- IRS forms

- Form 944

Form 944 Guide: Federal Tax Return for Small Businesses

Download Form 944Introduction

As a small business owner, one of your many responsibilities is to ensure that your business is complying with all applicable tax laws. This includes filing various tax forms with the IRS, such as Form 944, and the Employer's Annual Federal Tax Return. In this blog, we will cover what Form 944 is, who needs to file it, how to file it, when to file it, common mistakes to avoid when filing, what to do if you encounter an issue and a conclusion.

What is Form 944?

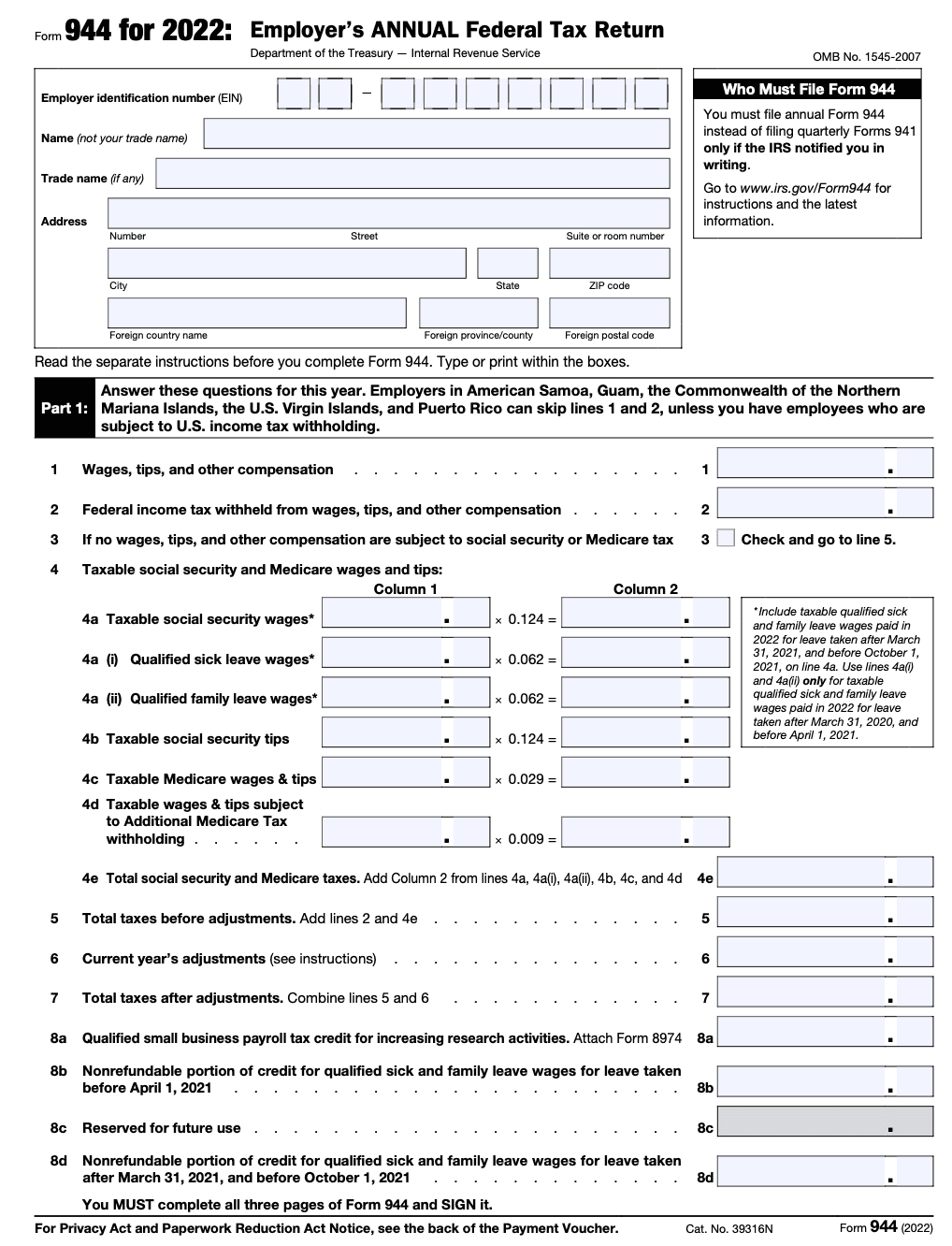

Form 944 is a tax form designed specifically for small businesses. It is used by employers to report their Social Security and Medicare tax liability for the year. The form is filed annually and is due by the last day of the month following the end of the calendar year.

When filing Form 944, employers must report their gross wages and tips, wages subject to withholding, total Social Security and Medicare taxes, and any other taxes due for the year. Additionally, employers must also include any applicable adjustments for prior periods.

Who needs to file Form 944?

- Form 944 must be filed by any employer who is required to pay Social Security, Medicare, or Railroad Retirement taxes and whose estimated tax liability for the year is less than $1,000.

- This includes employers with one or more employees, self-employed individuals, and agricultural employers.

- Employers who are required to file Form 944 must do so even if they do not owe any taxes for the year.

- Small businesses, such as sole proprietorships, partnerships, and S corporations, may be eligible to file Form 944.

- Businesses that are unsure if they need to file Form 944 should consult with a tax professional or visit the IRS website for more information.

- Failure to file Form 944 or filing it late can result in penalties and interest.

Steps on how to file Form 944

Here are the steps on how to file Form 944:

**Step 1: **Gather your information

Part 1: Business Information

In this part, you will need to enter your business name, address, and (link: https://fincent.com/irs-tax-forms/form-ss-4#:~:text=An%20EIN%20is%20a%20unique,Tax%20Identification%20Number%20(TIN). text: Employer Identification Number (EIN)). You will also need to indicate the type of business entity you have (such as a sole proprietorship or corporation) and provide contact information for the person responsible for the payroll taxes.

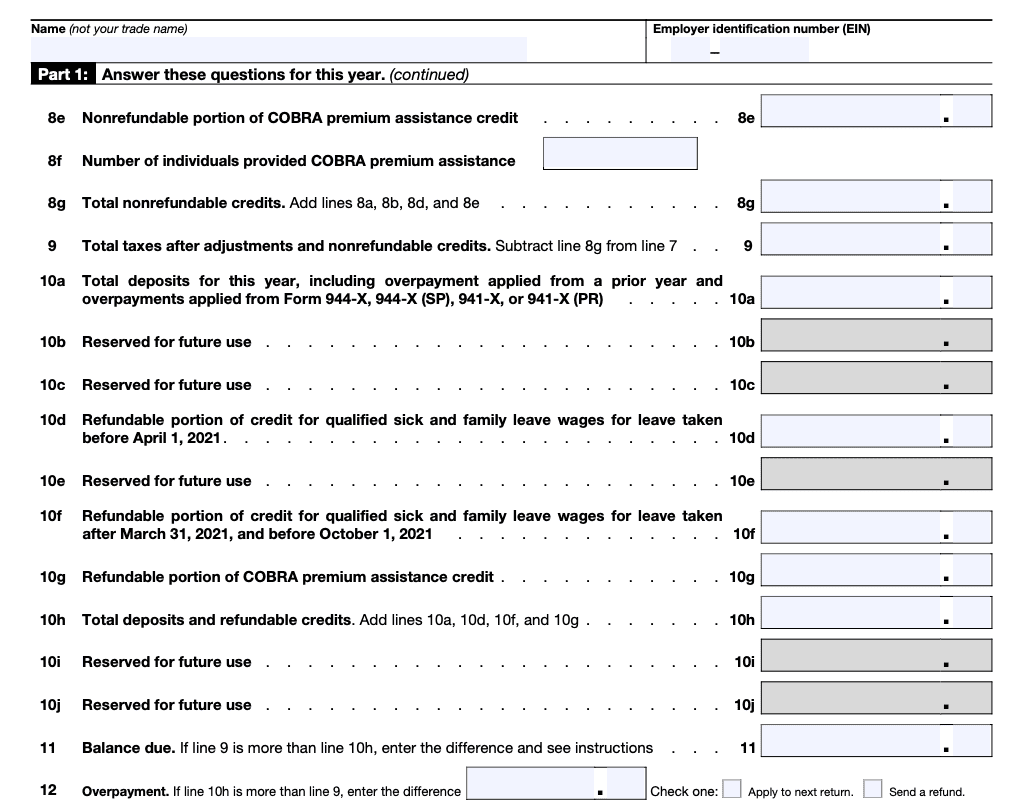

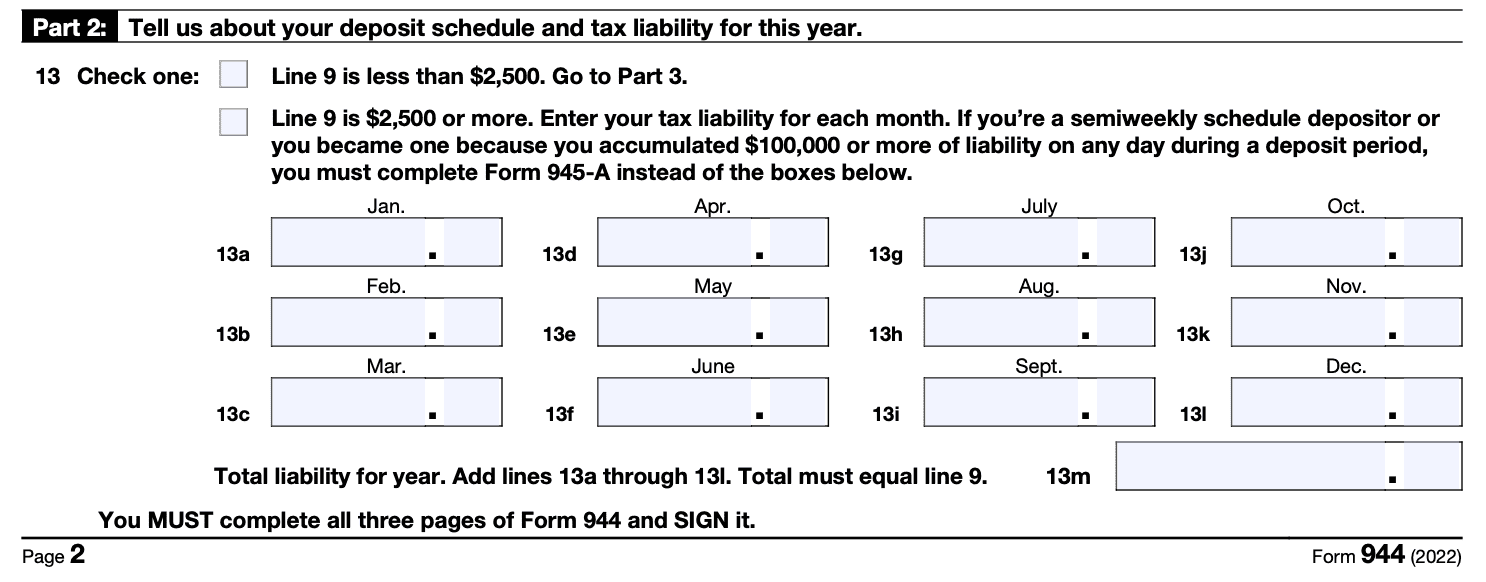

Part 2: Taxes and Deposits

This part requires you to report the total wages you paid to employees during the year, as well as the taxes you withheld from their paychecks for federal income tax, Social Security, and Medicare. You will also need to report any advanced earned income credit (AEIC) payments you made to employees during the year.

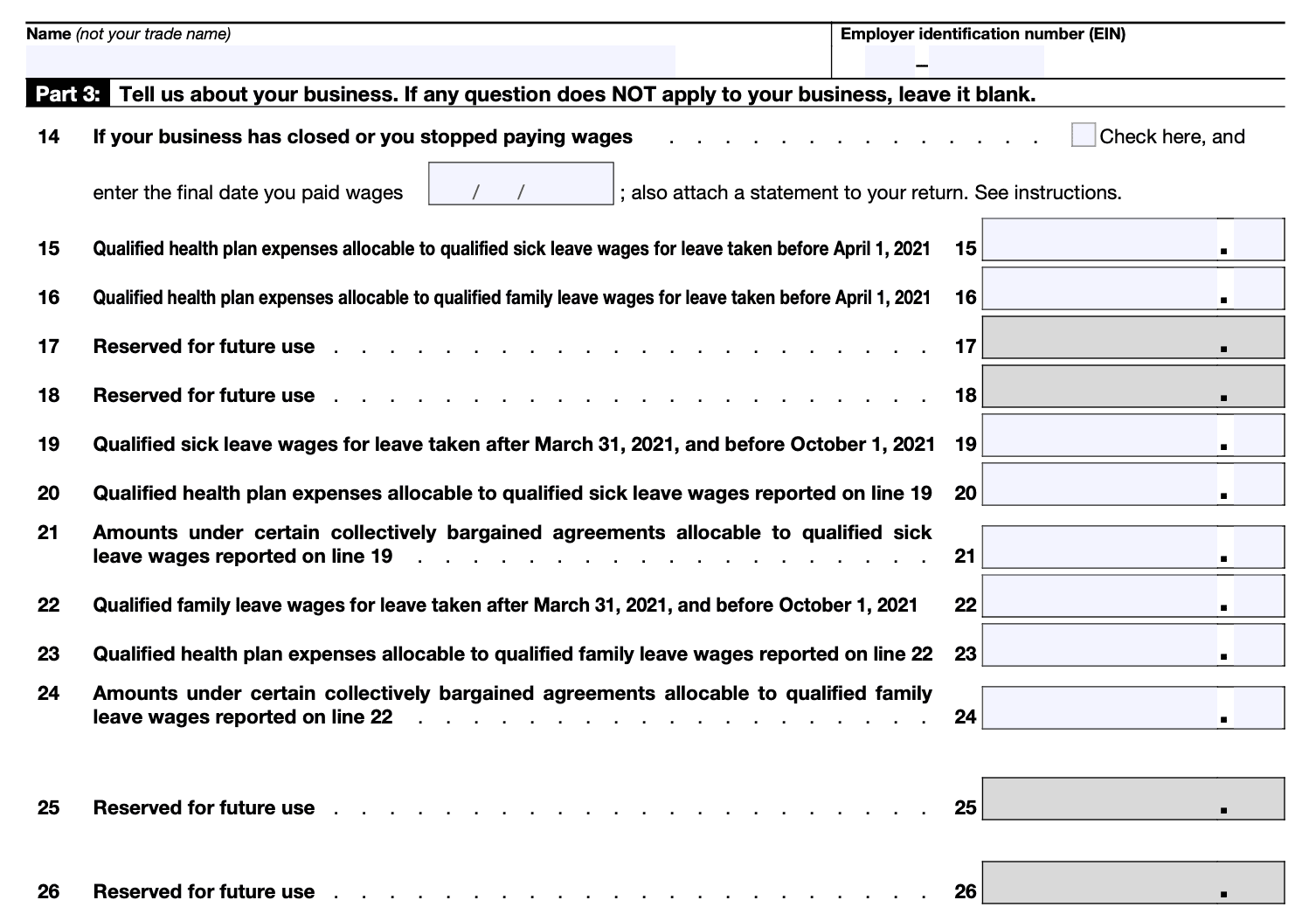

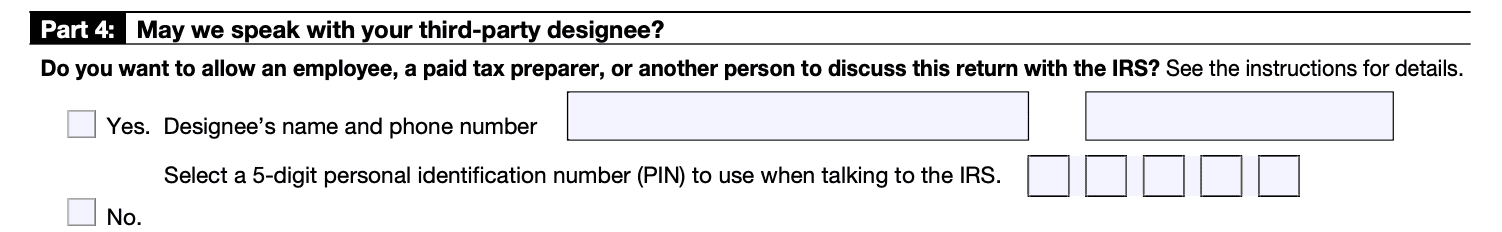

Part 3: Adjustments to Taxes and Deposits

If there were any adjustments made to your taxes and deposits during the year, you will need to report them in this part. This could include corrections to previous tax returns or adjustments made by the IRS.

Part 4: Prior Year’s Tax and Payments

If you had a tax liability from the previous year, you will need to report it in this part. You will also need to report any payments you made toward that liability during the year.

Part 5: Refund or Balance Due

In this part, you will calculate whether you owe additional taxes or if you are due a refund. If you owe additional taxes, you will need to make a payment along with the form. If you are due a refund, you can apply it to the following year's tax liability or request a refund check.

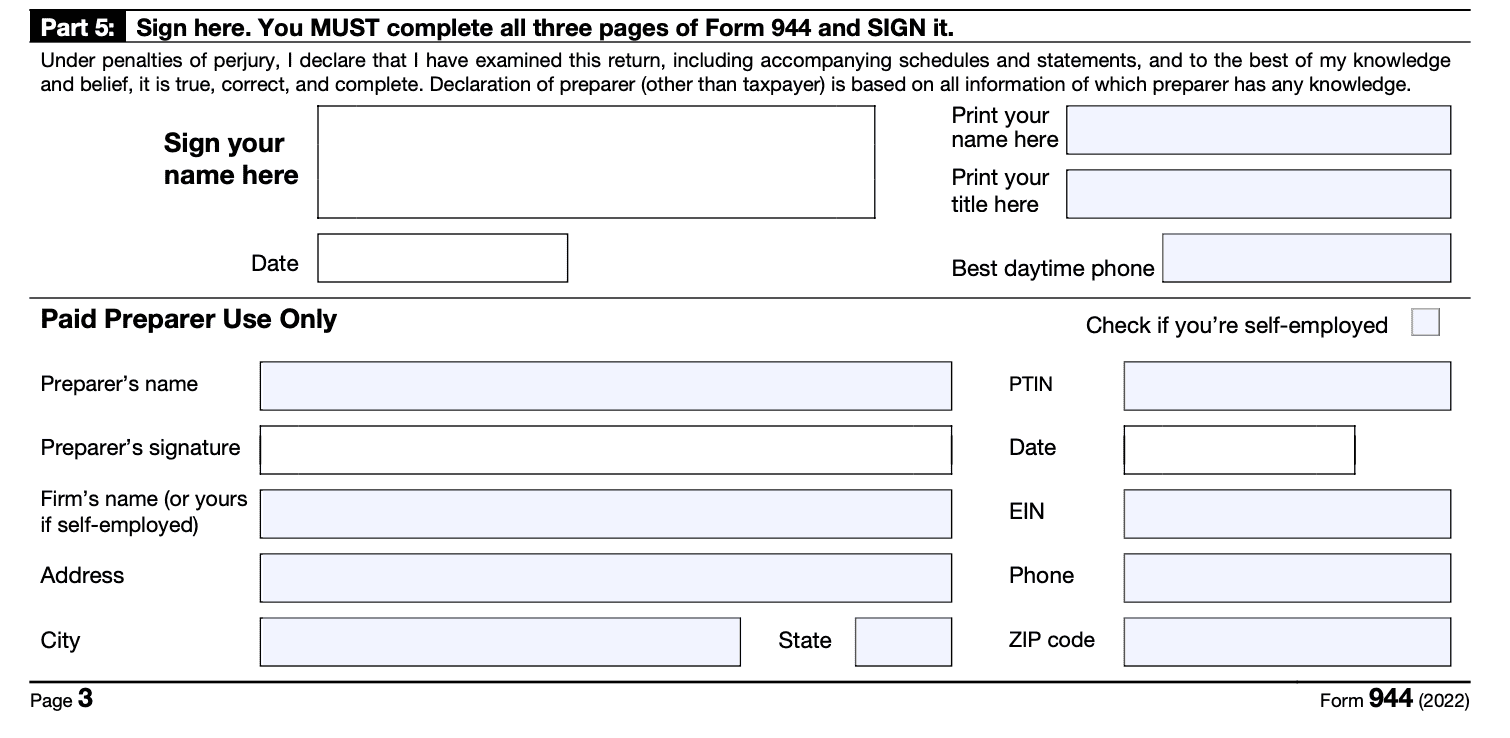

Overall, when filling out Form 944, it's important to double-check all information entered and calculations made to avoid any errors.

Step 2: Fill out the form

Once you have all the necessary information, you can begin filling out Form 944.

**Step 3: **Submit the form and any required payments

Once you have completed Form 944, you will need to submit it to the IRS along with any required payments. You can file the form electronically or by mail. If you choose to file electronically, you can use the IRS e-file system or a third-party provider. If you file by mail, be sure to include any payments due with the form.

Where do I send Form 944?

The IRS recommends filing Form 944 electronically and you can find more information on electronic filing at IRS.gov/EmploymentEfile. However, if you choose to file a paper return, the address to which you should mail it depends on whether you're including a payment with the form. You can refer to the table below to find the appropriate mailing address for your location.

When to file Form 944

Form 944 is an annual tax form, and the filing deadline is January 31st of the following year. For example, the deadline for filing Form 944 for the 2022 tax year is January 31, 2023.

How to make your FICA and income withholding tax payments on For 944

- (link: https://fincent.com/glossary/federal-insurance-contributions-act text: Calculate the amount of FICA) and income (link: https://fincent.com/how-to/adjust-your-tax-withholding-for-maximum-benefit text: tax withholding tax) you owe based on the information you provided on Form 944.

- Choose a payment method. You can make your payment by check or electronically using the Electronic Federal Tax Payment System (EFTPS).

- If you choose to pay by check, make your check payable to "United States Treasury" and write your business name, EIN, and "Form 944" on the memo line. Be sure to include a payment voucher with your check, which is included in the Form 944 instructions.

- If you choose to pay electronically using EFTPS, you will need to enroll in the system first. Once enrolled, you can make payments online or by phone. You will need to provide your business name, EIN, and the amount you wish to pay.

- Be sure to make your payment on time to avoid penalties and interest charges. The due date for Form 944 and payment of FICA and income tax withholding taxes is January 31st of each year.

- Keep a record of your payment. If you pay by check, keep a copy of the check and payment voucher. If you pay electronically, print or save a copy of the payment confirmation.

- Submit Form 944 and payment together. Mail your completed Form 944 and payment to the address indicated on the form.

What are some common mistakes to avoid when filing

Here are some common mistakes to avoid when filing Form 944:

- Failing to file on time or pay the correct amount of taxes.

- Failing to include all necessary information on the form.

- Using incorrect figures or calculations.

- Failing to keep accurate records of wages and taxes withheld.

What if I made a mistake on Form 944?

- Determine the type of mistake: Identify what type of mistake you made on your Form 944. This could be a mathematical error, incorrect information, or a missing entry.

- File an amended Form 944: If you discover an error on your Form 944 after you have filed it, you can file an amended return using Form 944-X, also known as the "Adjusted Employer's Annual Federal Tax Return". Fill out the amended form with the correct information, indicating which lines you are correcting, and provide an explanation of the error. Attach any necessary documentation to support your correction.

- Submit the amended Form 944: Once you have completed Form 944-X, mail it to the IRS at the address listed in the instructions for the form. Be sure to include any payment due as a result of the correction.

- Keep accurate records: Keep a copy of the amended Form 944-X, as well as any supporting documentation, for your records.

It's important to note that if your correction results in additional taxes due, you should pay the additional amount as soon as possible to avoid penalties and interest charges. If you are unsure how to proceed, consult with a tax professional or contact the IRS for guidance.

What are some common concerns when filing form 944?

- **Incorrect or incomplete information: **Providing inaccurate or incomplete information can lead to delays in processing or even penalties. It's important to ensure that all information entered is accurate and complete.

- Incorrect calculations: Incorrect calculations of taxes or deposits can lead to underpayment or overpayment of taxes. Double-checking all calculations can help prevent this issue.

- Late filing or payment: Failing to file or pay taxes on time can result in penalties and interest charges. It's important to know the due dates for filing and payment and to ensure that all deadlines are met.

- Misclassification of employees: Misclassifying employees as independent contractors can lead to tax liability issues. It's important to properly classify workers and to understand the criteria for determining employee status.

- **Failure to report tips: **Employers are required to report tips received by their employees. Failure to report tips can result in penalties and interest charges.

It's important to take the time to review all information entered on Form 944 and to seek assistance if needed to ensure that it is completed accurately and on time. Consulting with a tax professional or accountant can be helpful in avoiding common issues or concerns.

Conclusion

Form 944 is an important tax form that small employers must file to report and pay their annual federal income, Social Security, and (link: https://fincent.com/glossary/self-employment-tax#:~:text=As%20previously%20mentioned%2C%20self%2Demployment,for%20the%202022%20tax%20year. text: Medicare taxes). By following the steps outlined in this blog and avoiding common mistakes, you can ensure that you file your taxes correctly and avoid any penalties or fines. If you have any questions or need assistance, don't hesitate to contact the IRS or a tax professional.