- IRS forms

- Form 1099-K

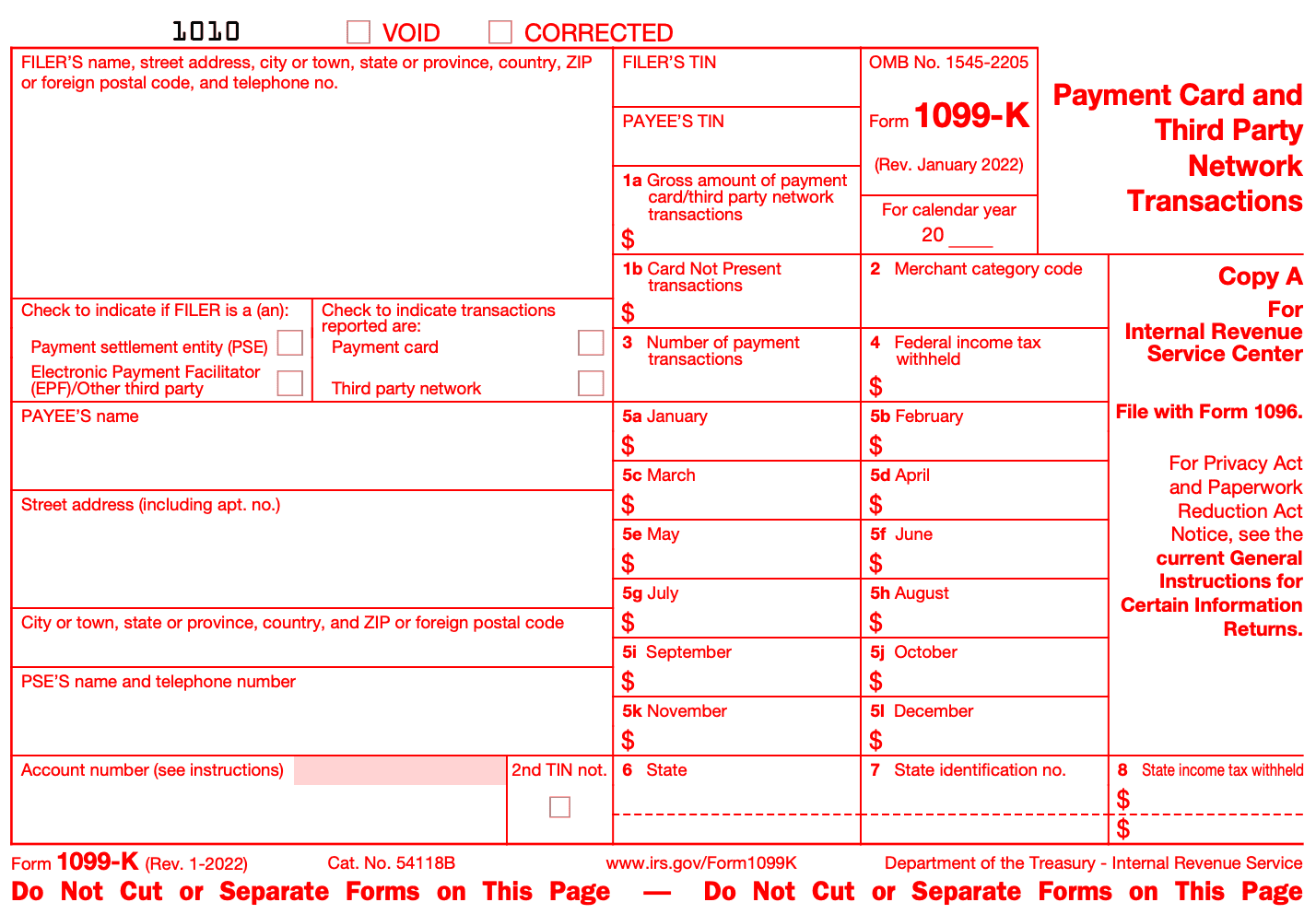

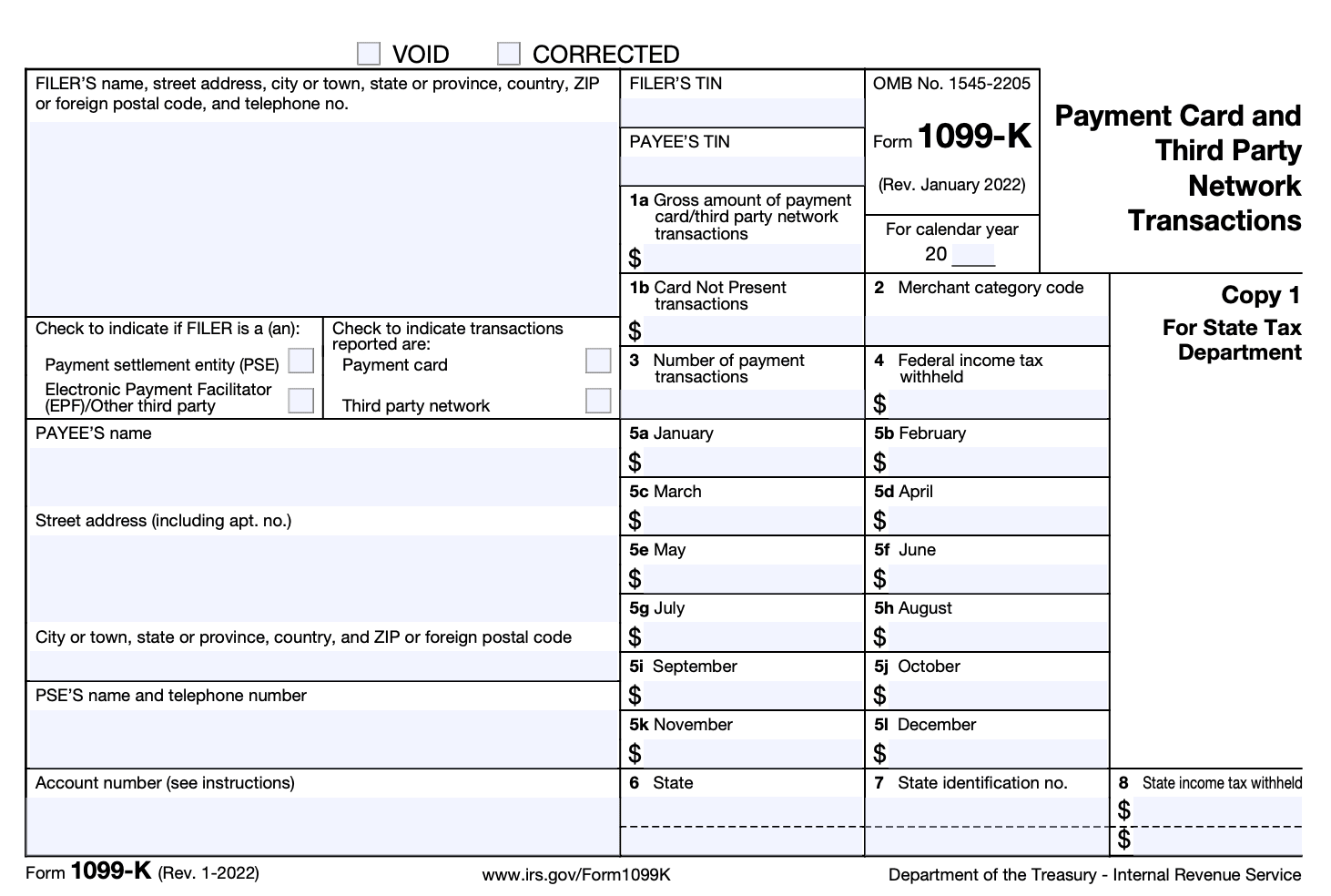

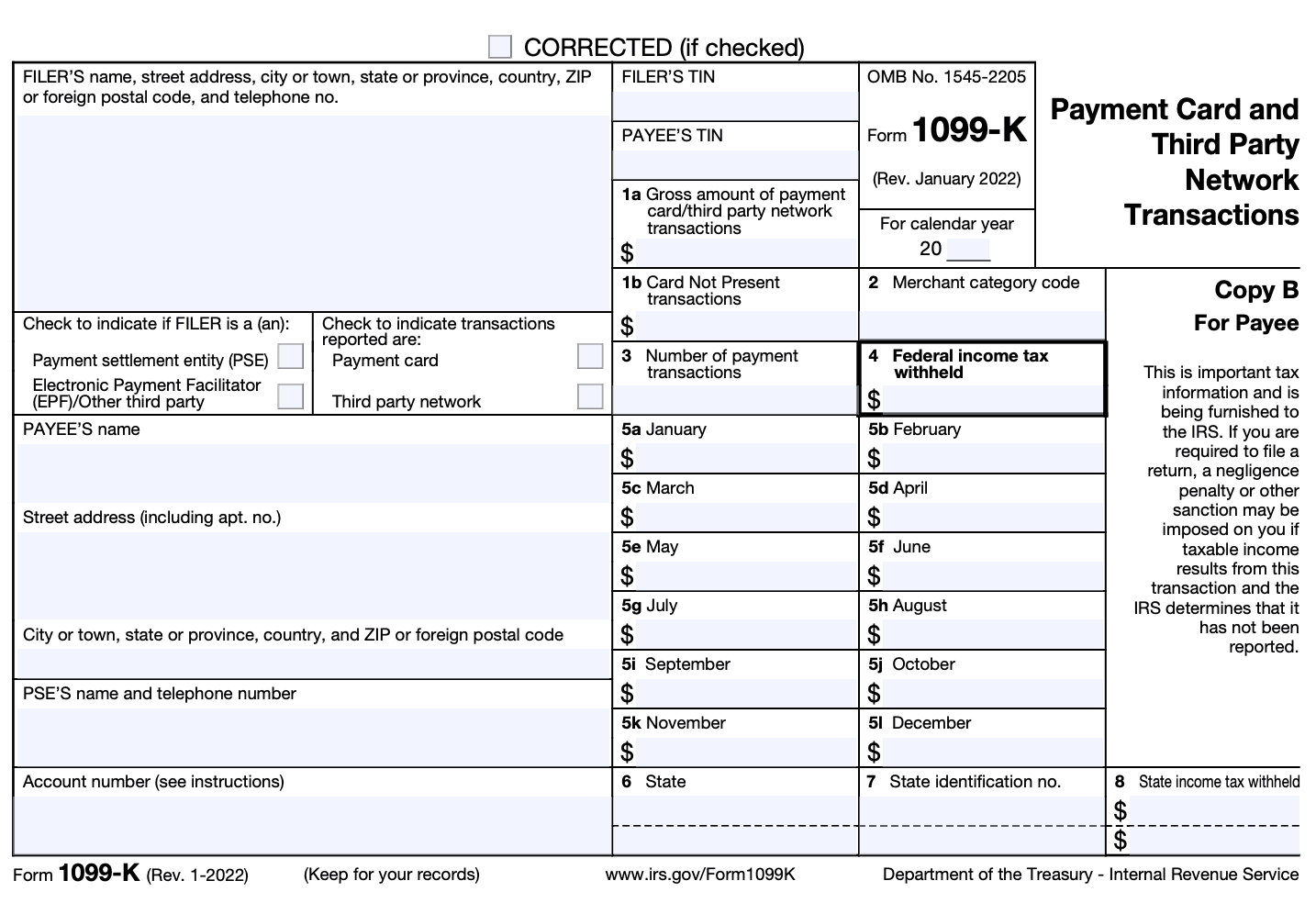

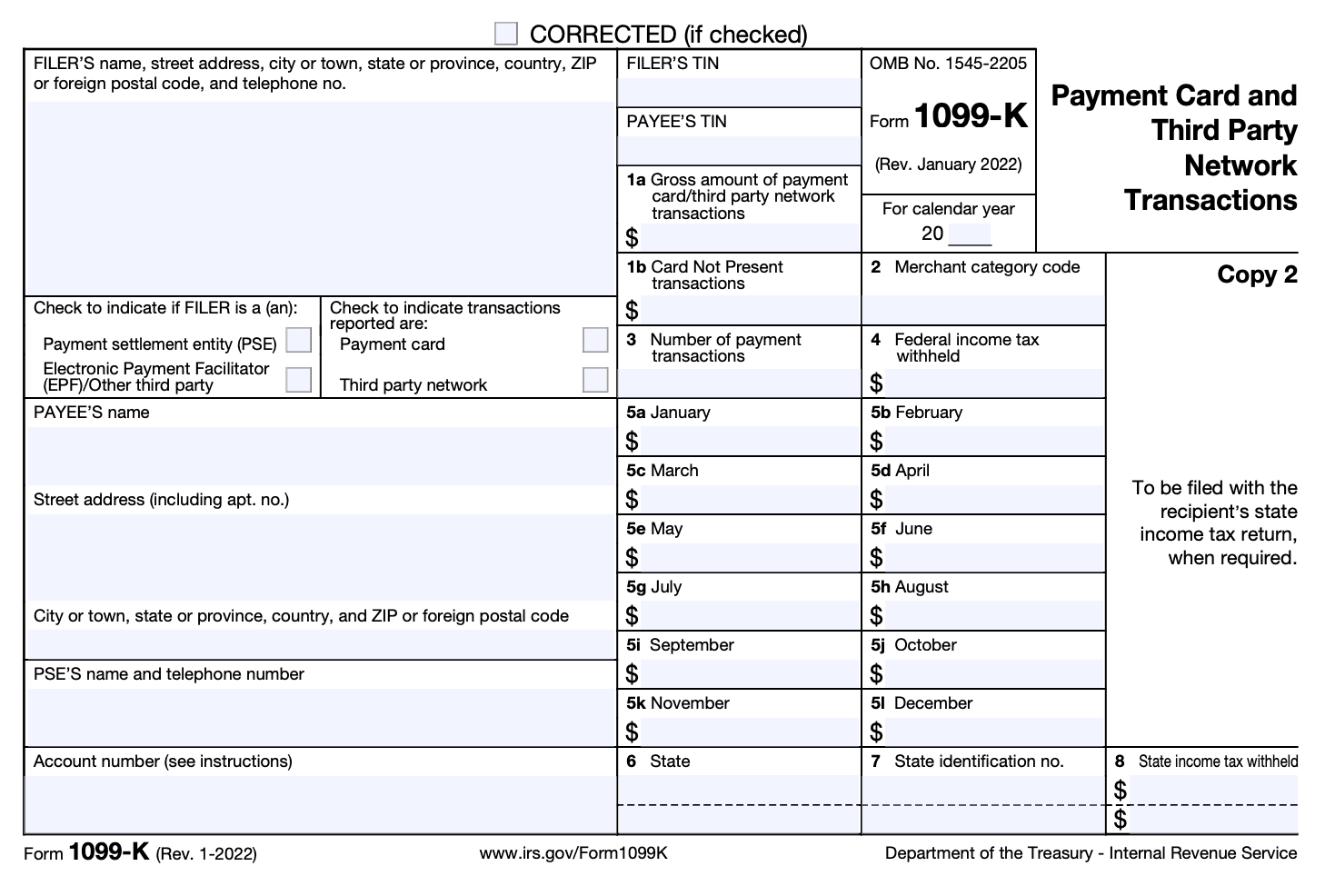

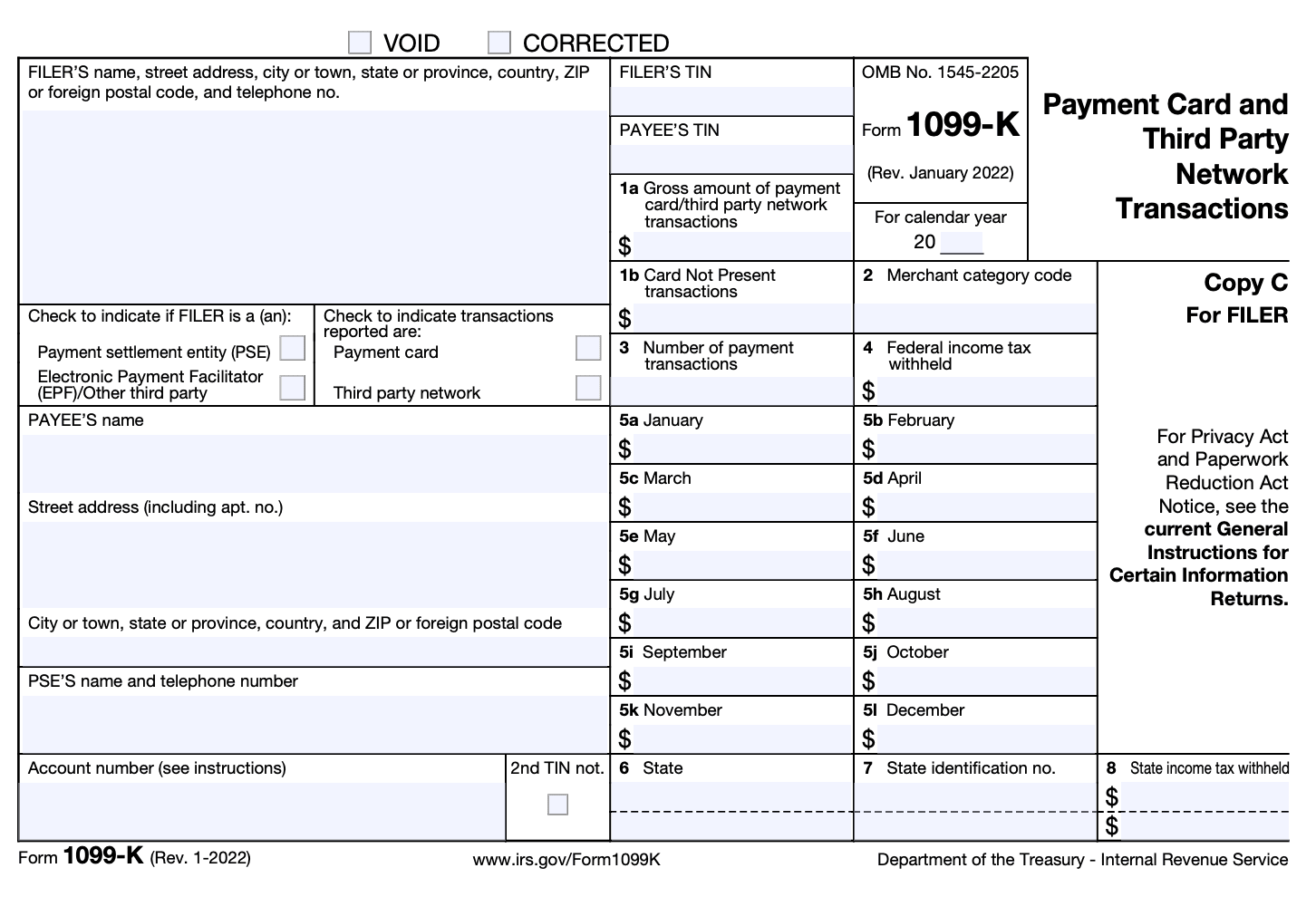

Form 1099-K: Payment Card and Third Party Network Transactions

Download Form 1099-KAs technology continues to transform the way we conduct business, online transactions have become increasingly prevalent. With the rise of payment processors, e-commerce platforms, and other digital marketplaces, it's essential for both businesses and individuals to understand their tax reporting obligations. One such requirement is Form 1099-K, which specifically pertains to payment card and third-party network transactions.

In this blog post, we will delve into the details of Form 1099-K and shed light on its significance in the realm of taxation.

Understanding Form 1099-K

Payment card transactions involve the use of credit cards, debit cards, or stored-value cards to make payments for goods or services. Merchants or businesses that accept these payment methods are responsible for reporting the gross amount of the transactions processed through payment cards, such as Visa, Mastercard, American Express, and Discover.

Form 1099-K is an information return that is used to report income received through payment card transactions and third-party network transactions. The form is filed by payment settlement entities, such as merchant acquiring banks, payment processors, and third-party settlement organizations, to report payments made to participating payees.

Purpose of Form 1099-K

The purpose of Form 1099-K is to provide information to the Internal Revenue Service (IRS) about transactions processed through payment cards and third-party networks.

The form is typically issued by payment settlement entities, such as banks or third-party processors, to both the IRS and the recipient of the income. It is used to report the gross amount of payment transactions made to an individual or business during the tax year.

The IRS requires the filing of Form 1099-K to enhance tax compliance and monitor electronic payment transactions. It helps ensure that income generated through payment card and third-party network transactions is accurately reported on an individual or business's tax return.

Recipients of Form 1099-K should use the information provided on the form to report their income on their federal income tax return. It is essential to review and reconcile the information on Form 1099-K with one's records to ensure accuracy and avoid discrepancies with the IRS.

It's important to note that the thresholds for reporting on Form 1099-K are relatively high. Generally, the form is issued if a recipient has received more than $20,000 in gross payments and conducted more than 200 transactions within a calendar year. However, specific thresholds may vary depending on the state and certain transaction types.

Benefits of Form 1099-K

While it primarily serves as a reporting mechanism for the Internal Revenue Service (IRS), there are several benefits associated with Form 1099-K for both taxpayers and businesses. Here are some key benefits:

-

Income reporting: Form 1099-K helps taxpayers accurately report their income received through payment settlement entities. By providing a summary of transactions, it ensures that income is properly reported, reducing the risk of underreporting or omitting income from tax returns.

-

Compliance with tax obligations: Form 1099-K promotes tax compliance by encouraging individuals and businesses to accurately report their income. It serves as a reminder that income generated through payment processors is subject to taxation, helping taxpayers fulfill their tax obligations.

-

Streamlined record-keeping: The form provides a consolidated summary of transactions processed through payment settlement entities, making it easier for taxpayers to keep track of their income. It simplifies record-keeping and can be used as a reference when preparing tax returns.

-

Verification for deductions: For businesses, Form 1099-K can be beneficial when claiming deductions related to business expenses. By matching the income reported on Form 1099-K with corresponding expenses, businesses can ensure that they have the necessary documentation to support their deductions.

-

Enhanced transparency: Form 1099-K increases transparency in financial transactions by capturing the flow of funds through payment settlement entities. This can be useful for financial analysis and auditing purposes, helping identify any discrepancies or potential fraudulent activities.

-

Avoiding penalties: Filing Form 1099-K correctly and on time helps taxpayers avoid potential penalties from the IRS. Failure to file the form when required can result in penalties that can add up over time, so compliance with reporting requirements is crucial.

Who Is Eligible To File Form 1099-K?

Form 1099-K is used to report payment card and third-party network transactions. It is filed by payment settlement entities (PSEs) that meet specific criteria set by the Internal Revenue Service (IRS). PSEs are generally entities that facilitate payment transactions on behalf of merchants or sellers.

The following entities are typically eligible to file Form 1099-K:

Payment processors: Companies or organizations that provide payment processing services, such as credit card companies, online payment platforms (e.g., PayPal), and digital wallet providers.

**Third-party settlement organizations (TPSOs): **Entities that facilitate payments between buyers and sellers but are not the payers or recipients of the transactions. Examples include online marketplaces, crowdfunding platforms, and gig economy platforms.

It's important to note that not all payment transactions are reported on Form 1099-K. The IRS requires filing Form 1099-K when a PSE meets both of the following criteria in a calendar year:

a) The PSE processes more than 200 transactions for a payee (merchant or seller).

b) The gross amount of payments made to the payee exceeds $20,000.

If you're a merchant or seller who receives payments through a PSE, you may receive a Form 1099-K from the PSE if your transactions meet the criteria outlined above.

How To Complete Form 1099-K: A Step-by-Step Guide

Completing Form 1099-K can be a straightforward process if you follow these step-by-step instructions:

Step 1: Gather necessary information

Collect all the required information to complete Form 1099-K. This includes your personal information, such as your name, address, and taxpayer identification number (TIN). Additionally, you'll need the recipient's information, such as their name, address, and TIN. You'll also need to gather details about the transactions for which you're filing the form.

Step 2: Obtain Form 1099-K

Obtain a copy of Form 1099-K from the Internal Revenue Service (IRS) website or your tax software. You can also request a physical copy by calling the IRS or visiting a local IRS office.

Step 3: Fill out payer information

In Box 1a, enter your TIN (Social Security Number or Employer Identification Number) as the payer. Enter your name, address, and any other required information in the corresponding boxes.

Step 4: Fill out recipient information

In Box 1b, enter the recipient's TIN. If you don't have their TIN, you may need to request it from them using Form W-9. Enter the recipient's name, address, and other necessary details in the corresponding boxes.

Step 5: Fill out payment card transactions

In Box 1a, report the gross amount of payment card transactions for the recipient. This includes the total dollar value of all transactions made using payment cards like credit cards, debit cards, and third-party payment processors like PayPal or Stripe.

Step 6: Fill out third-party network transactions

In Box 1b, report the gross amount of third-party network transactions for the recipient. This includes the total dollar value of transactions facilitated by third-party payment networks like Airbnb or Uber.

Step 7: Complete other boxes if applicable

Depending on the specific circumstances, you may need to complete other boxes on Form 1099-K. For example, if there are refunds or returns related to the payment card or third-party network transactions, you would need to report them in Box 5.

Step 8: Review and verify information

Double-check all the information you entered on the form for accuracy. Ensure that the TINs, names, and addresses are correct. Mistakes could lead to issues or delays in processing.

Step 9: File and distribute Form 1099-K

Submit Form 1099-K to the IRS by the appropriate deadline. The form must be filed electronically if you're reporting more than 250 transactions. Additionally, provide a copy of the form to the recipient by January 31 of the year following the tax year.

Step 10: Retain records

Keep a copy of the completed Form 1099-K, along with any supporting documentation, for your records. It's important to retain this information for at least three years in case of future inquiries or audits.

Special Considerations When Filing Form 1099-K

When filing Form 1099-K, there are several special considerations to keep in mind. Here are some key points:

Determine if you are required to file: As a general rule, you are required to file Form 1099-K if you operate a payment settlement entity (PSE) and you process payments for participating payees. A PSE is an organization that facilitates the transfer of funds between payers and payees. If you meet the threshold for filing, you must report the transactions made by your payees.

**Understand the reporting thresholds: **The filing thresholds for Form 1099-K are relatively high compared to other 1099 forms. You are required to file Form 1099-K if you have more than 200 transactions and the total gross payments exceed $20,000 during the calendar year.

Obtain accurate payee information: It is crucial to collect accurate information from your payees, including their legal names, addresses, and taxpayer identification numbers (TINs). Payees should provide you with a completed Form W-9, which includes their TIN and certifies their tax status.

**Review your records: **Ensure that your records are accurate and up to date. Keep track of the payment card and third-party network transactions processed on behalf of your payees, including the total gross payments and any adjustments or refunds made.

Use the correct form version: Use the most recent version of Form 1099-K provided by the Internal Revenue Service (IRS) when filing. The form may undergo updates or changes, so check the IRS website or consult with a tax professional to ensure you are using the correct form.

File and furnish copies on time: The due date for filing Form 1099-K with the IRS is typically January 31st of the year following the reporting year. Additionally, you must furnish copies of the form to your payees by January 31st. It's important to adhere to these deadlines to avoid penalties.

Maintain backup documentation: Retain copies of all filed Forms 1099-K and any supporting documentation for at least three years from the due date of the tax return on which the forms were filed. This includes transaction records, agreements with payees, and any other relevant documentation.

**Consider seeking professional assistance: **If you're unsure about the requirements or have complex reporting situations, it's advisable to consult a tax professional or accountant. They can guide you through the process, help ensure compliance, and address any specific considerations related to your business.

Filing Deadlines & Extensions on Form 1099-K

Here are some general guidelines regarding filing deadlines and extensions for Form 1099-K:

Filing deadline: The deadline to file Form 1099-K with the IRS is usually January 31st of the year following the calendar year in which the transactions occurred. For example, if you are reporting transactions for the year 2022, the deadline to file would be January 31, 2023. This deadline applies to both paper and electronic filings.

Copy to the recipient: The payment settlement entity must also furnish a copy of Form 1099-K to the recipient (the taxpayer) by January 31st.

Extension of time: If you need additional time to file Form 1099-K, you may request an extension. However, it's important to note that the extension applies only to the filing with the IRS, not to the copy provided to the recipient. To request an extension, you must submit Form 8809, Application for Extension of Time to File Information Returns, before the original filing deadline (January 31st).

Common Mistakes To Avoid While Filing Form 1099-K

When filing Form 1099-K, which is used to report payment card and third-party network transactions, it's important to be aware of common mistakes to avoid errors and potential penalties. Here are some common mistakes to watch out for:

Incorrect or missing taxpayer identification number (TIN): Ensure that you have the correct TIN for the recipient of the payment. The TIN can be either an Employer Identification Number (EIN) or a Social Security Number (SSN). Failure to provide the correct TIN can result in penalties.

Failing to report all required transactions: Make sure you report all transactions that meet the reporting thresholds. For Form 1099-K, you are required to report payment card transactions and third-party network transactions that exceed both 200 transactions and $20,000 in gross payments during the calendar year.

Including non-reportable transactions: Some payments are not required to be reported on Form 1099-K, such as cash advances, reimbursements, and refunds. Be sure to exclude these non-reportable transactions from your filing.

Mismatched amounts: Double-check that the amounts you report on Form 1099-K match the amounts reported to you by the payment settlement entity. This includes ensuring that any adjustments, fees, or refunds are accurately reflected.

Late or missing filing: Form 1099-K has specific deadlines for filing with both the recipient and the IRS. Failing to file on time or failing to furnish a copy to the recipient can lead to penalties. Make sure to adhere to the appropriate deadlines.

**Failing to keep accurate records: **Maintain detailed records of the transactions you report on Form 1099-K. This includes keeping track of the gross payment amounts, dates, and any adjustments made. Accurate records will help you avoid errors when filing.

**Neglecting to reconcile discrepancies: **Take the time to reconcile any discrepancies between the amounts reported on Form 1099-K and your own records. If there are any discrepancies, investigate and resolve them before filing.

Not seeking professional guidance: If you're unsure about any aspect of filing Form 1099-K or if your situation is complex, it's advisable to seek professional assistance from a tax advisor or accountant. They can provide guidance tailored to your specific circumstances.

Conclusion

Form 1099-K plays a vital role in the tax reporting process for individuals and businesses involved in payment card and third-party network transactions. By understanding the thresholds, responsibilities, and implications associated with this form, you can ensure compliance with IRS regulations and accurately report your income.

Remember to consult a tax professional or refer to the official IRS guidelines for specific instructions tailored to your unique situation. Being knowledgeable about Form 1099-K will help you maintain good tax practices and prevent any potential issues with the IRS in the future.