- IRS forms

- Form 1099-C

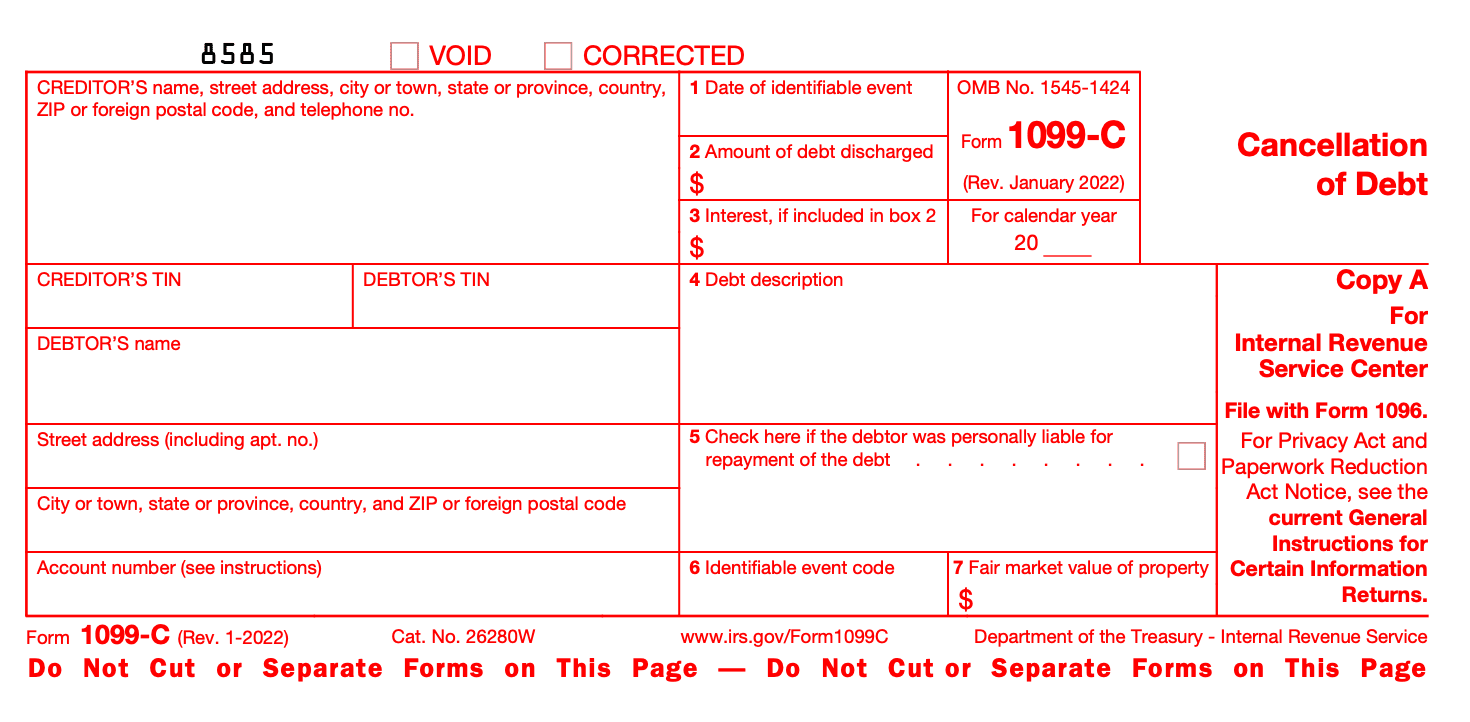

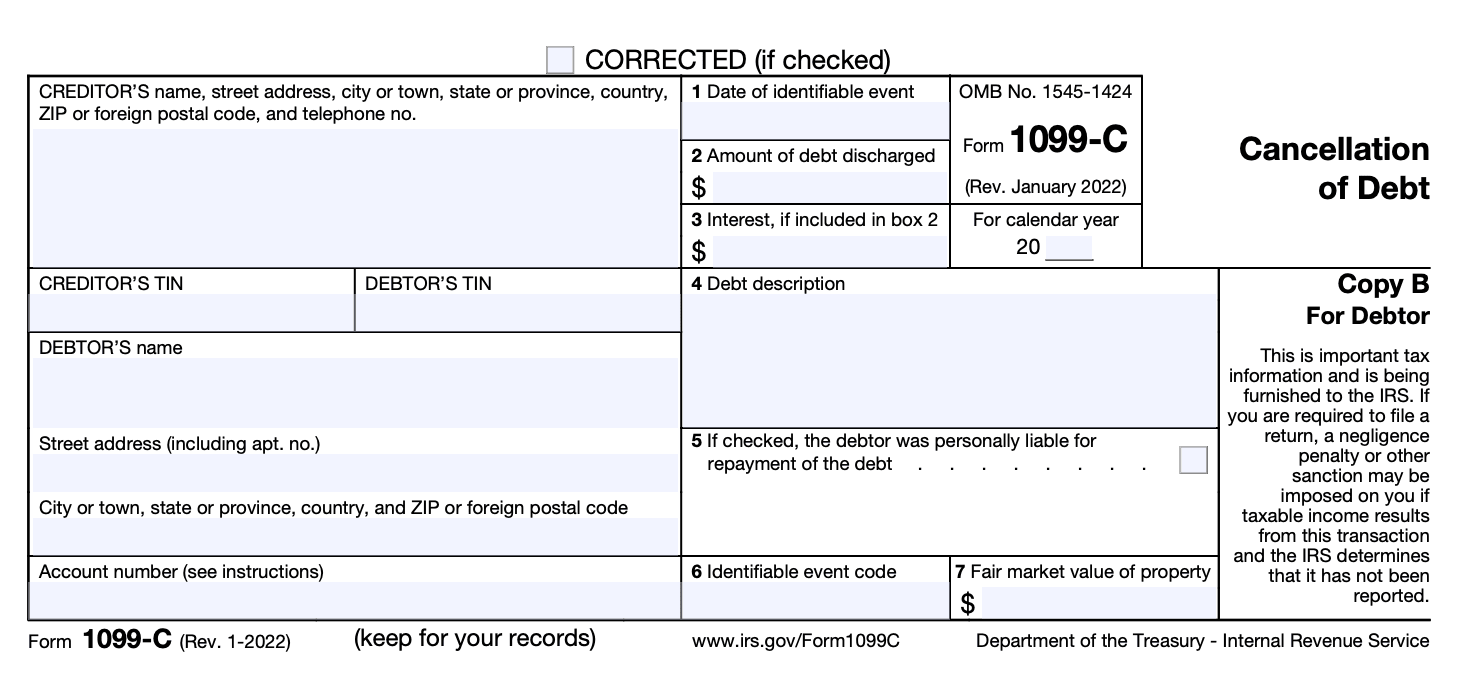

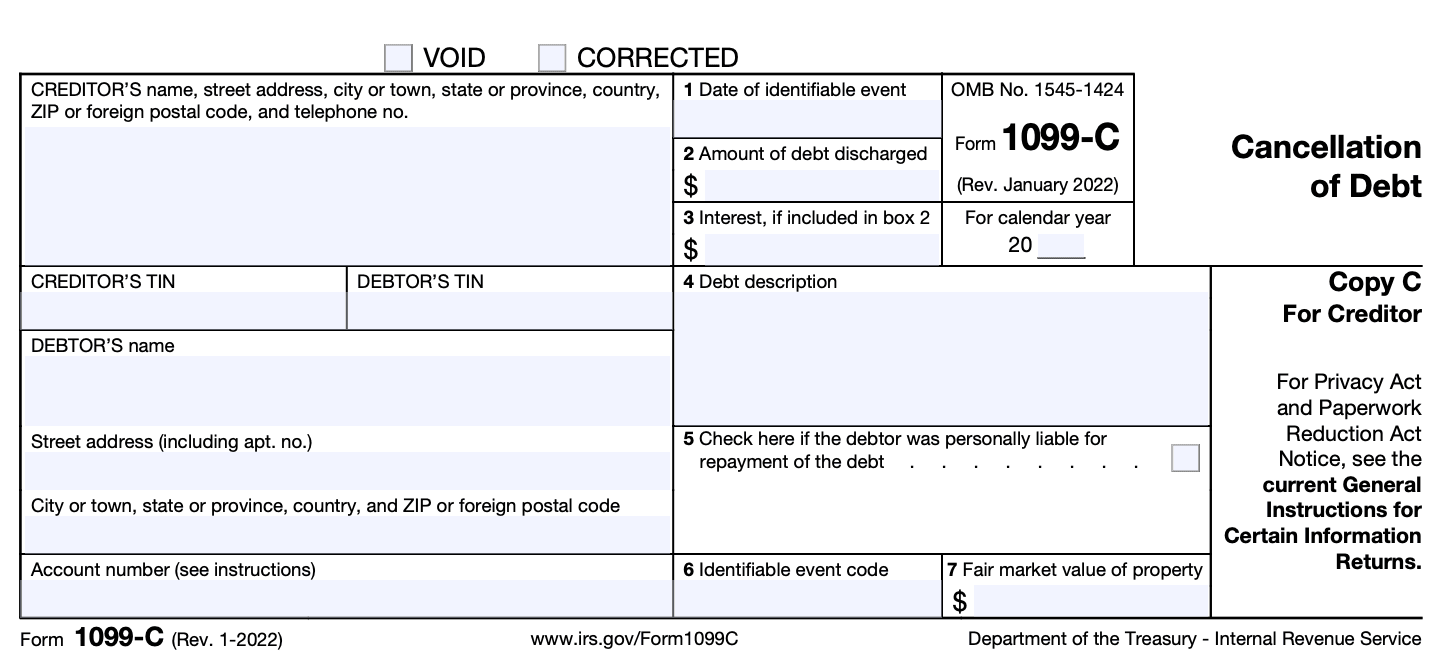

Form 1099-C: Cancellation of Debt

Download Form 1099-CIn the complex world of taxes, there are numerous forms that individuals need to navigate. One such form is the Form 1099-C, which deals with the cancellation of debt. If you have had debt forgiven or canceled, it's essential to understand the implications of this action and the reporting requirements associated with it.

Form 1099-C, also known as the Cancellation of Debt, is a tax form used to report the cancellation or forgiveness of debt exceeding $600. When a creditor forgives a debt, it means they have decided to stop trying to collect the outstanding amount. This canceled debt is considered income by the IRS, as it results in a financial benefit to the debtor. Consequently, the IRS requires the debtor to report this income on their tax return.

In this blog post, we will delve into the intricacies of Form 1099-C, helping you gain a better understanding of its purpose and how it affects your tax obligations.

Purpose of Form 1099-C

The purpose of Form 1099-C is to inform the debtor and the Internal Revenue Service (IRS) that a debt has been canceled and may be considered as taxable income.

When a creditor forgives or cancels a debt, the amount that is forgiven is typically considered taxable income because it represents an economic benefit to the debtor. The debtor may be required to report this canceled debt as income on their federal tax return and pay taxes on it accordingly.

The creditor or financial institution is responsible for reporting the canceled debt to the IRS using Form 1099-C. This form provides information about the canceled debt, including the debtor's name, address, taxpayer identification number, and the amount of debt that has been forgiven.

It's important for the debtor to receive Form 1099-C because they need to include the canceled debt as income on their tax return, unless they meet certain exceptions or exclusions that may allow them to exclude the canceled debt from their taxable income. These exceptions can include bankruptcy, insolvency, certain types of student loan forgiveness, and qualified principal residence indebtedness, among others.

Benefits of Form 1099-C

While the issuance of Form 1099-C may indicate a potential tax liability, there are several potential benefits associated with receiving this form. Here are some benefits of Form 1099-C:

-

Debt relief: If you receive a Form 1099-C, it means that a lender or creditor has canceled or forgiven a debt you owed them. This can provide significant relief, particularly if the debt was substantial or unmanageable. By canceling the debt, the creditor is essentially releasing you from the obligation to repay it.

-

Potential tax savings: While the cancellation of debt generally counts as taxable income, there are certain circumstances where you may qualify for an exclusion or exception. For example, if the debt was discharged in a bankruptcy case or if you were insolvent (your liabilities exceed your assets) at the time of cancellation, you may not have to include the canceled debt as taxable income. These exclusions or exceptions can result in significant tax savings.

-

Fresh financial start: Form 1099-C can provide individuals with a fresh start by allowing them to eliminate or reduce their debt burden. This can help alleviate financial stress and allow you to focus on rebuilding your financial situation.

-

Improved credit score: Although the cancellation of debt may initially have a negative impact on your credit score, over time, it can actually help improve it. By eliminating or reducing your debt, you can lower your debt-to-income ratio, which is a factor that credit agencies consider when calculating credit scores.

-

Negotiating power: If you receive a Form 1099-C, it means that the creditor has already written off the debt. This can provide you with an opportunity to negotiate with the creditor to settle the debt for a lower amount or explore other repayment options that may be more manageable for you.

Who Is Eligible To File Form 1099-C?

The following individuals and entities may be eligible to file Form 1099-C:

Financial institutions: Banks, credit unions, and other financial institutions that forgive or cancel a debt owed to them may file Form 1099-C to report the canceled amount to the IRS.

Credit card companies: If a credit card company forgives a portion of the debt owed by a cardholder, they may need to file Form 1099-C.

Mortgage lenders: If a mortgage lender forgives a portion of a borrower's mortgage debt, they are generally required to file Form 1099-C.

**Government agencies: **Government entities that cancel debts owed to them, such as the IRS or Department of Education, may file Form 1099-C to report the canceled debt.

**Certain businesses: **In certain situations, businesses that forgive debts owed to them may need to file Form 1099-C. For example, if a business cancels a loan provided to another business, they may have to report it.

How To Complete Form 1099-C: A Step-by-Step Guide

Here's a step-by-step guide to completing Form 1099-C:

Step 1: Obtain the necessary information

Before you begin filling out the form, gather all the required information, including:

Creditor's information: Name, address, and taxpayer identification number (TIN).

Debtor's information: Name, address, and TIN.

Description of the debt: The amount of debt canceled and the date it was canceled.

Step 2: Obtain Form 1099-C

Obtain a copy of Form 1099-C from the IRS website or your tax software provider. You can also order a physical copy by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

Step 3: Enter your information

Fill out the top of Form 1099-C with your name, address, and TIN. If you're filing the form on behalf of a business, use the business's name and TIN.

Step 4: Complete the recipient's information

Provide the debtor's information in Box 1 to Box 9:

Box 1: Debtor's identifying number (TIN or SSN).

Box 2: Debtor's name.

Box 3: Debtor's address.

Box 4: Account number (optional).

Box 5: Check the box if the debtor was personally liable for the debt.

Box 6: Identifiable event code. Use the appropriate code from the instructions for the event that triggered the debt cancellation.

Box 7: Fair market value of property. If the debt was canceled through foreclosure or repossession of property, enter the fair market value of the property here.

Box 8: Check the box if the debtor is a qualified real property business indebtedness.

Box 9: Check the box if the debtor is a qualified principal residence indebtedness.

Step 5: Complete the creditor's information

Provide the creditor's information in Box 10 to Box 13:

Box 10: Creditor's identifying number (TIN).

Box 11: Creditor's name.

Box 12: Creditor's address.

Box 13: Account number (optional).

Step 6: Fill out the debt information

In Box 2, enter the amount of debt canceled. If applicable, enter the date of cancellation in Box 1.

Step 7: Copy the form

Make copies of Form 1099-C for your records, the debtor, and the IRS. If you're filing electronically, follow the instructions provided by your tax software.

Step 8: File the form

Send Copy A of Form 1099-C to the IRS by the due date. The due date is typically at the end of February for paper filing, or by the end of March if filing electronically. Check the instructions for the specific year to confirm the due date.

Step 9: Provide a copy to the debtor

Send Copy B of Form 1099-C to the debtor by the due date. The debtor will need this form to report the canceled debt on their tax return.

Special Considerations When Filing Form 1099-C

When filing Form 1099-C, there are several special considerations to keep in mind. Here are some important points to consider:

Correct identification: Ensure that the taxpayer identification number (TIN) of the debtor is accurately reported on Form 1099-C. The TIN is typically the debtor's Social Security number (SSN) or employer identification number (EIN).

Debt cancellation thresholds: Report debt cancellations of $600 or more on Form 1099-C. If the canceled debt amount is less than $600, you generally don't need to file Form 1099-C, but the debtor may still be required to report it as income on their tax return.

Exclusions and exceptions: Certain types of canceled debts may be excluded from income or qualify for an exception. For example, if the debtor is insolvent, bankrupt, or the debt is discharged due to certain types of student loans, the canceled debt may be excluded or partially excluded from taxable income. Be aware of the various exclusions and exceptions outlined by the IRS.

Identifying information: Include the name, address, and other identifying information of both the debtor and the creditor on Form 1099-C. This information helps the IRS match the reported income to the correct taxpayer.

**Filing deadlines: **Form 1099-C must be furnished to the debtor by January 31st of the year following the year of debt cancellation. It must also be filed with the IRS by the last day of February if filed on paper, or by the last day of March if filed electronically.

Reporting in the correct tax year: Report the canceled debt in the tax year in which it was canceled, not necessarily the year in which the debtor received the Form 1099-C. This ensures proper alignment of income and deductions on both sides.

**Multiple creditors: **If there are multiple creditors involved in the canceled debt, each creditor should file a separate Form 1099-C for their portion of the canceled debt.

State requirements: Some states may have specific requirements for reporting canceled debts. Be sure to check the state's tax guidelines to ensure compliance with any additional reporting obligations.

Filing Deadlines and Extensions on Form 1099-C

The filing deadline for Form 1099-C is typically January 31st of the year following the tax year in which the cancellation of debt occurred. For example, if a debt was canceled in 2022, the Form 1099-C would generally be due by January 31, 2023.

If you need additional time to file Form 1099-C, you can request an extension. To request an extension, you must submit Form 8809, Application for Extension of Time to File Information Returns, before the original due date of the form. The extension will typically give you an additional 30 days to file.

However, it's important to note that an extension only extends the filing deadline and not the due date for any payments that may be required.

Common Mistakes To Avoid While Filing Form 1099-C

When filing Form 1099-C, which is used to report canceled debts, it's important to avoid common mistakes to ensure accurate reporting and compliance with tax regulations. Here are some common mistakes to avoid:

Incorrect identification information: Ensure that the recipient's name, address, and taxpayer identification number (TIN) are accurately entered on the form. Double-check the details to avoid errors.

Incorrect reporting of canceled debt amount: Report the exact amount of debt that was canceled in Box 2 of Form 1099-C. Take care to include the correct currency symbol and decimal points. Avoid rounding up or down unless required by specific circumstances.

Failure to report debt discharge as income: Canceled debt is typically considered taxable income, subject to certain exceptions. Ensure that you report the discharged debt correctly and include it as income on the recipient's tax return, unless an exception applies.

Not checking the appropriate cancellation of debt (COD) box: Form 1099-C includes several checkboxes to indicate the reason for debt cancellation. Ensure that the appropriate box is checked based on the reason for cancellation. This helps the recipient properly understand the tax treatment of the canceled debt.

Late or incomplete filing: Make sure to file Form 1099-C by the designated deadline, typically by January 31st of the year following the debt cancellation. Failure to file or filing late can result in penalties or fines. Additionally, ensure that all required fields and boxes are properly filled out on the form.

Incorrect use of codes in Box 6: Box 6 of Form 1099-C contains specific codes that represent the identifiable event triggering the debt cancellation. Use the correct code that accurately corresponds to the situation. The IRS provides a list of valid codes to assist with proper reporting.

Failing to furnish a copy to the recipient: After filing Form 1099-C with the IRS, it is crucial to provide a copy to the debtor (recipient) by January 31st. Failure to furnish the recipient with the necessary information can lead to penalties.

Conclusion

Understanding Form 1099-C is crucial when dealing with canceled or forgiven debt. The issuance of this form indicates that you may have taxable income, which must be reported on your tax return, unless you qualify for an exclusion or exception. It is vital to review the circumstances surrounding the canceled debt and consult with a tax professional to ensure accurate reporting and compliance with IRS guidelines.

Remember, taxes can be complex, and seeking professional advice is always recommended when dealing with unique tax situations. By being aware of your obligations and understanding the various exclusions and exceptions available, you can navigate the world of canceled debt and Form 1099-C with confidence.