here are some of the benefits of using Form 4506-T:

Verification of income: Form 4506-T allows individuals to request transcripts of their tax returns, which can be used to verify income for various purposes. This can be particularly useful when applying for a mortgage, student loan, or other types of financing where income verification is required.

Tax return copies: If you need copies of your previous tax returns for personal records, loan applications, or other purposes, Form 4506-T can be used to request these documents from the IRS. Having access to these records can help you maintain accurate financial records or provide proof of income when necessary.

Tax compliance and filing: Using Form 4506-T can assist individuals or businesses in ensuring they have complied with their tax obligations. By obtaining copies of past tax returns or transcripts, taxpayers can review their filing history, identify any errors, and rectify any issues with the IRS if required.

**Resolving tax issues: **If you are facing tax-related problems, such as disputes, audits, or questions about your tax account, Form 4506-T can be used to request transcripts or copies of relevant tax documents. These records can help you provide accurate information and resolve any discrepancies or disputes effectively.

Retrieval of wage and income information: Form 4506-T can also be used to obtain wage and income information from the IRS. This information is useful for individuals who need to report their income accurately or for employers verifying employee income during background checks or hiring processes.

Research and analysis: Researchers, analysts, or professionals in the financial or legal fields may find value in obtaining tax return transcripts or copies of tax records through Form 4506-T. These documents can be used for various research purposes, financial analysis, or legal investigations.

It is important to note that there may be fees associated with requesting tax return copies or transcripts using Form 4506-T, and it may take some time for the IRS to process your request.

Who Is Eligible To File Form 4506-T?

The form is commonly used for various purposes, such as obtaining copies of tax returns for loan applications, mortgage verification, income verification, or resolving tax-related issues.

The following entities or individuals are generally eligible to file Form 4506-T:

**Individuals: **This includes U.S. citizens, resident aliens, and non-resident aliens who have filed a tax return with the IRS.

**Businesses: **This includes partnerships, corporations, limited liability companies (LLCs), trusts, estates, and nonprofit organizations that have filed business tax returns or have been listed as a responsible party on certain tax forms.

It's important to note that the specific eligibility requirements may vary depending on the purpose for which the form is being filed. For example, if you are requesting a transcript for a deceased taxpayer, you may need to provide additional documentation or proof of authority to act on behalf of the deceased.

How To Complete Form 4506-T: A Step-by-Step Guide

Step 1: Download the form

Visit the official website of the Internal Revenue Service (IRS) or use a reputable tax preparation software to download Form 4506-T. Ensure that you have the most up-to-date version of the form.

Step 2: Fill in your personal information

Enter your personal information at the top of the form, including your name, Social Security number (SSN), current address, and phone number. If you are married and filing jointly, include your spouse's information as well.

Step 3: Choose the appropriate checkbox

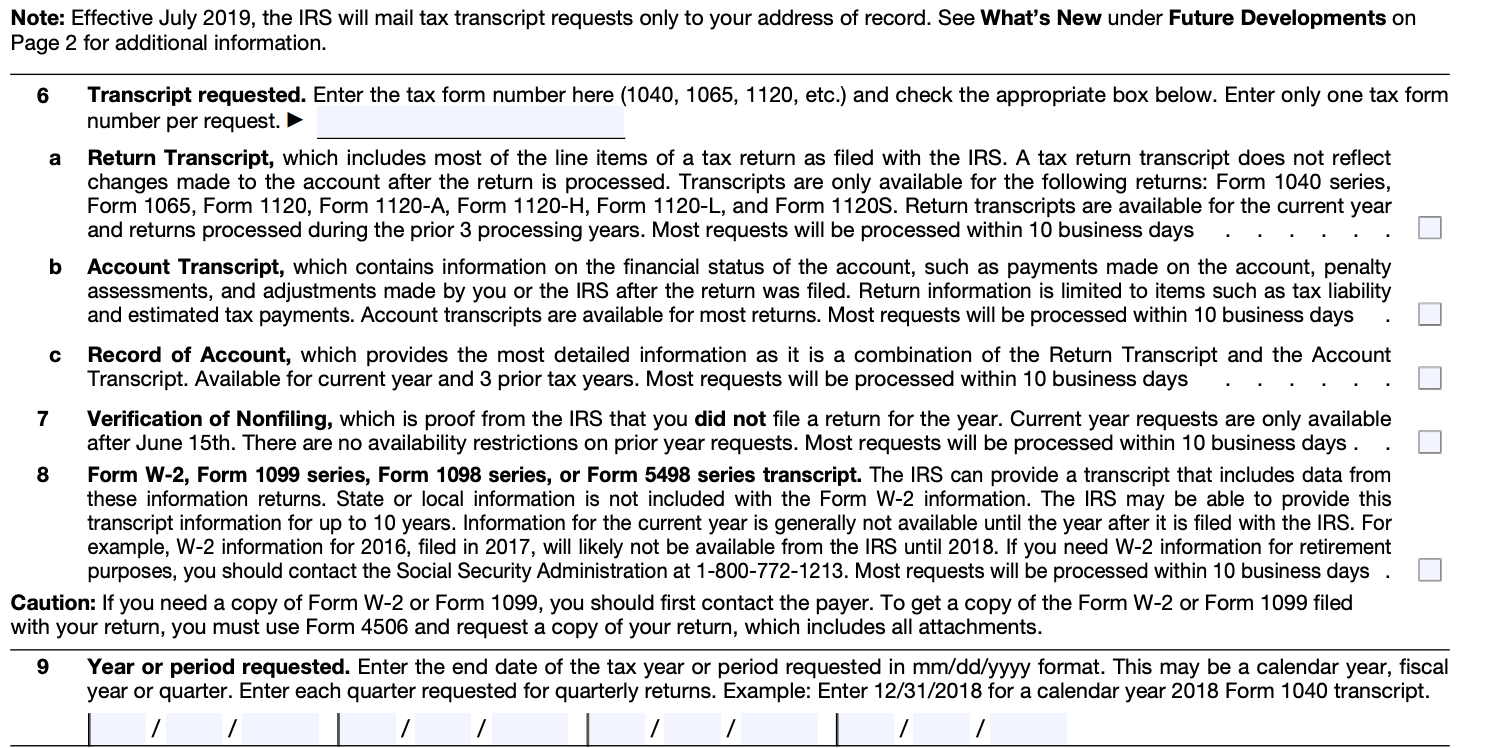

Review the checkboxes in Section 6 of the form and select the one that corresponds to the type of transcript you need. There are options for tax return transcripts, tax account transcripts, record of account transcripts, or wage and income transcripts. If you are unsure which one to select, consult the instructions or contact the IRS for guidance.

Step 4: Specify the tax years or periods

In Section 6, indicate the specific tax years or periods for which you need the transcript. Provide the relevant information in the spaces provided or attach a separate sheet if necessary.

Step 5: Provide third-party authorization (if applicable)

If you want the transcript to be sent directly to a third party, such as a mortgage lender or tax professional, complete Section 6 and fill in the name, address, and telephone number of the designated party.

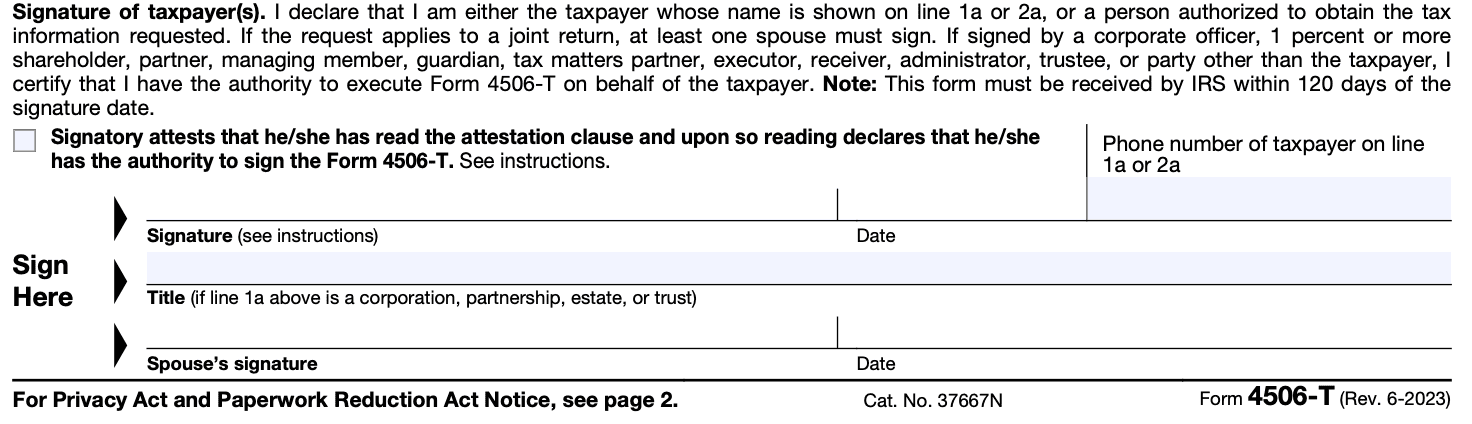

Step 6: Sign and date the form

Read the declaration at the bottom of the form, then sign and date it. If you are filing jointly, your spouse should also sign and date the form.

Step 7: Submit the form

Make a copy of the completed Form 4506-T for your records and send the original to the IRS using one of the following methods:

- Mail: Send the form to the address provided in the instructions for Form 4506-T, based on your state of residence.

- Fax: Fax the form to the number provided in the instructions for Form 4506-T.

- Electronic request: If available, you can also submit the form electronically through the IRS's online tools or authorized third-party providers.

Step 8: Verification and processing

The IRS will verify the information provided on the form and process your request. The processing time may vary, so check the IRS website or contact them for estimated processing times.

Special Considerations When Filing Form 4506-T

When filing Form 4506-T, which is the Request for Transcript of Tax Return, there are several special considerations to keep in mind. Here are some important points to consider:

Correctly fill out the form: Ensure that all information is accurately entered on the form, including your name, address, Social Security Number (SSN), and tax years for which you are requesting transcripts.

Select the appropriate box: Form 4506-T provides different checkboxes to indicate the type of transcript you need. Make sure to select the appropriate box based on your requirements. For example, you may request a transcript of your tax return (Form 1040) or a verification of a non-filing letter.

Specify the tax years: Clearly indicate the tax years for which you are requesting transcripts. If you need multiple years, you can enter them in the designated section on the form.

Choose the transcript type: Form 4506-T offers different transcript types, such as the Return Transcript, Account Transcript, or Record of Account. Be sure to select the one that suits your needs. If you're unsure which transcript type you need, you can contact the IRS for assistance.

Sign and date the form: The form must be signed and dated by the taxpayer or authorized representative. If you have an authorized representative, they must also provide their information and sign the form accordingly.

**Delivery options: **Form 4506-T allows you to choose how you want to receive the transcripts. You can select to have them mailed to your address or directly to a third party, such as a mortgage company or educational institution. Ensure that you select the appropriate delivery option and provide the necessary details.

**Use the latest version of the form: **Always make sure you are using the most recent version of Form 4506-T, which can be obtained from the IRS website (irs.gov). Using an outdated form may cause delays or rejection of your request.

**Keep a copy of the form: **It's essential to retain a copy of the completed Form 4506-T for your records. This will help you track your request and serve as proof of your submission.

Filing Deadlines & Extensions for Form 4506-T

Here are some general guidelines:

**Tax return transcripts: **If you need tax return transcripts, the deadline for filing Form 4506-T is typically April 15 of the year following the tax year you are requesting. For example, if you are requesting tax return transcripts for the tax year 2022, the deadline would be April 15, 2023.

Extensions: If you are unable to meet the deadline for filing Form 4506-T, you can request an extension. As of my knowledge cutoff, the standard extension period is six months. To request an extension, you should file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, with the IRS.

Common Mistakes To Avoid While Filing Form 4506-T

When filing Form 4506-T, which is the Request for Transcript of Tax Return, it's important to be accurate and thorough to ensure your request is processed correctly. Here are some common mistakes to avoid while filing Form 4506-T:

Incomplete or incorrect information: Ensure that you fill out all the required fields on the form accurately. Double-check your name, Social Security number (SSN), address, and other personal information to avoid any discrepancies.

Incorrect tax year or period: Provide the correct tax year or period for which you are requesting the transcript. Be specific and ensure that it matches the tax return you filed.

Missing signature: Make sure you sign and date the form. An unsigned form will be considered incomplete and may result in processing delays or rejection.

Incorrect form type: Select the appropriate box on Form 4506-T to indicate whether you are requesting a transcript of your tax return (Form 1040) or other specific forms such as W-2, 1099, or 1098. Check the box that accurately represents the information you need.

Mailing address: If you choose to receive the transcript by mail, verify that you have provided the correct mailing address. A mistake in the address can lead to delays or delivery to the wrong location.

Non-eligible third party: If you are authorizing a third party to receive the transcript on your behalf, ensure that the designated recipient is eligible to receive it. Check the instructions provided with the form to determine the eligibility criteria for third-party requests.

Inaccurate payment information: If you need to request a specific tax return or tax period that is subject to a fee, provide accurate payment information such as credit card details or a check to cover the required fees. Make sure the payment information is filled out correctly to avoid any payment processing issues.

Incorrect submission: Verify that you are sending the completed form to the correct address. The mailing address can vary based on the state where you reside. Check the instructions or the IRS website for the correct address to mail the form.

Conclusion

Form 4506-T, the Request for Transcript of Tax Return, is a valuable tool when you need to obtain copies or summaries of your previously filed tax returns. Whether you require them for income verification, tax compliance, or tax preparation purposes, Form 4506-T simplifies the process of retrieving official IRS records.

By understanding how to fill out the form and where to submit it, you can access the information you need efficiently and effectively. Remember, always consult the latest instructions and guidelines provided by the IRS to ensure accurate completion of Form 4506-T.