- IRS forms

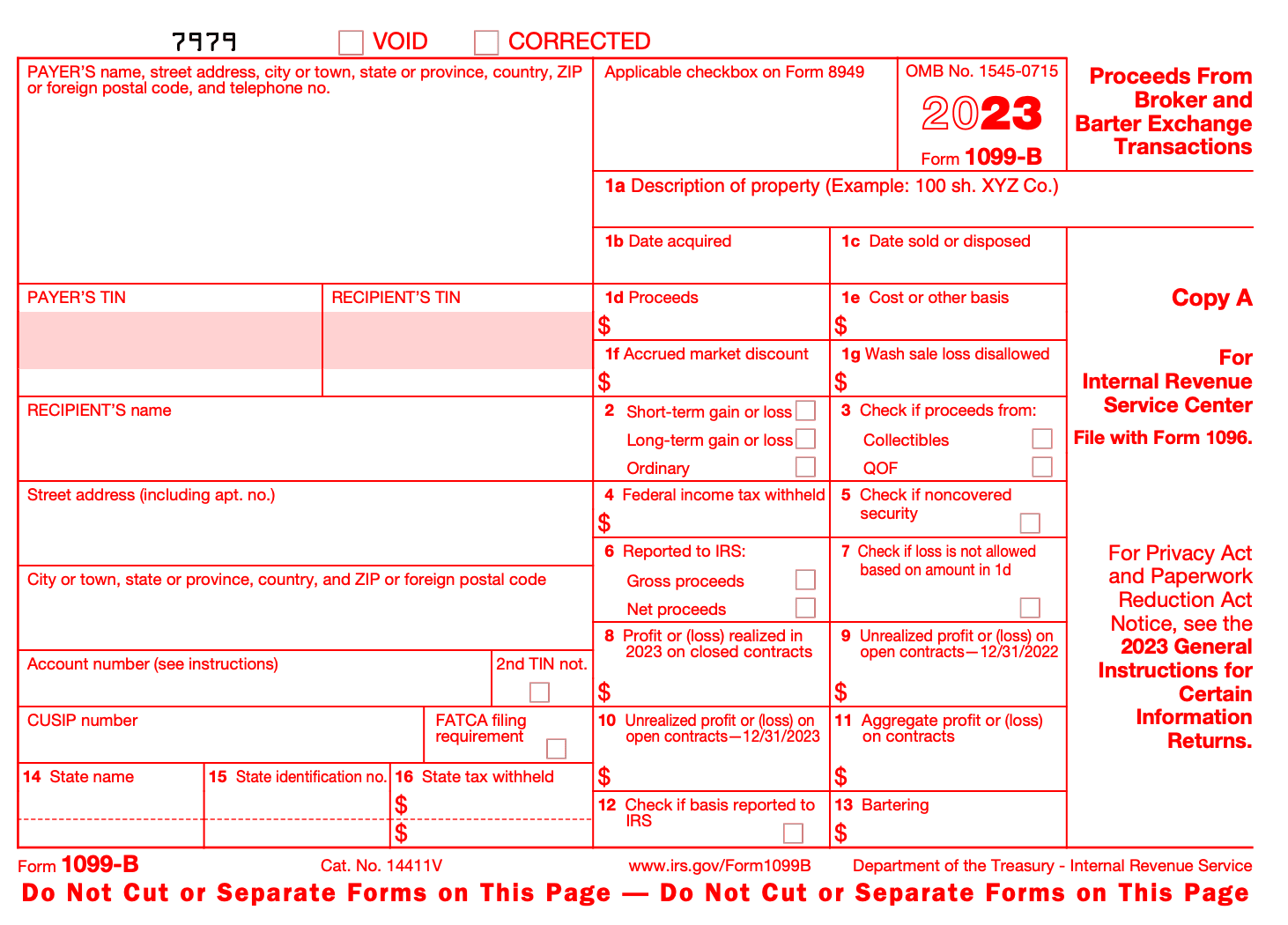

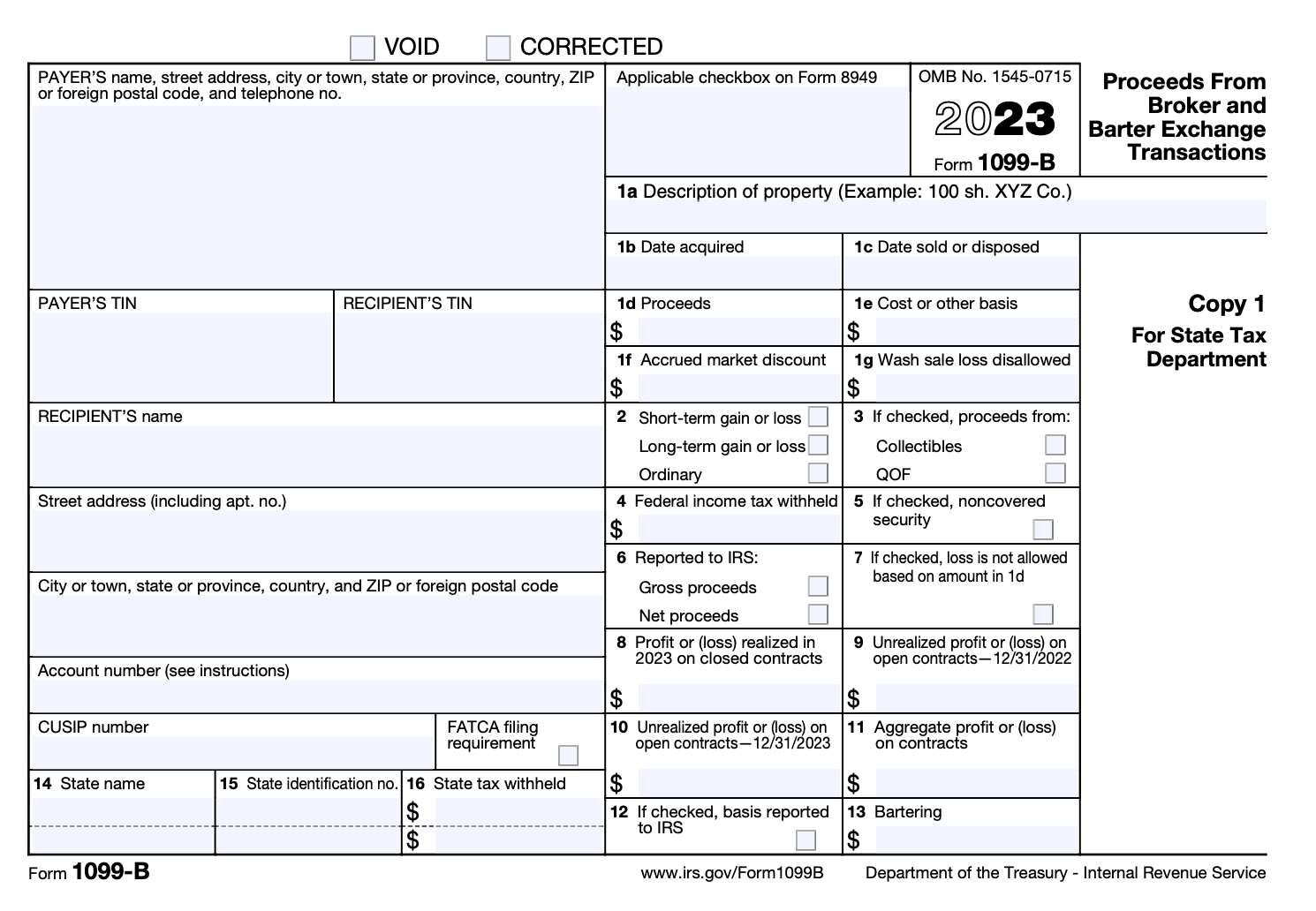

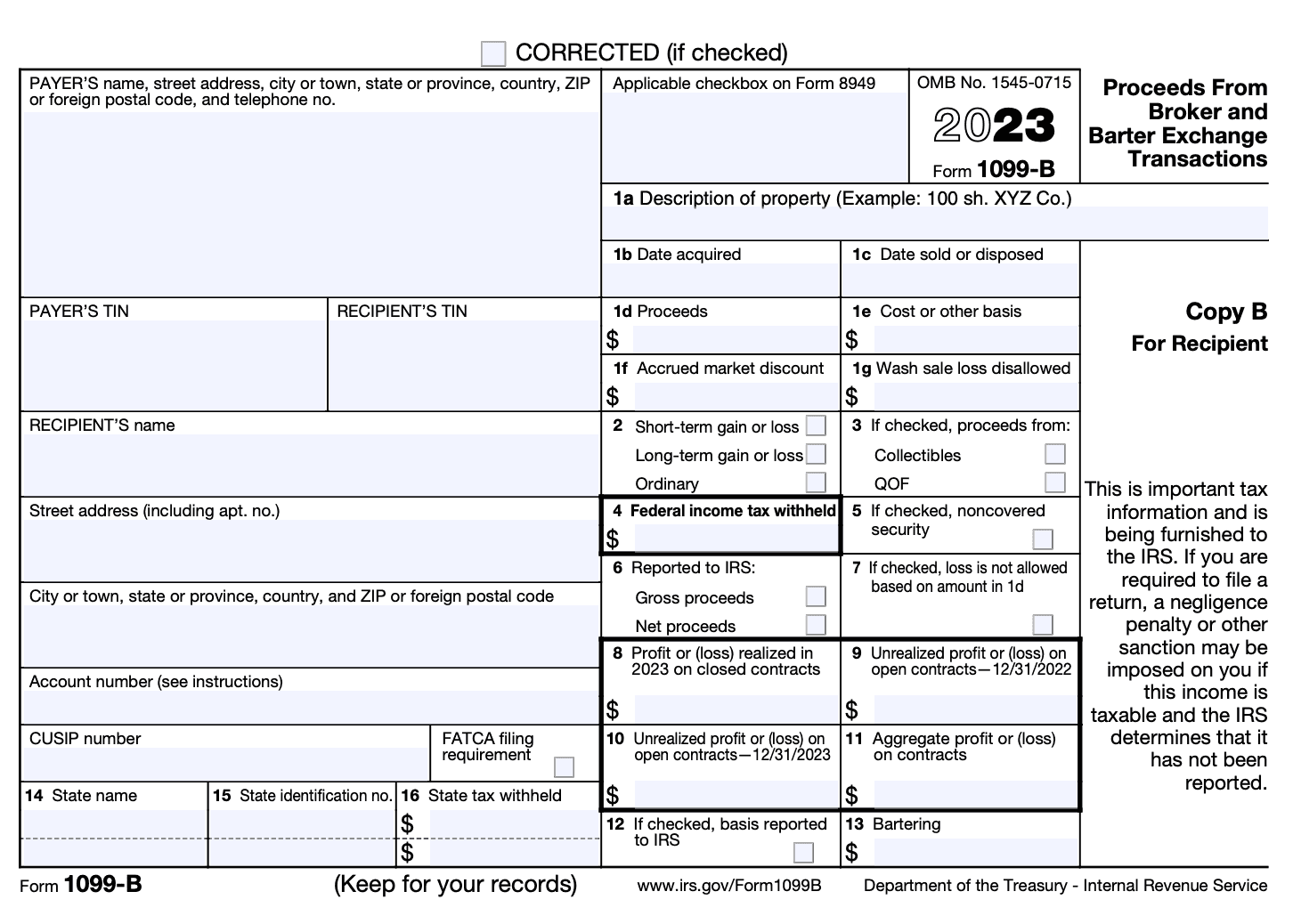

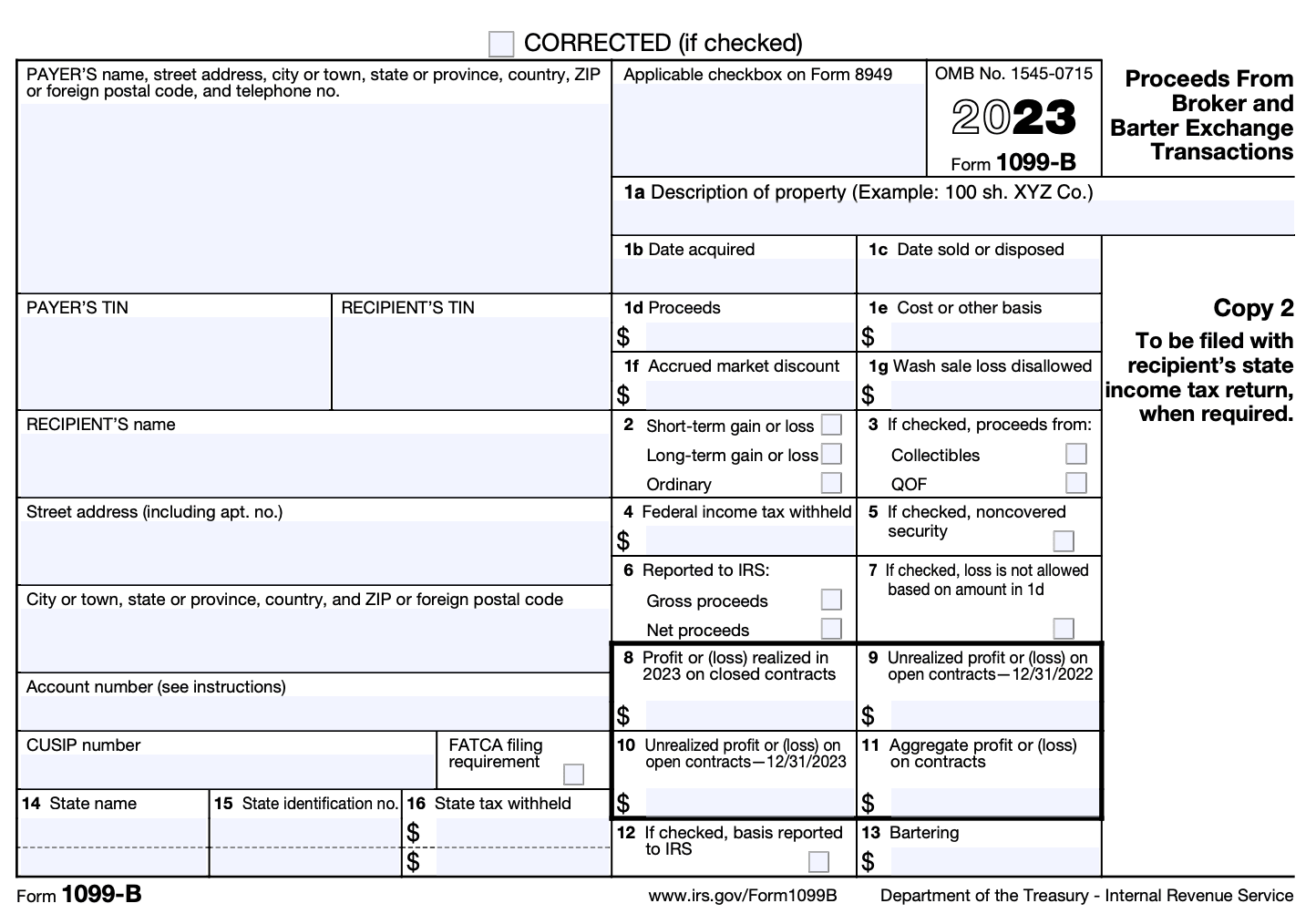

- Form 1099-B

Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

Download Form 1099-BIf you've engaged in financial transactions through a broker or participated in barter exchanges during the past tax year, you may come across Form 1099-B. This form is an important document that reports proceeds from broker and barter exchange transactions to the Internal Revenue Service (IRS).

Form 1099-B is an IRS tax form used to report sales or exchanges of securities, commodities, futures contracts, and other financial instruments. It is also used to report barter exchange transactions. The form is submitted by brokers or barter exchange organizations to the IRS, providing crucial information on these transactions for tax purposes.

In this blog post, we'll delve into the details of Form 1099-B, its purpose, who receives it, and what information it contains.

Purpose of Form 1099-B

The purpose of Form 1099-B is to provide information to the Internal Revenue Service (IRS) about these transactions, specifically the proceeds from the sale or exchange and any associated gains or losses.

Financial institutions and brokers are responsible for issuing Form 1099-B to taxpayers who engage in these types of transactions. The form typically includes details such as the taxpayer's name, taxpayer identification number (e.g., Social Security Number), the description of the security sold or exchanged, the date of the transaction, the sales proceeds, and the cost basis of the security.

When filing their income tax returns, taxpayers must report the information from Form 1099-B, along with any additional relevant details, on Schedule D (Capital Gains and Losses) of Form 1040 or 1040-SR. This allows the IRS to track and verify taxpayers' capital gains or losses from the sale or exchange of securities, ensuring that the appropriate taxes are paid.

It's important for taxpayers to carefully review the information provided on Form 1099-B and reconcile it with their own records to ensure accuracy. If there are any discrepancies or errors, they should be addressed with the financial institution or broker that issued the form to ensure that the taxpayer's tax return reflects the correct information.

Benefits of Form 1099-B

Form 1099-B for both taxpayers and the Internal Revenue Service (IRS). Here are some key benefits:

-

Accurate reporting: Form 1099-B ensures accurate reporting of capital gains and losses from the sale or redemption of securities. This helps taxpayers correctly calculate their taxable income and comply with tax laws.

-

Simplified tax reporting: The form provides taxpayers with essential information needed to complete their tax returns, including the date of sale, proceeds from the transaction, and cost basis. This simplifies the process of reporting capital gains and losses, reducing the chances of errors or omissions.

-

Cost basis information: Form 1099-B includes the cost basis of the securities sold or redeemed. This information is crucial for determining the taxable gain or loss on the transaction. Having accurate cost basis data on the form helps taxpayers ensure they report the correct amount and avoid overpaying or underpaying their taxes.

-

IRS oversight: The IRS receives a copy of Form 1099-B from brokers and financial institutions. This allows them to cross-check the information reported by taxpayers against the data provided by the brokers. It helps the IRS identify discrepancies, potential underreporting, or tax evasion, ensuring tax compliance and fairness.

-

Audit trail: Form 1099-B creates a reliable audit trail for both taxpayers and the IRS. It helps taxpayers substantiate their reported gains or losses in case of an IRS audit. Similarly, the form provides the IRS with documented evidence of the reported transactions, facilitating their examination and verification process.

-

Capital loss deductions: Form 1099-B helps taxpayers identify capital losses that may be eligible for tax deductions. Capital losses can be used to offset capital gains, reducing the overall tax liability. Accurate reporting of capital gains and losses on Form 1099-B allows taxpayers to claim the appropriate deductions and potentially reduce their tax burden.

-

Compliance enforcement: The requirement to file Form 1099-B enhances compliance enforcement by ensuring that brokers and financial institutions report transactions accurately and timely. This helps the IRS detect any potential noncompliance and take appropriate actions to address tax evasion or underreporting.

Who Is Eligible To File Form 1099-B?

The following individuals or entities are generally eligible to file Form 1099-B:

Brokers and barter exchanges: If you are a broker or barter exchange, you must file Form 1099-B to report the proceeds from broker and barter exchange transactions for your clients or members.

Investors: If you are an individual investor who sold or exchanged financial assets during the tax year, you may receive Form 1099-B from your broker or financial institution reporting the transactions. Although investors are not required to file Form 1099-B themselves, they need to use the information provided on the form to report their capital gains or losses on their tax returns.

It's important to note that the specific requirements and thresholds for reporting transactions on Form 1099-B can vary. Brokers and barter exchanges have reporting obligations for their clients, while individual investors typically receive the form from their financial institutions.

How To Complete Form 1099-B: A Step-by-Step Guide

Here's a general outline to help you get started:

Step 1: Gather the necessary information

Collect all the relevant information needed to complete Form 1099-B. This includes your name, address, and taxpayer identification number (TIN), as well as the recipient's information if you're filing on behalf of someone else.

Step 2: Obtain the official Form 1099-B

Download the official Form 1099-B from the IRS website or request a copy from the IRS. You can also use tax software or online platforms that provide Form 1099-B.

Step 3: Identify the type of transaction

Determine the type of transaction you need to report on Form 1099-B. This form is used to report proceeds from broker and barter exchange transactions, such as sales of stocks, bonds, commodities, or mutual funds.

Step 4: Complete the payer and recipient information

Enter your information as the payer, including your name, address, and TIN, in the appropriate boxes on the form. If you're filing on behalf of someone else, enter the recipient's information as well.

Step 5: Report the transaction details

Provide the necessary details for each transaction you're reporting. This includes the description of the property or stock sold, the quantity sold, the date acquired, the date sold, the sales price, and any associated expenses. You'll need to complete a separate row for each transaction.

Step 6: Determine the cost basis and check the appropriate box

Determine the cost basis of the sold property or stock and indicate the method used to calculate it. The cost basis is usually the original purchase price, adjusted for factors like fees, commissions, and stock splits. Check the appropriate box to indicate whether the cost basis was reported to the IRS or if it wasn't reported.

Step 7: Complete the adjustments, if applicable

If there are any adjustments to the reported basis or gain/loss, make the appropriate adjustments and include them on the form.

Step 8: Calculate the proceeds and gains/losses

Calculate the total proceeds from all transactions and the total gains or losses. Enter these amounts in the designated boxes on the form.

Step 9: Review and verify the information

Double-check all the information you've entered on Form 1099-B for accuracy. Ensure that all calculations are correct and that you've included all the necessary details.

Step 10: File and distribute the form

File Form 1099-B with the IRS by the designated deadline, typically by the end of February. Provide a copy of the form to the recipient by the same deadline.

Special Considerations When Filing Form 1099-B

When filing Form 1099-B, which is used to report sales or exchanges of securities, there are several special considerations to keep in mind. Here are some important points to consider:

Reporting requirements: If you are a broker or other intermediary involved in the sale or exchange of securities, you are generally required to file Form 1099-B for each person to whom you have sold securities for cash, reported on an installment sale statement, or to whom you have exchanged securities or commodities.

Correct and complete information: It's crucial to ensure that the information on Form 1099-B is accurate and complete. This includes the name, address, and taxpayer identification number (TIN) of the person or entity receiving the form.

TIN verification: Before filing Form 1099-B, you should make reasonable efforts to obtain and verify the recipient's TIN. This can be done using the IRS TIN Matching Program or by requesting a Form W-9 from the recipient. If the TIN is missing or incorrect, you may be subject to backup withholding requirements.

Transactions to be reported: Form 1099-B is used to report various types of transactions, including stock sales, bond sales, mutual fund sales, and other securities transactions. You need to accurately report the date of sale or exchange, proceeds from the sale, cost or other basis, and any relevant adjustments.

Wash sales: A wash sale occurs when a taxpayer sells a security at a loss and acquires a substantially identical security within 30 days before or after the sale. These transactions have special reporting requirements and may require adjustments to the reported proceeds and cost basis.

Basis reporting: Brokers are required to report the cost basis of securities sold on Form 1099-B. It's important to ensure that the correct basis is reported, including any adjustments for corporate actions, such as stock splits, mergers, or spin-offs.

Form 8949 and Schedule D: The information reported on Form 1099-B is used to complete Form 8949, Sales and Other Dispositions of Capital Assets, and Schedule D, Capital Gains and Losses. You will need to transfer the relevant information from Form 1099-B to these forms when preparing your tax return.

Deadlines: The deadline for furnishing the Form 1099-B to the recipient is generally January 31st of the year following the calendar year of the sale or exchange. The deadline for filing with the IRS depends on whether you are filing electronically or by mail.

Penalties for non-compliance: Failure to file accurate and timely Form 1099-B may result in penalties imposed by the IRS. Penalties can apply for failure to file correct information returns, failure to furnish correct payee statements, and intentional disregard of the filing requirements.

Filing Deadlines & Extensions on Form 1099-B

The filing deadlines and extensions for Form 1099-B, which is used to report proceeds from broker and barter exchange transactions, are as follows:

Deadline for furnishing Copy B to recipients: January 31

By this date, the payer (broker or barter exchange) must provide a copy of Form 1099-B to the recipient (the taxpayer) who was involved in the transaction. Copy B is for the recipient's records.

Deadline for filing with the IRS: February 28 (paper filing) or March 31 (electronic filing)

The payer must file Form 1099-B with the Internal Revenue Service (IRS) by either the paper filing deadline of February 28th or the electronic filing deadline of March 31st.

Extensions

If the payer is unable to meet the above deadlines, they can request an extension by filing Form 8809, Application for Extension of Time to File Information Returns. This form must be filed with the IRS on or before the original due date of the return. If approved, it grants an automatic 30-day extension for filing Form 1099-B.

It's important to note that the extension only applies to the filing deadline with the IRS, not the deadline for furnishing Copy B to the recipient. Therefore, it's still necessary to furnish the recipient with their copy by January 31st, even if an extension is granted for the IRS filing

Common Mistakes To Avoid While Filing Form 1099-B

When filing Form 1099-B, which is used to report sales or exchanges of securities, there are several common mistakes you should avoid. Here are some examples:

**Incorrect reporting of cost basis: **The cost basis represents the original purchase price of the securities. It is important to report this accurately to calculate the correct capital gains or losses. Ensure that you include any adjustments, such as commissions or fees, when determining the cost basis.

Omitting transactions: Failing to report all relevant transactions on Form 1099-B can lead to discrepancies and potential IRS penalties. Make sure you include all sales or exchanges of securities, including short-term and long-term transactions.

**Mismatched information: **Ensure that the information reported on Form 1099-B matches the information provided by the taxpayer. This includes the taxpayer's name, Social Security number or taxpayer identification number, and other relevant details. Any discrepancies can trigger IRS inquiries or delays in processing.

Incorrect classification of transactions: Different types of securities transactions have specific reporting requirements. For example, short sales, wash sales, and corporate actions like mergers or spin-offs have specific rules for reporting on Form 1099-B. Understand the requirements for each type of transaction and classify them correctly.

Failure to report wash sales: Wash sales occur when you sell a security at a loss and purchase a substantially identical security within 30 days before or after the sale. These transactions must be reported on Form 1099-B. Failing to do so can result in inaccurate reporting of capital gains or losses.

Not reporting cost basis adjustments: Certain events can lead to adjustments to the cost basis of securities, such as corporate actions or return of capital. These adjustments should be reported correctly on Form 1099-B to ensure accurate reporting of capital gains or losses.

Ignoring electronic filing requirements: Depending on the number of forms you need to file, you may be required to file Form 1099-B electronically. Make sure to follow the IRS guidelines for electronic filing to avoid penalties or processing delays.

Late or missed filing: Form 1099-B has specific deadlines for filing, both to the recipient and the IRS. Failing to meet these deadlines can result in penalties. Ensure that you are aware of the due dates and file the form in a timely manner.

Conclusion

Form 1099-B plays a vital role in reporting proceeds from broker and barter exchange transactions. As a taxpayer, it is essential to understand the purpose of this form and the information it provides.

By accurately reporting your financial transactions using Form 1099-B, you ensure compliance with tax regulations and minimize the risk of errors or penalties.

If you have any questions or concerns about Form 1099-B or your tax reporting, consulting a tax professional or reaching out to the IRS can provide the necessary guidance.