- IRS forms

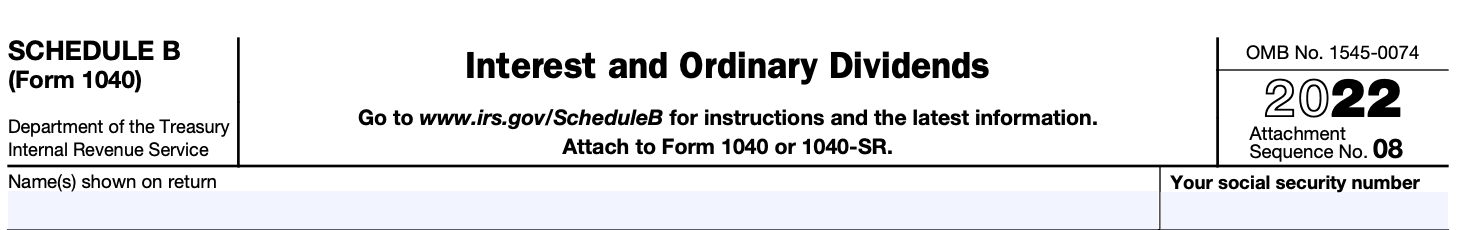

- Schedule B (Form 1040)

Schedule B (Form 1040): Interest and Ordinary Dividends

Download Schedule B (Form 1040)When it comes to filing your taxes, it's essential to understand the various forms and schedules that may be required. One such form is Schedule B (Form 1040), which is used to report interest and ordinary dividends earned during the tax year.

Schedule B is an IRS form that accompanies Form 1040, the individual income tax return. Its primary purpose is to report interest and ordinary dividends earned from various sources, such as savings accounts, bonds, mutual funds, and stocks. By providing this information, the IRS can determine the appropriate amount of taxable income and assess any tax liability or eligibility for deductions related to these types of income.

In this blog post, we will delve into the details of Schedule B, providing a comprehensive overview of its purpose, who needs to file it, and how to accurately complete it.

Purpose of Schedule B (Form 1040)

The purpose of Schedule B is to provide the Internal Revenue Service (IRS) with detailed information about the interest and dividend income earned by an individual or household.

Here are a few key points about Schedule B:

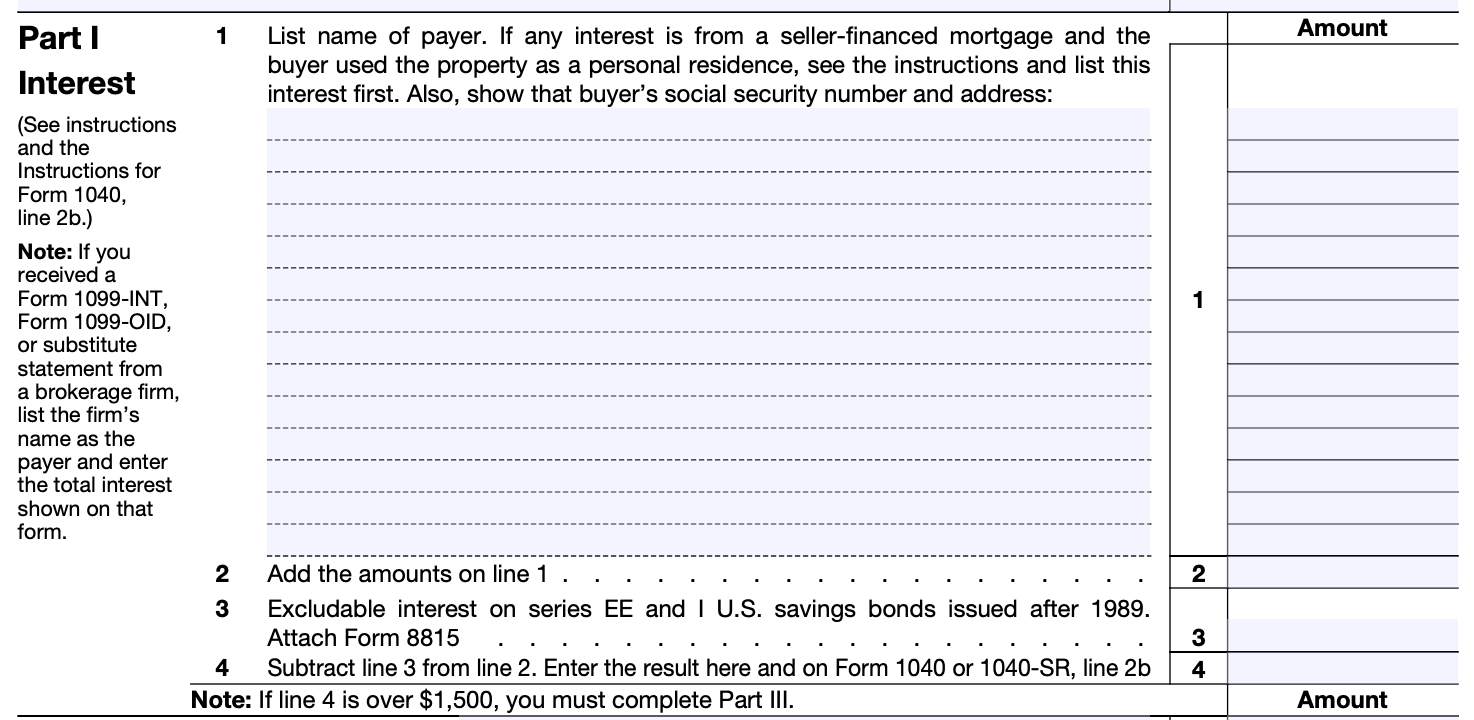

Reporting interest income: If you earned more than $1,500 in interest income from sources such as bank accounts, savings accounts, or certificates of deposit (CDs), you are required to report it on Schedule B.

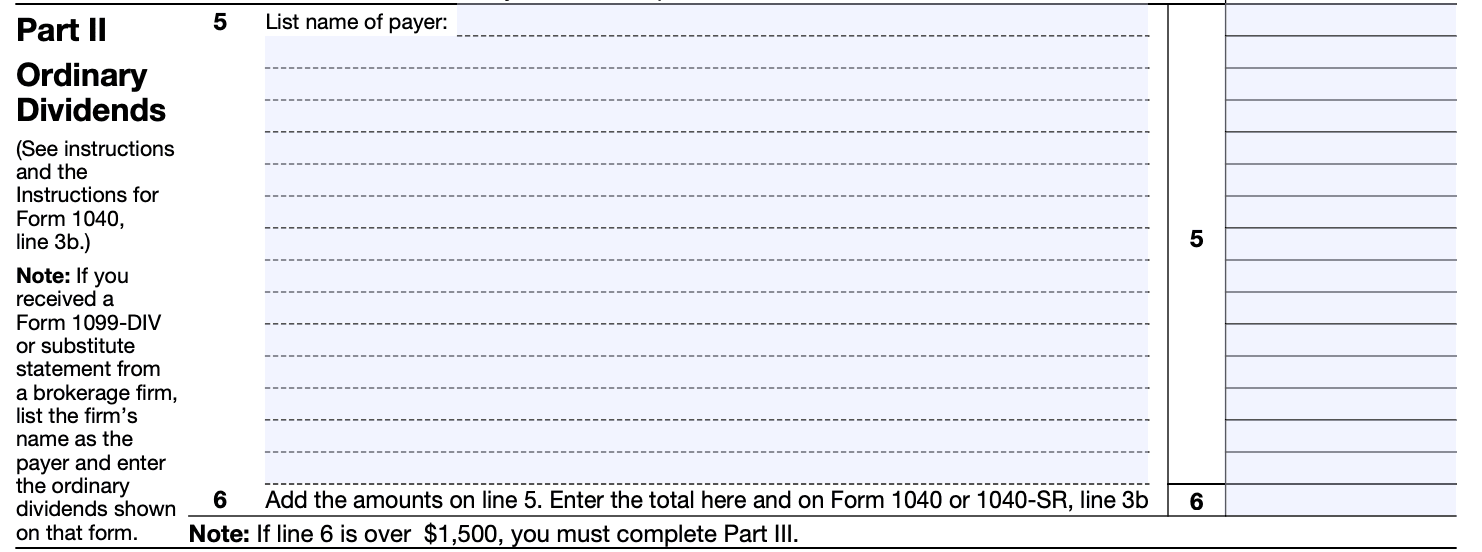

Reporting dividend income: If you received dividends, including those from stocks or mutual funds, and the total amount exceeds $1,500, you need to report it on Schedule B.

Thresholds: If your interest or dividend income falls below the $1,500 threshold, you do not need to file Schedule B. Instead, you can report the income directly on the appropriate lines of Form 1040.

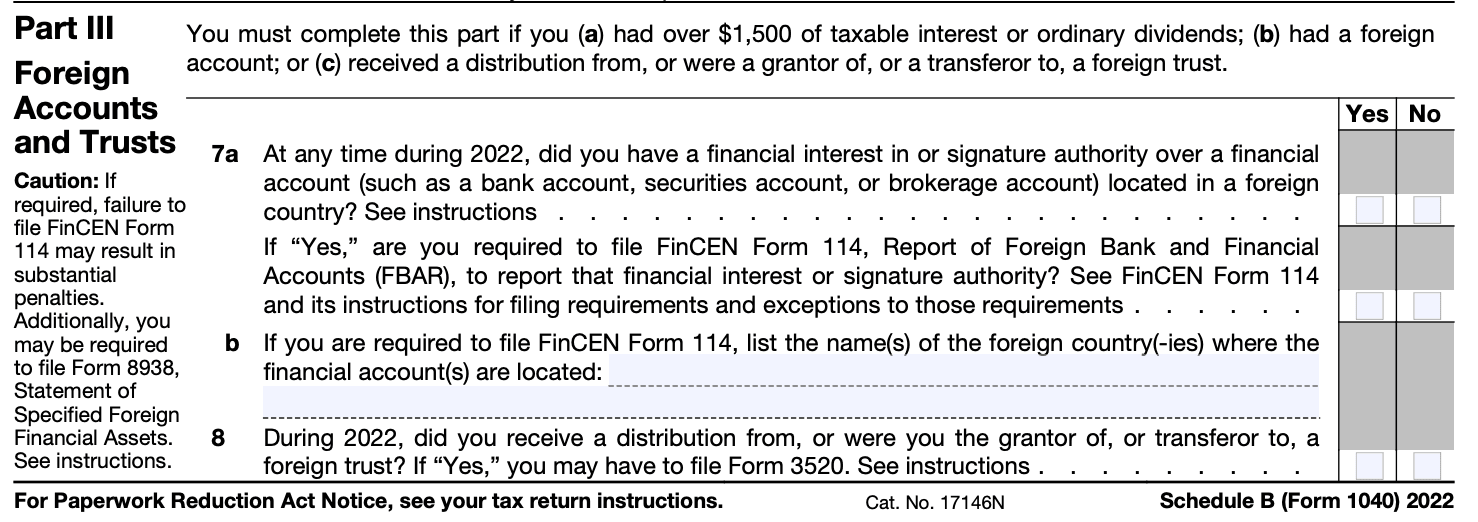

Additional reporting: Schedule B may also require additional reporting for certain types of income, such as foreign accounts, foreign trusts, or ownership of foreign corporations.

Part I and Part II: Schedule B is divided into two parts. Part I is used to report interest income, while Part II is used to report dividend income. You may need to complete one or both parts depending on your sources of income.

Attachments: If you have to file Schedule B, you must attach it to your Form 1040 when filing your federal income tax return.

It's important to note that Schedule B is only necessary for reporting interest and dividend income above the specified thresholds. If you earned less than $1,500 in interest and dividend income, you can report it directly on your Form 1040 without the need for Schedule B.

Benefits of Schedule B (Form 1040)

The primary purpose of Schedule B is to ensure that taxpayers accurately report their investment income to the Internal Revenue Service (IRS). Here are some benefits of using Schedule B:

-

Reporting interest and dividend income: Schedule B allows taxpayers to report their interest and dividend income separately from their main Form 1040. This helps in organizing and providing a detailed breakdown of income from investments.

-

Tax compliance: By using Schedule B, taxpayers can ensure that they are in compliance with IRS regulations regarding the reporting of investment income. Failing to report such income accurately could result in penalties or additional scrutiny from the IRS.

-

Eligibility for certain tax credits and deductions: Some tax credits and deductions are tied to the amount of interest or dividend income received. By accurately reporting this income on Schedule B, taxpayers can determine their eligibility for these benefits and potentially reduce their overall tax liability.

-

Tracking investment income: Schedule B serves as a record of interest and dividend income received during the tax year. By maintaining this information, taxpayers can easily track and monitor their investment earnings, which is useful for personal financial planning and future tax filings.

-

Accuracy and documentation: Using Schedule B provides a structured format for reporting investment income, reducing the chances of errors or omissions. This promotes accuracy in tax reporting and provides documentation in case of an IRS audit or review.

-

Compliance with foreign accounts and assets: Taxpayers with certain foreign accounts or assets may be required to report them on Schedule B, depending on the specific requirements outlined by the IRS. Failing to report such accounts or assets can result in severe penalties, so using Schedule B helps ensure compliance.

Who Is Eligible To File Schedule B (Form 1040)?

Individuals who meet any of the following criteria are generally required to file Schedule B:

-

If you received over $1,500 in taxable interest or ordinary dividends during the tax year.

-

If you had any foreign accounts or received distributions from, or were a grantor of, or a transferor to, a foreign trust.

-

If you had any foreign financial assets and you were required to file Form 8938, Statement of Specified Foreign Financial Assets.

-

If you received interest as a nominee (i.e., you received the interest on behalf of someone else).

-

If you had accrued interest on bonds, notes, or other similar obligations, even if you haven't received the interest income yet.

How To Complete Schedule B (Form 1040): A Step-by-Step Guide

Completing Schedule B (Form 1040) is relatively straightforward. Schedule B is used to report interest and dividend income if you meet certain criteria. Here's a step-by-step guide on how to complete it:

Step 1: Gather your documents

Collect all the necessary documents that contain information about your interest and dividend income. This may include statements from your bank accounts, brokerage accounts, and other financial institutions where you earned interest or received dividends.

Step 2: Obtain Schedule B

Download Schedule B (Form 1040) from the official website of the Internal Revenue Service (IRS). You can find it in the "Forms & Instructions" section.

Step 3: Provide your personal information

At the top of Schedule B, you'll need to fill in your name, Social Security number, and any other required personal information.

Step 4: Determine if you meet the filing requirements

Review the instructions provided with Schedule B to determine if you meet the requirements for filing it. Generally, you need to file Schedule B if any of the following apply to you:

- You received over $1,500 of taxable interest or ordinary dividends.

- You had a foreign account with a value exceeding $10,000 at any time during the tax year.

Step 5: Report interest income

If you earned interest income, you'll need to report it on Part I of Schedule B. The interest income can come from various sources, such as bank accounts, certificates of deposit (CDs), bonds, or loans you made. You'll need to provide the name of the payer, the amount of interest income earned, and any associated taxes withheld. Continue to add all your interest income from different sources and enter the total in the designated box.

Step 6: Report dividend income

If you received dividend income, you'll need to report it on Part II of Schedule B. Dividends are typically paid by stocks, mutual funds, or other investments. Similar to reporting interest income, you'll need to provide the name of the payer, the amount of dividend income received, and any associated taxes withheld. Add up all your dividend income and enter the total in the designated box.

Step 7: Answer additional questions

There are a few additional questions on Schedule B that you need to answer. These questions mainly pertain to foreign accounts and income. Carefully read and respond to these questions based on your specific situation.

Step 8: Calculate the total interest and dividend income

After reporting all your interest and dividend income, add up the totals from Part I and Part II and enter the combined amount on the designated line.

Step 9: Transfer information to Form 1040

Once you have completed Schedule B, transfer the total interest and dividend income amount from Schedule B to the appropriate sections of Form 1040. Follow the instructions on Form 1040 to ensure accurate reporting.

Step 10: Keep a copy for your records

Make sure to keep a copy of your completed Schedule B for your records. It may be necessary to refer to it in the future or provide it as supporting documentation if requested by the IRS.

Special Considerations When Filing Schedule B (Form 1040)

When filing Schedule B (Form 1040), there are a few special considerations you should keep in mind. Schedule B is used to report interest and dividend income, and it may be required if you meet certain criteria. Here are some important points to consider:

Threshold for filing: You are generally required to file Schedule B if you have more than $1,500 of taxable interest or ordinary dividends, or if you received interest or dividend income from a foreign source regardless of the amount. If you received less than $1,500 in interest and dividends and they were not from a foreign source, you may be able to report the income directly on your Form 1040 without filing Schedule B.

Reporting all interest and dividend income: You must report all taxable interest and dividend income you received during the tax year, even if the amounts are small or if you did not receive a Form 1099-INT or 1099-DIV from the payer. It's important to keep accurate records of your interest and dividend income throughout the year.

Foreign accounts and investments: If you had a financial interest in or signature authority over any foreign accounts, such as bank accounts, brokerage accounts, or mutual funds, you may need to file FinCEN Form 114 (Report of Foreign Bank and Financial Accounts, also known as FBAR). Additionally, if you have certain foreign investments, such as ownership in a foreign corporation or partnership, you may have additional reporting requirements like filing Form 8938 (Statement of Specified Foreign Financial Assets).

Tax-exempt interest: If you received tax-exempt interest, such as interest from municipal bonds, you still need to report it on Schedule B. However, tax-exempt interest is generally not subject to federal income tax.

Accurate reporting and documentation: It's crucial to accurately report your interest and dividend income on Schedule B and attach any necessary forms or statements. If you received Form 1099-INT or 1099-DIV, make sure to include them with your tax return. Be sure to review the instructions for Schedule B and any other related forms for detailed guidance.

Penalties for non-compliance: Failure to report interest and dividend income or comply with the reporting requirements for foreign accounts and investments can result in penalties. It's important to fulfill your tax obligations and ensure proper reporting to avoid any potential issues.

How To File Schedule B (Form 1040): Offline/Online/E-filing

To file Schedule B (Form 1040), you have several options: filing offline, filing online, or e-filing. Here's a brief overview of each method:

Offline filing

a. Obtain a physical copy of Schedule B (Form 1040) from the Internal Revenue Service (IRS) website or a local IRS office.

b. Fill out the form manually using a pen or typewriter, following the provided instructions.

c. Once completed, attach Schedule B to your Form 1040 when you file your tax return by mail.

Online filing

a. Use tax preparation software or an online tax filing service to file your tax return electronically.

b. Most reputable tax software and online platforms will provide a guided process to enter your information accurately.

c. The software will automatically generate Schedule B if necessary based on the information you provide.

E-filing

a. E-filing refers to electronically filing your tax return directly with the IRS.

b. If you choose to e-file, you'll need to use IRS-approved software or work with a tax professional who has access to e-filing services.

c. The software or tax professional will guide you through the process, including filling out and submitting Schedule B if required.

It's important to note that the specific method you choose may depend on your personal circumstances, preference, and the complexity of your tax situation.

Common Mistakes To Avoid While Filing Schedule B (Form 1040)

When filing Schedule B (Form 1040), there are several common mistakes that you should avoid to ensure accurate and error-free reporting. Here are some of the most important ones:

Omitting interest and dividend income: Schedule B is used to report interest and dividend income from various sources, such as banks, brokerage firms, and mutual funds. Make sure to include all the relevant income, even if you don't receive a Form 1099-INT or 1099-DIV.

Failing to report foreign accounts: If you have foreign financial accounts, such as bank accounts or brokerage accounts, you may be required to report them on Schedule B and file a Foreign Bank Account Report (FBAR) separately. Ensure you understand the reporting requirements and include any applicable foreign account information.

Incorrectly calculating interest income: Interest income should be reported on Schedule B based on the amount you actually received during the tax year. Avoid including accrued interest or interest that will be received in future years.

Mistakenly reporting tax-exempt interest: Tax-exempt interest, such as interest from municipal bonds, should not be reported on Schedule B. It should be excluded from your interest income total.

**Failing to report dividend income from mutual funds: **If you own mutual funds, you may receive dividend income from them. Ensure you report all dividend income, including those that have been reinvested and not distributed to you in cash.

Neglecting to report qualified dividends: Qualified dividends are taxed at a lower rate than ordinary dividends. Make sure you correctly identify and report any qualified dividends you received. They are usually reported in Box 1b of Form 1099-DIV.

Forgetting to include all relevant information: Schedule B requires detailed information about each source of interest and dividend income, including the name of the payer, their identification number (such as a Social Security number or employer identification number), and the amount received. Double-check that you've provided accurate and complete information for each source.

Failing to attach additional forms: Depending on your specific situation, you may need to attach additional forms or schedules to Schedule B. For example, if you have foreign accounts, you might need to attach Form 8938 or FinCEN Form 114 (FBAR). Review the instructions for Schedule B to determine if any additional forms or schedules are required.

Conclusion

Schedule B (Form 1040) is a crucial component of your tax return if you have earned interest or ordinary dividends during the tax year. Understanding who needs to file Schedule B and how to complete it accurately is essential for ensuring compliance with IRS regulations and reporting your income correctly.

If you find the process overwhelming or have complex investment portfolios, it may be wise to seek the assistance of a tax professional or use tax preparation software to help you navigate Schedule B and ensure accurate reporting.

Remember, staying organized, keeping track of your interest and dividend income, and staying up to date with the IRS guidelines will help you file your taxes smoothly and minimize the chances of any issues or penalties down the line.