- IRS forms

- Form 965-C

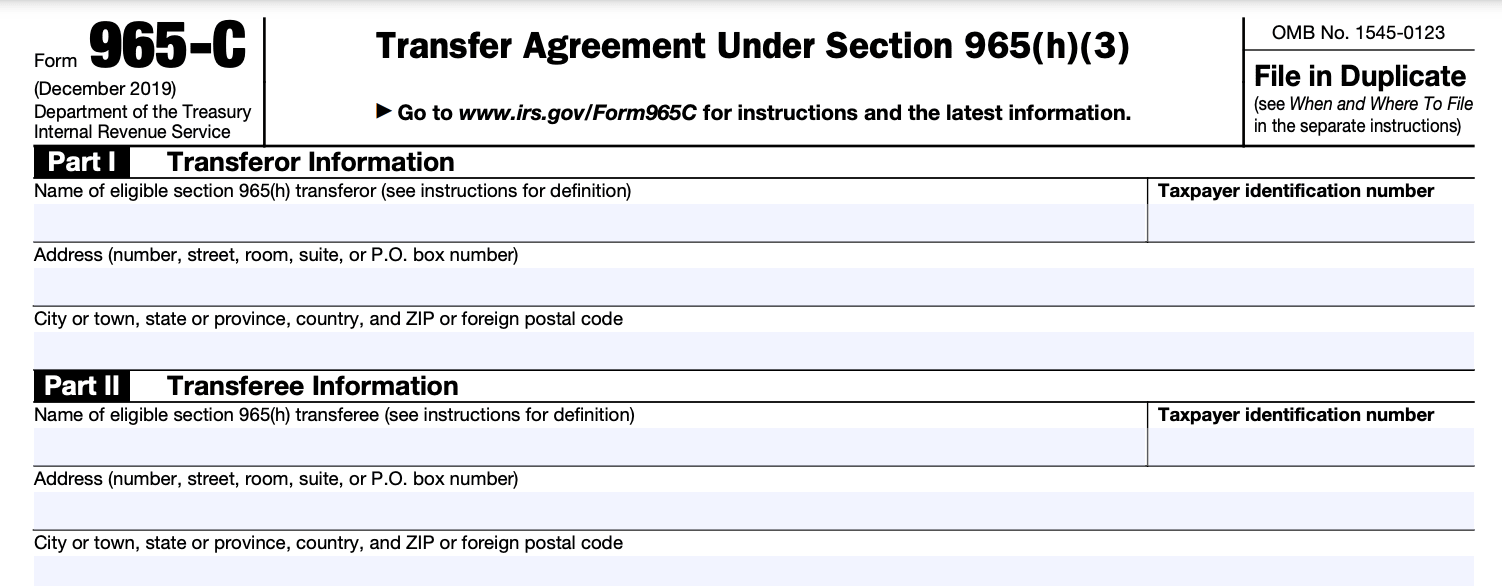

Form 965-C: Transfer Agreement Under Section 965(h)(3)

Download Form 965-CForm 965-C, the Transfer Agreement under Section 965(h)(3), is an essential document for U.S. multinational corporations (MNCs) that find themselves subject to the transition tax under Section 965 of the Internal Revenue Code (IRC). This provision requires MNCs to pay a one-time tax on their accumulated offshore earnings and profits (E&P). The IRS introduced Form 965-C as a means for corporations to enter into an agreement to defer their tax payments and fulfill their obligations under Section 965(h)(3).

Form 965-C is an agreement entered into between a U.S. MNC and the IRS. It allows the corporation to elect to pay the transition tax in installments over an eight-year period. The deferral is subject to the payment of a specified percentage of the total tax liability for the taxable year of the Section 965(a) inclusion. The election is irrevocable once made and is binding on both the taxpayer and the IRS.

In this blog post, we will explore the purpose, requirements, and implications of Form 965-C.

Purpose of Form 965-C

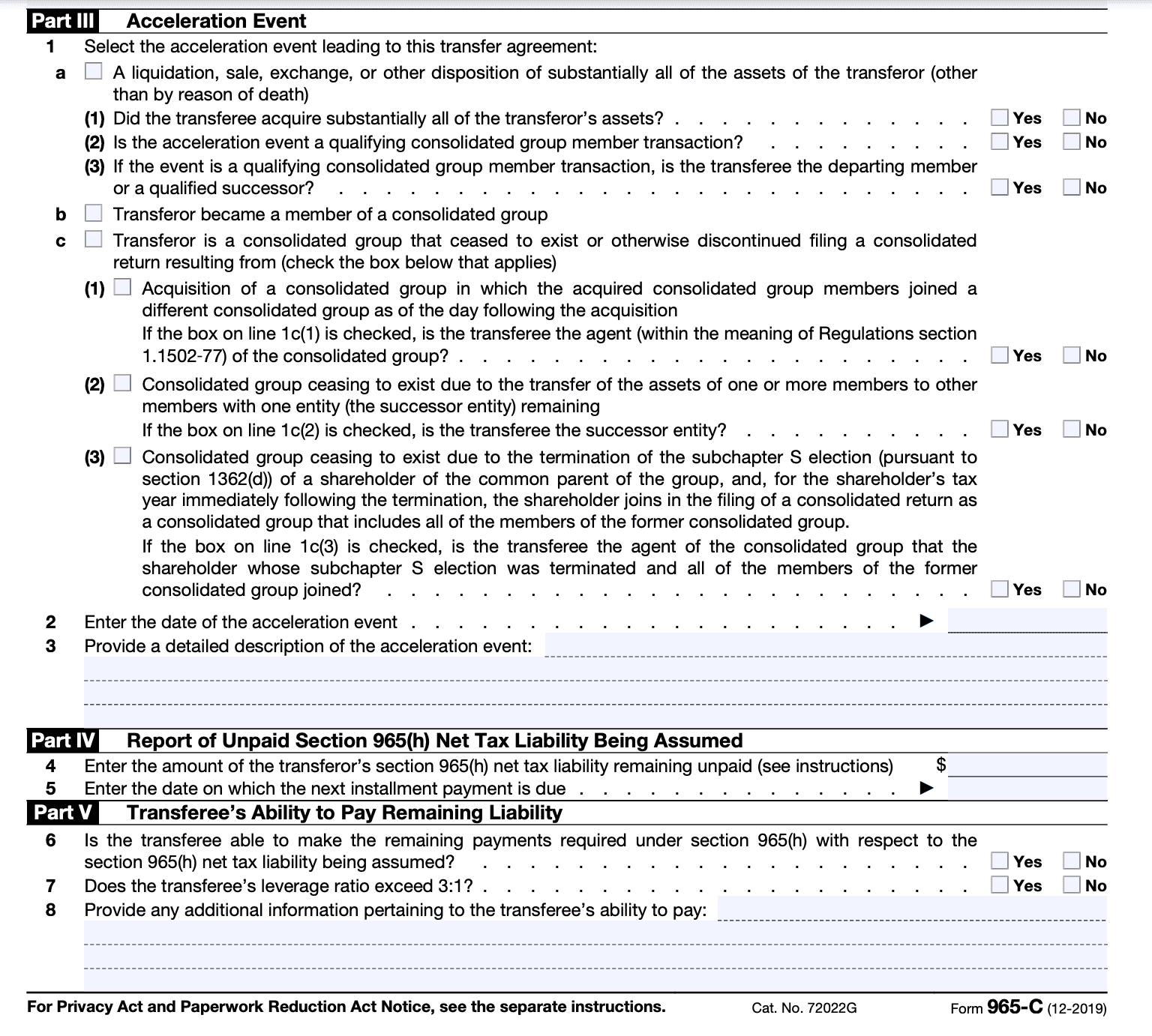

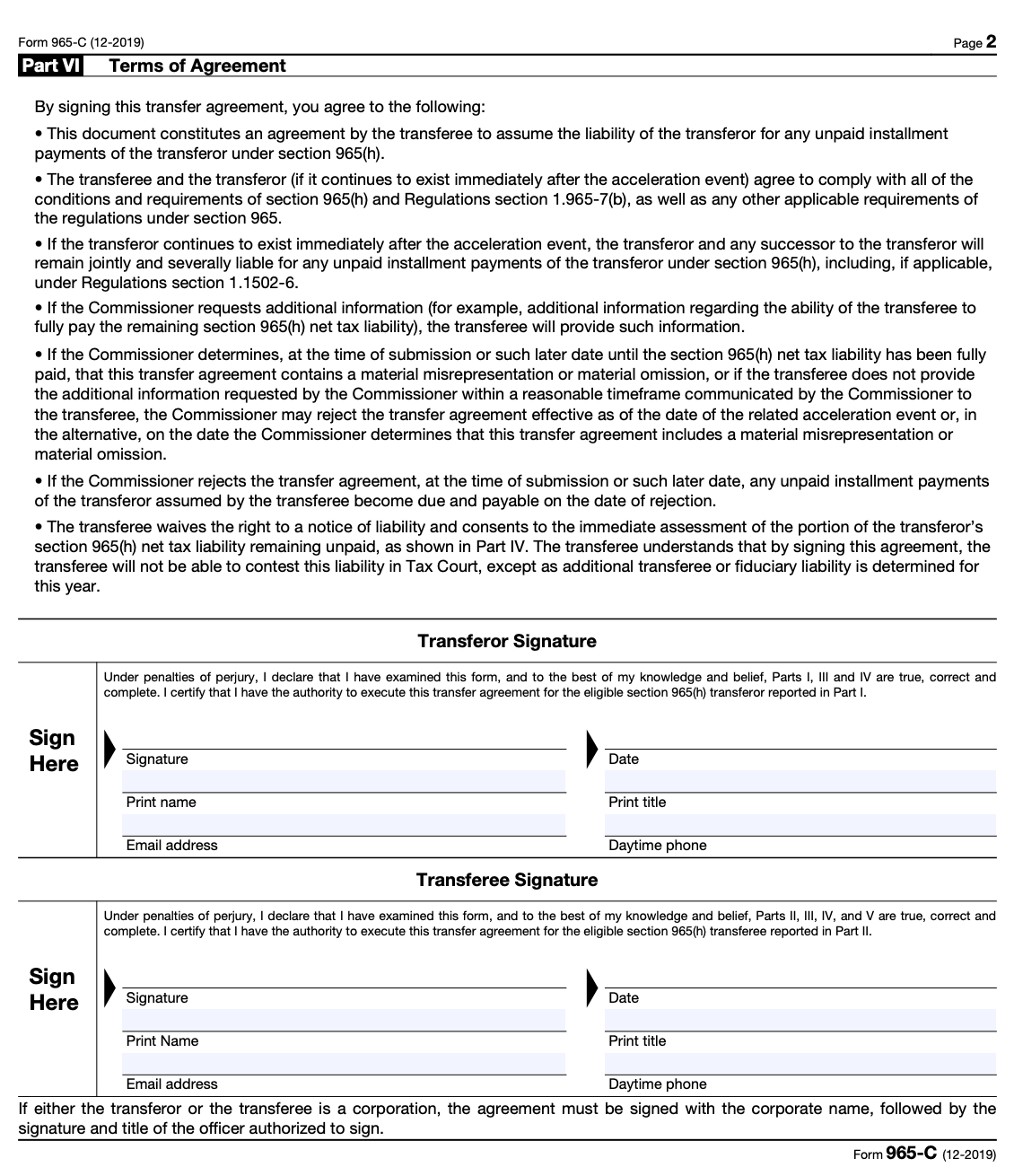

The purpose of Form 965-C Transfer Agreement is to facilitate the transfer of specified payment amounts between related parties to comply with the requirements of Section 965. This form is typically used when the taxpayer has elected to pay the transition tax liability in installments over an 8-year period.

The form is used to document the agreement between the taxpayer and one or more related parties for the transfer of specified payment amounts, which are essentially installment payments of the transition tax liability. It outlines the terms and conditions of the transfer and ensures that the related parties understand their obligations regarding the payment and reporting of the transition tax.

It is important to note that the information provided here is based on the knowledge available up until September 2021, and there may have been updates or changes to the tax laws since then.

Components of Form 965-C

Identification information: The form begins with general identification information, such as the name, address, and employer identification number (EIN) of the transferor and transferee. It also requires information about the specific type of transfer, whether it is a transfer of stock or property.

**Transfer information: **This section requires detailed information about the transfer of stock or property. It includes the description and fair market value of the transferred stock or property, as well as the date and the exchange ratio used for determining the allocation of the Section 965(a) previously taxed earnings and profits (PTEP).

Allocation of liability: Form 965-C also requires the allocation of the Section 965(a) PTEP liability between the transferor and transferee. The form provides a table where the amounts are allocated based on the respective ownership percentages of the transferor and transferee.

**Attachments: **The form may require certain attachments, such as a schedule listing the transferor and transferee's respective ownership percentages and any other additional information required by the IRS.

Benefits of Form 965-C

Here are some of the benefits associated with the Form 965-C transfer agreement:

Deferral of transition tax liability: The primary benefit of the Form 965-C transfer agreement is the ability to defer the payment of the transition tax liability. This allows taxpayers to pay the liability in installments over a period of eight years, rather than making a lump sum payment.

Reduced interest charges: By entering into the transfer agreement, taxpayers can reduce the interest charges that would typically apply to unpaid tax liabilities. The interest rate is generally lower than the standard rate that applies to unpaid taxes.

**Improved cash flow management: **The installment payment option provided by the Form 965-C transfer agreement enables taxpayers to manage their cash flow more effectively. Instead of depleting their cash reserves with a large upfront payment, taxpayers can spread the tax liability over multiple years, potentially easing financial strain.

**Flexibility in meeting obligations: **The transfer agreement offers flexibility by allowing taxpayers to make payments in installments, giving them more time to gather the necessary funds to fulfill their transition tax obligations. This can be particularly beneficial for businesses facing liquidity challenges or those with limited immediate cash resources.

**Avoidance of penalties: **By entering into the Form 965-C transfer agreement and adhering to its terms, taxpayers can avoid certain penalties that would otherwise apply for failure to pay the transition tax liability in full by the due date.

It is important to note that the benefits of the Form 965-C transfer agreement are specific to the transition tax imposed under Section 965. Taxpayers should consult with a tax professional or qualified advisor to understand the full implications of entering into such an agreement, as individual circumstances may vary, and the tax code is subject to change.

Who Is Eligible To File Form 965-C?

Generally, individuals, corporations, partnerships, trusts, estates, and other entities that are considered U.S. shareholders of specified foreign corporations may be eligible to file Form 965-C.

U.S. shareholders of specified foreign corporations are typically defined as:

- U.S. citizens or residents

- Domestic corporations

- Domestic partnerships

- Domestic estates and trusts

However, eligibility to file Form 965-C is subject to specific criteria and requirements outlined by the Internal Revenue Service (IRS). It is advisable to consult a qualified tax professional or refer to the official IRS instructions for Form 965-C to determine your eligibility and understand the specific circumstances that apply to your situation.

How To Complete Form 965-C: A Step-by-Step Guide

Step 1: Obtain the form

You can download Form 965-C from the IRS website (www.irs.gov) or obtain a copy from your tax professional.

Step 2: Provide general information

Enter your name, address, and taxpayer identification number (TIN) at the top of the form. Make sure the information matches what is on your tax return.

Step 3: Part I - Transfer Agreement

In this section, you will provide details about the transfer agreement. Specifically, you'll need to:

- Check the box to indicate whether you are an individual, corporation, partnership, or other entity.

- Enter the total transition tax liability as determined under Section 965.

- Indicate the amount of previously paid transition tax liability, if any.

- Calculate the remaining balance by subtracting the previously paid amount from the total transition tax liability.

- Enter the amount you are requesting to pay immediately and the remaining amount you wish to defer.

- If you choose to defer payment, you may be required to provide an installment agreement or another form of security. Check the appropriate box and provide the necessary information.

Step 4: Part II - Statement of Understanding

Carefully read the statement of understanding provided and make sure you comprehend the terms and conditions. If you agree with the terms, sign and date the form.

Step 5: Retain a copy

Before submitting the form, make a copy for your records.

Step 6: Submission

Send the completed Form 965-C to the IRS address specified in the instructions. It's recommended to use certified mail or a reputable delivery service to ensure proper delivery.

Again, please note that this is a general guide, and the specific instructions for completing Form 965-C may vary. It's crucial to consult the official instructions provided by the IRS or seek guidance from a tax professional to ensure accuracy and compliance with the latest regulations.

Filing Deadlines & Extensions for Form 965-C

The filing deadline for Form 965-C depends on the taxpayer's specific tax return filing deadline. Here are the general deadlines and extensions for filing Form 965-C:

Original filing deadline: For most taxpayers, the original filing deadline for Form 965-C is the same as the deadline for their tax return. The regular filing deadline for calendar year taxpayers is typically April 15. However, the filing deadline may vary for fiscal year taxpayers or taxpayers who have received an extension.

Extension for individuals: Individual taxpayers can request an extension by filing Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." This form extends the filing deadline by six months, moving it from April 15 to October 15.

Extension for partnerships and S corporations: Partnerships and S corporations use Form 7004, "Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns," to request an extension. This form extends the filing deadline by six months, moving it from the original deadline to September 15.

It's important to note that while these extensions grant additional time to file the tax return, they do not extend the payment deadline. Tax liabilities are still generally due by the original deadline (April 15 for individuals, March 15 for partnerships and S corporations), even if an extension is filed.

Common Mistakes To Avoid While Filing Form 965-C

When filing Form 965-C, it's important to avoid certain common mistakes to ensure accurate and compliant reporting. Here are some mistakes to avoid:

-

Incorrect calculations: Ensure that all calculations on Form 965-C are accurate. Double-check your numbers, including the amounts of accumulated foreign earnings, tax liability, and any adjustments or deductions.

-

Missing or incorrect information: Provide all the required information on the form, such as the taxpayer's identification number, the specified foreign corporations' details, and the correct tax year. Make sure to enter accurate and up-to-date information to avoid delays or errors.

-

Failure to attach necessary schedules: Form 965-C may require additional schedules to be attached, depending on the complexity of your situation. Examples include Schedule E, Schedule P, and Schedule S. Review the instructions carefully and attach the required schedules when applicable.

-

Not complying with reporting requirements: It's crucial to comply with the reporting requirements outlined in the instructions for Form 965-C. Failure to provide all necessary information or follow the instructions can result in penalties or delays in processing your return.

-

Missed deadlines: Ensure that you file Form 965-C by the appropriate deadline. Missing the deadline can result in penalties and interest charges. Stay informed about the due date and make sure to file your form on time.

-

Incomplete or inconsistent documentation: Maintain proper documentation to support the information reported on Form 965-C. This includes records of accumulated foreign earnings, calculations, and any adjustments or deductions. Incomplete or inconsistent documentation can lead to questions or challenges from tax authorities.

-

Not seeking professional advice if needed: Form 965-C involves complex tax calculations and reporting requirements. If you are unsure about any aspect of the form or have a complex situation, it's advisable to seek professional advice from a tax accountant or tax attorney who specializes in international tax matters.

Conclusion

Navigating the tax implications of Section 965 and complying with its provisions can be a daunting task for businesses. Form 965-C plays a crucial role in reporting the transfer of specified foreign corporation stock or property and the allocation of liability between the transferor and transferee. As tax regulations continue to evolve, businesses are advised to consult with qualified tax professionals or advisors to ensure compliance with the ever-changing tax landscape and avoid potential penalties or misunderstandings related to Form 965-C.