- IRS forms

- Schedule H (Form 1040)

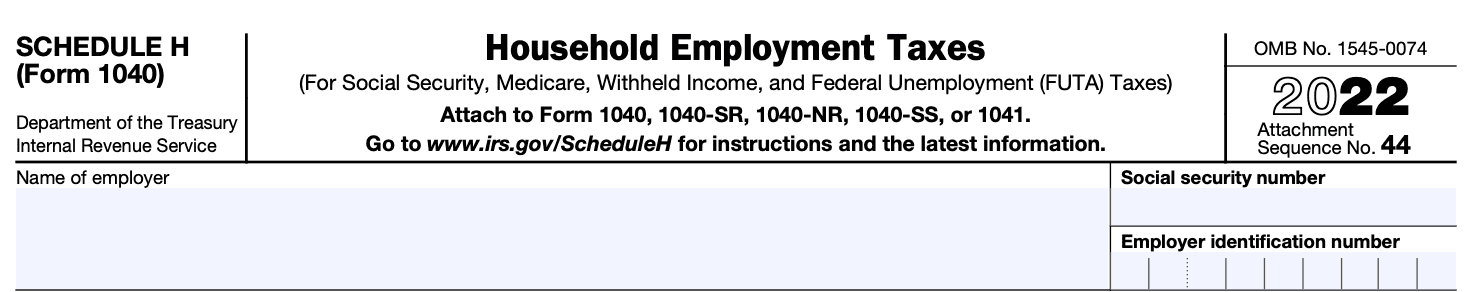

Schedule H (Form 1040): Household Employment Taxes

Download Schedule H (Form 1040)As a responsible taxpayer, it is essential to be aware of the various tax obligations associated with different types of income. One area that often goes overlooked is household employment taxes. If you employ a household worker, such as a nanny, caregiver, or housekeeper, you may be required to report and pay taxes on their wages.

Schedule H (Form 1040) is an IRS tax form used to calculate and report household employment taxes. It is attached to your annual individual income tax return (Form 1040) if you paid wages to one or more household employees during the tax year. The purpose of Schedule H is to ensure that the appropriate employment taxes, such as Social Security, Medicare, and federal unemployment taxes, are paid.

In this blog post, we will focus on Schedule H (Form 1040), which helps taxpayers navigate the world of household employment taxes.

Purpose of Schedule H (Form 1040)

If you employ someone to work in or around your home, such as a nanny, babysitter, caretaker, housekeeper, or other household employee, you may be required to file Schedule H along with your annual tax return (Form 1040).

The purpose of Schedule H is to calculate and report the taxes owed on wages paid to household employees. It helps ensure that household employees are subject to employment taxes, such as Social Security and Medicare taxes, just like any other employee. By filing Schedule H, you report the wages paid, calculate the employment taxes owed, and reconcile any tax payments made throughout the year.

On Schedule H, you provide information about your household employees, including their names, Social Security numbers, wages paid, and the taxes withheld. You may also need to report any federal unemployment taxes (FUTA) owed on the wages paid to household employees.

Benefits of Schedule H (Form 1040)

Here are some benefits of filing Schedule H:

-

Compliance with the law: Filing Schedule H ensures that you are in compliance with the tax laws and regulations regarding household employment. By reporting your household employment taxes accurately, you avoid potential penalties or legal issues.

-

Social Security and Medicare benefits: When you pay employment taxes on behalf of your household employee, such as Social Security and Medicare taxes, it helps the employee earn credits towards these programs. This can make them eligible for Social Security retirement benefits, disability benefits, or Medicare coverage when they qualify.

-

Protecting the worker: By properly reporting household employment taxes, you provide a level of protection to your household workers. They become eligible for certain benefits and protections, such as Social Security, Medicare, and unemployment insurance. It also establishes a record of employment, which can be helpful for them when applying for loans or other forms of financial assistance.

-

Tax deductions and credits: When you file Schedule H, you may be eligible for certain tax deductions and credits associated with household employment. For example, you can deduct the employer portion of Social Security and Medicare taxes paid, as well as any federal unemployment taxes paid. These deductions can help offset the costs of hiring household employees.

-

Peace of mind: Filing Schedule H and fulfilling your tax obligations can give you peace of mind, knowing that you are adhering to the law and fulfilling your responsibilities as an employer. It eliminates the risk of potential audits or legal issues related to underreporting or nonpayment of employment taxes.

Who Is Eligible To File Schedule H (Form 1040)?

Schedule H (Form 1040) is used to report household employment taxes for individuals who employ household workers. The following individuals are eligible to file Schedule H:

Individuals who have a household employee: You need to file Schedule H if you employ someone in your home for personal services such as a nanny, caregiver, housekeeper, private nurse, or gardener.

You pay cash wages of $2,300 or more: If you pay cash wages of $2,300 or more to any household employee in a calendar year, you are required to file Schedule H.

It's important to note that if you only employ household workers through an agency or if you hire independent contractors, you generally don't need to file Schedule H.

How To Complete Schedule H (Form 1040): A Step-by-Step Guide

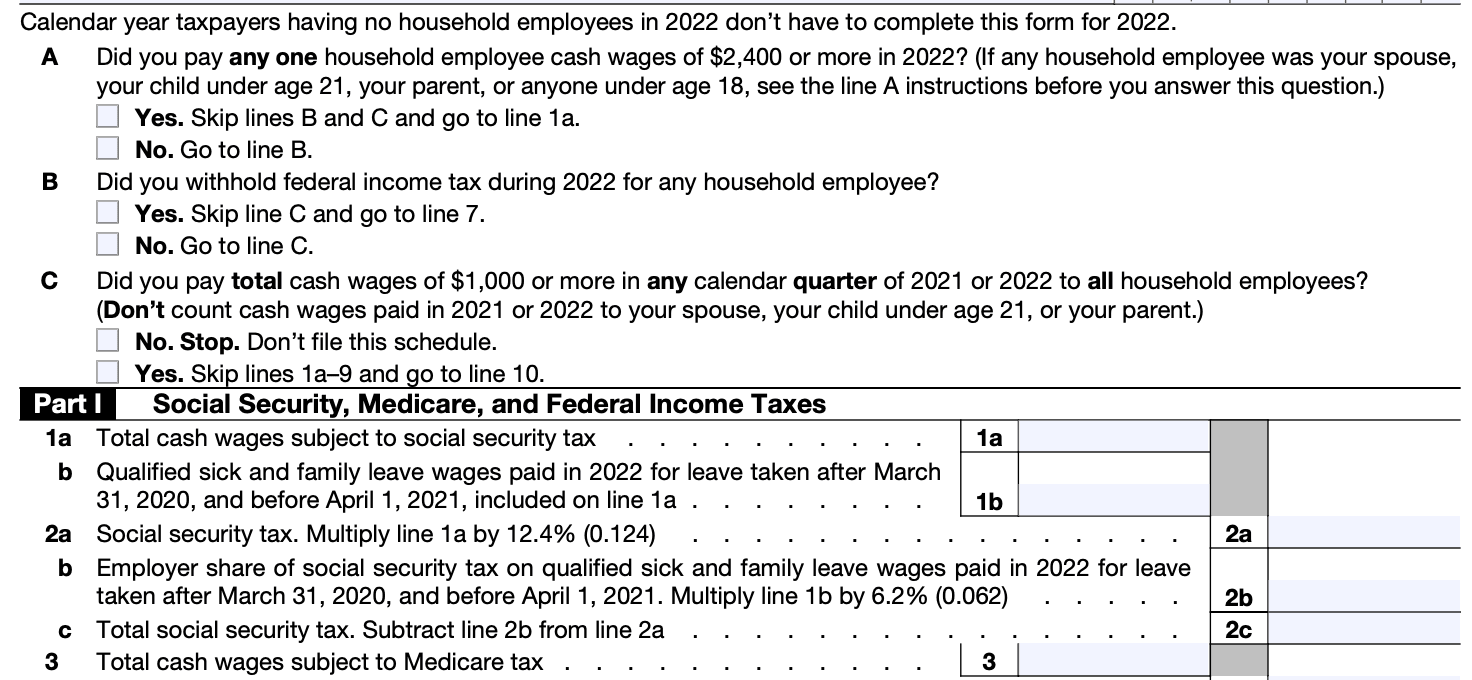

Completing Schedule H (Form 1040) involves reporting household employment taxes if you paid cash wages to household employees such as nannies, caregivers, or domestic workers. Here's a step-by-step guide to help you complete Schedule H:

Step 1: Gather necessary information

Collect all the relevant information and documents related to household employment taxes. This includes records of wages paid to employees, employment tax forms (such as Form W-2), and any other supporting documentation.

Step 2: Obtain Schedule H (Form 1040)

Download Schedule H (Form 1040) from the official IRS website (www.irs.gov) or obtain a copy from a tax preparation software if you're using one.

Step 3: Provide your personal information

At the top of Schedule H, enter your name, Social Security number, and the tax year for which you're filing the form.

Step 5: Determine if you're liable for the Additional Medicare Tax

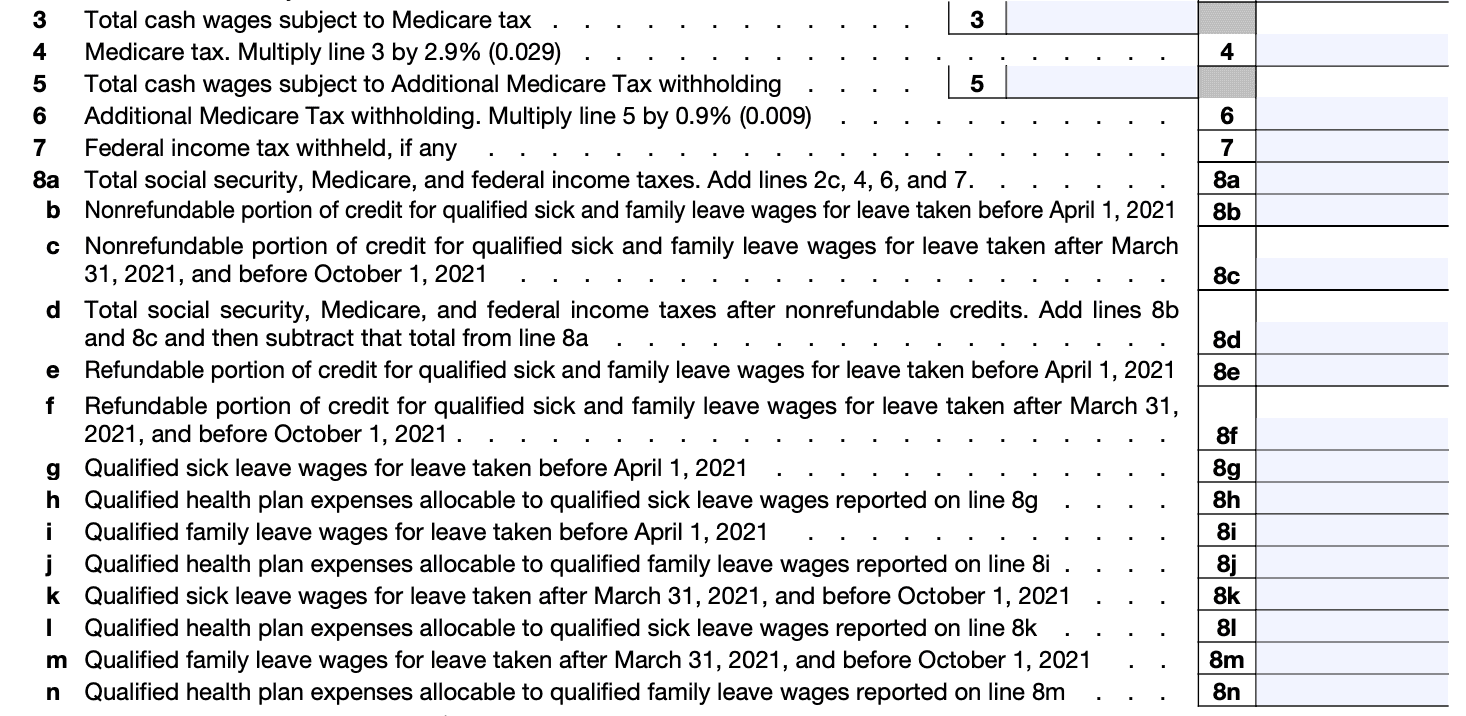

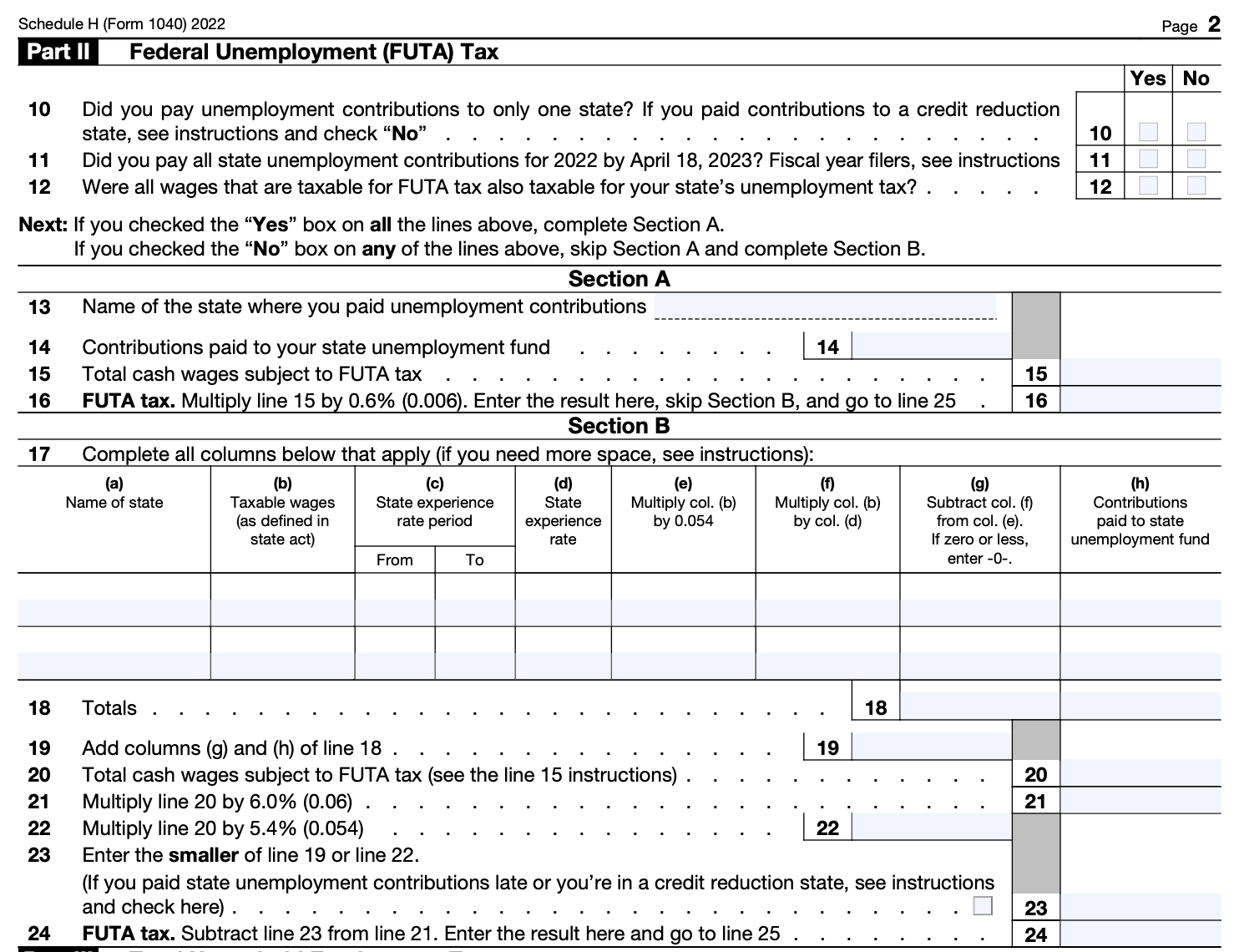

In Part II of Schedule H, you'll determine if you owe the Additional Medicare Tax. If you paid any employee wages over a certain threshold (which is subject to change), you may be liable for this tax. Refer to the instructions on Schedule H to calculate this tax, if applicable.

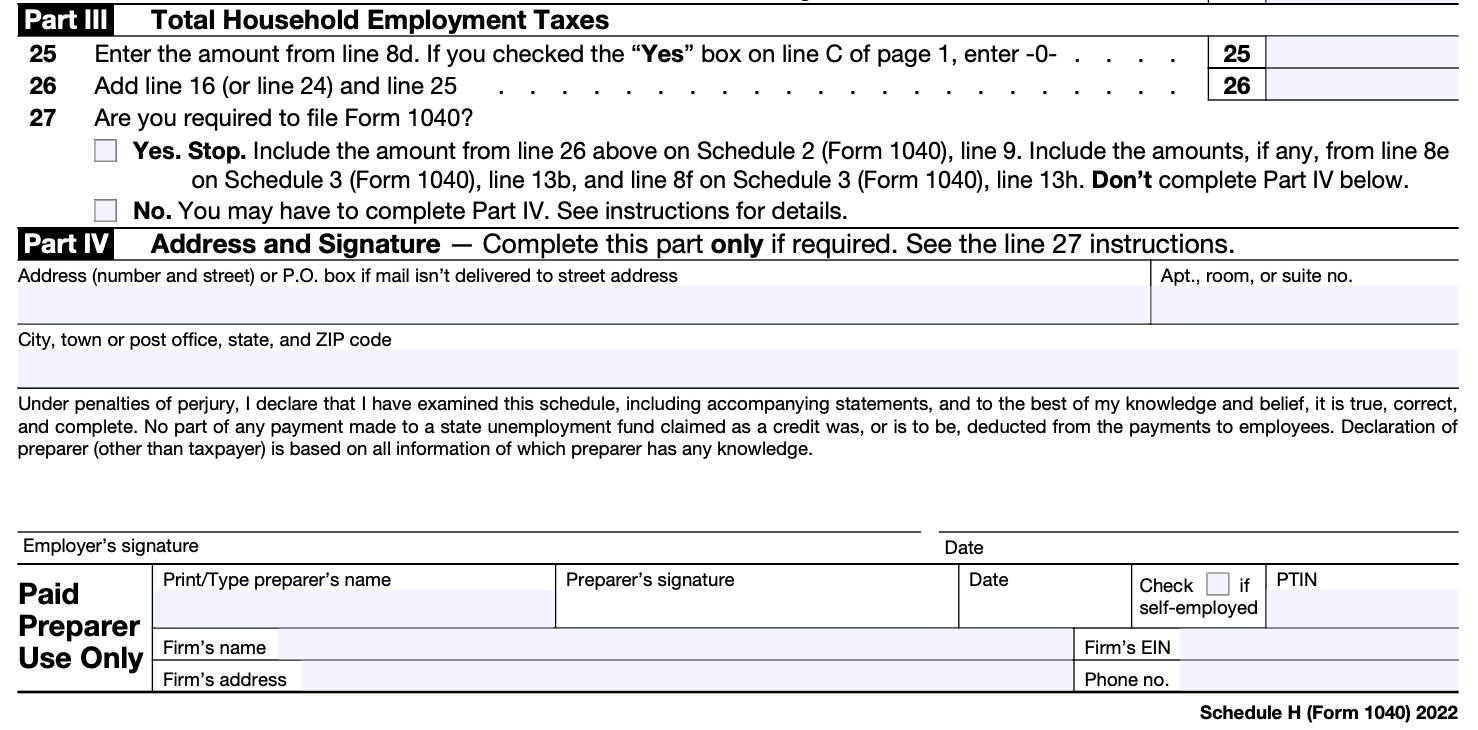

Step 6: Calculate your total household employment taxes

Combine the amounts from Part I and Part II to calculate your total household employment taxes.

Step 7: Report your household employment taxes on Form 1040

Transfer the total amount of household employment taxes from Schedule H to the appropriate line on your Form 1040.

Step 8: Retain records

Make sure to keep copies of Schedule H and any supporting documentation with your tax records for future reference.

Step 9: File your tax return

Include Schedule H (Form 1040) along with your Form 1040 when filing your tax return. If you're using tax preparation software, follow the instructions provided to e-file your return.

Special Considerations When Filing Schedule H (Form 1040)

When filing Schedule H (Form 1040), there are a few special considerations you should keep in mind. Here are some important points to consider:

**Determine if you are a household employer: **Schedule H is specifically used by individuals who employ household workers such as nannies, babysitters, housekeepers, caregivers, etc. If you pay someone to work in your home, and you have control over what work is done and how it is done, you may be considered a household employer.

Obtain the correct tax identification numbers: Before filing Schedule H, you need to ensure you have the correct tax identification numbers. You will need to obtain an Employer Identification Number (EIN) from the IRS if you haven't already. You should not use your Social Security Number (SSN) for this purpose.

**Collect required information from your employees: **You should gather essential information from your household employees, including their full name, Social Security Number, and address. This information will be needed to accurately report the wages and taxes on Schedule H.

Calculate wages and taxes: Determine the wages you paid to your household employees during the tax year. Include cash wages, as well as the value of non-cash compensation like room and board if applicable. Calculate the Social Security and Medicare taxes owed based on the wages paid.

Withhold and pay employment taxes: As a household employer, you are responsible for withholding and paying employment taxes on behalf of your employees. You may need to withhold the employee's portion of Social Security and Medicare taxes or pay both the employee and employer portions of these taxes. Refer to IRS Publication 926, Household Employer's Tax Guide, for detailed instructions on calculating and paying employment taxes.

Complete Schedule H: Use Schedule H to report the household employment taxes you owe. Enter the wages paid to your household employees, the taxes withheld, and any payments you made during the tax year. Calculate the total tax liability, and include it on your Form 1040 when filing your individual tax return.

Keep accurate records: It's important to maintain thorough records of your household employment taxes, including copies of Schedule H, Forms W-2, and any other relevant documents. These records should be kept for at least three years from the tax filing deadline or the date you filed your taxes, whichever is later.

Consider state and local requirements: In addition to federal taxes, some states or local jurisdictions may have their own employment tax requirements for household employers. Research and comply with any applicable state and local tax laws to ensure full compliance.

Filing Deadlines & Extensions on Schedule H (Form 1040)

Here are some general guidelines regarding filing deadlines and extensions for Form 1040:

**Original filing deadline: **For most individuals, the original deadline for filing Form 1040 and any associated schedules, including Schedule H, is April 15th of the following tax year. However, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day.

Extension deadline: If you need more time to file your tax return, you can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form provides an automatic six-month extension, moving the deadline to October 15th. It's important to note that the extension applies to the filing of the tax return but not the payment of any taxes owed. If you anticipate owing taxes, you should estimate your tax liability and make a payment by the original filing deadline to avoid potential penalties and interest.

**State filing deadlines: **In addition to federal taxes, you may have state and local tax filing obligations. The deadlines and extension rules for state taxes vary by jurisdiction, so you should check with the appropriate state tax agency for specific information.

Common Mistakes To Avoid While Filing Schedule H (Form 1040)

When filing Schedule H (Form 1040), it's important to be aware of common mistakes to avoid. Here are some key errors to watch out for:

Failure to report all household employment taxes: Ensure that you accurately report all wages paid to household employees and calculate the correct employment taxes owed. This includes both federal income tax withholding and Social Security and Medicare (FICA) taxes.

Incorrectly classifying workers: It's crucial to properly determine whether a household worker is an employee or an independent contractor. Generally, if you have control over what work is done and how it is performed, the worker is considered an employee. Misclassifying workers can lead to incorrect tax calculations and potential penalties.

Neglecting to obtain an employer identification number (EIN): If you hire household employees, you need to obtain an EIN from the IRS. Some individuals mistakenly use their own Social Security number instead of an EIN when reporting household employment taxes, which can cause issues.

**Not withholding enough taxes: **Calculate and withhold the correct amount of federal income tax from your employee's wages based on their W-4 form. Failing to withhold the appropriate amount could lead to underpayment penalties.

Neglecting to make estimated tax payments: If you anticipate owing a significant amount in household employment taxes, you may need to make estimated tax payments throughout the year to avoid penalties for underpayment. Be mindful of these payment requirements.

**Failing to keep accurate records: **It's essential to maintain accurate records of all wages paid, taxes withheld, and employment tax deposits made. Neglecting to keep these records can cause issues during an audit or when filing subsequent tax returns.

Not filing Schedule H when required: If you pay a household employee over a certain threshold (in 2021, it was $2,300), you are generally required to file Schedule H and report the employment taxes. Failing to file the appropriate forms can result in penalties and interest charges.

Conclusion

As an employer of household help, it is important to understand your obligations regarding household employment taxes. Schedule H (Form 1040) serves as a tool to calculate and report these taxes accurately.

By fulfilling your responsibilities and paying the required taxes, you can avoid potential penalties or legal issues with the IRS.

Consulting a tax professional or utilizing tax preparation software can be helpful in ensuring accurate reporting and compliance with the tax laws related to household employment.