- IRS forms

- Form 1095-B

Form 1095-B: Your Guide to Health Coverage Reporting

Download Form 1095-BIntroduction:

Filing taxes can be a daunting task, especially when you have to navigate the complexities of the Affordable Care Act (ACA). One aspect of the ACA that taxpayers need to be aware of is the requirement to report their health insurance coverage on their tax returns.

This is where Form 1095-B comes in. Form 1095-B is a tax form used to report information about an individual's health insurance coverage. It provides evidence that an individual or their dependents had minimum essential coverage, which is required under the ACA. In this blog, we'll dive into the details of Form 1095-B, including who needs to file, when to file, and common mistakes to avoid.

By the end of this guide, you'll have a better understanding of what Form 1095-B is, how to file it, and how to stay compliant with the ACA.

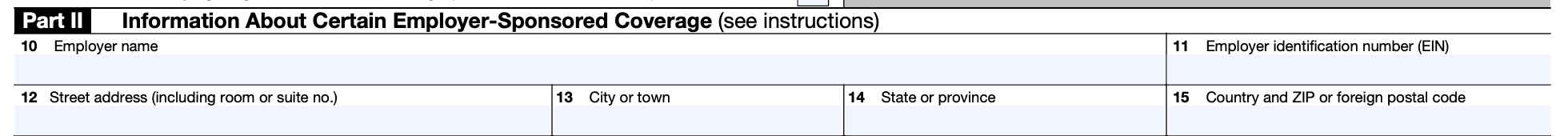

What is Form 1095-B: Health Coverage?

Form 1095-B is a document that reports information about an individual's health insurance coverage, including the type of coverage, the period of coverage, and the individuals covered by the plan. The form is sent by health insurance providers, including self-insured employers, to individuals who are covered by their plans.

Who needs to file Form 1095-B: Health Coverage?

Health insurance providers, including self-insured employers, are required to file Form 1095-B for each individual they cover. Individuals who receive coverage through Medicaid or the Children's Health Insurance Program (CHIP) will also receive Form 1095-B.

Who receives a copy of Form 1095-B?

Form 1095-B is sent to each individual who was covered by the plan, including the policyholder or primary insured and any covered dependents. The form is also sent to the IRS.

Steps on How to file Form 1095-B: Health Coverage:

- Collect Information: The first step is to gather all the necessary information required to complete Form 1095-B. This includes the names and social security numbers or other tax identification numbers (TIN) of all covered individuals, their dates of birth, and the months in which they had minimum essential health coverage.

- Complete Part I, II, III and IV: Covered in detail below.

- File the Form: Once the form is completed, it must be filed with the IRS along with a Form 1094-B, which is a transmittal form that summarizes all the information provided in Form 1095-B.

- Distribute Copies: Employers and health insurance providers must also distribute copies of Form 1095-B to covered individuals by March 31 of each year.

It is important to note that there may be additional requirements for filing Form 1095-B, depending on the size of the employer or health insurance provider, as well as other factors. It is recommended to consult with a tax professional or the IRS for more information.

When to file Form 1095-B: Health Coverage?

Health insurance providers are required to send Form 1095-B to individuals by January 31st of each year. Providers must also file a copy of Form 1095-B with the IRS by February 28th if filing by paper or March 31st if filing electronically.

Specific Instructions for Form 1095-B

Part 1: Responsible Individual

- Line 1: Enter the name of the responsible individual who will receive the statement. To determine who is a "responsible individual," see the description under "Statements Furnished to Individuals" in the form instructions.

- Line 2: Enter the responsible individual's nine-digit social security number (SSN) in the format 111-11-1111. If the responsible individual doesn't have an SSN, enter their other taxpayer identification number (TIN). Note that no SSN or other TIN is required if the responsible individual isn't a covered individual identified in Part IV. See "Statements Furnished to Individuals" for information on truncating the SSN or other TIN.

- Line 3: Only enter the responsible individual's date of birth (YYYY/MM/DD) if line 2 is blank.

- Lines 4-7: Enter the complete mailing address of the responsible individual. If mail isn't delivered to the street address and the responsible individual has a P.O. box, enter the box number instead of the street address.

- Line 8: Enter the letter corresponding to the origin of the health coverage. See "Who Must File" to determine which types of coverage fall under each category listed below:

- A. Small Business Health Options Program (SHOP).

- B. Employer-sponsored coverage, except for an individual coverage HRA.

- C. Government-sponsored program.

- D. Individual market insurance.

- E. Multiemployer plan.

- F. Other designated minimum essential coverage.

- G. Employer-sponsored coverage that is an individual coverage HRA.

- Line 9: For the 2022 tax year, this line should be left blank.

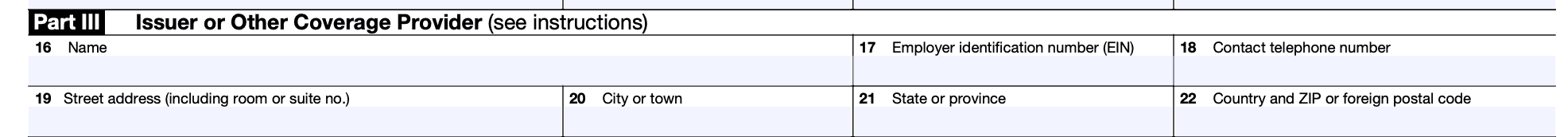

Part 2: Information about Certain Employer-Sponsored Coverage

Form 1095-B pertains to certain employer-sponsored coverage and must be completed by the issuers or carriers of insured group health plans, including coverage purchased through the SHOP.

If insurance companies enter code A or B on line 8, they must complete Part II. Employers who are reporting self-insured group health plan coverage on Form 1095-B, except for an individual coverage HRA, should enter code B on line 8 but do not have to complete Part II. In case you have entered code B for self-insured coverage, you must skip Part II and go to Part III.

In Lines 10-15, provide the name, (link: https://fincent.com/glossary/employer-identification-number text: EIN), and complete mailing address of the employer sponsoring the coverage. If the mail is not delivered to the street address and the employer has a P.O. box, enter the box number instead of the street address.

If the employer is a member of a controlled group, enter the details of the specific controlled group member who is the covered employee’s employer. If the coverage is provided through an association or a Multiple Employer Welfare Arrangement, enter information for the participating employer of the covered employee. However, if the coverage is provided through a multiemployer plan, you don't need to complete Part II.

Part 3: Issuer or Other Coverage Provider

Lines 16-22 are for the provider's information. This includes their name, EIN, and complete mailing address. The provider can be an insurance company offering insured coverage, a sponsor of a self-insured employer plan, a government agency providing government-sponsored coverage, or another type of coverage sponsor.

Line 18 is where the provider should enter a telephone number that individuals can call for additional information.

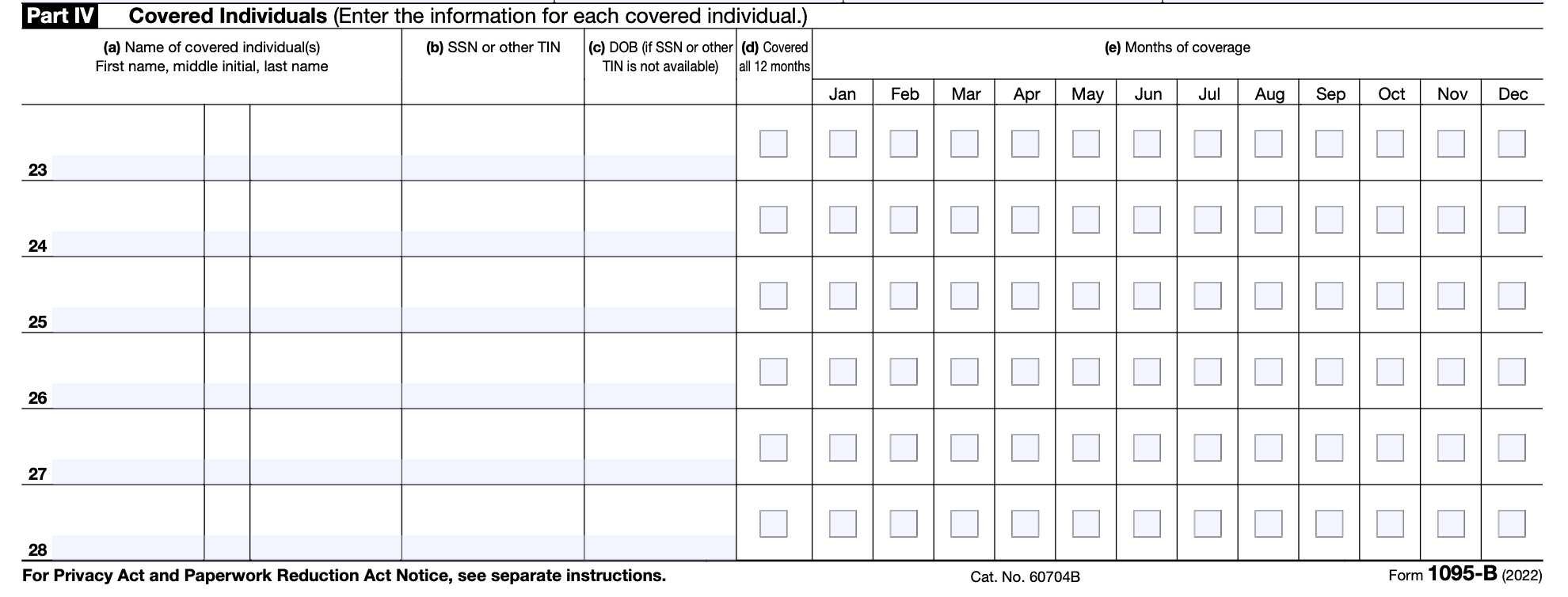

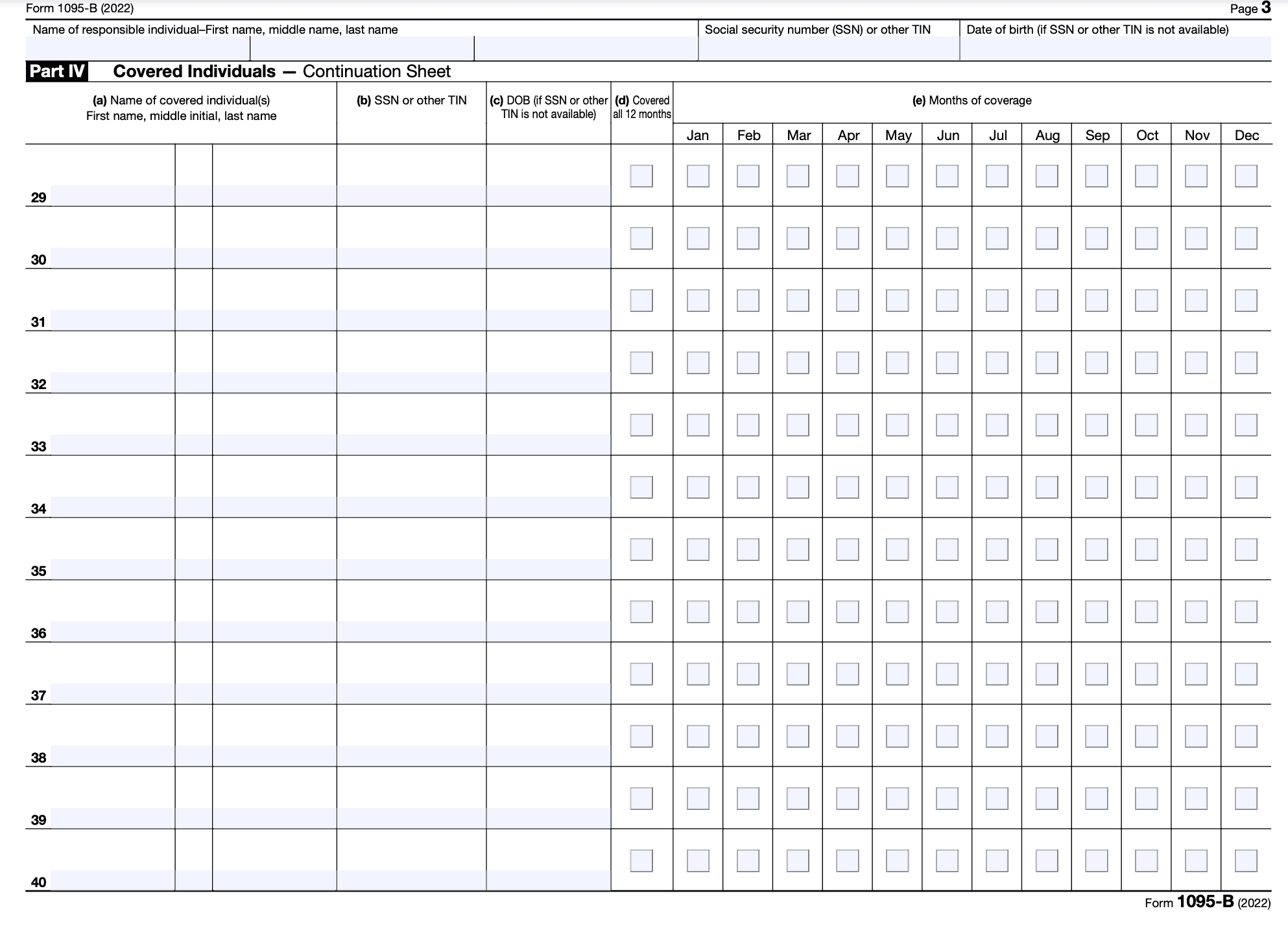

Part 4: Covered Individual

- Column (a): Fill in the name of each person who is covered by the insurance plan.

- Column (b): Enter the individual's nine-digit SSN or other TIN (111-11-1111). If the individual does not have a TIN, this field may be left empty. Refer to Statements Furnished to Individuals for guidance on truncating the SSN or other TIN.

- Column (c): Enter the individual's date of birth (YYYY/MM/DD) if you have not entered an SSN or other TIN in column (b).

- Column (d): Check this box if the individual was covered for at least one day per month for all 12 months of the calendar year.

- Column (e): If the individual was not covered for all 12 months, check the box(es) that apply to the month(s) in which the individual was covered for at least one day.

- If there are more than six individuals covered, complete the information for the additional individuals on Part IV, Continuation Sheet(s). Do not include the Continuation Sheet(s) in the count of forms submitted with the accompanying Form 1094-B.

Common mistakes to avoid when filing:

- Failing to send a copy of Form 1095-B to each individual who was covered by the plan, failing to file Form 1095-B with the IRS by the deadline, or failing to accurately report information on Form 1095-B can result in penalties and fines.

- If you fail to send a copy of Form 1095-B to individuals who were covered by the plan, they may not have the necessary information to correctly report their health coverage on their tax returns. This can lead to penalties and a delay in processing their returns.

- Failing to file Form 1095-B with the IRS by the deadline can result in penalties, which can be substantial. The deadline for paper filing Form 1095-B with the IRS is February 28, while the deadline for electronic filing is March 31.

- Inaccurately reporting information on Form 1095-B can also result in penalties. The information reported on Form 1095-B is used to determine whether individuals have met their individual shared responsibility requirement under the Affordable Care Act. Therefore, it's important to make sure that the information reported is accurate.

- If you encounter an issue when filing Form 1095-B, you can contact your health insurance provider or tax professional for assistance. They can provide guidance on how to correctly fill out the form and can help resolve any issues that you may encounter.

- Additionally, the IRS has resources available to help individuals and providers with questions about Form 1095-B. You can visit the IRS website or call the IRS helpline to get answers to any questions that you may have. It's important to address any issues or errors on Form 1095-B as soon as possible to avoid penalties and fines.

Is Form 1095-B the same as Form 1095-A or Form 1095-C?

No, Form 1095-B is not the same as (link: https://fincent.com/irs-tax-forms/form-1095-a text: Form 1095-A) or Form 1095-C. Form 1095-A is used to report information for individuals who received health insurance coverage through the Health Insurance Marketplace, while Form 1095-C is used to report information for individuals who received health insurance coverage through their employer, if the employer is an applicable large employer (ALE). Form 1095-B is used to report information for individuals who received health insurance coverage that is not provided through the Health Insurance Marketplace and not provided by an ALE employer.

Conclusion:

Form 1095-B is an important tax form used to report information about an individual's health insurance coverage. Health insurance providers are required to file this form for each individual they cover, and individuals who receive coverage through Medicaid or CHIP will also receive a copy of the form. By following the steps outlined in this blog and avoiding common mistakes, individuals and providers can ensure they are in compliance with the ACA and avoid penalties.