- IRS forms

- Form 13909

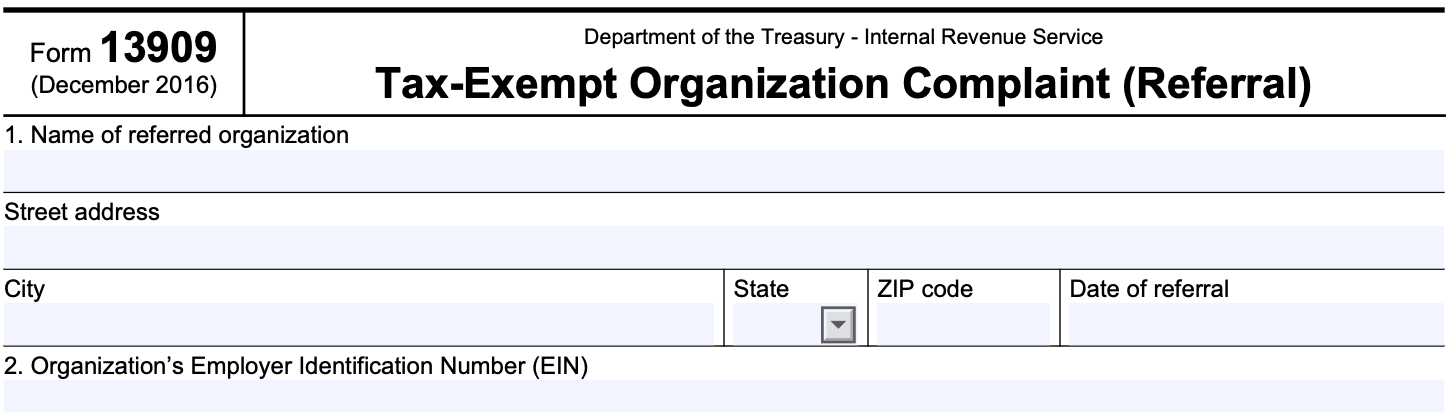

Form 13909: Tax-Exempt Organization Complaint (Referral)

Download Form 13909The Internal Revenue Service (IRS) acknowledges the significance of credible information and credible complaints. To address concerns related to tax exempt organizations, the IRS has introduced Form 13909, the tax exempt organization Complaint Referral.

Form 13909 serves as a tool for individuals like you to report suspected violations by tax exempt organizations. It provides a structured format to submit detailed and relevant information, enabling the IRS to conduct efficient and effective investigations into potential misconduct. Your willingness to come forward with accurate and specific data empowers the IRS to ensure that tax exempt organizations adhere to the rules and regulations governing their tax exempt status.

In this blog, we will delve into the significance of Form 13909 and how to file it correctly.

Purpose of Form 13909

The purpose of Form 13909 is to facilitate the reporting of potential violations or concerns related to tax exempt organizations. Individuals or whistleblowers who suspect that an organization is engaging in activities that may jeopardize its tax exempt status, or if they suspect (link: https://fincent.com/irs-tax-forms/form-14157-a text: fraudulent or abusive behavior), can use this form to provide information to the IRS.

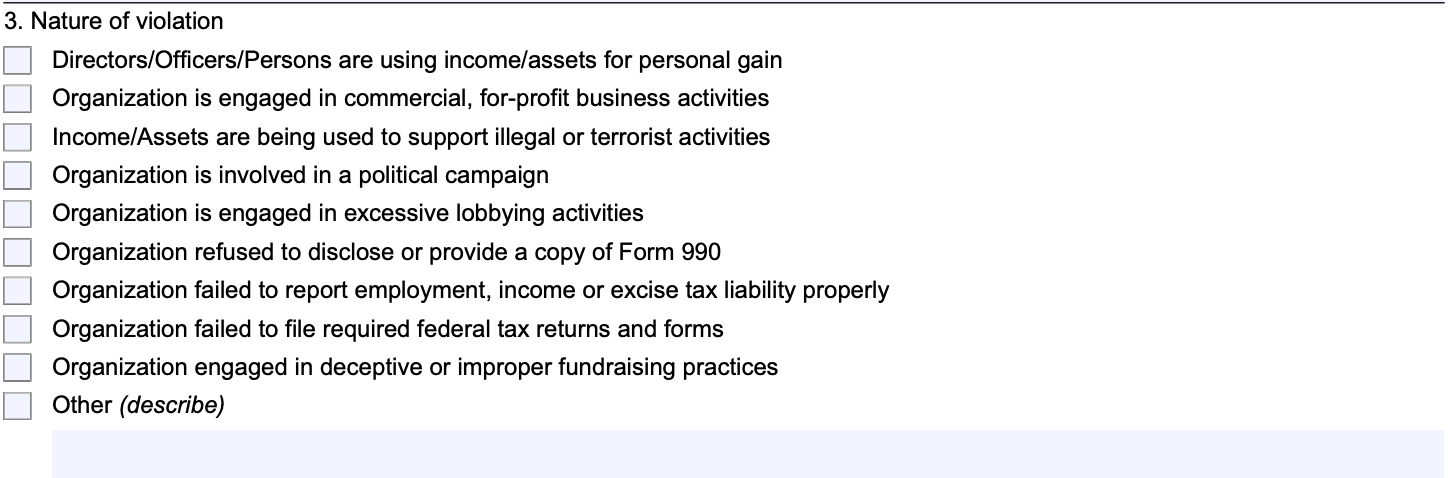

Some of the issues that can be reported on this form include:

- Improper political intervention or excessive lobbying by the tax exempt organization

- Unauthorized private benefit or excessive compensation to individuals associated with the organization

- Diversion of assets for non-charitable purposes

- Failure to meet the requirements of tax exempt status, such as engaging in prohibited activities

- Misuse of funds or other financial improprieties

- Violation of rules related to tax exempt status under Section 501(c) of the Internal Revenue Code

When submitting Form 13909, it is essential to provide as much specific and detailed information as possible about the alleged violations or misconduct. Including supporting evidence or documentation can strengthen the credibility of the complaint and assist the IRS in conducting a thorough investigation.

Benefits of Form 13909

As of September 2021, Form 13909 is used to report alleged (link: https://fincent.com/glossary/irs-scams text: tax fraud or abusive tax schemes) to the Internal Revenue Service (IRS) in the United States. Submitting this form can have several potential benefits:

- Report tax fraud: Form 13909 provides a way for individuals to report suspected tax fraud or abusive tax practices that they believe are being committed by individuals, businesses, or organizations.

- Anonymity: The form allows for anonymous reporting, which can be beneficial for individuals who fear retaliation or have concerns about their identity being disclosed.

- Contributing to enforcement efforts: By submitting Form 13909, individuals can assist the IRS in identifying and investigating potential cases of tax evasion or fraudulent activities, thereby contributing to overall tax compliance and enforcement efforts.

- Protection of taxpayer rights: The IRS takes tax fraud and abusive tax schemes seriously. Submitting Form 13909 helps protect honest taxpayers by ensuring that those who engage in fraudulent practices are identified and held accountable.

- Preventing revenue loss: Tax fraud and abusive tax schemes can result in significant revenue loss for the government. By reporting such activities, individuals can potentially help recover lost tax revenue.

- Encouraging tax compliance: Public reporting mechanisms like Form 13909 can act as a deterrent against tax fraud and abusive tax practices, as they signal that the IRS actively investigates and takes action against those who engage in such activities.

Who Is Eligible To File Form 13909?

Here are some key points to consider when filling out Form 13909:

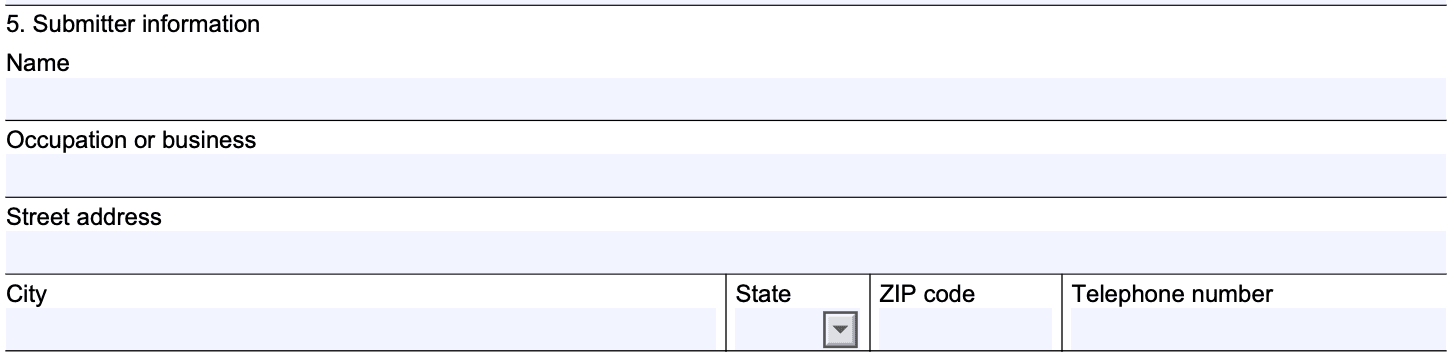

Anonymous reporting: The form allows for anonymous reporting, which means you can choose not to disclose your identity when submitting the information. However, providing your contact information can be helpful to the IRS in case they need to follow up or request additional details.

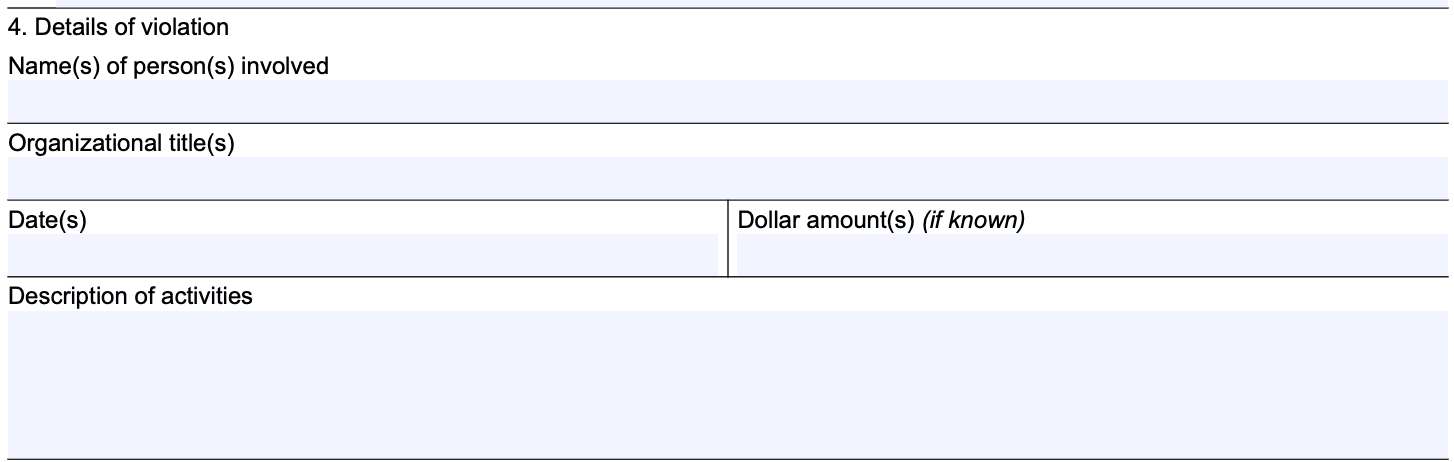

Detailed information: When completing Form 13909, you should provide as much detailed and accurate information as possible about the alleged tax violations or abusive tax practices. Include specifics such as names, addresses, taxpayer identification numbers, types of income, and any other relevant details.

Supporting evidence: While not required, providing supporting evidence or documentation can strengthen your report and assist the IRS in their investigation. Any relevant documents or records that you have should be submitted along with the form.

Unauthorized access or inspection: The form explicitly states that it is unlawful for any person to disclose to any other person that the IRS has received Form 13909 or the actions taken by the IRS as a result of the information provided. This is to protect the anonymity of the individual making the report.

To be eligible to submit Form 13909, you should have credible information regarding any of the above mentioned misconduct related to a tax exempt organization. Keep in mind that the form is for reporting serious allegations, so it is essential to provide detailed and accurate information to support your claim.

How To Complete Form 13909: A Step-by-Step Guide

Here is a general outline of the steps involved in completing (Form 13909):

Step 1: Obtain Form 13909

Visit the official IRS website (irs.gov) and search for "Form 13909." Download the form and ensure you have the most recent version.

Step 2: Gather information

Before filling out the form, gather all relevant information about the organization you are reporting. You will need details such as the name, address, and contact information of the organization in question. Additionally, gather any evidence or supporting documentation you have related to the alleged tax fraud or suspicious activity.

Step 4: Complete Part II - Organization information

Fill in the details of the organization you are reporting. Include the organization's name, address, and any other information you may have, such as their Employer Identification Number (EIN) if available.

Step 5: Complete Part II - Description of alleged violation

This is the critical section where you provide a detailed description of the alleged tax fraud or suspicious activity. Be as specific as possible and include all relevant information and dates. Attach any supporting documents that can help the IRS understand the nature of the violation better.

Step 3: Complete Part III - Complainant's information

In this section, provide your personal information as the complainant. This includes your name, address, phone number, and email address. The IRS might need to contact you for further information or clarification if required.

Step 6: Complete Part IV - Signature

Ensure you have reviewed the information provided, and it is accurate to the best of your knowledge. Sign and date the form in Part IV.

Step 7: Submit form

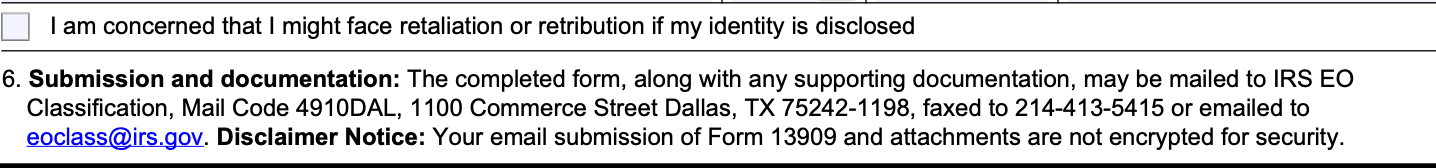

After completing the form and gathering all necessary documentation, you can submit it to the IRS. As of my last update, the form and supporting documents could be submitted by mail to the following address:

Step 8: Await response

After submitting the form, the IRS will review your complaint and take appropriate action. They may contact you for additional information if needed.

Special Considerations When Filing Form 13909

Here are some special considerations to keep in mind when filing Form 13909:

Accuracy: Ensure that all the information you provide on the form is accurate and complete. Any false statements could lead to penalties or legal consequences.

Supporting documentation: Include any relevant documentation or evidence to support your claim of tax fraud or abusive tax schemes. This can strengthen your case and aid the IRS in its investigation.

**Anonymity: **The form allows you to remain anonymous when reporting tax fraud. However, providing your contact information may be helpful if the IRS needs additional information or clarification.

Timeliness: File the form as soon as possible after discovering the alleged tax fraud or abusive tax scheme. Prompt reporting can help the IRS take appropriate action quickly.

**Understanding the allegation: **Make sure you have a clear understanding of what constitutes tax fraud or abusive tax schemes before filing the form. The IRS provides resources and definitions to help you identify potential violations.

Specifics: Be specific and provide as much detail as possible about the alleged fraud or abusive scheme. Include names, addresses, dates, amounts, and any other relevant information.

Protection against retaliation: The IRS prohibits employers from retaliating against employees who report tax fraud in good faith. If you are concerned about potential retaliation, you can find more information on the IRS website about whistleblower protections.

Professional advice: If you are unsure about the information to include or have questions about the process, consider seeking advice from a tax professional or legal counsel.

Remember that Form 13909 is a serious matter, and it is essential to provide accurate information. The IRS takes allegations of tax fraud seriously and will investigate the claims thoroughly.

How To File Form 13909: Offline/Online/E-filing

Offline filing

You could download the form from the IRS website and then fill it out manually. Once completed, you would mail the filled form and any supporting documentation to the IRS at the address provided in the instructions.

Online filing (e-filing)

As of September 2021,, the IRS did not have a direct online filing option for Form 13909. However, this may have changed, and they might have introduced an electronic filing system since then. It's best to check the official IRS website for any updates on electronic filing options.

E-filing via whistle-blower office (if applicable)

If you are reporting information related to tax non-compliance by an individual or business with substantial income or assets, you might be eligible for a whistleblower reward through the IRS Whistleblower Office. In such cases, there's a separate process for filing Form 211, Application for Award for Original Information.

This form is for individuals who want to claim a whistleblower reward for reporting tax-related fraud. The process for this is typically done through the IRS Whistleblower Office, and you can find relevant information on the IRS website.

Common Mistakes To Avoid While Filing Form 13909

When filing Form 13909, it's important to avoid common mistakes to ensure accurate and timely processing. Here are some mistakes to avoid:

Incomplete information: Ensure you provide all the required information on the form. Avoid leaving any fields blank or providing insufficient details that might hinder the IRS's ability to investigate the alleged violation.

**Vague or unclear allegations: **Be specific and clear in your description of the alleged violation. Avoid using general or ambiguous language that could make it challenging for the IRS to understand the issue.

Lack of supporting evidence: Provide any relevant documentation or evidence to support your allegations. Unsupported claims may be challenging for the IRS to act upon.

Filing for personal disputes: Form 13909 is intended to report issues related to tax exempt organizations, not for personal disputes or grievances against an individual or organization.

Multiple allegations without merit: Filing multiple frivolous or baseless allegations can undermine the credibility of your report and may lead the IRS to dismiss your claims entirely.

Not following the instructions: Carefully read and follow the instructions provided with Form 13909. Failure to do so could result in errors or omissions that may delay or hinder the investigation process.

**Missing contact information: **Ensure that you provide accurate contact information so that the IRS can get in touch with you if additional information or clarification is needed.

Filing anonymously when unnecessary: While the IRS allows anonymous submissions, providing your contact information can help the IRS gather additional details if required.

Delay in reporting: If you become aware of a potential violation, it's essential to report it promptly. Delaying the submission may allow the issue to worsen or make it more challenging for the IRS to take appropriate action.

Submitting false information: Providing false information on Form 13909 is a serious offense and can result in penalties. Make sure all the information you provide is accurate to the best of your knowledge.

Conclusion

The purpose of Form 13909 is to provide a means for concerned individuals to report potential misconduct or non-compliance within tax exempt organizations. The information gathered through this form plays a crucial role in maintaining the integrity of the tax exempt sector and upholding the public's trust in these organizations.

The purpose of Form 13909 is to provide a means for concerned individuals to report potential misconduct or non-compliance within tax exempt organizations. The information gathered through this form plays a crucial role in maintaining the integrity of the tax exempt sector and upholding the public's trust in these organizations.

In summary, Form 13909 plays a critical role in maintaining the trust and credibility of tax exempt organizations. It empowers individuals to act as responsible citizens and contribute to the proper functioning of the nonprofit sector, ultimately benefiting the public and society as a whole.