- IRS forms

- Form 2555

Form 2555: Foreign Earned Income

Download Form 2555Living and working abroad can be an exhilarating experience, allowing individuals to immerse themselves in different cultures and gain a broader perspective on life. However, when it comes to taxes, the complexities of earning income overseas can create confusion and headaches for many expatriates. Enter Form 2555, a crucial tax form that helps individuals claim the benefits of foreign earned income exclusions.

Form 2555, officially known as the "Foreign Earned Income" form, is an essential document used by U.S. citizens or resident aliens to exclude a portion of their foreign income from federal taxation. The form is filed annually with the Internal Revenue Service (IRS) and allows eligible individuals to reduce their taxable income, potentially resulting in substantial tax savings.

In this blog post, we will delve into the intricacies of Form 2555 and shed light on how it can benefit those earning income outside their home country.

Components of Form 2555

Here are few of the key components of Form 2555:

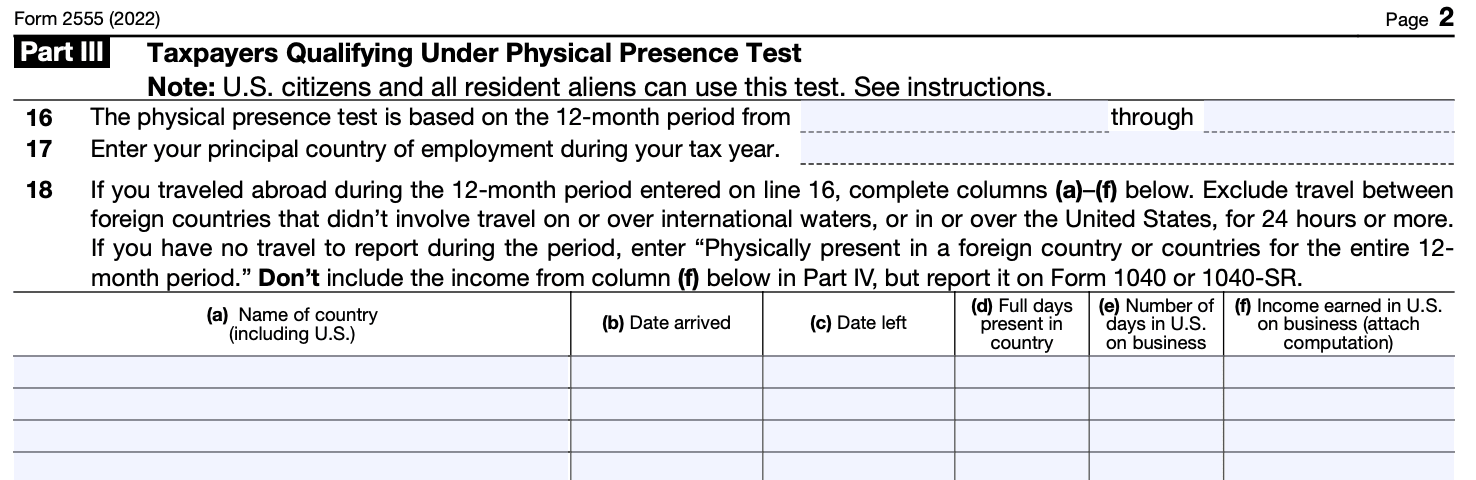

Physical presence test

To qualify for the foreign earned income exclusion, individuals must meet either the physical presence test or the bona fide residence test. Under the physical presence test, one must spend at least 330 full days in a foreign country within a 12-month period. This requirement ensures that individuals have a significant presence in the foreign country and are not merely transient visitors.

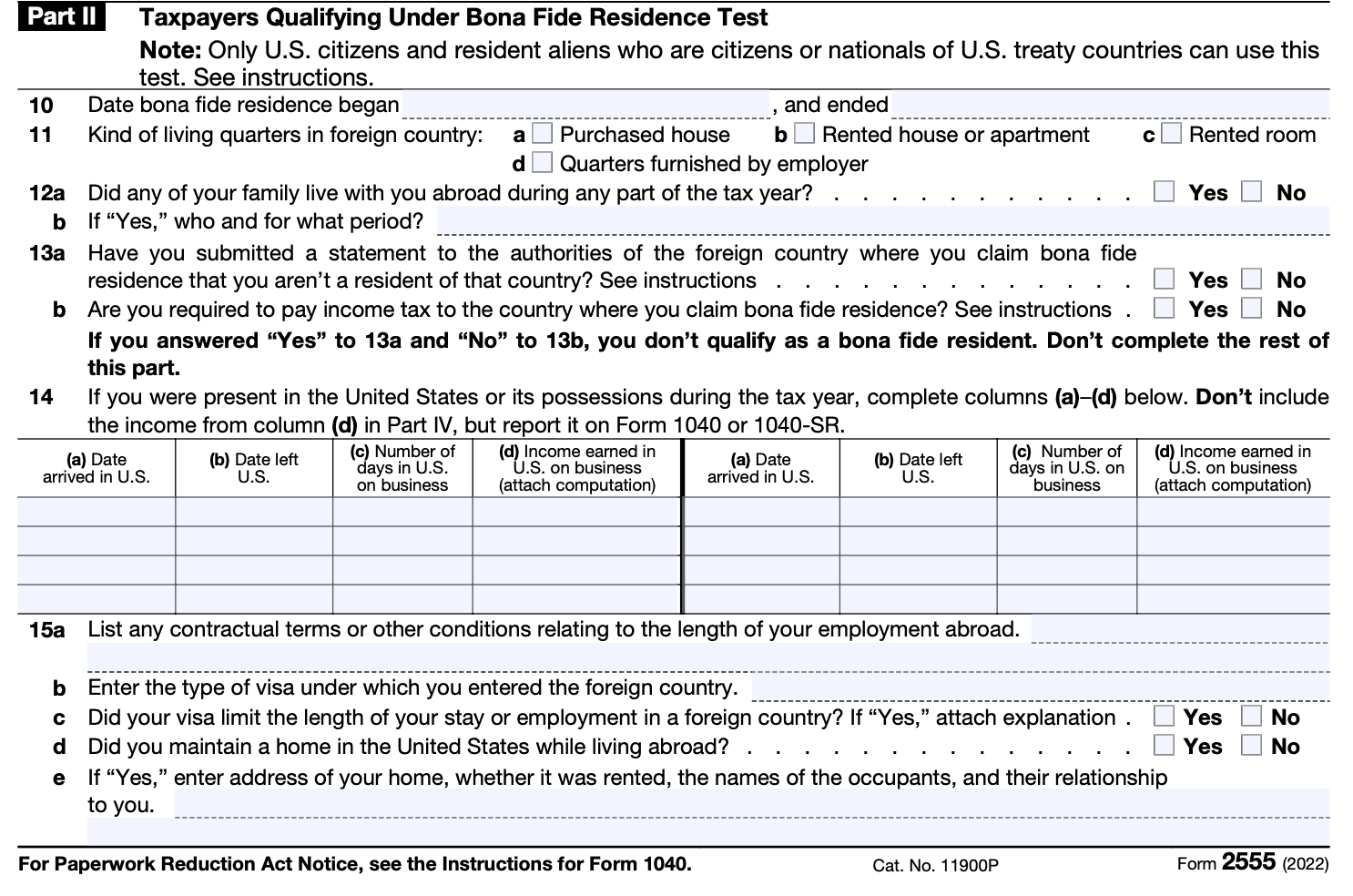

Bona fide residence test

The bona fide residence test establishes that an individual has established a genuine and permanent residence in a foreign country. To qualify, one must reside in the foreign country for an uninterrupted period that includes an entire tax year. Factors such as intention, duration, and nature of stay are considered when determining bona fide residence.

Foreign earned income exclusion

The primary benefit of Form 2555 is the ability to exclude a portion of foreign earned income from U.S. taxation. For the tax year 2022, the maximum exclusion amount is $108,700. This means that eligible taxpayers can exclude up to this amount from their taxable income, effectively reducing their tax liability. Any income earned above this limit will still be subject to regular taxation.

Housing exclusion or deduction

In addition to the foreign earned income exclusion, Form 2555 allows for a housing exclusion or deduction. This provision accounts for the higher cost of living in certain foreign countries. Taxpayers can exclude or deduct qualifying housing expenses that exceed a specific base amount determined by the IRS.

Benefits of Form 2555

Here are some of the benefits of filing Form 2555:

-

Exclusion of foreign earned income: The primary benefit of Form 2555 is the ability to exclude a certain amount of foreign earned income from U.S. taxation. As of 2021, the maximum exclusion amount is $108,700 per qualifying individual. This means that if you qualify, you can exclude up to this amount from your taxable income, effectively reducing your tax liability.

-

Reduced tax liability: By excluding foreign earned income, individuals who qualify for the FEIE can potentially reduce their overall tax liability. This can be particularly beneficial for individuals working in countries with lower tax rates than the United States.

-

Increased disposable income: By lowering your tax liability through the foreign earned income exclusion, you can have more disposable income available for savings, investments, or other financial goals. This can be advantageous for individuals living and working abroad, as it allows them to keep more of their earnings.

-

Tax savings for self-employed individuals: If you are self-employed or a freelancer working abroad, the FEIE can be especially valuable. You can exclude your net self-employment income from U.S. taxation, which can significantly reduce your tax obligations.

-

Incentive for foreign employment: The FEIE serves as an incentive for U.S. citizens or resident aliens to take up employment opportunities abroad. It encourages individuals to explore career opportunities outside the United States without being subject to double taxation on their foreign income.

-

Foreign housing exclusion: In addition to the foreign earned income exclusion, Form 2555 also allows for a foreign housing exclusion or deduction. This provision enables eligible taxpayers to exclude or deduct certain housing expenses incurred while living and working abroad, further reducing their tax liability.

Who Is Eligible To File Form 2555?

To be eligible to file Form 2555, you must meet certain requirements:

Foreign earned income: You must have earned income from a foreign country or countries. This can include wages, salary, self-employment income, or professional fees.

**Tax home in a foreign country: **You must have a tax home in a foreign country. Your tax home is generally considered to be the main place where you conduct your business or employment activities.

Bona fide residence test: You must meet the bona fide residence test, which requires you to be a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year (January 1 to December 31).

**Physical presence test: **Alternatively, if you don't meet the bona fide residence test, you may qualify under the physical presence test. This test requires you to be physically present in a foreign country or countries for at least 330 full days during a period of 12 consecutive months.

U.S. citizenship or resident alien status: You must be a U.S. citizen or a U.S. resident alien. Nonresident aliens cannot claim the Foreign Earned Income Exclusion.

How To Complete Form 2555: A Step-by-Step Guide

Here is a step-by-step guide to completing Form 2555:

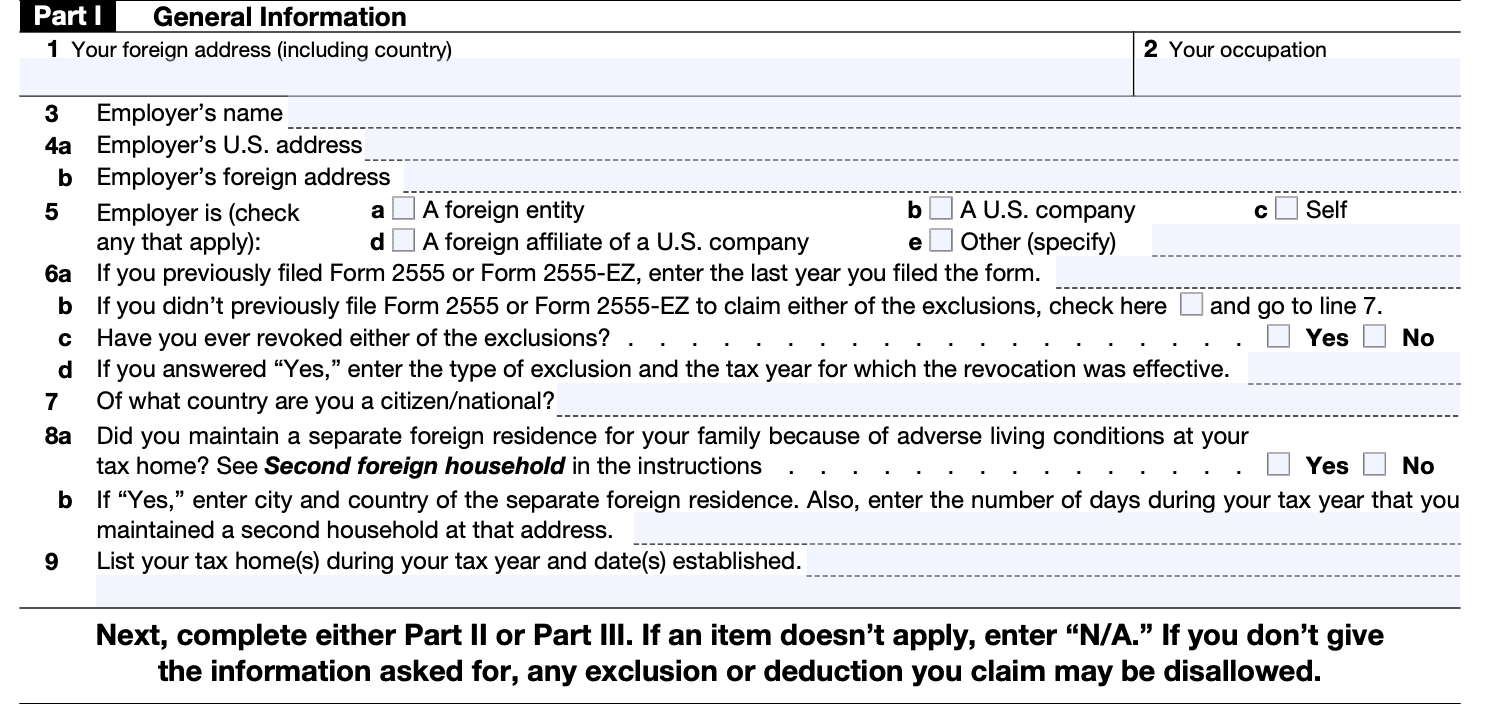

Step 1: Gather necessary information

Before starting the form, gather the following information:

- Personal information: Your name, Social Security number, and address

- Foreign earned income information: Details of your foreign earned income, including the countries where you earned it, the amounts, and the dates

- Foreign residency information: The dates of your foreign residency, including any trips back to the United States

- Housing expenses: If you are claiming the foreign housing exclusion or deduction, gather details of your housing expenses.

- Any other relevant financial information: This may include information on self-employment income, employer-provided housing, and any other deductions or exclusions you may be eligible for.

Step 2: Download Form 2555

You can download Form 2555 from the IRS website (www.irs.gov) or use tax software that supports this form.

Step 3: Provide personal information

Fill out your personal information at the top of Form 2555, including your name, Social Security number, and address.

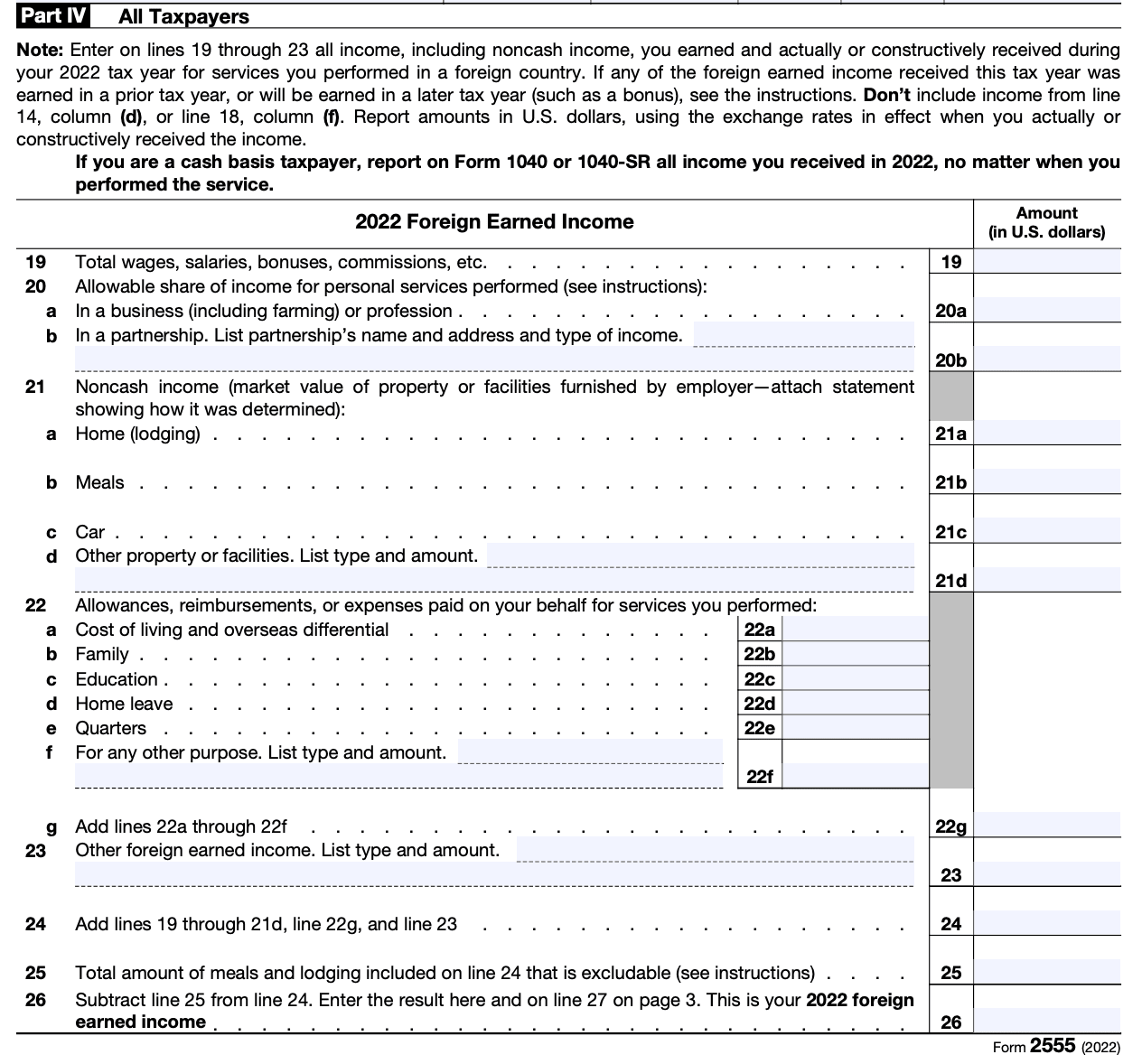

Step 4: Complete Part I - Foreign Earned Income

In Part I, you will report your foreign earned income. Provide details of the countries where you earned income, the dates of your foreign residency, and the amounts of your foreign earned income.

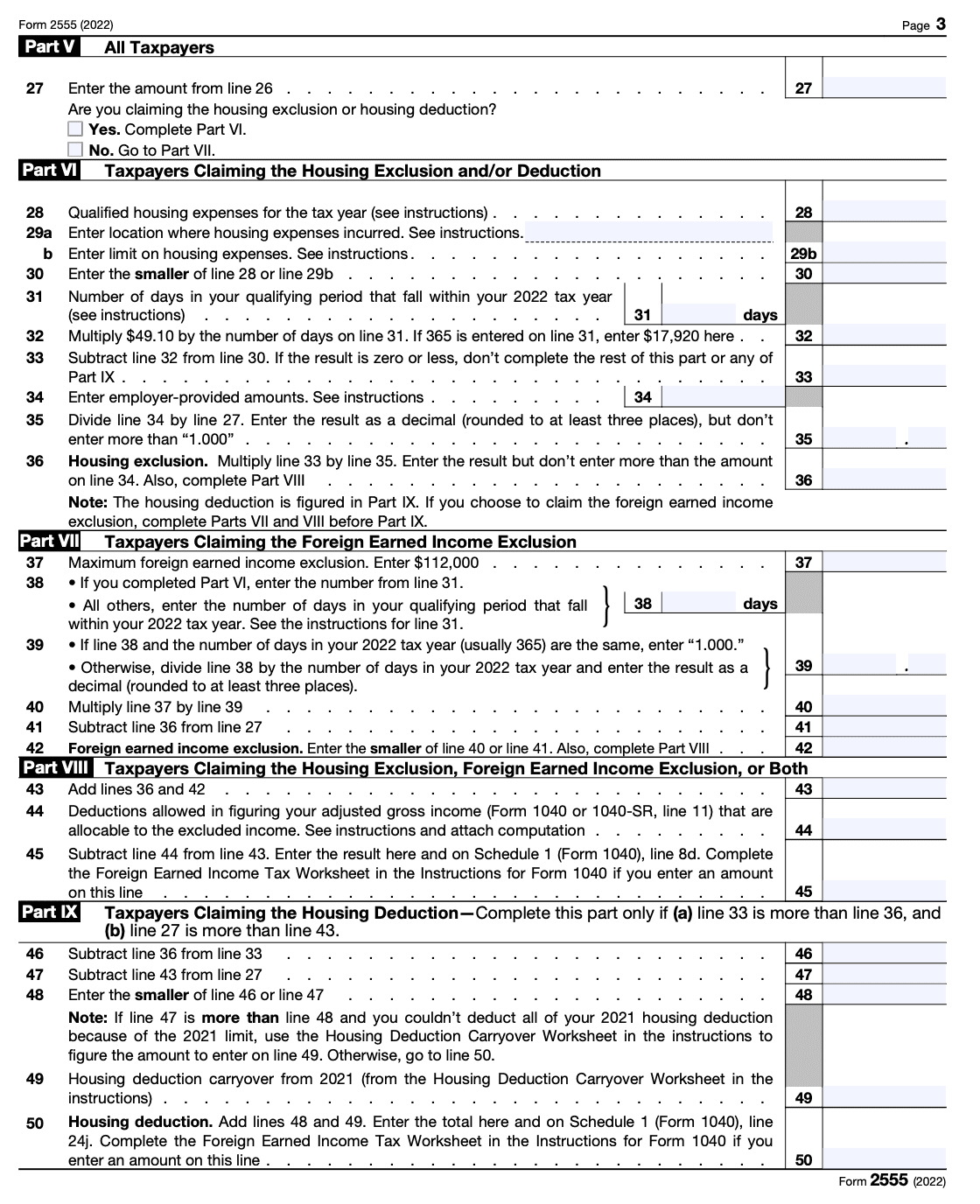

Step 5: Complete Part II - Exclusion/Deduction

In Part II, you will calculate the amount of your foreign earned income that can be excluded from your taxable income. You can choose to claim either the foreign earned income exclusion or the foreign housing deduction (or both).

a. Foreign earned income exclusion: Calculate the maximum exclusion amount based on the tax year. For the current year, refer to the IRS website or tax resources for the specific amount. Calculate the exclusion based on your foreign earned income and the maximum exclusion amount.

b. Foreign housing deduction: If you are claiming the foreign housing deduction, complete the necessary calculations using the instructions provided with the form.

Step 6: Complete Part III - Physical Presence Test or Bona Fide Residence Test

In Part III, you will need to determine your eligibility for the foreign earned income exclusion by meeting either the physical presence test or the bona fide residence test. Follow the instructions provided with the form to complete the appropriate test and provide the required information.

Step 7: Complete Part IV,V,VI,VII,VIII,IX - All Taxpayer Credits

If you are eligible for any tax credits related to your foreign income, complete Part IV accordingly.

Step 8: Sign and date the form

Review the completed form for accuracy and sign and date it. If you are married and filing jointly, your spouse will also need to sign the form.

Step 9: Attach supporting documents

Attach any required supporting documents to Form 2555. This may include copies of your foreign income statements, Form W-2, Form 1099, or any other relevant documents.

Step 10: File the form

File Form 2555 along with your tax return. If you are e-filing your tax return, follow the instructions provided by your tax software. If you are mailing a paper return, send it to the appropriate IRS address for your location.

Special Considerations When Filing Form 2555

When filing Form 2555, there are several special considerations to keep in mind. Here are some key points:

Eligibility: The FEIE is available to U.S. citizens and resident aliens who meet either the bona fide residence test or the physical presence test. Ensure that you qualify for one of these tests before filing Form 2555.

Filing status: You must generally file a separate Form 2555 for each eligible individual, even if you are married and filing a joint income tax return. However, there are certain exceptions, such as when both spouses have the same foreign tax home.

Foreign tax home: You must establish a tax home in a foreign country to claim the FEIE. This generally means having a regular place of business, employment, or post of duty in the foreign country. Your tax home is not necessarily the same as your residence or domicile.

Exclusion limits: The maximum amount of foreign earned income that can be excluded in 2023 is $108,700. If you are married and both spouses qualify for the FEIE, each spouse can claim the exclusion up to the limit, effectively doubling the total exclusion.

Housing exclusion or deduction: In addition to the FEIE, you may be eligible for the Foreign Housing Exclusion or Deduction. This can be claimed on Form 2555 if you paid for housing expenses that exceed a certain threshold. Be sure to complete the appropriate sections of the form if applicable.

Documentation: Keep detailed records of your foreign income, foreign taxes paid, and any other relevant documents to support your claim. It is important to maintain accurate records in case of an audit or further verification by the Internal Revenue Service (IRS).

Tax treaty benefits: If you are eligible for benefits under a tax treaty between the United States and the foreign country where you earned income, you may need to attach additional forms or schedules to your tax return. Review the specific requirements outlined in the tax treaty and consult with a tax professional if needed.

Deadline: Form 2555 is generally filed with your annual income tax return, which is due by the regular filing deadline (usually April 15) or any extension granted by the IRS. Make sure to file your tax return on time to avoid penalties and interest charges.

Filing Deadlines & Extensions on Form 2555

The filing deadlines and extensions for Form 2555 are as follows:

Original filing deadline: The original filing deadline for Form 2555 is generally the same as the regular tax return deadline, which is April 15 of the year following the tax year. However, if you are living and working abroad on the regular tax return due date, you automatically qualify for an extension.

Automatic extension: If you are a U.S. citizen or resident alien living and working abroad, you are granted an automatic extension until June 15 to file your tax return, including Form 2555. You don't need to file any additional forms or request this extension; it is granted automatically.

Additional extension: If you need more time beyond the automatic extension deadline of June 15th, you can file for an additional extension until October 15 by submitting Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This extension is for the tax return filing, but it also applies to Form 2555.

Common Mistakes To Avoid While Filing Form 2555

Here are some mistakes to avoid while filing Form 2555:

Incorrect or incomplete information: Ensure that you provide accurate and complete information on the form. This includes your personal details, foreign income sources, dates of residency, and other required information. Double-check all entries to avoid errors.

Filing under the wrong tax status: Make sure you understand your tax status and select the appropriate one when filing Form 2555. There are different options available, such as "bona fide resident" or "physical presence test," depending on your circumstances. Review the instructions and consult a tax professional if you're unsure.

Failure to meet the eligibility requirements: The foreign earned income exclusion has specific eligibility requirements related to residency and income earned abroad. Ensure that you meet these requirements before claiming the exclusion. For example, you must have a tax home in a foreign country and meet either the bona fide residence test or the physical presence test.

**Not keeping proper documentation: **Maintain accurate records and supporting documentation for your foreign earned income, residency, and any other relevant information. This includes documents such as tax returns, employment contracts, proof of residency, and travel records. Keeping organized records will help you accurately complete Form 2555 and support your claims, if necessary.

Late or missed filing deadlines: Pay attention to the deadlines for filing Form 2555. If you fail to file the form on time, you may lose the opportunity to claim the foreign earned income exclusion. Be aware of both the general tax filing deadline and any extensions available to you.

Forgetting to include all eligible income: Ensure that you include all eligible foreign earned income when completing Form 2555. This includes wages, self-employment income, and other forms of earned income. Review your income sources carefully to avoid overlooking any income that should be reported.

**Ignoring foreign tax credits: **The foreign earned income exclusion and foreign tax credits are two separate provisions. Depending on your circumstances, you may need to choose between these options or use both to optimize your tax situation. Consider consulting a tax professional to determine the most beneficial approach for your specific situation.

Inconsistent reporting across tax forms: Ensure consistency across different tax forms and schedules. Any discrepancies or conflicting information on your tax return may raise red flags and potentially trigger an audit. Take the time to review all related forms, such as Schedule C (for self-employment income) or Schedule A (for itemized deductions), to ensure consistency.

Failing to seek professional advice: Filing Form 2555 and navigating the complexities of international taxation can be challenging. If you have questions or are unsure about any aspect of the form, consider consulting a qualified tax professional or seeking guidance from the IRS to ensure accurate and compliant filing.

Conclusion

Form 2555 plays a crucial role in helping expatriates properly report their foreign earned income while ensuring they take advantage of the available tax benefits. Understanding the eligibility criteria and following the correct steps for completing the form is vital to avoid potential errors or penalties. It's always wise to consult a tax professional or utilize reliable tax software to ensure accurate reporting and adherence to the latest IRS regulations.

Navigating the complexities of foreign earned income taxation can be challenging, but with the right knowledge and resources, you can confidently fulfill your tax obligations as a global citizen. Stay informed, seek expert guidance when needed, and ensure your tax affairs are in order, allowing you to fully embrace the exciting opportunities that living and working abroad brings.