- IRS forms

- Schedule 5 (Form 8849)

Schedule 5 (Form 8849): Section 4081(e) Claim

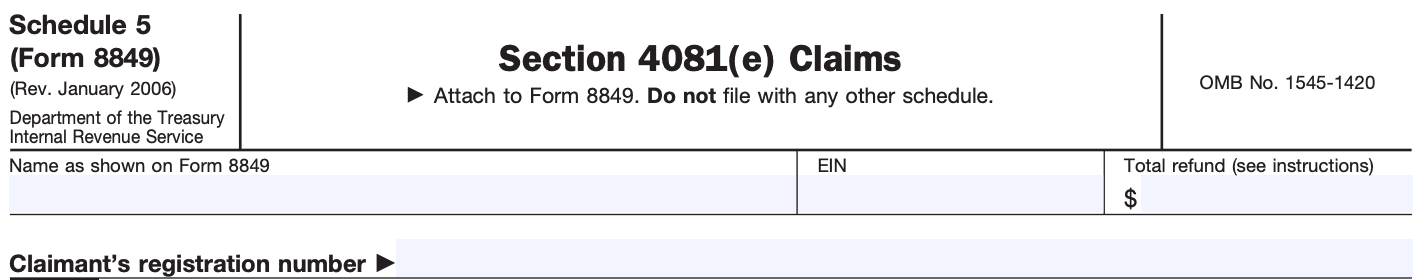

Download Schedule 5 (Form 8849)When it comes to taxes and government forms, things can often get confusing. For businesses in certain industries, navigating the intricacies of fuel tax credits and refunds can be particularly challenging. If you find yourself grappling with Section 4081(e) claims, you've come to the right place. Section 4081(e) Claims should attach to (link: https://fincent.com/irs-tax-forms/form-8849 text: Form 8849), should not file with any other schedule.

Schedule 5 (Form 8849) is a federal tax form used by businesses to claim various types of fuel-related credits and refunds. It is primarily designed for businesses engaged in specific industries that involve the use of certain fuels, such as gasoline, diesel, and aviation fuels. This form allows eligible businesses to seek a refund or credit for the excise taxes they paid on fuel in certain circumstances.

Section 4081(e) of the Internal Revenue Code (IRC) addresses a specific situation where fuel taxes have been paid but are not applicable. This provision allows eligible businesses to claim a refund or credit for fuel taxes paid on fuel that is ultimately used for a non-taxable purpose. Non-taxable purposes include activities like off-highway business use, exportation, or usage in a nontaxable manner.

In this blog, we will shed light on Schedule 5 (Form 8849) and help you understand the ins and outs of Section 4081(e) claims.

Purpose of Schedule 5 (Form 8849), Section 4081(e) Claim

The purpose of the Section 4081(e) claim on Schedule 5 is to request a refund or credit for the federal excise tax paid on certain types of fuel used for specific non-taxable purposes. This provision applies to fuels used in certain off-highway business uses, including use in farming, aviation, and other non-taxable activities.

To make a Section 4081(e) claim, you need to provide details about the type of fuel, the quantity used, the non-taxable purpose for which it was used, and other relevant information. The IRS will review the claim to determine if you are eligible for a refund or credit based on the information provided.

It's important to note that specific rules and requirements apply to Section 4081(e) claims, and not all fuel uses or activities may qualify. It's recommended to consult the official IRS guidelines, instructions for Schedule 5 (Form 8849), and if needed, seek professional tax advice to ensure compliance and maximize eligible refunds or credits.

Benefits of Schedule 5 (Form 8849), Section 4081(e) Claim

Here are some benefits of filing a Section 4081(e) claim on Schedule 5:

**Fuel tax refund: **Section 4081(e) of the Internal Revenue Code allows for a refund of the federal excise tax paid on certain types of fuel used for non-taxable purposes. By filing a Section 4081(e) claim, you can potentially receive a refund for the excise tax paid on fuel used in activities that are exempt from taxation, such as off-highway business use, farming, or certain non-profit activities.

**Cost recovery: **If you are engaged in activities that qualify for a Section 4081(e) claim, filing for this refund can help you recover some of the fuel costs associated with those activities. This can provide financial relief and potentially lower your overall operating expenses.

Incentive for specific industries: Section 4081(e) claims are particularly beneficial for industries that heavily rely on fuel consumption, such as agriculture, construction, or transportation. These industries often use significant amounts of fuel in their operations, and the ability to claim a refund on the excise tax paid can help mitigate some of the financial burden.

Compliance with tax regulations: Filing a Section 4081(e) claim ensures that you are in compliance with tax regulations. If you qualify for a refund under this section, it is important to submit the necessary documentation and claim the refund in a timely manner. By doing so, you can meet your tax obligations while maximizing your eligible refunds.

Potential savings and cash flow: The Section 4081(e) claim can result in significant savings for businesses and individuals engaged in eligible activities. By obtaining a refund on the fuel excise tax paid, you can increase your cash flow, reinvest the savings in your operations, or allocate funds to other business priorities.

Who Is Eligible To File Schedule 5 (Form 8849), Section 4081(e) Claim?

To qualify for a Section 4081(e) claim, your business must meet specific requirements. Here are some key criteria to consider:

-

Non-taxable use: The fuel must be used for off-highway business use, exported, or used in a nontaxable manner. Off-highway use generally refers to activities such as farming, certain types of construction, and industrial use.

-

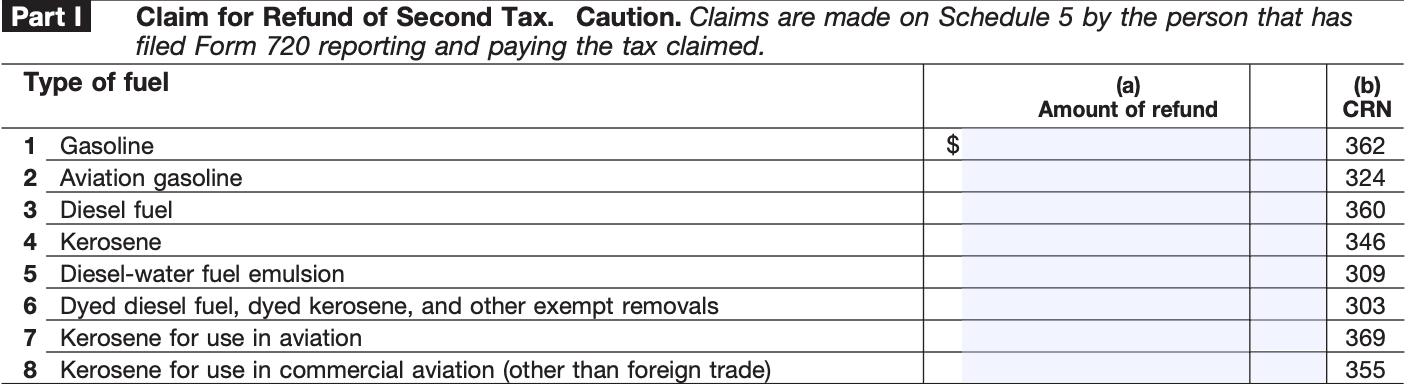

Applicable fuel types: Section 4081(e) claims apply to various fuel types, including gasoline, diesel, and aviation gasoline or jet fuel.

-

Proof of payment: You must have paid the applicable excise taxes on the fuel for which you are seeking a refund or credit.

-

Timely filing: Claims must be filed within the specified time limits. Generally, a claim must be made within three years from the date of the original tax payment or the date the return was filed, whichever is later.

How To Complete Schedule 5 (Form 8849), Section 4081(e) Claim: A Step-by-Step Guide

Completing Schedule 5 (Form 8849) for a Section 4081(e) claim requires careful attention to detail. Here's a step-by-step guide to help you through the process:

Step 1: Obtain the necessary forms and documents

Make sure you have the latest version of Schedule 5 (Form 8849) and the instructions provided by the Internal Revenue Service (IRS). You can download these forms and instructions from the official IRS website.

Step 2: Fill out the basic information

Start by entering your name, address, employer identification number (EIN), and other requested information at the top of Schedule 5.

Step 3: Identify the claim

In Part I of Schedule 5, check the box for "Section 4081(e) Claims." This indicates that you are making a claim related to certain fuels used for off-highway business use or in certain aviation activities.

Step 4: Provide the fuel-related information

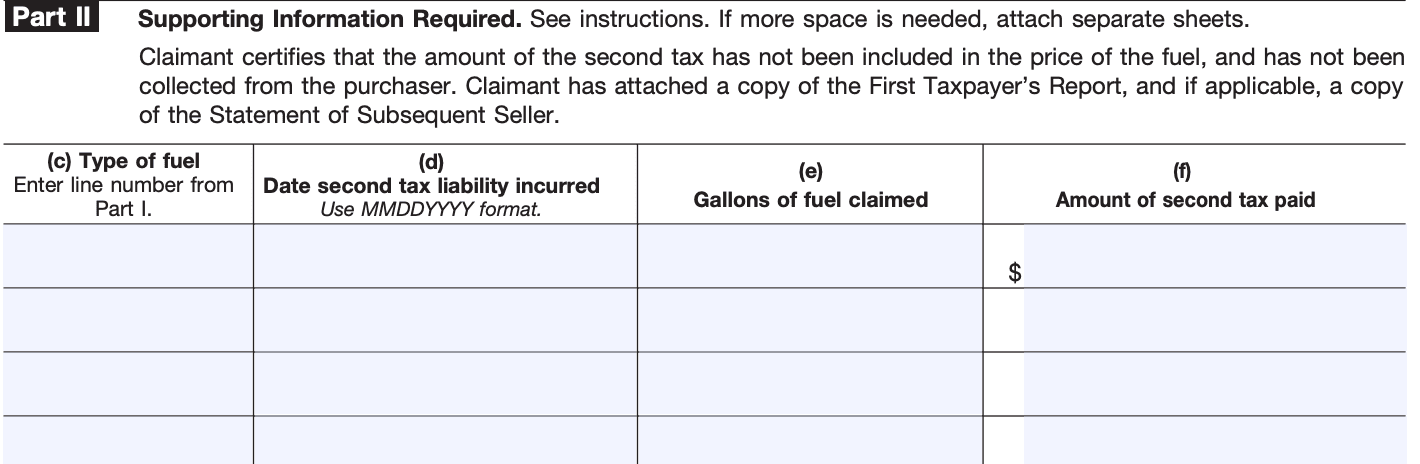

In Part II, you will need to provide details about the fuel for which you are making the claim. This includes the type of fuel, number of gallons, and the claim amount. Ensure that you accurately report the fuel type and quantities.

Step 5: Calculate the claim amount

Refer to the instructions to determine how to calculate the claim amount. Depending on the specific circumstances, the calculation method may vary. Follow the instructions carefully to ensure accurate calculations.

Step 6: Explain the basis for the claim

In Part III, you need to provide a detailed explanation of the basis for your claim. This should include supporting documentation, such as invoices, (link: https://fincent.com/blog/cant-find-your-receipts-dont-panic-heres-what-to-do text: receipts), or other records that establish your eligibility for the claim. Be sure to include all relevant information and keep copies of your supporting documents for your records.

Step 7: Review and double-check your form

Before submitting your completed Schedule 5, review all the information you have entered to ensure accuracy and completeness. Check for any errors or omissions that could potentially delay the processing of your claim.

Step 8: Attach additional documents, if necessary

If you have any additional supporting documents that are too extensive to fit on Schedule 5, attach them securely to the form. Make sure to label them appropriately and refer to them in your explanation in Part III.

Step 9: Sign and date the form

Sign and date your completed Schedule 5 to certify that the information provided is true, accurate, and complete. Remember to use your current signature and date the form with the current date.

Step 10: Submit the form

Keep a copy of the completed Schedule 5 and all supporting documents for your records. Mail the original form and attachments to the address specified in the instructions. It's advisable to send the form via certified mail or another method that provides proof of delivery.

Special Considerations When Filing Schedule 5 (Form 8849), Section 4081(e)

When filing Schedule 5 (Form 8849) for Section 4081(e), there are a few special considerations to keep in mind. Here are some important points to consider:

**Eligible claims: **Section 4081(e) provides for tax-free uses of fuel, such as when it is used in certain intercity, local, and school buses; in qualified buses used in the transportation of prisoners; and for exclusive use by a nonprofit educational organization for its school buses. Ensure that your claim falls within the eligible categories specified in Section 4081(e) before filing.

Supporting documentation: You will need to provide appropriate documentation to support your claim. This may include records that establish the tax-free use of fuel, such as (link: https://fincent.com/blog/freelancers-and-small-business-owners-guide-to-proper-invoicing text: invoices), fuel logs, or other relevant documentation. Maintain detailed and accurate records to substantiate your claim.

Claim period: Schedule 5 allows for claims of tax-free uses of fuel for a specific claim period. Make sure to enter the correct claim period for which you are seeking a refund or credit.

Timely filing: File your Schedule 5 (Form 8849) within the prescribed time limits. Generally, a claim for refund or credit of the fuel tax must be filed within three years from the date the tax was paid.

Correct calculations: Ensure that you accurately calculate the refund or credit amount you are claiming on Schedule 5. The form provides specific instructions on how to calculate the refund or credit based on the eligible fuel and the tax rates applicable.

Proper identification: Clearly identify the type and amount of fuel for which you are claiming a refund or credit. The form provides specific fields to enter this information.

**Electronic filing: **Schedule 5 (Form 8849) can be filed electronically using the IRS' e-file system. Electronic filing can simplify the process and expedite the processing of your claim.

Consult a tax professional: If you are unsure about any aspect of filing Schedule 5 for Section 4081(e), it is advisable to consult a tax professional or seek guidance from the IRS. They can provide specific advice based on your situation and help ensure accurate filing.

Filing Deadlines & Extensions on Schedule 5 (Form 8849), Section 4081(e)

Regarding filing deadlines and extensions, here are some general guidelines:

Filing deadline: Generally, you must file Schedule 5 (Form 8849) by the last day of the quarter following the quarter in which the tax liability was incurred. For example, if you incurred the tax liability in the second quarter (April to June), the filing deadline would be the last day of the following quarter (July to September). However, if the last day falls on a weekend or a legal holiday, the deadline is extended to the next business day.

Extensions: As of my knowledge cutoff in September 2021, extensions for filing Schedule 5 (Form 8849) are not available. The IRS does not provide an automatic extension of time to file this form. Therefore, it's important to file the form by the regular deadline to avoid potential penalties or interest charges.

Remember, these guidelines are general in nature, and it's always advisable to consult the most recent IRS instructions or seek professional tax advice to ensure compliance with current regulations.

Common Mistakes To Avoid While Filing Schedule 5 (Form 8849), Section 4081(e)

When filing Schedule 5 (Form 8849), Section 4081(e), it's important to be accurate and thorough to avoid potential errors or delays in processing your refund claim. Here are some common mistakes to avoid:

1.** Incorrect or incomplete information**: Ensure that you provide accurate and complete information on the form. This includes your name, address, tax identification number, and the specific details related to the claim for refund. Double-check all entries for accuracy and legibility.

- Missing or incorrect attachments: If any supporting documentation is required to substantiate your claim, such as invoices, receipts, or other relevant records, make sure to include them with your form. Failure to provide the necessary attachments can result in delays or rejection of your claim.

3.** Filing for the wrong quarter**: Be mindful of the correct tax period for which you are filing the claim. Schedule 5 (Form 8849) is filed by the last day of the quarter following the quarter in which the tax liability was incurred. Ensure that you are filing for the correct quarter to avoid errors.

-

Incorrect calculation of refund amount: Double-check all calculations to ensure accuracy. Incorrectly calculating the refund amount can result in delays or potential discrepancies with the IRS. Use the appropriate tax rates and follow the instructions provided by the IRS to calculate the refund amount correctly.

-

Missing the deadline: Pay close attention to the filing deadline and submit your form by the due date. Late filings can lead to penalties or interest charges. If you cannot meet the deadline, consider requesting a professional extension or consulting with a tax professional for guidance.

-

Not keeping copies: Always make copies of the completed Schedule 5 (Form 8849) and any supporting documents for your records. This helps you maintain a record of your claim and facilitates any future correspondence with the IRS.

Conclusion

Understanding Schedule 5 (Form 8849), Section 4081(e) Claim, is essential for businesses involved in activities that require the use of certain fuels in off-highway, non-taxable capacities. By carefully following the guidelines and providing the necessary documentation, you can potentially recover excise taxes paid on eligible fuel purchases.

Taking advantage of this opportunity not only helps reduce your tax liability but also contributes to the financial stability and competitiveness of your business. Consult with a tax professional or the IRS for specific guidance on filing Schedule 5 and making a Section 4081(e) claim to ensure compliance with the latest regulations and requirements.