- IRS forms

- Form 1310

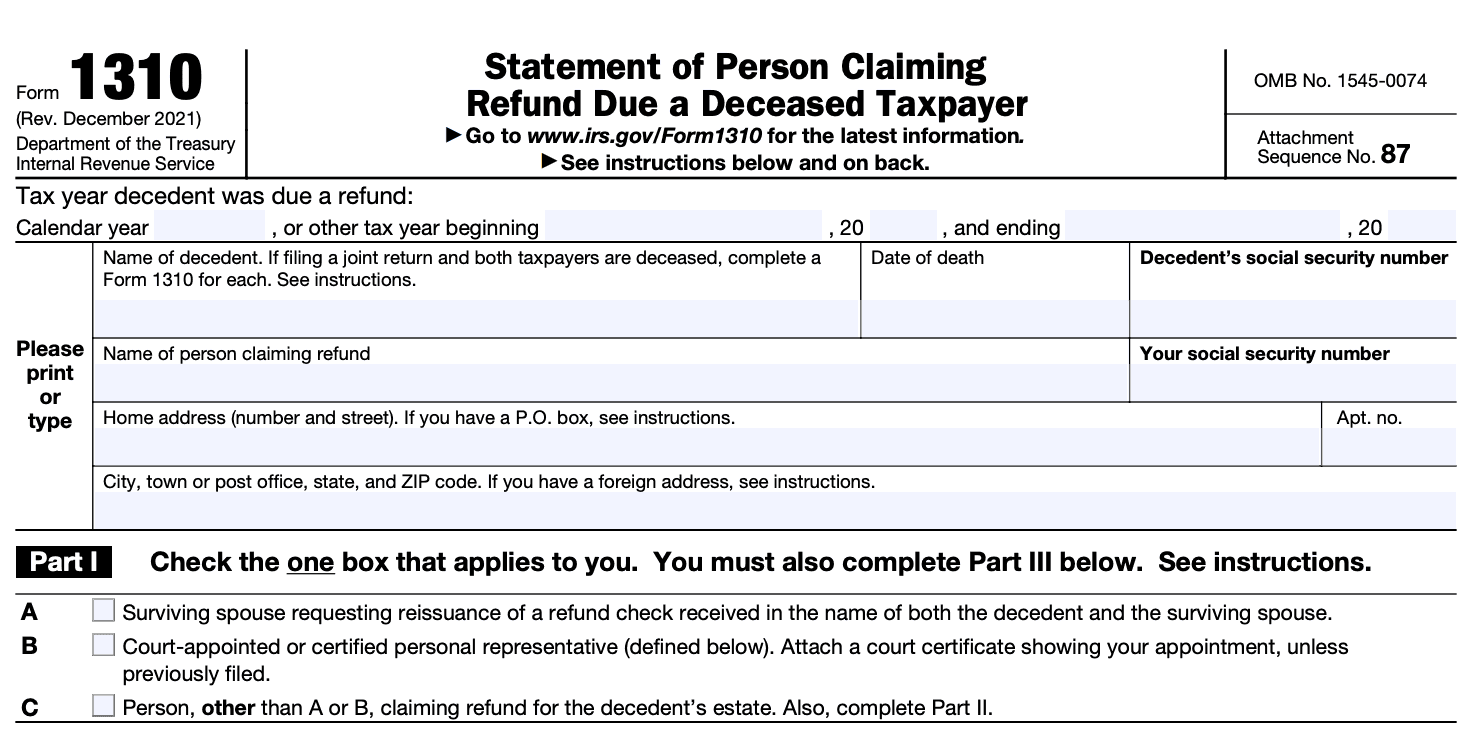

Form 1310: Statement of Person Claiming Refund Due a Deceased Taxpayer

Download Form 1310Dealing with the passing of a loved one is undoubtedly a difficult and emotional time. Unfortunately, there are still important matters to attend to, including the deceased taxpayer's tax affairs. The Internal Revenue Service (IRS) recognizes this and provides a specific form to address the issue of refunds owed to a deceased taxpayer.

Form 1310 is a document provided by the IRS for individuals who are entitled to claim a refund owed to a deceased taxpayer. This form is necessary to establish the legal authority of the claimant and ensure that the refund reaches the rightful person or entity. It serves as a statement of the claimant's relationship to the deceased taxpayer, confirming their eligibility to receive the refund on their behalf.

In this blog post, we will delve into Form 1310, the Statement of Person Claiming Refund Due a Deceased Taxpayer, and explore its purpose, eligibility criteria, and how to properly complete and submit it.

Purpose of Form 1310

When a taxpayer passes away before receiving a tax refund to which they were entitled, the refund can still be claimed and issued to the appropriate person or entity. Form 1310 serves as a declaration by the individual claiming the refund on behalf of the deceased taxpayer, stating that they are legally entitled to do so.

The form requires the claimant to provide information about the deceased taxpayer, including their name, Social Security number, and date of death. It also requires the claimant to state their relationship to the deceased taxpayer and provide their own identifying information.

By completing and submitting Form 1310, the claimant asserts their right to the refund and ensures that it is directed to the appropriate recipient. This form helps the IRS verify the claimant's eligibility to receive the refund and prevents potential issues or disputes regarding the distribution of funds.

Benefits of Form 1310

The form serves several benefits and purposes, including:

Claiming tax refunds: The primary purpose of Form 1310 is to allow the executor, administrator, or other authorized person to claim a refund on behalf of a deceased taxpayer. This form ensures that any tax refund owed to the deceased individual is properly distributed and claimed by the appropriate person.

Facilitating communication with the IRS: By completing Form 1310, the authorized person can effectively communicate with the Internal Revenue Service (IRS) regarding the refund claim for the deceased taxpayer. The form provides necessary information about the taxpayer, their date of death, and the claimant's relationship to the deceased.

Avoiding refund delays: Filing Form 1310 helps prevent delays in processing the refund claim. Without this form, the IRS may require additional documentation or evidence to validate the claimant's authority to request the refund. Providing the required information on Form 1310 streamlines the process and minimizes the likelihood of unnecessary delays.

Proper distribution of refunds: Form 1310 ensures that the tax refund is distributed to the appropriate party according to the deceased taxpayer's estate plan or the laws of intestate succession if there is no will. This helps prevent any disputes or confusion regarding the refund's rightful recipient and promotes a fair and orderly distribution of assets.

Clarifying taxpayer's filing status: In certain cases, the deceased taxpayer may have been married but filed taxes separately. Form 1310 helps clarify the taxpayer's filing status, ensuring that the refund is handled correctly based on the applicable tax laws and regulations.

Who Is Eligible To File Form 1310?

The following individuals may be eligible to file Form 1310:

Executor or administrator: If you are the court-appointed executor or administrator of the deceased taxpayer's estate, you can file Form 1310 to claim a refund on behalf of the deceased.

Surviving spouse: If you were the deceased taxpayer's spouse at the time of their death and you're not required to file a joint return, you may be eligible to file Form 1310.

Personal representative: If you're the personal representative designated by the deceased taxpayer, such as a trustee or other legally appointed representative, you can file Form 1310.

Legal representative: If you're an attorney, CPA, or enrolled agent representing the estate of the deceased taxpayer, you can file Form 1310 on their behalf.

Next of kin: In some cases, the next of kin or a family member responsible for the deceased taxpayer's affairs may be eligible to file Form 1310 to claim a refund.

How To Complete Form 1310: A Step-by-Step Guide

Here is a step-by-step guide to completing Form 1310:

Step 1: Obtain the form

You can download Form 1310, titled "Statement of Person Claiming Refund Due a Deceased Taxpayer," from the official website of the Internal Revenue Service (IRS). You can also request a copy by calling the IRS or visiting a local IRS office.

Step 2: Provide taxpayer information

Enter the taxpayer's information in Part I of the form. This includes the deceased taxpayer's name, Social Security number, and date of death. Fill in the executor's or administrator's name, address, and relationship to the deceased.

Step 3: Check the appropriate box

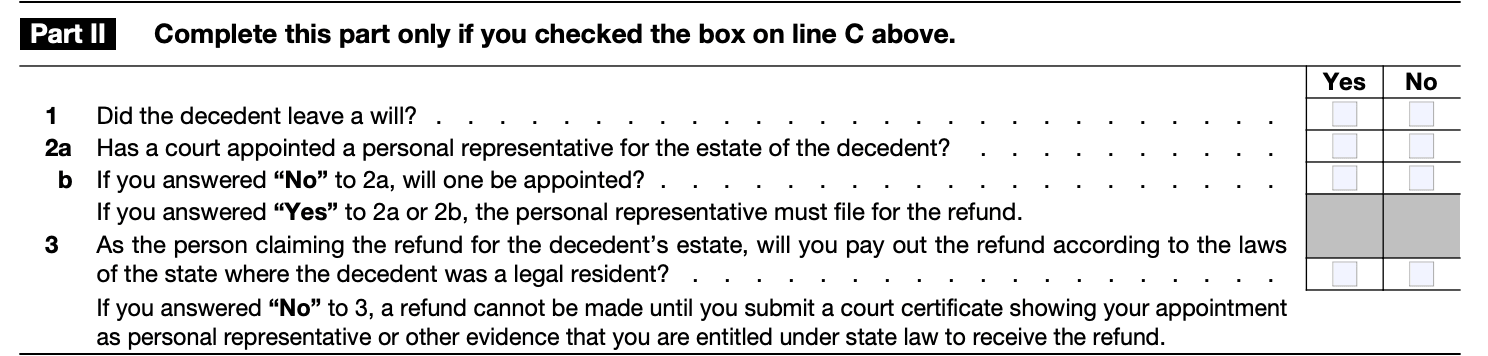

In Part II of the form, check the box that applies to your situation. There are two options:

Box A: You are the executor or administrator appointed by the court, and no personal representative has been appointed.

Box B: You are the personal representative appointed by the court.

Select the box that accurately reflects your role in the estate.

Step 4: Complete the refund information

Provide details about the refund you are claiming on behalf of the deceased taxpayer. Include the tax year for which the refund is claimed, the type of tax return filed (e.g., Form 1040), and the amount of the refund being claimed.

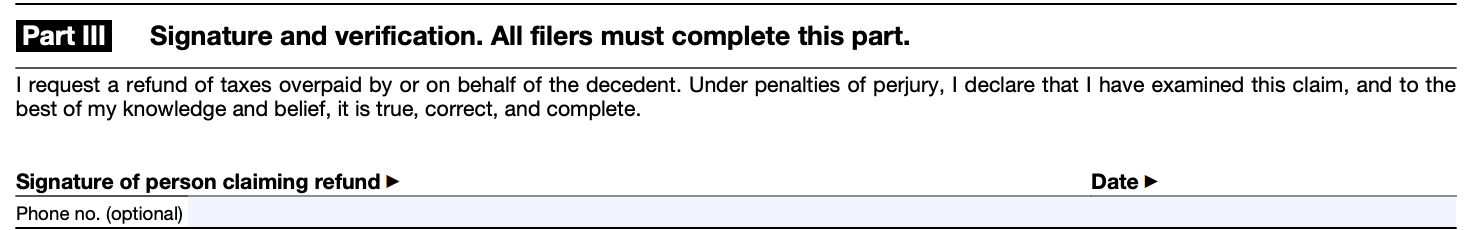

Step 5: Sign and date the form

In Part III, sign and date the form. If you are filing as the executor or administrator, you should sign on behalf of the estate. If you are filing as the personal representative, sign in your capacity as the personal representative.

Step 6: Attach supporting documentation

Attach a copy of the death certificate or a statement from the funeral director to substantiate the taxpayer's death. You should also include any other necessary documents, such as a copy of the will, letters testamentary, or other court documents that establish your authority to act on behalf of the deceased taxpayer.

Step 7: Submit the form

Make a copy of the completed form and all supporting documentation for your records. Mail the original form and attachments to the appropriate IRS processing center. The address is provided in the instructions accompanying Form 1310.

Special Considerations When Filing Form 1310

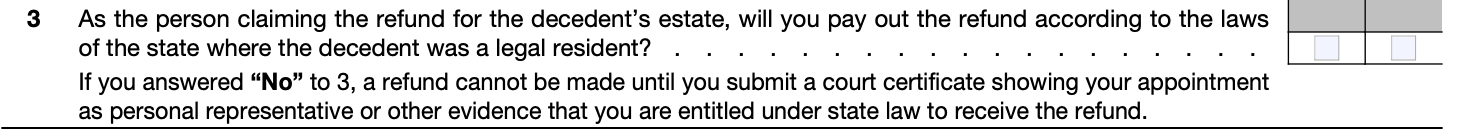

Form 1310 is used by an individual who is claiming a refund on behalf of a deceased taxpayer. Here are some important points to consider:

Eligibility: You can file Form 1310 if you are the legal representative of the deceased taxpayer's estate, the surviving spouse, or any person who is entitled to receive the refund.

Required documentation: You must attach a copy of the death certificate or a statement from the funeral director to substantiate the taxpayer's death. Additionally, you may need to include documentation that shows your authority to act on behalf of the deceased taxpayer, such as letters testamentary, letters of administration, or a court order.

Properly completing the form: Ensure that you accurately provide the deceased taxpayer's information, including their name, Social Security number, and date of death. Fill out your own information and indicate your relationship to the deceased taxpayer. Provide your contact information, including your address and phone number.

Signature requirements: If you are the legal representative of the estate, you must sign the form in your capacity as the representative. If you are a surviving spouse claiming the refund, sign the form as the surviving spouse. Other individuals claiming the refund must also sign the form. Unsigned or improperly signed forms may delay the processing of the refund.

Timing: Form 1310 should be filed as part of the deceased taxpayer's final tax return or as an amended return, depending on the circumstances. Make sure to file the form within the applicable time limits for claiming a refund. Generally, a refund claim must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later.

Mailing address: The mailing address for filing Form 1310 can vary depending on your location. Refer to the instructions provided with the form or visit the IRS website for the most up-to-date information on where to send the form.

Filing Deadlines & Extensions on Form 1310

Regarding filing deadlines and extensions for Form 1310, here's the general information:

Filing deadline

The filing deadline for Form 1310 is generally the same as the filing deadline for the individual income tax return (Form 1040). As of my knowledge cutoff in September 2021, the regular due date for filing individual income tax returns is April 15th.

However, please note that tax deadlines can change, and it's important to consult the official IRS website or a qualified tax professional for the most up-to-date information.

Extension of time

If you need more time to file Form 1310, you can request an extension by filing Form 4868, which is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form grants you an additional six months to file your tax return, including Form 1310.

It's important to remember that an extension of time to file your tax return does not grant an extension of time to pay any taxes owed. If you anticipate owing taxes, you should estimate the amount and submit payment with your extension request to avoid potential penalties and interest.

Common Mistakes To Avoid While Filing Form 1310

When filing Form 1310, it's important to be aware of common mistakes that can lead to delays or errors in processing. Here are some mistakes to avoid when completing Form 1310:

Incomplete or inaccurate information: Ensure that all sections of Form 1310 are completed accurately and legibly. Provide accurate details about the deceased taxpayer, the claimant, and any other relevant information requested.

Missing or incorrect taxpayer identification number (TIN): Include the correct TIN for both the deceased taxpayer and the claimant. For individuals, this is usually the Social Security number (SSN).

Failure to attach required documentation: Form 1310 may require supporting documents, such as a copy of the death certificate or legal documentation establishing your relationship to the deceased taxpayer. Make sure you include all necessary attachments as specified in the form's instructions.

Incorrect filing status: Choose the correct filing status for the deceased taxpayer based on their circumstances at the time of death. Common filing statuses include single, married filing jointly, married filing separately, or qualifying widow(er) with dependent child.

Inaccurate refund calculations: Double-check all calculations related to the refund amount being claimed. Ensure that the calculations are accurate and supported by appropriate documentation.

Failure to sign and date the form: Both the claimant and preparer (if applicable) must sign and date Form 1310. Unsigned or undated forms may be considered incomplete and cause delays in processing.

Late filing: File Form 1310 within the required time frame. Generally, this form should be filed within three years from the due date of the original return or two years from the date the tax was paid, whichever is later.

Using outdated or incorrect form version: Make sure you are using the most recent version of Form 1310 available from the Internal Revenue Service (IRS) website. Using an outdated form may lead to errors or rejection.

Not seeking professional assistance when needed: If you are uncertain about how to correctly fill out Form 1310 or have complex tax situations, consider seeking guidance from a tax professional or contacting the IRS directly for assistance.

Conclusion

Form 1310 serves as a vital tool for individuals or entities eligible to claim a refund on behalf of a deceased taxpayer. By providing the necessary information and supporting documentation, claimants can establish their right to receive the refund and ensure it reaches the intended recipient.

While the process may seem complex during an emotionally challenging time, properly completing and submitting Form 1310 will help facilitate the resolution of the deceased taxpayer's tax matters and provide closure to their financial affairs.

If you find yourself in such a situation, it is advisable to consult a tax professional or reach out to the IRS for further guidance to ensure compliance with all requirements.

FAQs:

Who needs to file Form 1310?

Anyone claiming a federal tax refund on behalf of a deceased taxpayer, unless they are filing a joint return as the surviving spouse or are a court-appointed representative with the court certificate attached to the return.

When should Form 1310 be filed?

Form 1310 should be filed as soon as possible after the taxpayer's death if a refund is due. It can be filed with the final tax return or separately.

What happens if Form 1310 is not filed?

If Form 1310 is not filed when required, the IRS may not issue the refund due to the deceased taxpayer, delaying the process until the proper documentation is provided.

Can multiple people file Form 1310 for the same deceased taxpayer?

No, only one person should file Form 1310 to claim the refund. Disputes between potential claimants may need to be resolved through the courts.

How long does it take to process Form 1310?

Processing times can vary, but it typically takes several weeks for the IRS to process Form 1310 and issue a refund.

What if the deceased taxpayer owes taxes?

If the deceased taxpayer owes taxes, the amount due must be paid before any refund can be issued. The tax return should reflect the balance due or the refund amount after accounting for any taxes owed.

How do I check the status of a refund claimed with Form 1310?

You can check the status of a refund using the IRS "Where's My Refund?" tool on their website or by contacting the IRS directly.

Is Form 1310 required if the deceased taxpayer had no refund due?

No, Form 1310 is only necessary if a refund is due to the deceased taxpayer.

What if I am a surviving spouse filing a joint return?

If you are a surviving spouse filing a joint return with the deceased taxpayer, you do not need to file Form 1310. The refund will be issued in both names.

Can I claim a refund for a prior tax year using Form 1310?

Yes, you can use Form 1310 to claim a refund for a prior tax year if the deceased taxpayer was owed a refund for that year.

What if the deceased taxpayer had no estate or will?

If there is no estate or will, the refund can still be claimed by a surviving spouse or next of kin using Form 1310, provided they meet the criteria for claiming the refund.

Can I fax Form 1310 to the IRS?

Generally, Form 1310 should be mailed to the IRS. Faxing is not a standard method for submitting this form.

What if I make a mistake on Form 1310?

If you realize a mistake after submitting Form 1310, you should file an amended form or contact the IRS for guidance on how to correct the error.

Do I need to attach a death certificate to Form 1310?

A death certificate is not typically required when filing Form 1310, but you should be prepared to provide one if requested by the IRS.

How do I find the correct mailing address for Form 1310?

The mailing address for Form 1310 depends on the state where the deceased taxpayer lived. Check the instructions for the relevant tax return form (e.g., Form 1040) for the appropriate IRS service center address.

What if there are multiple beneficiaries?

Only one person should file Form 1310 to claim the refund. The person filing the form should be agreed upon by all beneficiaries, or the issue may need to be resolved through legal channels.

Can Form 1310 be used to claim refunds for state taxes?

No, Form 1310 is specifically for federal tax refunds. Each state has its own process for claiming state tax refunds on behalf of deceased taxpayers.

How do I know if the IRS received my Form 1310?

You can confirm receipt by tracking the delivery of your mailed form or by contacting the IRS to inquire about the status.

Is there a deadline for filing Form 1310?

There is no specific deadline for filing Form 1310, but it should be filed as soon as possible after the taxpayer’s death to expedite the refund process.

What if the refund check is issued in the deceased taxpayer’s name?

If the refund check is issued in the deceased taxpayer’s name, you will need to follow the IRS procedures for cashing or depositing the check, which may involve presenting Form 1310 or other documentation.

Can I file Form 1310 online?

Currently, Form 1310 must be filed by mail. It is not available for electronic filing.

What if the deceased taxpayer’s final return was already filed without Form 1310?

If the final return was filed without Form 1310, you can submit Form 1310 separately to claim the refund. Ensure you include all necessary information and reference the previously filed return.

Can I use Form 1310 to claim refunds from amended returns?

Yes, you can use Form 1310 to claim refunds from amended returns filed on behalf of the deceased taxpayer.

Does Form 1310 apply to both individual and joint returns?

Form 1310 is typically used for individual returns. If you are a surviving spouse filing a joint return, you do not need to file Form 1310.

What if the deceased taxpayer had a business?

If the deceased taxpayer had a business and a refund is due related to business taxes, you may need additional forms or documentation to claim the refund. Consult the IRS for specific guidance.

Can Form 1310 be used for refunds from social security or other federal benefits?

No, Form 1310 is only for federal income tax refunds. Other types of refunds, such as from social security benefits, have different procedures.