Form 8879 in E-Filing Taxes: Ensuring Compliance and Accuracy

Download Form 8879Introduction to E-Filing and Form 8879

With the IRS producing more and more of a digital paper trail, e-filing is no longer just an option, but many taxpayers' preference. The U.S. has used this approach to simplify the process of taxation and increase accuracy. But as electronic submissions grow so does the need to ensure safe permissioning and compliance. A crucial form in this sector is the Form 8879, IRS e-file Signature Authorization. This form helps taxpayers with digital signatures which is mandatory for E-Filling.

Form 8879 permits a taxpayer to authorize their electronic return originator (ERO) to enter or create their personal identifying number (PIN) as an electronic signature when submitting their tax return electronically. Let us understand more about the authorization process and how it works under the US tax laws.

Who Can Claim Form 8879?

Form 8879 is required for taxpayers who are filing electronically. This form applies specifically when the Practitioner PIN method is used to file the return, allowing the taxpayer to either generate their own PIN or authorize the ERO to do so. The following taxpayer categories ought to utilize Form 8879:

● Taxpayers on an individual basis: Form 8879 is required to authorize an electronic signature for form filers who want to e-file through the ERO.

● Joint tax returns from married taxpayers: Form 8879, allowing permission for their individual PINs to be entered or produced by the ERO, must be completed and signed by both spouses.

● Use of an ERO by taxpayers: You must give them permission to transmit your PIN or enable them to generate it if you engage with a tax expert or ERO to prepare and file your return.

What is Form 8879 and why is it Crucial for E-Filing Compliance?

Form 8879 ensures that the IRS receives your tax return securely and confirms that the taxpayer’s signature is authentic. This form addresses the need for digital security in e-filing, preventing fraudulent filings or unauthorized transmissions of tax returns. With strict laws on tax compliance, Form 8879 protects both the taxpayer and the IRS from potential identity theft or filing errors.

This form also gives IRS the permission to exchange critical return data. By handling payments, banking institutions can deduct the amount of tax due on the individual. For those who are wanting to file their taxes or waiting for refund, filling out Form 8879 is a must.

How to Complete IRS Tax Form 8879?

Filling Form 8879 is an easy process that involves cross-checking the tax return information and authorizing the PIN. Below are the steps involved:

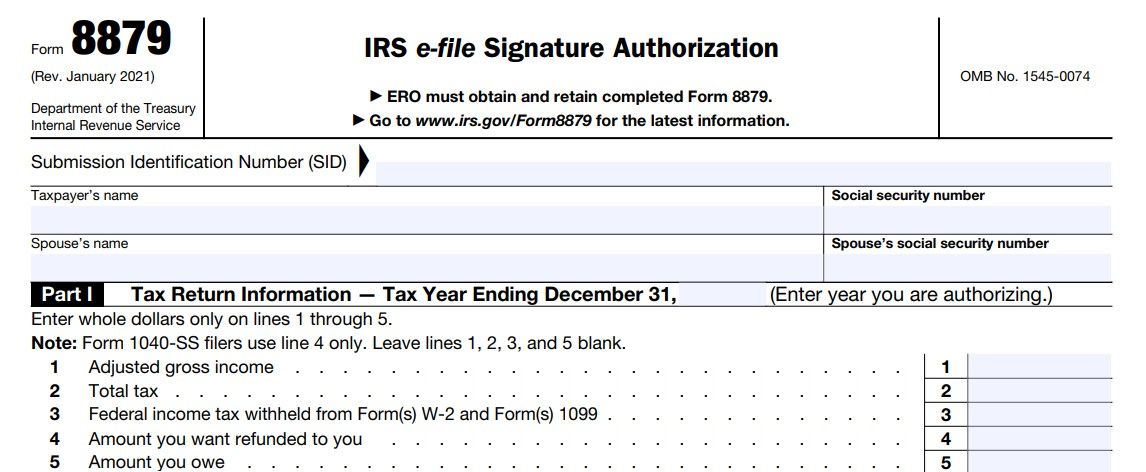

1. Part I: Tax Return Information – This section requires individuals to fill out the amounts from their tax return, including their AGI, total tax, and any amount owed. Only taxpayers filing Form 1040-SS should fill in Line 4 (refund amount), leaving the rest blank.

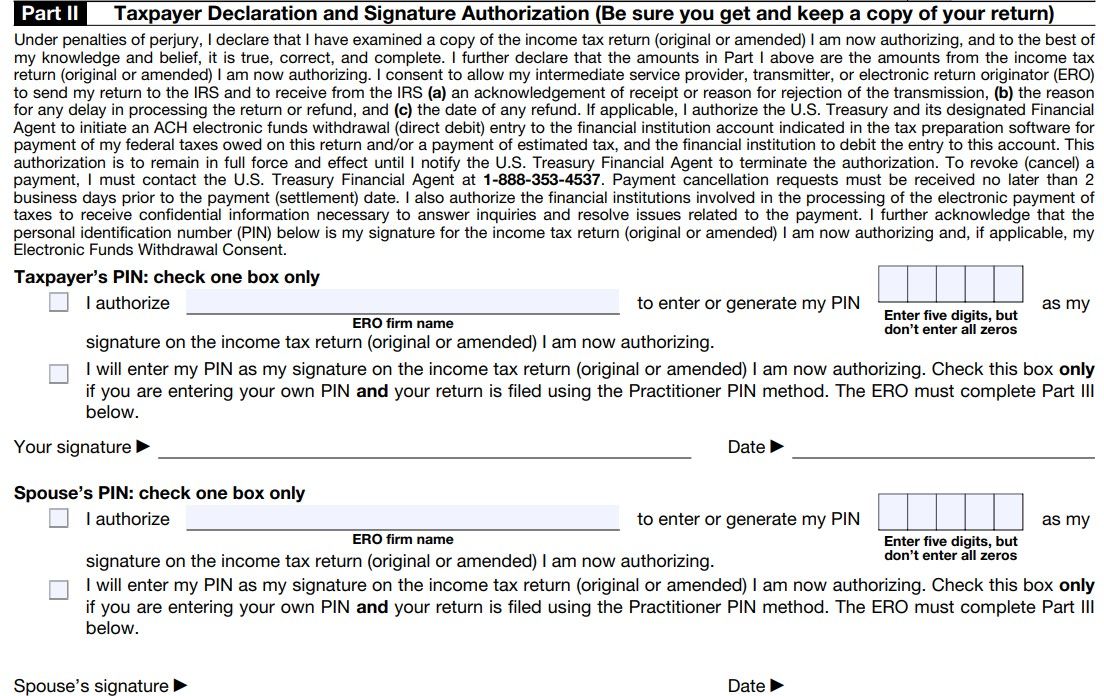

2. Part II: Taxpayer Declaration and Signature Authorization – In this section, you declare under penalty of perjury that you have reviewed your tax return and that the information is accurate. You will either generate your PIN or authorize your ERO to do so. This is essentially your signature for the electronic return.

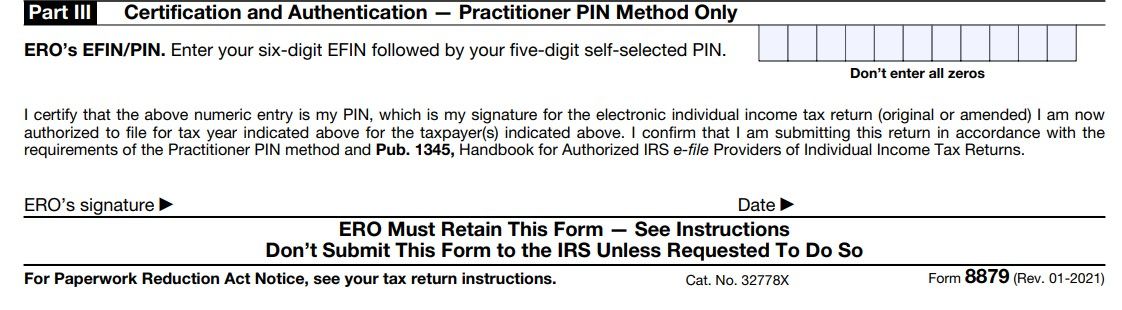

3. Part III: Certification for Practitioner PIN Method – If your ERO uses the Practitioner PIN method, they will complete this section. The ERO will enter their own electronic filing identification number (EFIN) and PIN as a signature certifying they have followed IRS procedures.

Form 8879 must be signed either electronically or with a handwritten signature, and the completed form must be returned to the ERO. One should ensure that without the ERO receiving the signed Form, one cannot send it ahead to the IRS.

ERO Responsibilities in Handling IRS Form 8879

The ERO has a huge role in the e-filing process. Their primary responsibility is to ensure that Form 8879 is completed, signed, and retained for at least three years after the due date or the IRS receipt date, whichever is later. The ERO must:

● Enter the taxpayer’s name and social security number on the form.

● Complete Part I with the tax return amounts.

● Enter or generate the taxpayer’s PIN in Part II, if authorized.

● Provide the taxpayer with a copy of Form 8879 for their records.

● Obtain the taxpayer’s signed form before transmitting the electronic return to the IRS.

This form is to be submitted to the IRS if requested. This form serves as legal evidence for taxpayers and its authorized submission for tax returns.

How to Fill Out the PIN Section

In Part II of Form 8879, the taxpayer must decide how they want to provide their personal identification number (PIN). The options are:

● Self-Entry: The taxpayer manually enters their own five-digit PIN. This is often used by those who prefer to manage their security details.

● ERO Entry: The taxpayer can authorize the ERO to generate or enter the PIN on their behalf. This option is typically used for convenience, especially for those filing jointly with a spouse or those who prefer to leave the technical aspects to the professional.

Security and Privacy Measures

Form 8879 curtails highly confidential and private information. This includes tax return data, Social Service Numbers, and different kinds of PINs. In order to protect the information. IRS advises taxpayers to strictly follow the guidelines laid down by them. The IRS website provides taxpayers with advisory rules and regulations that safeguard the e-filling process and don't compromise privacy laws.

Submission and Retention of Form 8879

The taxpayer must then hand deliver, U.S. mail, private delivery service (PDS), email, Internet website, or fax the signed Form 8879 to his ERO. If the ERO does not actually receive this form, the return cannot be filed electronically. The ERO has to hold onto the form and only send it into the IRS if they are asked to.

Conclusion

For those who wish to pay their taxes online and save the hassle of getting into lines, Form 8879 is a must. This form ensures that through secure servers you are able to generate an online PIN which can be used by you and form a digital Signature. This Form makes it easy for people to fill out their Income Tax Returns.