- IRS forms

- Form 1120

Form 1120: U.S. Corporation Income Tax Return

Download Form 1120When you start a new business, you take on a world of new responsibilities! One of these is filing Form 1120 (U.S. Corporate Income Tax Return) - a six-page form that needs to be filled with a lot of financial information.

Let’s take a look at what Form 1120 is, who needs to file this document, how to file it, and what business information is needed to fill in the form.

It's worth noting that as per the new (link: https://fincent.com/how-to/cut-taxes-without-itemizing text: Tax Cuts) and Jobs Act, all corporate income tax returns will be taxed at a fixed rate of 21%, regardless of their incomes. For the financial year 2020, the deadline for filing is set as April 15, 2021.

What Is IRS Form 1120?

IRS Form 1120 is a special document for American corporations to report their credits, deductions, losses, gains, and income. It also helps you find out how much income tax your business needs to pay, as per the IRS.

Companies getting taxed as (link: https://fincent.com/blog/everything-you-need-to-know-about-c-corporations text: C corporations) have to file their tax returns with IRS Form 1120. It is like a C corp equivalent to your personal (link: https://fincent.com/irs-tax-forms/form-1040 text: tax Form 1040).

Unlike other company structures, companies taxed as C corporations pay a flat 21% corporate tax rate on the taxable income. In contrast, (link: https://fincent.com/blog/everything-you-need-to-know-about-sole-proprietorship text: sole proprietorships) and (link: https://fincent.com/glossary/limited-liability-partnership-llp text: partnerships) are considered pass-through entities that do not pay entity-level taxes.

Form 1120 is also known as the U.S. Corporation Income Tax Return.

Specific organizational structures have designated tax forms, including:

- Form 1120-C for cooperative associations like farmers' co-ops.

- Form 1120-F for corporations based outside the U.S.

- Form 1120-H for managing entities of condominiums, residential real estates, and timeshare associations that opt for homeowners association treatment.

- Form 1120-L for life insurance companies.

- Form 1120-POL for political organizations.

- (link: https://nlmain.fincent.com/irs-tax-forms/form-1120-s text: Form 1120-S) for S corporations.

Who Files Tax Form 1120?

All American domestic companies, including C corporations and Limited Liability Companies (LLCs) that choose to be taxed as corporations are required to submit Tax Form 1120 every year of whether they have income. However corporations, with tax status under section 501 and those going through bankruptcy proceedings also have this obligation.

This tax form is crucial for businesses that opt for corporate tax status, which also entails (link: https://fincent.com/irs-tax-forms/form-8832 text: filing Form 8832) and attaching it to Form 1120. Partnership LLCs use (link: https://fincent.com/irs-tax-forms/form-1065 text: tax form 1065) for filing while (link: https://fincent.com/blog/how-do-single-member-llcs-work-a-complete-guide text: single member LLCs) typically do so by including it in the owners tax return. For farming corporations and foreign owned domestic disregarded entities Form 1120 is used to report income or losses. If applicable they must also attach (link: https://fincent.com/irs-tax-forms/form-5472 text: Form 5472).

Moreover corporations with operations or capital gains and losses need to complete schedules like Schedule N or D of Form 1120 respectively. These forms and other necessary documents can be accessed through the IRS' Forms and Publications tool.

A corporation, often referred to as a C corp is legally distinct, from its owners. This separation protects shareholders from liability related to the companys debts and actions. If a corporation anticipates owing $500 or more in taxes it should make use of Form 1120-W to estimate the amount and then make payments based on the liability after completing Form 1120.

Smaller corporations may not have to concern themselves with these forms. However once a business becomes incorporated these filing requirements become aspects of their tax responsibilities.

How To Complete Filing Form 1120: Step-by-Step Instructions

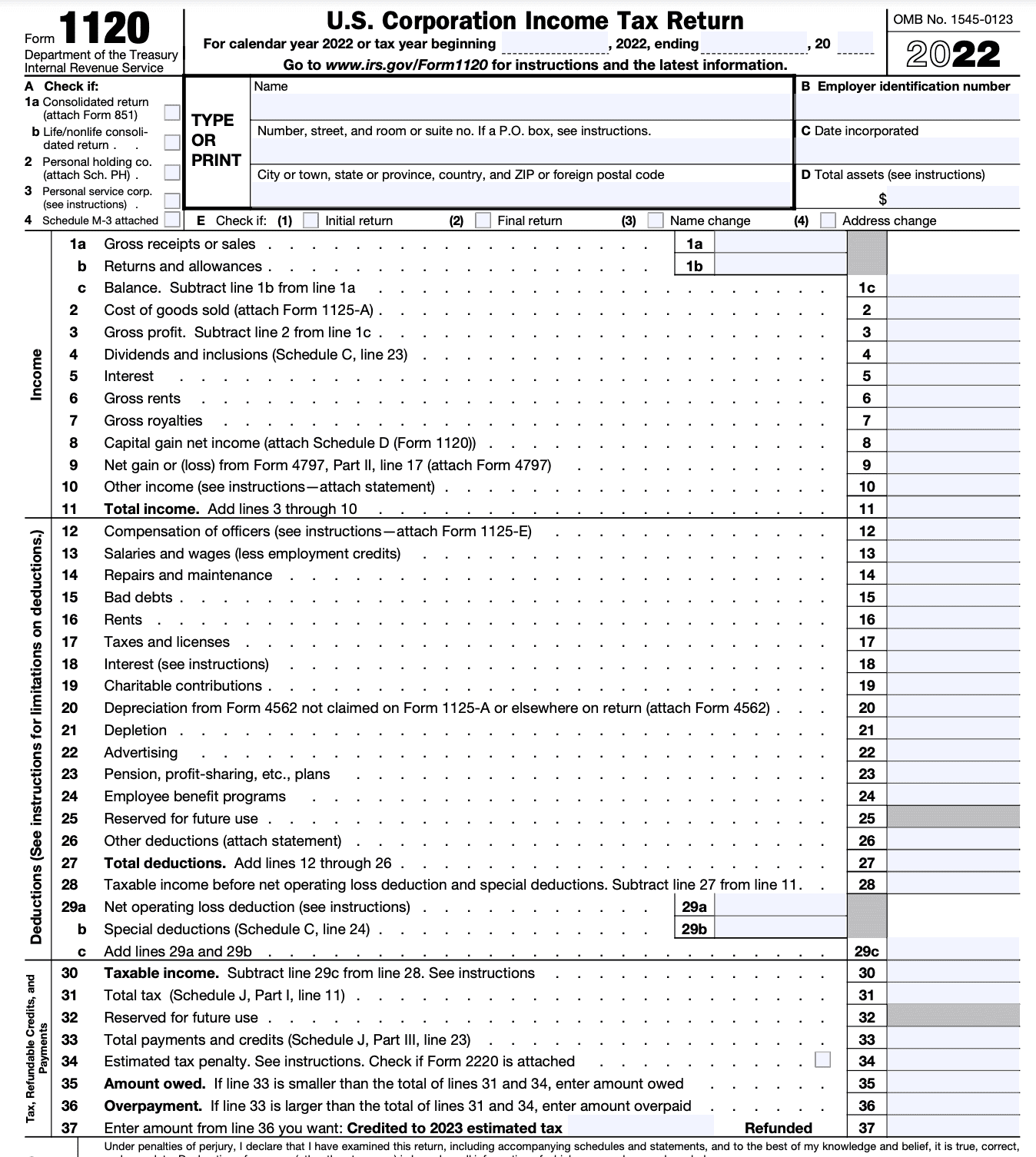

Form 1120 comprises six pages. The first page has four preliminary sections, which are:

- Basic corporation information

- Income

- Deductions

- Tax, refundable credits, and payments

The other five pages deal with more detailed information, like your dividends, special deductions, (link: https://fincent.com/glossary/balance-sheet text: balance sheet), and other accounting information.

Before you file Form 1120, make sure you sign and date the bottom of the first page.

Here are the instructions on how to fill Form 1120:

Step 1: Gather all the details you need

As a good practice, you should create a checklist of the information you should have on hand, whether you’re filing Form 1120 yourself or your accountant is taking care of it.

- (link: https://fincent.com/glossary/employer-identification-number text: Employer Identification Number (EIN))

- The date you incorporated the business

- Total assets held by your company

- Gross receipts *(link: https://fincent.com/glossary/cost-of-goods-sold text: Cost of goods sold (COGS))

- Total income

- Dividends earned

- Interest earned

- Royalties earned

- (link: https://fincent.com/glossary/capital-gains text: Capital gains)

- Tax deductions

Step 2: Build your tax team

Gather a tax team that should include a corporate tax professional and corporate tax filing software. It’s infamously long-winded, so engaging a tax professional would help you complete the form faster.

As an owner of a C corporation, you cannot use a self-employment tax software program. Rather, you need software that has options for C corporations, like TurboTax, or a complete (link: https://fincent.com/ text: bookkeeping solution) like Fincent.

Step 3: Fill out most of Page 1

The first page of 1120 asks for basic information, which gives the IRS a glance at your company’s tax situation. You can fill out most of this with the help of the information stored in your accounting software.

Step 4: Fill out the Form 1120 Schedules

As per the circumstances, it may be necessary to attach additional forms, also known as schedules. Here are the schedules you need to fill out along with filing tax Form 1120:

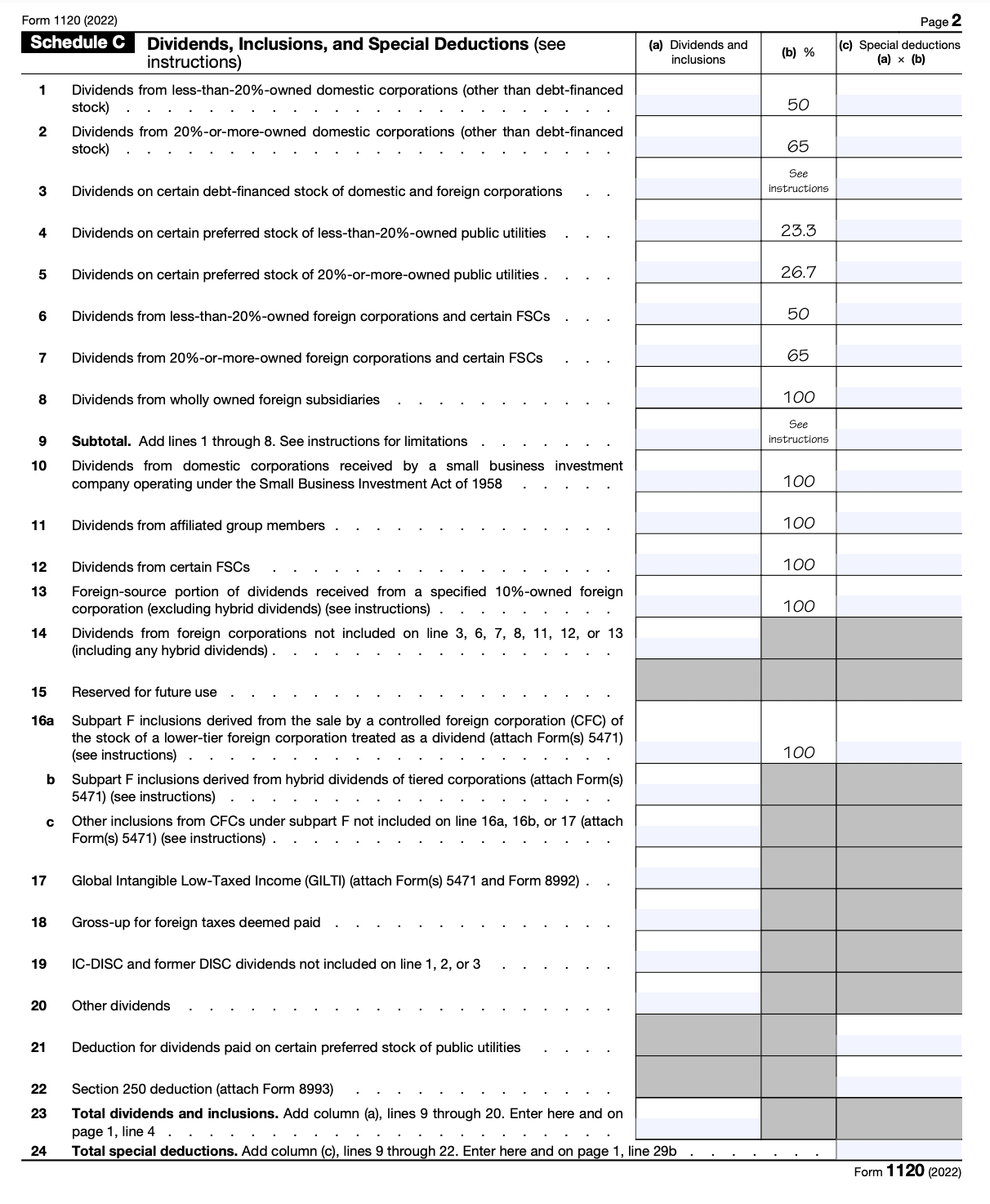

Schedule C: Dividends, Inclusions, and Special Deductions

Schedule C of Form 1120 is where a C corporation reports dividends received from both foreign and domestic subsidiaries, including income from debt-financed and public utility stock, as well as earnings from affiliates and other entities. It's also used to report less common types of income. Sum up all dividends and similar income on Line 23 and enumerate any special deductions on Line 24. Much like individuals, C corporations can invest in stocks of other companies and must declare the dividend income from these investments annually on Schedule C.

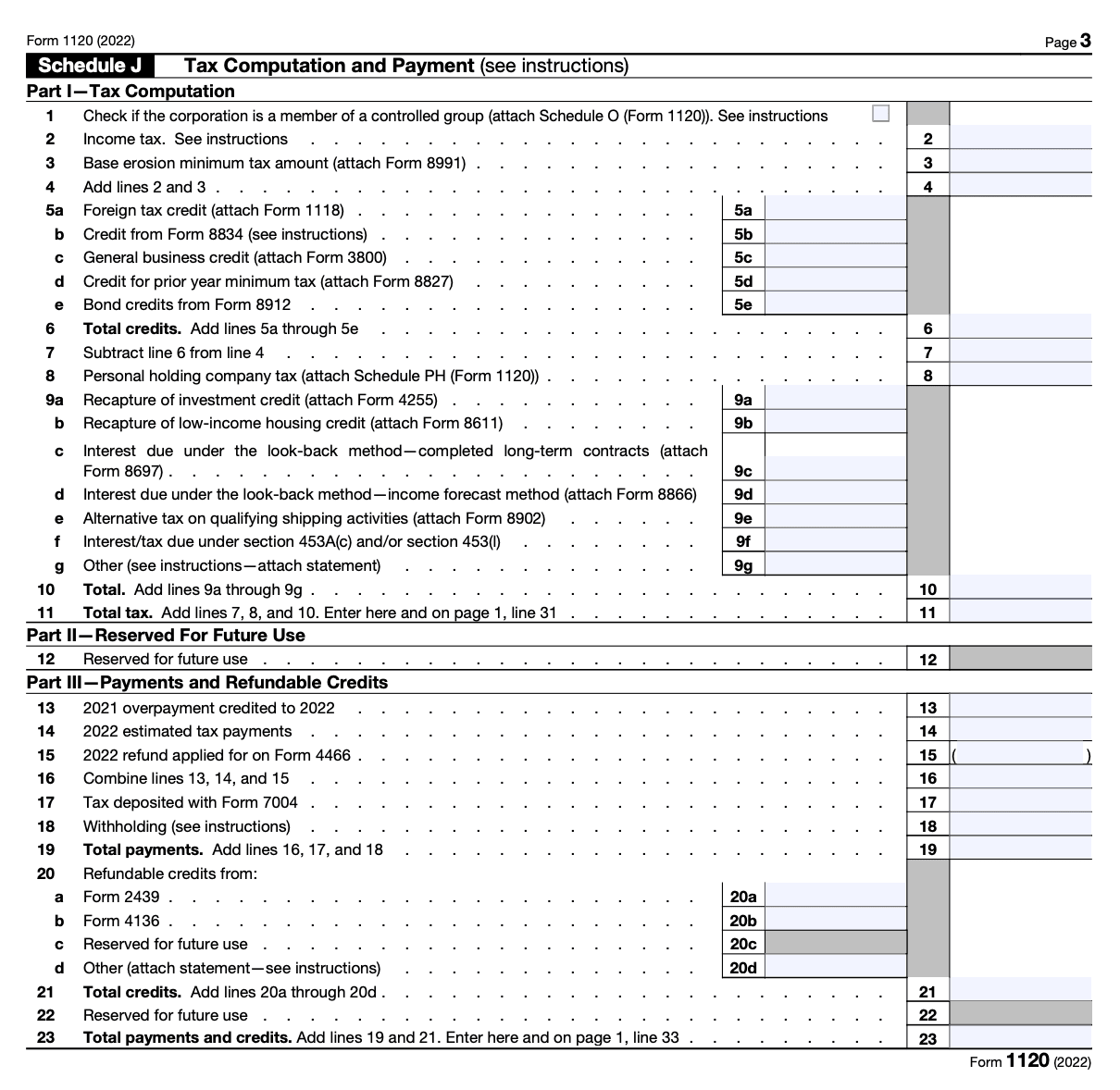

Schedule J: Tax Computation

This section calculates your tax liabilities by taking in information on your business tax credits and estimated tax payments. Tax credits are termed as dollar-for-dollar reductions on your tax liability.

Part I—Tax Computation

- Indicate if the corporation is a member of a controlled group and include Schedule O. Calculate income tax due, add any base erosion minimum tax from Form 8991.

- Include tax credits such as foreign tax credits from (link: https://fincent.com/blog/taxation-for-non-u-s-entrepreneurs#form-1118-foreign-tax-credit-corporations text: Form 1118), credits from Form 8834, general business credit from Form 3800, and others, then subtract these from the total tax.

Part II—Reserved For Future Use

- Line 12 is reserved for future updates or tax code changes and currently holds no entries.

- No additional point as this part is reserved for future use and has no current application.

Part III—Payments and Refundable Credits

- Document any overpayment credited from the previous year, estimated tax payments made for the current year, and refunds applied for on Form 4466. Combine these with any tax deposited with (link: https://fincent.com/irs-tax-forms/form-7004#:~:text=Form%207004%2C%20officially%20known%20as,to%20file%20certain%20tax%20returns. text: Form 7004).

- Report withholdings and total up all payments, adding refundable credits from forms such as Form 2439 and Form 4136 to finalize the total payments and credits for the year.

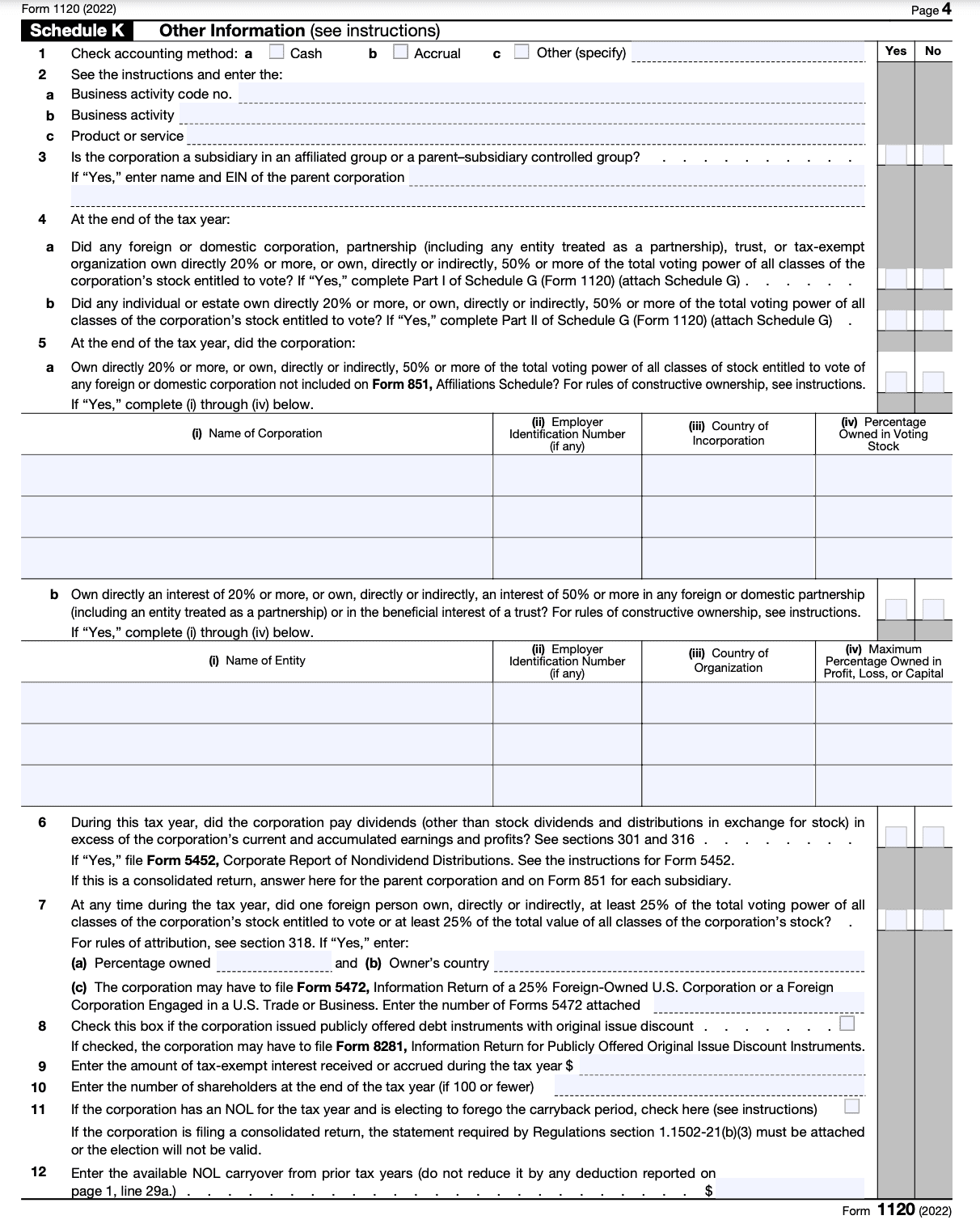

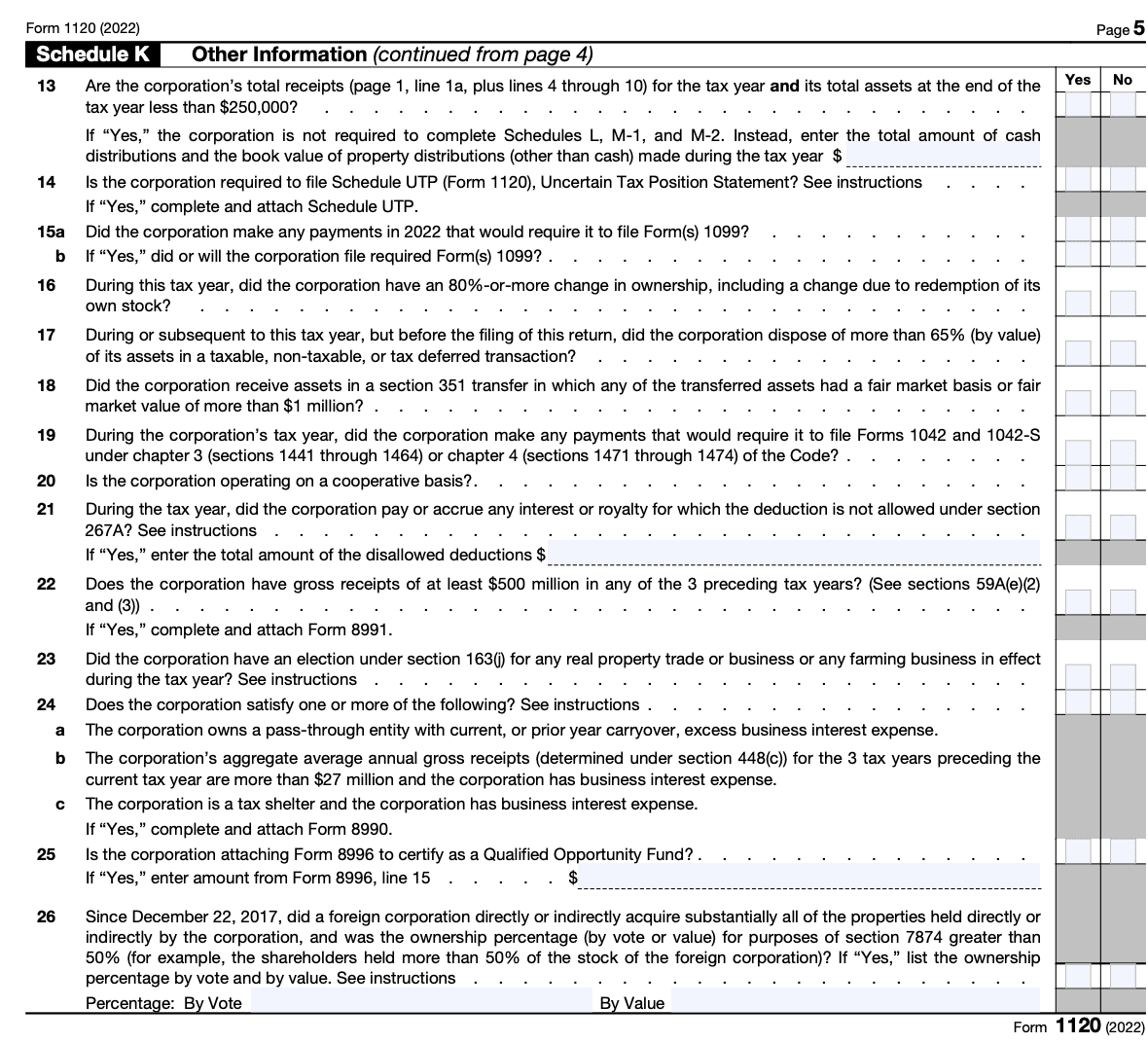

Schedule K

In Schedule K, you need to input additional details about the owners, along with their holdings in other companies. Fill out this section if your corporation's total receipts and end-of-year assets exceed $250,000. Ensure that the details provided match the corporation's official records.

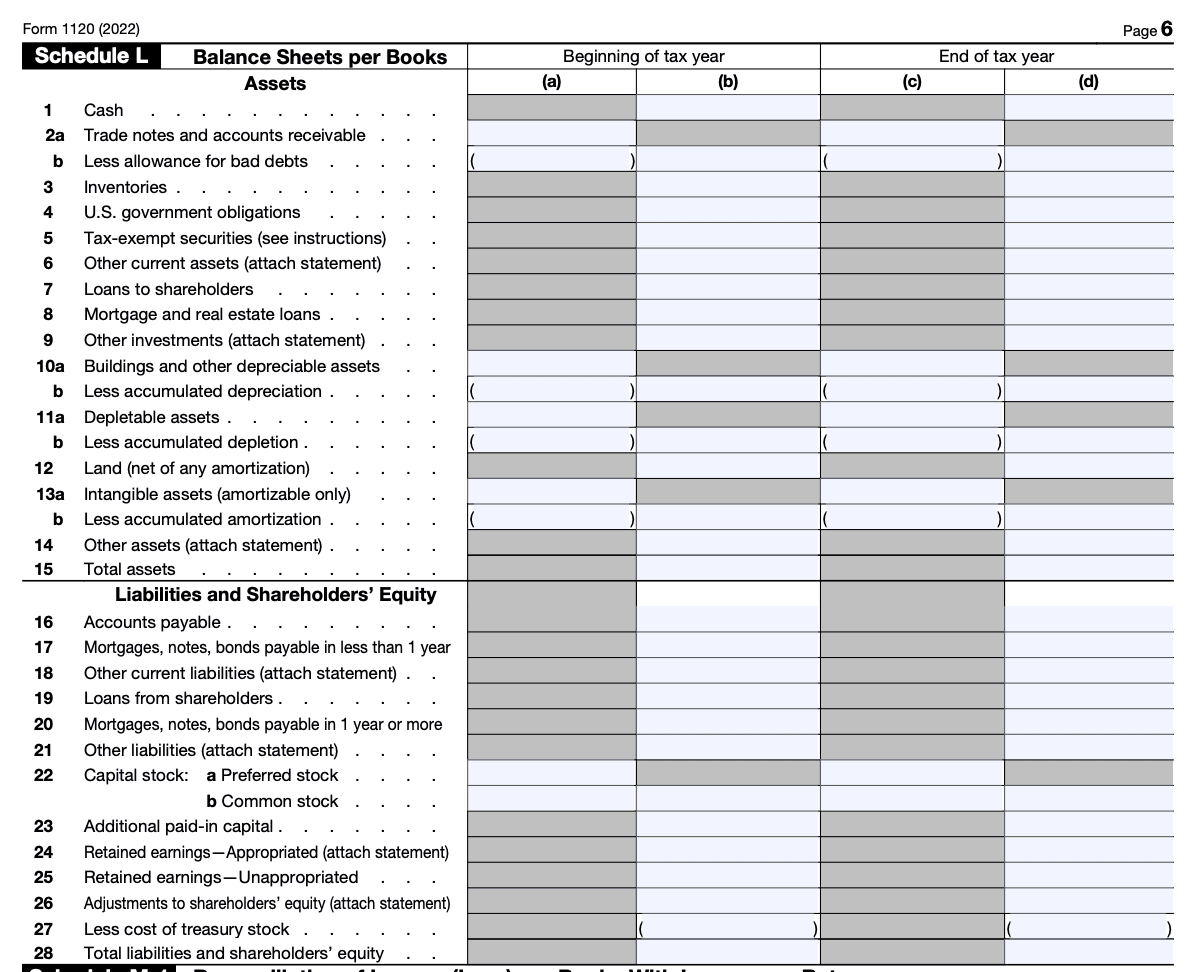

Schedule L

Schedule L recreates your company’s balance sheet per your books. You can open the balance sheet (year-end) in your accounting software to fill out this section.

Schedule 1 tax form is is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings

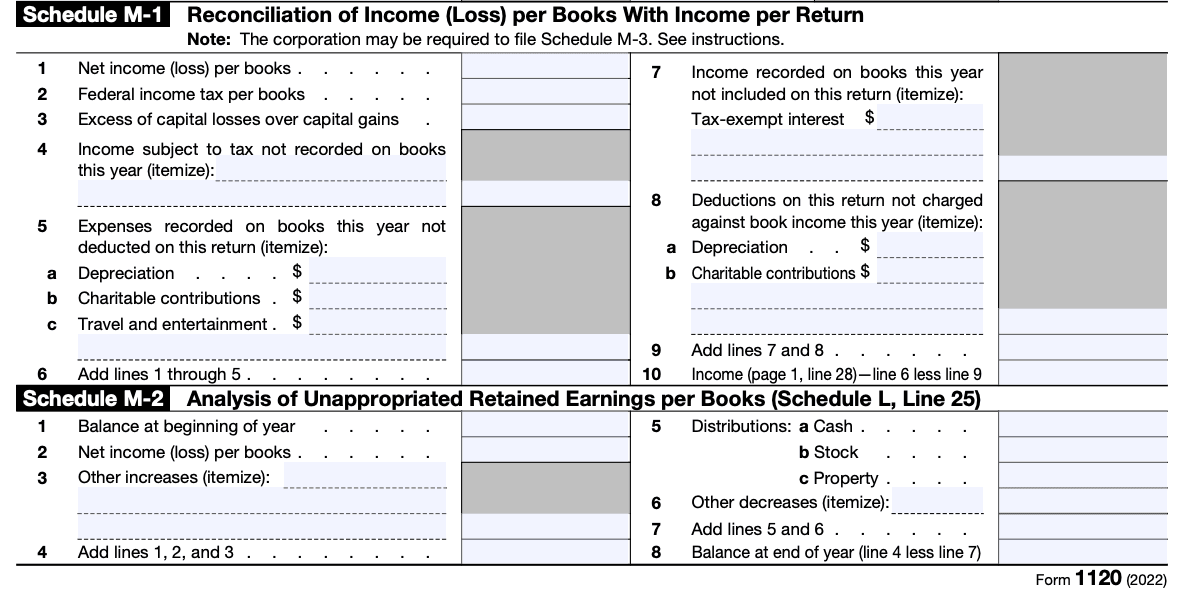

Schedules M-1 and M-2

As the IRS calculates some expenses, like depreciation, differently from the (link: https://fincent.com/glossary/generally-accepted-accounting-principles text: Generally Accepted Accounting Principles (GAAP)), Schedules M-1 and M-2 help explain to the IRS the differences between your statements for book and tax purposes.

Step 5: Look for other required schedules

Step 5: Look for other required schedules

Depending on specific business activities at your organization, you may have to fill up and attach a few more forms. Some common attachments include:

- Form 1125-A: For companies with a cost of goods sold

- Form 1125-E: To enlist compensations with gross receipts of $500,000 or more

- Form 4797: For the sale of any business property

- Form 4563: For calculating depreciation and amortization

- Schedule D: For capital gains and losses

Step 6: Return to Page 1

Once you are done with the rest of Form 1120 and the required schedules, you’re ready to hit the finish button on the first page.

6. Review and file your return

You’re done! After reviewing your return along with your tax team, you can e-file Form 1120 using the tax software or have your tax preparer do it.

Where To File Form 1120

You can either file Form 1120 online or by mail. However, we recommend submitting it online as it’s faster, easier, and cuts back on paperwork. Also, if your corporation has reportings of $10 million or more in assets, you are required to file online.

When Is Form 1120 Due or Deadlines?

The due date for Form 1120 depends on its fiscal year. Many C corporations use a calendar year, while others start their year in July or October.

Usually, C corporations must file their Form 1120 by the 15th day of the 4th month after the end of its tax year.

Assembling the Tax Returns

For accurate processing of the corporation's tax return, all accompanying schedules and forms should be affixed in a specific sequence directly after the 6th page of Form 1120. The order is as follows:

- Schedule N (Form 1120)

- Schedule D (Form 1120)

- Schedule O (Form 1120)

- Form 8050

- Form 1125-A

- Form 4136

- Form 8941

- Form 3800

- Any additional schedules, arranged alphabetically

- Any additional forms, sorted numerically

- Any supporting documentation and additional attachments

Fill out all required fields on Form 1120; refrain from using phrases like “See Attached” or “Available Upon Request” in lieu of actual details. Should the provided space on the forms or schedules prove insufficient, append extra sheets that mirror the format of the official forms.

Supporting documents should be organized in the same sequence as the schedules or forms they correlate with and are to be attached at the end. Ensure the corporation's name and Employer Identification Number (EIN) are on each supplementary statement or attachment.

##Who Must Sign

The return needs to be signed and dated by:

- The president, vice president, treasurer, assistant treasurer, chief accounting officer, or any other authorized corporate officer.

- If filed by a receiver, trustee, or assignee, the fiduciary must sign instead of a corporate officer. Accompany the return with a court order or instructions authorizing signing by the receiver or trustee in bankruptcy.

For paid preparers, they should:

- Sign the return in the preparer's signature area.

- Include their (link: https://fincent.com/how-to/renew-your-irs-ptin-annually text: Preparer Tax Identification Number (PTIN)).

- Give a copy of the return to the taxpayer.

If the corporation wishes to permit the IRS to discuss its 2022 tax return with the preparer, they should check the “Yes” box in the signature area. This authorization applies only to the individual preparer, allowing them to provide missing information, inquire about the return's processing, and respond to certain IRS notices.

This authorization will automatically expire by the due date for filing the 2023 tax return (excluding extensions). If further authorization or revocation is needed, refer to (link: https://www.irs.gov/pub/irs-pdf/p947.pdf text: Pub. 947), Practice Before the IRS and Power of Attorney.

##Interest and Penalties for IRS tax form 1120

If the corporation receives a notice regarding penalties post filing, sending an explanation to the IRS is necessary for assessing reasonable-cause criteria. Avoid attaching explanations with the return upon filing.

Interest: Charges apply for late tax payments, extensions notwithstanding. Interest also applies to penalties for late filing, negligence, fraud, substantial valuation misstatements, substantial understatements of tax, and reportable transaction understatements, from the due date (including extensions) until payment. The interest rate is determined under section 6621.

Late Filing: A penalty of 5% of the unpaid tax per month (or part) the return is late, up to 25% of the unpaid tax, applies for corporations not filing by the due date, including extensions. A minimum penalty of the tax due or $450 is imposed if the return is over 60 days late, waived only for reasonable cause.

Late Payment: Corporations not paying tax on time may face a penalty of ½ of 1% of the unpaid tax per month (or part), up to 25% of the unpaid tax.

Trust Fund Recovery Penalty: The trust fund recovery penalty may be levied on individuals found by the IRS responsible for collecting, accounting, or paying over these taxes, and who willfully neglected to do so. The penalty equals the entire unpaid trust fund tax. These taxes are typically reported on various tax return forms:

- (link: https://fincent.com/irs-tax-forms/form-720 text: Form 720: Quarterly Federal Excise Tax Return)

- (link: https://fincent.com/irs-tax-forms/form-941 text: Form 941: Employer's QUARTERLY Federal Tax Return)

- (link: https://fincent.com/irs-tax-forms/form-943 text: Form 943: Employer's Annual Federal Tax Return for Agricultural Employees)

- (link: https://fincent.com/irs-tax-forms/form-944 text: Form 944: Employer's ANNUAL Federal Tax Return)

- Form 945: Annual Return of Withheld Federal Income Tax

Conclusion

Tax keeping can be an added burden to your ongoing business processes, and failure to submit even one form may lead to penalties from the IRS. Additionally, allocating existing resources for this activity may take a toll on your productivity and efficiency during tax season.

That's why it is recommended to hire a (link: https://fincent.com text: professional bookkeeping service) like Fincent.

Fincent is designed especially for creative businesses. We have a unique process that is rightly suited to manage the finances of entrepreneurs, sole proprietors, or freelancers working in the creative services field.

FAQs

What is the difference between a 1040 and 1120?

Form 1040 is used by individuals to file their personal income taxes, while Form 1120 is used by C corporations to file their corporate tax returns. The key difference lies in the type of taxpayer: 1040 is for individuals, and 1120 is for corporations.

What should you do if you make a Form 1120 mistake?

To correct a mistake on Form 1120:

- File Form 1120X, "Amended U.S. Corporation Income Tax Return."

- Do this within three years of the date you filed the original Form 1120.

- Include your business name, address, EIN, and revise income, deductions, payments, and credits.

- Attach any relevant schedules or forms if changes affect income, deductions, or credits.

- Provide an explanation for each change.

- Sign and submit the amended return.

Professional Advice: If a corporation has a short tax year and must file 10 or more different types of returns (such as income tax, employment tax, excise tax, or information returns) during the calendar year that encompasses the short tax year, it is obligated to file those returns electronically.