What is a Bad Debt Expense? How Do I Calculate It?

A nightmare for any business, bad debts are a painful reality. Hardly any client will pay you upfront in cash, and you need to provide credit facilities to them

A nightmare for any business, bad debts are a painful reality. Hardly any client will pay you upfront in cash, and you need to provide credit facilities to them. The credit period varies from 15 days (Net 15) to 30 days (Net 30).

The clients you provide credit facilities to are known as your debtors. A bad debt arises when these debtors fail to pay you when the credit period is over. Goods sold on credit come under the Accounts Receivable section in your book of accounts.

An example will clarify things. Dev Patel is in his early 50s and owns a textile studio in Buffalo, New York. One of his clients failed to pay the billed amount. Dev tried persuading the client and sent them repeated emails. The client stated that due to insufficient funds, they would not pay Dev.

Dev did not have the time to take care of his accounts or account for such clients. He hired an online bookkeeping service to take care of his accounting worries and record his bad debt and fixed cost. This gave him the opportunity to focus on growing his business.

What is a Bad Debt Expense?

The payment due from the client that you cannot recover is known as a bad debt. This amount needs to be removed from the Accounts Receivable by showing it as an expense. The Accounts Receivable will go down by this amount.

This financial transaction is recorded in your book of accounts as a bad debt expense. It denotes the amount due by your debtors that you cannot recover. The reason you need to record this expense is that your book of accounts is maintained on an accrual basis.

The accrual basis of accounting takes into consideration the income and expenses that are receivable or payable respectively for the financial year. You may not receive it for the period. Using the cash basis of accounting is no help since you have no income to set off the bad debt against.

Accounting for bad debt expenses is important since you know the actual financial condition of your business. The net profit of your business is more accurate since you have excluded income that is doubtful or bad. More importantly, know about what is accrued expenses and also you pay fewer taxes if you have accounted for bad debts since you can't be taxed on profits you haven't earned.

How to Find Bad Debt Expenses

All financial transactions, including bad debt expenses, can be found under the General Ledger. These expenses are not directly associated with the production of products, and they are classified as selling, general and administrative expenses. You can find these expenses in your income statement, which includes all income and expenses incurred by your business in a financial year.

Bad debt expense forms part of your operating cost, including the cost of goods sold (associated directly with production) and administrative expenses (not directly associated with production).

How to Calculate Bad Debt Expense

Is there a formula to calculate bad debt expense? Yes, there are two ways to account for bad debt:

- Reducing or writing off Accounts Receivable

- Allowance method

Writing Off or Adjusting Accounts Receivable

If you don't have too many customers who do business on credit, then you can make adjustments individually. You will find both the bad debt expense and Accounts Receivable in General Ledger. An entry will be made in the Accounts Receivable, and a corresponding entry will be made in the bad debt expense account.

There are certain guidelines that the IRS follows for bad debts. There should be no chance of recovering such debts. You should have taken reasonable steps for the collection of such debt.

You need to provide proof like call/email records proving that you tried to call the customer or provide easier repayment terms. When the IRS is convinced regarding your bad debt expense, you are authorized to write off the debt.

Allowance Method

If the number of customers doing business on credit is high, then you can account for bad debts using the allowance method. You set aside a certain amount from your profits and create a reserve fund for bad debts. If there is a bad debt expense, you withdraw funds from the allowance for bad debts created for this purpose.

This reserve for bad debts is created using a percentage of the bad debts formula. So how does this formula work?

Based on experience, a certain percentage of your 'customers on credit' will form bad debt. This percentage is calculated by dividing your past bad debts by your past sales.

The formula for this is:

Percentage of Bad Debt = Total Bad Debts / Total Credit Sales

Textile studio owner Dev had around $600,000 in credit sales in the last financial year. Of that, $42,000 turned out to be a bad debt expense. You want to set up a bad debt reserve in advance, but how do you calculate how much you should set aside?

Percentage of Bad Debt = $42,000 / $600,000 or 7%

Your ballpark figure for a bad debt reserve fund would be 7% of your total credit sales for the following financial year. If Dev expects that credit sales for the financial year 2021-22 will be $500,000, he needs to create a bad debt allowance of $35,000.

This method of protection against bad debts can't always be accurate; you could have new customers who might default this year. However, it's a great starting point, and you could keep an extra percentage or two in your bad debt allowance.

How To Record A Bad Debt Expense

There are two ways to record a bad debt expense in your book of accounts - writing them off the Accounts Receivable account and creating a bad debt reserve fund.

Accounting for Bad Debts Using the Direct Write-Off Method

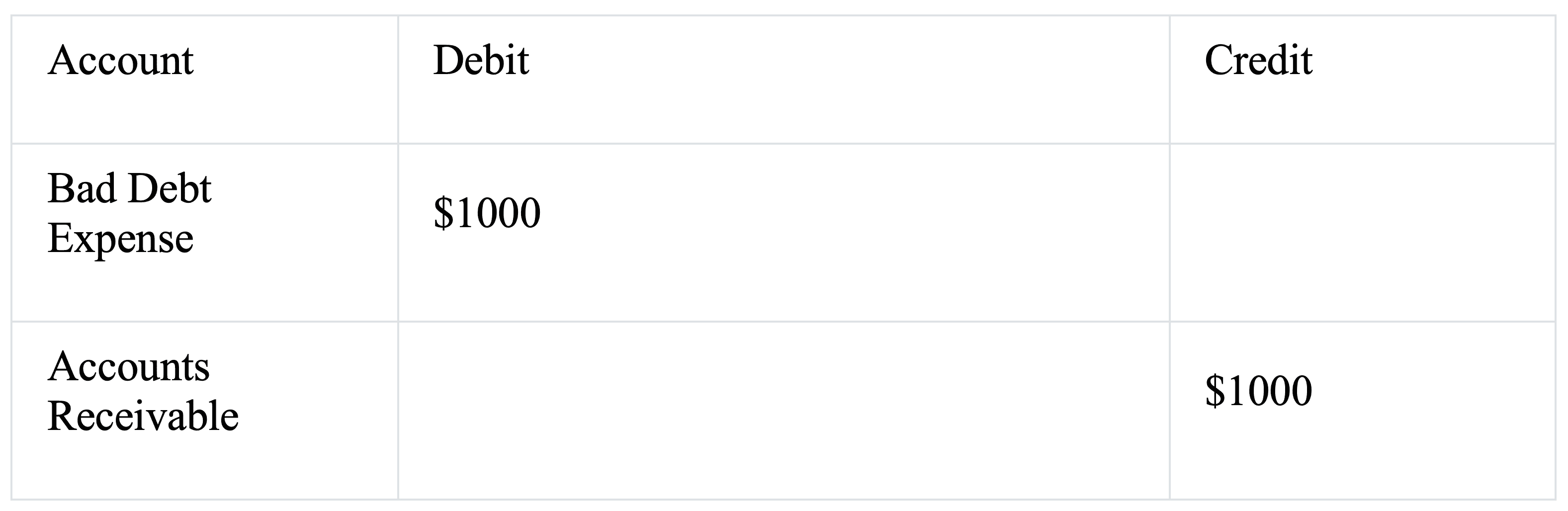

Let's go back to Dev's example. The client said they wouldn't be able to pay Dev $1000. Dev tried his best to collect the amount due by calling the customer regularly and emailing them too, but he got no response.

The following entries will have to be passed in Dev's General Ledger:

Accounting for Bad Debts Using the Allowance Method

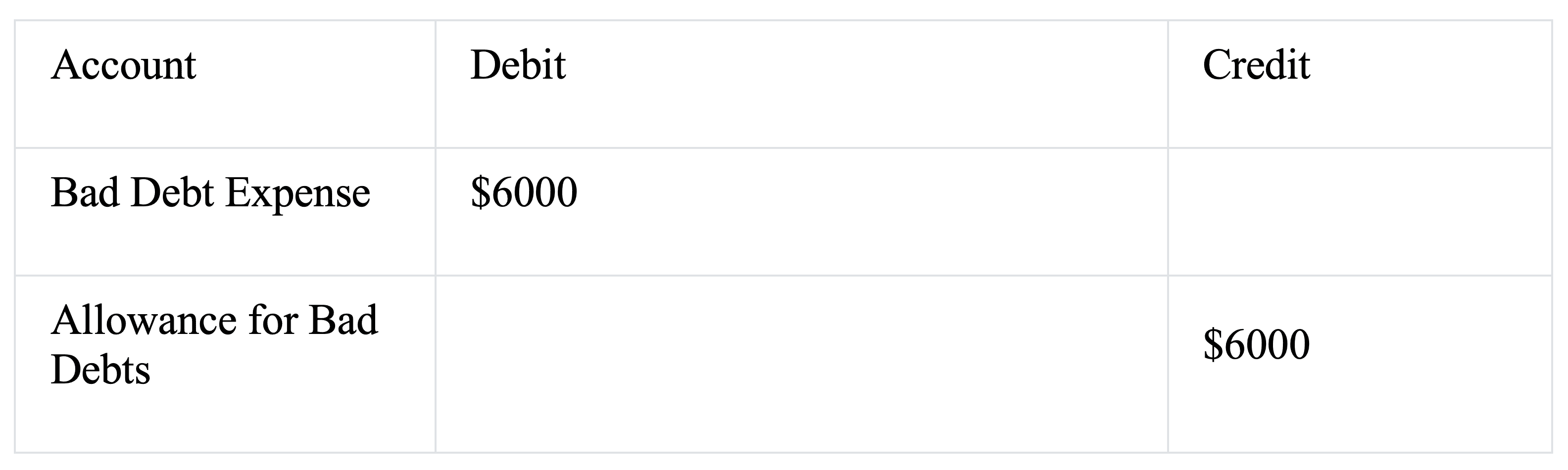

If Dev has estimated that the allowance for bad debts should be $6000, then the following journal entry has to be made in his books of accounts.

The allowance for bad debts is a contra-asset account. The reason it is known as a contra-asset account since it has a credit balance, unlike other asset accounts that appear on the balance sheet and have debit balances. Assets have debit balances according to accounting principles.

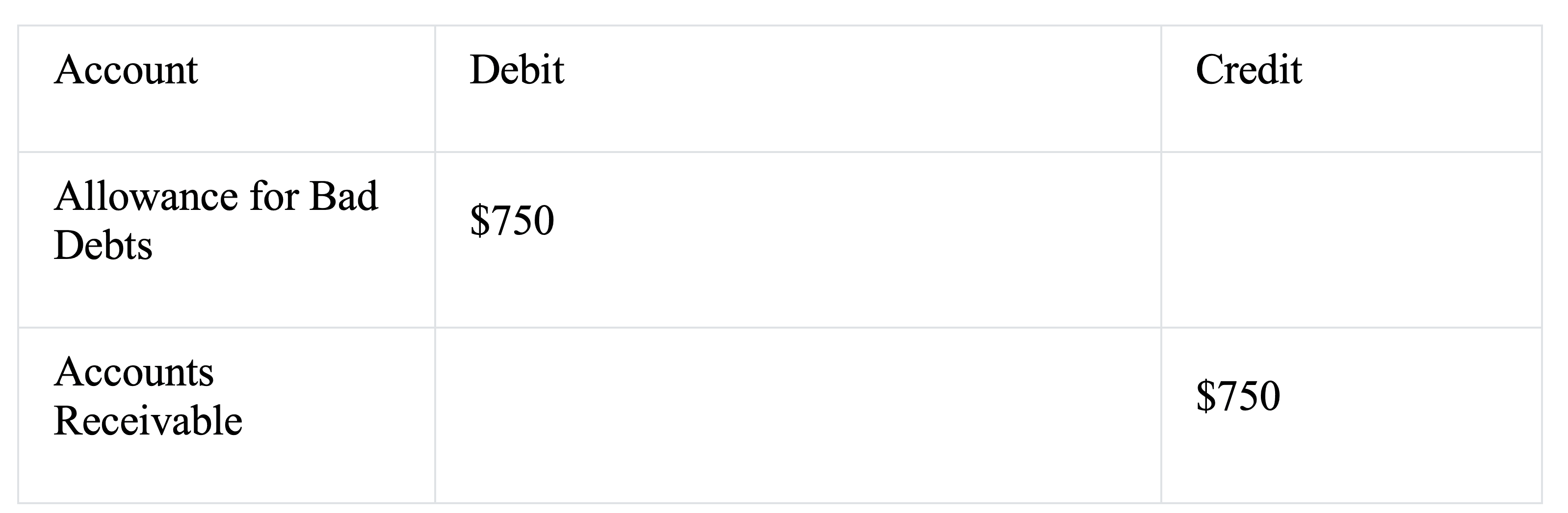

If during the financial year, one of Dev's customers who owes him $750 informs him that they cannot pay, then $750 would be a bad debt expense. Dev needs to write off the $750 from the Accounts Receivable account.

Since there is already a provision for bad debts of $6000, the bad debt will be adjusted against this account. The journal entry for recording this transaction would be:

With this method of accounting for bad debts, all losses for the current year are covered, and you won't have any cash flow issues. If there are further bad debts during the financial year, they can be adjusted against the reserve fund for bad debts.

If you find that the bad debts for the year are higher than anticipated, Also understand what is accrual basis of accounting then the estimate for the reserve fund can be revised accordingly.

In Conclusion

An allowance for your bad debt expense is crucial to keep your business running smoothly. However, taking care of all these financial aspects of your business can be quite challenging, which is why you could consider partnering with bookkeeping services like Fincent so that you can focus entirely on growing your business.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more