- IRS forms

- Form 990

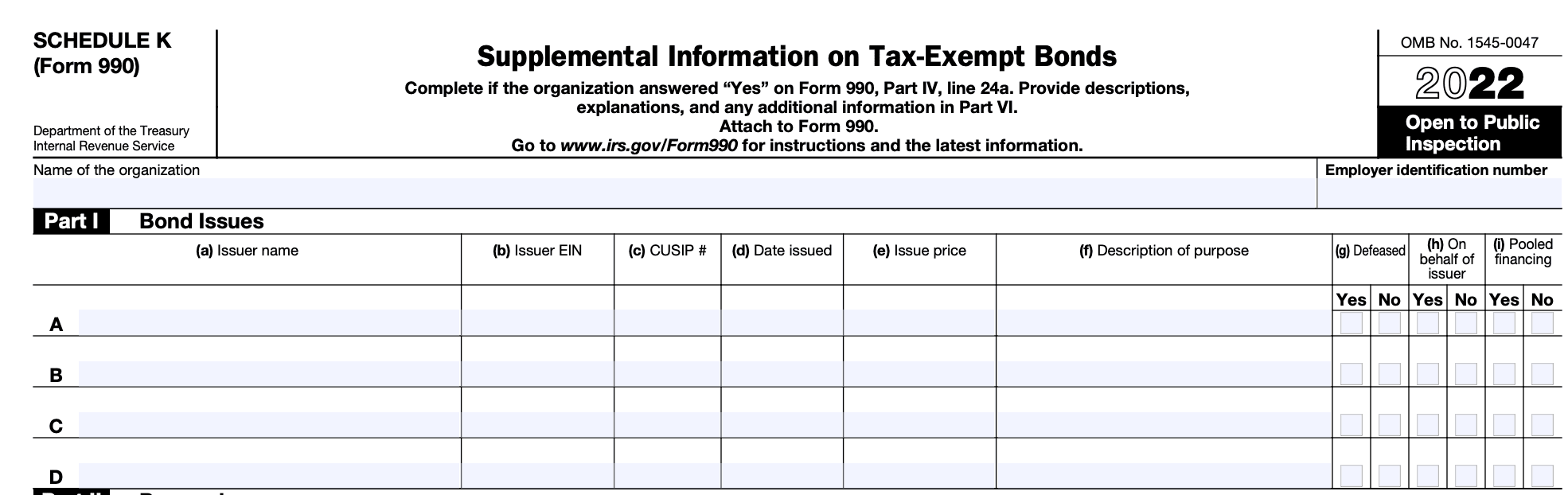

Form 990: Schedule K, Supplemental Information on Tax-Exempt Bonds

Download Form 990Taxes are an essential part of our lives, and for tax exempt organizations, transparency and compliance are of utmost importance. The Internal Revenue Service (IRS) requires these organizations to file an annual information return, Form 990, to provide details about their financial activities, governance, and mission. For organizations that have issued tax exempt bonds, Schedule K comes into play, offering a comprehensive breakdown of this financial aspect.

Understanding Form 990: Schedule K

Before delving into Schedule K, let's briefly understand tax exempt bonds. Tax-exempt bonds are financial instruments issued by qualifying organizations, such as municipal governments or certain non-profit organizations. These bonds are typically used to finance public projects like infrastructure, schools, hospitals, and other charitable initiatives.

The interest earned on tax exempt bonds is generally free from federal income tax, and in some cases, state and local taxes as well. This tax advantage is the government's way of encouraging investments in projects that benefit the public good. However, to maintain transparency and prevent misuse of this tax benefit, the IRS requires organizations that issue these bonds to disclose relevant information through Form 990 and Schedule K.

Purpose of Form 990: Schedule K

Schedule K is a part of Form 990 and is used to report certain information about a tax exempt organization's partnerships and other similar arrangements.

Specifically, Schedule K is used to report information about:

**Partnerships: **If the tax exempt organization is a partner in a partnership, Schedule K is used to provide details about the partnership, such as its name, Employer Identification Number (EIN), and financial information.

**Other similar arrangements: **If the tax exempt organization is involved in any other similar arrangements that are not considered partnerships, Schedule K is used to report information about these arrangements.

The purpose of Schedule K is to ensure transparency and to help the IRS understand the organization's involvement in partnerships and other arrangements that may have tax implications. It also helps the IRS monitor potential unrelated business income and ensure compliance with tax regulations.

Benefits of Form 990: Schedule K

The benefits of Form 990-Schedule K include:

- Compliance with IRS regulations: Filing Form 990 and Schedule K helps tax exempt organizations comply with IRS regulations and maintain their tax exempt status. It ensures transparency and accountability in the organization's financial dealings.

- Transparency for stakeholders: Form 990 is a publicly available document, and it provides transparency to donors, stakeholders, and the general public about the organization's finances, governance, and activities. Schedule K specifically discloses information about the organization's involvement with tax exempt bonds.

- Disclosure of bond transactions: Schedule K requires the organization to report details of its tax exempt bond transactions, such as the amount of bond proceeds used, the purpose of the bond issuance, and any private use of bond-financed facilities. This information helps the IRS and the public monitor the appropriate use of tax exempt bonds.

- Prevention of abuse: By requiring organizations to disclose their bond transactions, Schedule K helps prevent misuse or abuse of tax exempt bonds for personal gain or activities that do not align with the organization's tax exempt purpose.

- Comparative analysis: Researchers, donors, and other interested parties can analyze multiple organizations' Form 990 filings, including Schedule K, to compare their financial practices, management, and use of tax exempt bonds. This allows for better-informed decision-making and evaluation of organizations.

- IRS oversight and data collection: The information provided in Form 990, including Schedule K, aids the IRS in its oversight of tax exempt organizations. It helps the IRS ensure that these organizations are complying with tax laws and using tax exempt benefits appropriately.

Who Is Eligible To File Form 990: Schedule K?

Form 990 is an annual information return that certain tax exempt organizations in the United States must file with the Internal Revenue Service (IRS). Schedule K is a supplemental schedule to Form 990, and it is used to report information about a tax exempt organization's "Supplemental Information on Tax-Exempt Bonds."

Organizations that are required to file Form 990 are typically tax exempt under section 501(a) of the Internal Revenue Code. This includes organizations exempt under various subsections of section 501(c), such as 501(c)(3) charitable organizations, 501(c)(4) social welfare organizations, 501(c)(6) business leagues, etc. Generally, these organizations are exempt from income tax and eligible to receive tax-deductible contributions.

More specifically, the organizations that are eligible to file Form 990: Schedule K are those that have issued tax exempt bonds or have outstanding tax exempt bond liabilities during the tax year. It applies to organizations that have engaged in certain financial transactions involving tax exempt bonds.

How To Complete Form 990: Schedule K

Here are the general steps to complete Form 990: Schedule K:

Step 1: Obtain the necessary forms

You can access Form 990 and Schedule K on the IRS website or through other tax preparation software approved by the IRS.

Step 2: Gather information

Collect all the relevant information regarding the organization's tax exempt bonds. This includes details about the bond issuances, outstanding bonds, bond activities, and any private business use associated with the bonds.

Step 3: Fill out Part I & II - tax exempt bonds & proceeds

In Part I of Schedule K, you'll need to provide general information about the tax exempt bonds issued by your organization during the tax year. This includes details about bond proceeds, the purpose of the bond issuance, and the amounts spent on different projects.

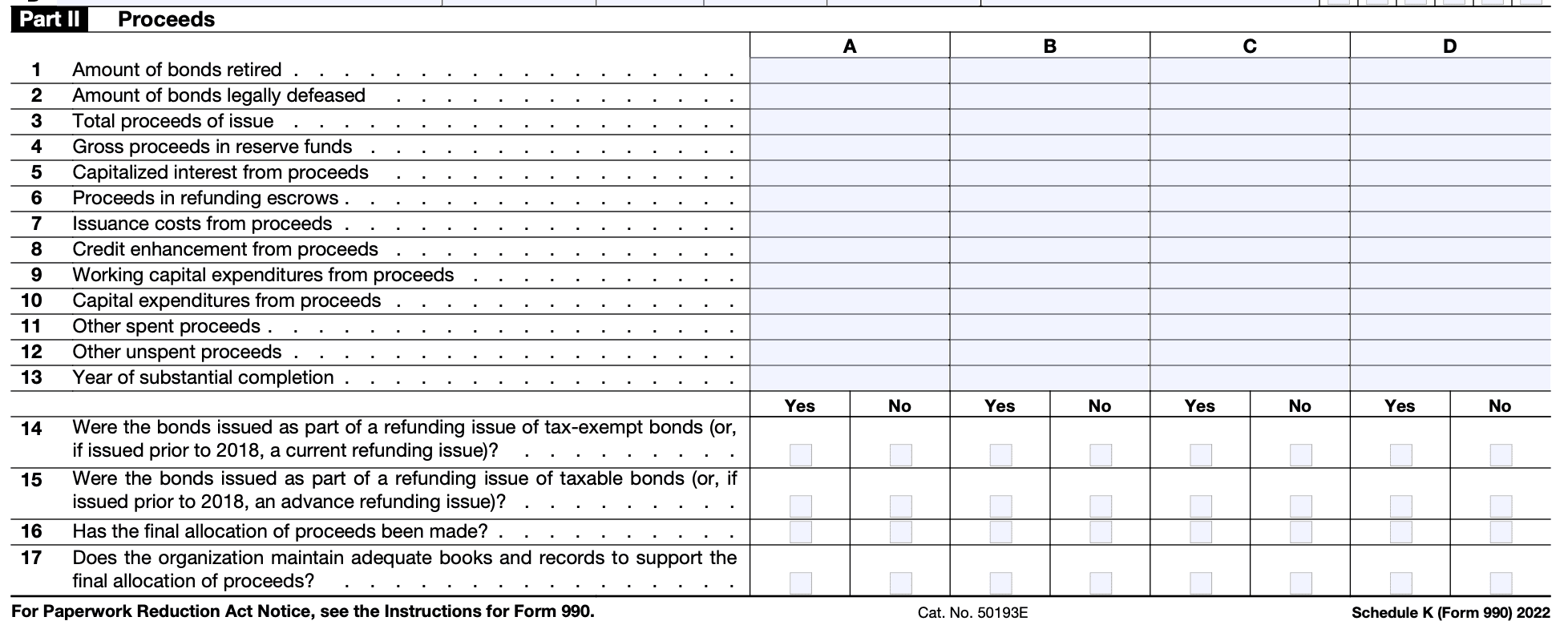

Step 4: Complete Part III - private business use

If your organization issued tax exempt bonds and used the bond-financed property for any private business use, you must complete Part II of Schedule K. Private business use refers to the use of the tax exempt bond-financed property by parties outside the tax exempt organization, such as for-profit companies.

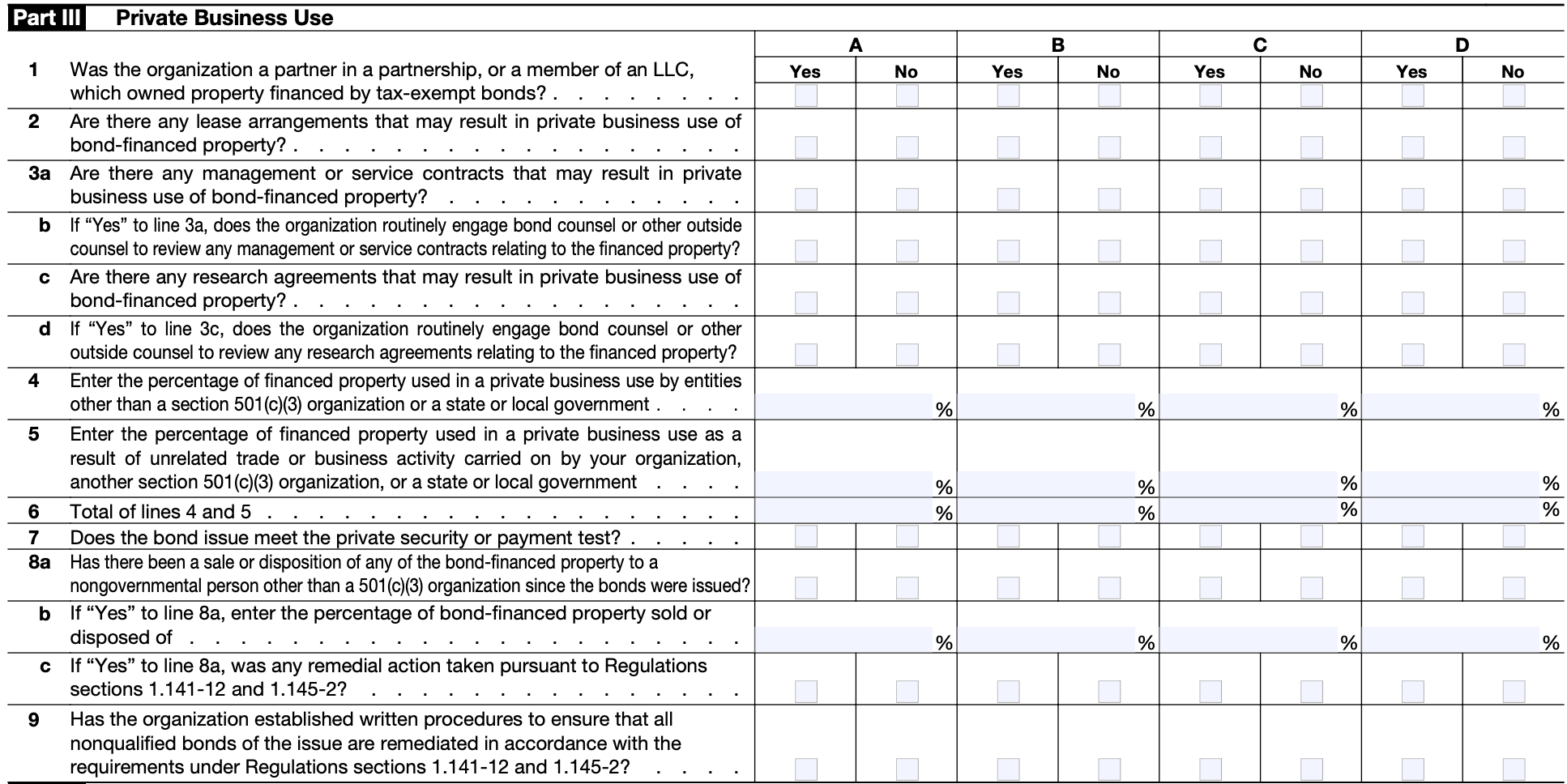

Step 5: Fill out Part IV & V - arbitrage & corrective actions

If your organization invested the bond proceeds and earned interest or other investment income, you'll need to report this information in Part III of Schedule K. The IRS imposes restrictions on arbitrage, which is the practice of earning a profit from the difference between the interest rate on the tax exempt bonds and the rate earned on the invested bond proceeds.

Step 6: Complete Part VI - other information

Part VI of Schedule K requires any other supplemental information related to tax exempt bonds that the IRS needs to know.

Step 7: Review and double-check

Once you've completed the Schedule K, review all the information provided to ensure accuracy and completeness.

Step 8: Attach Schedule K to Form 990

Once Schedule K is filled out, attach it to the organization's Form 990 when filing with the IRS.

Step 9: File the return

Submit the completed Form 990, along with any other required schedules and attachments, to the IRS by the appropriate filing deadline.

It's important to note that the completion of Form 990 and its associated schedules can be complex, especially for organizations with significant financial transactions and activities.

Special Considerations When Filing Form 990: Schedule K

When filing Form 990 with Schedule K, there are some special considerations to keep in mind:

Reporting tax exempt bonds: Schedule K requires the organization to provide details about any tax exempt bonds it has issued or holds during the tax year. This includes information about the outstanding principal amount, the purpose of the bonds, and the bond issuer.

Compliance with bond requirements: The organization must ensure that it complies with all federal tax requirements related to tax exempt bonds. Failure to meet these requirements may result in penalties or the loss of tax exempt status for the organization.

Accuracy of financial information: Schedule K requires detailed financial information related to tax exempt bonds. It is essential to ensure that all the financial data reported on Schedule K is accurate and supported by appropriate documentation.

Record-keeping: The organization should maintain proper records and documentation related to tax exempt bonds and other financial obligations. This includes bond issuance documents, bondholder information, bond proceeds usage, and any arbitrage compliance records.

Understanding IRS instructions: The IRS provides instructions for completing Schedule K, and it is essential to follow these instructions carefully. The instructions can be found on the IRS website or in the Form 990 instructions booklet.

Consultation with tax professionals: Filing Form 990 with Schedule K can be complex, especially when dealing with tax exempt bonds. It is recommended to seek the advice of tax professionals or financial advisors with experience in nonprofit tax matters to ensure accurate and compliant reporting.

How To File Form 990: Schedule K: Offline/Online/E-filing

General overview of how to file Form 990 and Schedule K, both offline and online.

Offline filing

To file Form 990 and Schedule K offline, you will need to obtain the physical forms from the IRS website or an authorized provider. Follow these steps:

- Obtain the forms: Go to the IRS website (irs.gov) and search for "Form 990" and "Schedule K." Download the forms and instructions in PDF format.

- Complete the forms: Print the forms and carefully fill them out following the instructions provided. Make sure to accurately report all required financial information.

- Gather supporting documents: Collect any necessary financial statements, schedules, or additional documentation that may be required to support the information provided in Form 990 and Schedule K.

- Mail the forms: Once the forms are completed and reviewed for accuracy, mail the printed forms and supporting documents to the appropriate IRS address. The address for filing Form 990 can be found in the form instructions.

Online filing

The IRS offers an electronic filing system called "e-Postcard," also known as Form 990-N, for small tax exempt organizations. However, for larger organizations that require Form 990 and Schedule K, the IRS has the Modernized e-File (MeF) system. Here's how to file online:

- Create an account: To use the MeF system, you must create an account on the IRS website.

- Access Form 990: Log in to your account on the IRS website and select the option to file Form 990. The MeF system will guide you through the process.

- Enter information: Enter all the necessary financial information and supporting details required by Form 990 and Schedule K.

- Review and submit: Once you have completed the forms and reviewed them for accuracy, submit the forms electronically through the MeF system.

E-filing with an authorized provider

The IRS allows authorized third-party providers to offer electronic filing services for Form 990 and Schedule K. These providers typically have specialized software to help organizations prepare and file their tax returns. If you choose to use an authorized provider, follow their instructions to file electronically.

Common Mistakes To Avoid While Filing Form 990: Schedule K

To ensure accurate reporting and compliance, it's essential to avoid common mistakes while filing Form 990: Schedule K. Here are some of the most common mistakes to avoid:

Incomplete or missing information: Ensure that all required fields in Schedule K are completed accurately. Missing or incomplete information can lead to delays in processing your form and may raise questions from the IRS.

Incorrect identification of related organizations: Clearly identify all related organizations, including subsidiaries, affiliates, and other entities that may be part of your organization's reporting requirements. Failure to disclose related organizations can result in penalties.

Not reporting all transactions: Report all transactions that your organization had with related organizations during the tax year. This includes financial transactions, grants, and other exchanges of value.

Mistakes in reporting transactions: Ensure that all financial transactions with related organizations are correctly classified and reported in the appropriate sections of Schedule K. For example, grants should be reported in the grants section, and other types of transactions should be reported in the appropriate sections.

Incorrect calculation of fair market value: If you are required to report fair market values of assets or other items, ensure that these values are calculated accurately and in accordance with IRS guidelines.

**Failure to attach required schedules: **If your organization engaged in certain types of transactions with related organizations, additional schedules may be required to be attached to Form 990. Make sure to include all necessary schedules as per the instructions.

Late filing: Filing the Form 990 after the deadline can lead to penalties and may raise suspicion with the IRS. Be aware of the filing deadline and submit the form on time.

Ignoring changes in instructions: The IRS may update the instructions for Form 990 or Schedule K from year to year. Always refer to the latest instructions and follow any changes or updates.

Inconsistent information: Ensure that the information reported on Schedule K is consistent with other parts of Form 990. Inconsistencies can lead to inquiries or audits by the IRS.

Not Seeking professional guidance: Form 990 can be complex, especially for larger or more complex organizations. Consider seeking professional tax or legal advice to ensure accurate and compliant reporting.

Key Takeaways

Form 990, Schedule K, plays a vital role in maintaining transparency and accountability for tax exempt organizations that have issued tax exempt bonds.

By providing a comprehensive breakdown of bond-related activities and financial transactions, the IRS can ensure that these organizations are using their tax exempt status responsibly and in accordance with the law.

For organizations issuing tax exempt bonds, it's essential to understand the reporting obligations associated with Schedule K and ensure timely and accurate filing to avoid potential penalties.

As transparency continues to be a critical aspect of the non-profit sector, complying with IRS requirements not only fulfills a legal obligation but also fosters trust and confidence among donors and stakeholders.