Charts of Accounts: A Simple Guide

A simple guide to a chart of accounts - what it is, how to use it, and why it's so crucial for your company's bookkeeping. Read the blog to find out more.

What is a Chart of Accounts?

A chart of accounts isa tool that includes all the financial accounts that form part of your company's financial statements. It helps categorize all the financial transactions that a company undertakes in a particular accounting period.Generally, companies provide a list of all the accounts that must be included in a general ledger which can then be organized in a chart of accounts.

The chart makes information processing much more accessible, which you can then use to assess the company's financial performance for a given period. Charts of accounts have now become a powerful utility tool for all banks and organizations.

A chart of accounts makes it effortless to look for a piece of information. This could include details like accounts, brief descriptions, and identification codes linked to specific accounts. First comes the balance sheet accounts, which are followed by those of the income statement.

The assets ,liabilities, and shareholders' equity form a part of the balance sheet. These major accounts are further broken down into several categories. All of these sub-categories are treated uniquely while they are recorded in the chart of accounts.

The income statement is another essential part of the chart of accounts.It shows a company's revenues and expenditures which are further broken down into several sub-categories.

Setting up Your Chart of Accounts

Setting up the chart of accounts might seem daunting at first, but it is a straightforward process. The accounts will be categorized based on the nature of the company. For instance, a finance company might have some specific accounts based on the nature of operations that an FMCG company might not have.

However, general accounts are common to all kinds of businesses irrespective of the nature of the work. For example, all companies have inventory accounts or an account for miscellaneous expenditures.

When setting up your chart of accounts, you should ideally number these different types for easier identification. Numbers also make the recording of transactions quite simple.You can follow a three or four-digit system to number accounts based on their number and the size of the business.

Categories of the Chart of Accounts

Five main categories are added to the chart of accounts. You can assign a specific range of numbers to each of these to simplify the recording process. It is essential to leave some numbers blank so that you can add any additional categories if required. Listed below are the five major ones:

- Assets

- Liabilities

- Shareholders’ equity

- Revenue

- Expenses

1. Balance Sheet Accounts

These accounts come into use while you prepare your business' balance sheet. It includes:

- Assets

The asset account comprises all the assets a business holds. The account includes intangible, tangible, and current assets. While preparing the chart of accounts, you can start with numbering the current assets and then can move on to the fixed cost ones. - Liabilities

The liability account includes all kinds of debts that a company owes to various stakeholders. It consists of any type of debt like accounts payable, salaries payable, etc.Liabilities can be both short-term as well as long-term. - Shareholders’ Equity

The value of the business left after small business tax deducting the value of liabilities from the assets comprises the owners' equity. It defines or measures the value of the companywith respect to the shareholders' wealth. It includes components like common stock, preference shares, retained earnings, etc

2. Income Statement Accounts

Income and expense accounts are the two components of any income statement. These accounts include the following features:

- **Revenue

**Income can also be called revenue in business. Revenue accounts include all kinds of payments that a company receives by performing its regular business activities. It does nothave any income that a business earns from other means like any windfall gain. The revenue account includes sales discounts, interest income, etc. There are several other types of accounts too, which differ from business to business. - Expense

Expense accounts capture the list of all accounts that show that the business has spent some money. This includes the expenses that a company incurs while generating business revenues. Creating an account for every expenditure is a good way of recording and handling expenses.

Example of a Chart of Accounts

As mentioned before, you can assign numbers to these accounts for a proper structure. You can referto the following example to understand how you can do this.

- **Current Accounts (Numbers given: 10000 – 15999)

**10100 Cash

10200 Bank

10600 Inventory

10800 Accounts receivable

14000 Prepaid Rent - **Property, Plant, and Equipment (Numbers given: 16000-21000)

**16100 Land

16200 Machinery

16300 Vehicles

17000 AccumulatedDepreciation - Machinery

18100 AccumulatedDepreciation - Building

You can follow a similar system of labeling for all the other categories. Once you decide on these numbers, you can input them into your chart of accounts. You can also change these numbers based on the business' requirements.

The accounting software that you choose to prepare your chart of accounts should ideally have sample charts. You can use them as a reference while creating one for your business.However, ensure that you have a provision to add more accounts in the future.

Sample Chart of Accounts

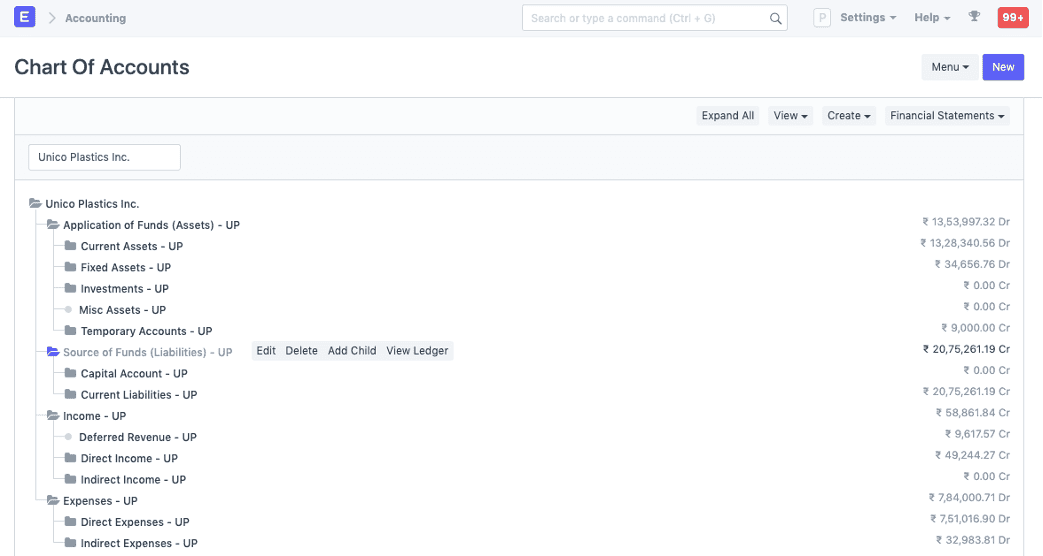

A chart of accounts gives a structured view of the various kinds of accounts a company maintains. The structure given to the chart of accounts is in line with the double-entry accounting system that every company follows. A regular chart of accounts is displayed, as shown in the picture below.

Regular Chart of account

Why is it Important?

The chart of accounts is to a business what shelves and storage bins are to warehouses. It provides a framework where you can record information related to the accounts involved in business operations. These accounts store information of every transaction that a business is a party to.

Maintaining the chart of accounts is vital as it provides a structure to the accounting function of any organization. With the help of the chart of accounts, you can easily pick any required account and check the transaction details associated with it.

Also, the chart of accounts helps you understand your organization's value. It also gives you a clear picture of how much you owe to its various stakeholders, along with your business' profits. You can also access the chart of accounts to check the break-up of the company's expenses.

The chart of accounts also generates reports on various financial accounts from time to time. These reports can help you analyze your company's performance during a given period.You can also use these reports to make comparisons with previous year's financial performance.

The chart of accounts simplifies the accounting process for companies that have multiple business domains. If you have business functions like production, selling, financing, etc., you should maintain separate books of accounts for all of them. The chart of accounts will help you consolidate all these accounts while preparing the annual financial statements.

How to Adjust Your Chart of Accounts

The cash accounts follow a numeric system of labeling. The primary category will be marked with acertain number. The labels of all the sub-categories within the account will start with that number.

The use of numbers makes the process of categorization much easier and synchronized. For instance, if your assets are classified as accounts that start with the digits 1000, your bank reconciliation account may be labeled as 1100, cash account as 1200, and so on. The gap of 100 or 10 is maintained between the accounts to make space for any accounts added later on.

You can assign numbers to an account while creating an account on the chart of accounts. You can also change the given number by updating it so that the system automatically renames the accounts and transactions stored in it.

Conclusion

It is essential to maintain the chart of accounts for a business smooth functioning. Charts of accounts are a beneficial tool that aid any company in recording transactions and maintaining an organized system. You should make proper use of it to analyze various financial statements and come up with actionable plans.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more