- IRS forms

- Form 11-C

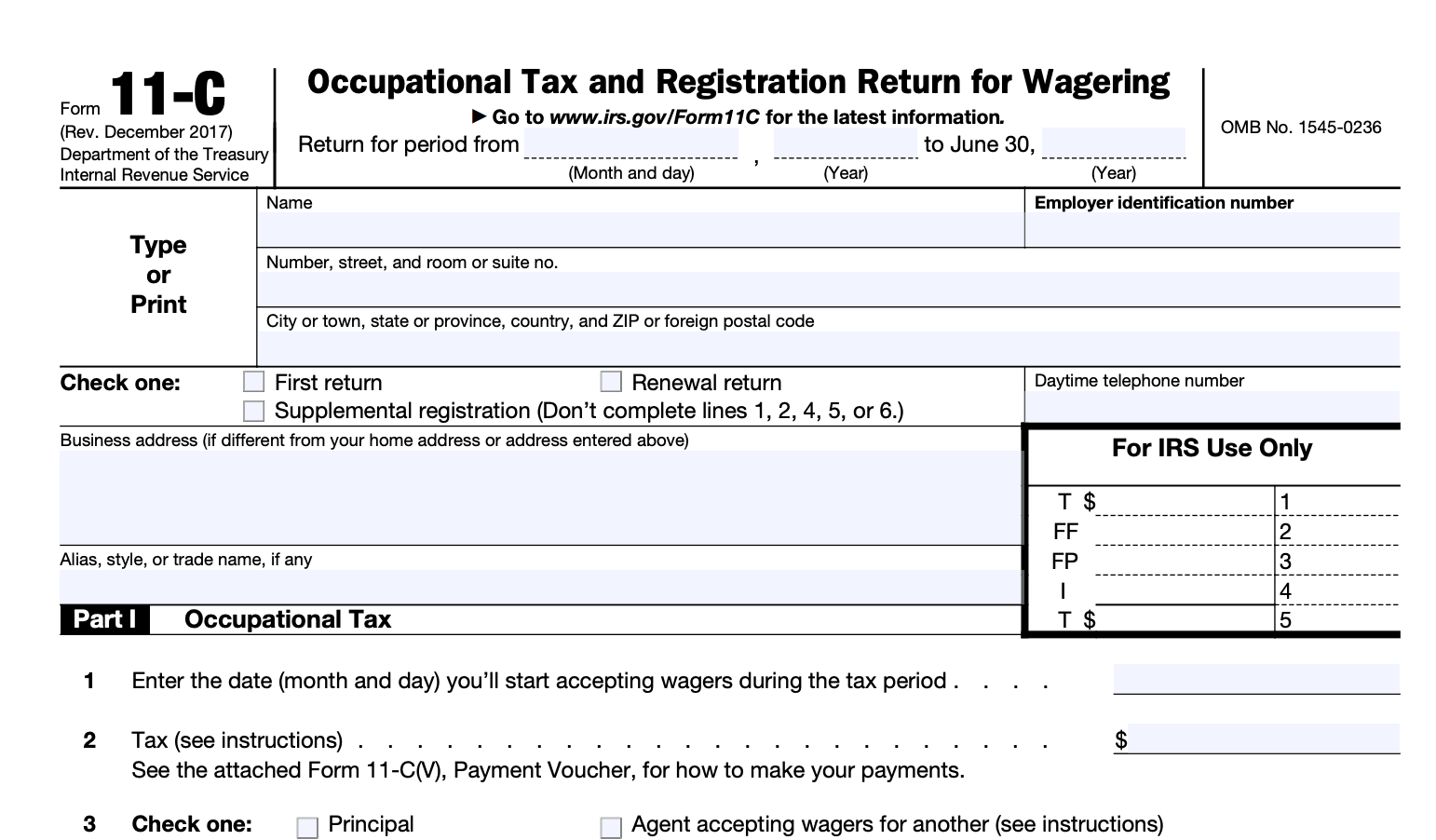

Form 11-C: Occupational Tax and Registration Return for Wagering

Download Form 11-CGambling and wagering activities have always been popular forms of entertainment for many people. However, operating a gambling business comes with certain responsibilities, including complying with various tax regulations. In the United States, the Internal Revenue Service (IRS) requires businesses engaged in wagering to file Form 11-C, the Occupational Tax and Registration Return for Wagering.

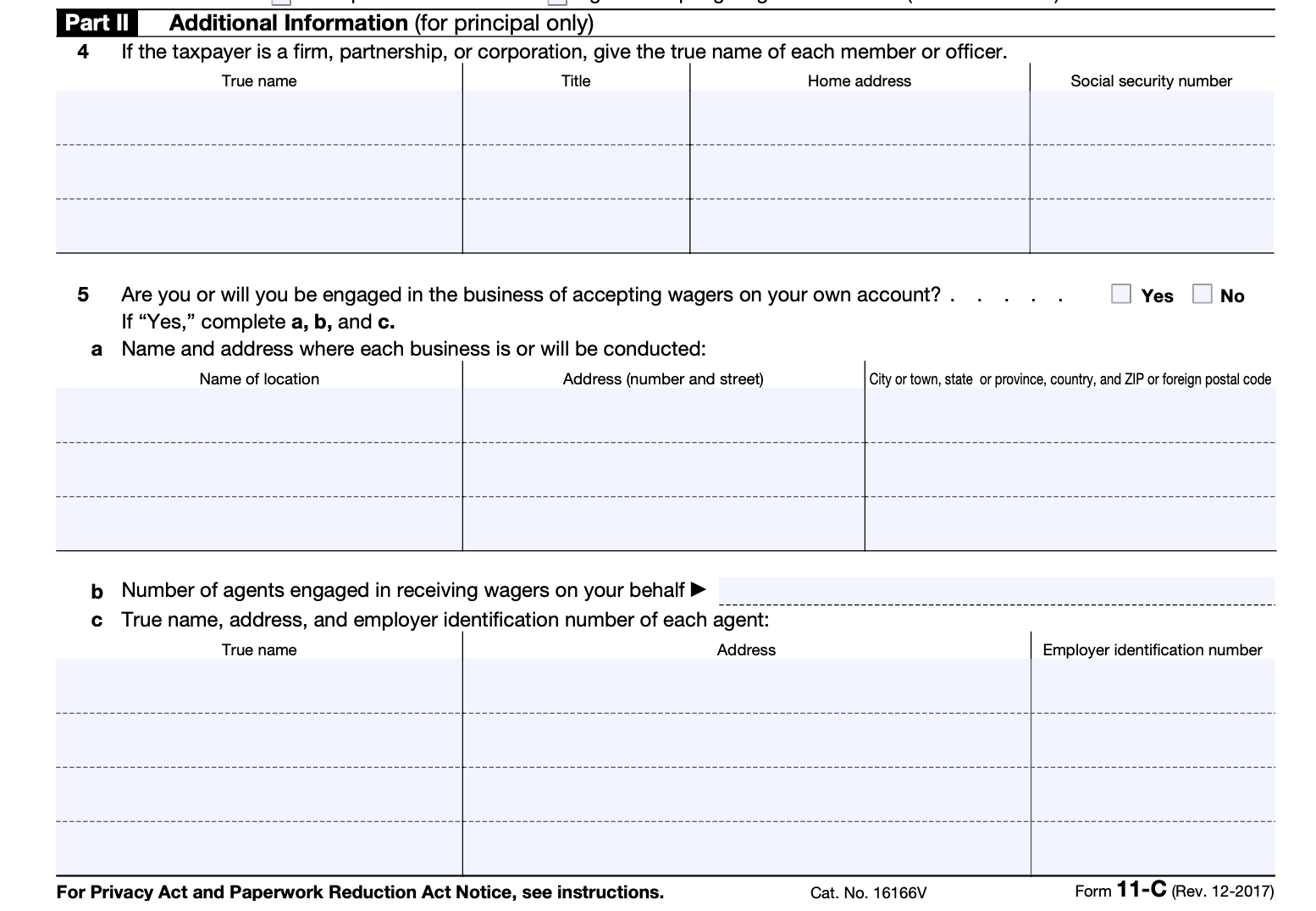

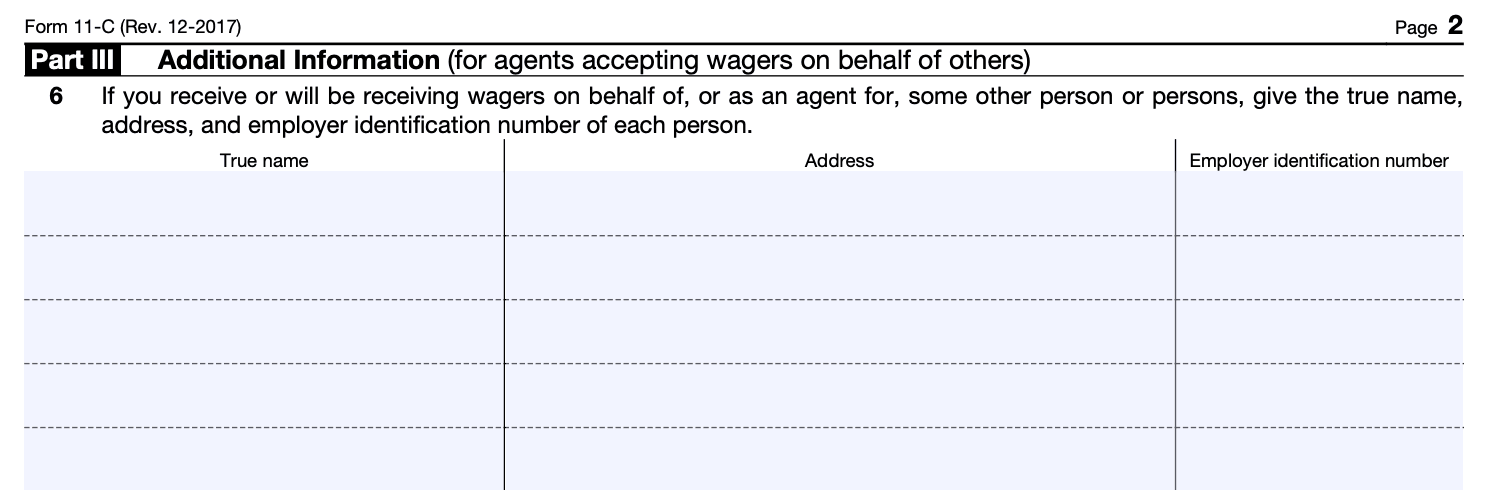

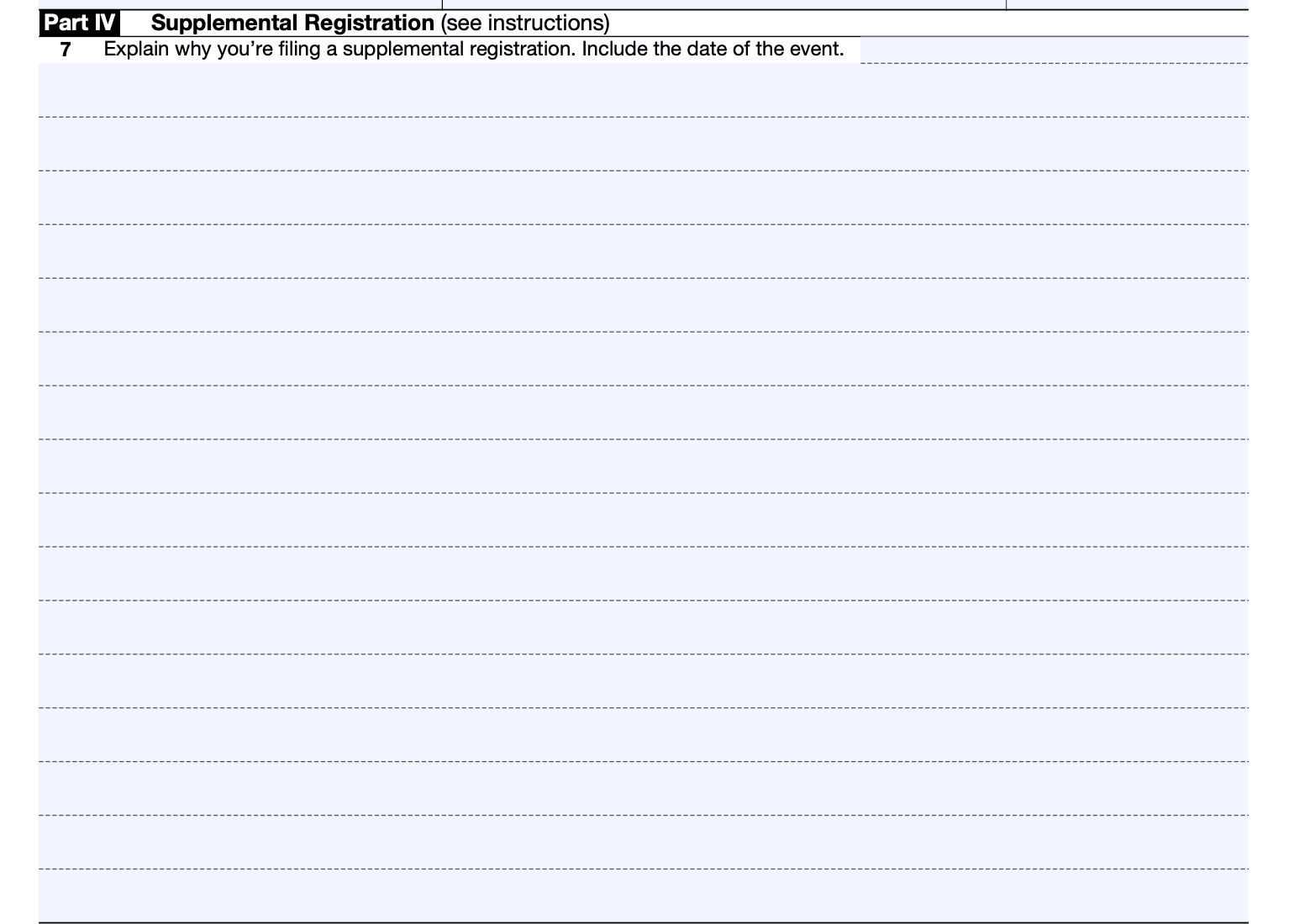

Form 11-C, officially known as the Occupational Tax and Registration Return for Wagering, is a tax document required by the IRS. It serves as a registration form for businesses involved in gambling or wagering activities, including casinos, racetracks, and lotteries. The purpose of this form is to register the business and pay the required occupational tax.

In this blog, we will delve into the details of Form 11-C, discussing its purpose, who needs to file it, and how to complete the form accurately.

Purpose of Form 11-C

The primary purpose of Form 11-C is to comply with the federal law requirements for individuals and businesses engaged in specific wagering activities. It applies to activities such as accepting wagers, conducting wagering pools, or accepting wagers on behalf of others.

By filing Form 11-C, individuals and businesses can register with the IRS and obtain an occupational tax registration number. This number serves as proof of registration and allows the filer to engage in the specified wagering activities legally.

The form requires information such as the applicant's personal or business details, including name, address, and taxpayer identification number. It also asks for details about the specific wagering activities being conducted and the estimated amount of wagers expected during the taxable year.

Upon receiving Form 11-C, the IRS processes the information provided and issues an occupational tax registration number if the application is approved. The tax period for wagering activities typically runs from July 1 to June 30.

Benefits of Form 11-C

Form 11-C has several benefits associated with it. Here are a few:

Compliance with regulatory requirements: Form 11-C ensures compliance with the federal regulations governing wagering activities. It allows businesses engaged in wagering, such as casinos, racetracks, and sportsbooks, to fulfill their obligations under the law.

Registration of wagering activities: By submitting Form 11-C, businesses can register their wagering activities with the Internal Revenue Service (IRS). This registration is necessary for legally operating in the wagering industry.

Clear identification of the taxpayer: Form 11-C includes sections that require the taxpayer to provide detailed information about their business, such as the legal entity name, address, and contact information. This facilitates accurate identification and communication between the taxpayer and the IRS.

Record keeping and documentation: Completing Form 11-C helps businesses maintain comprehensive records of their wagering activities. These records serve as essential documentation for financial and regulatory purposes, including audits, inquiries, and potential disputes.

**Efficient tax reporting: **Form 11-C provides a structured format for reporting occupational taxes related to wagering activities. It helps businesses calculate and report the tax liability accurately, ensuring compliance with the IRS guidelines.

Access to relevant tax deductions and credits: By properly completing Form 11-C, businesses can ensure that they take advantage of available tax deductions and credits related to their wagering activities. This can help reduce their overall tax liability and maximize tax savings.

Avoidance of penalties and interest: Timely and accurate submission of Form 11-C, along with payment of the associated taxes, helps businesses avoid penalties and interest charges. Failing to file or pay taxes on time can result in significant financial consequences, which can be mitigated through proper compliance with the form.

It is important to note that the benefits mentioned above are specific to the Occupational Tax and Registration Return for Wagering (Form 11-C) and may not apply to other forms or contexts.

Who Is Eligible To File Form 11-C?

The following entities or individuals may be eligible to file Form 11-C:

Wagering businesses: This includes businesses involved in accepting wagers, such as bookmakers, off-track betting establishments, and establishments offering legal gambling activities.

Wagering establishments: These are entities that conduct gambling operations, such as casinos, card rooms, and racetracks.

Wagering professionals: Individuals who earn income from wagering activities, such as professional gamblers and individuals involved in the gambling industry, may also need to file Form 11-C.

It's important to note that the eligibility criteria and requirements for filing Form 11-C may vary depending on the specific type of wagering activity and the jurisdiction in which the business operates.

How To Complete Form 11-C: A Step-by-Step Guide

Here's a step-by-step guide to completing Form 11-C:

Step 1: Obtain the form

Visit the official website of the Internal Revenue Service (IRS) at www.irs.gov and search for Form 11-C. Download the form and make sure you have the most recent version.

Step 2: Provide general information

In Part I of the form, provide the following information:

- Tax period: Enter the beginning and ending dates of the tax period you are reporting.

- Name: Enter the name of the person or entity that is responsible for the wagering activity.

- Employer Identification Number (EIN): If applicable, provide the EIN of the entity responsible for the wagering activity.

- Address: Enter the address of the responsible person or entity.

Step 3: Determine the type of business

In Part II, select the appropriate box that corresponds to the type of business you are engaged in. The options include:

- Acceptance of wagers

- Conducting a wagering pool

- Operating a wagering establishment

- Conducting bookmaking activities

Step 4: Calculate the tax

In Part III, calculate the tax due by referring to the instructions provided with the form. The tax amount will depend on the type of wagering activity and the gross wagers received during the tax period.

Step 5: Determine the filing status

In Part IV, select the appropriate filing status for the tax period:

- Initial return

- Amended return

- Final return

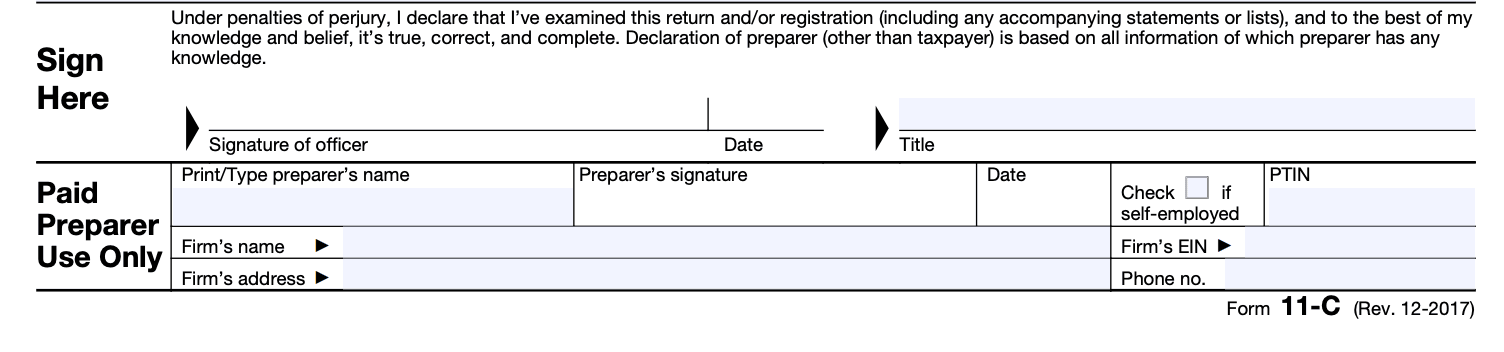

Step 6: Sign and date the form

In Part V, sign and date the form to certify that the information provided is true and accurate.

Step 7: Submit the form

Make a copy of the completed Form 11-C for your records and submit the original form to the address specified in the instructions. It's recommended to send it via certified mail or a recognized courier service to ensure proof of delivery.

Remember to review the instructions provided with Form 11-C for any additional requirements specific to your situation.

Special Considerations When Filing Form 11-C

When filing Form 11-C,there are several special considerations to keep in mind. Here are some important points to note:

Purpose of Form 11-C: This form is used to register and pay the federal occupational tax for businesses engaged in wagering activities. It applies to various gambling-related businesses, such as casinos, off-track betting facilities, and dog or horse racing tracks.

Registration requirement: Any person or entity involved in a wagering business must register by filing Form 11-C. This includes both businesses operating legally under state law and those engaged in illegal wagering activities.

**Filing deadlines: **Form 11-C must be filed on an annual basis. The tax period covered by the form is from July 1 of the current year to June 30th of the following year. The deadline for filing is on or before July 1 of each year.

**Tax calculation: **The occupational tax amount varies depending on the type of wagering activity and the specific business. The tax rates are outlined in the instructions accompanying Form 11-C. Make sure to accurately calculate the tax liability based on the applicable rates.

**Payment options: **The tax payment should be included with the completed Form 11-C. The form provides options for payment by check, money order, or electronic funds transfer (EFT). If using EFT, the Electronic Federal Tax Payment System (EFTPS) should be utilized.

Recordkeeping: It is crucial to maintain proper records of all wagering activities, including receipts, wagers, payouts, and any other relevant documentation. These records may be subject to review or audit by the Internal Revenue Service (IRS).

**Additional reporting requirements: **In addition to filing Form 11-C, wagering businesses may have other reporting obligations. For example, casinos are required to file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, for certain large cash transactions.

State and local requirements: Businesses involved in wagering activities should also comply with applicable state and local laws and regulations. These may include additional registration, reporting, and tax obligations.

It is essential to consult the instructions provided with Form 11-C and seek guidance from a tax professional or the IRS directly to ensure compliance with all applicable requirements.

Common Mistakes To Avoid While Filing Form 11-C

When filing Form 11-C , there are several common mistakes that you should avoid to ensure accurate and compliant reporting. Here are some key mistakes to watch out for:

Incorrect or incomplete information: Make sure you provide all the necessary details accurately. This includes your name, address, taxpayer identification number (TIN), and other identifying information. Double-check the form for any missing or incorrect information.

Filing the wrong form: Ensure that you are using the correct form for wagering activities. Form 11-C is specifically used for reporting and paying the tax on wagers. Using the wrong form may result in incorrect reporting and potential penalties.

Failing to report all wagers: It's essential to report all wagers accurately, including those made through casinos, sports books, online platforms, or any other gambling establishments. Be diligent in compiling all the necessary information and keep accurate records of your wagers.

Incorrect calculation of tax liability: Take care when calculating the tax liability owed on your wagers. Use the correct tax rate for your specific situation and ensure that you accurately calculate the amount owed. Double-check your calculations to avoid errors.

Neglecting to include payment: When filing Form 11-C, you must include payment for the tax liability. Failure to submit the correct payment or omitting it altogether can result in penalties and interest charges. Verify the payment details and ensure that you include the correct amount.

Missing the filing deadline: Stay aware of the filing deadline for Form 11-C. The due date may vary depending on your circumstances, so review the instructions carefully. Failing to submit the form on time may lead to penalties and interest charges.

**Not retaining copies of the form: **After filing Form 11-C, it's crucial to keep copies of all documents for your records. Retain copies of the completed form, payment receipts, and any supporting documentation. This will help you maintain a comprehensive and organized record of your wagering activities.

Conclusion

Form 11-C, the Occupational Tax and Registration Return for Wagering, plays a vital role in regulating and taxing the wagering industry in the United States. By filing this form, individuals and businesses engaged in wagering activities fulfill their obligations to the IRS, both in terms of paying the occupational tax and registering their business.

Understanding the requirements and deadlines associated with Form 11-C is crucial for maintaining compliance and avoiding penalties. If you are involved in the wagering industry, consult with a tax professional or review the IRS guidelines to ensure accurate reporting and timely filing of Form 11-C.

FAQs

Q1: What is Form 11-C?

A1: Form 11-C is a tax form used by businesses engaged in wagering activities, such as accepting wagers or conducting a wagering pool, to report their information and pay the federal occupational tax.

Q2: Who needs to file Form 11-C?

A2: Businesses that engage in wagering activities, including bookmakers, racetracks, and casinos, are generally required to file Form 11-C. This form is used to register the business with the IRS and report the applicable occupational tax.

Q3: When should Form 11-C be filed?

A3: Form 11-C must be filed on or before July 1st of each year, or within 30 days of starting a new wagering operation. If the due date falls on a weekend or holiday, the form is due on the next business day.

Q4: How do I obtain a copy of Form 11-C?

A4: You can download Form 11-C from the official IRS website (www.irs.gov) by searching for "Form 11-C." The form can be filled out electronically or printed and completed manually.

Q5: What information is required on Form 11-C?

A5: Form 11-C requires various details, including the business name, address, contact information, type of wagering activity, and the amount of occupational tax due. The form also includes sections for reporting changes in ownership or cessation of wagering operations.

Q6: How is the occupational tax calculated?

A6: The occupational tax amount depends on the type of wagering activity conducted. The tax rates for different activities are outlined on Form 11-C. The specific calculation instructions can be found in the instructions accompanying the form.

Q7: Where should I send Form 11-C once completed?

A7: The completed Form 11-C should be mailed to the Internal Revenue Service Center designated in the instructions for the form. The specific address can vary depending on your location, so it's important to refer to the instructions for the correct mailing address.

Q8: Are there any penalties for not filing Form 11-C?

A8: Yes, failure to file Form 11-C or pay the required occupational tax can result in penalties imposed by the IRS. The penalties may vary depending on the circumstances, but it's important to file the form and pay the tax on time to avoid potential penalties.