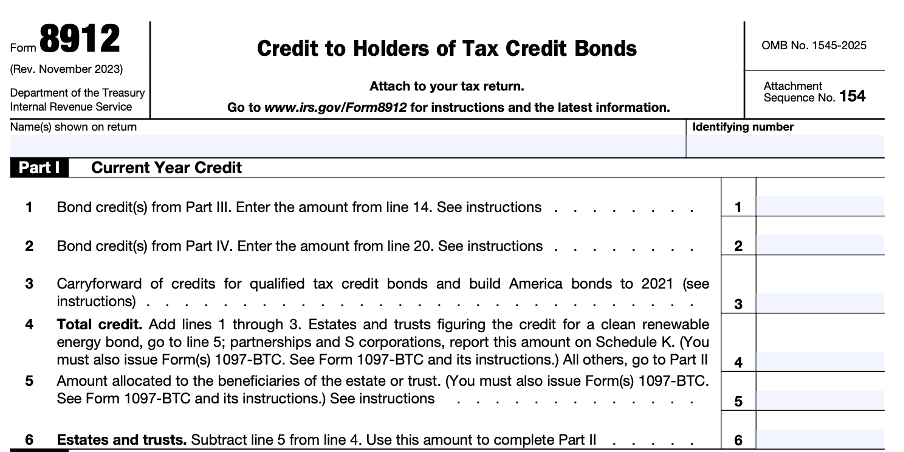

Form 8912: Credit to Holders of Tax Credit Bonds

Form 8912 is designed for taxpayers to claim credits for holding qualified tax credit bonds, such as clean energy, school construction, or other infrastructure-focused bonds. These bonds help fund essential public projects, promoting advancements in renewable energy, education, and community development. By filing Form 8912, taxpayers can reduce their tax liability while supporting government-backed initiatives aimed at building a sustainable and equitable future. This form not only provides a financial benefit but also encourages investment in projects that have a lasting positive impact on society.

It is essential for all individuals to pay taxes. Whether they are working at a company or have an organization of their own, certain taxes are levied on all individuals and are mandatory to be paid. Form IRS 8912 is about Credit Holders of Tax Credit Bonds. In simple language, this means individuals can claim credit for certain kinds of tax bonds. This form is essential for all those individuals who hold specific kinds of bonds, allowing them to claim different kinds of tax credits which can help them in offsetting their tax liabilities.

What is the primary objective of Form 8912?

Form 8912, as we all know, is for individuals to claim tax credits for certain kinds of tax credit bonds they hold. The primary objective of this form is to encourage the public and different organizations to invest in different projects that foster public benefits. These projects are mainly in fields such as energy, infrastructure, education, or any such field that can be beneficial and encouraging to the public. Individuals can offer tax incentives through various tax bonds they hold. This form is ideal for all individuals, organizations, trusts, corporations, and estates.

Why is Form 8912 required?

Form 8912 was initially introduced by the federal government in order to promote public sector investments. These investments are likely to be made in many industries. The prime example of investing these bonds in any public sector can be renewable energy, infrastructure projects, or any project that essentially deals with education. Form 8912 is required to be filled by certain individual taxpayers who own a certain tax credit bond and wish to claim the associated or corresponding tax credits. Tax credit bonds vary highly from traditional bonds as an individual taxpayer receives a tax credit rather than receiving an interest payment.

Those individuals who own these bonds are liable to claim credits which can help in reducing their taxable amount to be paid to the federal government. These bonds can be divided into four categories, and these categories are:

- Qualified Zone Academy Bonds

- Build America Bonds

- Qualified Energy Conservation Bonds

- Clean Renewable Energy Bonds

By filing this form, individual taxpayers are ensuring that they are claiming these bonds which otherwise go unclaimed.

When is Form 8912 required?

Form 8912 is required to be filled out by any taxpayer when they are qualified for holding a certain kind of tax credit bond and are eligible to claim credit on their taxes. This form is to be filled with the individual’s regular tax return, which they file every year when they are eligible to claim these bonds. This form can be typically filled and submitted by partnerships, individuals, corporations, and those who own estates and trusts. These individuals either hold or have been allocated tax credit related to the tax bonds.

How is Form 8912 required?

Taxpayers can claim the credit for the tax credit by filling out Form 8912. This form is to be filled and attached to their tax return. This form allows the individual to calculate the allowable credit that they can claim based on the bond they hold and its details. The credit amount largely depends upon the face value of the bond and the total percentage of tax credit allocated to the kind of bond the taxpayer holds.

The form 8912 has four primary parts to it. Let us discuss these four parts and then proceed onto how to fill out the form.

Part I

It is the Current Year Credit for Tax Credit Bonds: This part of the form requires the individual to detail the kind of bond, its credit rate, and the total credit received for the year for the bond.

Part II

It is the Allowed Credit: This section of the form ideally helps the taxpayer calculate the allowable credit by comparing it with the taxpayer's overall tax liability and other credits.

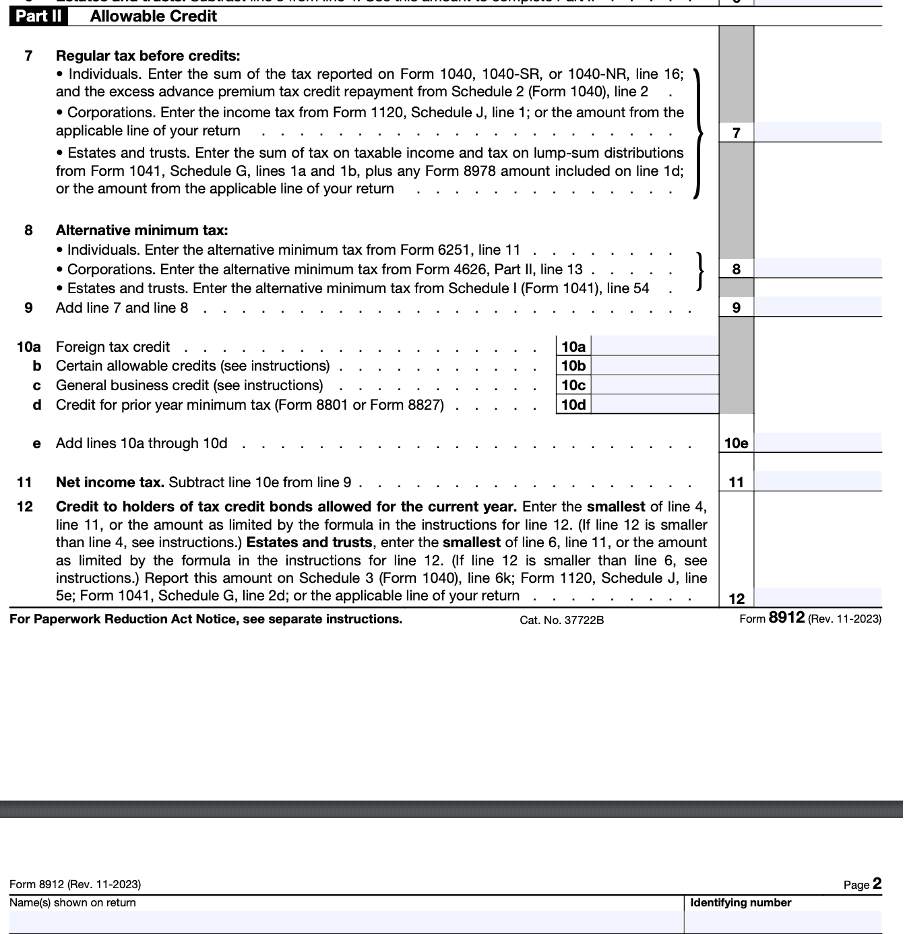

Part III

Bond Credit Received by the individual via Form 1097 - BTC: If the taxpayer receives this form from an issuer of the Tax Credit Bond, then they need to fill out this field.

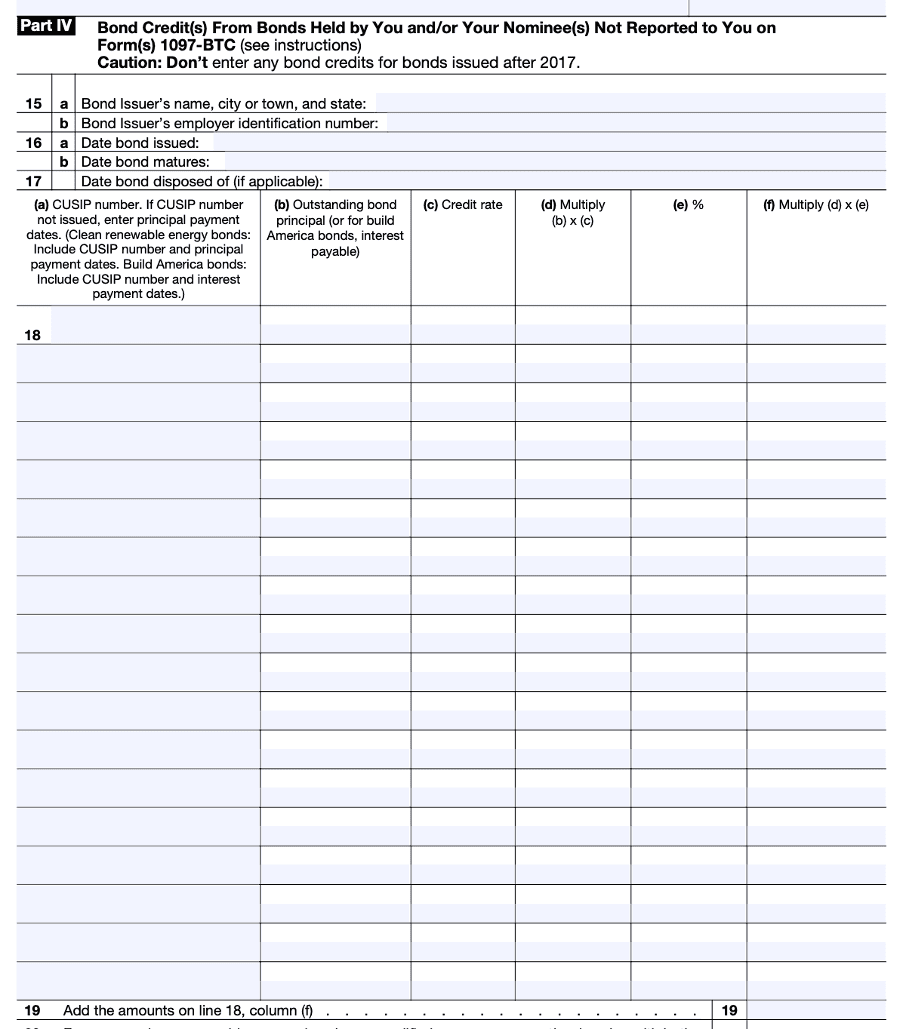

Part IV

Bonds which are held by the individual taxpayer but are not reported on Form 1097 - BTC: This section is for those individuals to fill out who have credit bonds but have not received the Form 1097 - BTC for them.

Steps for filling out Form 8912

The procedure to fill out any form is critical and technical. Form 8912 is no different from other forms that need to be filled out by taxpayers. The Form 8912 essentially deals with claiming tax credit for the tax bonds they hold, and it is important to fill out all the details necessary.

-

The first and foremost step while filling out Form 8912 is to gather all the documentation. This necessary documentation includes:

Form 1097 - BTC, which is issued by the bond issuer only if it is applicableBond certificates or other necessary proof that show the bond is held by the individualTax return forms such as Form 1040 if filled out by individuals or Form 1120 if filled out by corporations.

-

Step 2 of filling out the form is to enter the amount of credit which has been reported on the Form 1097 - BTC. If any individual does not have the Form 1097 - BTC, then they can skip this part and start filling Part IV of the form.

-

After filling out Part II, individuals can determine the total allowable credit. While filling out the form, the individuals must input their regular tax before any credit they intend to claim. This credit can be either the credit held by these bonds or any foreign tax credit or general business credit.

-

Depending upon the type of credit, the individuals can report bond credit with the help of Form 1097 - BTC. This step is important as it validates the amount that needs to be claimed by the individual.

-

Once Form 8912 is filled, it needs to be attached to the individual's regular tax return form. Before submitting the form, one should ensure all the necessary documents are attached to the form, and only then should the form be submitted.

Conclusion

IRS Form 8912 is vital for taxpayers who hold specific tax credit bonds and wish to claim. By completing the form, taxpayers can take advantage of federal programs designed to encourage public investments that can help the public mainly. By holding bonds in the energy, education, and infrastructure sectors, individuals can claim credit as well as foster public benefits.

© 2024 Your Name. All rights reserved.

Related articles

How to Use the Foreign Tax Credit to Offset US Tax Liability

Foreign tax credit — a significant benefit for US taxpayers who live, work, or invest abroad. This article guides you through the process of utilizing the foreign tax credit to offset your US tax liability.

Read moreHow To Qualify for the FICA Tip Credit

Mastering the FICA Tip Credit is vital for businesses and employees alike. As we navigate 2023, understanding eligibility, accurate reporting, and compliance with evolving tax laws is paramount. Non-compliance bears significant financial, legal, and reputational consequences. Employers must adopt proactive measures, utilize technology, and seek expert guidance. Employees play a crucial role in accurate reporting to secure benefits. Stay informed, uphold transparency, and leverage the FICA Tip Credit to optimize financial operations.

Read more