6 Reasons You Shouldn’t Wait To Catch up on Bookkeeping in 2024

People delay their bookkeeping duties all the time for various reasons. However, catching up on your bookkeeping & being consistent have a lot of benefits – from preventing audits to securing loans.

You didn’t start a business to do accounting and taxes (that’s what we did).

But when your sales, revenue, and the number of vendors multiply, so does the complexity of your bookkeeping.

In our experience, bookkeeping gets overwhelming for many business owners sooner than later, and it gets swept under the rug. And it never works in the long term. During our client calls, we often meet business owners sitting on unmanaged books for months and frantically searching for a solution.

If you are in that situation for whatever reason, no judgment; we understand you and our catchup bookkeeping can be exactly what you need.

However, it’s better for you not to be in that situation in the first place. To get you moving, here are a few compelling reasons why you shouldn’t wait to catch up on bookkeeping.

##Reason 1: Avoid Last-Minute Rush

Catch up on bookkeeping, and you won’t be spending sleepless nights before the tax deadline.

It seems obvious, right? But you would be surprised how often businesses don’t try to catch up until the last minute. And when they try to rush things, they often end up incorrectly reporting their income (or missing the deadline), paying extra in penalties, and even getting an audit notice.

So, review your accounts, reconcile your bank statements, and send your invoices frequently. In case any mismatch is found, dig deeper and solve it. Also, you want to collect all of your documents and tax forms (1099 NEC, for example) before time.

As you continue updating your books on a regular basis, you will have less to deal with before the deadline and errors will be minimal. Besides, your tax professional needs time to review and file. If your books are ready, he/she will have an easier time to plan and file your taxes.

##Reason 2: Avoid Financial Mistakes

When it comes to making a financial decision, you should analyze your financial statements before coming to any conclusion. But how accurate would your statements be if you haven’t reviewed your transactions at all for months?

Probably not much.

That’s why you want to catch up on your bookkeeping.

No matter what software you use, there are always some chances of transactions getting incorrectly tagged, invoices getting significantly delayed, or something else going wrong. But such issues are easy to spot and fix if you do your books often. And accurate financial statements mean you will make reliable forecasts and informed decisions.

Also, the practice of catching up on your bookkeeping, can act as a financial safety valve in a way. Here is an example:

Let’s say you follow the accrual method and invoiced a big client in January. However, for some reason, that client couldn’t clear it even by mid April. If this situation goes unaddressed, your financial statements would show an erroneous financial situation; you will have less real cash than what you have on paper. That’s a ticking bomb.

Such situations can be spotted way earlier if you bring your records up to date sooner. To make the whole process easier, you can use user-friendly (our clients’ words, not ours) bookkeeping applications like Fincent. It directly connects your bank account and updates (and organizes) transactions in real time. That makes catching up on books a lot easier.

##Reason 3: Be Prepared for the Dreaded IRS Audit

When your books are up to date, you are less likely to make any mistakes and trigger an audit.

With that said, you can be just unlucky and still end up on the list without making any intentional mistakes. After all, the IRS uses algorithms to determine whose door auditors will be knocking on soon. And those algorithms aren’t always 100% unbiased or error-proof.

Even in such cases, if your books are up to date, you should have no trouble.

Usually IRS auditors ask for specific records during audits. When you are on top of your bookkeeping, you will be able to produce those on request within no time. That’s a huge green flag.

Not to mention,your prompt response with proper records is another plus in the IRs’s book. Such positive impressions can make the process significantly easier for you.

Also, even when you do not agree with auditors’ decisions and decide to appeal before the IRS, you can defend your arguments better if your books are accurate.

So being punctual with your bookkeeping is your best audit defense.

##Reason 4: Don’t Pay Extra in Taxes or Lose Free Money

Millions of dollars in tax refunds go unclaimed every year, a report by the Federal Bank of Chicago revealed. Shocking, right?

Chances are, similar things are happening with business tax write-offs too. Business owners are probably leaving millions on the table and paying what they owe just because their books are a mess. If you are wondering how, consider the following situations:

- You rushed at the last moment and added a few unprocessed invoices while calculating your taxable income. As a consequence, you have to pay more than what you really owe.

- On the flip side, say you underreported your income. In that case, the amount you receive as your tax deductions (for example,7.65% of self employed income as SECA tax deduction) might be lower than the actual.

- You used your vehicle for your business trip. But you forget to gather records that show how much your business travel cost you. As you can imagine, you can’t get a deduction on the business usage of your vehicle.

- You lost the bill during some maintenance work at your restaurant, and now there is no way to prove that expense and get a tax deduction. It has now essentially become your personal expense.

Long story short, if you don’t want to lose free money, and we cannot emphasize it enough, catch up on your bookkeeping. Any decent tax professional will be able to deduce all the tax benefits you can get if you hand them over updated books.

##Reason 5: Spend less time on Bookkeeping

Let me explain.

When you catch up on bookkeeping, you break down your bookkeeping tasks into manageable chunks. So once you clear your books, next time you would deal with a fraction of what you otherwise would have to do. Needless to say, it doesn’t take much time to do books, when previous records have already been reviewed.

But that’s just the start.

By catching up on bookkeeping, you identify and fix errors sooner next time. You save hours spent on digging through hundreds of old transactions, figuring out what went wrong, and fixing the issue down the road. From our experience, many business owners don't do it.

Also, it takes time to master the enter bookkeeping process. Of course, some tools (Fincent, for example) are designed for business folks and make the process dramatically easier. But you will always need time to learn how to get bank statements sooner, interpret results, communicate effectively to your bookkeeper, and so on.

When you catch up on bookkeeping and be consistent, you find ways to do those steps efficiently. And down the road, it makes a big difference in the total time spent on bookkeeping.

With all that said, we understand, books can pile up even with your best intentions. Maybe you weren’t aware of best bookkeeping practices two years ago. Or when you started your business, you had more pressing matters than doing books right.

In those situations you can opt for Fincent catch up bookkeeping service. It only costs $165/month for any Fincent client. Once you are in, a dedicated bookkeeper would take time to understand your business and then get to work. You can expect to get 1 year of books cleaned up within 30 days!

Noel Cabrera shared his experience with Fincent:

“Fincent delivers what they promise — peace of mind. I can truly focus on my business and my projects without worrying about the tedium of accounting.”-- Noel Cabrera, Black Nymph art.

##Reason 6: Get Loans More Easily

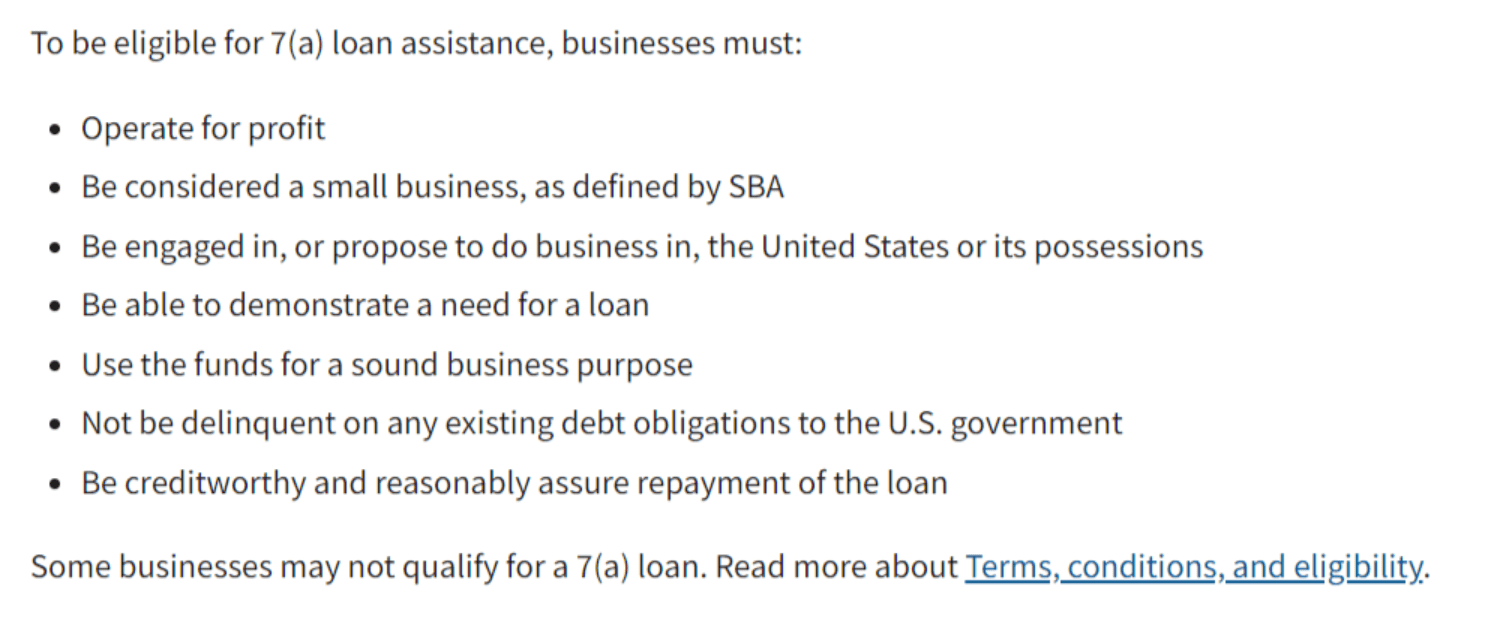

When it comes to giving loans, banks and lenders always prefer a business that is creditworthy and has reasonable chances to pay off the loan. To give you a clear idea, here are the eligibility criteria of SBA 7(a) loans:

To determine if your business measures up financially, they always turn to your financial reports. And that is where quality bookkeeping plays a role.

Up-to-date books guarantee your financial reports accurately reflect your business’s financial position. And financial institutions consider that a big plus.

Because completed books give them assurance that your business indeed has a healthy cash flow and is making profit, which makes it a good investment from their perspective.

Also, promising financial projections can get you loans faster. If you catch up on your bookkeeping, your projections will be more accurate; hence, those will have more credibility.

Last but not least, sometimes lenders may have specific financial reporting requirements to qualify for a business loan. If you catch up on bookkeeping by the time of application and show you have a proper bookkeeping process (higher chance of meeting those reporting requirements), your chances of approval go up.

Conclusion

People delay their bookkeeping duties all the time for various reasons. However, catching up on your bookkeeping and being consistent have a lot of benefits – from preventing audits to securing loans. So, it’s better you start doing your books before it starts to feel overwhelming.

However, as we addressed before, you may get behind on books for various reasons. In such cases, seek professional help and clean up your books. Fincent offers a very reliable catchup bookkeeping service that can straight up things in 30 days.

Once your books are done, you want to create a habit of doing books at least bi-monthly. Such a habit will take the pressure off of you and you will be confident during tax seasons. And Fincent application can be your perfect sidekick in this situation. Book a demo to know more.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more