- IRS forms

- Schedule A (Form 1040)

Schedule A: Lower Your Tax Bill with Itemized Deductions

Download Schedule A FormAre you looking to minimize your tax bill and keep more money in your pocket? Itemized deductions can help you achieve just that. Tax filings can be a source of stress and anxiety for many. Whether you are filing as an individual, couple, or business, (link: https://fincent.com/blog/you-made-it-tax-season-is-finally-over-heres-how-to-make-it-easier-next-year text: tax season) sure brings with it a lot of planning and drafting.

The goal of any taxpayer is to save as much money as possible and prevent the tax amount from becoming exorbitant. That is why 30% of individuals with middle or high incomes choose to itemize their expenses.

Itemized deductions help to categorize your expenses and reduce taxable income. For people as well as businesses, it is an efficient way to get the best out of the tax season. Our comprehensive guide will walk you through the process of identifying and claiming eligible deductions, and provide resources to make tax season a breeze. Get ready to navigate the world of itemized deductions with confidence, whether you're seeking information, tax assistance, or ready to dive into tax-saving tools.

Understanding Itemized Deductions (Schedule A - form 1040)

But before we get to that, let's look at what itemizing your expenses means. In this section, explore the basics of itemized deductions, how they differ from the standard deduction, and when it's advantageous to itemize.

- What are itemized deductions?

- Which Expenses Can You Itemize?

- Itemized Expenses Rules

- Standard deduction vs. itemized deductions

- When should you itemize? and more…

What Are Itemized Deductions?

An itemized deduction is basically any expense that can be subtracted from your (link: https://fincent.com/glossary/adjusted-gross-income text: adjusted gross income (AGI)). It helps to reduce your taxable income on (link: https://fincent.com/blog/federal-income-tax-brackets-tax-rates-for-2021 text: federal tax returns).

Some deductions are allowable under the itemized list. They are subject to certain limits and may include expenses such as mortgages, interests, medical expenses, charity donations, etc.

To get your total taxable income, you need to itemize all eligible expenses that fall under deductibles, then add them together. The total amount is then to be deducted from the AGI to calculate the taxable income.

Taxpayers who are filing federal tax with the help of Form 1040, which is for individual tax returns, can choose to itemize their deductible income or opt for the standard deduction. We will get into the details of standard deductions soon.

However, you should go for an itemized deduction if its total is estimated to be higher than the standard deduction amount. This choice is unavailable for non-resident aliens, i.e., individuals who are not US citizens and do not possess a green card.

For a married couple, both individuals must choose the same option of either claiming itemized deductions or the standard deduction. This means that if one claims the standard, the spouse cannot opt to itemize their expenses.

Which Expenses Can You Itemize?

Although there is a wide range of expenses you can optimize, only certain kinds of expenses fall under this category. Some common itemizable tax deductions are:

- Real estate mortgages and interests

- Cash or check gifts or donations

- Medical and dental expense

- Local and state taxes

- Casualties or losses from a federally declared disaster

- Theft losses

To itemize all these successfully, the key is to keep track of your expenses throughout the year. And merely keeping track isn’t enough. You also need to save relevant documentation, like bank statements, receipts, charity letters, medical expense bills, and so on.

How to Figure Out Your Total Tax Savings

Since your itemized deductions are related to taxable income, they depend on the tax bracket you fall under. For individual taxpayers, there are specific tax brackets depending on their annual income.

If your income is $100,000 or more yearly, you will fall under the 24% tax bracket. However, if you claim $20,000 or more under itemized deductions, your taxable income will reduce, placing you in the 22% tax bracket.

Consult the IRS website for the latest tax brackets so you can make informed claims and receive maximum refunds.

How to Itemize Deductions

A list of available deductions for the year is given on Form 1040, which lets an individual file their federal taxes. Simply read the rows in the form carefully and fill out all applicable deductions. Keep all proofs of claim handy during this process.

How Fill Schedule A (Form 1040) for Itemized Deductions

Here is the step-by-step guide to filling out Schedule A (Form 1040) for itemized deductions.

Step 1: Gather necessary documents and receipts

Before you begin filling out Schedule A (Form 1040), collect all relevant documents and receipts related to your itemized deductions. This may include medical bills, mortgage interest statements, property tax bills, charitable contribution receipts, and other records of deductible expenses.

Step 2: Obtain Schedule A (Form 1040) and instructions

Download a copy of Schedule A (Form 1040) and its instructions from the IRS website (www.irs.gov). Review the instructions to familiarize yourself with the form and the specific requirements for each itemized deduction category.

Step 3: Complete the form

Fill in the requested information for each itemized deduction category. Schedule A (Form 1040) is divided into several sections, corresponding to different types of deductions:

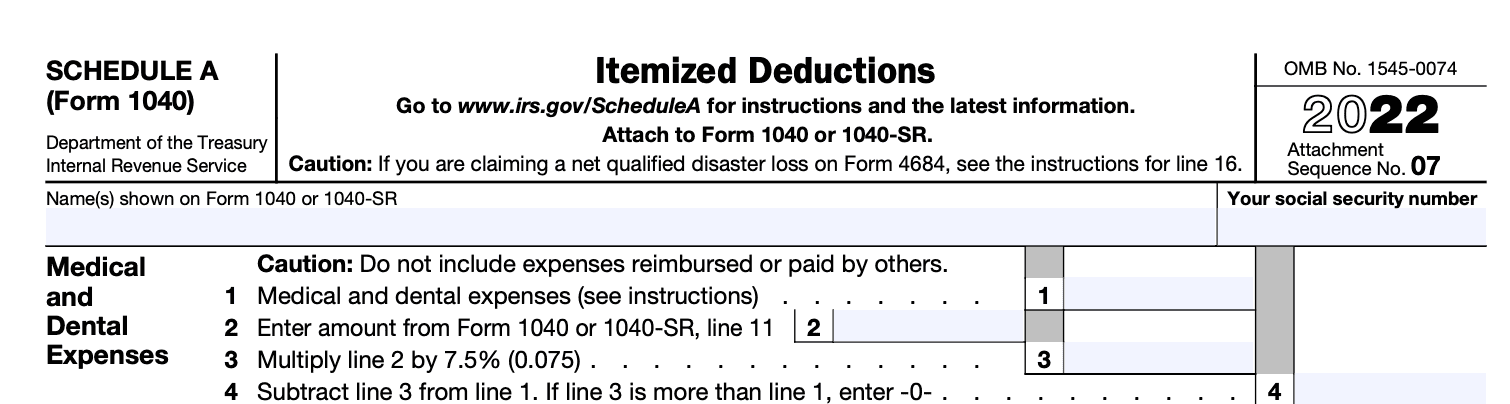

Section 1: Medical and Dental Expenses

Report your total medical and dental expenses on line 1, and your adjusted gross income (AGI) on line 2. Calculate 7.5% of your AGI and enter it on line 3. Subtract line 3 from line 1 and enter the result on line 4.

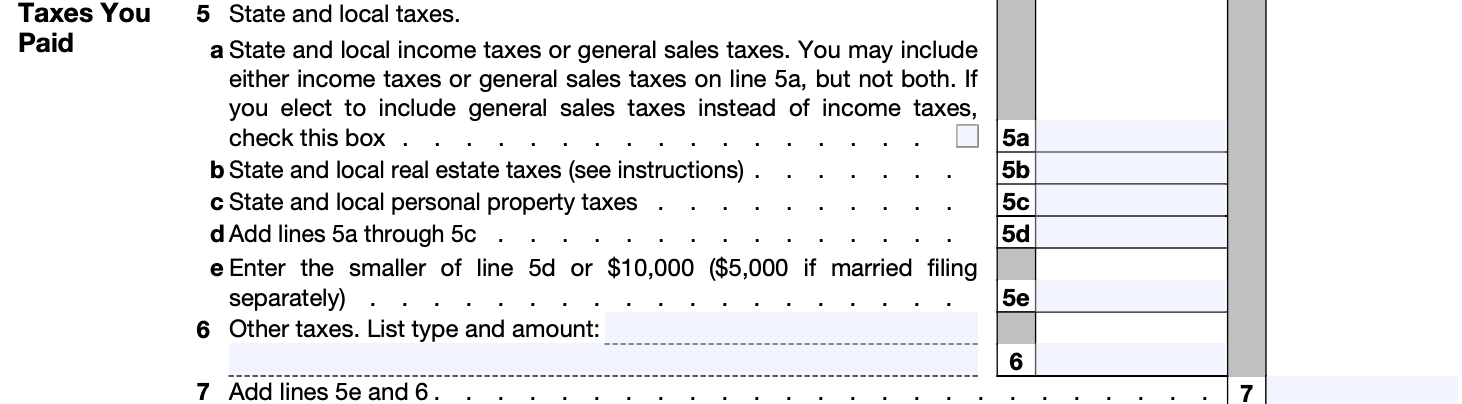

Section 2: Taxes You Paid

Enter the total state and local income taxes or general sales taxes paid on line 5a, real estate taxes on line 5b, and personal property taxes on line 5c. Add lines 5a, 5b, and 5c, and enter the result on line 5d, subject to the (link: https://fincent.com/glossary/state-and-local-tax-deduction text: SALT deduction limit) ($10,000 or $5,000 if married filing separately).

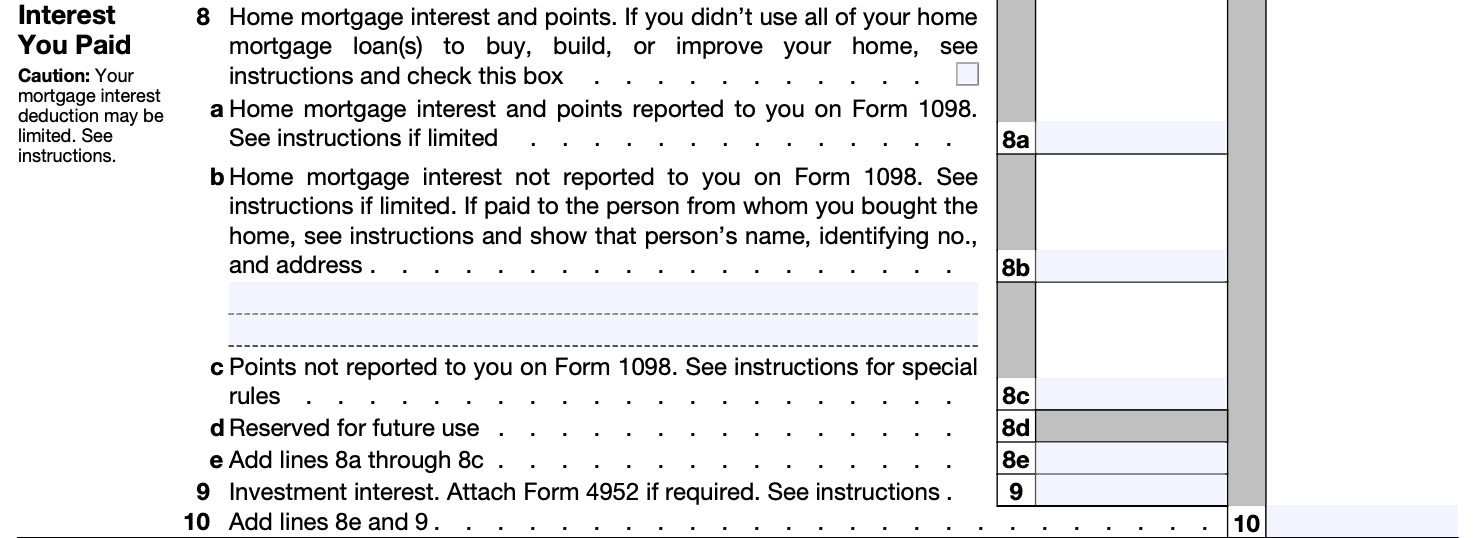

Section 3: Interest You Paid

Report home mortgage interest and points on lines 8a and 8b, and mortgage insurance premiums (if applicable) on line 8c. Add lines 8a, 8b, and 8c, and enter the total on line 8d.

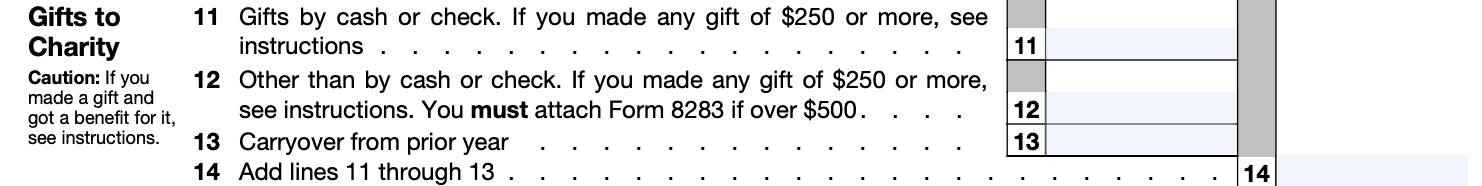

Section 4: Gifts to Charity

Enter your total cash contributions on line 11, and non-cash contributions on line 12. Add lines 11 and 12, and enter the result on line 13.

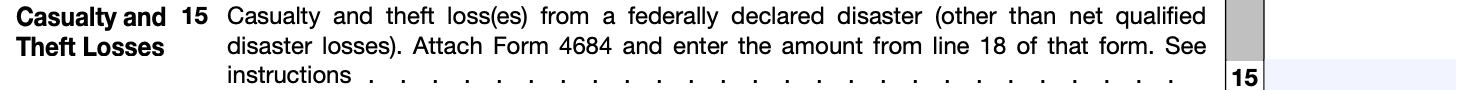

Section 5: Casualty and Theft Losses

If you have eligible casualty or theft losses, complete and attach Form 4684. Enter the total losses from Form 4684 on line 16.

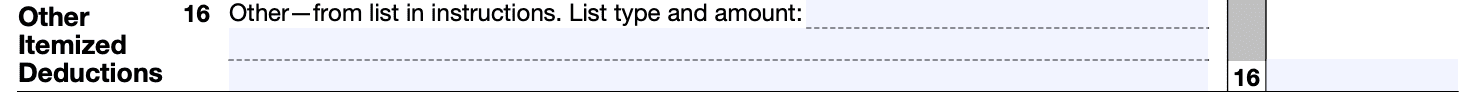

Section 6: Other Itemized Deductions

List any other itemized deductions not covered in the previous sections on line 17.

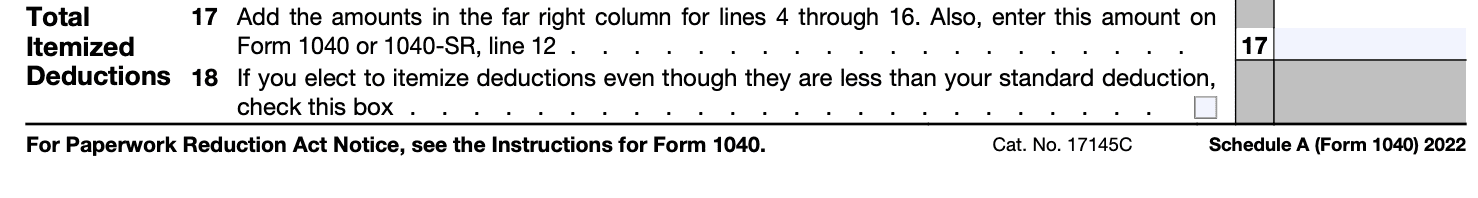

Section 7: Total Itemized Deductions

Add the amounts from lines 4, 5d, 8d, 13, 16, and 17. Enter the total on line 18.

Step 4: Transfer the total to Form 1040

Copy the total from line 18 of Schedule A (Form 1040) to line 12a of Form 1040. This is the total amount of your itemized deductions.

Step 5: File your tax return

Attach Schedule A (Form 1040) to your tax return and submit it to the IRS by the tax filing deadline. Be sure to keep copies of all forms, documents, and receipts for your records.

What Is the Standard Deduction?

The standard deduction is a flat amount that can be deducted from your taxable income. The IRS allows you to take the deduction irrespective of how many itemized expenses you may have. This flat amount depends on your filing status and amount.

Till 2017, the standard deduction amount for individuals and married couples was $6,350 and $12,700, respectively. However, these amounts were almost doubled after the Tax Cuts and Jobs Act (TCJA) was passed.

With the new limits, you can save more money during tax season by opting for standard deductions. On the other hand, you must now increase your tax deduction list to reach the standard deduction threshold.

For states with higher taxes, this process becomes easier through state income taxes, property taxes, and so on. But for other instances, simple prepayments and donations might not push you over the standard limit. In that case, you will have to spend more to opt for itemized deductions.

Itemized Deductions vs. Standard Deduction

You might get confused about whether to itemize your deductions or opt for a standard deduction. But the difference between these two comes down to basic math.

| Standard Deduction | Itemized Deductions | |

| Definition | Fixed amount reducing taxable income | Specific expenses reducing taxable income |

| Complexity | Simplified tax filing process | Requires completion of Schedule A form |

| Recordkeeping | No need to maintain records | Must maintain records for each deduction |

| Tax Savings | Beneficial with fewer deductions | Potentially larger savings with significant deductions |

| Personalization | Fixed amount based on filing status | Allows for personalized tax planning strategies |

| Choosing the Best Option | Compare to total itemized deductions | Choose if total deductions exceed standard deduction |

Simply put, the standard deduction reduces your taxable income by a specific amount, whereas itemized deductions lower your income based on a list of expenses that are eligible under deductions.

If you are the head of a household, married, or a qualifying widow or widower, your standard deduction amount is higher by more than a thousand dollars, which can benefit you while claiming taxes.

Claiming the standard deduction makes sense for people with:

- No expenses to itemize but who still qualify for the standard deduction

- No significant medical expenses or donations

- A lack of detailed expense documentation throughout the year

On the other hand, you should choose to itemize deductions if:

- Your total itemized deductions amount to more than the standard deduction amount

- You had big medical or dental expenses

- You pay mortgage interests or (link: https://fincent.com/industry/bookkeeping-software-for-real-estate text: real estate taxes)

- You have faced losses due to natural disasters, theft, or gambling

- You have donated generously to charities

- You have other allowable deductions like impairment-related expenses, debt repayments, and so on.

To make better sense of this, you should consult your previous tax statements and list eligible deductions based on filing status.

Itemized Expenses Rules with Example

For example, let’s say a married couple, Luis and Sally, have had an AGI of $100,000 for 2020. They expect their 2021 income to be along these lines as well.

Medical Expenses

For medical and dental expenses, itemized deductions only make sense if the expense exceeds 7.5% of the adjustable gross income. Luis and Sally must spend more than $7,500 to qualify for this.

Unless they have had a major medical procedure, their medical expenses would amount to zero under itemized deductions.

Local and State Income Taxes (SALT)

Let’s say Luis pays a quarterly estimated tax amount of $5,000 for state income taxes. Sally does not have any tax liabilities as she is a housewife.

Their total tax amount, including property and vehicle taxes, comes to $10,200, but they can claim only $10,000 since state and local taxes are capped at that amount.

Mortgage Interests

For home mortgages, you can deduct interest paid on mortgage debt up to $1,000,000. This is if you had purchased the property before December 16, 2017. For any home purchase after this date, you can deduct interest paid on $750,000. However, for eligibility under this category, the mortgage must be related to buying, building, renovating, or remodeling your house.

The couple assumably pays $6,000 in mortgage interests on their home. Since their mortgage balance is lower than $750,000, their deduction won’t be limited. So, they can claim $6,000 under itemized deductions.

Donations and Gifts

For charitable donations, you can claim deductions on cash or property that has been donated to a qualified tax-exempt or nonprofit organization.

Let’s say Luis and Sally's annual donation amount is $500 in cash and $200 in assorted donations of old clothes and household items. Their total deductions under this value will be $700.

Casualties or theft

For casualties or theft, deductions can be filed only if the incident is a federally declared disaster.

Total Value

Adding up all the amounts for 2021, Luis and Sally’s total itemized deductions would be $10,000 + $6,000 + $700, which makes $16,700.

Since they are filing taxes jointly as a married couple, their standard deduction amount for 2021 is $25,100. So, if they choose to itemize their expenses, they will face a loss of $8,400. Hence, their best choice is to opt for the standard deduction.

This list is constantly changing due to tax reforms. As a result, some previously itemized expenses may have disappeared from the list, or new ones may have been added.

For instance, the IRS previously allowed you to claim deductions for investments, job expenses, and tax preparation. However, these items have been removed from individual claims and can only be found for business filings.

Final Thoughts

The key to making the right choice regarding itemized deductions is calculating your expenses beforehand and comparing them to the standard amount. If you go by the above example, it becomes easier to figure out which is the right choice for you.

At the end of the day, your goal is simply to reduce your tax bill and lower some of the tax season stress! Find out how Fincent's (link: https://fincent.com/ text: professional bookkeeping services) can make itemized deductions a breeze for you.

Frequently Asked Questions (FAQs)

Can I itemize deductions if I'm subject to the Alternative Minimum Tax (AMT)?

Yes, you can itemize deductions with AMT, but some deductions are disallowed or limited under AMT rules. Compare both tax systems to determine the best option.

What cannot be deducted on Schedule A?

The following expenses are not deductible on Schedule A:

- Federal income and excise taxes,

- Social Security or Medicare taxes,

- (link: https://fincent.com/irs-tax-forms/form-940 text: Federal Unemployment Tax Act (FUTA) taxes),

- Railroad Retirement Tax Act (RRTA) taxes,

- Customs duties,

- Federal gift taxes,

- Per capita taxes, and

- Foreign real property taxes.

What is the 2% rule for itemized deductions?

The 2% rule referred to a provision that allowed taxpayers to deduct certain miscellaneous expenses exceeding 2% of their adjusted gross income (AGI). However, since 2018, this rule has been altered, and only a few individuals can now claim specific unreimbursed employee business expenses as deductions.

What if my itemized deductions are less than the standard deduction?

If itemized deductions are less than the standard deduction, it's generally better to claim the standard deduction for tax savings and simplicity.

What will happen when itemized deductions go beyond your income?

If your deductions exceed your earned income and you had taxes withheld from your salary, you could be eligible for a refund. Additionally, you may be able to claim a (link: https://fincent.com/glossary/carryback-and-carryforward-of-net-operating-losses text: net operating loss (NOL)). An NOL arises when your annual deductions are greater than your income for that same year.

How do recent tax law changes affect itemized deductions?

Recent tax law changes have impacted itemized deductions, including a cap on the SALT deduction, limits on mortgage interest deductions, elimination of miscellaneous deductions, and a temporarily reduced medical expense deduction threshold.

How can I keep track of deductible expenses throughout the year?

To track deductible expenses, use expense tracking apps or software, separate personal and business finances, store receipts and documents, set reminders for (link: https://fincent.com/blog/tax-filing-extention-deadlines-everything-you-should-know text: tax deadlines), review finances periodically, and consider hiring a professional for assistance.