- IRS forms

- Schedule 8 (Form 8849

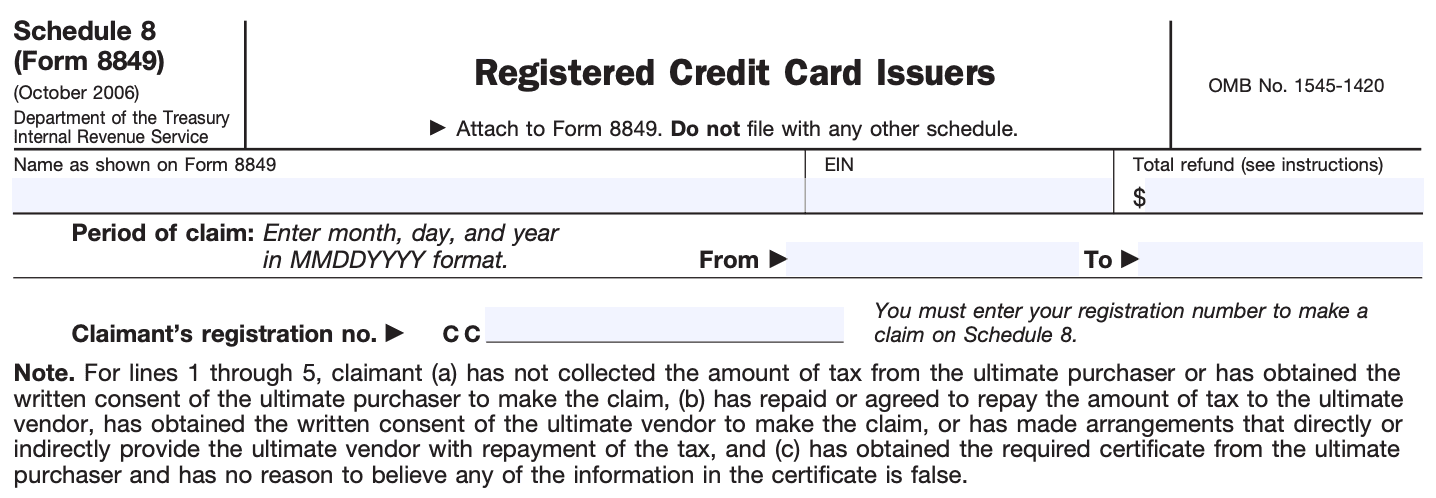

Schedule 8 (Form 8849): Registered Credit Card Issuer

Download Schedule 8 (Form 8849As a registered credit card issuer, it is crucial to understand and comply with the various tax obligations imposed by the Internal Revenue Service (IRS). One such obligation involves filing Schedule 8 (Form 8849).

Schedule 8 (Form 8849), also known as the "Registered Credit Card Issuer, Filer of (link: https://fincent.com/irs-tax-forms/form-720 text: Form 720)," is an IRS tax form used to claim refunds of excise taxes paid on certain transactions made with credit cards. This form is specifically designed for registered credit card issuers who are liable for collecting and remitting excise taxes under the federal tax laws.

This blog post aims to provide a comprehensive overview of Schedule 8, its purpose, and how it pertains to registered credit card issuers.

Purpose of Schedule 8 (Form 8849)

The purpose of Schedule 8 (Form 8849) is to provide a mechanism for registered credit card issuers to claim refunds for excise taxes they have paid on certain transactions. (link: https://fincent.com/irs-tax-forms/form-720#:~:text=Excise%20taxes%20are%20levied%20on,and%20certain%20transportation%2Drelated%20services. text: Excise taxes) are indirect taxes imposed on the sale or use of specific goods or services, and credit card issuers often encounter these taxes when their customers make taxable transactions using their credit cards.

By filing Schedule 8, registered credit card issuers can request a refund of the excise taxes they have paid, allowing them to recover their expenses and comply with tax regulations. This form ensures that credit card issuers are not burdened with unnecessary tax liabilities and helps maintain a fair tax system.

The refund process facilitated by Schedule 8 helps credit card issuers manage their financial obligations more effectively. It ensures that they are not subject to double taxation or overpayment of taxes on transactions made using their credit cards. By claiming refunds for the excise taxes they have paid, credit card issuers can enhance their financial stability and continue to provide valuable services to their customers.

Overall, the purpose of Schedule 8 (Form 8849) is to streamline the refund process for registered credit card issuers, allowing them to recoup their excise tax payments and maintain compliance with tax laws and regulations.

Benefits of Schedule 8 (Form 8849)

Form 8849, Schedule 8 is used to claim refunds of excise taxes for certain fuel-related activities. Here are some of the benefits of using Schedule 8 (Form 8849):

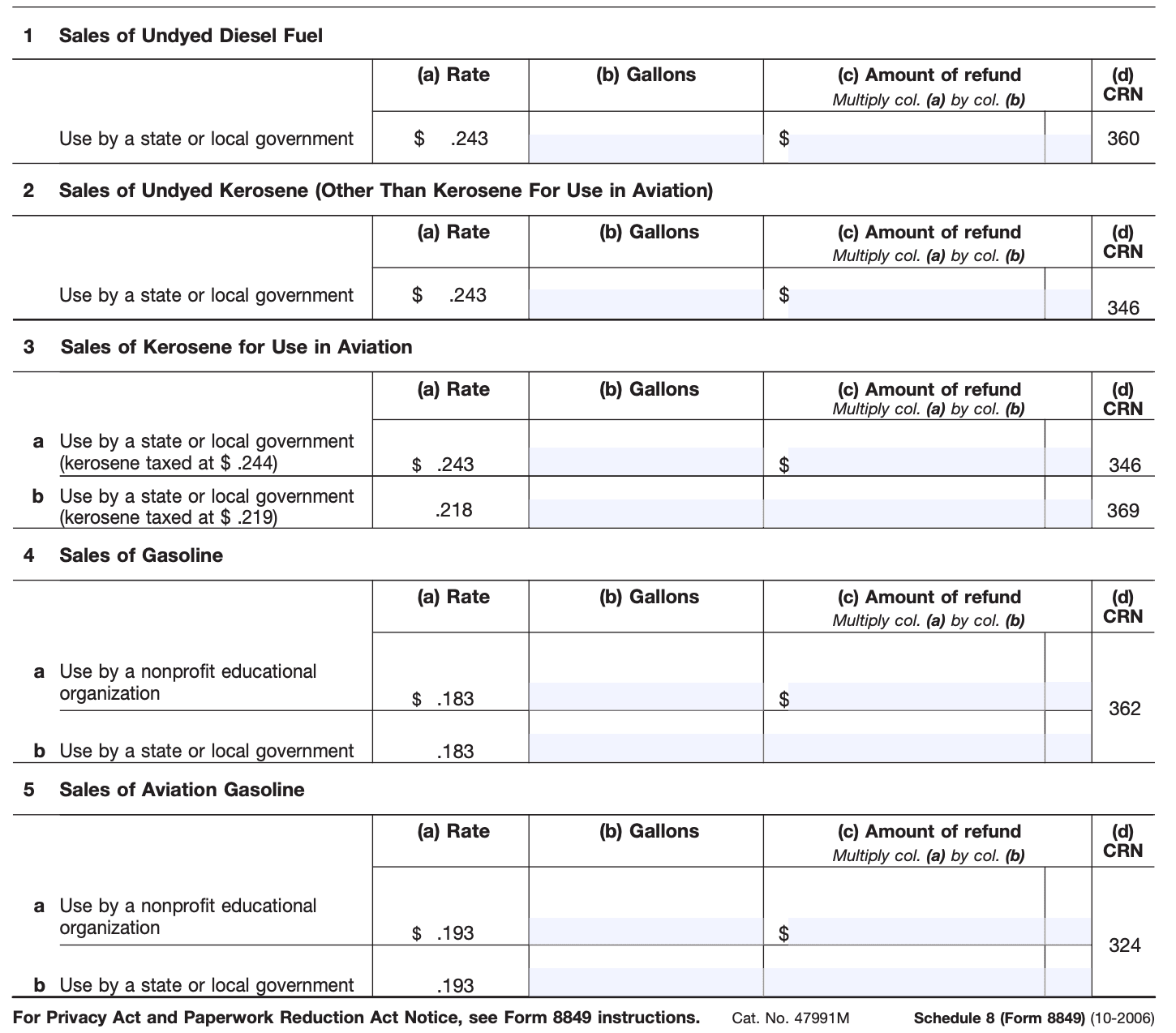

Excise tax refunds: Schedule 8 allows you to claim refunds for various types of excise taxes related to fuel usage, such as gasoline, diesel, aviation fuel, and alternative fuels. By filing this form, you may be eligible to receive a refund for the excise taxes you paid on these fuels.

Reduced tax liability: If you engage in activities that qualify for exemptions or credits under the Internal Revenue Code, using Schedule 8 can help you reduce your overall tax liability. For example, if you use alternative fuels for specific purposes, you may be entitled to claim a credit or refund for the excise taxes paid on those fuels.

Tax compliance: By filing Schedule 8, you ensure that you are in compliance with the IRS regulations regarding excise taxes. This form provides a structured way to report and claim the refunds or credits to which you may be entitled. It helps ensure that you accurately report and document your fuel-related activities, reducing the risk of non-compliance and potential penalties.

Financial savings: The primary benefit of Schedule 8 is the potential for financial savings. By claiming refunds or credits for excise taxes, you can recover some of the costs associated with fuel usage. This can be particularly beneficial for businesses or individuals who consume large amounts of fuel, such as trucking companies, airlines, or agricultural operations.

**Supporting documentation: **When you file Schedule 8, you are required to provide supporting documentation to substantiate your claims. This documentation can help you maintain proper records of your fuel-related activities, which may be useful for future audits or inquiries by the IRS.

Who Is Eligible To File Schedule 8 (Form 8849)?

Eligibility to file Schedule 8 depends on the specific type of excise tax and the nature of the business activities involved. Here are some examples of who may be eligible to file Schedule 8:

-

Farmers: Farmers who use fuel for farming purposes off the public highway, such as in farming machinery or equipment, may be eligible to claim a refund of the fuel tax paid.

-

Commercial fisherman: Fishermen engaged in the commercial fishing industry can claim a refund of fuel tax paid on fuel used in their fishing vessels.

-

State or local governments: Government entities that use gasoline or other taxable fuels for nontaxable purposes, such as public transportation or operating emergency vehicles, may be eligible to claim a refund.

-

Registered ultimate vendors: Registered ultimate vendors who have collected and paid taxes on sales of ozone-depleting chemicals may be eligible to claim a refund for these taxes.

-

Qualified blood collector organizations: These organizations can claim refunds on the excise taxes paid on the fuel used in their vehicles during the collection of blood.

How To Complete Schedule 8 (Form 8849): A Step-by-Step Guide

Here's a step-by-step guide to completing Schedule 8:

Step 1: Gather the necessary information

Collect all the required information and documents before you begin filling out Schedule 8. This includes your taxpayer identification number, the tax period for which you are claiming a refund, and details about the fuel taxes you paid.

Step 2: Download Form 8849 and Schedule 8

Visit the IRS website (www.irs.gov) or (link: https://fincent.com/irs-tax-forms/form-8849 text: download Form 8849), along with Schedule 8. You can find these forms in the "Forms and Publications" section by searching for their respective numbers.

Step 3: Provide basic information

At the top of Schedule 8, enter your name, address, and other identification details as required. Make sure the information is accurate and up to date.

Step 4: Determine the type of claim

Schedule 8 provides different sections to claim specific types of fuel tax refunds. Review the instructions to identify the appropriate section for your claim. Each section corresponds to a specific tax category, such as gasoline, diesel fuel, or aviation fuel.

Step 5: Complete the appropriate sections

Once you've identified the correct section, proceed to complete the corresponding part of Schedule 8. Provide the required information for each line item, which typically includes the amount of fuel tax paid, the gallons of fuel involved, and other relevant details.

Step 6: Calculate the refund amount

Follow the instructions provided within each section to calculate the refund amount for the specific type of fuel tax you are claiming. Some sections may have specific formulas or calculations to determine the refund.

Step 7: Complete the remaining sections

If you have multiple types of fuel tax refunds to claim, repeat Steps 4 to 6 for each section. Provide all the necessary information and calculate the refund amount accurately.

Step 8: Double-check the form

Review your completed Schedule 8 thoroughly for any errors or omissions. Make sure you have provided all the required information and that it is accurate. Mistakes or missing information could delay the processing of your refund.

Step 9: Sign and date the form

Sign and date the bottom of Schedule 8 to certify that the information provided is true and correct to the best of your knowledge.

Step 10: Submit the form

Attach Schedule 8 to Form 8849 and any other supporting documentation required for your claim. Make copies of the completed form and supporting documents for your records. Mail the original form to the appropriate address provided in the (link: https://fincent.com/irs-tax-forms/form-8849#special-considerations-when-filing-form-8849 text: Form 8849 instructions).

Special Considerations When Filing Schedule 8 (Form 8849)

When filing Schedule 8 (Form 8849), which is used to claim refunds for excise taxes, there are several special considerations to keep in mind. Here are some important points to consider:

Eligibility: Ensure that you are eligible to file Schedule 8 and claim a refund for the specific excise taxes you paid. Excise taxes are imposed on certain goods, activities, or transactions, such as fuel, heavy vehicles, air transportation, and environmental taxes. Review the instructions provided by the IRS to determine if your situation qualifies for a refund.

Correct form: Use the most recent version of Form 8849 and Schedule 8, as they can change from year to year. Visit the official IRS website to download the current version of the form and instructions.

**Supporting documentation: **Gather all necessary supporting documentation related to your claim. This may include invoices, receipts, bills of sale, or other relevant records that verify the excise taxes paid. Keep these documents organized and attach them to your Schedule 8 when filing.

Tax period: Ensure that you are filing for the correct tax period. Excise tax periods can vary depending on the specific tax type. Refer to the instructions provided with Form 8849 to determine the appropriate tax period for your claim.

Complete and accurate information: Fill out Schedule 8 accurately and provide all the required information. Include your name, address, taxpayer identification number, and other details as instructed. Make sure to double-check your entries for accuracy and legibility to avoid processing delays or errors.

Multiple claims: If you have multiple claims for different types of excise taxes, you can consolidate them on a single Schedule 8 form. However, be sure to clearly separate and identify each type of tax and the associated refund amount to ensure accurate processing.

**Electronic filing: **The IRS encourages electronic filing for faster processing and increased accuracy. If eligible, consider using the e-file system to submit your Schedule 8 and claim your refund. This can speed up the refund process compared to mailing a paper return.

Filing deadlines: Be mindful of the filing deadlines for excise tax refunds. The deadline may vary depending on the specific tax type. Review the instructions or consult the IRS website to determine the due date for your claim.

**Record-keeping: **Keep copies of all filed documents, including your completed Schedule 8 and any attachments, for your records. Retain these records for at least three years from the date of filing, as they may be required for future reference or in case of an audit.

Seek professional assistance: If you're uncertain about any aspect of filing Schedule 8 or claiming an excise tax refund, it's advisable to consult a tax professional or seek assistance from the IRS. They can provide guidance based on your specific circumstances and help ensure accurate and timely filing.

Filing Deadlines & Extensions on Schedule 8 (Form 8849)

Form 8849 is used to claim refunds or credits for certain federal excise taxes. Schedule 8 is a specific section of Form 8849 used to claim refunds for the excise tax on gasoline, diesel fuel, kerosene, biodiesel, and other fuels.

The general deadline to file Form 8849 is the last day of the quarter following the quarter in which the tax was paid. For example, if you paid excise taxes in the first quarter (January to March), the deadline to file Form 8849 would be the last day of the second quarter (April to June).

If you are unable to file Form 8849 by the deadline, you may be able to request an extension by filing Form 8849-EXT, Application for Extension of Time to File Form 8849. This form must be filed before the regular due date of Form 8849 and can provide an additional 6 months to file the form. However, please note that the extension is for filing the form only and not for paying any taxes owed.

Common Mistakes To Avoid While Filing Schedule 8 (Form 8849)

Here are some common mistakes to avoid while filing Schedule 8 (Form 8849):

Incorrect or incomplete information: Make sure to provide accurate and complete information on the form, including your name, address, taxpayer identification number (TIN), and the tax period you're filing for. Double-check the information before submitting the form.

Using outdated or incorrect form: Always use the most recent version of Schedule 8 (Form 8849) provided by the IRS. Using an outdated or incorrect form may result in processing delays or rejection of your claim.

Filing for the wrong tax period: Ensure that you're filing for the correct tax period. The tax period should correspond to the period for which you're claiming a refund.

Inaccurate calculation of refund amount: Double-check all calculations on the form to ensure accuracy. Mistakes in calculations can lead to incorrect refund amounts, which may result in processing delays or underpayment/overpayment of taxes.

Failure to attach supporting documentation: Depending on the type of refund you're claiming, you may need to attach supporting documentation to substantiate your claim.

For example, if you're claiming a refund for fuel taxes, you may need to provide fuel receipts or other documentation. Review the instructions for Schedule 8 to determine what supporting documents are required and ensure they are included with your submission.

Filing late or missing the deadline: Be aware of the deadline for filing Schedule 8 (Form 8849). Filing late may result in penalties or the loss of your refund eligibility. Stay updated with the IRS guidelines and ensure your form is submitted on time.

Failure to sign the form: Make sure to sign and date the form where required. Unsigned forms will be considered incomplete and may be rejected.

Sending the form to the wrong address: Verify the correct mailing address for filing Schedule 8 (Form 8849) with the IRS. Using the wrong

Conclusion

As a registered credit card issuer, understanding and complying with tax obligations is essential for maintaining compliance and ensuring financial stability. Schedule 8 (Form 8849) plays a crucial role in enabling credit card issuers to claim refunds for excise taxes paid on certain transactions.

By accurately completing and filing this form within the designated time frame, credit card issuers can recoup their expenses and meet their tax obligations effectively.

However, it's important to note that tax regulations may change over time, and it's always advisable to consult with a qualified tax professional or refer to the latest IRS guidelines for the most up-to-date information.