- IRS forms

- Form 4506

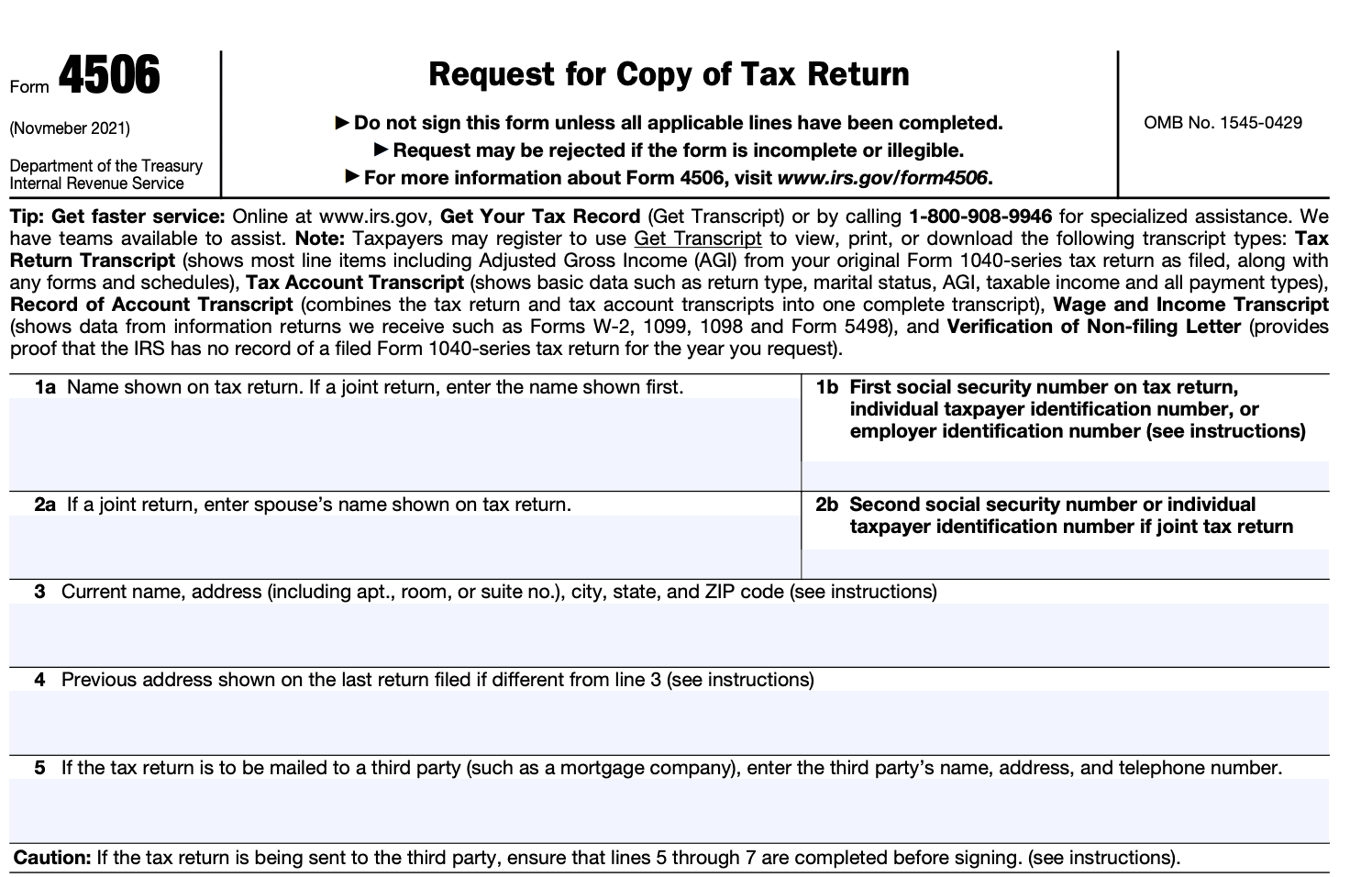

Form 4506: Request for Copy of Tax Return

Download Form 4506Tax returns are an essential aspect of every individual's financial life. Whether you're applying for a mortgage, seeking financial aid, or resolving tax disputes, having accurate information about your income and tax filings is crucial. Form 4506, also known as the "Request for Copy of Tax Return" or "Request for Transcript of Tax Return," is a document that allows individuals to obtain their tax return information directly from the Internal Revenue Service (IRS).

Form 4506 is an official document used to request copies of past tax returns or transcripts of tax return information from the IRS. It enables individuals to access their financial records and verify the accuracy of their tax filings. The form can be used for personal, business, or non-profit tax returns, depending on the type of tax return information you require.

In this blog post, we will delve into the details of Form 4506 and explore its significance in various financial scenarios.

Purpose of Form 4506

Form 4506 serves several purposes:

Verification of income: Lenders, mortgage companies, and other financial institutions often require individuals to provide copies of their tax returns as part of the loan application process. Using Form 4506, these entities can request the taxpayer's past tax returns directly from the IRS to verify the income stated on the loan application.

**Tax compliance and audits: **The IRS may request a taxpayer's previous tax returns when conducting an audit or examination. Form 4506 enables the IRS to obtain copies of the taxpayer's filed returns for the requested tax years.

**Taxpayer records: **Individuals or organizations may need copies of their tax returns for personal or business purposes, such as financial planning, legal matters, or historical records. Form 4506 allows them to request these copies from the IRS.

It's important to note that there are different versions of Form 4506, including Form 4506-T for transcript requests, which provide summarized information from the tax returns rather than the full copies.

Key Components of Form 4506

The form contains several key components that need to be completed accurately. Here are the main sections of Form 4506:

Personal information

- Name: The taxpayer's name as it appeared on the tax return being requested.

- Current address: The taxpayer's current mailing address.

- Social Security number (SSN) or Employer Identification Number (EIN): The taxpayer's SSN or EIN, depending on whether it is an individual or a business requesting the tax return.

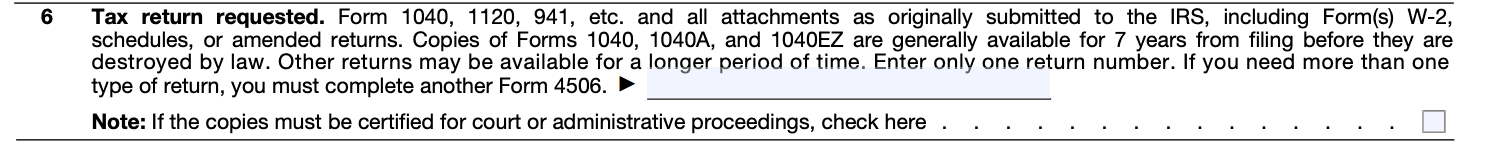

Type of return

Check the appropriate box to indicate the type of return being requested. This could be an individual income tax return (Form 1040), business tax return (Form 1065 for partnerships, Form 1120 for corporations, etc.), or other applicable form.

Tax years

Enter the specific tax years for which copies of the tax return are being requested. Include all relevant tax years, and ensure accuracy to avoid delays or incorrect information.

Return transcript or copy of tax form

Select the appropriate box to indicate whether you are requesting a return transcript (a summary of the tax return information) or a copy of the actual tax return.

Signature and date

The taxpayer or authorized representative must sign and date the form.

Third-party authorization (if applicable)

If the taxpayer wants the tax return information to be released to a third party, such as a tax professional or a lender, the relevant authorization section must be completed.

Benefits of Form 4506

Here are some benefits of filing Form 4506:

-

Verification of income: Form 4506 allows individuals and organizations to obtain official copies of their tax returns, which can be useful for various purposes, including verifying income for loan applications, mortgage refinancing, student financial aid, or rental applications. Lenders and other entities often require tax return copies to assess an individual's financial situation and determine their eligibility.

-

Tax return reconstruction: In some cases, taxpayers may need to recreate their tax returns due to loss or destruction of their records. By submitting Form 4506, individuals can obtain past tax return copies and use them as a reference to reconstruct their financial information accurately.

-

Tax audit preparation: If a taxpayer is facing an IRS audit or needs to review their previous filings in response to an audit, Form 4506 allows them to obtain copies of the relevant tax returns. These copies can help individuals prepare and gather the necessary documentation to support their tax positions and comply with audit requests.

-

Amending tax returns: Form 4506 can be used to obtain copies of previously filed tax returns when a taxpayer needs to make amendments or corrections. Having access to the original tax return can help in identifying errors, discrepancies, or omissions that require rectification.

-

Historical financial records: Retaining copies of tax returns using Form 4506 enables individuals to maintain a record of their financial history. These records can be helpful for personal financial management, applying for government benefits, providing evidence in legal matters, or addressing tax-related inquiries.

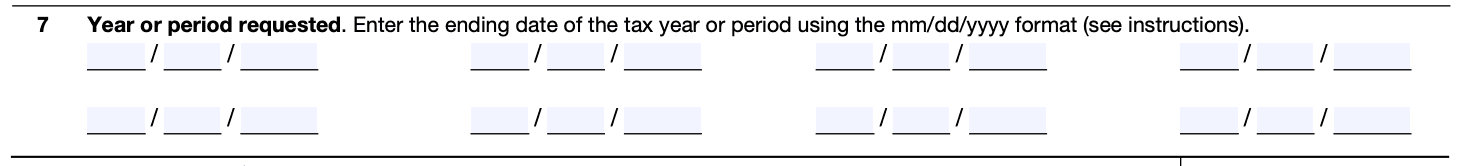

It's important to note that there may be fees associated with requesting copies of tax returns using Form 4506, and the process can take several weeks to complete. Additionally, the availability of certain tax returns may vary depending on the IRS's record retention policies.

How To Complete Form 4506: A Step-by-Step Guide

Here's a step-by-step guide to completing Form 4506:

Step 1: Obtain the form

You can download Form 4506 directly from the IRS website (www.irs.gov) or request a copy by calling the IRS at 1-800-829-3676.

Step 2: Fill in the taxpayer information

Provide your personal information at the top of the form, including your name, address, Social Security number (SSN), and the tax year or years you're requesting information for.

Step 3: Choose the type of transcript or return requested

Check the appropriate box in Section 6 to indicate whether you're requesting a transcript of your tax account (most common) or an actual copy of your tax return.

Step 4: Enter the tax return information

If you're requesting a copy of your tax return, fill in the applicable boxes in Section 6. Enter the tax form number (e.g., 1040, 1040A, etc.), the tax year(s) you're requesting, and the number of returns you need.

Step 5: Specify the purpose of the request

In Section 7, indicate the reason for your request. This could be for personal records, mortgage application, student loan application, etc. Check the appropriate box or provide additional details as needed.

Step 6: Sign and date the form

Sign and date the form in Section 8. If you're completing the form on behalf of someone else, such as a deceased taxpayer or a business, provide your title and relationship to the taxpayer.

Step 7: Provide your third-party designee information (if applicable)

If you want to authorize a third-party to receive the information on your behalf, complete Section 9 by providing their name, phone number, and any other requested details. This step is optional.

Step 8: Submit the form

Make a copy of the completed Form 4506 for your records and send the original to the appropriate IRS address based on your location. The address can be found in the instructions accompanying the form. Ensure you include any required payment if applicable.

Special Considerations When Filing Form 4506

When filing Form 4506, which is the Request for Copy of Tax Return, there are a few special considerations to keep in mind:

**Correctly select the appropriate form: **Form 4506 has multiple variations, including Form 4506-T (Request for Transcript of Tax Return) and Form 4506-A (Request for Public Inspection or Copy of Exempt or Political Organization IRS Form). Ensure you select the correct form that matches your purpose.

Provide accurate and complete information: It is crucial to provide accurate and complete information on Form 4506. This includes your name, Social Security Number (SSN), current address, and any other information requested. Inaccurate or incomplete information may delay the processing of your request.

Specify the tax years or periods: On Form 4506, you need to indicate the specific tax years or periods for which you are requesting copies of tax returns. Clearly state the years or periods you need copies for, as the IRS will not automatically provide returns for all years.

**Choose the appropriate box for the type of return: **There are different boxes on Form 4506 to indicate the type of return you are requesting. Make sure to select the correct box that corresponds to the type of return you need, such as Form 1040 (individual return) or Form 1120 (corporate return).

**Use the correct mailing address: **The mailing address where you should send your completed Form 4506 depends on your location and the type of return requested. The instructions accompanying the form will provide the appropriate address based on your circumstances.

**Understand the fees and processing time: **There may be a fee associated with requesting copies of tax returns using Form 4506. As in September 2021, the fee for each tax return copy was $50. The processing time can vary, but it typically takes a few weeks to receive the requested copies.

Keep copies of your submitted form: It's always a good idea to keep copies of the completed Form 4506 and any supporting documentation for your records. This will help you track your request and provide proof of your submission if needed.

Filing Deadlines & Extensions for Form 4506

Regarding filing deadlines and extensions for Form 4506, it's important to note that the form itself is not typically subject to specific filing deadlines or extensions. Unlike tax return forms, which have specific due dates, Form 4506 can generally be submitted throughout the year as needed.

However, it's worth mentioning that processing times for Form 4506 requests can vary depending on the IRS workload, especially during peak tax season. Therefore, if you require the information by a certain deadline, it's advisable to submit the form well in advance to allow for processing and potential delays.

For the most accurate and up-to-date information regarding filing deadlines, extensions, and any changes to the process, it's recommended to consult the official IRS website (www.irs.gov) or contact the IRS directly for assistance. They will be able to provide you with the latest guidelines and instructions regarding Form 4506.

Common Mistakes To Avoid While Filing Form 4506

When filing Form 4506, which is the Request for Copy of Tax Return, it's important to be thorough and accurate to ensure the process goes smoothly. Here are some common mistakes to avoid:

Incomplete or inaccurate information: Make sure to provide all the required information on the form, including your name, Social Security number, address, and tax years requested. Double-check your entries for accuracy to prevent delays or incorrect documents.

Incorrect form version: Ensure that you are using the most recent version of Form 4506, as forms can change over time. Using an outdated version may result in processing delays or rejection of your request.

Missing signature: Your request must be signed and dated. An unsigned or undated form will be considered incomplete, and the IRS may not process it. Remember to sign and date the form before submitting it.

Incorrect mailing address: Use the correct mailing address provided in the instructions for Form 4506. Sending the form to the wrong address can cause delays or result in the form being lost in transit.

Insufficient payment: If you are requesting copies of your tax returns for multiple years, be sure to include the appropriate payment for each year. The current fee for each tax return copy is mentioned in the instructions for Form 4506.

Sending the form to the wrong IRS office: Depending on your location, there are specific IRS offices designated for processing Form 4506 requests. Refer to the instructions to find the correct office based on your state of residence.

Failure to attach required documentation: In some cases, you may need to attach additional documentation, such as a power of attorney or a court order, to support your request. Check the instructions carefully to see if any additional documents are required and include them with your submission if necessary.

Incomplete or incorrect reason for the request: Provide a clear and accurate reason for your request. Whether you need the tax return copies for personal use, loan applications, or other purposes, ensure that you select the appropriate reason code and provide any necessary additional information.

Lack of follow-up: Once you've submitted your Form 4506, keep track of your request and follow up with the IRS if you haven't received the requested tax returns within the expected timeframe. This will allow you to address any issues or delays promptly.

Conclusion

Form 4506 and Form 4506-T play a crucial role in providing individuals with access to their tax return information. Whether you need a copy of your tax return or a transcript for various financial purposes, these forms serve as powerful tools to verify income, resolve disputes, and plan for the future.

Understanding the importance of these forms and how to request them can help you navigate the complex world of taxes and financial documentation with confidence. Remember to consult with a tax professional if you have specific questions or concerns regarding your tax returns or transcripts.