- IRS forms

- Form 942

Filing Form 942: Guide for Household Employers

Download Form 942Introduction

As a business owner or employer, it's important to stay on top of your tax responsibilities. One such responsibility is filing Form 942, also known as the Employer's Quarterly Tax Return for Household Employees. In this blog,

We will discuss everything you need to know about Form 942, including who needs to file it, how to file it, and common mistakes to avoid.

Note: Form 942, Employer's Quarterly Tax Return for Household Employees (no longer used, replaced by Schedule H of Form 1040 beginning with tax year 1995)

Purpose of Form 942?

Form 942 is a tax form used by employers who hire household employees, such as nannies, housekeepers, or caregivers. It's used to report and pay federal income tax, Social Security, and Medicare taxes for household employees. It is used to report any withheld income tax on wages paid to household employees.

Who needs to file it?

File if you paid an employee cash wages of $50 or more in a calendar quarter for household work in or around your private home. File if you paid less than $50 in a quarter, but withheld income tax at the employee’s request.

Exceptions

- Do not file Form 942 if the household employee worked in your home on a farm operated for profit.

- Do not file Form 942 if the household employee worked for a college club, fraternity, or sorority.

What is household work?

Work performed in or around the employer’s private home. Includes services by babysitters, butlers, caretakers, cleaning people, cooks, gardeners, governesses, housekeepers, janitors, laundresses, maids, personal chauffeurs, and valets.

Social security and Medicare taxes

- Both employer and employee must pay social security and Medicare taxes on cash wages.

- The combined social security tax rate is 12.4% (6.2% employer tax + 6.2% employee tax).

- The combined Medicare tax rate is 2.9% (1.45% employer tax + 1.45% employee tax).

- There is no limit on the amount of cash wages subject to Medicare tax.

What is a $50 Test?

Social security and Medicare taxes are due if you pay an employee cash wages of $50 or more in a calendar quarter for household work. Taxes apply to all cash wages paid in the quarter regardless of when earned. The $50 test applies separately to each household employee.

When to file Form 942?

Form 942 must be filed from the first quarter in which you pay social security and Medicare taxes or withhold income tax, and quarterly returns have specific due dates. The due date for each quarter is the last day of the following month. If the deadline falls on a weekend or holiday, file on the next business day.

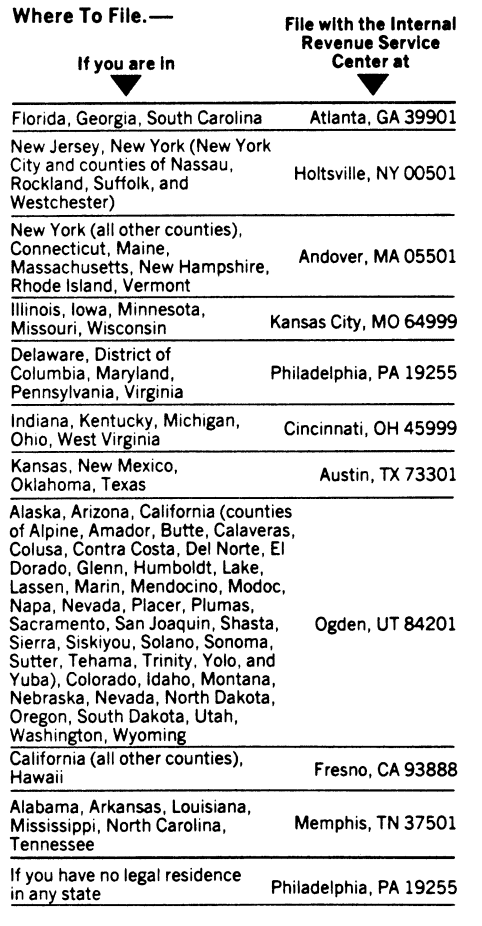

Where to fill Form 942?

Mail your returns to the IRS at the address listed below for your legal residence.

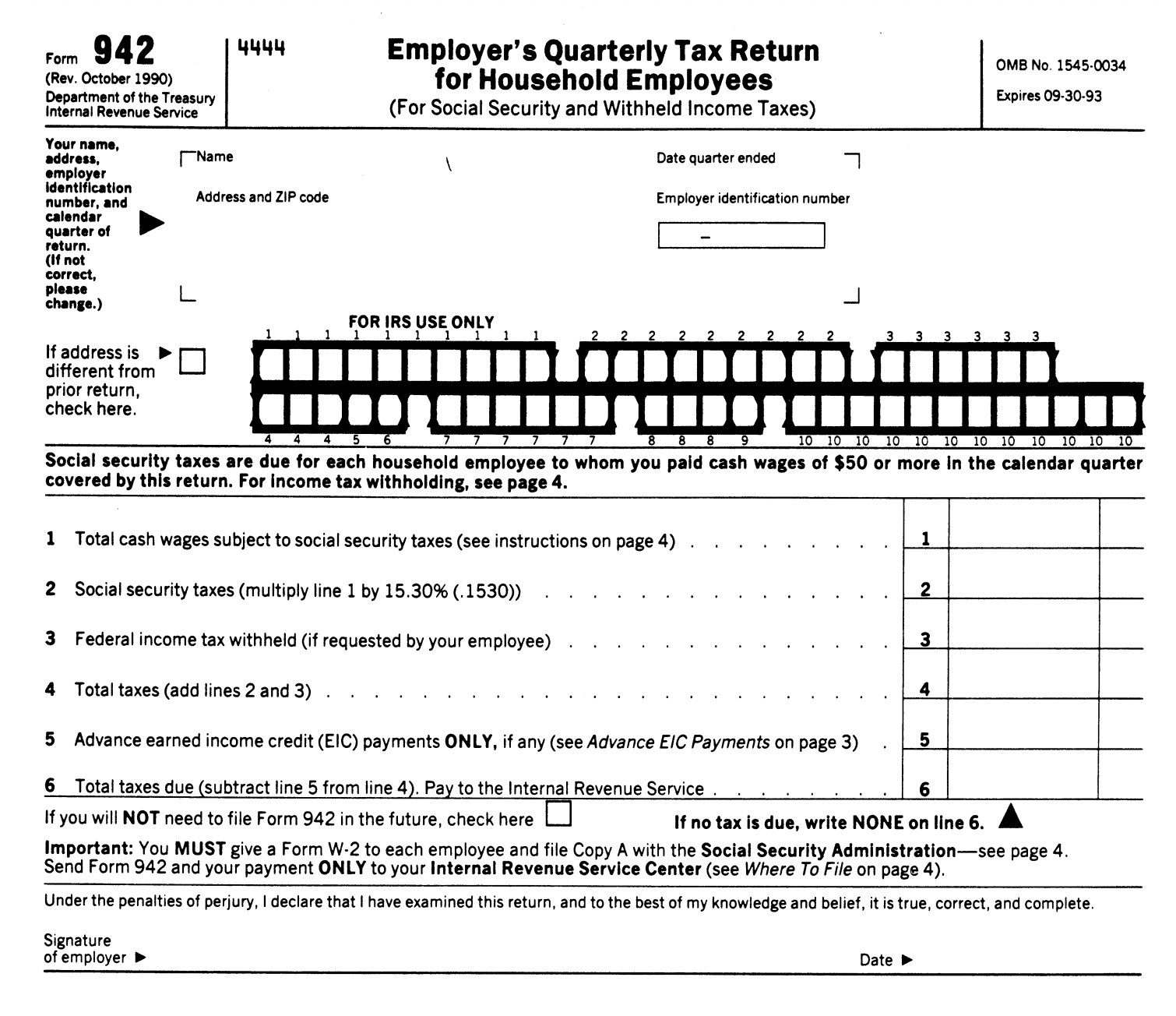

Special Instructions

- Name, address, (link: https://fincent.com/glossary/employer-identification-number text: employer identification number (EIN)), and calendar quarter.

- Cross out any errors on preprinted information, print correct information, and add missing information.

- Check the box below the name and address section if you changed your address.

- Enter the date of the last day of the month of the calendar quarter being filed.

- An EIN is a nine-digit number issued by the IRS.

- Use the EIN if you already have one, or write NONE if you don't have one yet.

- If you applied for an EIN but have not received it, write “Applied for” in the space for the EIN.

- DO NOT enter your social security number as an EIN.

- You don't need to file Form SS-4 if your only employees are household employees in your private home.

- Check the box above line 1 if you don't expect to pay taxable wages in the future.

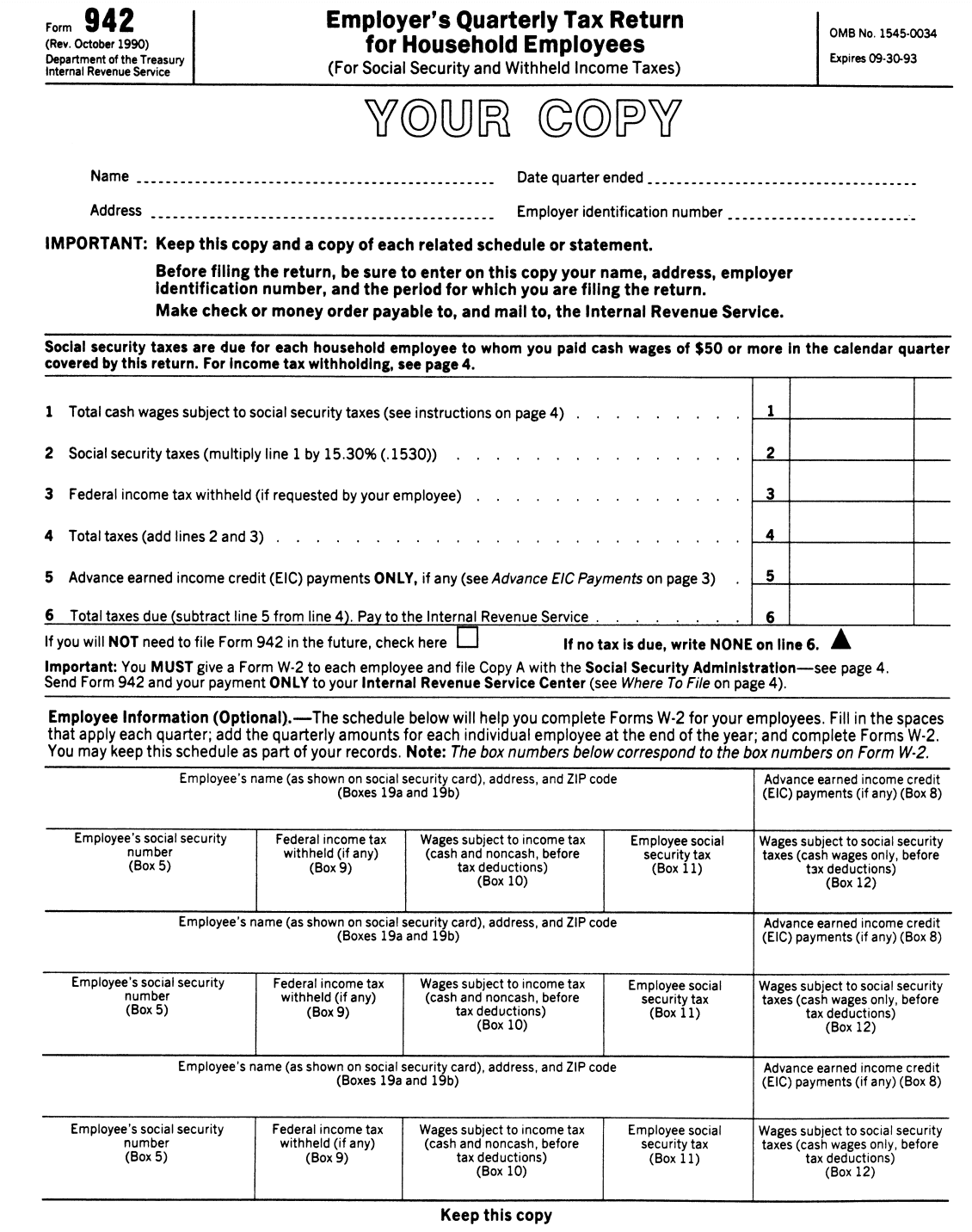

- Give a Form W-2 to each employee you paid wages to during the year and file copies with the SSA.

- Line 1: show the total cash wages you paid in the quarter to all employees who met the $50 test.

- Do not include wages for employees not subject to social security taxes or an employee who has been paid $60,600 in 1994.

- Line 2: multiply the wages on line 1 by 12.4% (.124) and enter the result.

- Line 3: show the total cash wages you paid in the quarter to all employees who met the $50 test.

- Do not include wages for employees not subject to Medicare taxes.

- Line 4: multiply the amount on line 3 by 2.9% (.029) and enter the result.

- Line 5: show the total Federal income tax withheld, if any, in the quarter.

- Line 6: add lines 2, 4, and 5 and enter the total.

- Line 7: show the total advance EIC payments, if any, made to employees in the quarter.

- Line 8: subtract line 7 from line 6 and enter the result on line 8.

- If no tax is due, enter “NONE” on line 8, sign and date the return, and mail it to the IRS by the last day of the month following the end of the quarter.

- If you owe tax, make your check or money order for the amount on line 8 payable to “Internal Revenue Service.”

- Write your EIN, the period to which the payment applies, and “Form 942” on the check or money order.

- Sign and date Form 942 and mail it with your payment to the address indicated in Where To File on page 2.

- DO NOT use Federal Tax Deposit (FTD) Coupons to pay taxes.

Common Mistakes to Avoid When Filing

One common mistake when filing Form 942 is not calculating the taxes correctly. It's important to use the correct tax rates and follow the IRS instructions carefully. Another mistake is missing the filing deadline or not submitting the correct payment amount. Make sure to double-check your calculations and submit your payment on time to avoid penalties and interest charges.

What to Do if You Encounter an Issue

If you encounter any issues when filing Form 942, such as incorrect calculations or missing information, you can contact the IRS for assistance. They have a dedicated phone line for household employers at 1-800-829-4933. You can also consult with a tax professional for guidance.

Conclusion

Form 942 is a tax form used by employers who pay wages to household employees such as nannies or domestic workers. It helps employers calculate and report their Social Security and Medicare taxes. Even though the form was introduced in 1994, it is still relevant and must be used by those who employ household workers and meet certain criteria. Using Form 942 ensures compliance with tax laws and helps avoid penalties. It is a simple and straightforward form that can help household employers fulfill their tax obligations and keep their finances in order. By following the steps outlined above and avoiding common mistakes, you can ensure that you stay compliant with IRS regulations. Remember to file and pay on time to avoid penalties and interest charges.