Simplifying Tax Payments: Annualized Income Installment Method

The annualized income installment method aids self-employed individuals and those with irregular income by aligning estimated tax payments with actual earnings. It offers a flexible solution to navigate fluctuating income and tax uncertainties.

If you’re self-employed and somewhat confused about your quarterly tax estimation, we’ve got you covered. After all, how can you estimate how much tax you owe on your income in a year when you don’t have a clear projection of that income? We’ll say it: Self-employment and income predictability don’t always go hand in hand. No matter the satisfaction your business brings you, your income can sometimes be a bit of a guessing game, especially if it’s seasonal. And to top it all off, your quarterly tax payments rely on this estimation. So how do you navigate this uncertainty?

Lucky for you, there is a way to work within your circumstantial constraints: the annualized income installment method. Using this method, you can sidestep some of the pitfalls of using the regular installment method and make some estimations based on the income information at hand. Let’s see how.

How Do Quarterly Tax Payments Usually Work?

So, let’s first discuss how the income tax system usually works. Usually, it works on a “pay as you go” basis. This means that you remit taxes as you generate income throughout the year. Now, this can be achieved by your employer deducting taxes from your earnings. However, if you receive income that is not subject to automatic withholding, you will have to personally submit estimated tax payments on a quarterly basis. This applies to earnings like self-employment income, interest, dividends, prizes, and rental income.

This estimation of your taxes usually happens based on two assumptions, i.e., you:

- Earn consistent income throughout the year

- Have a clear projection of your yearly income by April

If you use the regular method to calculate your estimated annual tax liability, you would have to use your anticipated earnings to estimate your total annual tax liability. Then, you would divide it into four equal portions for payment.

But what happens if you’re self-employed or, for some reason, have unpredictable income? Well, that’s where the annualized income installment method comes in.

What Is the Annualized Income Installment Method (AIIM)?

The annualized income installment method helps calculate your estimated tax payments in a manner that actually aligns with when you actually earn your income during a tax year. This method is aimed at reducing the likelihood of underpayment and the associated penalties that may arise from uneven payments, especially if you are a taxpayer whose income varies throughout the year. In short, the annualized income installment method allows for lower tax payments during periods of lower earnings.

Now, it’s important to note that if you are a person with irregular earnings, you are **not required to **calculate your income using the annualized income installment method; it is a choice you have if you prefer not to make equal installment payments of your estimated taxes. To reiterate, opting to annualize your income might lead to lower payments in certain quarters and higher payments in others.

But the annualized income installment method doesn’t change when you’re required to pay your taxes. Regardless of the method chosen, your taxes are due on the same due dates:

- April 15

- June 15

- September 15

- January 15 of the next year

What’s also interesting about this method is that apparently not a lot of people know about it, but its benefits are many:

- Flexibility for irregular income: It accommodates individuals and businesses with fluctuating or uneven income streams. This method allows for lower payments during low-income periods and higher payments during high-income periods.

- Avoiding underpayment penalties: It helps prevent underpayment penalties, which may be incurred if estimated tax payments are consistently lower than required throughout the year. But remember, whether you follow the standard or annualized approach, failing to make a full or accurate quarterly payment can result in penalties.

- Accurate reflection of cash flow: It aligns tax payments with the actual cash flow available to the taxpayer, providing a more accurate representation of their ability to meet tax obligations.

- Savings on interest: By making timely payments that reflect their income situation, taxpayers may reduce the amount of interest that would otherwise accrue on underpaid taxes.

- Less administrative burden: For individuals or businesses with irregular income, this method can simplify the process of calculating and making estimated tax payments.

- Easier budgeting: It allows for more predictable and manageable financial planning, especially for those with income that varies significantly from quarter to quarter.

- Compliance with tax law: It ensures compliance with tax laws by helping taxpayers meet their obligations in a manner that corresponds with their actual income patterns.

How Does the Annualized Income Installment Method (AIIM) Work?

This method calculates your estimated tax liability as your income accumulates throughout the year, instead of dividing your estimated tax liability for the entire year by four as if you earned equal income in all four quarters. It’s also important to remember each period includes all the prior periods.

So, let’s say that your total tax liability for the year is $100,000. Following the regular installment method, you would have to make your estimated payments in four equal installments of $25,000 each. In this case, your tax liability would be equally distributed over all four quarters.

But say that your earnings are sporadic due to the nature of your business - say you have a seasonal business, where your earnings spike during some months and see a dip during others. So, as opposed to making 25% of your total income each quarter (thereby being able to meet your tax liability each quarter), your earnings were distributed more like 0%, 10%, 20%, and 70% across four quarters. What then?

What would happen is that you may have difficulty coughing up your taxes in the first two - or even first three - quarters. If you used the regular installment method, you would end up paying less the first two quarters, thereby incurring underpayment penalties (even if you end up meeting your entire tax liability by year end).

Overlapping Payment Periods

On the other hand, by using the annualized income installment, you can adjust your payments according to how much you actually earn in a certain period. As mentioned earlier, each payment period includes all the previous ones, with each period commencing on January 1. The initial period concludes on March 31, the second on May 31, the third on August 31, and the fourth on December 31. The last period covers the whole year.

This approach allows you to project your tax payments based on your earnings up to that juncture in the year. This means that you can estimate your tax payments based on your income up to a certain point, which helps you avoid liabilities.

IRS Publication 505 provides taxpayers with the necessary forms, schedules, and worksheets for those who wish to recalculate their installments using the annualized income installment method. However, this process is intricate and is most effectively handled by a trusted tax professional like Fincent and using an IRS worksheet.

Tax Form for the Annualized Income Installment Method

To use the annualized method, you must file Form 2210, Underpayment of Estimated Tax by Individuals, Estates and Trusts, with your regular individual income tax return that you file on or by tax day each year.

But just to be clear, you have to file this to avoid/reduce underpayment penalties, although the form title suggests otherwise.

Form 2210

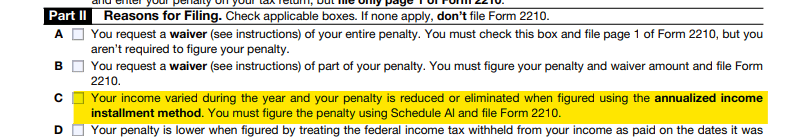

Reasons for filing

First things first, you need to indicate to the IRS why you are filing this form. To this end, you can check Box C in Part II - Reasons for Filing. This indicates to the IRS that you are utilizing the annualized income installment method by submitting the form.

By checking this option, you are also letting the IRS know why some of your quarterly tax payments were lower and why this should reduce or avoid underpayment penalties entirely. Now, let’s move on to discussing how to annualize your income.

Calculating Annualized Income - AGI

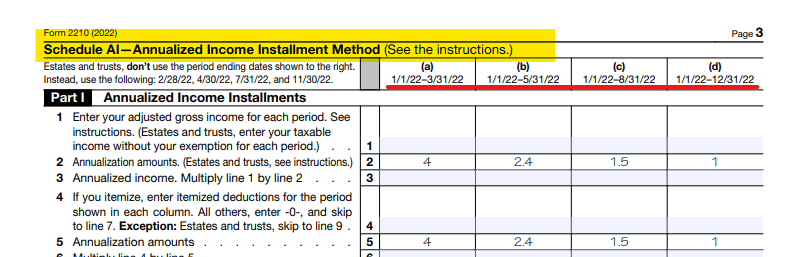

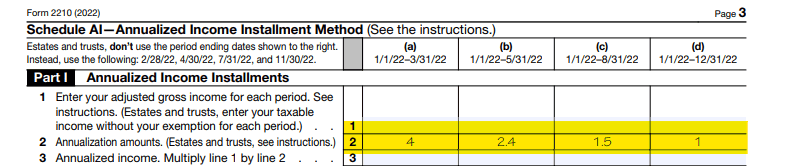

On Page 3 of the Form, you’ll find the part of the form that is concerned with annualizing your income.

As mentioned earlier (and underlined in red in the image), the year is divided into four periods, each beginning on January 1:

- January 1 to March 31 (a)

- January 1 to May 31 (b)

- January 1 to August 31 (c)

- January 1 to December 31 (d)

Next, you need to enter your adjusted gross income (AGI) on Line 1 for each period. Adjusted gross income is calculated by subtracting modifications to income from gross income. Gross income includes your:

- Earnings

- Dividends

- Capital gains

- Retirement payouts, etc.

Adjustments to income can be applied for expenses such as:

- Interest on student loans

- Alimony payments

- Contributions to retirement accounts

Now calculating your AGI accurately also requires that you track your expenses carefully. But you don’t have to go it alone; we at Fincent can help you with that. Fincent provides a user-friendly platform to seamlessly manage all your financial needs in one place. Moreover, it offers a comprehensive expense tracking system that makes categorizing expenses and monitoring spending patterns a breeze, helping you stay on top of your finances with ease. This will help you figure out what adjustments to make to figure your AGI.

Annualizing your income

Having determined your AGI for each interval, you must now annualize it. This involves extrapolating how your income would appear if you maintained the same earning rate for the remaining months of the year.

To do this, you will have to multiply your AGI for each interval by specific “annualization factors.” You can find these figures in lines 2 and 5 of Schedule AI - this is shown in the following image.

- Period (a) = 4

- period (b) = 2.4

- Period (c) = 1.5

- Period (d) = 1

So, for each period, to annualize your income, you need to multiply your AGI with the annualization factor. For instance, if your AGI for period (a) is $8,000, your annualized income would be $32,000 ($8,000 x 4). Let’s take an example to better understand this. Suppose you have a seasonal business that sees a revenue spike in the latter half of the year.

| Period | AGI |

| January 1 to March 31 | $5,000 |

| April 1 to May 31 | $5,000 |

| June 1 to August 31 | $15,000 |

| September 1 to December 31 | $30,000 |

What does this mean?

Well, here’s how you would use your AGI for each period to annualize your income:

- Between January and March, you earn $5,000. This is your AGI for period (a). By multiplying it with the annualization factor 4, you get $20,000 - your projected income for the year.

- Between April and May, you earn another $5,000. This means that for period (b), from January 1 to May 31, your AGI is $10,000 ($5,000 + $5,000). By multiplying it with the annualization factor 2.4, you get $24,000 - your projected income for the year.

- From June to August, you earn $15,000. So for period (c), from January 1 to August 31, your AGI is $25,000. By multiplying it with the annualization factor 1.5, you get $37,500.

- From September through December, you earn $30,000. So, for period (d), your AGI is $55,000. This is also your total income - $5,000 + $5,000 + $15,000 + $30,000.

What Is the IRS Underpayment Penalty?

If you fail to remit accurate estimated taxes throughout the year, the IRS can charge a tax penalty for your failure to do so. This penalty is calculated based on the following:

- Amount of the underpayment

- Period when the underpayment was due and underpaid

- Interest rate for underpayments the IRS publishes quarterly

Avoiding the penalty

You can escape the penalty for underpayment of estimated tax if you did the following:

- Your filed tax return indicates that you owe less than $1,000.

- You’ve paid either 90% of the tax amount shown on the return for the current taxable year or 100% of the tax amount shown on the return for the previous year, whichever is lower.

The IRS may reduce (or waive) the penalty under any of the following circumstances:

- If you or your spouse (in the case of a joint return) retired within the last two years after turning 62, or became disabled, and you had a valid reason for the underpayment or late payment of your estimated tax. (Waiver of Penalty in Instructions for Form 2210)

- If you had the majority of your income tax withheld earlier in the year, rather than distributing it evenly throughout the year (Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts)

- If your income experiences fluctuations throughout the year (which is what this article mainly discusses - also Form 2210)

- If the underpayment is the result of a casualty, local disaster, or other unusual circumstance such that it would not be fair to impose the penalty

IRS payment plans

If you are not in a position to pay the entire tax amount promptly, pay what you can at present and apply for a payment plan. Establishing a payment plan may lead to decreased penalties in the future.

Key Takeaways

- For some, if not most, self-employed people, income predictability can be a challenge, especially for those with seasonal income.

- The regular tax payment method assumes consistent income throughout the year and a clear projection of yearly income by April.

- The annualized income installment method aligns tax payments with actual income patterns, reducing underpayment and associated penalties.

- This method provides flexibility for irregular income, helps avoid underpayment penalties, and reflects cash flow accurately.

- It simplifies the process of calculating and making estimated tax payments for those with irregular income.

- It allows for more predictable financial planning, especially for those with significant income variations.

- This method ensures compliance with tax laws by matching tax obligations with actual income patterns.

- The annualized method divides the year into four overlapping periods, allowing for adjustments based on actual earnings.

- Form 2210 is used to file for the annualized income installment method; you indicate the reason for filing by checking Box C under Reasons for Filing.

- To annualize income, you have to calculate your adjusted gross income (AGI) for each period and apply specific annualization factors.

- The IRS may impose underpayment penalties, but these can be avoided by meeting specific criteria or arranging payment plans.

Conclusion

The annualized income installment method offers a crucial lifeline for self-employed individuals or people with irregular income to navigate the tax challenges posed by their fluctuating income. By allowing you to align your estimated tax payments with your actual earnings throughout the year, it provides a flexible and practical solution. Also, this approach not only helps prevent or reduce underpayment penalties but also ensures that your tax obligations are in sync with your cash flow, simplifying the entire process.

However, remember, regardless of the method used, compliance with tax laws is paramount. By following the steps outlined, including the use of Form 2210, you can effectively leverage this method to your advantage, ultimately reducing the risk of underpayment penalties. With the potential for significant savings on interest and a streamlined approach to budgeting, the annualized income installment method stands as a valuable tool for individuals and businesses alike, offering a more accurate reflection of your ability to meet tax obligations.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more