- IRS forms

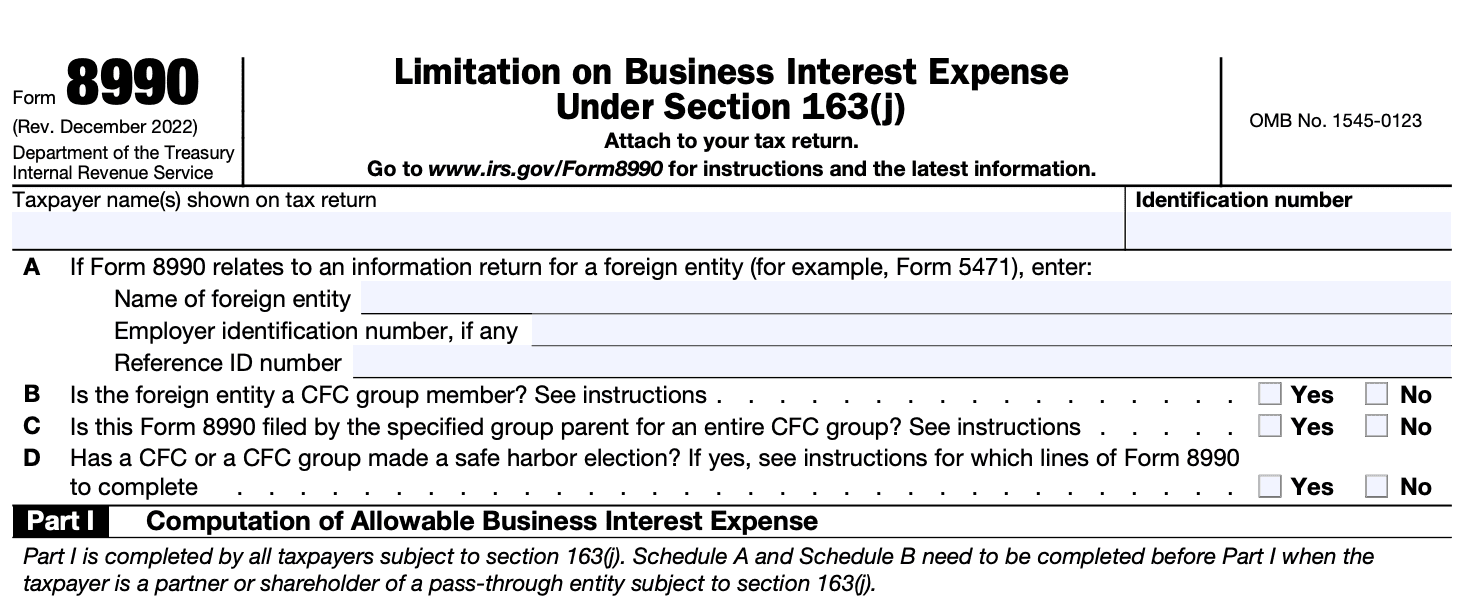

- Form 8990

IRS Tax Form 8990: Limitation on Business Interest Expense Under Section 163(j)

Download Form 8990In the ever-evolving landscape of tax regulations, businesses must stay informed about the latest changes to ensure compliance and optimize their financial strategies. One such significant development is the introduction of Form 8990, which aims to prevent excessive interest deductions and their potential abuse by businesses.

Section 163(j) was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017 and has since undergone several amendments. The primary goal of this section is to limit the deduction of business interest expenses to prevent corporations from using excessive interest payments to reduce their taxable income unfairly. The limitation applies to businesses with gross receipts exceeding certain thresholds, making it more relevant for large corporations.

In this blog, we'll explore the key aspects of Form 8990 and how it impacts businesses' ability to deduct interest expenses.

What is the Purpose of Form 8990?

The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to the treatment of business interest expense deductions. Prior to the TCJA, businesses could generally deduct all business interest expenses without any limitations. However, under the TCJA, businesses are subject to a limitation on the amount of business interest they can deduct, which is based on their adjusted taxable income.

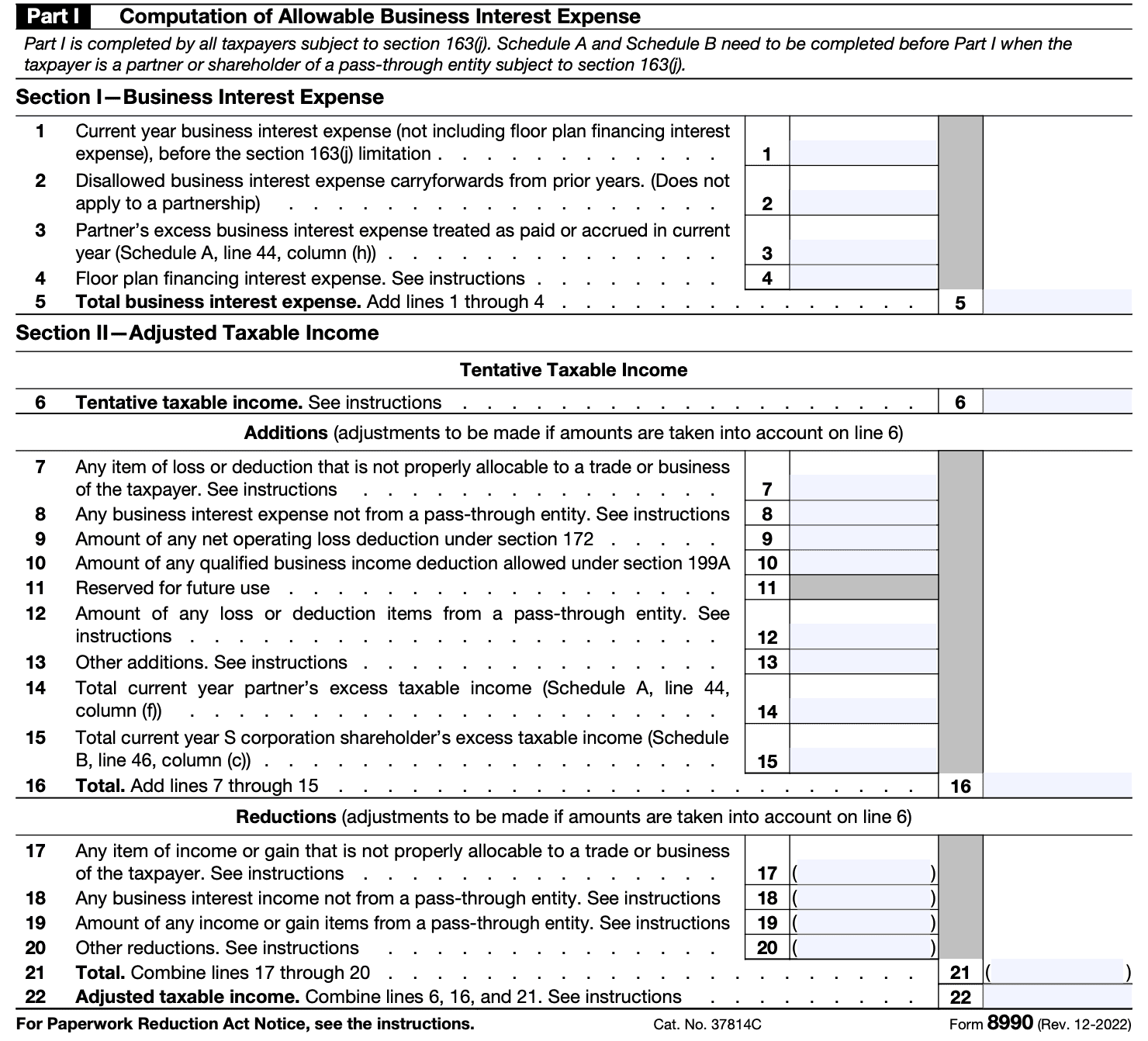

Form 8990 helps businesses calculate their adjusted taxable income, which is an important factor in determining the allowable deduction for business interest expenses. If a corporation's business interest expense exceeds the allowable deduction, the excess amount can be carried forward to future tax years, subject to certain rules.

Benefits of Form 8990

Form 8990 is designed to help businesses determine the amount of business interest expense they can deduct on their tax returns, subject to certain limitations.

The benefits of Form 8990 include:

-

Determining allowable interest deduction: Form 8990 helps businesses determine the maximum amount of interest expense they can deduct on their tax returns, considering the limitations set by the TCJA. This is essential for accurate tax reporting and compliance.

-

Tax planning and optimization: By understanding the limitations on the deduction of business interest expenses, corporations can plan their financial strategies more effectively to optimize their tax position and minimize tax liabilities.

-

Avoiding potential penalties: Filing Form 8990 correctly ensures that businesses comply with the tax laws regarding the deduction of business interest expenses. By accurately reporting this information, businesses can avoid potential penalties and scrutiny from tax authorities.

-

Improved transparency and documentation: Completing tax Form 8990 requires businesses to organize and document their interest expense information thoroughly. This can lead to better transparency in financial reporting and help businesses have a clear overview of their financial health.

-

Consistency and compliance: By using Form 8990, businesses can ensure consistency in reporting their interest expense deductions, thus reducing the risk of errors and discrepancies in their tax filings.

Who Is Eligible To File Form 8990?

Corporations, partnerships, and individuals with business interest expenses may be required to file Form 8990 if they meet certain criteria.

Generally, the following taxpayers are eligible to file Form 8990:

C Corporations: Regular corporations subject to income tax at the corporate level.

**S Corporations: **Certain small business corporations that have elected to pass corporate income, losses, deductions, and credits through to their shareholders.

Partnerships: Entities taxed as partnerships, including limited liability partnerships (LLPs) and limited liability companies (LLCs) with multiple members.

Individuals: Sole proprietors and individuals who have business interest expenses.

It's important to note that the rules and regulations regarding the eligibility to file Form 8990 and the specifics of reporting business interest expenses can be complex and may vary based on changes in tax laws and regulations.

How To Complete Form 8990: A Step-by-Step Guide and Instructions

Unlock the complexities of filing IRS tax form 8990 with our detailed instructions, making the process straightforward and manageable.

Step 1: Obtain the form

Go to the IRS website (www.irs.gov) and search for "Form 8990." Download the form and its instructions, which are usually available as PDF documents.

Step 2: Review the instructions

Thoroughly read through the instructions provided with Form 8990. This will help you understand the form's purpose, eligibility criteria, and how to properly fill it out.

Step 3: Gather required information

Gather all the necessary information and documents you'll need to complete the form, including partnership financial records, Section 108(b) basis difference adjustments, and other relevant tax information.

Step 4: Identify the partnership

Fill in the basic information at the top of the form, such as the partnership's name, address,(link: https://fincent.com/glossary/employer-identification-number text: Employer Identification Number (EIN)), and the tax year being reported.

Step 5: Complete Part I - Section 108(b) basis difference

In Part I of Form 8990, report any adjustments required for the Section 108(b) basis difference. Follow the instructions provided to calculate the correct amounts for each line item.

Step 6: Complete Part II - Tentative Schedule B basis adjustments

In Part II, use the information from Part I to calculate the tentative Schedule B basis adjustments. Again, follow the instructions carefully.

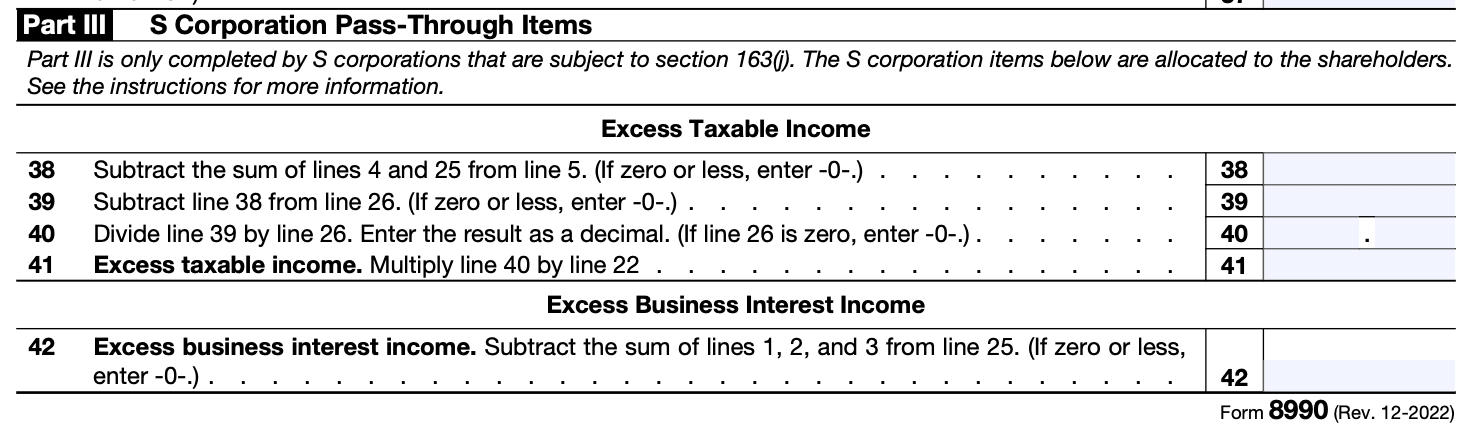

Step 7: Complete Part III - Final Schedule B basis adjustments

In Part III, determine the final Schedule B basis adjustments. You may need to make further calculations based on any reductions or limitations that apply.

Step 8: Complete Part IV - Partner's distributive share items

In Part IV, you'll allocate the adjusted items from Part III to the partners in the partnership. This section may require you to provide information about each partner's share and tax identification number.

Step 9: Review and sign the form

Before submitting the form, carefully review all the information you've entered to ensure accuracy. Once you are satisfied that the form is complete and accurate, sign and date it.

Step 10: Attach the form to the partnership's tax return

Once completed, attach Form 8990 to the partnership's tax return when filing with the IRS.

Special Considerations When Filing Form 8990

If you are looking to file Form 8990, here are some general considerations that may still be relevant:

Familiarize yourself with the purpose of Form 8990: This form is used to calculate the limitation on business interest expenses that a corporation can deduct on its tax return, as required by Section 163(j) of the Internal Revenue Code.

Determine eligibility: Not all businesses are subject to the limitation on business interest expense. If your corporation meets certain criteria (e.g., gross receipts under a certain threshold or not engaged in certain activities), it might be exempt from the limitation. Make sure your corporation qualifies for filing Form 8990.

Gather necessary information: You'll need to have all the relevant financial information, including interest expense, adjusted taxable income, business interest income, and other applicable items to accurately complete the form.

**Be aware of the limitations and adjustments: **The calculation of the limitation on business interest expense can be complex, involving several adjustments and calculations. Double-check the instructions provided by the IRS to ensure you are correctly calculating the limitation.

Reporting accuracy: Ensure that all the data entered on the form is accurate and that you have properly filled out all sections and schedules as required.

**Filing deadlines: **Be aware of the filing deadlines for Form 8990. Typically, it should be filed with the corporation's annual income tax return.

**Seek professional advice if necessary: **Due to the complexity of tax laws and forms, it's always a good idea to consult with a tax professional or accountant to ensure you are meeting all the requirements and taking advantage of any applicable deductions or exemptions.

How To File Form 8990: Offline/Online/E-filing

Offline (paper filing)

To file Form 8990 offline through traditional paper filing, you need to obtain a physical copy of the form and instructions.

- Here are the general steps:

- Go to the IRS website (www.irs.gov) and search for Form 8990 to download the PDF version.

- Print out the form and instructions.

- Fill out the form manually, following the provided instructions.

- Double-check the accuracy of the information entered.

- Mail the completed Form 8990 to the appropriate IRS address as indicated in the form's instructions.

Online filing (IRS website)

The IRS provides an option to file certain tax forms online through their official website. To file Form 8990 online, you can follow these steps:

- Visit the IRS website (www.irs.gov).

- Look for the section related to online filing or e-filing options.

- Follow the instructions provided on the website to access the appropriate tax filing platform.

- Enter the required information as prompted by the system and complete Form 8990 online.

- After completing the form, follow the website's instructions to submit it electronically to the IRS.

E-filing through authorized software

You can also use authorized tax preparation software to e-file Form 8990. Many commercial tax software packages support this form and streamline the e-filing process. Here are the general steps:

- Choose a reliable tax preparation software that supports Form 8990.

- Install and open the software on your computer or device.

- Follow the software's prompts to enter the necessary information for Form 8990.

- Verify the accuracy of the entered data.

- Use the software's e-filing feature to submit Form 8990 electronically to the IRS.

Common Mistakes To Avoid When Filing Form 8990

It's essential to be careful and accurate when filing Form 8990 to avoid potential errors and the risk of penalties. Here are some common mistakes to avoid:

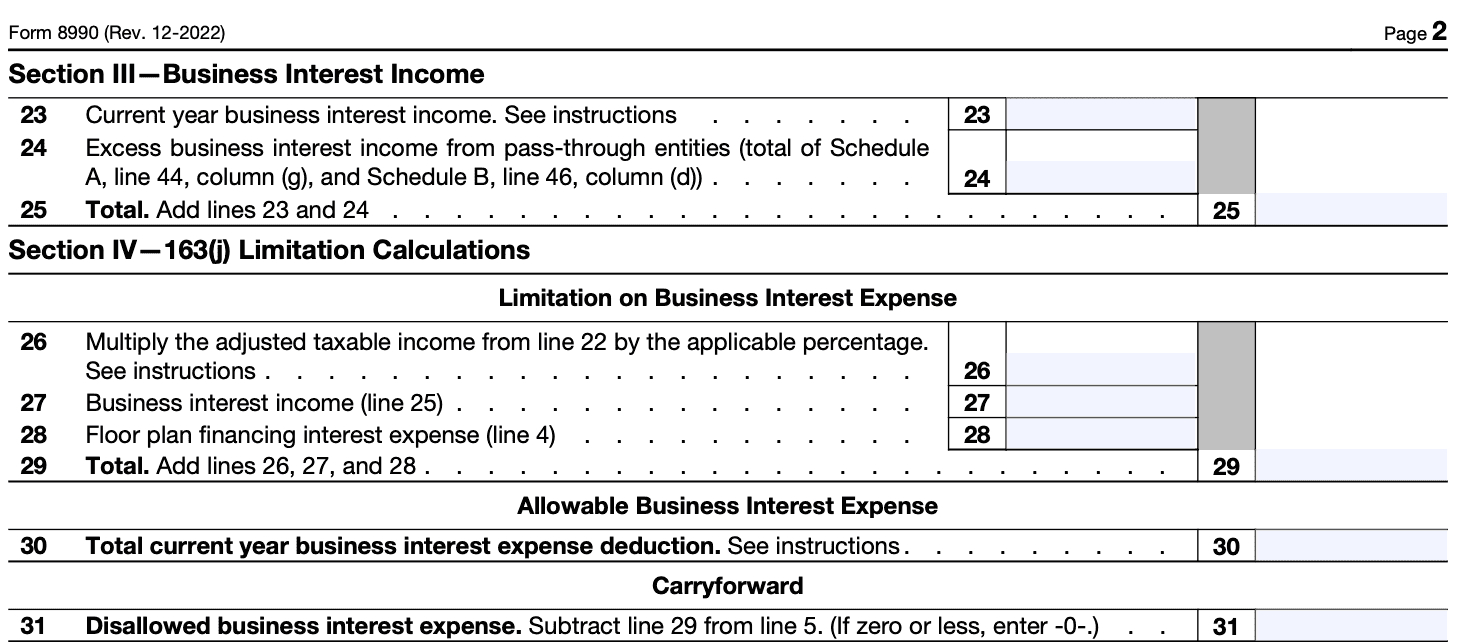

Incorrect calculations: Ensure that all calculations, including interest expense, adjusted taxable income, and the business interest expense deduction limitation, are accurate. Small errors in arithmetic can lead to significant discrepancies.

**Incorrect reporting of income and expenses: **Double-check all income and expense figures used in the form to ensure they match the corresponding values reported on other tax forms, such as (link: https://fincent.com/irs-tax-forms/form-1120 text: Form 1120), (link: https://fincent.com/irs-tax-forms/form-1120-s text: form 1120-S), or (link: https://fincent.com/irs-tax-forms/form-1065 text: form 1065).

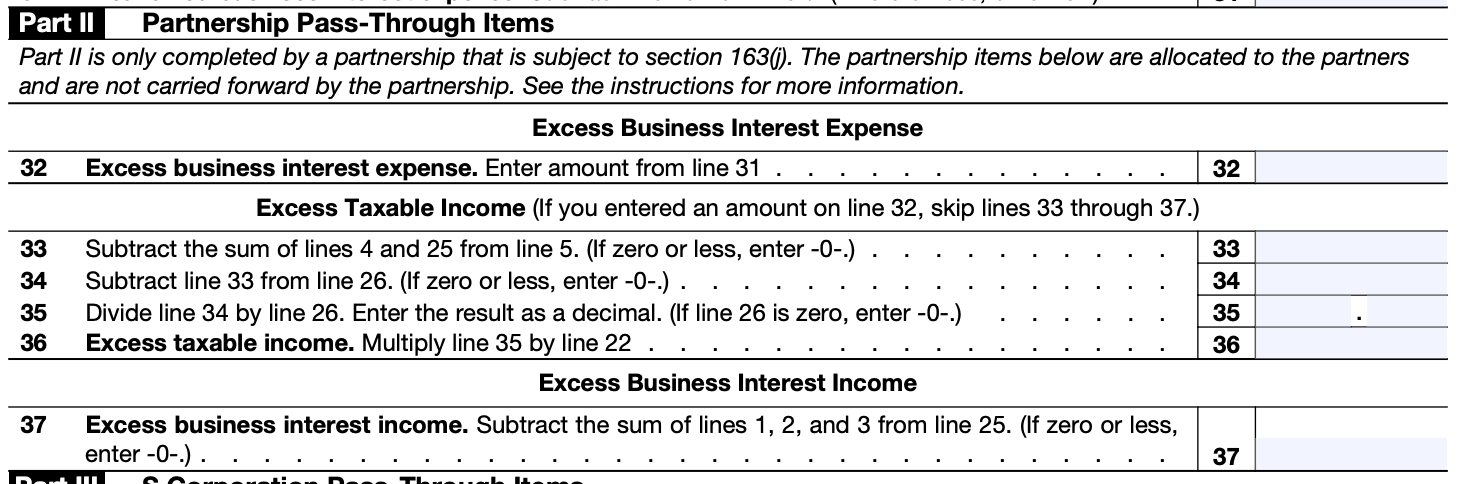

Failing to attach required schedules: Depending on the complexity of the entity's financial situation, additional schedules may need to be attached to Form 8990. Make sure all required schedules are included, and they are filled out correctly.

Disregarding carryforward/carryback amounts: If the entity has carryforward or carryback amounts from previous tax years, ensure that they are accurately accounted for in the current year's Form 8990.

**Not considering all applicable rules and regulations: **The business interest expense deduction limitation is subject to various rules and limitations depending on the tax year and type of entity. Stay up-to-date with the latest IRS guidance and tax laws to ensure compliance.

Ignoring aggregation rules: For affiliated groups of entities, aggregation rules may apply. Ensure that the rules are appropriately applied to avoid miscalculations and potential compliance issues.

Failing to check for updates: Tax laws and regulations are subject to change. Always verify that you are using the most recent version of Form 8990 and related instructions to avoid outdated information.

Missing the deadline: Ensure you file Form 8990 by the appropriate due date to avoid penalties and interest for late filing.

**Not seeking professional advice: **If you are uncertain about how to complete Form 8990 correctly, seek assistance from a qualified tax professional or advisor. They can help ensure accurate and compliant filing.

Conclusion

The Energy Efficient Commercial Buildings Deduction, administered through (link: https://fincent.com/irs-tax-forms/form-7205 text: Form 7205), presents a valuable opportunity for businesses to reduce their tax liability while contributing to a more sustainable future.

By investing in energy-efficient commercial buildings, businesses can enjoy the benefits of lower operating costs, reduced environmental impact, and improved occupant comfort.

As the world continues to prioritize sustainability, leveraging this tax incentive can be a wise decision for businesses committed to energy efficiency and responsible building practices.

FAQs:

How does Section 163(j) limit business interest expenses? Section 163(j) generally limits the deduction for net business interest expenses to 30% of the taxpayer's adjusted taxable income, plus any business interest income and floor plan financing interest.

What is adjusted taxable income on Form 8990? Adjusted taxable income is a taxpayer’s taxable income adjusted for items such as non-business income, business interest income, net operating losses, and depreciation, amortization, and depletion for tax years beginning before January 1, 2022.

Are there any exceptions to filing Form 8990? Yes, small businesses with average annual gross receipts of $26 million or less (for tax years 2019 through 2021) are exempt from the interest expense limitation and therefore not required to file Form 8990.

Can I carry forward disallowed interest expenses to the next tax year? Yes, business interest expenses that are not deductible in the current year due to the limitation can be carried forward to the following tax year(s).

How do I calculate the interest expense limitation? On Form 8990, you'll calculate your interest expense limitation as 30% of your adjusted taxable income, adding any business interest income and floor plan financing interest, and then subtracting your business interest expense.

Does Form 8990 apply to all business debts? Form 8990 applies to most business debts, but there are certain exceptions such as debts with floor plan financing interest and certain regulated utility trades or businesses.

What if my business is part of a controlled group? If your business is part of a controlled group, you must aggregate the group’s gross receipts to determine if you meet the filing threshold for Form 8990.

If my business interest expense is disallowed for a year, does it expire or can it be used indefinitely? Disallowed business interest expense can be carried forward indefinitely and used in subsequent tax years subject to the business interest limitation rules.

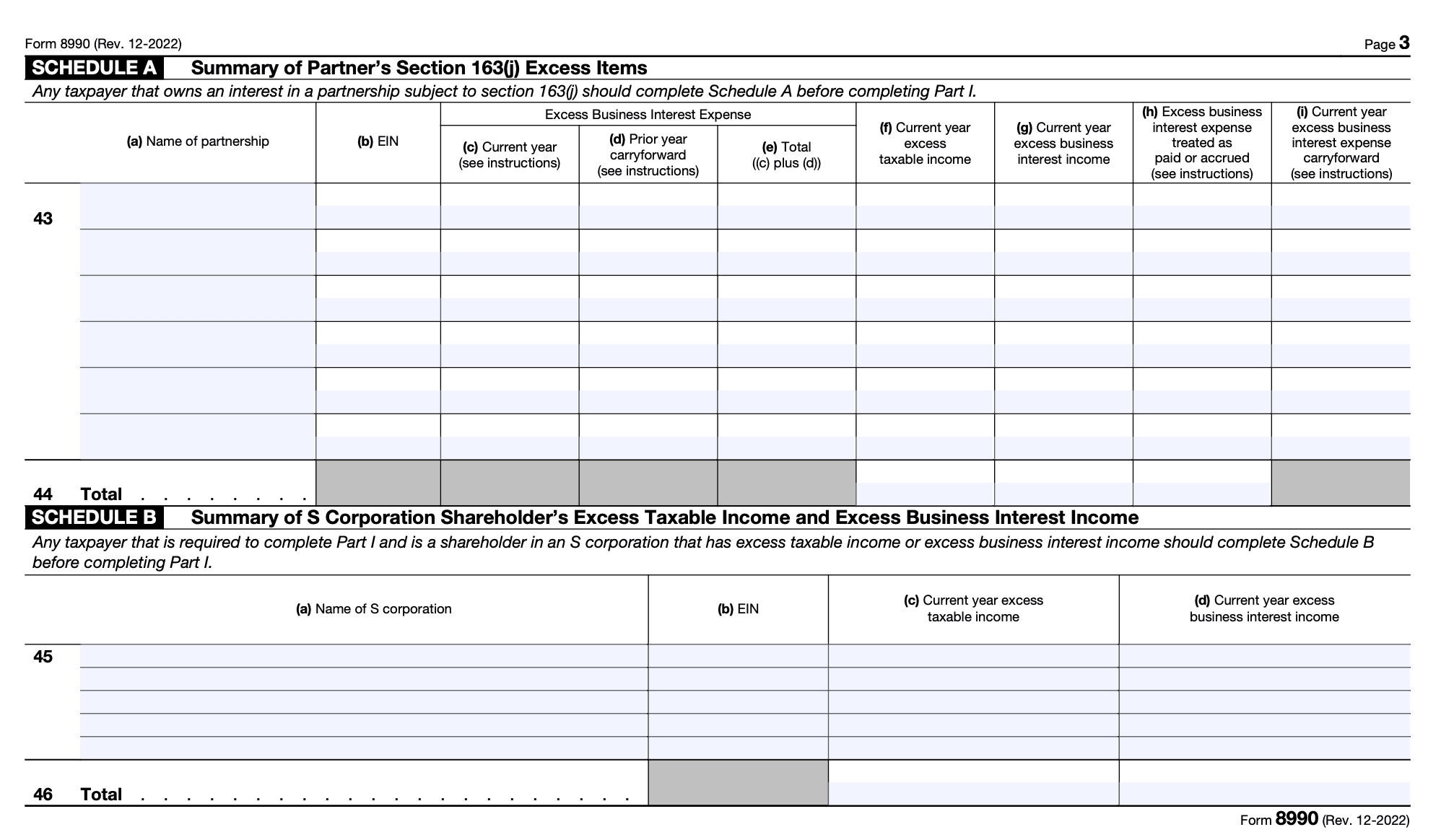

How does Form 8990 affect partnerships and S corporations differently from C corporations? For partnerships and S corporations, the business interest expense limitation is applied at the entity level first. Any excess business interest is then passed through to the partners or shareholders and may be deductible in future years subject to certain limitations and adjustments.