S Corp vs. C Corp: Definitions, Advantages & Disadvantages

S corp and C corp are corporation statuses assigned by the IRS to incorporated businesses. Read on for a comparison between the two corporate structures.

According to Investopedia, “A corporation is a legal entity that is separate and distinct from its owners.”

It is essentially a business structure wherein the organization legally acts as an individual and derives the associated rights and responsibilities. As such, the corporation can enter into contracts, loan or borrow money, own assets, sue or be sued, hire employees, and pay taxes.

Forming a corporation requires filing a document known as Articles of Incorporation. Once this is done, the corporation separates itself from the owners, who now have limited liability for corporate debts.

These corporations come tagged as S Corps and C Corps, a status determined by variables like taxation, the scale of operations, flexibility of ownership, etc. Here, we take an in-depth look at S Corps and C Corps and identifying their respective opportunities, drawbacks, and differences.

What is a C Corp?

C Corp is a business that functions as a legal entity that is separate from the owners. This separation protects their personal assets from creditors. However, it also results in a system that taxes profits from businesses at a personal and corporate level.

C Corp is the default status for any incorporated business. Even corporations that acquire an S Corp status start as C Corps. Most large publicly traded corporations in America are C Corps. Given that it can issue multiple classes of stock and can have unlimited shareholders, it attracts funds through equity financing.

Advantages of C Corps

Acquiring a C Corp status grants you the following benefits:

- Since it is the default corporation status, one has to go through fewer formalities, and it involves less paperwork.

- Getting your business incorporated formalizes and legitimizes it. It indicates that you are serious about your business and its growth.

- It imposes no restrictions on business ownership in that it can have an unlimited number of shareholders.

- You can raise funding through investors or sell the company in the future with ease.

- As long as charitable contributions and donations do not exceed 10% of your income, your company can deduct 100% of these components while filing corporate tax returns.

- Even though double taxation is a major drawback for C Corps, the Tax Cuts and Jobs Act puts a cap on it at 21%.

- C Corps can issue diverse classes of stock, which can accelerate their growth at a global scale.

Limitations of C Corps

While C Corp is an attractive status, it faces the following limitations:

- Double taxation is one of the greatest disadvantages of C Corps. Here, you have to pay personal tax, along with the tax on behalf of your business.

- Incorporating your business can be an expensive affair, especially in comparison to partnerships and sole proprietorships.

- Managing and updating your business can get quite intense as you have to regularly conduct board meetings and update your shareholders on any developments.

- In some states, businesses have to pay a fee to maintain their C Corp status.

What is an S Corp?

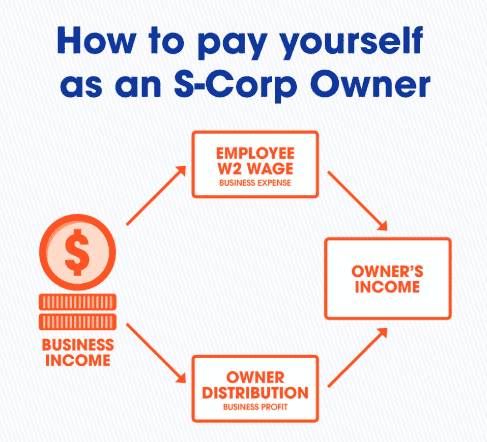

S Corp is a special status granted to incorporated businesses by the IRS. It allows the business to transfer its corporate income, credit, and deductions to its shareholders. The shareholders then split the profits or losses amongst themselves and report them against their personal tax returns. As a result, S Corps do not have to face double taxation.

However, obtaining an S Corp status is no walk in the park. Here are the prerequisites that one needs to satisfy to be eligible for consideration:

- The business must be based and operational in the United States.

- You can only have allowable shareholders, namely, individuals, certain trusts, and estates. Partnerships, corporations, and non-resident shareholders are not allowed.

- The maximum number of shareholders is restricted to 100.

- You can only issue a single class of stock.

- Businesses must not be ineligible corporations, such as certain insurance companies, financial institutions, international sales corporations, etc.

- All shareholders must unanimously agree to obtain the S Corp status.

Benefits Enjoyed by S Corps

The S Corp status offers you the following benefits:

- The S Corp status reduces the burden of double taxation that C Corps experience.

- By reducing the number of shareholders, you no longer have to sift through the jumble of varying opinions to reach an extract. This quality can be particularly helpful if the voice of your shareholders carries ample weight.

- Limiting the number of shareholders also restricts the number of business owners, which can benefit some organizations.

- Employees can be shareholders, and involving them in the decision-making process motivates them to perform better.

- Business owners have to report only on the income and loss incurred by the business in their personal income tax returns. Plus, they can deduct as much as 20% of business' income while filing their personal income tax returns.

Limitations of S Corps

Despite the wealth of benefits, the S Corp status poses the following impediments:

- Filing to form an S Corp requires more paperwork, such as Form 2553. These requirements may also change depending on the state in which you're getting your business incorporated.

- S Corp tax filings undergo rigorous scrutiny by the IRS. Any discrepancy could lead to the cancellation of your S Corp status.

- The rules governing S Corp ownership are highly restrictive and inflexible. Failing to abide by these standards can potentially result in the revocation of your S Corp status.

- S Corps can issue only one class of stock.

Notable Differences Between S Corps and C Corps

S Corps and C Corps are both incorporated entities, with the former being a form of the latter. As a result, they share several similarities, these being:

- Requirement of filing documents (Forms 1120, 1120-W, and 941) for incorporation

- Acting as separate legal entities

- Limited liability protection to business owners

- Business structure and framework

- Corporate duties and formalities

However, the major differences between S Corps and C Corps are summarized in the table below:

S Corp vs. C Corp Status: Which One to Choose?

Now that the differences between S Corps and C Corps are obvious, you may face a crucial question - which one should you choose?

The answer mainly depends on your business objectives and status.

If you are a new business that aims to achieve accelerated growth and intends to recycle the profits through the organization, then obtaining a C Corp status may be beneficial for you. It also leaves you room to raise money from investors.

On the other hand, if you wish to derive the profits externally and distribute them amongst the shareholders as a “reasonable salary,” then the S Corp status would be suitable for you. In essence, it indicates that the business has reached maturity, and the shareholders will now receive their profits as a salary. However, do remember that you cannot have more than 100 shareholders, and they should all be US-based, which could be a restriction.

Based on these factors, you can now make a calculated decision on the corporation status most appropriate for your business.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more